The over-the-counter (OTC) institutional cryptocurrency market saw a dramatic increase in spot transaction volume in the first half of 2024. A recent report by Finery Markets reveals a 95% year-over-year growth, highlighting a significant rise in institutional engagement. Institutional Interest Drives Massive Growth in Crypto’s Over-the-Counter Industry The Finery Markets team analyzed data from two […]

The over-the-counter (OTC) institutional cryptocurrency market saw a dramatic increase in spot transaction volume in the first half of 2024. A recent report by Finery Markets reveals a 95% year-over-year growth, highlighting a significant rise in institutional engagement. Institutional Interest Drives Massive Growth in Crypto’s Over-the-Counter Industry The Finery Markets team analyzed data from two […]

Source link

driven

Bitwise CIO says Bitcoin’s dip driven by ETF overenthusiasm, not Grayscale outflows

Bitwise chief investment officer Matt Hougan attributed the recent decline in the crypto market to overinflated expectations regarding the potential impact of the newly launched Bitcoin exchange-traded funds (ETFs).

In a Jan. 23 post on X (formerly Twitter), Hougan explained that the current market sell-off is driven by what he terms an “ETF Expectations-led” phenomenon.

According to him, investors anticipating “larger net flows into (these) ETFs” front-ran the approval news by piling into both spot and derivatives positions on the flagship digital asset. However, with the expected inflows not materializing, these investors are now “unwinding that bet,” prompting the current market situation.

“Just as the market overestimated the short-term impact of ETFs, it is underestimating the long-term impact,” Hougan concluded.

Since the Securities and Exchange Commission (SEC) approved the launch of several spot Bitcoin ETFs in the U.S., the value of the top cryptocurrency has been on a downturn. The digital asset fell to as low as under $39,000 on Jan. 23 but has recovered to $40,389 as of press time, according to CryptoSlate’s data.

This downward trend raised concerns within the crypto community, with some attributing it to the outflows from Grayscale’s Bitcoin Trust ETF (GBTC).

Contrary to this sentiment, analysts, including CryptoQuant founder Ki Young Ju, share a perspective aligned with Hougan’s.

Young Ju recently emphasized that Bitcoin operates in a futures-driven market, making it less susceptible to spot-selling activities from GBTC-related issues.

“BTC falls due to derivative market selling, not GBTC. OTC (over the counter) markets are very active, but no price impact,” he added.

ETFs are BTC net buyers.

Meanwhile, the Bitwise investment chief also clarified that the recently launched ETFs are net buyers of Bitcoin despite the outflows emanating from GBTC.

Hougan pointed out that while GBTC functions as a net seller, the cumulative BTC acquisitions from the new ETFs surpass that being offloaded by Grayscale.

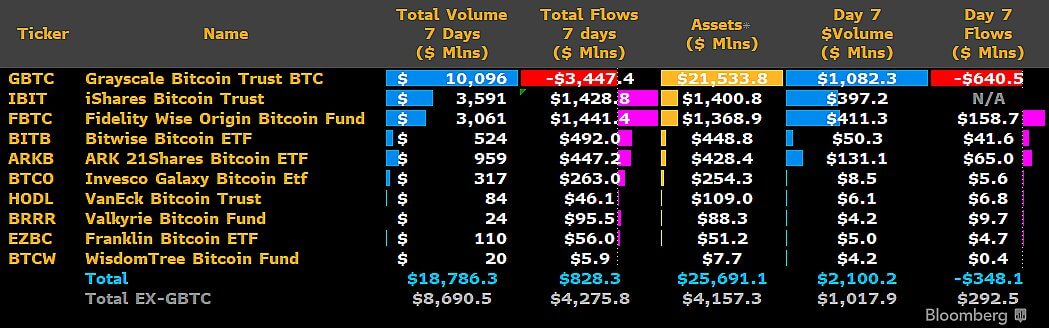

Bloomberg data corroborates Hougan’s view. As of Jan. 23, GBTC’s outflows stood at $3.45 billion, while the newly introduced nine ETFs had a combined inflow of more than $4 billion in assets under management.

This data stresses a compelling narrative—that the ETFs have seen substantial interest from the community, leading to a swift and significant accumulation of the leading cryptocurrency.

Gensler testimony — Crypto enforcement actions driven by “wide-ranging noncompliance”

The United States House Financial Services Committee will hear how the Securities and Exchange Commission is changing its oversight and rules to keep pace with technological advancements, including cryptocurrencies and artificial intelligence.

SEC Chair Gary Gensler is set to outline how the U.S. securities regulator is updating its rules to align with “technology and business models of the 2020s.” As is customary, Gensler’s opening remarks have been published ahead of the Sept. 27 hearing, outlining the SEC’s wider oversight of securities and exchanges in the United States.

There is particular interest in the SEC’s approach to the cryptocurrency sector, which has copped criticism for its “regulate-by-enforcement” approach that has been criticized for quashing innovation and adoption in America.

Related: Ripple CTO says ‘tide is turning’ on US regulatory environment

Gensler will directly address two areas of emerging technology, namely predictive data analytics and cryptocurrencies. The SEC chair is set to stress that investors and issuers involved in “crypto asset securities markets” deserve protections afforded by securities laws.

Referring to the establishment of the 1933 Securities Act, Gensler said that the U.S. Congress made a decision to include a list of more than 30 items in the definition of a security, including the term “investment contract.”

“As I’ve previously said, without prejudging any one token, the vast majority of crypto tokens likely meet the investment contract test.”

Gensler is set to tell the House Financial Services Committee that the SEC’s view that most cryptocurrencies are subject to securities laws also necessitates that intermediaries such as exchanges, brokers and dealers must comply with these laws as well.

The SEC chair suggests that the wider industry has been guilty of “wide-ranging noncompliance with the securities laws,” which has led to a number of enforcement actions. Gensler added that the SEC has looked to address the cryptocurrency “security markets” sector through rulemaking.

Related: US lawmakers call on SEC chair to approve spot Bitcoin ETFs ‘immediately’

This included a reopening release published in April 2023 that reiterated the applicability of existing SEC rules to platforms that trade cryptocurrencies, including decentralized finance (DeFi) protocols. Included in the release were further guidelines for systems that would fall under a new, proposed exchange definition.

“While our current investment adviser custody rule already applies to crypto funds and securities, our proposal updating it would cover all crypto assets and enhance the protections that qualified custodians provide.”

According to the SEC chair, predictive data analytics and artificial intelligence have brought about a “transformational age,” driving efficiencies across the economy. The potential of the technology stands to increase financial inclusion and user experience, but it also poses risks of exploitation.

“This also raises the possibilities that conflicts may arise to the extent, for example, that advisers or broker-dealers are optimizing to place their interests ahead of their investors’ interests.”

Gensler’s address also notes an SEC proposal in July 2023 that would require firms to analyze conflicts of interest arising from the use of predictive data analytics to interact with investors. These potential conflicts would need to be eliminated or neutralized by the firms concerned.

It remains to be seen whether Gensler will be drawn to comment on ongoing legal battles with Coinbase and Binance.US, two U.S.-based cryptocurrency exchanges that the regulator has charged with a litany of alleged securities laws violations.

Magazine: ‘AI has killed the industry’: EasyTranslate boss on adapting to change

Weekly mortgage demand rises, driven by a strange surge in refinancing

A for sale sign in front of a home in Arlington, Virginia, on August 22, 2023.

Andrew Caballero-Reynolds | AFP | Getty Images

Mortgage rates rose again last week, and so did demand for refinances, which at face value doesn’t make a lot of sense.

Applications to refinance a home loan jumped 13% last week compared with the previous week, according to the Mortgage Bankers Association’s seasonally adjusted index. Application volume was still 29% lower than the same week one year ago.

Refinancing demand usually moves in the opposite direction as mortgage rates, but that was not the case. Last week the average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($726,200 or less) increased to 7.31% from 7.27%, with points remaining unchanged from 0.72 (including the origination fee) for loans with a 20% down payment.

It may be that borrowers are concerned rates could go even higher, and so they’re jumping in now. It may also be that the number of refinances are so small right now that any minor change results in a big percentage move.

Applications for a mortgage to purchase a home increased 2% for the week and were 26% lower than the same week one year ago.

“Purchase applications increased for conventional and FHA loans over the week,” said Joel Kan, an MBA economist in a release. “Homebuyers continue to face higher rates and limited for-sale inventory, which have made purchase conditions more challenging.”

With home prices now rising again, the average loan size on a purchase application was $416,800, the highest level in six weeks. Demand may be coming back, because more homes have recently come on the market. The overall level of supply, however, is still quite low, which is leading to bidding wars again.

Mortgage rates haven’t moved much this week, as investors wait to hear the results of Wednesday’s Federal Reserve meeting and commentary from Chair Jerome Powell on the future of interest rates.