The stock rose another 35% on Friday after Germany voted to decriminalize cannabis.

Source link

doubles

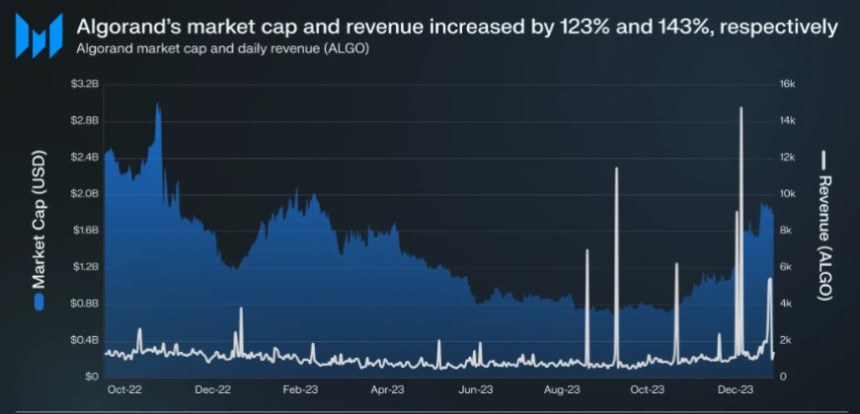

According to a recent report by Messari, smart contract platform Algorand (ALGO), showcased notable growth and outperformed the general crypto market during the fourth quarter of 2023.

Algorand Outperforms Crypto Market Growth

Per the report, Algorand experienced a surge in market capitalization during Q4 2023, with a significant growth rate of 123%. This substantial increase can be attributed to the overall positive momentum of the crypto market, which witnessed a 53% growth in market capitalization during the same period.

Transactions on the Algorand network also saw a significant uptick, increasing by 58% quarter-on-quarter (QoQ). Consequently, fee revenue rose by 60%, reaching its highest level in a year when measured in ALGO terms, while revenue in USD terms surged by an impressive 143%.

According to Messari, Algorand’s success can be attributed to its “thriving” ecosystem, which saw the launch of multiple innovative applications in Q4 2023. These applications covered diverse areas such as regulated and programmable euro, tokenized farmland, and a developer marketplace for selling code snippets.

The introduction of these applications further solidified Algorand’s position as a “dynamic and versatile” platform, attracting users from various domains, according to the report.

Moreover, Algorand witnessed a substantial increase in user adoption during Q4 2023, with the addition of 1.9 million new addresses, representing a 72% QoQ growth.

The platform also experienced a surge in transaction volume, with transactions surpassing 5.5 million towards the end of the quarter, marking the highest number recorded in the past year. Notably, ALGO transactions increased by 43% QoQ.

Messari further suggests that the rise in transactions can be attributed to the popularity of sticky applications like Lofty.ai, which boasted over 7,000 monthly active users, and TravelX, which issued over 2 million NFT plane tickets, with over 1 million issued in Q4 alone.

Decrease In Staked ALGO

Despite growth in key metrics, the report highlighted a decline in the amount of staked ALGO during Q4, with a 49% year-on-year (YoY) decrease. Messari attributed this decline to the reduction in rewards per governance period.

The diminishing rewards indicate a preference among users to utilize the native asset for transactions rather than committing it to governance. This is further supported by the notable 58% QoQ increase in transactions on the Algorand network.

Similarly, Algorand’s stablecoin market cap experienced a steady decline throughout the year, with a QoQ decrease of 43% and a YoY decrease of 74%.

Notably, Tether’s USDT stablecoin experienced a more severe fall on Algorand, with over $100 million withdrawn in Q3. However, Quantoz launched EURD on Algorand, issuing over 1 million euro-backed tokens in Q4, contributing to 1.4% of the stablecoin market cap on the platform.

Despite previous declines, Algorand’s decentralized finance (DeFi) total value locked (TVL) witnessed a significant growth of 109% in Q4 2023.

The platform’s DeFi ecosystem rebounded from a recent downturn, reaching its second-highest level in the past year, with a 12% YoY increase. Notably, Folks Finance experienced substantial growth, doubling its market share value from 55% to 58%, while Pact and Tinyman accounted for approximately 14% of each of the DeFi TVL market share in Q4.

As of the latest update, the ALGO token is currently trading at $0.1753. It has experienced significant declines across various time frames, with notable decreases of 8.7%, 12.4%, and 18.5% in the past fourteen days, thirty days, and one year, respectively.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Bitcoin (BTC) began 2024 on a positive note gaining by 3.18% in the first week of the year, according to data from CoinMarketCap. The premier cryptocurrency is expected to herald in a bull crypto season, with many investors expecting immediate approval of Bitcoin spot ETF proposals by various asset managers.

However, regardless of the decision of the US Securities and Exchange Commission (SEC) in the next few days, crypto analyst Ali Martinez believes Bitcoin is still poised for massive gains in 2024 as there is another bullish factor in play.

Bullish 2024 For Bitcoin With Or Without ETF Approval – Analyst

In an X post on January 6, Martinez expressed much optimism about Bitcoin’s potential price performance in 2024. He stated that irrespective of developments in the Bitcoin spot ETF saga, BTC is still set for major price surges due to another bullish narrative – namely, the Bitcoin Halving.

To explain, the Bitcoin Halving is an event in which the block rewards for miners are reduced by 50%. It happens every four years, with the first occurrence being in 2012. The halving event causes a reduction in BTC supply in comparison to demand, causing scarcity which leads to a price increase.

Whatever happens with the #Bitcoin ETF, remember we have another bullish narrative this year: The $BTC Halving!

It has historically been a catalyst for major price surges. Just take a look at the percentage increases in #BTC price following past halvings. 👇 pic.twitter.com/FF1F99l34c

— Ali (@ali_charts) January 5, 2024

Martinez highlighted this fact stating that historically, there has been a significant increase in Bitcoin’s price following past halvings. When the first halving occurred on November 28, 2012, BTC was trading at around $12. In the next year, the token had attained a new price of $1,000.

A similar phenomenon was noted after the second halving on July 9, 2016, at which Bitcoin was valued at $670. However, By December 2017, BTC had surged to an all-time high of $19,700. The third halving event took place in May 2020, with Bitcoin being traded at $8,821. By November 2021, BTC had surged by 700%, attaining its current all-time high of $68,783.

Based on this price history, Martinez believes that BTC investors are well placed to reap large profits in the coming months as the next Bitcoin halving is set for April 2024. He postulates that these cyclical gains should remain constant, notwithstanding the SEC’s approval for Bitcoin spot ETF or not.

BTC Price Overview

At the time of writing, Bitcoin trades at $43,665, experiencing a slight decline of – 0.30% in the last 24 hours. On a larger scale, the leading cryptocurrency has demonstrated resilience over the past seven days, posting a noteworthy gain of 4.07%.

Over the last year, BTC’s performance has been remarkable, witnessing a substantial surge of 159.94%. However, amidst market fluctuations, there is a noticeable dip in daily trading volume, down by 22.25%, which is currently valued at $26.8 billion.

BTC trading at $43, 691.10 on the hourly chart | Source: BTCUSDT chart on Tradingview.com

Featured image from Mint, chart from Tradingview

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Omega Therapeutics stock more than doubles on Novo Nordisk obesity drug research pact

Novo Nordisk has entered research collaboration agreements with Omega Therapeutics Inc. and Cellarity Inc. on new treatments for obesity management, sending Omega’s stock up 109% on Thursday.

The stock was on track for its biggest one-day gain since it went public in 2021. Volume of more than 55 million shares traded compared with the daily average of 246,500 over the last 65 days.

The Danish developer of weight-loss drugs Ozempic and Wegovy said the agreements are the first to be drawn up under an existing partnership with Cambridge, Mass.-based biotech Flagship Pioneering.

The Omega

OMGA,

collaboration will leverage that company’s proprietary platform technology to develop an epigenomic controller that aims to enhance metabolic activity. Omega, which is also based in Cambridge, is a clinical-stage biotech specializing in programmable epigenomic mRNA medicines to treat or cure a range of diseases.

Read now: Five obesity-drug trends to watch in 2024: Who can compete with Eli Lilly and Novo Nordisk?

The Cellarity collaboration aims to discover biological drivers of metabolic dysfunction-associated steatohepatitis, or MASH, and will seek to develop a small molecule therapy against this disease. MASH is a chronic liver disease with a high unmet patient need for which there is currently no treatment.

Cellarity, based in Somerville, Mass., was created by Flagship Pioneering and launched in December 2019 with the aim of developing medicines by studying and altering the cellular signatures of disease.

Novo Nordisk

NVO,

NOVO.B,

will reimburse R&D costs for each company and Flagship’s Pioneering Medicines will be eligible to receive up to $532 million in upfront and milestone payments, along with tiered royalties.

“Novo Nordisk is committed to advancing new treatment options for people living with cardiometabolic diseases,” Novo Nordisk’s Chief Scientific Officer Marcus Schindler said in a statement.

“To that end, it is essential that we complement our internal research with external innovation and work with partners who are bringing forward cutting-edge technology.”

More than 800 million adults globally are living with obesity, according to Novo Nordisk. Most of the existing therapies focus on appetite regulation. The Omega platform seeks to use the body’s innate mechanisms to control cellular identity and gene expression and enhance thermogenesis, or the production of heat within tissues to raise body temperature, a natural metabolic function that regulates overall energy balance.

“Precision epigenomic control is an emerging approach to medicine that allows us to pre-transcriptionally modulate gene expression with an unparalleled level of specificity,” said Mahesh Karande, president and CEO of Omega Therapeutics.

Novo’s U.S.-listed shares were up 3%.

See now: Novo Nordisk, maker of Ozempic and Wegovy, to invest more than $6 billion to expand production

Russian President Vladimir Putin attends a joint press statement with his Kyrgyz counterpart after talks in Bishkek on Oct. 12, 2023.

Vyacheslav Oseledko | Afp | Getty Images

There has been long-standing speculation that Russian President Vladimir Putin uses body doubles to stand in for him at public engagements for health or security reasons, but the Kremlin ridiculed the rumors Tuesday.

Asked by reporters to comment on an unsourced report on a Russian Telegram channel claiming Putin had suffered a serious health episode on Sunday — a report picked up by some Western media outlets nonetheless — Kremlin spokesman Dmitry Peskov laughed.

“Everything is fine with him, this is absolutely another fake,” Peskov said, according to a Reuters translation, denying a further question on whether Putin uses any body doubles.

“This belongs to the category of absurd information hoaxes that a whole series of media discuss with enviable tenacity. This evokes nothing but a smile,” Peskov added.

Putin has built much of his leadership on an image of him as an active, macho “tough guy,” and has even been photographed topless when riding a horse during fishing and hunting trips.

Aged 71, Putin is widely expected to run for the presidency again in 2024 following changes to Russia’s constitution allowing him to do so, although he has not confirmed this.

Putin himself has denied using body doubles but said in a 2020 interview with Russia’s TASS news agency that he had been offered the opportunity to use one for security reasons, during Russia’s second war against Chechnya in the early 2000s, but had not done so.

“I refused to have doubles. It was during the most difficult time of the fight against terrorism,” Putin said, without giving further details.

It’s not the first time the Kremlin has rebuffed such rumors, which typically abound when Putin is pictured appearing slightly different, such as having a different skin complexion or not wearing a watch, for example.

In April, Putin’s spokesman Peskov again rejected the body double claims, saying, “you have probably heard that he [Putin] has very many doubles who work instead of him while he sits in a bunker.”

Calling it “yet another lie,” Peskov said, in comments published by TASS, that “as a matter of fact, he has always been and is mega-active. We can hardly keep up with him – those who work with him. His energy is enviable and one can only wish to be as healthy as he is,” Peskov said.

“Of course, he doesn’t sit in any bunkers. This is also a lie,” Peskov added.

The president, a former Judo champion, is said to be very wary of his health, with extremely strict measures introduced during the Covid-19 pandemic to limit his exposure to the infectious disease.

Nigerian SEC doubles down on Binance warning despite its recent approval in Dubai

The Nigerian Securities and Exchange Commission (SEC) reiterated its warning that Binance’s operation within the country was illegal, according to a July 28 statement.

In its new notice, the regulator specifically mentioned Binance’s official website, stating that:

“The Commission again reiterates that the activities of Binance, and any such other platform through which the Company solicits investors is neither registered nor regulated by the Commission and its operations in Nigeria are therefore illegal.”

As of press time, Binance has yet to respond to CryptoSlate’s request for comment.

Despite the Nigerian SEC warning, Binance remains a top crypto platform in the African country. The exchange cemented itself as a market leader following FTX’s collapse, with its USDT/Naira trading pair approaching $500,000 in the last 24 hours, according to data on the platform.

Global Regulatory Concerns

Meanwhile, the warning is coming on the heels of Binance’s recent regulatory approval in Dubai after suffering multiple setbacks in Europe. Earlier today, on July 31, the exchange revealed that it became the first digital asset exchange to receive an Operational Minimum Viable Product (MVP) license within the region, allowing it to trade in the area.

After failing to get the appropriate regulatory approval, Binance has exited several European markets, including the Netherlands, Cyprus, Germany, and the U.K. The exchange’s spokesperson stated that the firm was focused on complying with the forthcoming Markets in Crypto Assets (MiCA) regulations to offer its services in Europe.

Binance Nigeria

Further, in June, the Nigerian SEC declared Binance Nigeria Limited’s operations illegal and urged the investing public to desist from using the platform.

Binance clarified that the Binance Nigeria firm mentioned by the Nigerian financial watchdog was unaffiliated with Binance.com, and CEO Changpeng ‘CZ’ Zhao stated that the exchange issued a cease and desist notice to the unaffiliated ‘scam’ entity. However, the new statement indicates that the Nigerian SEC has doubled down on its warning about Binance.

The post Nigerian SEC doubles down on Binance warning despite its recent approval in Dubai appeared first on CryptoSlate.