The latest bitcoin derivatives data indicates a continued climb in bitcoin futures open interest, hitting all-time peaks. Over the last day, statistics reveal an open interest of $32.30 billion across fourteen distinct bitcoin futures markets. Soaring Open Interest in BTC Futures Signals Growing Derivatives Market Friday, March 8, 2024, marked a notable day when BTC […]

The latest bitcoin derivatives data indicates a continued climb in bitcoin futures open interest, hitting all-time peaks. Over the last day, statistics reveal an open interest of $32.30 billion across fourteen distinct bitcoin futures markets. Soaring Open Interest in BTC Futures Signals Growing Derivatives Market Friday, March 8, 2024, marked a notable day when BTC […]

Source link

Derivatives

Binance’s Derivatives Arm Launches Tesla Model Y and Bitcoin Voucher Challenge

Binance has announced a competition through its crypto derivatives arm, Binance Futures, offering participants the chance to win a Tesla Model Y. According to the crypto exchange, the contest will unfold over four weekly challenges spanning from Feb. 18 to Mar. 17, 2024. Binance Futures Unveils Tesla Model Y Challenge and Daily Crypto Rewards Beginning […]

Binance has announced a competition through its crypto derivatives arm, Binance Futures, offering participants the chance to win a Tesla Model Y. According to the crypto exchange, the contest will unfold over four weekly challenges spanning from Feb. 18 to Mar. 17, 2024. Binance Futures Unveils Tesla Model Y Challenge and Daily Crypto Rewards Beginning […]

Source link

Is $203 Trillion In Derivatives Held By Goldman Sachs, JPMorgan And Other Top Banks Causing an ‘Everything Bubble?’

The scale of derivatives held by major banks like JPMorgan Chase & Co., Citibank and Goldman Sachs, amounting to $203 trillion, has raised concerns about the potential risks these positions might pose to the global economy. The third-quarter Quarterly Report on Bank Trading and Derivatives Activities, published by the Office of the Comptroller of Currency, provides a comprehensive dive into this issue.

This figure surpasses the world’s gross domestic product (GDP) by roughly double, highlighting the enormity of the market.

JPMorgan Chase, in particular, is noted for its substantial exposure to derivatives risk, topping the list with roughly $58 trillion in derivatives. The mounting scale of derivatives owned by banks raises several questions and concerns among regulators and investors.

Don’t Miss:

The 15-digit number has recently drawn speculation among retail investors on social media platforms like Reddit and TikTok. But as recently as March 9, 2023, Congress held a hearing on managing volatility in global commodity derivatives markets.

A derivative is a contract that derives its value from the performance of an underlying entity. This underlying entity can be an asset, index or interest rate. Derivatives can be used to offset risks in the future or used as leverage to increase gains or losses.

But it’s unlikely the banks are the ones holding these derivatives. Rather, many of the top banks act as market makers for entities buying and selling derivatives.

While these banks have large derivative positions on their balance sheets, the notional value is a fraction of the total derivatives market. This is because there are typically two sides to every trade: a short and a long. Because each side has a bullish and bearish position, the total size of the derivatives market doesn’t necessarily correlate to risk.

Trending: Copy and paste Mark Cuban’s startup investment strategy according to his colorful portfolio.

According to the Federal Reserve, the total long exposure for financial derivatives for hedge funds, for example, has remained largely unchanged since being tracked in 2012. There was a large spike between 2017 and 2018, but as the total derivatives market size increased, the notional value slowly approached 0. Hedge funds have a total long exposure of about $1 trillion.

The banks likely don’t hold exposure to most of these individual positions. They are market makers for these transactions and largely facilitate the transactions between parties. Those parties often use the derivatives market to manage risk by hedging their bets or using swaps to limit future exposure.

This isn’t to say there isn’t significant market exposure to derivatives. By all metrics, the use of derivatives is increasing. Between the first quarter of 2022 and the third quarter of 2023, the notional amounts of derivatives increased by about $10 trillion. If an entity mismanages its risks and becomes too exposed to derivatives, there could be risks associated with those trades. But regulatory measures like the Dodd-Frank Act and higher capital requirements imposed by the Federal Reserve are regularly used to mitigate such risks.

A larger concern is the lack of reporting and availability of data surrounding the derivatives market. For example, a recent BIS article highlighted the growing trillions in missing debt created by certain derivatives. Forex swaps, forwards and currency swaps create debts that don’t appear on balance sheets and most debt statistics. Swaps such as these are an underlying common denominator for many financial crises and shocks to the system, causing entities to fail or creating funding squeezes. These off-sheet debts are estimated to be at a staggering $97 trillion globally across all currencies and growing fast.

The lack of reporting for these debts makes it difficult to predict future recessions and make policy regulating derivatives.

The $203 trillion in derivatives held by major banks underscores a complex financial landscape where the interplay of risk management and market speculation is pivotal. While banks often act as intermediaries rather than principal holders, the sheer size of these positions raises questions about systemic risk and market stability.

Regulatory frameworks and reporting standards, although improved, still face challenges in fully capturing the nuances of the derivatives market. The need for enhanced transparency and oversight in the sector remains critical, particularly in light of the growing off-balance-sheet debts that continue to elude conventional monitoring mechanisms.

Read Next:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article Is $203 Trillion In Derivatives Held By Goldman Sachs, JPMorgan And Other Top Banks Causing an ‘Everything Bubble?’ originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

By providing $20 million, M&G is helping GFO-X create a properly regulated environment for safe access to crypto derivatives trading.

Global Futures and Options (GFO-X), a crypto derivatives trading platform based in the UK, has announced it received a $20 million investment from the asset management arm of pensions provider M&G Plc.

According to GFO-X, the investment was part of a $30 million series B funding round for the company. This confirms that M&G is the lead in the funding round. The funds will help GFO-X with its launch as it tries to innovate in the crypto sector and repair any lost trust or credibility.

The crypto company supports large institutional players that require a safe and regulated trading platform for secure access to crypto derivatives. According to an announcement, GFO-X already prides itself in a ‘regulation first’ approach, a method that has helped the company garner some trust with large institutional players.

M&G to Help GFO-X Create Safe Regulatory Environment For Crypto Derivatives Trading

M&G Portfolio Manager Jeremy Punnett says that the investment in GFO-X helps to create an enabling environment for investors to trade digital asset derivatives on a regulated platform. The Portfolio Manager also believes the UK has the potential to become a worldwide hub for crypto tech and investment. According to Punnett:

“The lack of regulated trading venues is materially hampering the growth of the crypto derivatives trading market…This investment enables GFO-X to scale its operations as the business is set to benefit from investors shifting their trading from unregulated to regulated venues.”

GFO-X CEO Arnab Sen also spoke on the investment. Sen said that as crypto enters mainstream finance, a proper market structure is essential to handle risks properly. This is crucial, so that mainstream finance does not suffer crypto problems. However, solving this problem requires cultivating a regulated financial market ecosystem with all of its complexities. Sen then adds that this is something GFO-X is willing to do with a “patient long term capital planner such as M&G.”

GFO-X is the first regulated and centrally cleared trading platform in the UK, authorized by the Financial Conduct Authority (FCA). According to the company:

“Our mission is to deliver enhanced liquidity, institutional connectivity and risk mitigation through high-performance technology and optimised contract specifications.”

In April, GFO-X announced a strategic partnership with the London Stock Exchange Group (LSEG)’s LCH SA clearing house, to allow users trade cash-settled Bitcoin index futures and options.

Blockchain in Stock Trading

In September, Coinspeaker reported that the LSEG plans to incorporate blockchain technology into its operations. The LSEG, one of the world’s oldest stock exchanges, is considering the possibility that blockchain technology could improve the efficiency of its processes. Also, the LSEG wants to use blockchain to help clients better purchase, sell, or hold assets.

The LSEG hopes that blockchain can help to automate its operations. If successful, this would significantly reduce the need for paperwork and any intermediaries. Also, blockchain will help to improve transparency and reduce the risk of fraud. However, the stock exchange has clarified that its interest in blockchain technology is limited to improving its operations. It currently has no plans or interest in “building anything around cryptoassets.”

next

Blockchain News, Business News, Cryptocurrency News, Investors News, News

You have successfully joined our subscriber list.

Since the latest Bitcoin rally started, there has been speculation going on as to whether derivatives fuel the surge. Here’s what Glassnode says.

Bitcoin Funding Rates Have Remained Cool Recently

In its latest weekly report, the on-chain analytics firm Glassnode has talked about what the derivatives side of the market has looked like while the latest rally in the asset has occurred.

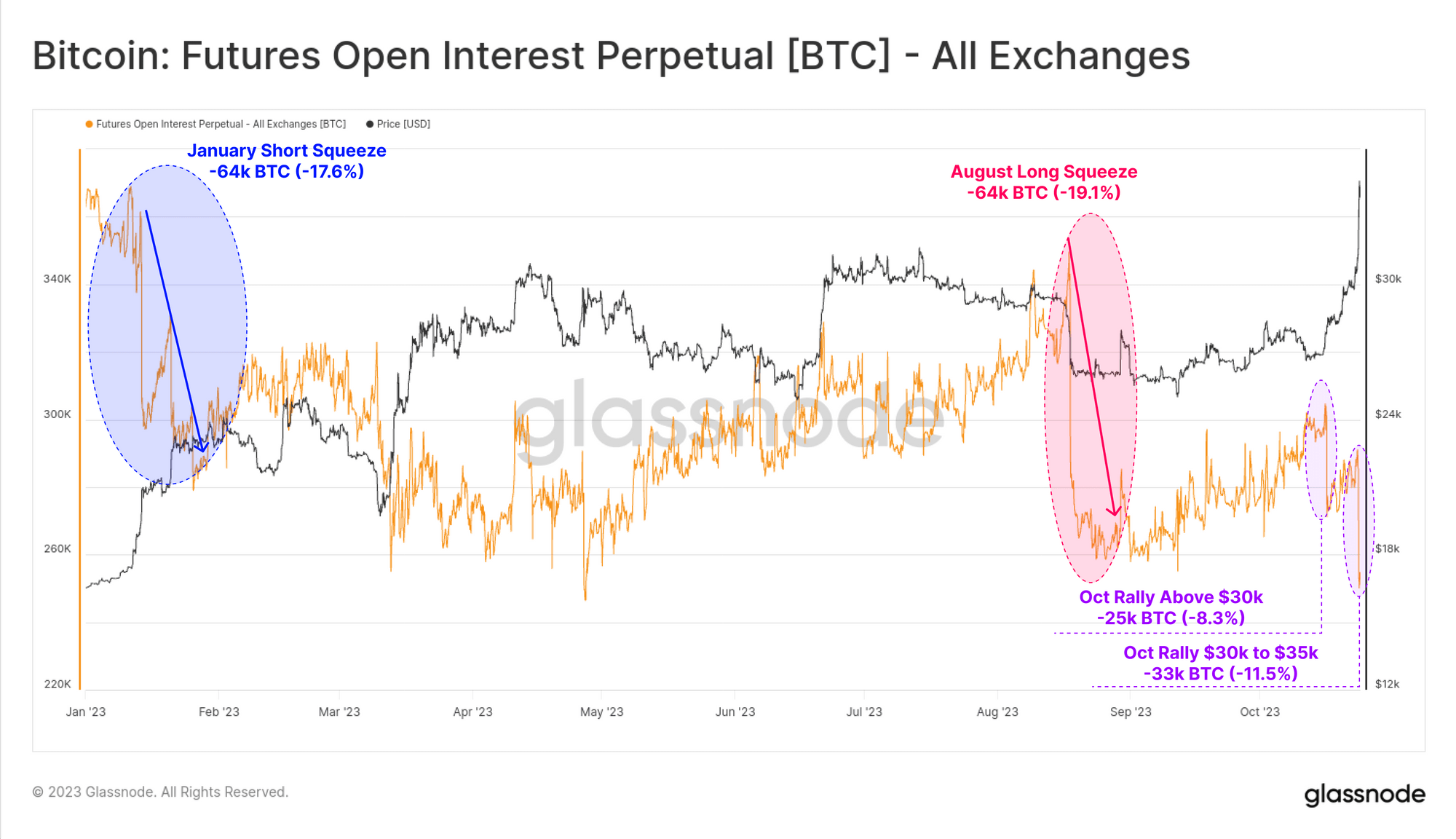

First, the report has looked into the open interest of the perpetual swap markets, where “open interest” refers to the total amount of Bitcoin contracts currently open. The metric has been measured in terms of BTC here so that the USD price fluctuations don’t affect the trend.

Looks like the value of the metric has plunged in recent days | Source: Glassnode's The Week Onchain - Week 43, 2023

From the chart, it’s visible that the Bitcoin open interest saw two large liquidation squeezes back in January and August, with the former one being a short squeeze and the latter one being a long squeeze.

Since the latest rally started, BTC has observed two liquidation events: one of 25,000 BTC and the other of 33,000 BTC. This combined short squeeze is now of the same scale as the aforementioned mass liquidation events.

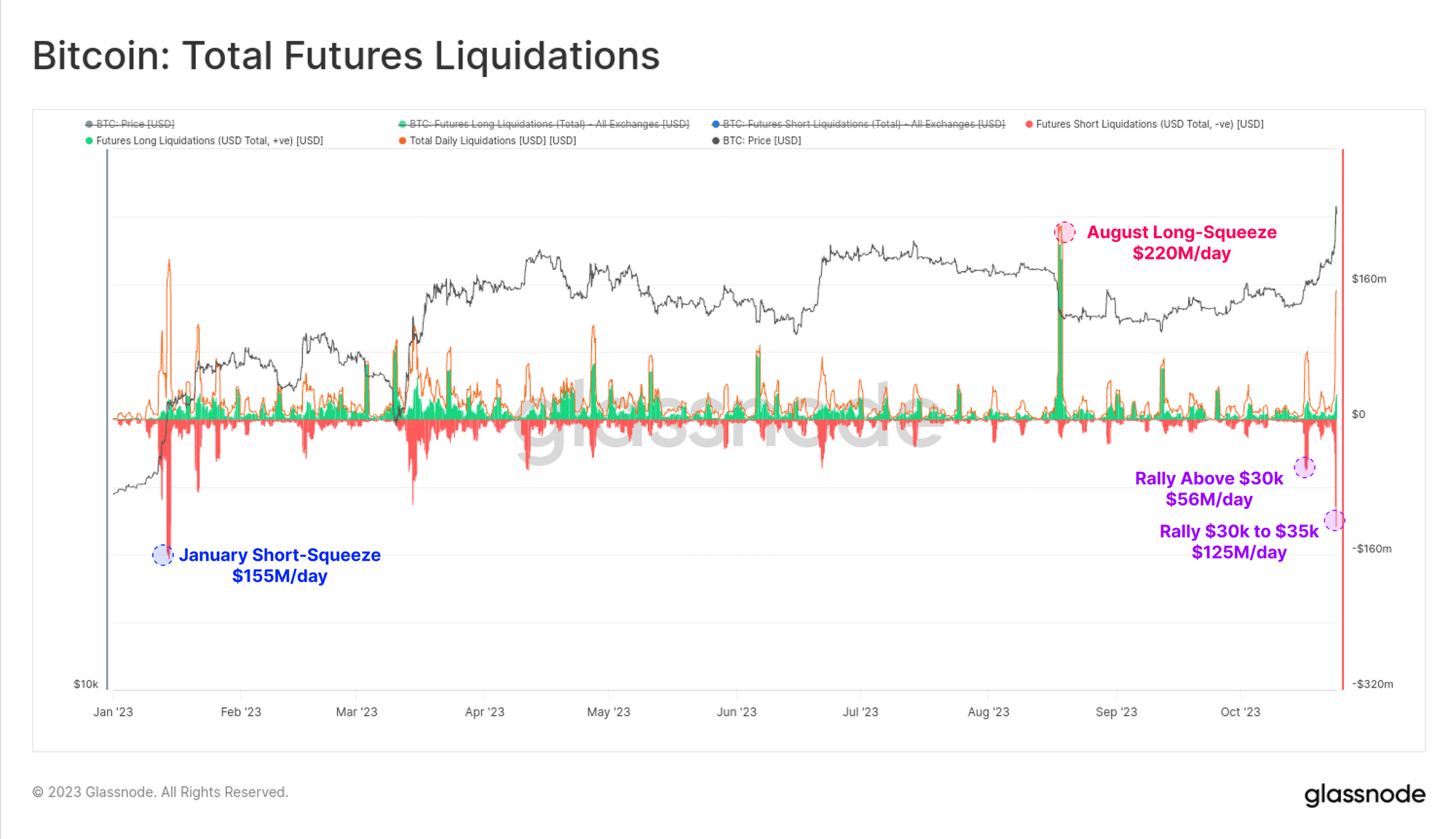

In terms of the USD values of the liquidation events, the latest squeeze is again comparable with the other ones this year:

A large amount of short liquidations seem to have occurred recently | Source: Glassnode's The Week Onchain - Week 43, 2023

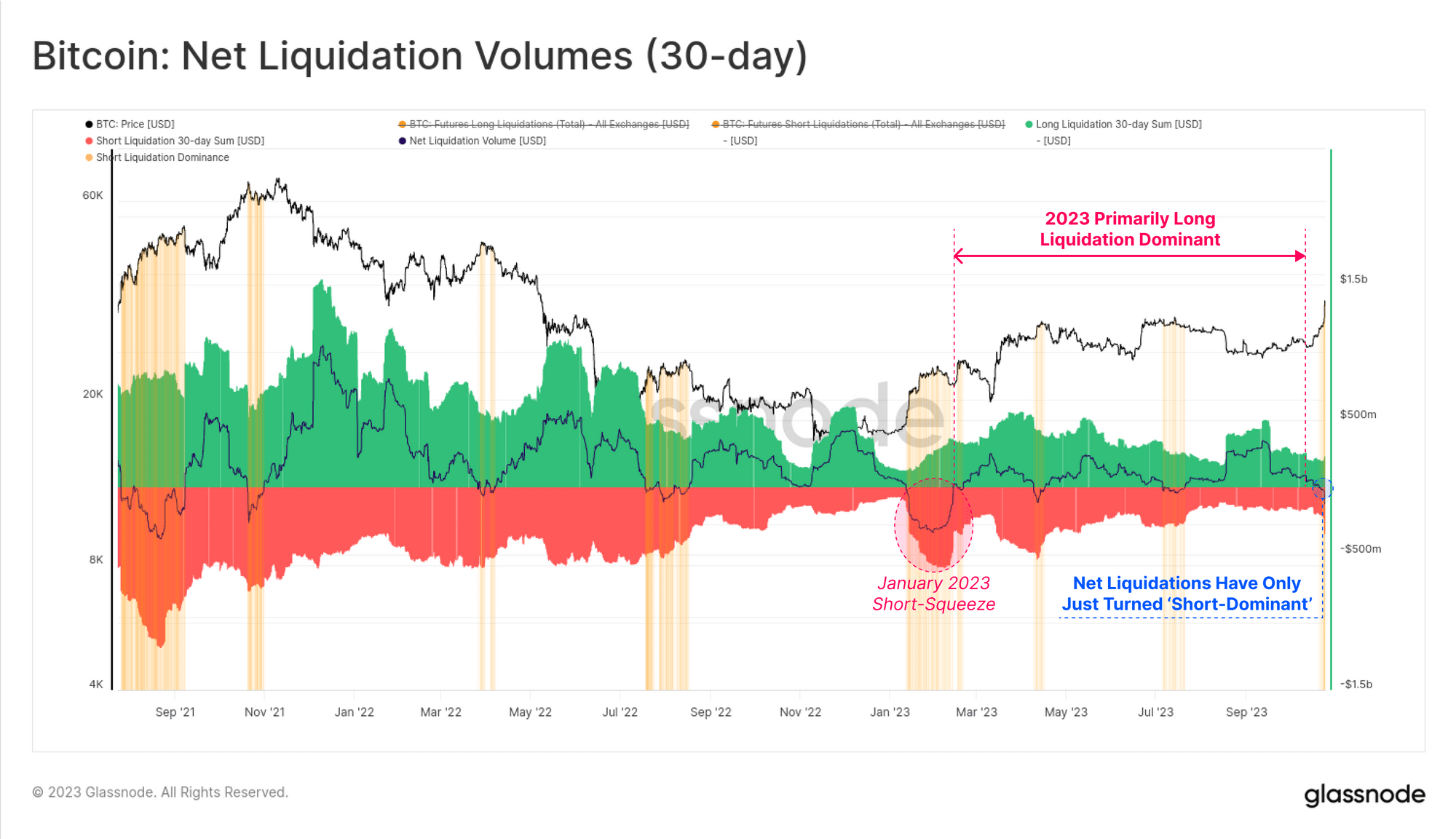

On the topic of liquidations, Glassnode reveals that, interestingly, the market has been dominated by long liquidations throughout the history of Bitcoin. There have only been a few phases where shorts have dominated the longs over 30 days.

The latest large short liquidations have resulted in the shorts just overtaking the longs, as the chart below shows.

Short liquidations have surpassed long liquidations | Source: Glassnode's The Week Onchain - Week 43, 2023

Curiously, it would appear that during the few periods that the short liquidations have dominated the market (highlighted in yellow), Bitcoin has observed a point of extreme in its price.

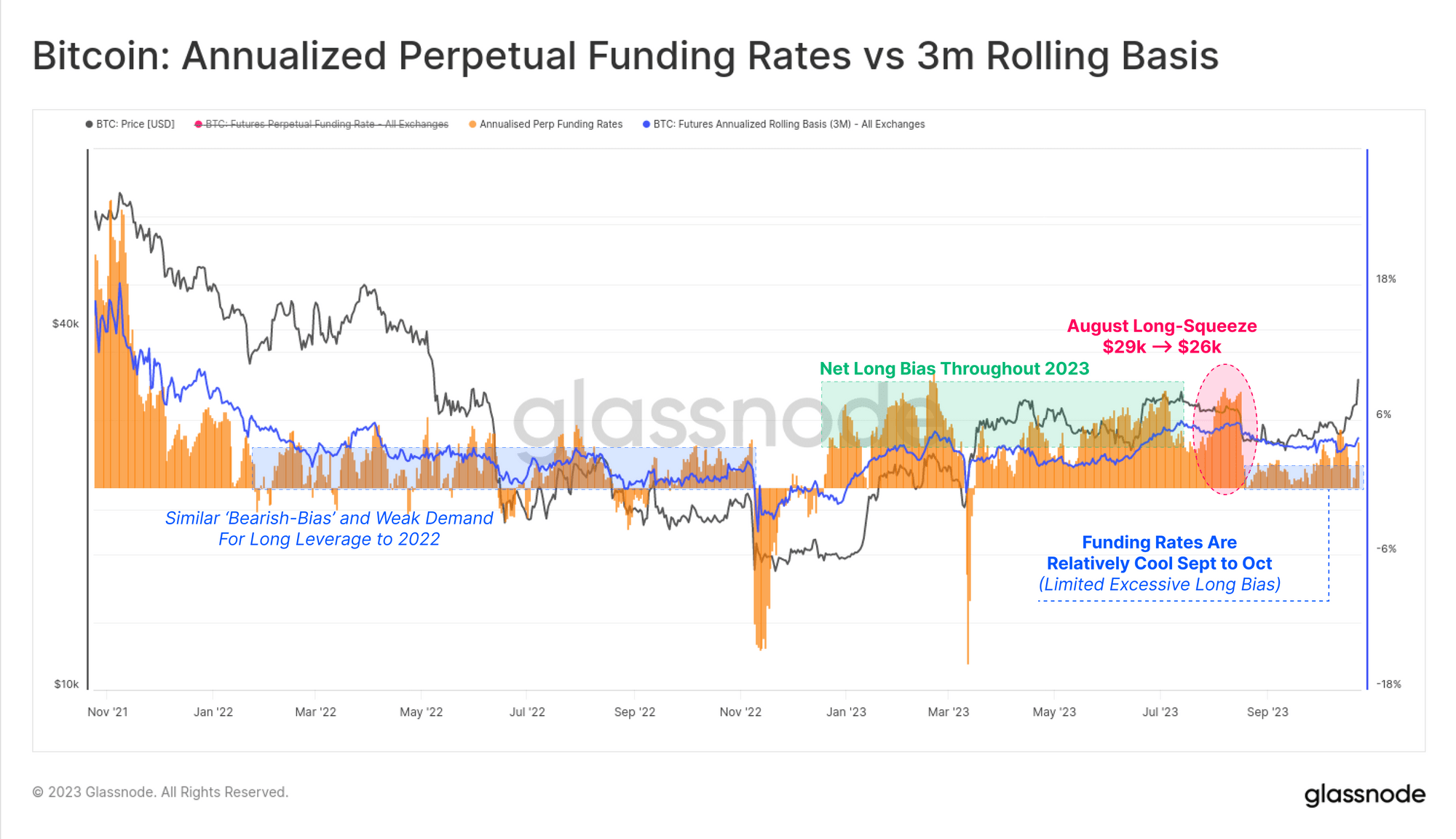

While the liquidation data would suggest that the derivatives have indeed played a role in driving the market through this latest rally, the funding rates could tell a different story.

The funding rates have been positive recently | Source: Glassnode's The Week Onchain - Week 43, 2023

“Of note is that funding rates and cash-and-carry basis in futures markets have remained relatively calm all things considered,” explains Glassnode. “2023 has generally seen futures markets yield annualized rates over 6%, which are greater than US treasury rates.”

Back in August, however, the selloff cooled off these funding rates, and they have since remained relatively low. Even with the latest chaos in the market, the metric still hasn’t seen any significant uptick. The analytics firm notes that this could imply the Bitcoin rally is only partially driven by leveraged speculation.

BTC Price

At the time of writing, Bitcoin is trading at around $34,300, up 23% in the past week.

BTC has observed some sharp bullish momentum in the past few days | Source: BTCUSD on TradingView

Featured image from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com

Bitstamp is also looking to expand its operations in the UK after securing the FCA license earlier this year.

One of the oldest cryptocurrency exchanges Bitstamp is looking to expand its footprint and service offerings amid the current talks of raising fresh funding. Jean-Baptiste Graftieaux, global chief executive officer of the exchange appraised the recent developments. As per the company spokesperson, Bitstamp started its fundraising efforts earlier this year in June 2023. Mike Novogratz’s Galaxy Digital is acting as an adviser in the entire process. Earlier, Galaxy Digital served as an adviser to Pantera, which later sold its minority stake in Bitstamp to Ripple in 2023. Bitstamp said that they would be using these funds to launch crypto derivatives trading in the European continent next year.

Additionally, they would also use these funds to expand the number of markets that it serves in Asia. The company spokesperson said that Bitstamp is also looking to expand its operations in the U.K. In a statement to Bloomberg, Graftieaux said:

“Bitstamp is not for sale, and we are not actively looking to sell the company. Our current and exclusive priority is to raise money through strategic investors to accelerate Bitstamp’s growth by providing new products and services to retail and institutional crypto customers.”

Earlier this year in June, Bitstamp also secured approval from UK’s Financial Conduct Authority (FCA) to function as a registered crypto firm in the region. After obtaining the license, Bitstamp stated its dedication to increasing its presence and investments in the UK market.

Bitstamp’s Growth Over the Years

As said, Bitstamp is one of the oldest crypto exchanges established in 2011 and based out of Luxembourg. Back then Bitstamp was among the major competitors to now-defunct Bitcoin exchange Mt. Gox. Now, it’s the seventh-largest exchange in the world. It had around $126 million worth of trading in a recent 24-hour period.

Bitstamp also has a part in the US entity called Bitstamp USA. The exchange also has a special license called BitLicense, essential to operate in New York state.

More platforms for cryptocurrencies are getting into the derivatives market. This market used to be mostly dominated by FTX and Binance. But after the FTX collapse, Bitstamp seems to be grabbing an opportunity here. Coinbase Global Inc and Gemini, two other big companies in the cryptocurrency world, started their own derivatives markets outside the US this year. Bitstamp was among the first exchanges to allow XRP trading after the court ruling.

next

Blockchain News, Cryptocurrency News, News

Bhushan is a FinTech enthusiast and holds a good flair in understanding financial markets. His interest in economics and finance draw his attention towards the new emerging Blockchain Technology and Cryptocurrency markets. He is continuously in a learning process and keeps himself motivated by sharing his acquired knowledge. In free time he reads thriller fictions novels and sometimes explore his culinary skills.

You have successfully joined our subscriber list.