The chief investment officer at Bitwise Asset Management has explained why the current bitcoin bull market differs from prior bull markets. He doesn’t expect the bull market or the alts season to “end early,” emphasizing that he expects to see “more of an ‘everything season,’” rather than a classic alts season. Bitwise’s CIO Predicts an […]

The chief investment officer at Bitwise Asset Management has explained why the current bitcoin bull market differs from prior bull markets. He doesn’t expect the bull market or the alts season to “end early,” emphasizing that he expects to see “more of an ‘everything season,’” rather than a classic alts season. Bitwise’s CIO Predicts an […]

Source link

early

Here’s Why It’s Dangerous To Tap Your Retirement Account Early — Even if You Don’t Incur a Penalty

Savers who put money into traditional IRAs and 401(k)s get a nice tax break. Contributions up to an annual limit exempt some of your earnings from taxes, so if you fund one of these accounts, you get to not only set money aside for retirement, but pay the IRS a little less.

But because your contributions to a traditional IRA or 401(k) plan go in on a pre-tax basis, the IRS wants you to leave your money alone long enough for it to serve as income for retirement. As such, there’s a 10% early withdrawal penalty that generally applies to distributions from these accounts taken prior to age 59 1/2.

Now there are a few exceptions. IRAs, for example, allow you to withdraw up to $10,000 to purchase a first-time home. You can also tap an IRA early to pay for higher education.

Image source: Getty Images.

But even if you’re able to take an IRA or 401(k) withdrawal without incurring a penalty, doing so prior to actual retirement could hurt you in a very big way. Here’s why.

It’s a matter of lost investment gains

Clearly, a 10% early withdrawal penalty has the potential to cause you financial harm. But even if you’re able to avoid that penalty, raiding your IRA or 401(k) might harm you financially in another way.

The money in your IRA or 401(k) shouldn’t just sit in cash. Ideally, you’re investing that money so your balance grows nicely over time. As such, any dollar you remove from an IRA or 401(k) early is money you can’t keep investing. And the consequences there could be huge.

Let’s say you take a $10,000 withdrawal from your IRA at age 35 to purchase a home. But let’s also assume you then don’t retire until age 70. Furthermore, let’s assume that your IRA portfolio delivers an average annual return of 8%, which is a bit below the stock market’s average.

By missing out on the opportunity to earn 8% on your $10,000 withdrawal over 35 years, you’re losing out on almost $148,000 of retirement income. That could potentially constitute a few years’ worth of bills for your senior self, depending on what your costs turn out to be.

Be careful even when taking a withdrawal after age 59 1/2

Once you turn 59 1/2, you can remove funds from your IRA or 401(k) without having to worry about a penalty. But even then, it’s important to be careful.

Let’s say you’re thinking of removing $20,000 from your 401(k) to renovate your home at age 60. That money is yours free and clear of penalties. But let’s also assume you’re not retiring until age 68, and that your portfolio delivers a yearly return of 6% in your 60s (since, by then, it’s good to shift to more conservative investments).

Losing out on a 6% return on $20,000 over eight years means missing out on about $32,000 in retirement income. That’s still a notable sum. It could, for example, end up being money you need to pay for healthcare down the line.

The fact that the IRS imposes early withdrawal penalties on IRAs and 401(k)s is actually sort of a good thing, since it may be the factor that helps you stay disciplined and avoid tapping your savings prematurely. But even if you’re able to avoid a penalty, it still pays to try not to take a withdrawal from your IRA or 401(k) until you’re actually retired and absolutely need that money.

As retirement approaches you must face the question, “What is the best age for me to claim Social Security?”

They almost unanimously advise waiting until full retirement age (66 and 6 months in 2024) to receive 100% of benefits earned. Postponing until the maximum payout at age 70 is even better, since 8% is added to your monthly check for each year you delay.

A missing term in the equation

From a purely financial perspective, the logic is irrefutable. But there is another asset often ignored. One that could be considered even more valuable than money because it is constantly being spent and can never be saved.

Time.

We both started receiving Social Security at age 62, and it has turned out to be one of the best decisions we have ever made. Well, actually the choice was made for us when the 2007-09 recession of 2008 swept away our careers and much of our net worth.

Had what seemed at the time like a calamity not happened, we would have most likely followed conventional wisdom and kept working to save more money. Instead we took a leap of faith, moved abroad to a lower cost of living, and found ourselves staring at a blank canvas titled “Our Future” far sooner than planned.

It is said there are three phases of retirement — Go-Go (age 60 to 70), Slow-Go (70 to 80) and No-Go (80 and up). We hit the ground running at the beginning of our Go-Go period, and what an unexpected blessing those extra years have turned out to be in the following important aspects of life.

Also read: Think Donald Trump has promised not to change Social Security? Think again.

Improved health

It is estimated that 7 out of 10 Americans aged 65 and older will need some form of costly long-term care. The most proactive way to be among the 30% who avoid this expense is by optimizing your health.

Full-time workers have trouble finding enough hours in their schedule for fitness and healthy food preparation. A recent study reveals only 25% of American adults meet CDC exercise standards, while another indicates a paltry 10% eat enough vegetables.

Early retirement provides an opportunity to jump-start improving one’s health. In addition to our pedestrian lifestyle (we haven’t owned a car for 14 years), devoting time each week to strength training, yoga and cardiovascular exercise keeps us in outstanding physical condition. Creating nutritious meals filled with lots of fresh fruits and vegetables is a fun activity instead of a chore.

Also see: I have about $3 million in pension and savings. Should I claim Social Security earlier than 70?

Less stress

According to the American Psychological Association, stress is at an all-time high in the U.S. At the same time, research from Age Wave and Merrill Lynch reveals that retirement is the happiest and most content period of our lives.

Our experience certainly mirrors those findings. Leaving behind financial worries and the daily grind by retiring early has rewarded us with bonus years to expand our social network and pursue long-postponed activities and new interests.

More: Many retirees can’t wait until 70 to collect Social Security benefits, but they could if they used this strategy

More time with grandchildren

Before moving to Ecuador we lived three time zones from our family. That travel distance combined with limited vacation days made visits shorter and less frequent than we desired.

Now, even though our residence is on a different continent, we have been fortunate to spend weeks at a time each year being with our grandchildren as they’ve grown from infants to pre-teens. This level of connection would have been difficult with only occasional long weekend trips.

Active travel

We can share from a travel perspective that the Go, Slow and No-Go periods are accurately described. During the first decade of early retirement we flew back to the States multiple times each year as our four grandchildren were born. Between visits we explored Ecuador, cruised around the tip of South America, and spoke at conferences throughout Latin America.

Post-COVID, we recently concluded a full-time travel adventure of 2½ years to Mexico, Europe, Colombia, Argentina and locations within the U.S. Now squarely in the Slow-Go years, we are acutely aware that the level of activity we sustained for over a decade is no longer possible despite being in excellent health.

Our bank balance would without a doubt be higher if we could have waited until age 67 or 70 to begin collecting Social Security. Yet looking back, how thankful we are to have retired early and been able to share so many priceless memories during those initial retirement years.

You might like: This style of travel is growing more popular among the 50-plus set, and it can offer a richer, more relaxing experience

How long you live vs. how much

As you contemplate when to begin receiving Social Security benefits, carefully envision your ideal retirement. What do you want to accomplish, see and do? If you intend to work until the maximum retirement age of 70, keep in mind that the Social Security Administration estimates that American men who reach that age are likely to live another 13½ years, on average; American woman, almost another 16 years.

Keeping this information in mind, be realistic about your physical capabilities when making plans. Do you really want to spend the most active years you have left in the office and your entire, extended retirement in your Slow-Go and No-Go years? How unfortunate it would be to devote your Go-Go years to the workplace, only to find yourself having to use the extra income to pay for health issues instead of enjoying those activities you’ve looked forward to.

Also see: Vacations, cars and roof repairs: You may be surprised by how much you spend in retirement

It is tempting to fear you can never accumulate sufficient assets to retire comfortably. Instead, consider asking yourself, “How can I manifest the future I’ve dreamed of with what I have?”

Discovering ways to make more money in retirement is possible. But you can never create another minute of precious time.

Edd and Cynthia Staton write about retirement, expat living and health and wellness. They are authors of three bestselling books and creators of Retirement Reimagined!, an online program to help people considering the retirement option of moving abroad. Visit them at eddandcynthia.com.

This article is reprinted by permission from NextAvenue.org, ©2024 Twin Cities Public Television, Inc. All rights reserved.

More from Next Avenue:

Satoshi Nakamoto to Martti Malmi: The Correspondence That Shaped Bitcoin’s Early Days

In a series of insightful emails between Martti Malmi and Satoshi Nakamoto, the foundational discussions shaping the early development of Bitcoin are revealed. These exchanges offer a rare glimpse into the critical thinking and technical challenges overcome in the cryptocurrency’s infancy. Blueprints of a Digital Revolution: Nakamoto’s Conversations With Sirius The dialogue initiated in May […]

In a series of insightful emails between Martti Malmi and Satoshi Nakamoto, the foundational discussions shaping the early development of Bitcoin are revealed. These exchanges offer a rare glimpse into the critical thinking and technical challenges overcome in the cryptocurrency’s infancy. Blueprints of a Digital Revolution: Nakamoto’s Conversations With Sirius The dialogue initiated in May […]

Source link

Dai (DAI) investors buy Pushd (PUSHD) early to see summer profits while Bitcoin (BTC) hits $52k

Some crypto projects are not as volatile as other projects on the blockchain, they are called stablecoins, Dai (DAI) is one of such coins. Dai (DAI) is linked to the US dollar by 1:1. Investors use stable coins like Dai (DAI) to escape the level of uncertainty that comes with regular coins. Bitcoin (BTC) is the oldest cryptocurrency on the blockchain. Bitcoin (BTC) paved the way for other cryptocurrency projects. We do not know the identity of the creator(s) of Bitcoin (BTC), they use the moniker, Satoshi Nakamoto.

Pushd (PUSHD) is the new project on the scene that has investors talking, they all want to get a piece of the action. Pushd (PUSHD) has now gone through four presale stages and is currently on its fifth. In these stages, Pushd (PUSHD) has been able to get over 25,0000 sign-ups.

Dai (DAI) and the end of stablecoins

The argument for stablecoins like Dai (DAI) is that even though it records red lines, it will not stray too far even if a stablecoin goes below the line by 0.05% it is still a cause for concern. Dai (DAI) has spent more than half of last week below the line. Dai (DAI) holders are worried because Dai (DAI) is not as stable as they would like and they would rather just make profits with projects with great predictions like Pushd (PUSHD).

Bitcoin (BTC) is still in good shape

Being the first decentralized cryptocurrency project, Bitcoin (BTC) has already made its mark in history. Bitcoin (BTC) holders are satisfied with their investments as Bitcoin (BTC) keeps climbing in the charts. In the last year, Bitcoin (BTC) has grown by 109% but experts believe that Pushd (PUSHD) will be a better investment for 2024.

Pushd (PUSHD) has the market singing its praise

The news of Pushd (PUSHD) has spread all over the decentralized market but what is this new project that even experts are excited about? Pushd (PUSHD) is going to be the first decentralized project that allows people to buy and sell items online. Pushd (PUSHD) will usher in the world to the era of decentralized online marketplaces. Pushd (PUSHD) will change the way the world looks at online shopping and the decentralized economy.

Experts predict that there will be many more people joining the Web3 world because they want to shop on Pushd (PUSHD). Why would they come to shop in Pushd (PUSHD)? Because Pushd (PUSHD) has so many benefits that traditional marketplaces will not be able to keep up. For example, Pushd (PUSHD) will enjoy the lowest transaction fees possible, this is because, unlike traditional marketplaces, Pushd (PUSHD) has no middleman between buyer and seller. Users will also enjoy faster transactions and a safer shopping environment.

Pushd (PUSHD) has even more benefits that have investors buying into its fifth presale stage at $0.094. Find out more about the Pushd (PUSHD) presale by visiting the website here.

Find out more about the PUSHD presale by visiting the website here

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

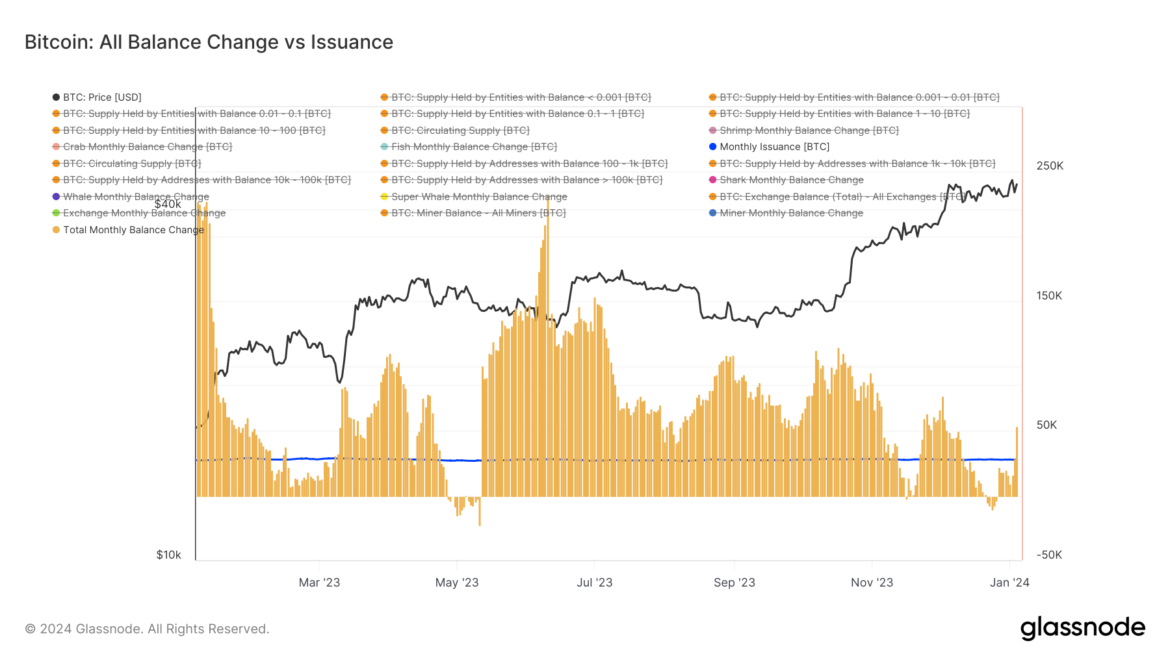

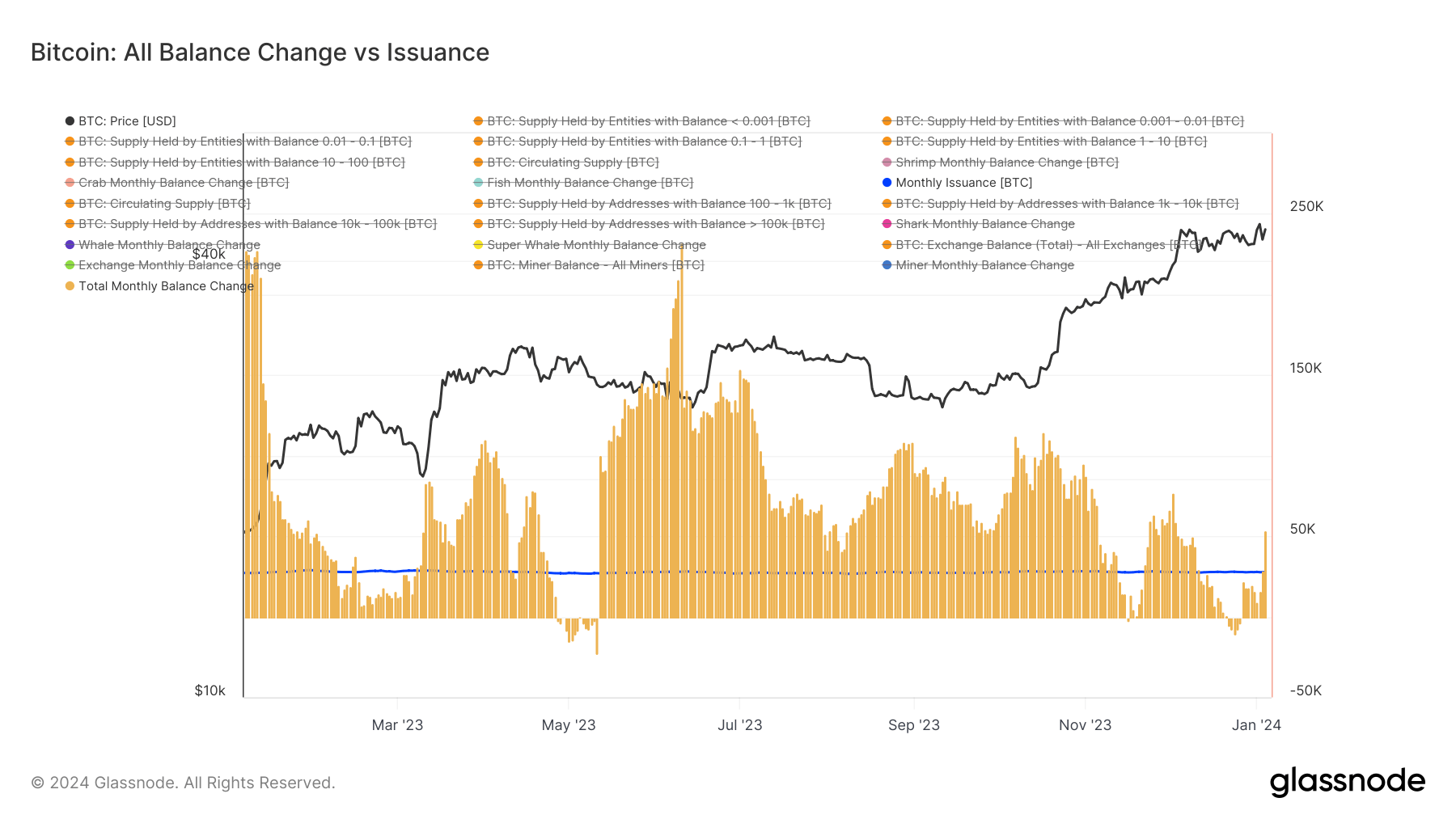

Investor cohorts outpace Bitcoin’s monthly mined supply for the first time since early December

Quick Take

When juxtaposed with the volume of newly mined BTC, the balance change of Bitcoin investor cohorts offers intriguing insights into the dynamics of the digital asset markets’ ecosystem. This analysis reveals a relative measure of new Bitcoin issuance absorbed by all different investor cohorts. Impressively, values above the blue line indicate a cohort’s aggregate balance increasing beyond the total coins mined in a given month, acting as a net absorber.

Contrarily, values on the blue line suggest a relatively flat balance for the cohort over a month against issuance, while negative values indicate a reduction in the cohort’s aggregate balance, indicating a distribution along with fresh coin issuance. A daily mining rate of approximately 900 BTC translates into a monthly volume of around 27,000 BTC.

For the first time since Dec. 4th, the aggregate balance of all cohorts is surpassing this monthly issuance. As of Jan. 4th, the total monthly balance change stood at 53,800, implying roughly 25,000 Bitcoins plus issuance were absorbed from the market. This absorption marks a halt in the preceding distribution phase, a phenomenon only previously seen in May 2023.

The post Investor cohorts outpace Bitcoin’s monthly mined supply for the first time since early December appeared first on CryptoSlate.

So much for ‘the January effect’: Here are five things that could interrupt the U.S. stock market rally in early 2024.

U.S. stocks capped off a wild 2023 with a two-month sprint that has carried the Dow to record highs and the S&P 500 index to within a whisker of a similar milestone.

But after such a powerful advance, some portfolio managers and strategists are concerned that the market could suffer its own post-New Year’s Eve hangover once the calendar turns to January 2024.

Instead of providing a tailwind for the market, several who spoke with MarketWatch worried that the “January effect” might work in reverse as investors scramble to lock in gains after the S&P 500 rose 24% in 2023, according to FactSet data.

“Any time you have a big burst like that, I think you’re vulnerable to some profit-taking,” said James St. Aubin, chief investment strategist at Sierra Investment Management, during an interview with MarketWatch. “It wouldn’t surprise anybody to see the market cool off a bit after a strong run.”

From high valuations, to bullish sentiment indicators, to economic data, to geopolitics and beyond, here are a few things that could trip up the market in January.

U.S. stocks are already overbought

A technical gauge that’s widely followed by Wall Street portfolio managers and technical analysts has been screaming that U.S. stocks are overbought for a month.

The 14-day relative strength index on the S&P 500, a momentum indicator that’s supposed to help put the magnitude of the index’s latest moves into context, climbed as high as 82.4 on Dec. 19, its highest since 2020, according to FactSet data.

FACTSET

Although the RSI has since pulled back, it continues to hover around 70, seen by analysts as the threshold for when something can be considered “overbought.”

Sentiment has swung from extremely bearish to extremely bullish

In the span of just two months, investors have gone from incredibly bearish to incredibly bullish, according to the American Association of Individual Investors’ weekly sentiment survey.

That should give investors pause, since the gauge is seen as a reliable counter-indicator. When sentiment becomes stretched in either direction, it can signal that the market is about to turn. Investors say that is what happened back in July, and also in October after the S&P 500 touched its 2022 bear-market nadir.

RAYMOND JAMES

According to the AAII survey published ahead of the Christmas holiday, nearly 53% of respondents said they were bullish, the highest since April 2021. That number came down a bit this week, but it remains high relative to levels from October.

The VIX is extremely low

Wall Street’s favorite “fear gauge” is giving the all-clear. To some, that’s reason enough to worry.

The Cboe Volatility Index

VIX,

better known as the Vix, measures implied volatility, or how volatile traders’ expect the S&P 500 to be over the coming month based on trading activity in options contracts tied to the index.

In December, the Vix dropped below 12 for the first time since before the advent of the COVID-19 pandemic.

Nancy Tengler, CEO and CIO of Laffer Tengler Investments, said in emailed commentary that she is keeping a close eye on the Vix. Once volatility starts to climb, investors should consider taking some chips off the table.

Progress on inflation could stall in January

Some investors are already anxious about the next U.S. inflation report, due Jan. 11.

The Cleveland Fed’s inflation nowcast has core CPI rising more than 0.3% in December. If this proves accurate, it would be the hottest inflation reading since May.

And even if core inflation comes in slightly cooler, stocks might not greet it with the same enthusiasm they have shown in the past.

“U.S. CPI for December will hopefully continue to show a disinflationary trend, although the question is: can we keep rallying on this same dynamic?” said Larry Adam, chief investment officer at Raymond James, in emailed comments.

Earnings season could disappoint

For three straight quarters beginning with the final three months of 2022, the largest U.S. companies saw their earnings shrink on a year-over-year basis.

This “earnings recession” finally came to an end in the third quarter, but the conundrum that investors now face is whether companies can manage to satisfy Wall Street’s lofty expectations for 2024.

The artificial-intelligence software boom and the fact that the U.S. economy avoided a recession in 2023 has helped boost analysts’ confidence about earnings, strategists said.

According to the bottom-up consensus estimate from FactSet, analysts expect S&P 500 aggregate earnings to increase by 11.7% for the calendar year 2024.

“Markets have been baking in this 11.7% earnings growth figure for a while now. That’s a lot of optimism,” Goldman said during an interview with MarketWatch.

And that’s not all…

To be sure, this list is hardly comprehensive.

Politics and geopolitics also came up a lot in discussions with analysts. Investing professionals cited Taiwan’s upcoming presidential election, another looming federal debt-ceiling showdown in the U.S., the beginning of the 2024 Republican presidential primaries, the ongoing conflicts in Gaza and Ukraine, and more as potential threats to market calm.

Some expressed concern that the Treasury could spark a selloff in bonds and stocks with its next quarterly refunding announcement in early 2024.

But in the view of Cetera’s Goldman, a dynamic that Wall Street traders call it “buy the rumor, sell the news” could represent a bigger threat.

The thinking works like this: investors have already front-run aggressive Federal Reserve interest rate cuts. So, if the Fed delivers, the rush to take profits could drive stocks lower instead of propelling the main U.S. indexes to new highs. Put another way, many strategists believe investors have already priced in pretty aggressive Fed rate cuts.

So unless the central bank finds a way to deliver something even greater than what Wall Street is expecting, the main U.S. equity indexes could struggle to continue their advance.

“Markets are already buying the rumor that we’re going to have a better 2024, that the Fed is going to cut rates, that breadth is going to widen,” Goldman said.

“Maybe we’re already seeing that priced in.”

The Austrian subsidiary of European lender Raiffeisen Bank is preparing to allow its clients to trade cryptocurrencies like Bitcoin (BTC) in the coming months.

After initially announcing its crypto plans in April 2023, Raiffeisen Bank’s Raiffeisenlandesbank Niederösterreich-Wien (RLB NÖ-Wien) is moving forward with a crypto rollout in collaboration with the Austrian crypto firm Bitpanda.

RLB NÖ-Wien expects to start rolling out crypto trading services in Vienna in the first quarter of 2024, a spokesperson for the bank told Cointelegraph.

“Raiffeisenlandesbank NÖ-Wien has signed a cooperation agreement with Bitpanda. Via this cooperation, we plan to offer an attractive digital investment platform early in 2024,” the representative stated, adding:

“We have seen the demand from customers for easy, intuitive, digital investment platforms. Our main intention to take customer-centric decisions has triggered these efforts, which we are excited about bringing to market.”

With the crypto rollout, RLB NÖ-Wien users will gain access to all cryptocurrencies provided by the bank’s partner Bitpanda, the spokesperson said.

Bitpanda Deputy CEO Lukas Enzersdorfer-Konrad previously told Cointelegraph that Raiffeisen’s crypto offering would support the full range of Bitpanda’s digital asset offerings, which feature more than 2,500 cryptocurrencies, including Bitcoin and Ether (ETH). The exec also said Raiffeisen was willing to make the crypto trading service available to all customer segments, including retail, private banking and corporate customers.

“As we announced in April, the end goal is to make our offer available to all RLB NÖ-Wien customers. However, the rollout will begin with their customers in Vienna,” a spokesperson for Bitpanda noted.

Related: Top Swiss bank launches Bitcoin and Ether trading with SEBA

Raiffeisen’s move into crypto is another sign of Bitcoin’s growing adoption, with companies like Ferrari starting to accept cryptocurrency as payment in October 2023. Raiffeisen Bank is one of the oldest banks in Europe, with the first Raiffeisen bank launching in Austria’s Mühldorf in 1886. As of 30 June 2023, the Raiffeisen Group had 247 billion Swiss francs ($280 billion) in assets under management and 219 billion CHF ($248 billion) in client loans.

Magazine: 5,050 Bitcoin for $5 in 2009: Helsinki’s claim to crypto fame

I’m Happy With My Retirement Accounts. Can I Use Rule 72(t) to Retire Early?

Tapping into your retirement savings before age 59.5 typically triggers a 10% early withdrawal penalty in addition to the income taxes you’ll owe. Using Internal Revenue Service Rule 72(t) can help you generate income from your nest egg in your 50s or earlier without paying that penalty. If you use it, you’ll still have to pay regular income taxes, and the process is complicated and inflexible.

Talk to a financial advisor to get personalized guidance on your options for generating retirement income before 59.5.

Rule 72t Fundamentals

Rule 72(t) is a section of the tax code covering early withdrawals from retirement savings plans. This particular rule allows you to take substantially equal periodic payments (SEPPs) from an IRA, 401(k) or other qualified retirement plan without incurring the 10% early withdrawal penalty you would otherwise generally have to pay.

To employ Rule 72t strategy, you must take annual distributions calculated using one of three IRS-approved methods for determining the payment amount. These SEPPS must continue for five years or until you reach age 59.5 – whichever is longer.

You can’t adjust the payment amounts during this time or else you’ll face the penalty you initially avoided. You also can’t make additional withdrawals from the account beyond your scheduled payments. This inflexibility makes Rule 72(t) tricky to use. But for those with adequate savings who want to retire early, it can provide penalty-free income.

Understanding Substantially Equal Periodic Payments

The IRS has a specific interpretation of what constitutes a SEPP. The three methods allowed by the IRS for calculating SEPPs are:

-

Required minimum distribution (RMD) method: This typically produces the smallest annual payment.

-

Amortization method: This spreads your balance over life expectancy to produce a larger payment amount.

-

Annuity method: This provides a fixed mid-range payment between the RMD and amortization methods.

You must calculate payments based on your life expectancy, so the older you are when starting them, the higher the amounts will be.

A Rule 72t Example

To get an idea of how Rule 72t might work in a hypothetical case, consider a retirement saver who is 55 and has $800,000 in their retirement accounts when they decide to retire early. Using the amortization method and a 5% assumed interest rate, they could take annual payments of $49,500 from their accounts for the next 10 years until they turn 65.

By doing this, they would avoid having to pay the 10% early withdrawal penalty, which would save $4,950 for each of the payments until they reach age 59.5.

Talk to a financial advisor about the best plan to finance your retirement.

Rule 72(t) Limitations

While Rule 72(t) offers a path to penalty-free retirement income before 59.5, there are some real and potential limitations to its benefits. They include:

-

You still must pay income tax on distributions at your regular rate.

-

Once started, you can’t discontinue payments without a penalty.

-

Calculating your precise payment involves complex math.

-

You lose tax-deferred growth by withdrawing the money.

-

You can no longer contribute to the account after you start withdrawing from it.

Given these restrictions, Rule 72(t) works best for those who have adequately saved and are sure they want to begin retirement distributions in their 50s.

Rule 72(t) Alternatives

Rule 72t can provide a way to tap retirement funds penalty-free without having to wait, but it’s not the only approach. Other potential options include:

-

401(k) loans, allowing you to borrow from yourself and repay the money.

-

Using the Rule of 55, which lets you tap a 401(k) penalty-free after leaving an employer at 55 or later.

-

First-time homebuyer withdrawal, permitting a $10,000 penalty-free IRA withdrawal towards buying your first home.

-

Certain other exceptions, such as for higher education costs and some medical expenses.

Each approach has pros and cons to weigh. Hardship withdrawals are still taxed as income but avoid the 10% penalty. 401(k) loans allow access without taxes or penalties but must be repaid. The Rule of 55 only applies to employer plans, not IRAs. A financial advisor can help you weigh your options and make a plan for a comfortable retirement.

Bottom Line

Rule 72(t) allows penalty-free early withdrawals from retirement accounts, but comes with major restrictions. While avoiding the 10% penalty, you still owe income taxes on distributions. Payments are fixed for 5+ years and can’t be changed without penalty. You lose tax-deferred growth and can’t contribute anymore. Given the limitations, Rule 72(t) only works for someone with adequate savings who is fully committed to early retirement.

Tips

-

Have a financial advisor walk through the pros, cons and calculations involved with a Rule 72(t) distribution strategy. SmartAsset’s free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

-

SmartAsset’s Retirement Calculator helps you determine whether you’re saving enough to retire.

Photo credit: ©iStock.com/jacoblund

The post I Have Enough in My Retirement Accounts. Can I Use Rule 72(t) to Retire Early? appeared first on SmartReads by SmartAsset.

Prenuvo offers $2,500 full-body MRI scans that can detect cancer early

Prenuvo MRI machine

Courtesy of Prenuvo

While celebrating the July Fourth holiday last year on a boat in Tyler, Texas, Dr. Julianne Santarosa received the results from her full-body MRI scan. What she saw put a damper on the festivities.

Radiologists at Prenuvo, which performed the scan, had identified a nodule in her lungs. Santarosa, who works as a spinal access surgeon in Dallas, could see the spot circled as she looked at the images from the patient portal on her phone.

“I was like, unless I swallowed a taco chip, that something should not be there,” she told CNBC in an interview.

Before paying $2,500 for the Prenuvo scan, Santarosa, who was 41 at the time, hadn’t felt any pain in and around her lungs and had no reason to suspect anything specific was wrong. Rather, she’d felt generally off since going through in vitro fertilization and had a gut feeling she should do the scan after seeing a Prenuvo ad on Facebook.

The day after seeing her Prenuvo results, Santarosa had a follow-up CT scan at a local hospital. The nodule was cancerous. She had it removed the following week.

Curious and concerned patients like Santarosa are flooding Prenuvo’s nine clinics in the U.S. and Canada. There’s so much demand that the 5-year-old Silicon Valley-based company has announced 11 more locations opening by 2024, including one in London and another in Sydney.

Kim Kardashian called Prenuvo a “life saving machine” in an August post on Instagram that’s generated more than 3.4 million likes. Actress and model Cindy Crawford is an investor, alongside Google ex-Chairman Eric Schmidt, 23andMe co-founder Anne Wojcicki and Nest Labs founder Tony Fadell. The company raised $70 million late last year in a funding round led by Felicis Ventures.

Prenuvo CEO Andrew Lacy said he wants to help customers understand what’s going on beneath their skin, which his company’s technology can do by identifying more than 500 conditions like cancer, multiple sclerosis and brain aneurysms. As of now, the scans have a limited audience because they aren’t covered by insurers, requiring patients to pay out of pocket.

For Santarosa, the imaging was worth every penny and more. Her cancer was detected early enough that she didn’t need to undergo treatments like chemotherapy or radiation. More importantly, it hadn’t spread to the point that it was life threatening.

“There’s no screening test for this,” Santarosa said. “I would’ve been stage 4. I would’ve figured this out when I was coughing up blood.”

Prenuvo CEO Andrew Lacy

Courtesy of Prenuvo

An MRI, which stands for magnetic resonance imaging, is traditionally used when ordered by a doctor. Interpreting the images is a complex science, and the scan alone can take more than an hour, even if it covers just part of the body.

Prenuvo’s custom MRI machines, which received clearance from the U.S. Food and Drug Administration in 2018, can scan a person’s entire body in about an hour. Once a scan is complete, the images are reviewed by one of the company’s 30 licensed radiologists. Customers usually receive their results back within five to 10 business days.

Waitlists are long. According to Prenuvo’s website, the next available slot for a full-body scan in New York is in March. The same is true for the Los Angeles clinic. In the Dallas suburb of Irving, there’s availability starting in mid-December.

Lacy said the business has spiked as awareness in the past 12 months has grown “incredibly.”

“These days, when people ask me what I do, and I say I work at Prenuvo, it’s ‘Oh, I heard that on this podcast,’ or ‘That influencer talked about it,'” he said.

In addition to full-body scans, Prenuvo offers a head and torso scan for $1,800 and a scan of just the torso for $1,000.

‘Old-fashioned scaling’

Lacy said Prenuvo is working to bring prices down through “old-fashioned scaling.”

Some companies have started offering Prenuvo scans as a perk for employees, which has helped increase access to the technology. Lacy said it works for companies with self-funded insurance plans, because they’re able to customize their offerings while assuming the risks.

Traditional insurance companies are paying attention.

“Over time, that data helps inform insurance companies about whether this should be something that would be covered across the insurance plans that they offer,” Lacy said.

Prenuvo is looking for other ways to lower costs through artificial intelligence and by potentially reducing the durations of the scans even further. Lacy said the cost is directly correlated to the amount of time customers spend in the expensive machines.

Prenuvo MRI machine

Courtesy of Prenuvo

Radiologists are at the core of Prenuvo’s business. That brings its own challenges.

Many radiologists are fighting burnout as an aging population has led to mounting caseloads. Emerging technologies like AI have also discouraged some young physicians from pursuing the practice. By 2034, the U.S. could see an estimated shortage of up to 35,600 radiologists and other specialists, according to a report from the Association of American Medical Colleges.

So far, it’s a problem Prenuvo has managed to avoid.

Lacy said Prenuvo has a backlog of radiologists who want to work for the company. In traditional medicine, radiologists are often diagnosing patients with serious and advanced diseases, so identifying conditions early can be a welcome change, he said.

“When you’re catching stage 1 cancer, what you’re doing will save lives,” Lacy said.

Prenuvo is still in its early days. Medical experts caution that, in addition to the steep price, full-body MRI scans won’t catch everything and aren’t meant to replace targeted screenings like colonoscopies and mammograms.

“It is a tool that your physician and you can use, but it does not replace a full diagnostic examination,” said Dr. Jasnit Makkar, an assistant professor of radiology at Columbia University Medical Center, in an interview. “It is a work in progress.”

Dr. Kimberly Amrami, vice chair of the department of radiology at Mayo Clinic Rochester, said that because of the limitations, patients’ expectations have to be set accordingly. She said it can be challenging to identify lesions in the lungs, for instance, and scanning different body parts like the knee, the pelvis, the breasts and the prostate all require different techniques.

“There’s always a wish to do an exam that’s going to answer every question,” Amrami said in an interview. “It’s just not really the way that it works with MRI in particular, because the way that you evaluate different body parts in different disease states is quite different.”

Prenuvo doesn’t use contrast, a heavy metal that’s injected into the blood vessels, when conducting its scans. Contrast can help radiologists visualize certain conditions better, but there’s controversy surrounding its use, and the company doesn’t want to deter people.

Lacy said Prenuvo’s hardware was designed to do “almost as good a job” as contrast by using other techniques.

“We believe that that’s the best possible solution for screening patients who are at normal risk and asymptomatic,” he said. “If we find something that’s very concerning, oftentimes, we will suggest that the patient gets some type of follow-up dedicated imaging that might involve contrast.”

Amrami said people should consult with their physicians to determine what kind of imaging works best for them.

“There is no one-size-fits-all for MRI,” Amrami said.

A look inside a Prenuvo clinic

Prenuvo’s clinic in New York City, New York.

Courtesy of Prenuvo

Lacy said he was inspired to create Prenuvo after he started to wonder about how his high-stress lifestyle was affecting his body. He previously started an internet search company and helped found a gaming company, among other ventures.

He found a radiologist who was offering an early version of a full-body MRI scan. Lacy said he learned a lot from that experience.

“Although my lifestyle was impacting my health, there was nothing crazy going on,” Lacy said. “I remember just this incredible feeling of peace of mind.”

Prenuvo designed its experience for relaxation. Its New York location has the feel of a cross between a spa and a doctor’s office.

Upon arrival at the clinic, patients are led from a cozy waiting room to a private area where they can change into scrubs and remove their jewelry.

While lying down in the machine, patients are given a pair of headphones and can choose to listen to music or watch TV during the scan.

Dr. Eduardo Dolhun, a family physician in San Francisco, decided to get his first Prenuvo scan more than five years ago after Lacy stopped by his office. He said he was skeptical but intrigued by the technology, so he decided to fly to Vancouver, British Columbia, to try an early version of it.

After going through his results with a Prenuvo radiologist, Dolhun called one of his medical school peers at the Mayo Clinic.

“I think this is going to change medicine,'” Dolhun said, recalling the conversation.

Dolhun said he gets a scan every 18 months or so and recommends it to some of his patients. He still advises them to get screening exams like physicals and mammograms as well.

“Good science takes time,” he said.

WATCH: Amazon links One Medical to Prime offering