Quick Take

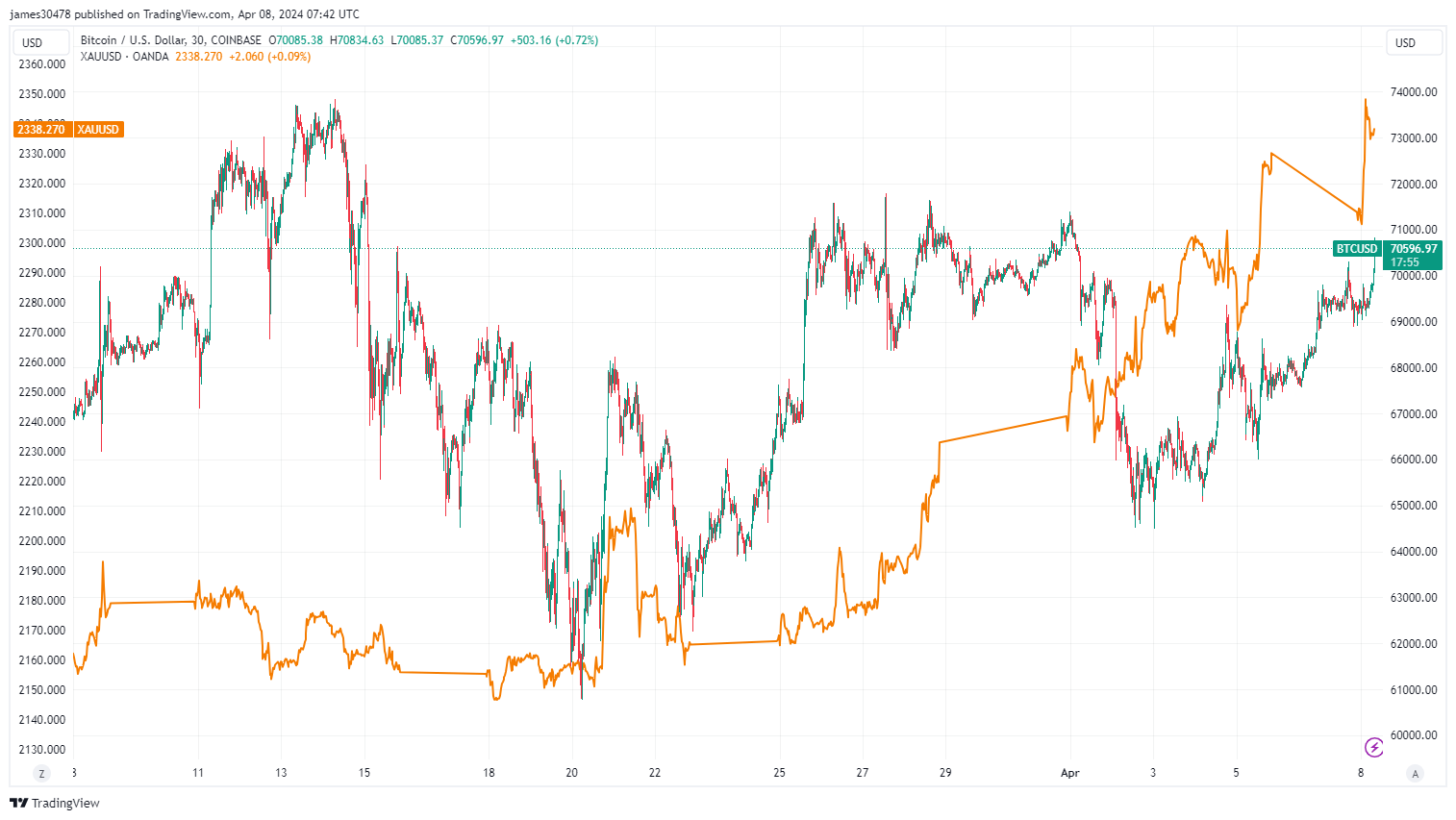

In the midst of economic uncertainty, Bitcoin continues to dance around the crucial $70,000 level, demonstrating its resilience despite the DXY index steadily climbing towards 106 and US yields on the rise. As investors seek safe-haven assets, many are looking to gold for guidance, hoping that Bitcoin, often referred to as “digital gold,” will follow suit.

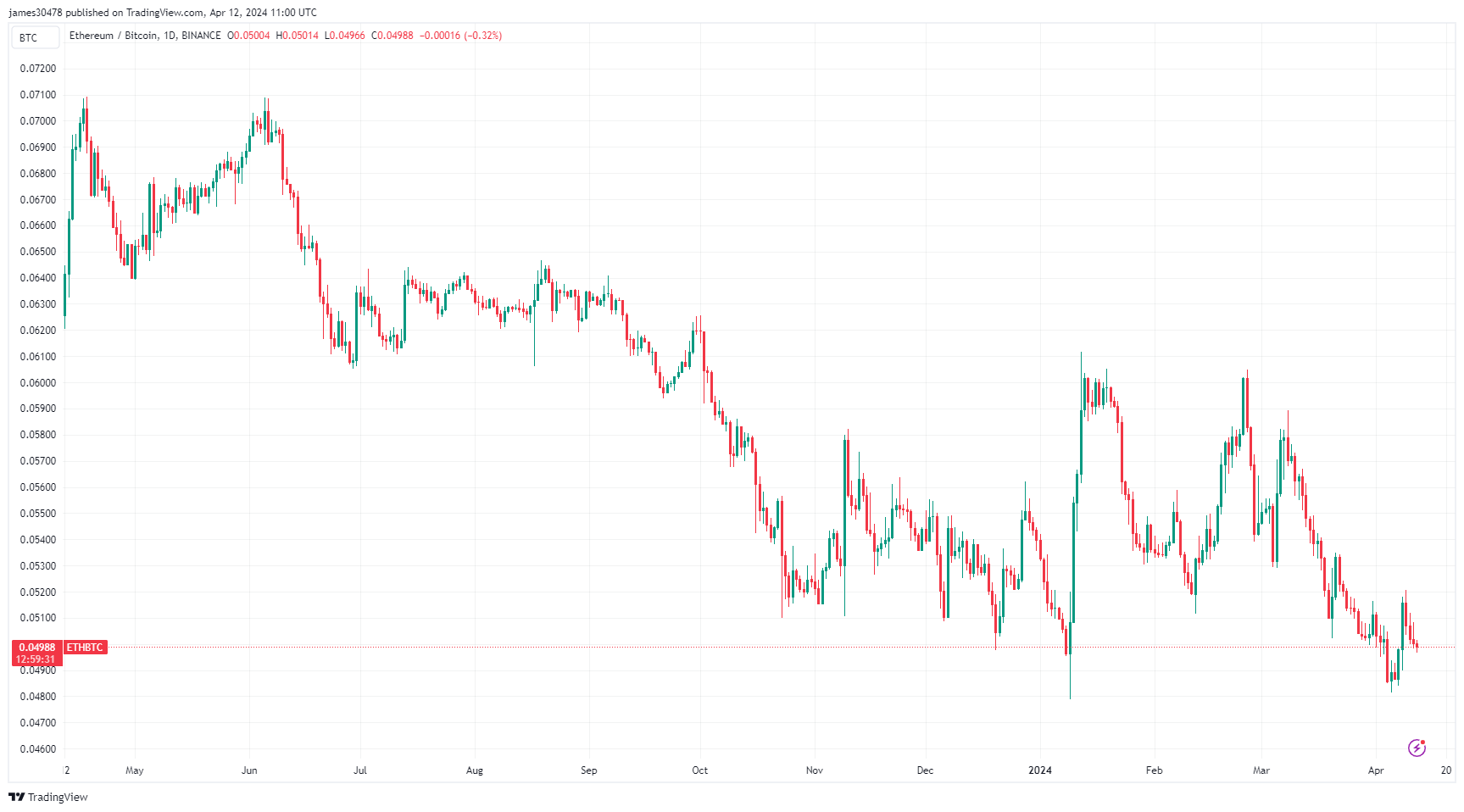

Despite a slight dip at the beginning of April, Bitcoin’s dominance in the digital asset market remains strong, currently at 54.6%, just below the cycle highs of 55.2%. This growth in dominance, up 6% year-to-date, indicates that investors, on aggregate, are favoring Bitcoin over other digital assets.

Another noteworthy trend is the ETH/BTC ratio, which remains below the critical 0.05 threshold, suggesting that Bitcoin is outperforming Ethereum. The ETH/BTC ratio has declined by 6% year-to-date and 20% over the past year. As the DXY index continues to surge, market observers are keeping a close eye on Bitcoin and gold, anticipating that they may continue to hold their ground or even follow the upward trend, providing a potential hedge against economic instability.

The post Bitcoin holds steady against economic headwinds, outshining Ethereum appeared first on CryptoSlate.

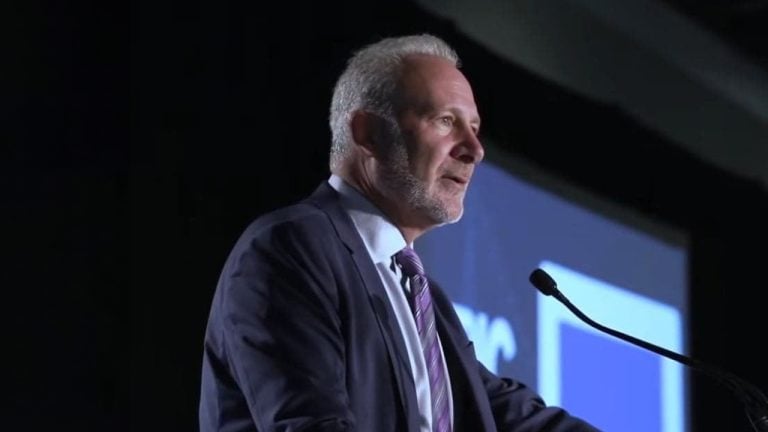

In a recent analysis, economist Peter Schiff draws stark comparisons between the current U.S. economic optimism and the prelude to the 2008 financial crisis. Schiff, leveraging his expertise, warns of impending financial turmoil, emphasizing the critical role of money supply in understanding economic health. Peter Schiff Warns: U.S. Economy on the Brink, Echoes of 2008 […]

In a recent analysis, economist Peter Schiff draws stark comparisons between the current U.S. economic optimism and the prelude to the 2008 financial crisis. Schiff, leveraging his expertise, warns of impending financial turmoil, emphasizing the critical role of money supply in understanding economic health. Peter Schiff Warns: U.S. Economy on the Brink, Echoes of 2008 […]

U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler has outlined a “very real economic difference” between crypto like bitcoin and fiat currencies like the U.S. dollar. “You have a whole central bank, and support for one currency, generally per economic region,” the SEC chief noted, adding that we don’t have the same in bitcoin. […]

U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler has outlined a “very real economic difference” between crypto like bitcoin and fiat currencies like the U.S. dollar. “You have a whole central bank, and support for one currency, generally per economic region,” the SEC chief noted, adding that we don’t have the same in bitcoin. […]