Some markets have seen a big bump in newly built homes, which is affecting supply-and-demand dynamics.

Source link

Economist

A hard-landing recession is guaranteed as the full impact of Fed rate hikes have yet to hit the economy, Morgan Stanley’s chief economist says

-

A hard landing is guaranteed for the US, Morgan Stanley’s chief US economist has said.

-

She said the full impacts of the Federal Reserve’s tightening hadn’t been fully felt in the economy.

-

It could take 18 months after the last rate hike to feel the full weight of higher rates.

A hard-landing recession is certain to come for the economy, and high rates are to blame even as markets start positioning for the Federal Reserve to loosen monetary policy this year, says Ellen Zentner, Morgan Stanley’s chief US economist.

Speaking to CNBC on Monday, Zentner responded to Jamie Dimon’s recent comments on the economy, in which the JPMorgan boss warned that the chance of a soft landing was about half of the 70% to 80% odds other forecasters were predicting. He said that was because of several risks still facing the US, including the Fed’s tightening campaign, geopolitical conflict, and interest rates, which central bankers have said could remain higher for longer.

Zentner said she was expecting the US to avoid a recession this year as there was no data to support a soon-to-come downturn. But she warned that a hard landing was unavoidable.

“We will have a hard landing at some point. I guarantee you that. We’re all wondering: When does that come?” she said. “The point that Dimon makes is that there are these cumulative impacts that build over time, and we are in the camp that we haven’t yet seen all of the tightening impacts from monetary policy,” she added, referring to the impact of Fed rate hikes.

Fed officials raised interest rates a whopping 525 basis points in 18 months to tame inflation, a move that’s taken borrowing costs in the economy to their highest level since 2001.

Economists have warned that high interest rates could spark a recession as financial conditions become restrictive and that the full impact of rate hikes probably hasn’t been felt, as they typically take about 18 months to fully work their way through the economy.

Signs of stress are beginning to show in parts of the financial system. Corporate defaults soared last year to their highest level since the pandemic, according to Moody’s Analytics. Bank lending has fallen for three straight quarters, according to Fed data.

Still, signs point to the Fed keeping interest rates elevated as it keeps an eye on inflation. Consumer prices came in hotter than expected last month, with inflation rising 3.1% year-over-year in January.

Zentner predicted that inflation would probably reaccelerate over the first quarter, pointing to the 3.9% growth in core inflation last month. That reacceleration could show up in the next consumer-price-index report, which markets are expecting later this week.

“We do expect inflation reacceleration to be temporary, but that is an open question,” Zentner said, adding that markets might have to consider Fed rate cuts pushed beyond mid-year.

Investors had been pricing in ambitious rate cuts to come in 2024, but many forecasters have dialed back their expectations amid hot inflation data. Markets are now pricing in a 39% chance that the Fed could lower rates by 100 basis points or more by the end of the year, according to the CME FedWatch tool.

Read the original article on Business Insider

The stock market is looking a lot like it did before the dot-com and ’08 crashes, top economist says

-

The stock market looks similar to the periods that preceded the dot-com and 2008 market events.

-

David Rosenberg pointed to the exuberance for AI, which has sparked a “raging bull market.”

-

The “speculative mania” carrying the stock market could soon end, he warned.

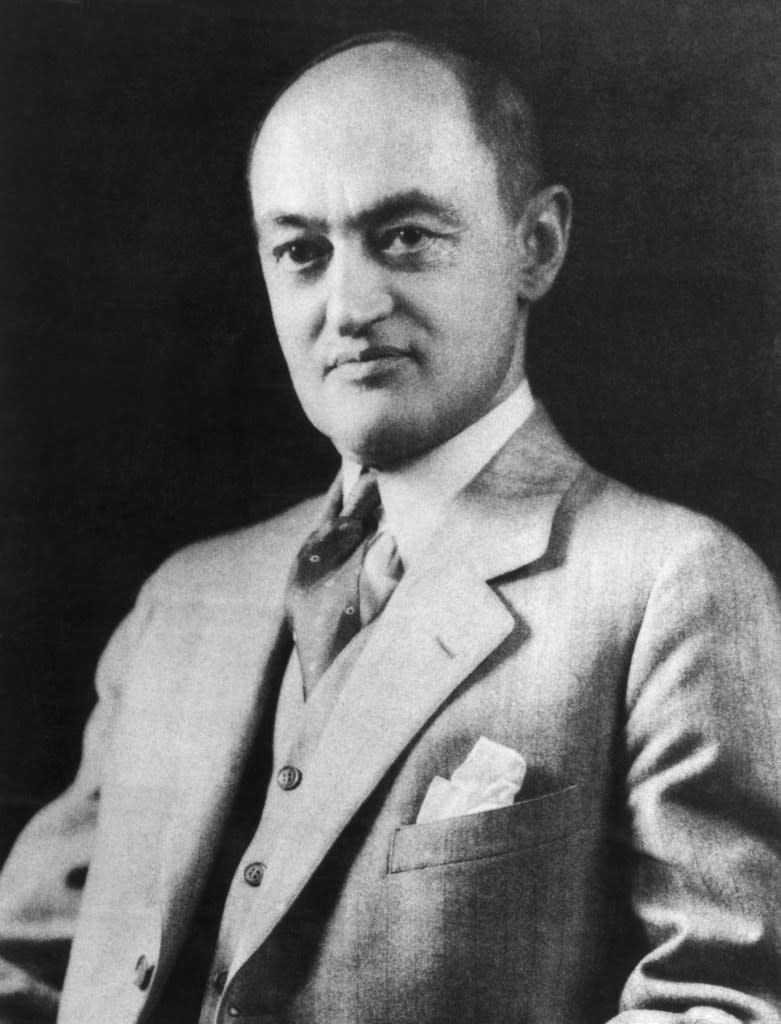

The stock market is flashing the same warning signs of “speculative mania” that preceded the crashes of 2008 and 2000, according to economist David Rosenberg.

The Rosenberg Research president — who called the 2008 recession and who’s been a vocal bear on Wall Street amid the latest market rally — pointed to the “raging bull market” that’s taken off in stocks, with the S&P 500 surpassing the 5,000 mark for the first time ever last week.

The benchmark index has soared around 22% from its low in October last year, clearing the official threshold for a bull market. The index has also gained for the last five weeks and has been up for 14 of the last 15 weeks — a winning streak that hasn’t been seen since the early 1970s.

But the stellar gains are a double-edged sword for investors, as the market looks dangerously similar to the environment prior to the dot-com and 2008 crashes, Rosenberg wrote in a note on Monday.

“With each passing day, this has the feel of being a cross between 1999 and 2007. It is a gigantic speculative price bubble across most risk assets, and while AI is real, so was the Internet, and so were the high-flying stocks that populated the Nifty Fifty era,” he said, referring to the group of 50 large-cap stocks that dominated the stock market in the 60s and 70s, before falling by around 60%

Other Wall Street strategists have warned of the parallels between today’s market and similar stock booms in the past. The hype for artificial intelligence pushed the Magnificent Seven stocks to dominate most of the S&P 500’s gains last year, and a major price correction is on the way as valuations soar to unsustainable levels, Richard Bernstein Advisors said in an October 2023 note.

“This is the problem when a group of mega cap ‘concept’ stocks trade at double the multiple of the rest of the market. The lesson is that (i) the higher they are, the harder they fall, and (ii) there are dangers when too much growth gets priced in,” Rosenberg said. “Being real in an economic sense does not mean we have not entered a realm of excessive exuberance when it comes to the financial markets,” he added, referring to the hype surrounding AI.

The outlook for stocks is also shadowed by an uncertain economic picture. Geopolitical risks, recession risk, and the risk that the Fed will disappoint investors hoping for rate cuts aren’t being priced into markets at the moment, Rosenberg added.

“I don’t find speculative manias a turn-on and in my personal finances, I avoid them like the plague. Not everyone likes to hear that, especially since I missed so much of this rally but that’s how I roll,” he said.

Rosenberg has warned investors to tread carefully before, given the slew of risks he sees ahead for markets. Previously, he said that the S&P 500 looked “eerily similar” to 2022, the year the index plunged 20%. That’s partly because a recession that “few see and few are positioned for” is coming for the economy, he wrote in a post on LinkedIn last month.

Read the original article on Business Insider

Working longer won’t solve the retirement crisis — seniors need a ‘Gray New Deal’ to retire with dignity, this economist says

The Value Gap is a MarketWatch interview series with business leaders, academics, policymakers and activists on reducing racial and social inequalities.

Most Read from MarketWatch

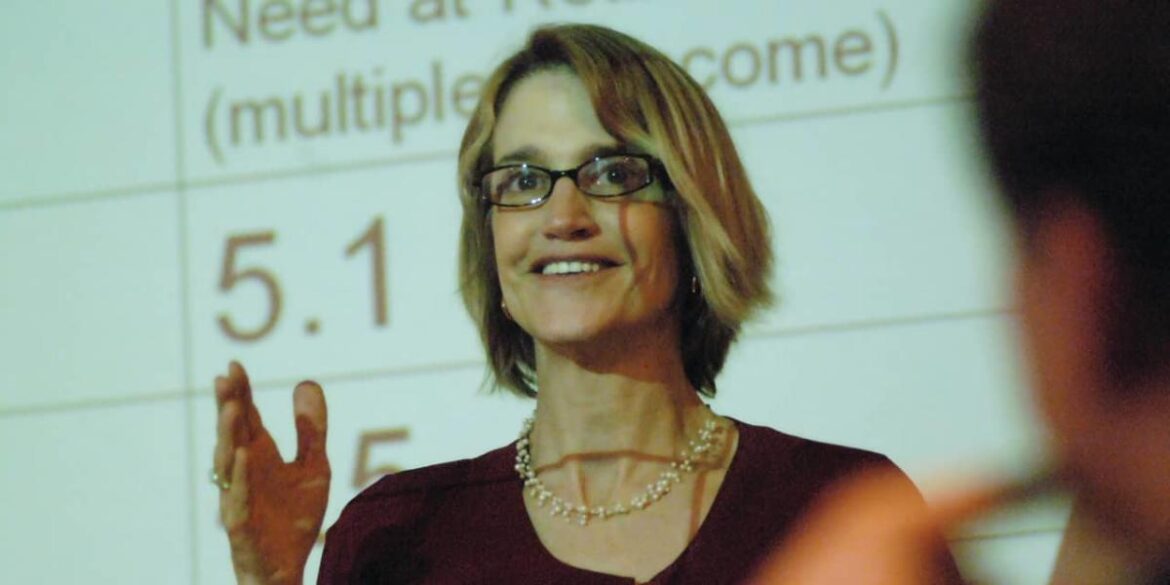

Teresa Ghilarducci thinks older adults shouldn’t have to work in retirement. She wants people to stop feeling shame about the size of their retirement accounts, and envisions a “Gray New Deal” that creates job and pension improvements for older Americans.

Those positions may be surprising for a labor economist.

But Ghilarducci is also a professor at the New School for Social Research and an expert on retirement security who explains complicated subjects in an accessible way. She has authored several books and papers, and her latest book, “Work, Retire, Repeat: The Uncertainty of Retirement in the New Economy,” talks about how employees are laboring in the broken U.S. retirement system.

As American society urges people to work longer, this takes a disproportionate toll on middle- and lower-income people who may not have the ability to work longer in physically demanding jobs, Ghilarducci told MarketWatch in an interview.

Fifty percent of women and 47% of men between the ages of 55 and 66 have no retirement savings, according to the Census Bureau.

Ghilarducci calls for a Gray New Deal as a public-policy imperative. Today’s do-it-yourself retirement system — in which workers fund their retirement through 401(k)s, savings and sheer grit — is not working, she said. This interview has been edited for length and clarity:

MarketWatch: You’ve written several books. What did you still want to say in this new book?

Ghilarducci: My other books really focused on how to have enough money for retirement. This is a different subject about the policy push to work longer. We have a retirement crisis that’s a complex problem and expensive to fix. People retreated to the safe place that we can’t fix it. They say, “We have to work a little longer,” and that’s the solution.

My experience with the rest of the world was that they did not have this sense that working longer was the solution. Other countries have 25- to 30-year work lives and have a dignified old age. This working-longer idea robs us of a dignified old age, which we deserve. There’s a cost to our bodies and our lives in working longer.

MarketWatch: Can you talk about the Gray New Deal, what it entails and how insurmountable it may be to see it come to fruition?

Ghilarducci: We have a responsibility to rethink how people work and retire from that work. If you do not ignore the retirement period — people are entitled to retire — there’s got to be new ways to think about it. It has to be part of public policy. It has to be as encompassing as the original New Deal. Ninety percent of workers have no problem embracing this idea of retirement, but 53% of retired people when surveyed say they didn’t choose when to retire. They were laid off or their bodies wore out. Workers get it that they won’t be able to work until they’re 62, and working to 70 is nearly impossible for most.

Policy makers, meanwhile, have better, easier jobs. No one’s telling them what to do — they are telling other people what to do. It makes them a bit unsympathetic. But if they hear enough from workers — there’s lots of support for Social Security. I’m hopeful.

MarketWatch: The demographic bubble known as Peak 65 is happening this year, with a historic number of people turning 65. What will this mean for society, the economy and our culture?

Ghilarducci: Peak 55 happened 10 years ago, and people got really nervous about their retirement savings. Now it’s Peak 65, and all illusions about what’s possible are gone. There will be 35 million people realizing that their work lives are over and the money won’t stretch. We’ll have a sea change in views on Social Security. There’s no stomach among voters for benefit cuts. There’s a bill in Congress — from [Democratic Sen. John] Hickenlooper, [Republican Sen. Thom] Tillis, [Democratic Rep. Terri] Sewell and [Republican Rep. Lloyd] Smucker — that calls for a government match. It gets the individual employer out of it and focuses on the worker and the government.

Peak 65 shows me that the population is aging, and older people vote. There’s also an electorate that’s younger, and they support Social Security. They’re struggling with student debt and they are financially sophisticated. They’re learning about compound interest in high school. There’s a groundswell of concern about their parents. There’s also women in their late 40s and 50s who are having to take care of older parents. Not only are they taking care of older parents, but a lot of the care costs are coming out of their own retirement savings. They’re also giving a lot of their own time to provide care that they could be using for work, making more money and providing for their own security, and they’re not.

MarketWatch: Does increased longevity mean increased senior poverty?

Ghilarducci: We started charting higher levels of increased poverty years ago — millions of people living in de facto poverty. As the numbers of people go up, the rate and number of people in poverty will go up. The ghoulish good news is that people living in poverty don’t live as long. There’s a real inequality in longevity, in that the people with means are living longer. That inequality is real.

MarketWatch: In your book, you talk about how working longer weakens political pressure to expand Social Security and employer retirement plans. How so?

Ghilarducci: It could cost $1 trillion to bring Social Security up to full benefits. It would be spread out over decades, but it’s still a lot of money. Workers and employers have to set aside money for retirement. Workers also have to pay for emergency savings, housing, student debt. The urgency on the retirement crisis dissipates when people say everyone can work more years, and by working for more time, they won’t draw on Social Security. But that’s like saying, “Hey, we can afford lunch by not having lunch.” And people can just work longer? That’s not realistic. There’s a push to have everyone in the labor pool and a spate of work to end age discrimination. But a lot of that is turning the other way.

It’s also psychological — people making policy didn’t want to think of themselves as useless and facing mortality. It’s appealing to human beings: Never say die. The do-it-yourself retirement system is false that one can do it themselves. There’s this shame that you didn’t save enough. We’re a country of very old baristas — people are doing jobs that are a lot less than they had before because they have to.

But I think people are rising up. People are angry and empowered. There’s all sorts of ways to do that — vote for politicians who pay attention. It’s hard to talk to 55-year-old women who have no retirement. They should be angry.

MarketWatch: What do you see happening to Social Security in 10 years as the trust funds supporting it hit insolvency?

Ghilarducci: Social Security is purely a political problem. The country could afford to put more money into the system. We could have a 3-percentage-point increase in payroll tax. It wouldn’t mean job displacement or funding taken away from other groups. It’s not an economic problem. It’s a political problem that will be solved at the last minute, which will make it even more expensive. Any cuts to Social Security will mean more poor older adults. The last time there was a crisis, in 1983, we went to the brink. This time, I think politically there is the will to get something done because no one wants to see benefits cut.

MarketWatch: Will you ever retire? And what will that look like?

Ghilarducci: I have one of the strangest jobs in the U.S. I’m like a medieval priest or something. I have an endowed chair and I’m tenured. I have no supervisor. I have a really rare job. I’ll only retire when my body or my mind gives out. I’m not typical. And those of us with atypical jobs — and policy makers are not typical — we need to be more humble and realize we are not representative of most people.

MarketWatch: What’s the one lesson you want people to take away from your new book?

Ghilarducci: I want people to realize that they deserve retirement and a dignified retirement. It’s not shameful if they haven’t been able to save. It’s not because they got a divorce or had too much avocado toast in their 20s. It’s not their fault. Every American deserves a retirement, and working longer is not the solution.

Most Read from MarketWatch

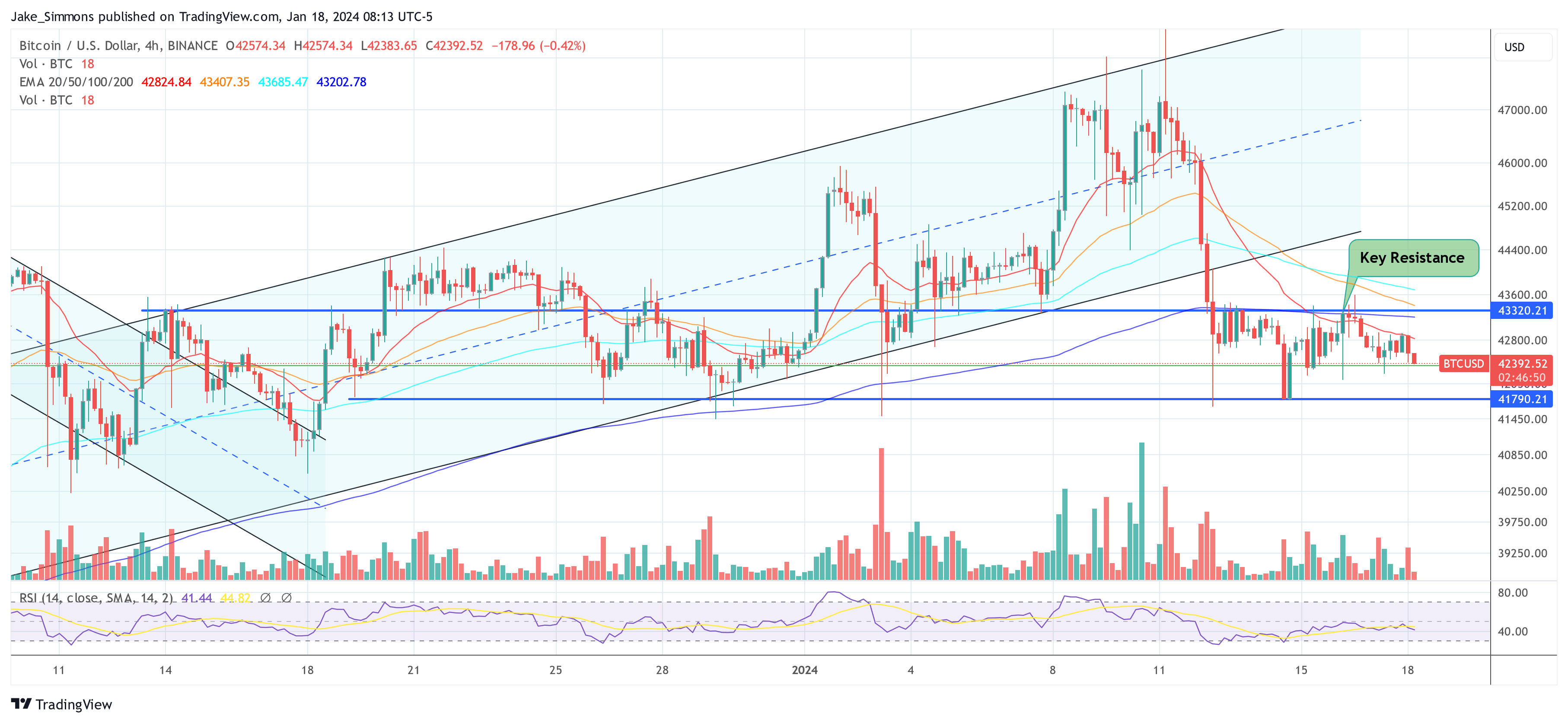

Renowned macroeconomist Henrik Zeberg has set the financial world abuzz with a stark prognosis on X (formerly Twitter), forecasting a dramatic surge in the Bitcoin price to a peak of $115,000 to $150,000. However, this meteoric rise is predicted to find an abrupt end, caused by a devastating macroeconomic downturn, one that Zeberg anticipates will be the most severe since the 1929 crash.

Why A Recession Will Hit The US In 2024/2025

At the core of Zeberg’s argument are seven reasons. Zeberg asserts, “Our Business Cycle has flashed a recession signal in 2023. Leading Indicators have crashed under our Equilibrium Line. In 80 years of data, the recession Signal from our Model has NEVER been wrong. No false signals – ever!” This model, with its unwavering accuracy over eight decades, forms the bedrock of his grim forecast.

Zeberg also delves into the significance of yield inversion, a well-documented precursor to economic downturns. Despite the signal’s dismissal by analysts in 2023 due to impatience, Zeberg emphasizes its historical reliability, noting, “From the bottom of the Yield Inversion, we normally see 12-15 months before a recession sets in. This signal is very much alive!” His remarks underscore a widespread underestimation of this critical indicator.

The economist further examines the trajectory of US industrial production, drawing alarming parallels to the period just before the 2007-08 financial crisis. He observes a similar pattern of divergence and warns of a strong impending drop in industrial production, signaling the onset of a recession.

Zeberg’s analysis extends to the housing market, where he highlights the plummeting NAHB index as a significant warning sign. “The bigger the decline in NAHB – the larger the rise in Unemployment,” he states, pointing to the direct relationship between housing market distress and the broader economy. This situation is exacerbated by rising interest rates, which lead to reduced consumer spending and, consequently, an economic downturn.

Moreover, personal interest payments are another cornerstone of Zeberg’s argument. He notes the historical pattern where increases in market rates burden consumers with higher mortgage and debt payments, ultimately leading to recessions. “Every rise in rates over the years has caused a recession, as consumers need to pull back on their Consumption,” Zeberg cautions, highlighting the lag inherent in the economic business cycle.

Housing affordability, or the lack thereof, is also a critical component of his analysis. With affordability plummeting below levels seen before the financial crisis, Zeberg paints a grim picture of the near future, where a deteriorating unemployment situation could lead to widespread defaults and a housing market collapse.

Lastly, Zeberg points to the bloated inventory levels of retailers and companies worldwide. He describes this as a hangover from the demand hype of 2021-22, driven by stimulus funds that have since dried up. This mismatch between supply and anticipated demand, he suggests, is a ticking time bomb for the economy.

Bitcoin: A Mirage Before The Storm

In the midst of this dire economic forecast, Zeberg casts a unique spotlight on Bitcoin. He predicts a fleeting period of euphoria for the cryptocurrency, with its value skyrocketing to an all-time high, potentially reaching between $115,000 and $150,000. He also provocatively states, “@Peter Schiff: See you at BTC = 100X 1 ounce of Gold.”

See you at BTC = 100X 1 ounce of Gold

— Henrik Zeberg (@HenrikZeberg) January 17, 2024

However, Zeberg cautions that this surge is part of a broader misleading narrative. “The Soft Landing Narrative is what will dominate into the top in #Equities #Crypto #BTC,” he elaborates. This narrative, according to him, is a mirage that will mislead economists and analysts as they try to rationalize the ‘blow off top,’ a phenomenon they failed to forecast.

The reality, as Zeberg sees it, is starkly different: “Stock Market and Crypto will SOAR into early 2024. Euphoria will develop. Everybody will get onto the wrong side of the boat – just as Equity and Crypto Markets put in a major top. Recession sets in a few months later in 2024.”

In conclusion, Zeberg’s analysis foresees a major recession, one that he believes is inevitable and imminent. “The Titanic has already hit the Iceberg – and it will sink,” he starkly notes, dismissing any interventions from the Fed or any administration as futile.

The question is how Bitcoin might behave in a recession, something the cryptocurrency has not experienced since its inception in 2009. Will BTC become a safe haven, or will it follow the fate of equities, as Zeberg predicts?

At press time, the Bitcoin price continued its sideways trend, trading at $42,392.

Featured image from DALL·E , chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Housing market affordability will improve in 2024 as home prices fall amid more inventory, Morgan Stanley’s chief US economist says

-

Housing market affordability is expected to improve in 2024, Morgan Stanley’s chief US economist said.

-

Growth in inventory as homebuilding activity grows stronger will offset an increase in demand.

-

Home sales will pick up in the second half of 2024 and further into 2025, as prices see “modest” declines.

A change of fortune will be in the cards for the housing market next year, according to Morgan Stanley’s chief US economist.

Improving home affordability will thaw what has been a largely frozen housing landscape this year, according to Ellen Zentner’s recent market podcast.

“We expect home sales to be weak in the first half of next year, but activity should pick up in the second half and further into 2025, and that’s primarily because affordability will improve,” she said.

Also massaging the shift will be an increasing supply of homes next year, Zentner predicted. Inventory has been tight after the the spike in mortgage rates over the past year kept many buyers and sellers on the sidelines.

With fewer existing homes on the market, new construction has been the main source of additional supply. And Morgan Stanley expects homebuilding activity to grow stronger next year.

“Home prices should see modest declines as growth in inventory offsets the increase in demand. By 2025, with lower rates, existing home sales should rise more convincingly,” Zentner added.

It’s been a harsh year for the housing market as mortgage rates, riled up by a breathless rise in Treasury yields, touched 8% in October.

And despite the rising cost of taking out a home loan, home prices remained sky high amid the supply crunch in available dwellings.

But mortgage rates have come down recently as hopes that the Federal Reserve will soon pivot to rate cuts sent Treasury yields plunging.

Markets will see those cuts become a reality by mid-2024 as inflation continues to decelerate, allowing the Fed to keep rates steady and finally make an initial quarter-point reduction in June, according to Zentner.

That will be followed by another 25-basis-point cut in September, she added. And starting in the fourth quarter of 2024, the central bank will likely lower rates by that amount at every meeting, eventually bringing the real rate down to 0.4% by late 2025.

Other positive themes playing out next year will be improving business investment and equipment spending that will finally turn positive after two years of declines.

And while banks tightened their lending conditions this year, many companies dodged refinancing their debt at ultra-high interest rates and won’t be pummeled by increasing costs of financing in 2024.

The bad news, Zentner said, will be a slowdown in consumer spending, driven by a cooling labor market which weighs on real disposable income. Higher-for-longer rates will also put further pressure on debt servicing costs for consumers.

Meanwhile, GDP growth is also projected to slow from 2.5% this year to 1.6% in 2024 and 1.4% in 2025. While that represents a soft landing, Zentner noted growth will still be below its potential.

Read the original article on Business Insider

Deflation could soon hit the US as real estate and stock prices are at risk of crashing, economist says

-

The US economy could soon be at risk of deflation, according to Wermuth Asset Management.

-

Wobbling commercial property values a correction of lofty stock valuations would drag prices lower.

-

Inflation accelerated 3.3% on an annual basis in July, well-below the pace of inflation recorded last year.

Disinflation could soo turn to deflation in the US, partly due to the risk of crashing stocks and real estate prices, according to Wermuth Asset Management.

Already, commercial property values are under pressure, while a potentially overvalued stock market could face a swift correction if conditions sour. A plunge in the price of these assets would go a long way in sparking deflation, the firm argues.

“To speculate about deflation again at this point looks premature at first glance, but not at the second. For several reasons the risk of a falling consumer price level has increased,” economist Dieter Wermuth said in a note on Wednesday, pointing to various pressures that could weigh down inflation in the economy.

That’s contrary to what other economists have been saying, with many warning that inflation is a lingering problem and will stay sticky. Prices accelerated 3.3% year-per-year in July, slightly higher than the 3% price growth seen in June.

But deflation could soon be in the cards when examining the huge downside risk that lies ahead for stocks and real estate assets, Wermuth warned.

The S&P 500 has rallied 16% from the start of the year, leaving stocks “dangerously overpriced,” Wermuth said, especially when considering the weakening outlook for corporate earnings. Businesses could struggle to maintain profits as financial conditions remain tight and inflation continues to cool off. That could result in one of the worst earnings recessions since 2008, Morgan Stanley has warned, an event the bank predicted could cause stocks to fall as much as 16%.

Trouble is also brewing in commercial real estate market. There’s around $1.5 trillion in debt in the sector that will soon hit maturity and will need to be refinanced, but interest rates are now higher, and banks are pulling on lending. That could produce a boatload of distressed commercial properties, leading prices to crash as much as 40%, per an estimate from Capital Economics.

Falling inflation will also be stoked by slowing GDP growth across major global economies, including the US. The Fed has raised interest rates and aggressively reduced its balance sheet over the past year to fight inflation.

“Enough is enough. By mid and end-September when central banks discuss their next steps, it will be obvious that deflation, not inflation is the main risk,” Wermuth warned.

Markets are expecting the Fed to leave interest rates unchanged at its September policy meeting as central bankers respond to progress on inflation. Investors are pricing in an 89% chance that the central bank will keep rates level in September, with odds rising that the Fed cuts rates in the first quarter of 2024.

Read the original article on Business Insider

China has announced in the past week a series of measures aimed at boosting its economy ahead of a key Politburo meeting later this week focused on reviewing the first half performance of the world’s second-largest economy.

Str | Afp | Getty Images

China’s central bank unexpectedly cut rates on Tuesday, as policymakers continued to ramp up support for its struggling economy.

Early Tuesday, the People’s Bank of China trimmed the interest rate on 401 billion yuan ($55.25 billion) worth of one-year medium-term lending facility (MLF) loans from 2.65% to 2.50. It was the second rate cut in three months.

The move came just before China posted largely disappointing July data. Industrial output rose by 3.7% in July from a year ago, below the 4.4% increase analysts had expected, while retail sales also rose at a slower pace by 2.5% last month.

Then in the late afternoon, the PBOC cut short term rates. Overnight, seven-day, and one-month standing lending facility rates were each trimmed by 10 basis points to 2.65%, 2.8% and 3.15%, respectively.

China is facing a “confidence crisis” as Beijing’s policy delay is being perceived as “inaction” to spur growth, according to an economist.

“There’s no hiding from the fact we’ve had a very horrible July — not just the data we’ve seen coming up to this, but also today’s data,” Louise Loo, lead economist at Oxford Economics, told CNBC’s “Street Signs Asia” on Tuesday.

The latest data comes on top of a slew of weak economic numbers over the past week including sluggish trade and consumer price numbers and record-low credit growth.

The lessons from the past two month “is that policy delay — markets are essentially seeing it as policy inaction,” Loo added.

“In a crisis such as this … you can’t really call it a consumption crisis or investment crisis. It’s really a confidence crisis,” she noted, adding the best way to tackle it “is to be very quick on the stimulus.”

China’s policymakers recently announced a raft of measures to boost consumption, private sector investment and foreign investment. Still, the overall approach to additional stimulus has been cautious.

The move toward stimulus has been “more targeted, more specific,” said Loo. “They’ve very clearly wanted to target the big ticket items in terms of consumption.”

“Is that really enough to lift consumer sentiment, business sentiment? I really don’t think that they’ve been doing enough in that front.”

More rate cuts to come?

In addition to the rate cut on Tuesday, the central bank also injected 204 billion yuan through seven-day reverse repos, cutting borrowing costs by 10 basis points to 1.80% from 1.90%.

“We expect 1yr and 5yr loan prime rates (LPR) to be lowered by 15bps accordingly on 21 August (next Monday), but this should be far from being enough to boost growth,” Goldman Sachs analysts wrote in a note.

“We continue to expect more easing measures in coming months, with a combination of monetary, fiscal, housing and consumption, although the magnitude of stimulus should be smaller than previous easing cycles.”

Hao Zhou, chief economist at Guotai Junan International, echoed a similar sentiment.

“The market will question whether the LPR rate for the five year, which is the important kind of benchmark for the mortgage rate will be cut further or cut more aggressively,” he told CNBC’s Capital Connection on Tuesday.

“That’s the most important thing for the market to watch — the impact or the influence on the property market for now,” he said, adding that’s critical to stabilize economic growth.

China is grappling with an ongoing slump in its massive real estate sector that has taken a toll on its economy. Property market troubles have come to the forefront again with developer Country Garden now on the brink of default.

“The nervousness that investors have around Country Garden is not so much the problems that it’s facing. But the fact that the government has been quite silent on that,” said Loo, adding the property sector is headed for “a long overdue correction.”

China’s post-pandemic doldrums

Overall, China’s consumption driven story of economic recovery “is pretty much over,” noted Loo from Oxford Economics.

“If you look into the two quarters ahead, the government is very much focused on lifting the industry production, lifting some of these business sentiment. So really, I think that pivot is going to come into play.”

“That’s something they will have to grapple with further down the road.”

— CNBC’s Evelyn Cheng, Clement Tan and Lim Hui Jie contributed to this report.

The Chicago school economist who warned years ago of America’s ‘business dynamism’ fading still sees ‘something broken in the background’

Ufuk Akcigit is a distinguished economist. He’s the Arnold C. Harberger professor of economics at the University of Chicago, one of the most influential departments in the discipline of the last century (the so-called “Chicago school”), and holds a PhD from MIT. The Turkish national has also won multiple awards for his research, including Germany’s Max Planck-Humboldt and Kiel Institute awards, as well as the prestigious Guggenheim Fellowship.

A pioneer in the field of Quantitative Economic Growth, Akcigit examines how market innovation and policy combine to optimize an economy’s expansion—or the opposite. Akcigit’s work on “business dynamism,” a hugely important metric that gauges an economy’s ability to sustain growth, has borne grim tidings for his adopted country of the United States. Simply put, he’s found that over time, the American economy has become a hostile environment for innovation.

In 2019, Akcigit and his co-author Sina T. Ates, of the Federal Reserve Board, released findings that pinned the blame for fading U.S. dynamism on “poor knowledge diffusion.” Four years later, he tells Fortune that the problems just haven’t gone away.

“For productivity to improve, we need to have ‘creative destruction’ and turnover,” Akcigit told Fortune. “Better firms should replace worse firms in the economy, and that turnover will push productivity forward.”

(Ates, a principal economist at the Federal Reserve Board, was unable to speak on the record due to his position. The researchers’ findings do not reflect the opinion of the Fed.)

Something’s broken

Business dynamism, measured by the rate of new firm creation in markets, is directly tied to innovation and productivity. In Akcigit’s field, researchers have known that it’s been declining in the U.S. since the 1980s, the cause of which has prompted various theories. This decline in dynamism is significant because it’s linked to a general slowing of productivity and creative momentum, which need to be strong for the U.S. to remain the world’s dominant economy in the long term.

The majority of U.S. markets have become more concentrated, and thus less competitive due to the slowing firm turnover rate, the co-authors argued. The result has been markets increasingly dominated by big players who don’t drive their sectors forward, and higher barriers for new businesses to enter markets. The dip in new entrants is a hit to the economy, as new entrepreneurs are the engines of growth under capitalism.

“Creative destruction,” a phrase coined in 1942 by the great Austrian economist Joseph Schumpeter, is the process where unproductive firms are cyclically edged out of a market as the natural result of healthy competition and as new, more productive companies surge ahead. It therefore bodes ill that, according to Akcigit, the number of new firms launching the U.S. economy has been declining for the past several decades in tandem with a productivity slowdown.

The 2020s are providing evidence of green shoots for dynamism. In the three years since the pandemic, there’s been a well-reported rise in new business formation, while productivity has largely declined as CEOs nationwide weather remote and hybrid work, only for a surprise uptick in the second quarter of 2023. Still, the U.S. has seen a steady secular decline in establishment births for decades. This is especially troubling, Akcigit says, because the U.S. has been greatly increasing its investments in research and development. The government’s investment in R&D was an estimated $792 billion in 2021, nearly double the $407 billion it spent in 2010.

“There’s something broken in the background, these are the indicators according to the textbook definition,” says Akcigit, who is also a researcher at Germany’s Halle Institute for Economic Research. “Normally as we invest more in R&D and innovation, we should grow faster, but that’s not happening…and the amount of knowledge that diffuses from market leaders to followers seems to be the dominant factor to explain all these facts together.”

Akcigit and Ates modeled various “alternative horse races” to test which factors—including potentially corporate taxes, inflation, or subsidies—could be causing the decline in dynamism. They worked with quantitative data on firm entry rate, job reallocation, productivity dispersion, and other vectors, building on previous research with new models. Ultimately, their research indicates that the key to sustained economic growth may be a democratic distribution of great ideas.

“Knowledge diffusion” is the dispersion of innovation across an industry. If one firm makes a breakthrough, the spread of its ideas can supercharge productivity across the sector, but siloing that information only benefits the original business. Knowledge diffusion is crucial for economic productivity, because productivity aggregates all firms and can’t be accelerated by just a few strong leaders. For a whole society to benefit from new knowledge, it has to be shared with as many potential users of that knowledge as possible.

But right now, Akcigit and Ates found, new breakthroughs are getting more concentrated. The existing big players across markets are becoming more entrenched, and the turnover rate among market leaders is declining. This means that firms that historically would be replaced by newer, more creative firms are remaining in power and dragging down the market’s productive potential.

“Firms are experimenting less, they are entertaining less radical ideas over time,” Akcigit told Fortune. “They are trying to go for safer things.”

What broke?

Akcigit and Ates’ research posits three main reasons for the dynamism decline. First, the U.S. has outsourced more and more of its production over the past four decades. When production is concentrated in the same area, various firms have the benefit of learning from each other through interacting in the region. Increased offshoring of production abroad means communication—and thus cross-pollination of ideas—between firms has naturally declined.

Second, the rise of data as a form of capital interfered with traditional means of knowledge diffusion. In decades past, a smaller rival could better compete against an entrenched player by studying its production facilities: they could see what kind of machines were used and reverse-engineer them. But now, machines and data capital are not easily studied in person to be reverse-engineered.

“Today, one of the main ingredients for production is data, customer data, or A.I.,” Akcigit says. “Firm data is not something that you can replicate unless you share it and make it publicly available, which obviously firms don’t do. So as a result, whoever has managed to collect enough information on the largest possible customer base gets a disproportionate advantage.”

Data primacy, of course, favors established firms with larger, richer databases and customer bases from which to extract new data.

The third reason to which Akcigit and Ates attribute weak U.S. dynamism is the most significant: intellectual property hogging. They measure the growing concentration of intellectual property by patent ownership. In the early ’80s, 30% of patents were produced by the largest 1% of firms. By 2019, that number had doubled to 60%.

Not only are more than half of all new inventions owned by the economy’s largest firms, but those same firms are always vying to purchase more patents invented by other firms, to essentially monopolize new ideas. In the ’80s, 35% of the patents on the secondary market were purchased by the largest firms, but now it’s around 65%.

“There’s a massive concentration of intellectual property within the hands of the market leaders,” Akcigit says. “You buy these patents to build a wall around yourself so that competition is harder, and followers cannot leapfrog your boundaries. And whenever they try to leapfrog you, you threaten them, you sue them, you take them to court.”

How do we fix it?

There are some listening to this—including in the White House. President Joe Biden has made what he calls pro-competitive reforms a priority of his administration, particularly with regard to antitrust policy, where he’s actively seeking to break with 40 years of precedent and practice. Notably, he nominated Lina Khan, flagbearer of the populist, hard on Big Tech “New Brandeis” movement in antitrust, as chairwoman of the FTC, and as chair of the agency she has formed a triumvirate of likeminded pro-competition regulators, with Jonathan Kanter at the Justice Department and Tim Wu at the White House’s National Economic Council, although Wu resigned in late 2022 to return to teaching at Columbia University.

Khan is known for her anti-monopolism and goal of reforming federal merger guidelines. She’s taken on several big players in the tech industry, and endured many setbacks in her efforts to block mergers. While at Yale Law School, she published the influential article “Amazon’s Antitrust Paradox,” which takes aim at the retail behemoth and similar big players, calling for increased anti-monopoly, pro-competition policy.

Biden has also created a White House Competition Council and issued an executive order in July calling for the deconsolidation of American industries.

“[T]he answer to the rising power of foreign monopolies and cartels is not the tolerance of domestic monopolization, but rather the promotion of competition and innovation by firms small and large,” the executive order reads.

For his part, Akcigit says policies to bolster knowledge diffusion may be most effective in the intellectual property realm. Right now, most patent authorities monitor the amount of original patents being produced, but they should also be keeping a close eye on the secondary market. The leap in large firms purchasing patents on the secondary market, buying competitors’ inventions, is a primary contributor to idea-clogging in markets.

“The secondary market for technologies has to be watched,” Akcigit says. “Instead of having patent resale in a productive way, the secondary market is being used for so-called killer acquisitions. So the market leaders are buying out other firms or their intellectual property, not to use them, but to put them to sleep so that they don’t compete.”

The economist told Fortune that competition policymakers and authorities should keep a “dynamic and forward-looking” mindset. Small companies can be hugely important idea crucibles and become quickly successful, but are the most vulnerable to macroeconomic headwinds. If authorities don’t know which startups to keep watch over, important breakthrough firms can easily fail due to their fragility.

Akcigit compared young firms to children in the economic family, who fall ill easily and have to be carefully protected. “We should look at their future potential,” he advised.“Whenever there’s some macro-turbulence, small firms get affected very easily—but, they are the future of the economy.”

This story was originally featured on Fortune.com

More from Fortune:

5 side hustles where you may earn over $20,000 per year—all while working from home

Looking to make extra cash? This CD has a 5.15% APY right now

Buying a house? Here’s how much to save

This is how much money you need to earn annually to comfortably buy a $600,000 home

Veteran Economist Steve Hanke Suggests that US Inflation Is Now Gone

Hanke’s commentary follows barely 24 hours after the US inflation rate for June came in lower than expected at 3%.

Steve Hanke, a highly-revered professor of applied economics at Johns Hopkins University, has shared an expert opinion on inflation in the United States. According to him, inflation, as far as the US is concerned, is now a thing of the past.

The veteran economist shared his view in the early hours of Thursday while speaking on CNBC’s “Street Signs Asia”. He was quoted as saying:

“I think the inflation story is history. One reason for that is that money supply has been contracting on a year-over-year basis by minus 4% in the United States.”

Hanke also recalled that the last time changes in the money supply happened like that was in 1938. “Money supply changes cause changes in the price index and inflation,” he added.

Hanke’s commentary follows barely 24 hours after the US inflation rate for June came in lower than expected at 3%. That is, notably, the smallest year-on-year increase in two years. Also, the core consumer price index (CPI), which generally excludes food and energy prices, rose 4.8% in a year, but 0.2% month-on-month.

In his explanation, Hanke revisited how inflation rose, almost simultaneously, with the producer price index and the consumer price index. However, he also pointed out how the core was the slowest to rise at the time.

Similarly, now that policies are proving somewhat effective and the producer price, as well as consumer price indexes, are falling hard, the core lags yet again, he claims.

Nonetheless, Steve Hanke is positive that even the core would eventually come down significantly. But that is as long as policymakers “continue with quantitative tightening”.

As of publication, core inflation is still running well above the Fed’s 2% annual target. But if the Fed sustains its tightening policy, “it can reach the 2% range pretty fast,” Hanke concluded.

The US producer price index is due later today. And if it also shows prices falling, the Fed may have to end the rate hiking cycle soon.

Meanwhile, the CMEFedWatch tool also suggests that traders have a 92.4% expectation that the Fed rates will remain unchanged in the Fed’s July meeting.

next

Market News, News

Mayowa is a crypto enthusiast/writer whose conversational character is quite evident in his style of writing. He strongly believes in the potential of digital assets and takes every opportunity to reiterate this.

He’s a reader, a researcher, an astute speaker, and also a budding entrepreneur.

Away from crypto however, Mayowa’s fancied distractions include soccer or discussing world politics.

You have successfully joined our subscriber list.