Deribit FZE, an entity owned by crypto derivatives platform Deribit, has secured a conditional virtual asset service provider from the Dubai virtual assets regulator. The license, which covers spot and derivative trading, will remain non-operational until Deribit meets the regulator’s localization requirements. Meeting Dubai’s Localization Requirements Deribit FZE, a wholly owned entity of the crypto […]

Deribit FZE, an entity owned by crypto derivatives platform Deribit, has secured a conditional virtual asset service provider from the Dubai virtual assets regulator. The license, which covers spot and derivative trading, will remain non-operational until Deribit meets the regulator’s localization requirements. Meeting Dubai’s Localization Requirements Deribit FZE, a wholly owned entity of the crypto […]

Source link

Dubai

ftNFT International Awards 2024 Announces Winners at a Glamorous Ceremony in Dubai

PRESS RELEASE. Dubai, UAE (March 1, 2024) – The ftNFT Annual International Awards celebrated the 2024 ceremony on February 27 at Dubai’s iconic Armani restaurant, unveiling this year’s winners. The event, known for its exclusivity and commitment to advancing the NFT and blockchain sectors, assembled premier talents and groundbreaking projects. These awards spanned a variety […]

PRESS RELEASE. Dubai, UAE (March 1, 2024) – The ftNFT Annual International Awards celebrated the 2024 ceremony on February 27 at Dubai’s iconic Armani restaurant, unveiling this year’s winners. The event, known for its exclusivity and commitment to advancing the NFT and blockchain sectors, assembled premier talents and groundbreaking projects. These awards spanned a variety […]

Source link

Following the approval of its license by the Dubai Virtual Assets Regulatory Authority, OKX will be offering spot services and spot pairs to UAE residents. This comes as the country is establishing itself as a welcoming hub for crypto business.

Crypto businesses looking to expand all over the world often face the challenge of needing to secure approval from various regulators to get started. As we’ve seen in the past, this is not always the most straightforward process and can come with a horde of challenges. Thankfully for OKX Middle East Fintech FZE, the Middle Eastern subsidiary of OKX, it will be able to begin its operations in the UAE. This comes as the company has secured a license from the Dubai Virtual Assets Regulatory Authority (VARA).

OKX to Begin Operations in the Middle East

This news was announced on January 16, 2024, and with it, the company can begin offering spot services and spot pairs to both institutional and qualified retail customers. According to OKX, it will begin operations within the next few weeks and these services can be accessed from both its main exchange and its app.

The company’s management has also made it clear that it will be ambitious in pursuing the UAE market.

“This allows us to offer services to UAE residents, which we’re going after, including spot trading and fiat-related services, which means deposits and withdrawals of local currency, United Arab Emirates dirham (AED),” said Rifad Mahasneh, OKX General Manager for the MENA Region.

Some of the trading pairs that UAE residents will have access to include AED/BTC and AED/ETH. It is quite fitting that OKX is targeting the UAE market considering just how accepting it has been of cryptocurrency in the past.

Back in 2016, the country launched a blockchain strategy, making it one of the first in the world to do so. This was followed up with a regulatory framework for cryptocurrency in 2018 which, again, preceded the rest of the world. Historically, the UAE has been a hub for tech development and entrepreneurship and its population has seemed very open to new innovations. Even now, the UAE has the highest public adoption of cryptocurrency, which means that digital assets are well-known to the public.

With this sort of foundation, companies like OKX have a viable environment to engage in crypto businesses, as well as the support of the government. In 2022, the UAE formed the Virtual Asset Regulatory Authority (VARA), which granted the license to OKX. The aim of VARA is to develop regulations that help the crypto sector grow and position the UAE as a global leader in the cryptocurrency industry while still protecting the consumer.

Around the world, we have seen countless examples of countries being indifferent, nonchalant and outright hostile to the crypto industry. Fortunately, it seems to not be the case with the UAE, to the benefit of all involved.

next

Blockchain News, Cryptocurrency News, News

You have successfully joined our subscriber list.

XRP, TON Are Given Green Light by the Dubai International Financial Centre (DIFC) for Legal Use

More than 4,300 registered companies operating within the DIFC can now integrate XRP and TON tokens into their virtual asset services.

The Dubai Financial Services Authority (DFSA) has added XRP (XRP) and Toncoin (TON) to the list of tokens that can be legally utilized within the Dubai International Financial Centre (DIFC). Now the total list of approved coins is brought to five, with Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC) authorized back in 2022.

Recognition by the Dubai International Financial Centre is a significant milestone for tokens that can expand their use. Notably, DIFC is the leading international financial hub in the Middle East, Africa, and South Asia, with more than 4,300 registered companies located in this special economic zone. All those companies operating within the DIFC can now integrate XRP and TON tokens into their virtual asset services.

Back in 2020, Ripple chose the DIFC as the location for its MENA headquarters due to Dubai’s innovation-forward regulations, expansive network, and reputation as a leading global financial center. The region has become one of the key markets for the company, as about 20% of Ripple’s clients are located in the Middle East and North Africa (MENA) region. Amid strong growth in the Middle East, Ripple opened a new office located in the heart of the Dubai International Financial Centre. Besides, the company is bringing Swell Global 2023, the seventh edition of its annual customer conference, to Dubai on November 8th and 9th.

Ripple CEO Brad Garlinghouse commented:

“It’s refreshing to see the DFSA encourage the adoption and use of digital assets such as XRP to position Dubai as a leading financial services hub intent on attracting foreign investment and accelerating economic growth.”

For Toncoin, winning approval from DFSA is a breakthrough achievement in its history and a great opportunity to expand its client base.

DIFC Leading In Crypto Regulation

With its comprehensive approach to crypto industry regulation, DIFC zone pioneers in the digital assets space, offering a robust regulatory framework for crypto and investment tokens.

In 2021, the Dubai Financial Services Authority (DFSA) – an institution that regulates the DIFC zone – introduced the Investment Token Regime for governing digital assets. That was the initial phase of the whole legislation at that time. The key highlights included defining tokens, categorizing them, and introducing custody rules for digital wallets.

In November 2022, DFSA launched the second phase of the Investment Token Regime, providing more clarification and removing potential ambiguities. Firstly, the DFSA expanded its initial list of ‘recognized’ crypto tokens for the DIFC. The list applies to all entities in the DIFC. Once a crypto token is ‘recognized’ by the DFSA, an application for recognition does not need to be made by another entity. Now, XRP and TON are among the recognized tokens.

Secondly, while non-fungible tokens (NFTs) and utility tokens are not covered by DFSA regulation, they have been brought within the remit of the DFSA’s anti-money laundering and counter-terrorist financing regime. Issuers of such tokens (unless their issuance does not exceed a $15,000 de minimis threshold), as well as service providers (such as auction houses, issuance platforms, and safekeeping services), have to be registered with the DFSA as designated non-financial businesses or profession and comply with the associated AML requirements.

The next step will be the introduction of public consultations on other areas including staking, DeFI, and AML / CTF issues such as the travel rule.

next

Editor’s Choice, News

Darya is a crypto enthusiast who strongly believes in the future of blockchain. Being a hospitality professional, she is interested in finding the ways blockchain can change different industries and bring our life to a different level.

You have successfully joined our subscriber list.

Web3 wallet Backpack to launch VASP-licensed crypto exchange in Dubai

The Dubai Virtual Assets Regulatory Authority (VARA) has issued a Virtual Asset Service Provider (VASP) license to the crypto wallet Backpack, resulting in the launch of Backpack Exchange.

Backpack’s VARA license is limited to crypto exchange services in Dubai and does not allow the company to offer any other of its virtual asset products and services. According to the announcement, Backpack Exchange incorporates zero-knowledge (ZK) proof-of-reserves, multi-party computation (MPC) for custody and low-latency order execution, among other features.

The announcement also revealed that Backpack Exchange had bagged operational licenses across several jurisdictions worldwide over the past five months.

Sign up for the waitlist pic.twitter.com/aTE9FqmyJ3

— Backpack (@xNFT_Backpack) October 31, 2023

The flagship Backpack Wallet currently stands as an unregulated product; however, it is designed to help users transition from fiat to on-chain applications in the future. Backpack CEO and co-founder Armani Ferrante shared his intent to “put an end” to the opacity of crypto exchanges.

Speaking against the norm of running full-fledged crypto exchanges with a single point of failure and without proof-of-reserves or auditability, Ferrante stated:

“Using cryptographic techniques like zk-proofs, MPC, and state machine replication, Backpack Exchange hopes to raise the bar for transparency and compliance to demonstrate the best this technology has to offer. Don’t trust, verify.”

Existing Backpack and Mad Lads users will gain initial access to Backpack Exchange from November 2023 and will be made public in Q1 2024. During this time, Backpack plans to add various trading functionalities, such as derivatives, margin and cross-collateral into its offerings.

Backpack has not yet responded to Cointelegraph’s request for comment.

Related: Nomura’s crypto arm Laser Digital bags Dubai VARA license

Dubai VARA regulator issued various degrees of operational licenses to numerous crypto exchanges over the past year, further strengthening its position as a crypto-friendly jurisdiction.

⚠️Dubai News

Dubai’s Vurtual Assets and Regulatory Authority issued the long-awaited Full Market Regulations for Vurtual Assets Services Providers (VASPs).

— Irina ₿. Heaver (@IrinaHeaver) February 7, 2023

In February 2023, the regulator issued new guidelines for VASPs operating within the emirate. All crypto exchanges must adhere to marketing, advertising and promotion regulations. Violators will be fined between 20,000 UAE dirhams ($5,500) and 200,000 dirhams ($55,000), and repeat offenders could see fines as high as 500,000 dirhams ($135,000).

Magazine: Ethereum restaking: Blockchain innovation or dangerous house of cards?

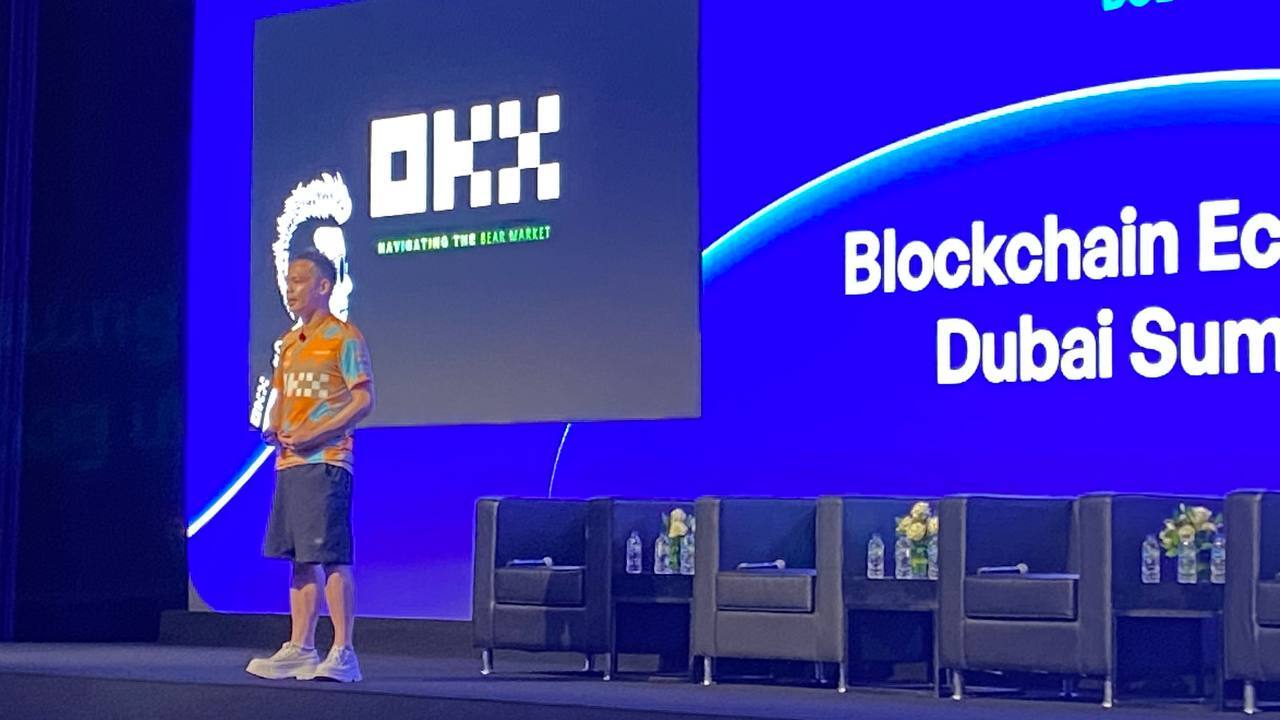

OKX exec says KYC will ‘raise the bar,’ bring real capital into crypto: Blockchain Economy Dubai 2023

While some areas of the crypto space focus on privacy and anonymity, others focus on raising the standards within the space and on bringing in traditional players and more capital in the world of digital assets.

At the recent Blockchain Economy Summit held in Dubai, Cointelegraph spoke with Lennix Lai, the global chief commercial officer at crypto exchange OKX. During the interview, the executive discussed several topics, including the differences between working in traditional finance and crypto, how OKX handled the wave of exchanges implementing mandatory Know Your Customer (KYC) checks and how the exchange navigates the rapidly changing regulatory landscape.

Lai and Cointelegraph’s Ezra Reguerra at the Blockchain Economy Summit in Dubai. Source: Joanna Alhambra

According to Lai, crypto is “a lot more fun” than traditional finance. Lai, who previously worked in traditional firms, said there are many processes in the old finance world that he believes are inefficient. He explained:

“It’s relatively difficult to innovate in traditional finance. In crypto, it’s a lot better and more efficient. And in terms of cost, it is a lot more cheap. So, you can see the pace is a lot faster, and we can serve an even bigger audience than traditional finance right now.”

When problems arose, the executive said that there was lots of internal and external friction before being able to fix problems in traditional finance, even when the solutions were obvious. Furthermore, Lai said there are also regulatory aspects to consider before coming up with solutions.

When it comes to crypto, Lai told Cointelegraph that regulators share almost the same guidelines and expectations as they share the goal of protecting the consumer. The executive said that navigating different regulations from various jurisdictions across the world requires extensive research and mapping out the different requirements.

Lai delivering his keynote speech at the Blockchain Economy Summit Dubai event. Source: Cointelegraph

“Different level of requirement, different level of regulation. But I think all the regulators share similar guidelines and expectations. For example, they want to protect the customer, they want to monitor the trade, they want customer segregation,” he said.

Related: How OKX convinced F1 star Daniel Ricciardo it’s safe to promote crypto

When asked about OKX following the trend of bringing mandatory KYC to its exchange, Lai said there is a need to “raise the bar” in crypto, similar to traditional finance. According to the executive, this will bring what he described as “the real capital and the main money” to the space. He explained:

“That’s how we grow the real market, because if ever your compliance standard cannot meet or somehow talking in the same language with traditional finance, they can never, despite of their interest, despite of our innovation, invest or bring in capital to the space.”

According to Lai, KYC is the first level and the first step to trying to raise the compliance standard in the space so that it can welcome other players in the world of finance.

Magazine: $3M OKX airdrop, 1-hour due diligence on 3AC, Binance AI — Asia Express

Nigerian SEC doubles down on Binance warning despite its recent approval in Dubai

The Nigerian Securities and Exchange Commission (SEC) reiterated its warning that Binance’s operation within the country was illegal, according to a July 28 statement.

In its new notice, the regulator specifically mentioned Binance’s official website, stating that:

“The Commission again reiterates that the activities of Binance, and any such other platform through which the Company solicits investors is neither registered nor regulated by the Commission and its operations in Nigeria are therefore illegal.”

As of press time, Binance has yet to respond to CryptoSlate’s request for comment.

Despite the Nigerian SEC warning, Binance remains a top crypto platform in the African country. The exchange cemented itself as a market leader following FTX’s collapse, with its USDT/Naira trading pair approaching $500,000 in the last 24 hours, according to data on the platform.

Global Regulatory Concerns

Meanwhile, the warning is coming on the heels of Binance’s recent regulatory approval in Dubai after suffering multiple setbacks in Europe. Earlier today, on July 31, the exchange revealed that it became the first digital asset exchange to receive an Operational Minimum Viable Product (MVP) license within the region, allowing it to trade in the area.

After failing to get the appropriate regulatory approval, Binance has exited several European markets, including the Netherlands, Cyprus, Germany, and the U.K. The exchange’s spokesperson stated that the firm was focused on complying with the forthcoming Markets in Crypto Assets (MiCA) regulations to offer its services in Europe.

Binance Nigeria

Further, in June, the Nigerian SEC declared Binance Nigeria Limited’s operations illegal and urged the investing public to desist from using the platform.

Binance clarified that the Binance Nigeria firm mentioned by the Nigerian financial watchdog was unaffiliated with Binance.com, and CEO Changpeng ‘CZ’ Zhao stated that the exchange issued a cease and desist notice to the unaffiliated ‘scam’ entity. However, the new statement indicates that the Nigerian SEC has doubled down on its warning about Binance.

The post Nigerian SEC doubles down on Binance warning despite its recent approval in Dubai appeared first on CryptoSlate.

OKX Middle East had been offering certain products and services in the region since last July.

Dubai’s Virtual Assets Regulatory Authority (VARA) has granted crypto exchange OKX a minimal viable product (MVP) preparatory license. This implies that the exchange is now cleared to fulfill all requirements to bag a full operational license in the region.

According to a Thursday statement by OKX Middle East, once it receives this license, it will be able to extend its “approved suite of duly regulated virtual assets activities”. That is, it then can start offering spot, derivatives, and fiat services. By that time, the firm will also be able to carry out various transactions such as US dollar and UAE dirham deposits and withdrawals and also offer spot pairs to institutional and qualified retail customers.

Recall that OKX Middle East had been offering certain products and services in the region since last July. That was after VARA granted it a provisional virtual assets provider license.

OKX Signals Expansion in the Region

With the new MVP license, it appears that the ambition of the firm to scale its business in the Middle East is now in full throttle. And riding on the current wave, OKX has revealed plans to increase its staff in Dubai to 30 people. However, most of the recruits will be locals and top management, says OKX.

According to the exchange, the UAE is a strategic point for its business. More so, given that the region is fast establishing itself as a haven for crypto businesses in light of regulatory pressure and uncertainties in the US.

As a result, OKX is looking to establish its presence in the region by all means necessary. The firm has already opened an office at Dubai’s World Trade Centre building. It has also revealed plans to extend its nine-figure brand partnerships to the region, albeit with different customer-based activities.

OKX’s move into the Middle East follows a March announcement of its planned exit from Canada. At the time, the exchange revealed that it will no longer operate in Canada by June 22.

next

Blockchain News, Cryptocurrency news, News

Mayowa is a crypto enthusiast/writer whose conversational character is quite evident in his style of writing. He strongly believes in the potential of digital assets and takes every opportunity to reiterate this.

He’s a reader, a researcher, an astute speaker, and also a budding entrepreneur.

Away from crypto however, Mayowa’s fancied distractions include soccer or discussing world politics.

You have successfully joined our subscriber list.