JPMorgan has warned of a downside risk in crypto markets, citing subdued crypto venture capital flows. The global investment bank’s analysts also remain cautious about the U.S. Securities and Exchange Commission (SEC) greenlighting spot ethereum exchange-traded funds (ETFs) in May. Crypto Market’s Downside Risk Warning Global investment banking giant JPMorgan published a report on Thursday, […]

JPMorgan has warned of a downside risk in crypto markets, citing subdued crypto venture capital flows. The global investment bank’s analysts also remain cautious about the U.S. Securities and Exchange Commission (SEC) greenlighting spot ethereum exchange-traded funds (ETFs) in May. Crypto Market’s Downside Risk Warning Global investment banking giant JPMorgan published a report on Thursday, […]

Source link

downside

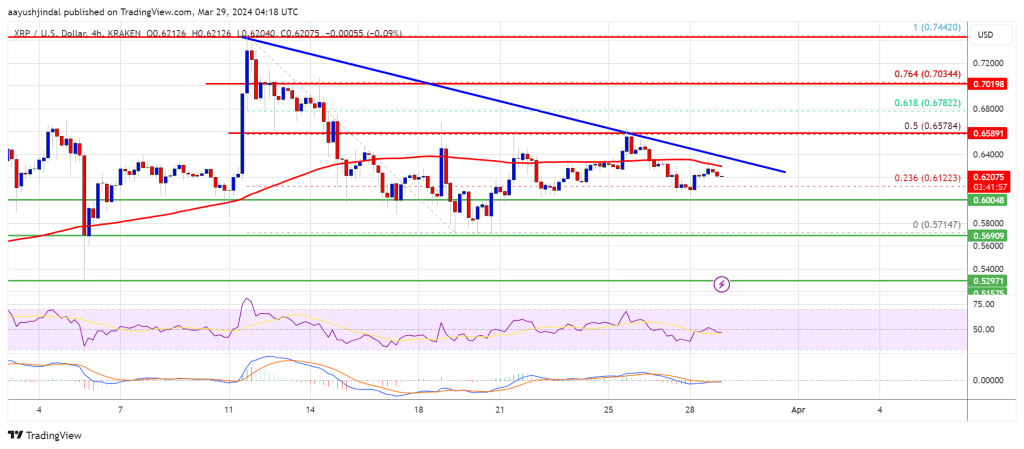

XRP price is holding gains above the $0.60 zone. The price could gain bearish momentum if there is a close below the $0.570 support zone.

- XRP is facing a major hurdle near the $0.6580 zone.

- The price is now trading below $0.640 and the 100 simple moving average (4 hours).

- There is a key bearish trend line forming with resistance near $0.640 on the 4-hour chart of the XRP/USD pair (data source from Kraken).

- The pair could gain bearish momentum if there is a close below the $0.5720 support.

XRP Price Faces Uphill Task

After a steady decline, XRP price found support near the $0.5720 level. A low was formed at $0.5714 and the price started a fresh increase, like Bitcoin and Ethereum.

There was a move above the $0.5880 and $0.600 resistance levels. The price cleared the 23.6% Fib retracement level of the downward wave from the $0.7442 swing high to the $0.5714 low. The bulls pushed the price above the $0.620 resistance zone, but the bears are active near $0.640.

Ripple’s token price is now trading above $0.6320 and the 100 simple moving average (4 hours). On the upside, immediate resistance is near the $0.640 zone. There is also a key bearish trend line forming with resistance near $0.640 on the 4-hour chart of the XRP/USD pair.

The next key resistance is near $0.6580. It is close to the 50% Fib retracement level of the downward wave from the $0.7442 swing high to the $0.5714 low. A close above the $0.6580 resistance zone could spark a strong increase. The next key resistance is near $0.700. If the bulls remain in action above the $0.700 resistance level, there could be a rally toward the $0.7440 resistance. Any more gains might send the price toward the $0.800 resistance.

More Losses?

If XRP fails to clear the $0.640 resistance zone, it could start another decline. Initial support on the downside is near the $0.600 zone.

The next major support is at $0.5720. If there is a downside break and a close below the $0.5720 level, the price might accelerate lower. In the stated case, the price could retest the $0.5250 support zone.

Technical Indicators

4-Hours MACD – The MACD for XRP/USD is now losing pace in the bullish zone.

4-Hours RSI (Relative Strength Index) – The RSI for XRP/USD is now above the 50 level.

Major Support Levels – $0.600, $0.5720, and $0.5250.

Major Resistance Levels – $0.640, $0.6580, and $0.700.

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

XRP Price Prediction – Downside Thrust Possible Before Fresh Surge To $0.72

XRP price is moving lower from the $0.732 resistance. The price is now at risk of more losses toward the $0.550 support before the bulls take a stand.

- XRP started a downside correction below $0.638 and $0.612.

- The price is now trading below $0.625 and the 100 simple moving average (4 hours).

- There is a key declining channel forming with resistance near $0.622 on the 4-hour chart of the XRP/USD pair (data source from Kraken).

- The pair dive toward the $0.550 support before the bulls take a stand.

XRP Price Turns Red

In the past few days, XRP saw a steady decline from the $0.740 zone. There was a move below the $0.685 and $0.638 support levels. The price even dived below the $0.612 support, underperforming Bitcoin and Ethereum.

There was a recovery wave from $0.572, but the bears were active near $0.638. A high was formed near $0.6385 and the price is now moving lower. There was a break below the 50% Fib retracement level of the upward move from the $0.5723 swing low to the $0.6385 high.

XRP is now trading below $0.625 and the 100 simple moving average (4 hours). There is also a key declining channel forming with resistance near $0.622 on the 4-hour chart.

On the upside, immediate resistance is near the $0.615 level. The first major resistance is near the $0.622 zone or the 100 simple moving average (4 hours) or the channel upper zone. A close above the $0.622 resistance zone could spark a steady increase.

Source: XRPUSD on TradingView.com

The next key resistance is near $0.638. If the bulls remain in action above the $0.638 resistance level, there could be a rally toward the $0.700 resistance. Any more gains might send XRP toward the $0.720 resistance.

More Downsides?

If XRP fails to clear the $0.622 resistance zone, it could start a fresh decline. Initial support on the downside is near the $0.588 zone.

The next major support is at $0.572. If there is a downside break and a close below the $0.572 level, XRP price might accelerate lower. In the stated case, the price could retest the $0.540 support zone.

Technical Indicators

4-Hours MACD – The MACD for XRP/USD is now gaining pace in the bearish zone.

4-Hours RSI (Relative Strength Index) – The RSI for XRP/USD is now below the 50 level.

Major Support Levels – $0.588, $0.572, and $0.540.

Major Resistance Levels – $0.622, $0.638, and $0.700.

AMC shares fall after Citigroup opens downside 30-day catalyst watch for stock

AMC Entertainment Holdings Inc.’s stock fell 1.7% premarket Monday, after Citigroup opened a downside 30-day catalyst watch for the stock.

The move comes as investors await a chancery court decision that’s expected to clear the way for the company to convert its AMC Preferred Equity units

APE,

known as APEs, into common stock. The APEs were unchanged in premarket trades Monday.

Related: AMC shares fall, while APE units rise as stock-conversion battle reaches Delaware Chancery Court

AMC

AMC,

shareholders voted in support of the company’s proposal to convert the APEs in March, but the company was then hit with a class-action lawsuit. AMC subsequently reached an agreement to settle the court fight but a chancery judge must approve the settlement proposal after a two-day hearing last week. A ruling is expected within weeks, according to the Wall Street Journal.

On Thursday an AMC shareholder opposed to the settlement told the court that some investors felt the cinema chain had “stabbed them in the back,” Reuters reported.

Related: AMC shares make biggest gain in nearly three months ahead of stock-conversion hearing

Citigroup is expecting a ruling in favor of the proposal. “As a result, we would expect the value of AMC common units and APE units to converge,” analysts wrote in a note. “Given AMC’s common units trade at a premium to the APE units, we would expect downward pressure on AMC shares in the coming days.”

Last week shares of AMC made their biggest gain in nearly three months ahead of the stock conversion hearing. Shares of the movie-theater chain and meme-stock darling have risen 8.1% in 2023, while the APEs have risen 23.4%.

Related: Largest investor in AMC’s APE stock sells again, cuts stake to below 10%

Of eight analysts surveyed by FactSet, three had a hold rating and five had a sell rating for AMC.