Bitcoin’s network difficulty climbed to an unprecedented peak on April 10, 2024, at block height 838,656, increasing by 3.92% to reach 86.39 trillion. This escalation in difficulty will make it increasingly challenging to mine blocks as the fourth halving event nears, with fewer than 1,250 blocks remaining until block 840,000 is mined. Block 838,656 Marks […]

Bitcoin’s network difficulty climbed to an unprecedented peak on April 10, 2024, at block height 838,656, increasing by 3.92% to reach 86.39 trillion. This escalation in difficulty will make it increasingly challenging to mine blocks as the fourth halving event nears, with fewer than 1,250 blocks remaining until block 840,000 is mined. Block 838,656 Marks […]

Source link

difficulty

Bitcoin’s Path to Halving — Anticipated Increase in Difficulty Sets Stage

Based on current metrics, the Bitcoin blockchain is set to undergo another difficulty adjustment before the halving, with an anticipated increase of 1.2% to 2.16% around April 11, 2024. Following this adjustment, there will be 1,344 blocks remaining until the reward is halved. Estimated Increase in Difficulty Precedes Halving In April, bitcoin (BTC) miners face […]

Based on current metrics, the Bitcoin blockchain is set to undergo another difficulty adjustment before the halving, with an anticipated increase of 1.2% to 2.16% around April 11, 2024. Following this adjustment, there will be 1,344 blocks remaining until the reward is halved. Estimated Increase in Difficulty Precedes Halving In April, bitcoin (BTC) miners face […]

Source link

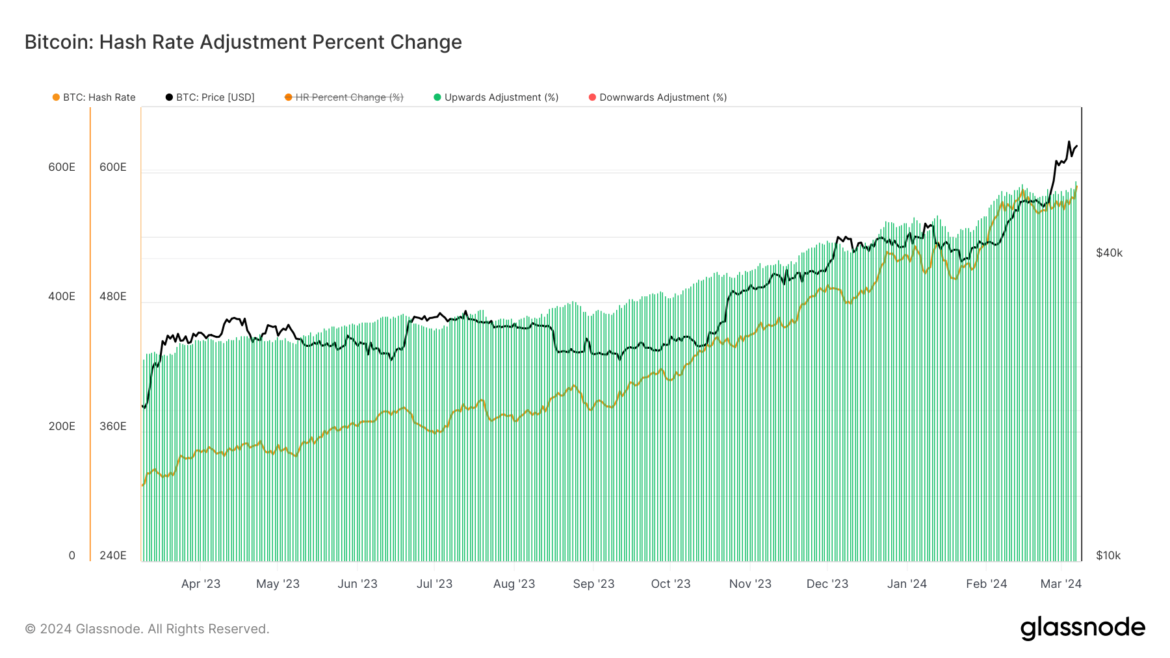

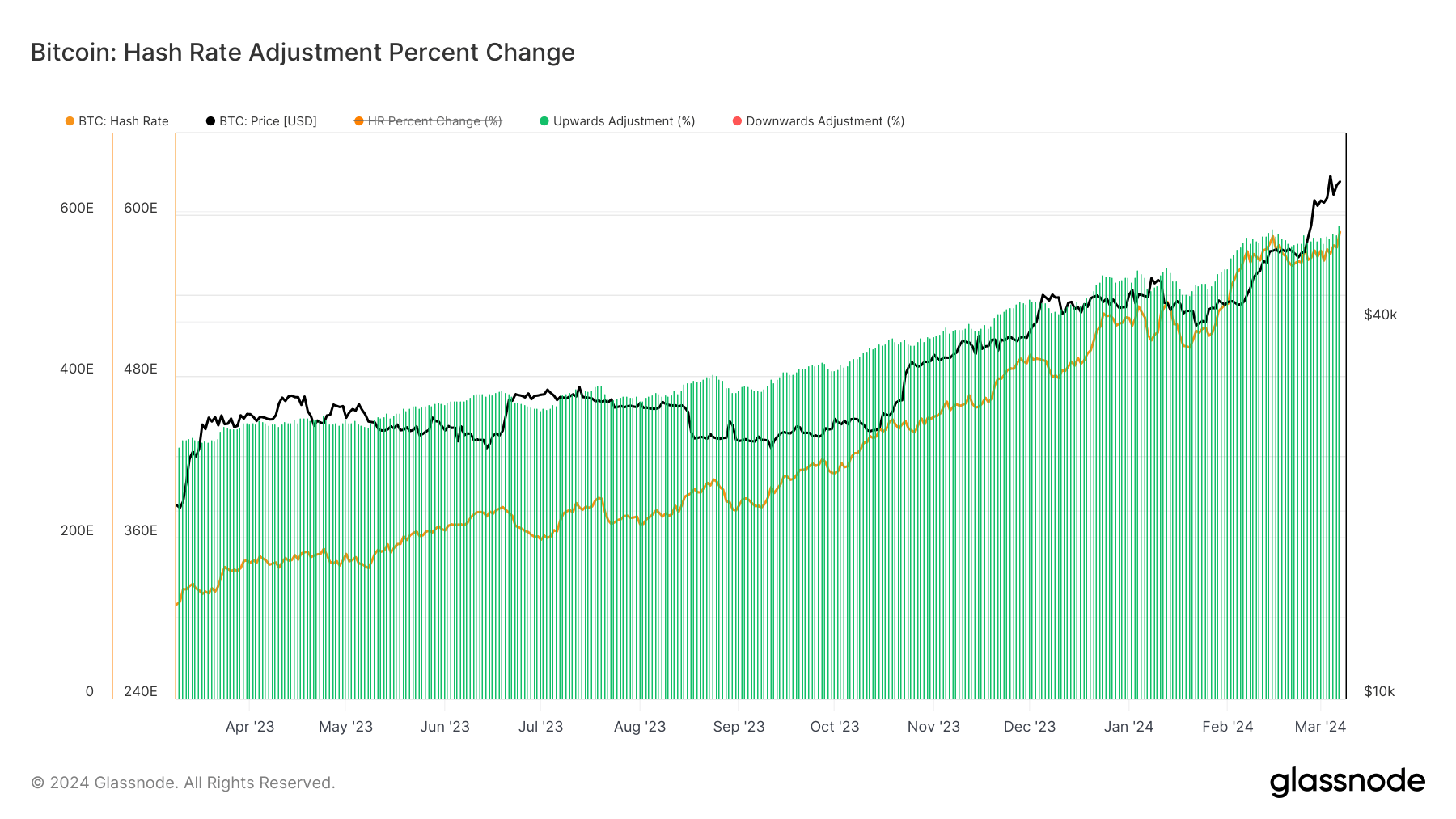

The winds of change are blowing through the Bitcoin landscape. On March 14th, 2024, the network witnessed a monumental shift – mining difficulty skyrocketed to a record-breaking 84 trillion hashes. This unprecedented challenge coincides with another significant event on the horizon: the Bitcoin halving slated for April.

According to BTC.com, the rate has risen by nearly 5.80% since the previous modification. The mining hashrate for the original coin has also peaked, indicating that more people are now participating in the mining process. At present, the value stands at 617 EH/s.

Source: BTC.com

Bitcoin Mining: The Difficulty Dilemma

Mining Bitcoin is no easy feat. Miners compete to solve complex cryptographic puzzles, and the difficulty of these puzzles adjusts based on the overall network hash rate. As more miners join the network, the difficulty increases to ensure a steady block production rate (roughly 1 block every 10 minutes).

This recent surge in difficulty signifies an influx of new miners, likely drawn by Bitcoin’s recent price rally that saw it peak at a staggering $73,800 on the same day.

The Halving Effect

The upcoming halving event in April throws another variable into the equation. Every four years, the block reward for miners – the amount of Bitcoin earned for successfully mining a block – is cut in half.

This economic policy is a cornerstone of Bitcoin’s design, aiming to control inflation and maintain scarcity over time. The last halving in May 2020 witnessed a significant price increase in the following months, and many analysts believe the upcoming halving will follow suit.

BTCUSD weakens today and trades at $68,178: TradingView.com

Here’s the logic: with the supply of new Bitcoins being halved, the existing ones become relatively more scarce, potentially driving the price up due to increased demand.

A Balancing Act For Miners

Despite the rising difficulty, the potential for Bitcoin’s price to appreciate after the halving could incentivize miners to weather the storm. This economic incentive is bolstered by the recent spike in mining rewards, which reached nearly $79 million

This suggests that even with the increased difficulty, miners are still reaping substantial profits due to the high Bitcoin price. However, the long-term sustainability of this model is debatable.

As difficulty continues to climb, the energy consumption required for mining will also rise. It raises concerns about the environmental impact of Bitcoin mining, especially considering the reliance on non-renewable energy sources in some regions.

Beyond The Headlines

The narrative surrounding Bitcoin’s recent surge often focuses on its price and the upcoming halving. However, there are crucial underlying factors to consider.

The ever-increasing mining difficulty raises questions about the long-term viability of proof-of-work, Bitcoin’s current consensus mechanism. Alternative, more energy-efficient mechanisms are being explored, but their widespread adoption remains uncertain.

Featured image from Unsplash, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Bitcoin Mining Hits Record Difficulty as Countdown to 2024 Halving Begins

On Thursday, Bitcoin’s network difficulty escalated by 5.79% at block height 834,624, signaling the year’s fourth rising adjustment. The mining difficulty now stands at an unprecedented peak of 83.95 trillion, with the forthcoming adjustment anticipated around March 27, 2024. Bitcoin Difficulty Jumps 5.79% Mining Bitcoin has reached unprecedented levels of difficulty, peaking at 83.95 trillion […]

On Thursday, Bitcoin’s network difficulty escalated by 5.79% at block height 834,624, signaling the year’s fourth rising adjustment. The mining difficulty now stands at an unprecedented peak of 83.95 trillion, with the forthcoming adjustment anticipated around March 27, 2024. Bitcoin Difficulty Jumps 5.79% Mining Bitcoin has reached unprecedented levels of difficulty, peaking at 83.95 trillion […]

Source link

Quick Take

Bitcoin’s hash rate, an indicator of the computational power used for mining and processing transactions, has recently achieved a historic high. The 14-day moving average hash rate now stands at an unparalleled 586 eh/s, further enhancing the digital assets security. While the one-day hash rate peak of 711 eh/s on March 7 stands out, the 14-day moving average is considered a more reliable indicator as it smooths over short-term volatility.

This increase in hash rate signals a predicted adjustment of over 3% in the current difficulty epoch, expected on March 14, according to Newhedge.

This adjustment aligns with Bitcoin’s core design principle of maintaining a target block time of 10 minutes, directly influencing the projected timing of the next halving event. Per the Clarkmoody dashboard, if the ten-minute average block time is maintained, the halving event could potentially occur on April 21.

The post Bitcoin’s hash rate hits record high after difficulty drop appeared first on CryptoSlate.

Bitcoin’s Latest Difficulty Retarget Jumps 8.24%: Miners Navigate the Toughest Mining Landscape Yet

Bitcoin’s mining difficulty has hit an unprecedented peak, marking the most significant jump of 2024. On Thursday, at the milestone of block 830,592, the network experienced its fourth adjustment this year with a sharp 8.24% uptick. Bitcoin Mining Difficulty Skyrockets, Setting New Records in 2024 Mining bitcoin (BTC) has become considerably more challenging, following an […]

Bitcoin’s mining difficulty has hit an unprecedented peak, marking the most significant jump of 2024. On Thursday, at the milestone of block 830,592, the network experienced its fourth adjustment this year with a sharp 8.24% uptick. Bitcoin Mining Difficulty Skyrockets, Setting New Records in 2024 Mining bitcoin (BTC) has become considerably more challenging, following an […]

Source link

Bitcoin Braces for Record Difficulty Surge Ahead of Retarget as Miners Push Network to New Heights

Scheduled for Feb. 15, 2024, the upcoming Bitcoin difficulty retarget is poised to mark a notable upswing in the network. Current projections forecast an estimated difficulty surge ranging from 8.45% to 9.2%, setting the record for the steepest increase of 2024 thus far. Bitcoin Difficulty Poised for a Steep Increase This week, bitcoin (BTC) mining […]

Scheduled for Feb. 15, 2024, the upcoming Bitcoin difficulty retarget is poised to mark a notable upswing in the network. Current projections forecast an estimated difficulty surge ranging from 8.45% to 9.2%, setting the record for the steepest increase of 2024 thus far. Bitcoin Difficulty Poised for a Steep Increase This week, bitcoin (BTC) mining […]

Source link

Bitcoin’s recent surge past $34,000 has been a significant event in the cryptocurrency market. Monitoring miner behavior and metrics is paramount when analyzing the Bitcoin market, as miners play a foundational role in network security, transaction validation, and new Bitcoin issuance. Their actions and decisions can offer insights into market trends, future price movements, and overall network health.

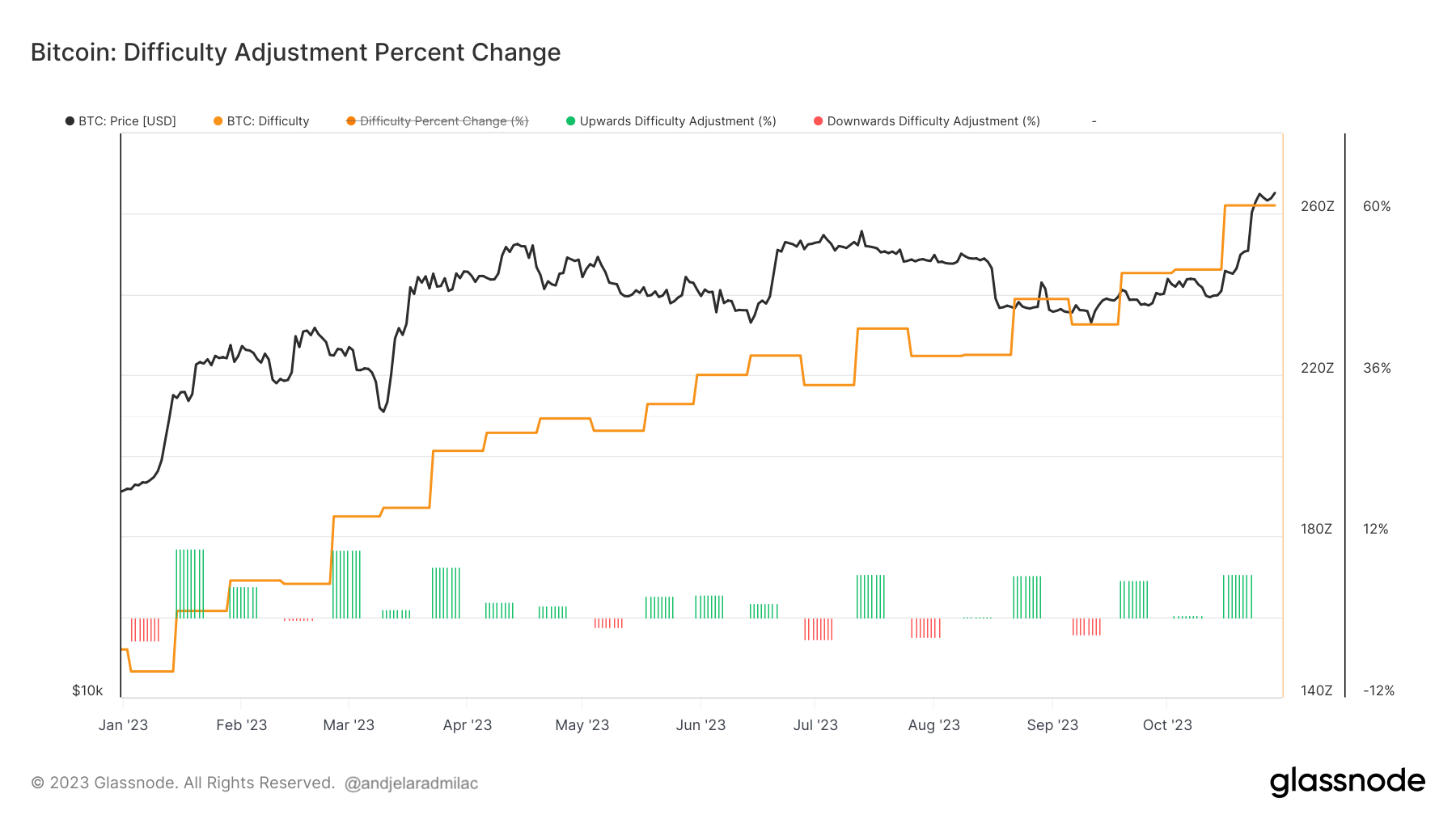

Between October 15 and 16, the mining difficulty of Bitcoin increased by 6.47%. This adjustment, which occurred as Bitcoin surpassed $28,000, reflects the network’s self-regulating mechanism to maintain consistent block times. As the price rose, it’s likely more miners were incentivized to join the network, escalating the competition. Consequently, while the increased price means rewards in USD value are higher, the intensified competition might make obtaining Bitcoin slightly more challenging.

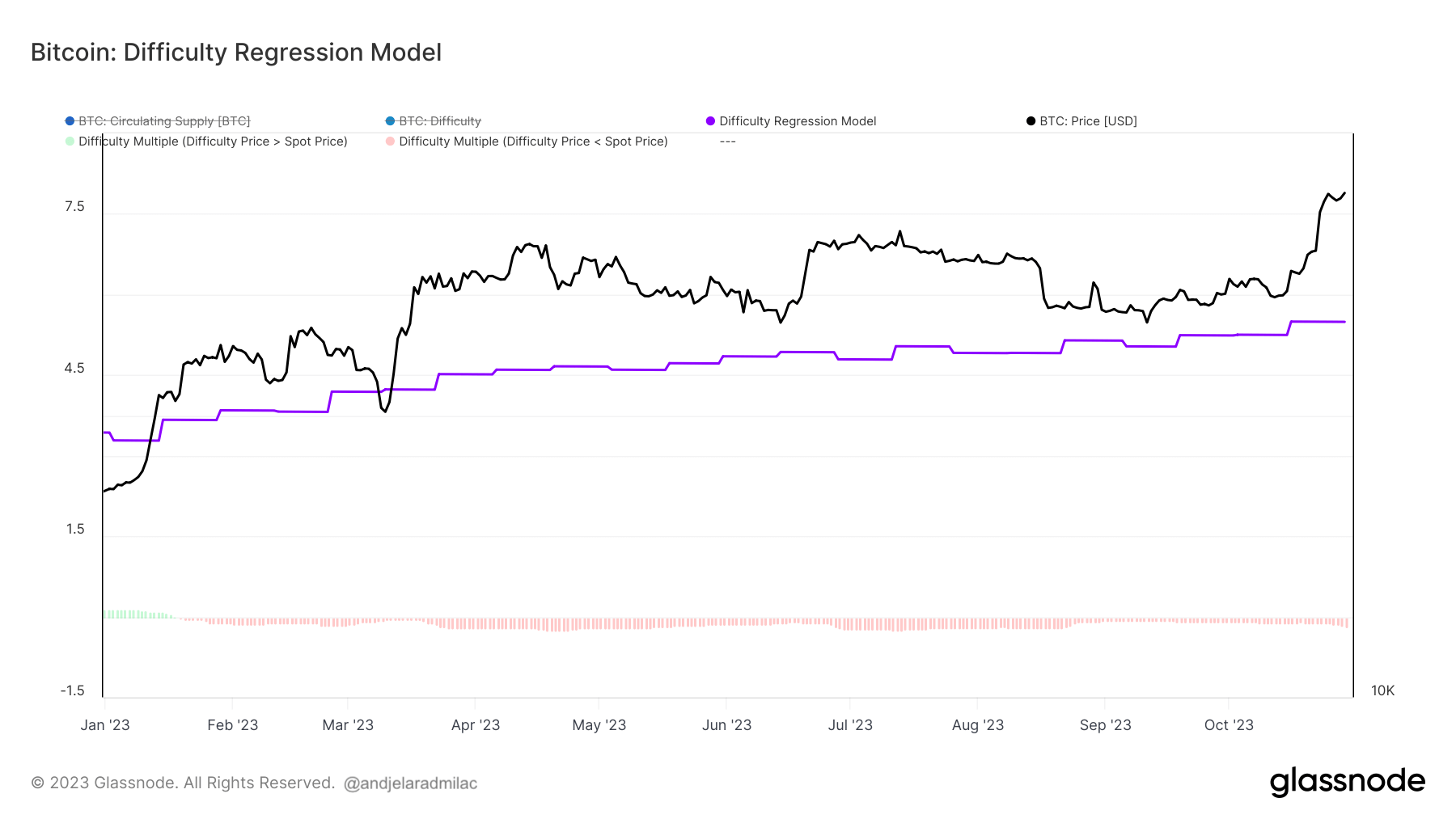

The difficulty regression model provides further clarity on the mining landscape. It represents the estimated cost of producing a Bitcoin. On October 15, this cost was $24,370, which modestly increased to $25,169 by October 29. This metric is crucial as it offers an understanding of the profitability landscape for miners. The growing disparity between the production cost and market price suggests a favorable profit margin, which could in turn, draw more participants to mining, augmenting the network’s overall security.

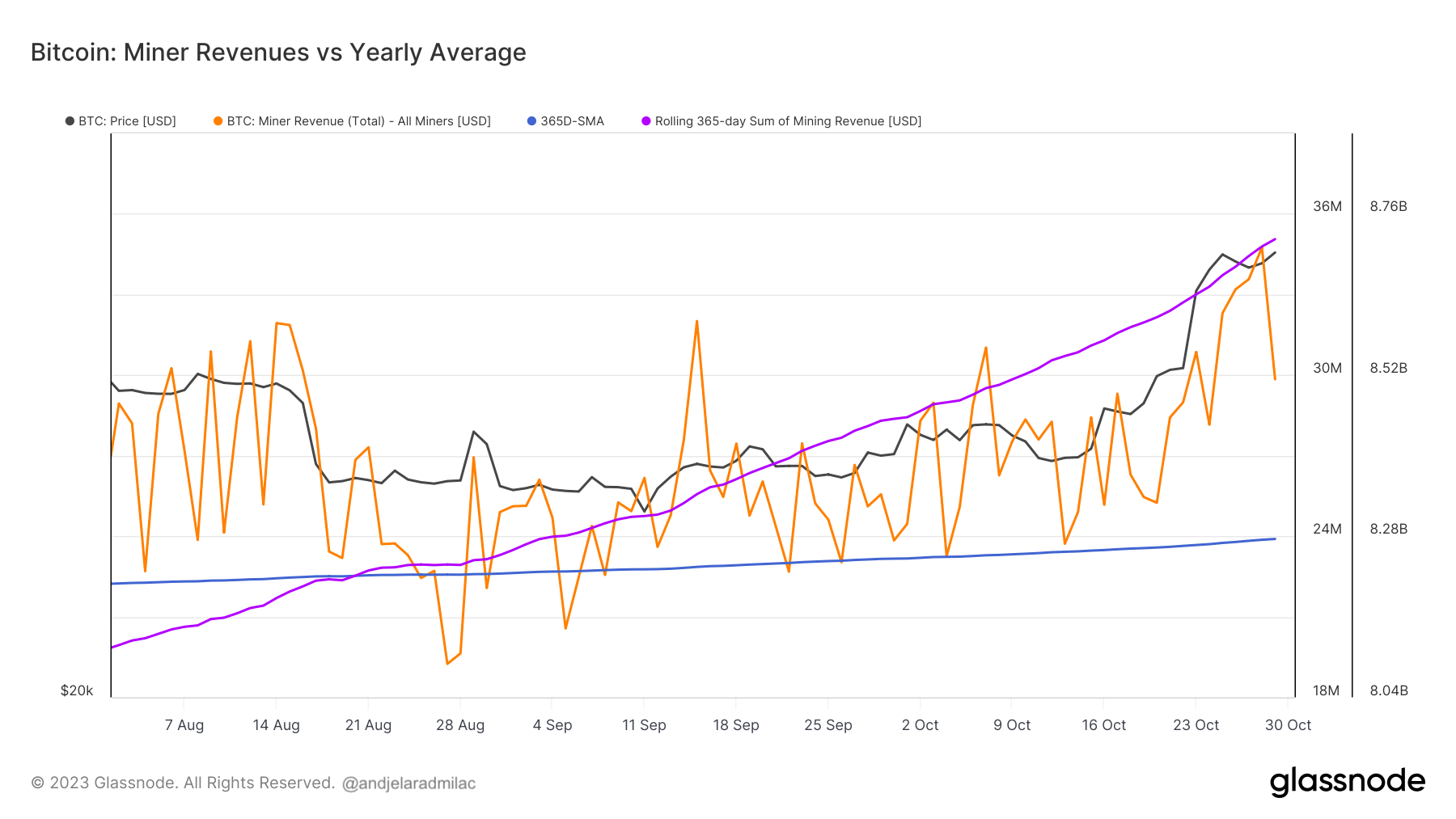

Miner revenue, another pivotal metric, underwent a significant change in October. As Bitcoin’s price escalated, so did the revenue for miners. The 365-day rolling sum of miner revenue, a comprehensive measure of their annual earnings, surpassed its 365-day simple moving average on September 9, and by October 29, it stood at a substantial $8.7 billion. This indicates a consistent and robust revenue stream for miners, which can be interpreted as a period of heightened activity and profitability.

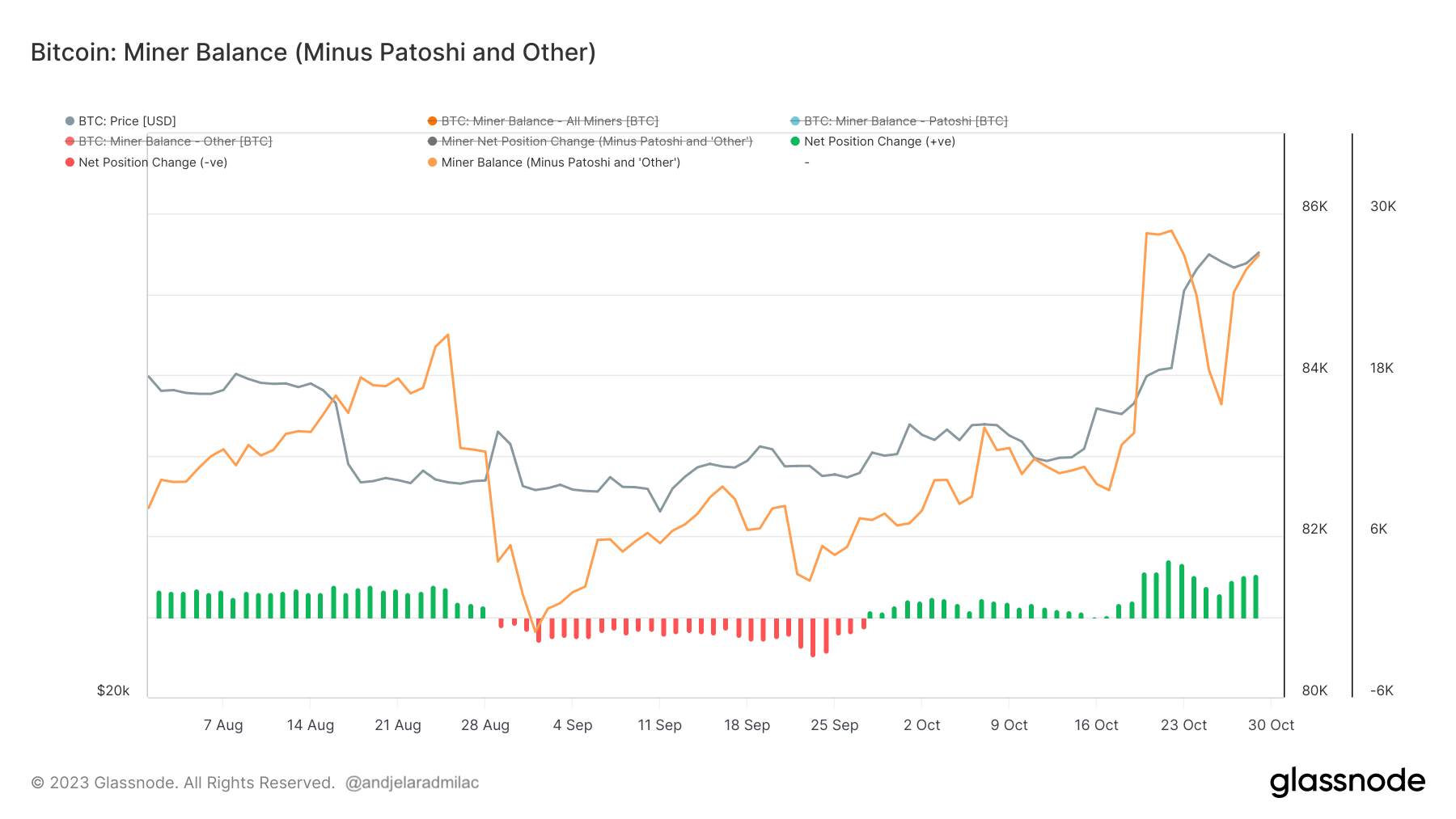

Lastly, the miner balance metric offers a window into miner sentiment and strategy. Excluding the Patoshi pattern, the balance rose from 82,800 BTC on October 15 to 85,500 BTC by October 23. Interestingly, after Bitcoin’s price exceeded $30,000, there was a decrease of around 2,000 BTC in this balance, suggesting some miners capitalized on the high prices. However, subsequent accumulation indicates a potential long-term bullish sentiment among miners, as they seem to anticipate further price appreciation.

In conclusion, when analyzed collectively, these metrics hint at a dynamic yet profitable environment for Bitcoin miners. The increased difficulty signifies a secure and robust network, the rising production cost against a surging market price indicates healthy profitability, the elevated revenue underscores sustained miner activity, and the evolving balances suggest strategic decision-making among miners. All these factors, taken together, reflect a market that is both competitive and optimistic.

The post Bitcoin miners navigate increasing difficulty for higher rewards appeared first on CryptoSlate.