Customer interest seems healthy and new products could soon start to contribute financially, according to a new bull.

Source link

Due

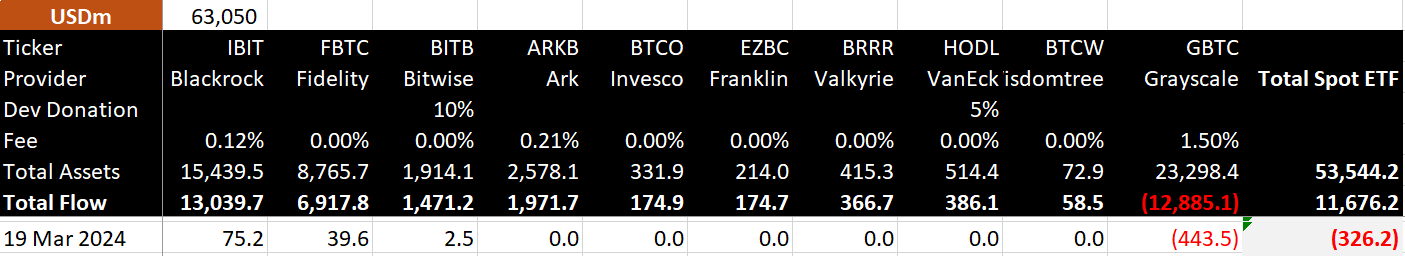

First back-to-back net outflows for Bitcoin ETFs since late January due to $443 million GBTC outflow

Bitcoin ETFs saw a second day of outflows on March 19, the first instances of back-to-back outflows since Jan 25. Net outflows totaled $362 million, with Grayscale accounting for all outflows at $443 million. Most funds saw no net movement, with BlackRock, Fidelity, and Bitwise seeing inflows, according to Bitmex Research.

BlackRock recorded just $75 million, Fidelity $39 million, and Bitwise $2.5 million in inflows on a rare poor performance day for the record-breaking Newborn Nine.

On a positive note, while Bitcoin fell approximately 9% on the day, the net outflows amounted to only 2.7% of total inflows since launch and 0.6% of total assets under management.

Further, $117 million was added to funds on a confidently ‘red’ day for Bitcoin. BlackRock, Fidelity, Bitwise, Ark Invest, Franklin Templeton, and Valkyrie are yet to post a single day of net outflows from their funds, regardless of volatility.

The lack of outflows from many funds can be seen as a bullish indicator, as authorized participants appear reluctant to sell Bitcoin even at prices above $60,000.

The post First back-to-back net outflows for Bitcoin ETFs since late January due to $443 million GBTC outflow appeared first on CryptoSlate.

Webull ended crypto offerings due to SEC opposition during past IPO attempts

Online brokerage Webull decided to cut its crypto offerings because of the unfavorable regulatory landscape in the US as it waits for approval to list on Nasdaq via a special purpose acquisition company (SPAC), Bloomberg News reported on Feb. 28.

The company said that its previous attempt to carry out an initial public offering (IPO) was likely blocked due to its crypto-related services. Webull has attempted to carry out several initial public offerings (IPOs) but failed on each occasion.

Webull US CEO Anthony Denier said:

“For different reasons we were unsuccessful … I can name a few, and I think the latest one is crypto exposure. The [SEC has] not been friendly, which is widely known.”

End of crypto services

According to Bloomberg, Webull sold its digital asset business and discontinued its crypto offerings at the end of the third quarter of 2023 because of the SEC’s unclear rules for registered broker-dealers that work with crypto.

The firm continues to offer crypto buying and selling in partnership with Bakkt through its Webull Pay App, which is described as a separate business in the firm’s support pages.

However, despite Webull’s concerns around SEC regulation, at least one retail brokerage with crypto services succeeded in launching an IPO.

Webull’s major competitor, Robinhood, has offered crypto trading features since 2018 and successfully completed its IPO in 2021.

Listing via SPAC

Webull currently plans to list on Nasdaq via a $7.3 billion special purpose acquisition company (SPAC) deal with SK Growth Opportunities Corp, a blank check company.

Though there are various advantages, SPACs are broadly considered less demanding than IPOs and notably allow an upfront valuation.

According to a press release, the deal will see ordinary SKGR stock begin trading under a new ticker label, while the combined company will take on the name “Webull Corporation.”

The deal is not yet complete but awaits shareholder and regulatory approval.

SKGR shares were trading at $11.11 as of press time — up 1.18% over the last 24 hours.

SEC delays BlackRock’s spot Ethereum ETF; decisions are still due in May

The U.S. Securities and Exchange Commission (SEC) extended the decision period on BlackRock’s planned spot Ethereum ETF on Jan. 24.

That notice concerns a proposed rule change allowing Nasdaq to list and trade shares of the BlackRock iShares Ethereum Trust.

Previously, the SEC was required to approve, reject, or institute proceedings to approve or reject BlackRock’s proposal by Jan. 25, 2024. However, securities laws permit the agency to extend the decision period to March 10, 2024.

The SEC noted Nasdaq initially filed the proposed rule change on Nov. 21, 2023 and that the proposal was published for comment in the Federal Register on Dec. 11, 2023. The date of publication determines the deadlines described above.

The SEC added that it has not received any comments on BlackRock’s spot Ethereum ETF proposal. By contrast, BlackRock’s spot Bitcoin ETF proposal received about 15 comments within two months of its June 2023 filing.

SEC still expected to make decision in May

The delay around BlackRock is not expected to affect broader Ethereum ETF proceedings. Bloomberg ETF analyst James Seyffart said today:

“Spot Ethereum ETF Delays will continue to happen sporadically over the next few months. [The] next date that matters is May 23rd.”

May 23 is relevant as the SEC must approve or deny VanEck’s spot Ethereum ETF by that date without any possibility of further delays. The securities regulator will likely decide on other similar applications with different deadlines, including BlackRock’s, alongside VanEck’s application at that time.

The SEC similarly delayed proceedings around Fidelity’s spot Ethereum ETF this month. Once again, this will not impact the May decision deadline.

Though it is required to make a decision by May 23, it is unclear whether the SEC will opt to approve the funds. FOX Business’ Eleanor Terrett has reported internal resistance at the SEC while suggesting that some ETF issuers are optimistic.

Polymarket odds currently suggest a 54% chance of approval by May 31. Bloomberg ETF analyst Eric Balchunas predicts a 70% chance of approval.

Gensler calls Bitcoin ETFs ‘ironic’ due to their centralized nature, responds to Warren

SEC Chair Gary Gensler said it is ironic that people call the approval of spot Bitcoin ETFs a historical moment considering its centralized nature, which is the antithesis of Satoshi Nakamoto’s vision.

He said:

“Think about the irony of those who say this week is historic. This [the approval] was about centralization and traditional means of finance.”

Gensler made the statement during a CNBC “Squawk Box” interview on Jan. 12, where he delved into the reasons behind the SEC’s approval and addressed some of the concerns raised by Senator Elizabeth Warren.

Respecting the courts

Gensler said that the SEC approved the 11 spot Bitcoin ETFs due to the recent court decision in the regulator’s lawsuit against Grayscale. The court ruled that the SEC did not have legitimate grounds to reject a spot Bitcoin ETF since it had approved products based on futures for the flagship cryptocurrency.

Gensler said that the SEC has the utmost respect for the law and will always follow the court’s directives regarding regulation. He added that the approval of the ETFs does not equate to an endorsement of Bitcoin, and he continues to hold a critical stance toward the asset.

According to the SEC chair:

“Bitcoin itself we did not approve, we do not endorse. This is a product called an exchange-traded product that investors can invest in the underlying non-security commodity asset.”

He added that Bitcoin remains a “volatile store of value” that is not being used for any legitimate payments. However, he acknowledged that the underlying technology holds promise and that approving the ETFs was the “most sustainable path forward.”

Gensler also clarified that Bitcoin is the only cryptocurrency it considers a non-security commodity, likening it to gold and silver-based products. He added that the regulator continues to hold the view that the majority of crypto tokens are securities.

Response to Warren

Gensler’s remarks also touched upon Warren’s criticism of the decision. The senator has been a vocal critic of the cryptocurrency market, arguing that the SEC’s approval was legally and policy-wise erroneous.

Responding to these concerns, Gensler expressed respect differing opinions but reaffirmed his commitment to following legal and court directives. He stated:

“While I understand and respect the concerns raised by Senator Warren, our decision is grounded in a rigorous consideration of the legal framework and the current financial realities.”

Despite the controversy surrounding the SEC’s decision, the approval of these Bitcoin ETFs signifies a potentially new era for cryptocurrency in the mainstream financial market.

The inaugural trading session following the approval witnessed significant activity, indicating strong investor interest and potentially paving the way for more widespread acceptance of digital assets.

A new report released by the CFTC’s Digital Assets and Blockchain Technology Subcommittee has released a comprehensive report — “Decentralized Finance” — outlining the risks inherent in the burgeoning field of Decentralized Finance (DeFi).

Spearheaded by CFTC Commissioner Christy Goldsmith Romero, the report raises critical concerns about the lack of clear responsibility and accountability within DeFi systems. Its release aligns with previous concerns raised by the Department of Treasury regarding the potential for illicit finance risks in the DeFi space.

Romero has positioned the report as a critical tool to foster dialogue between policymakers and industry leaders, aiming to shape an informed and effective regulatory approach to DeFi.

Core Findings and Implications

The report stands as a comprehensive analysis of the DeFi sector, revealing how its benefits and risks are heavily influenced by the design and operational features of specific systems. A central concern identified is the lack of clear lines of responsibility and accountability in some DeFi systems.

According to the report, these gaps pose substantial threats to consumer and investor protection, financial stability, and market integrity while increasing the sector’s vulnerability to illicit activities, such as cyber hacks and financial crimes.

The report calls for urgent government and industry collaborative action to better understand and manage these emerging challenges. It marks an essential step in addressing the complexities of DeFi and serves as a wake-up call for the industry and policymakers.

The report also recommends specific actions to strengthen anti-money laundering (AML) and counter-terrorism financing (CFT) protections within the DeFi ecosystem. This involves assessing how identity information is collected in DeFi systems, identifying compliance gaps and requirements, and evaluating options for regulating and imposing identity information discoverability and verification requirements.

Policy recommendations

According to the report, the global nature of DeFi calls for enhanced monitoring, data gathering, compliance assessment with financial regulations, and identification of regulatory gaps. It outlines several recommendations to achieve these goals.

The report suggests increasing technical capacity and understanding of the DeFi sector. This involves developing continuous data gathering, monitoring, information sharing, and forming regulatory partnerships to comprehend DeFi systems’ operational nuances better.

Given the global nature of DeFi, the report emphasizes the importance of engaging and collaborating with domestic and international standard-setters, regulatory bodies, and DeFi developers. This international cooperation is crucial for harmonizing regulatory efforts and ensuring a cohesive approach to DeFi governance globally.

A significant part of the recommendations involves identifying and assessing various risks associated with DeFi. These include risks posed by asymmetric information, conflicts of interest, operational and security vulnerabilities, liquidity mismatches, over-leverage, and other forms of market manipulation. The report also highlights the need to address the financial and technological complexities of DeFi compositions and their inherent risks.

The CFTC suggests evaluating a range of potential policy responses to mitigate the identified risks. These responses might include implementing disclosure requirements, regulatory reporting, third-party auditing, entry restrictions, regulatory supervision, governance regulation, product regulation, balance sheet regulation, activity restrictions, structural regulation, and resolution planning.

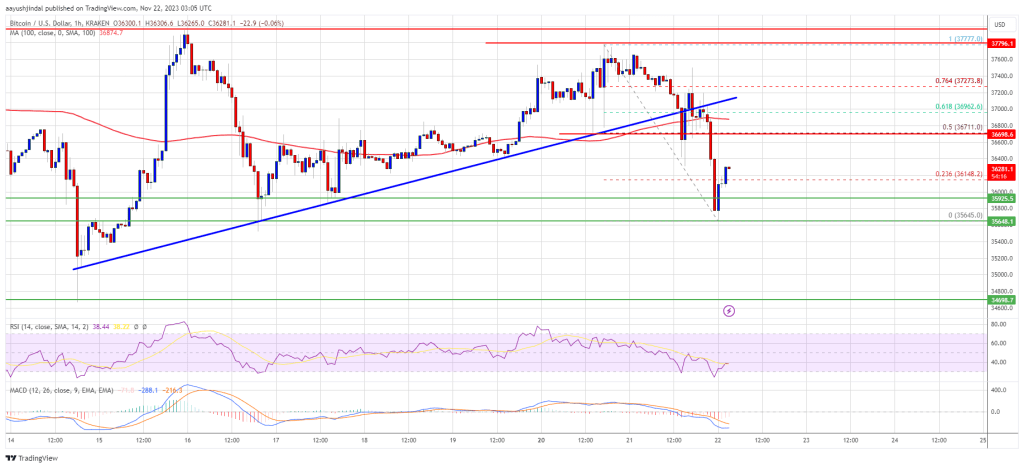

Bitcoin Price Plunge Due to Binance’s Settlement Could Be ‘Buy Dips’ – Here’s Why

Bitcoin price declined over 4% and traded below the $36,500 support. BTC is still holding the key $35,650 support zone and dips might attract buyers.

- Bitcoin started a fresh decline after reports of Binance’s settlement and CZ stepping down.

- The price is trading below $37,000 and the 100 hourly Simple moving average.

- There was a break below a key bullish trend line with support near $36,980 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could struggle in the short term, but dips might be attractive to the bulls.

Bitcoin Price Takes Hit

Bitcoin price failed to continue higher above the $37,800 resistance zone. BTC formed a short-term top and started a fresh decline after reports of Binance’s settlement and CZ stepping down.

There was a sharp decline below the $37,000 level. There was a break below a key bullish trend line with support near $36,980 on the hourly chart of the BTC/USD pair. The pair even broke the $36,500 support zone. Finally, it spiked below the $36,000 level.

A low is formed near $35,645 and the price is now consolidating losses. It recovered above the 23.6% Fib retracement level of the downward move from the $37,777 swing high to the $35,645 low.

Bitcoin is now trading below $37,000 and the 100 hourly Simple moving average. On the upside, immediate resistance is near the $36,500 level. The main resistance is now forming near the $36,700 level or the 50% Fib retracement level of the downward move from the $37,777 swing high to the $35,645 low.

Source: BTCUSD on TradingView.com

A close above the $36,700 resistance might start a decent increase. The next key resistance could be near $37,000. A clear move above the $37,000 resistance could send the price further higher toward the $37,500 level. In the stated case, it could even test the $37,800 resistance.

More Losses In BTC?

If Bitcoin fails to rise above the $36,700 resistance zone, it could start a fresh decline. Immediate support on the downside is near the $36,000 level.

The next major support is $35,650. If there is a move below $35,650, there is a risk of more downsides. In the stated case, the price could drop toward the $34,700 support in the near term. The next key support or target could be $34,200.

Technical indicators:

Hourly MACD – The MACD is now losing pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now below the 50 level.

Major Support Levels – $36,000, followed by $35,650.

Major Resistance Levels – $36,500, $36,700, and $37,000.

Crypto Analyst Identifies 6 Overlooked Altcoins That Could Be Due For A Price Surge

With tens of thousands of altcoins circulating the market, crypto investors can easily miss out on the next 100x coin due to it not being on their radar. This is often not the fault of the investor as it can be hard to keep track of so many coins. As a result of this, a Santiment analyst has presented a total of 6 overlooked altcoins that could be primed for a rally.

Crypto Analyst Presents Altcoins Using Network Activity

As pointed out by the crypto analyst in the Santiment post, the altcoins outlined were picked due to an uptick in their network activity. These tokens have been able to stay under the radar but their activities spread across transaction volumes, network growth, and large transaction numbers, among others, have caught attention.

“The extra juicy opportunities lie with projects that maybe haven’t seen any special price decouplings recently, yet have a surge in network growth, or whale transactions and accumulation.” He further added that these projects are “at minimum, likely to have some increased volatility due to extra activity that hasn’t existed on their respective networks in quite some time.”

1 – Bancor (BNT) Emerges Top Of Altcoins List

As outlined in the post, the Bancor Network, a permissionless protocol that caters to open-source DeFi protocols, has seen a notable rise in its network metrics. This spans across high transaction volumes, active addresses, network growth, whale transactions, exchange inflows, and age destroyed (Consumed). This could be a predecessor to a rise in the BNT price.

Source: Santiment

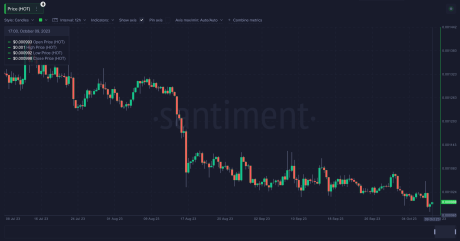

2 – Cartesi (CTSI)

The application-specific rollups Cartesi network which features a Linux runtime has also seen a rise in metrics similar to Bancor that could signal a rise in its native CTSI token. This also spans “High Transaction Volume, Active Addresses, Whale Transactions, Age Destroyed (Consumed)” as pointed out in the post.

Source: Santiment

3 – Holo (HOT)

Holo (HOT) on the Holochain allows for Peer-To-Peer (P2P) applications and has made it to this list mainly due to its whale transactions. The Santiment post shows a rise in whale accumulation among addresses holding between $100,000 and $1 million, as well as high whale transactions, exchange inflows, and age destroyed (Consumed).

Source: Santiment

4 – Powerpool (CVP)

The Powerpool (CVP) protocol is a governance-facing protocol that has seen similar trends to Holo (HOT) above. Just like Holo, there has been accumulation among whales holding $100,000 to $1 million. “High Active Addresses, Network Growth, $100K-$1M Whale Accumulation, Age Destroyed (Consumed),” the analyst writes.

Source: Santiment

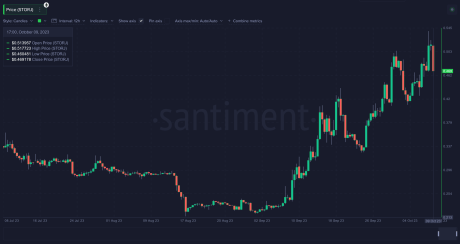

5 – Storj (STORJ)

The Storj (STORJ) project is one that aims to provide cleaner storage services, allowing organizations to cut down their carbon footprint as well as reduce their cloud storage costs. But this under-the-radar altcoin has made it into the list. The analyst points to “High Transaction Volume, Active Addresses, Network Growth, Whale Accumulation, Age Destroyed (Consumed)” as shown in the chart.

Source: Santiment

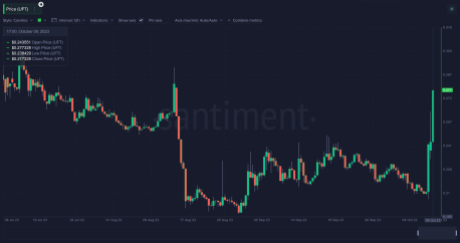

6 – UniLend (UFT)

Unilend (UFT), a protocol that brings all decentralized finance (DeFi) trading to offer in one place, making them accessible through smart contracts, has seen a rise in activity as well. Coming up as the 6th altcoin on the list, Unilend’s growth spans “High Transaction Volume, Active Addresses, Network Growth, Whale Transactions, $100K-$1M Whale Accumulation, Exchange Inflow.”

Source: Santiment

Altcoins: Exercise Caution With These Cryptos

Although these assets have seen a lot of increase in their network activities, the crypto analyst warns that “It appears that 4 out of these 6 highlighted projects are likely getting hot network activity BECAUSE of the price pump. For the other 2, there are no guarantees that a pump is around the corner.”

However, as always, crypto investors are urged to “make your own assessments, research these and the many other projects that show similar hot network activity on this model in weeks to come.”

Total market cap sitting at $1.045 trillion | Source: Crypto Total Market Cap on Tradingview.com

Featured image from Busha, chart from Tradingview.com

Venture funding for crypto hits lows last seen in 2020 due to SBF trial fallout

Global venture capital (VC) investments in the cryptocurrency sector are down 63% during the third quarter, marking the lowest level of funding since 2020, Bloomberg News reported, citing PitchBook research.

A mere $2 billion was poured into the sector, contrasting sharply with the enthusiasm seen in previous industry peaks, based on data provided by PitchBook.

VC Retreat from Crypto Investments

The decline coincides with the ongoing legal tumult involving FTX co-founder Sam Bankman-Fried (SBF) and his alleged mismanagement of the cryptocurrency exchange, which received hundreds of millions in venture funding.

Once the driving force behind the meteoric rise of the crypto industry, venture capitalists are now retreating in the face of increasing scrutiny due to their association with the beleaguered FTX platform.

Robert Le, a seasoned analyst at PitchBook, said:

“We aren’t seeing the big deals anymore. That’s one of the drivers of the decline – deals are smaller.”

Le further delved into the predicaments now facing companies that once thrived during the crypto bull market, such as FTX, OpenSea, and Yuga Labs.

With VCs stepping back, these companies might have no choice but to cut costs, lay off employees, or, in dire circumstances, face acquisition at slashed valuations.

He added:

“If they’re not able to raise a round, even a down round, they’re either going to go out of business or get acquired at a valuation that’s much, much lower.”

While early-stage crypto companies still see some investment deals, many established tech investors have vacated the scene entirely. Adding complexity to the situation is the continued ripple effects of the FTX scandal.

FTX fallout on VCs

Prominent VCs, such as the renowned Sequoia Capital, once backed FTX with relatively substantial investments, which it had to write off when the exchange went under.

FTX and its trading division, Alameda Research, were prolific investors in their own right before legal challenges clouded their horizons. Their vast investment portfolio boasted industry heavyweights like Circle, Paxos, Aptos Labs, and Anchorage Digital.

As FTX and Alameda navigate bankruptcy proceedings, their equity stakes in various startups have become crucial lifelines. The buzz surrounding a prospective funding round for AI startup Anthropic, an FTX investment, offers a silver lining for FTX’s creditors, holding out the promise of recouping losses through potential equity sales.

However, the U.S. Department of Justice (DOJ) is opposing SBF’s attempt to present the current value of investments, like AI startup Anthropic, in court. Prosecutors argue this is irrelevant and could mislead the jury.

Meanwhile, the prospect of a broad liquidation sale looms large, which, if executed hastily, could further drive down the valuations of crypto startups. Le accentuated this concern, stating:

“Because FTX and Alameda have such a huge portfolio, it could further depress valuations in this space.”

The global crypto investment community now waits with bated breath, keeping a keen eye on developments surrounding the FTX saga and its possible ramifications on the sector’s future.