Bloomberg Intelligence’s senior commodity strategist, Mike McGlone, says bitcoin is “becoming an alternative currency on a global basis,” noting that “The world’s going towards intangible assets and bitcoin is the most significant in cryptos.” However, the strategist warned that as bitcoin’s price approaches $70,000, a key test for the cryptocurrency may come “when the U.S. […]

Bloomberg Intelligence’s senior commodity strategist, Mike McGlone, says bitcoin is “becoming an alternative currency on a global basis,” noting that “The world’s going towards intangible assets and bitcoin is the most significant in cryptos.” However, the strategist warned that as bitcoin’s price approaches $70,000, a key test for the cryptocurrency may come “when the U.S. […]

Source link

drawdown

BNB Price Could See Major Drawdown If It Fails To Stay Above This Support

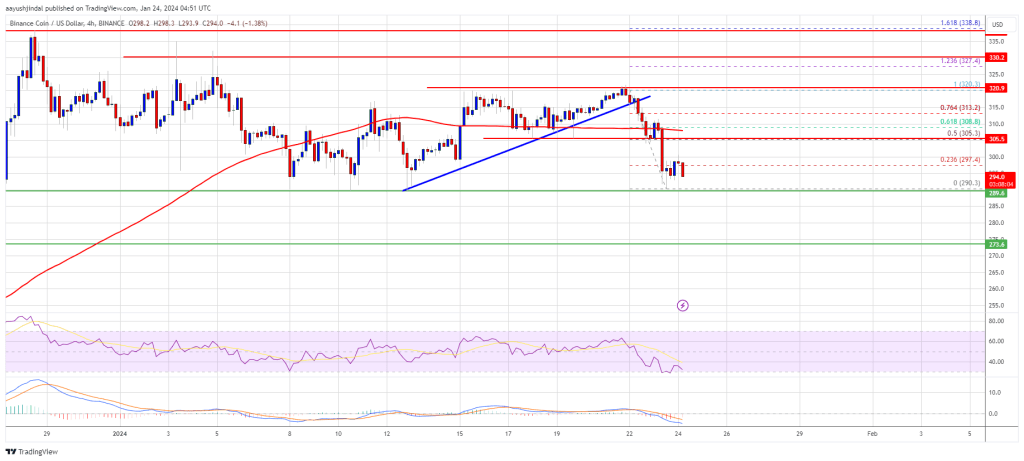

BNB price started a fresh decline from $320 resistance zone. The price is now retesting the $290 support and is at risk of more downsides.

- BNB price is gaining bearish momentum from the $320 resistance.

- The price is now trading below $310 and the 100 simple moving average (4 hours).

- There was a break below a key bullish trend line with support at $315 on the 4-hour chart of the BNB/USD pair (data source from Binance).

- The pair might continue to move down if it fails to stay above the $290 support.

BNB Price Takes Hit

In the past few days, BNB price made more than three attempts to clear the $320 resistance zone. However, the bears remained active and protected more gains.

As a result, there was a bearish reaction below the $315 level, like Bitcoin and Ethereum. There was a break below a key bullish trend line with support at $315 on the 4-hour chart of the BNB/USD pair. The pair even declined below the $300 level and tested the key support at $290.

A low is formed near $290.3, and the price is now struggling to correct higher. BNB price is now trading below $310 and the 100 simple moving average (4 hours). Immediate resistance is near the $298 level or the 23.6% Fib retracement level of the recent decline from the $320 swing high to the $290 low.

Source: BNBUSD on TradingView.com

The next resistance sits near the $305 level. It is close to the 50% Fib retracement level of the recent decline from the $320 swing high to the $290 low. A clear move above the $305 zone could send the price further higher. In the stated case, BNB price could test $320. A close above the $320 resistance might set the pace for a larger increase toward the $335 resistance. Any more gains might call for a test of the $350 level.

More Downsides?

If BNB fails to clear the $305 resistance, it could continue to move down. Initial support on the downside is near the $290 level.

The next major support is near the $285 level. The main support sits at $272. If there is a downside break below the $272 support, the price could drop toward the $250 support. Any more losses could initiate a larger decline toward the $220 level.

Technical Indicators

4-Hours MACD – The MACD for BNB/USD is gaining pace in the bearish zone.

4-Hours RSI (Relative Strength Index) – The RSI for BNB/USD is currently below the 50 level.

Major Support Levels – $290, $285, and $272.

Major Resistance Levels – $298, $305, and $320.

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Bitcoin falls 20% from YTH high with further 5% daily drawdown in cascading liquidation event

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Oops…you must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.