The European Central Bank (ECB) has published a blog post claiming that “bitcoin has failed to fulfill its original promise to become a global decentralized digital currency.” The ECB economists who authored the post added that bitcoin’s fair value is still zero and bitcoin transactions are “still inconvenient, slow, and costly.” Moreover, they asserted that […]

The European Central Bank (ECB) has published a blog post claiming that “bitcoin has failed to fulfill its original promise to become a global decentralized digital currency.” The ECB economists who authored the post added that bitcoin’s fair value is still zero and bitcoin transactions are “still inconvenient, slow, and costly.” Moreover, they asserted that […]

Source link

economists

Many Chinese developers have halted or delayed construction on presold homes due to cash flow problems. Pictured here is a property construction site in Jiangsu province, China, on Oct. 17, 2022.

Future Publishing | Future Publishing | Getty Images

China’s economy is sputtering.

Its property market is crumbling, deflationary pressures are spreading across the nation, and its stock market has weathered a turbulent ride so far this year, with the country’s CSI 300 index erasing some 40% of its value from its 2021 peaks.

Adding salt to the wound, January PMI numbers released by China’s National Bureau of Statistics showed manufacturing activity contracted for the fourth month in a row, driven by slumping demand.

The slew of downbeat data has consequently triggered a wave of skepticism toward the world’s second-largest economy. Allianz for one, reversed its buoyant view of China, now forecasting Beijing’s economy to grow by an average 3.9% between 2025 to 2029. That’s down from a 5% forecast before the Covid-19 pandemic broke out.

Ex-International Monetary Fund official Eswar Prasad also told Nikkei Asia that “the likelihood of the prediction that China’s GDP will one day overtake that of the U.S. is declining.”

Meanwhile, top economist and Allianz advisor Mohamed El-Erian highlighted China’s dismal stock market performance against those in the U.S. and Europe in a chart on X, saying it shows the stark divergence between all three equity markets.

China itself, however, isn’t willing to confess its economy is in tatters. Chinese leader Xi Jinping said on New Year’s Eve that the nation’s economy had grown “more resilient and dynamic this year.”

Feeding on such optimism, it’s fair to say there’s been some signs of hope for the beleaguered economy, but perhaps not enough to sway the bears. For instance, factory activity in China expanded for a third-straight month in January, while the nation’s luxury sector appears to be snapping back.

Such data has prompted bullish chatter among investors, suggesting consensus on China clearly lacks uniform.

Era of stagnation

Nobel laureate Paul Krugman has been among some of the most bearish voices toward China, saying the country is entering an era of stagnation and disappointment.

China was supposed to boom after it lifted its stringent “zero-Covid” measures, Krugman wrote in a recent New York Times op-ed. But it did the exact opposite.

From bad leadership to high youth unemployment, the country is facing headwinds from all corners, Krugman argued. And the country’s economic stumble isn’t isolated, Krugman warns, potentially becoming everyone’s problem.

Property crisis

China’s well-known property troubles have been the crux of Wall Street bearishness toward the Asian nation.

The International Monetary Fund said it expects housing demand to drop by 50% in China over the next decade.

Speaking at the World Economic Forum in Davos last month, IMF chief Kristalina Georgieva said China’s real estate sector needs “fixing,” while Beijing needs structural reforms to avoid a decline in growth rates.

Meanwhile, famed hedge fund manager and founder of Dallas-based Hayman Capital Kyle Bass said the country’s heavily indebted property market has triggered a wave of defaults among public developers. That’s a problem, given China’s real estate market can account for as much as a fifth of the nation’s GDP.

“This is just like the U.S. financial crisis on steroids,” Bass said, referring to China’s default-ridden property market.

“China is going to get much worse, no matter how much their regulators say, ‘we’re going to protect individuals from malicious short-selling,'” he added.

“The basic architecture of the Chinese economy is broken,” Bass continued.

Glimmers of hope

A gloomy picture for China, however, isn’t shared by all.

The Institute of International Finance said Beijing has the policy capacity to push China’s economy toward its growth potential and stuck to its above consensus forecast for 2024 growth at 5%, in a recent blog post. That view, however, depends on sufficient demand-side stimulus. The latest GDP numbers out of China for the last three months of 2023 missed analysts’ estimates, with a figure of 5.2%.

At the same time, Clocktower Group partner and chief strategist Marko Papic took an optimistic short-term view toward Chinese equities. In a Feb. 7 CNBC interview, Papic said he forecasts China stocks to jump at least 10% in the coming days as officials signal support efforts to bolster its flailing stock market.

A “10% to 15% rally in Chinese equities is likely in coming trading days,” Papic said.

JPMorgan Private Bank also outlined bull case scenarios for China in a recent post. “Despite the stock market’s slipping sentiment and persistent problems with the property market, certain segments of the Chinese economy have also proved their resilience,” it said.

The bank said China’s crucial role as a global manufacturer is unlikely to abate, adding that cyclical demand for its exports could remain intact.

Looking ahead, China has hurdles to overcome. Whether it has the firepower to do so, however, remains to be seen.

Bitcoin At A Crossroads? Economist’s Doom Prediction Clashes With Spot ETF Approval Hopes

As the world of crypto braces for a potential regulatory nod from the US Securities and Exchange Commission (SEC) in favor of a Bitcoin spot exchange-traded fund (ETF), Peter Schiff, a notable crypto critic, has voiced a dissenting opinion.

Schiff projected a grim future for Bitcoin, especially in the event of a spot ETF approval. His comments come at a time when the crypto community is abuzz with expectations of a boost in institutional investor interest in Bitcoin.

Economist Spells Gloom For Bitcoin

In a recent post on X, Schiff expressed his skepticism, suggesting that the speculative buzz around the US.-listed ETF directly investing in Bitcoin has been “inflating” the crypto’s value.

This view aligns with Bitcoin’s price trend, which saw an uptick in late last year, following a false report about the approval of BlackRock’s pending spot ETF application. While crypto enthusiasts view the potential spot ETF approval as a gateway for traditional investors into the crypto market, Schiff’s outlook starkly contrasts this sentiment.

Be careful what you wish for. The promise of a U.S. listed spot #BitcoinETF has been supporting the #Bitcoin price and speculative demand for years. Once the ETFs are launched and the highly anticipated institutional and other new investor demand does not show up, look out below!

— Peter Schiff (@PeterSchiff) January 2, 2024

Community Clashes With Schiff’s Pessimism

Peter Schiff’s statements have not gone unchallenged in the crypto community. On X, his posts have attracted critical responses, with users questioning the basis of his bearish predictions. One X user, known as Bloxpert, directly asked Schiff for examples of ETF launches that led to bearish outcomes.

Schiff, in response, questioned the necessity of a Bitcoin ETF, arguing that since Bitcoin can be bought and stored independently, an ETF seems redundant. He implicitly downplayed the need for such financial products in the crypto space, concluding: “You might as well just own a gold ETF.”

Well there is really no need for a Bitcoin ETF, as you can buy and store Bitcoin yourself for free. What’s the point of owning it in an ETF anyway? You might as well just own a gold ETF.

— Peter Schiff (@PeterSchiff) January 2, 2024

Despite Schiff’s bearish outlook, a significant portion of the crypto community and many experts remain optimistic. For instance, James Butterfill, head of research at CoinShares, sees the approval of a spot Bitcoin ETF in the US as a transformative event for the digital asset market.

Butterfill suggests that an investment increase of 20% from current assets under management could push Bitcoin prices to around $80,000. Such predictions stand in stark contrast to Schiff’s views, reflecting the diverse opinions and expectations surrounding Bitcoin’s future in the wake of potential regulatory changes.

Featured image from Unsplash, Chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Should you wait for a better deal on a home or jump in now? Here’s what housing market economists say.

-

Falling mortgage rates can lead to a surge in homebuyer demand, which pushes prices up.

-

But an uptick in housing inventory could blunt the impact of a demand spike, economists said.

-

In addition, mortgage rates have limited downside this time around.

The housing market is beginning to ease up, with mortgage rates slipping and prices softening. That’s good news for homebuyers who had been waiting on the sidelines.

But they may be tempted to see how much further conditions improve as mortgage rates are already falling at the fastest pace since the 2008 crash.

There’s a big catch to that idea though: as rates drop, more buyers may jump in, potentially sending home prices up. Due to that risk, real estate expert Barbara Corcoran has warned against waiting for a better deal.

We don’t have to look too far back to see what happened the last time interest rates fell. In 2020, when the Fed began easing to keep the economy chugging along during the pandemic, mortgage rates plummeted below 3%, and home prices rocketed higher.

That situation, however, is fundamentally from what’s coming up in 2024, said Lawrence Yun, chief economist at the National Association of Realtors.

“I don’t anticipate that type of situation this time,” he told Business Insider. “First, we’re not going to get to 3% mortgage rates. And the second is that I think we’re going to certainly see more inventory come out to the market.”

Indeed, many housing experts think mortgage rates won’t drop that much further, slipping to 6% next year from just below 7% now after hitting 8% in October.

And if more homes come on the market, a demand spike won’t force prices higher. Next year may see housing supply thaw after this year’s crunch kept the market largely frozen.

There are some signs that more homes are coming on the market — November’s housing starts data signaled fresh supply on its way.

Meanwhile, demand may not actually spike right away. Hannah Jones, senior economics research analyst at Realtor.com, said fewer people are in the market right now because buyers are waiting out the fall in mortgage rates.

While she expects rates to go a little bit lower next year, “a buyer may be facing less competition because less buyers have decided to re-enter the market.”

However, Redfin chief economist Chen Zhao cautioned that it’s hard to anticipate where mortgage rates or home prices will go.

In previous instances when mortgage rates have been coming down, it’s because the Fed was cutting rates into a recession, she pointed out.

“And that’s a really important distinction because right now going into 2024, the Fed anticipates cutting, markets anticipate the Fed cutting, but no one is anticipating the Fed cutting into a recession,” she said in an interview.

Read the original article on Business Insider

Luis Alvarez | Digitalvision | Getty Images

The U.S. economy inched closer to a so-called “soft landing” after a new batch of labor data, economists said.

A soft landing is a good thing. It would mean the Federal Reserve has accomplished the difficult task of taming inflation without triggering a recession.

Job openings, a barometer of employer demand for workers, fell by 617,000 to 8.7 million in October, the lowest since March 2021, the U.S. Department of Labor reported Tuesday in its monthly Job Openings and Labor Turnover Survey.

“Another key ingredient of a sustainably soft landing is falling into place,” Jason Furman, a professor at Harvard University and former chair of the White House Council of Economic Advisers during the Obama administration, wrote about job openings.

Why a soft landing is like ‘Goldilocks’ porridge’

Steaming bowl of oatmeal porridge, made with Irish oats, wheat berries and barley.

Jon Lovette | Photographer’s Choice Rf | Getty Images

On its face, a weakening labor market may sound like bad news — but that trend is by design.

The Fed started raising borrowing costs aggressively in early 2022 to tame stubbornly high inflation. By raising interest rates to their highest level since 2001, the central bank has aimed to cool the economy and the labor market.

The Fed has been walking a tightrope: bringing down inflation from four-decade highs without causing an economic downturn. The opposite — a hard landing — would mean a recession.

A soft landing is like “‘Goldilocks’ porridge’ for central bankers,” Brookings Institution economists wrote recently. In this scenario, the economy is “just right — neither too hot (inflationary) nor too cold (in a recession),” they said.

“It’s absolutely the best possible outcome,” said Julia Pollak, chief economist at ZipRecruiter. “And I think the chances [for it] get higher and higher all the time. We are very, very close.”

There is no official definition for a soft landing. According to conventional wisdom, it has only been achieved once — in 1994-95 — in the history of 11 Fed monetary-policy-tightening cycles dating to 1965, the American Economic Association wrote.

How the labor market fits in

Why the job market is already ‘back into balance’

The latest labor data added to encouraging news about a likely soft landing, economists said.

A big pullback in job openings didn’t coincide with weakness elsewhere. Quits and hires held steady around their respective pre-pandemic levels. Layoffs remain low and are about 17% below their pre-pandemic baseline, suggesting employers want to hold on to workers, Pollak said.

Despite the large monthly decline, job openings are still 25% above their February 2020 level, she added.

It’s absolutely the best possible outcome. And I think the chances [for it] get higher and higher all the time.

Julia Pollak

chief economist at ZipRecruiter

The ratio of job openings to unemployed workers fell to 1.3 in October, down from a pandemic-era high of 2.0 and near the pre-pandemic level of 1.2.

“This [JOLTS] report should bring abundant holiday cheer as the probability of a soft landing continues to rise,” Nick Bunker, director of economic research at the Indeed Hiring Lab, wrote Tuesday.

“The current state of the labor market suggests no further recalibration is necessary to bring [it] back into balance,” he added. “It’s already there.”

In short: The labor market has cooled while layoffs haven’t spiked and workers still enjoy relatively good job security and prospects, economists said.

“It’s still a favorable labor market,” Pollak said.

However, workers have lost leverage relative to 2021 and 2022. Big pay increases aren’t as prevalent, nor are signing bonuses. While there remain ample job opportunities, they are harder to get, Pollak said. Outside of industries such as health care, in which there’s an acute labor shortage, the opportunities “aren’t quite as attractive,” she added.

Don’t miss these stories from CNBC PRO:

The U.S. had more than 9 million open roles in June, and while that’s down from the peak of 12 million in March 2022, it’s still among the highest number of openings we’ve had since before 2000.

“You’re talking about passing up something like $1 trillion in production every year that these jobs go unfilled,” David J. Bier, associate director of immigration studies at the Cato Institute, told CNBC.

With 5.8 million unemployed workers in the U.S., some economists say all of these roles are unlikely to be filled by people currently living in the U.S.

Currently, American immigration policies bar many employers from hiring unskilled migrants.

Bier explained, “In 1986, Congress banned people working without authorization in the U.S. They made it impossible to hire someone who was in the U.S. illegally or without employment authorization.”

Now, some argue this protects workers already living in the U.S., but the public is split almost evenly on this. Fifty-one percent of Americans surveyed by the Cato Institute worry immigration could reduce the number of jobs available.

Meanwhile, the number of job openings remains at historic levels. Darrell Bricker, co-author of “Empty Planet: The Shock of Global Population Decline” and CEO of Ipsos Public Affairs said, “The effect of a shrinking aging population is a decline in innovation, combined with the fact that you’re just going to run out of the things that drove economic growth.”

He continued, saying there is “a huge opportunity for the United States to blunt some of the effects of fertility decline and population aging by having an immigration policy that may be a bit more focused, not necessarily on just accepting anybody for compassionate reasons, but for bringing in people to fill in those skill gaps.”

Bricker’s home country of Canada has a much more open immigration policy and credits its Covid pandemic recovery in part to its approach to immigration.

Dany Barah, associate professor of the practice of international and public affairs at Brown University and a Venezuelan immigrant, said, “One could argue that Canada has benefited a lot from the broken migration system in the U.S.”

Bahar and his colleagues are developing what they’re calling the Occupational Opportunity Network to help keep decision-makers informed about how migrants can help the U.S. economy grow.

“By looking at every occupation in every locality in the U.S. and projections and historical data, we’re able to actually come up with numbers that are much higher than the current caps in the U.S. system and we hope that these numbers are going to be the basis for a comprehensive immigration reform,” he told CNBC.

However, not all immigration experts agree we need more open borders. Simon Hankinson, senior research fellow, border security and immigration center, at the Heritage Foundation said: “We’re in a really unique environment at the moment. We’re sort of testing, pushing the envelope of our national sovereignty and our ability to to absorb people.”

Hankinson explained the current visa system, specifically in the case of the HB-1 visa, undercuts the skilled labor market by bringing in workers from abroad. “It’s never allowed the market to exercise that function where the wages go up and then people are tempted to go into those fields and fill those jobs.”

Watch the video to learn more about how U.S. immigration policies impact economic growth and how the U.S. can fix it.

Mortgage rates could hit 8%, economists say, citing a worrying sign not seen since the Great Recession

With mortgage rates firmly above 7%, homeownership has become much more expensive. But will rates go even higher?

Three experts told MarketWatch that if the economy continues to show signs of strength, and the U.S. Federal Reserve hikes its benchmark interest rate once again, rates could go up to 8%.

High rates have already taken a toll on the U.S. housing market. Even home builders, who have in recent months experienced strong demand from homebuyers, are reporting a drop in buyer traffic as those rising rates rattle their customers.

But experts also stressed that the U.S. economy is showing early signs of cooling, and that the rate of inflation is easing. That could lead to a slowdown — or even a drop — in mortgage rates. But such forecasts are not a guarantee, as Tuesday’s stronger-than-expected U.S. retail sales figures suggested.

How high can rates go?

Even though the 30-year fixed mortgage rate was averaging 7.26% as of Tuesday evening, the highest level since November 2022, economists say rates could go up further.

The 30-year is “at a critical stage,” Lawrence Yun, chief economist at the National Association of Realtors, told MarketWatch.

“If the 30-year-fixed mortgage rate can hold at a high mark of 7.2% — and the 10-year yield holds at 4.2% — then this would be the high for mortgage rates before retreating,” Yun said. “If it breaks this line and easily goes above 7.2%, then the mortgage rate reaches 8%.”

As of Tuesday afternoon, the 10-year Treasury note

BX:TMUBMUSD10Y

was above 4.2%.

“Mortgage rates could rise significantly if global investors demand higher yields for fixed-income assets,” Cris deRitis, deputy chief economist at Moody’s Analytics, told MarketWatch.

Currently, the spread between the 30-year fixed-rate mortgage and a 10-year Treasury bond is around 300 basis points, which is “elevated and highly unusual,” he said.

“‘Historically, the mortgage-rate spread has only been around this level only during periods of financial crisis such as the Great Recession or the early 1980s recession.’”

— Cris deRitis, deputy chief economist at Moody’s Analytics

“Historically, the mortgage-rate spread has only been around this level only during periods of financial crisis such as the Great Recession or the early 1980s recession,” deRitis added. “The historical average is closer to 175 basis points.”

If the 10-year continues to rise — and the U.S. Federal Reserve chooses to interest rates once again — it could go beyond 5%. If the spread stays elevated at 300 basis points, deRitis added, “a mortgage rate of 8% or more is a distinct possibility in the near term.”

Consumers seem to be prepared for 8% rates. In February, households surveyed by the New York Federal Reserve as part of its Survey of Consumer Expectations, found that they expect mortgage rates to rise to 8.4% by the following year, and 8.8% in three years’ time. Yet few saw the moment as an opportunity to buy.

To be clear, rates have been far higher in the past. In 1981, the 30-year mortgage rate went up to 18%, according to Freddie Mac

FMCC,

That year, the rate of inflation was 10.3%, according to the Minneapolis Fed.

“So in theory, mortgage rates can go up as much,” Selma Hepp, chief economist at CoreLogic, told MarketWatch. “But I don’t think they’re gonna go much beyond where they are right now.”

The yearly rate of inflation in July was just 3.2%. There was runaway inflation in the early 1980s. Though the year isn’t over yet, it is highly unlikely that the rate will suddenly surge, as economists expect the cost of housing — one of the biggest drivers of inflation — to ease in the coming months.

What happens to housing if rates surge?

If the 30-year mortgage interest rate reached 8%, there would be serious consequences for the housing market, Yun said. “At 8%, the housing market will re-freeze, with fewer buyers and far fewer sellers,” he added.

But don’t expect high rates to hurt home prices just yet, Yun added: “As long as the job market doesn’t turn negative, then home prices will be stable — though home sales will take another step downward. If there is a job-cutting recession, then home prices will fall as some will be forced to sell while there are few buyers.”

Other experts said that high rates have already taken a toll on the U.S. housing sector. “A mortgage rate in excess of 6% has already sidelined a large number of potential homebuyers, especially first-time home buyers,” deRitis said.

He noted that the monthly mortgage payment for a median-priced home at the prevailing 30-year mortgage rate has risen from close to $1,100 per month in January 2019 to over $2,100 today. “At 8%, the monthly payment would rise to over $2,300, excluding an even larger number of potential buyers with above-average incomes,” deRitis added.

High rates also discourage homeowners from selling, since they may have to surrender an ultra-low mortgage with a low monthly payment for a high rate. They may end up with a smaller budget to purchase a home, or worse, not find any listings at all, given an ongoing inventory crunch.

With high rates, many home buyers may be priced out of the market. Yet some buyers — particularly baby boomers — who have the means to put in all-cash offers on homes are keeping home prices elevated, Hepp said.

So who would be able to buy and sell? Cash buyers. “They tend to be older people like baby boomers who own their homes free and clear,” she added. “If they live in more expensive areas, like anywhere in California, they can sell their home and walk away with in excess of $500,000. And that in some markets buys them two homes.”

deRitis said that the ultimate fate of home prices falls on the strength of the job market. Even though rates are high for now, home prices may not fall significantly, as some buyers can still purchase homes with cash, he added.

But “if the labor market should weaken and unemployment rise, home foreclosures would rise,” deRitis added, “placing downward pressure on home prices.”

“So the housing market is definitely suffering from high rates,” Hepp said. “But I think even higher rates would be pretty devastating for the housing market.”

Economists are getting more optimistic about GDP and jobs, survey says

The U.S. economy will likely see stronger growth and add more jobs next year than previously expected, according to a quarterly survey of economists conducted by the Federal Reserve Bank of Philadelphia.

The economists see a brighter future for real GDP growth than they did when the Philadelphia Fed conducted the last Survey of Professional Forecasters three months ago.

The economy is forecast to grow 1.9% this quarter, a jump from the previous estimate of 0.6%. Growth will likely be over 1% in the fourth quarter of this year and throughout the first three quarters of 2024 — an improvement over the prior expectation of zero growth for the fourth quarter.

Respondents also predict greater job growth than they did before.

Unemployment will continue to grow, but not by as much as some economists once thought, likely increasing from 3.6% to 4% between now and the second quarter of 2024, they predict. Three months ago, economists expected unemployment to rise to 4.2% over the same period.

They project the U.S. will add an average of 288,600 jobs per month in 2023, an increase from the 257,500 projection of three months ago. And although job growth is expected to drop substantially next year, the predicted average of 94,800 jobs added each month is still 38,700 more than the the earlier forecast.

The respondents seem to feel better about some economic conditions than they did in the past, but their hopes for inflation are not getting brighter.

They now predict the inflation rate might not plummet quite as much as the Fed hopes, a slightly more pessimistic view than they once had.

Fed officials are trying to lower the inflation rate to 2% without driving the economy into a recession. Three months ago, economists predicted that the core personal consumption expenditures index would reach 2% at the end of 2025. Now, the 2025 PCE expectation is 2.1%, a slight uptick from before.

Still, inflation will fall over the next year, the economists predict — a forecast largely in line with their previous projection.

The PCE, the Fed’s preferred measure of inflation, is projected to fall to 2.8% in the fourth quarter of this year. Core PCE, which excludes the volatile food and energy categories, will drop to 2.3% in the third quarter of 2024, they expect.

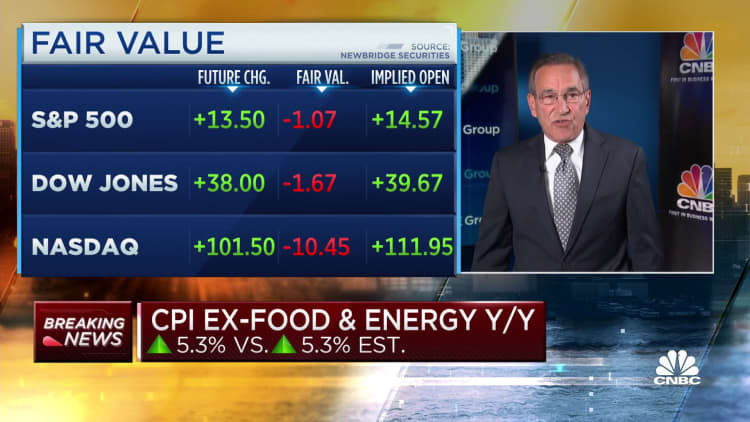

Eurozone Q2 GDP Beats Expectations, Inflation Down but Economists Still Fear Recession

While inflation in Eurozone shows signs of slowing down, it still remains much higher than the targeted 2%. Economists also pointed out other cracks in the Eurozone economy.

For the month of July 2023, the Eurozone has delivered a robust set of GDP numbers beyond market expectations. The new growth numbers show economic activity picking up during the second quarter with inflation slowing down. However, economists still fear that a recession could be on the cards.

In July, headline inflation in the euro area was 5.3%, lower than the 5.5% in June. However, it is still much higher than the European Central Bank’s target of 2%. Core inflation, which excludes food and energy prices, stayed the same at 5.5% in July. This outcome might be a “disappointment for policymakers,” according to Andrew Kenningham, chief Europe economist at Capital Economics.

For the past year, Eurozone has been facing high inflation, leading the ECB to implement consecutive rate hikes in an attempt to control prices. Last week, the central bank raised rates by another quarter percentage point, bringing the main interest rate to 3.75%.

Initially, the inflation was mainly driven by high energy costs, but in recent months, food prices have become the primary contributor. In July, food, alcohol, and tobacco prices increased by 10.8%, although this hike was lower than in previous months.

Eurozone GDP Beats Expectations

The inflation numbers came amid previously sluggish economic growth, with GDP remaining stagnant in the first quarter of the year. However, a separate data release on Monday revealed that growth picked up in the second quarter, expanding by 0.3%, surpassing the 0.2% forecasted by Reuters’ analysts.

Nonetheless, Capital Economics’ Kenningham believes that the second-quarter GDP increase in France and Ireland was due to one-off factors, which may present a misleading impression of the economy’s actual strength. In a research note, Kenningham added:

″[It] does not change our view that the economy is heading for recession. Excluding [France and Ireland] GDP growth would have been only 0.04% q/q, or zero to one decimal place! As these factors are unlikely to be repeated in the coming quarters and the impact of monetary policy tightening is still intensifying, we think euro-zone GDP will contract in the second half of the year.”

In the second quarter, both France’s and Ireland’s economies showed resilience, with France’s GDP rate being 0.5% and Ireland’s expanding by 3.3%. However, ING‘s Senior Euro Zone Economist Bert Colijn pointed out that Ireland’s growth was exceptional and without it, the overall growth would have been much lower. According to survey data, the economy has remained relatively stagnant, and there are concerns that the coming quarters may face downside risks.

Spain also performed well, experiencing growth of 0.4%. In contrast, Germany had weaker growth during the same three-month period.

next

Business News, Market News, News

Bhushan is a FinTech enthusiast and holds a good flair in understanding financial markets. His interest in economics and finance draw his attention towards the new emerging Blockchain Technology and Cryptocurrency markets. He is continuously in a learning process and keeps himself motivated by sharing his acquired knowledge. In free time he reads thriller fictions novels and sometimes explore his culinary skills.

You have successfully joined our subscriber list.

Subscribe to our telegram channel.

Join

Richard Newstead | Moment | Getty Images

Housing is perhaps the most consequential category in the consumer price index, a key inflation barometer.

As the largest expense for an average U.S. household, shelter accounts for more than a third of the CPI weighting, the most of any other consumer good or service. That gives housing an outsized influence on the overall direction of inflation data.

Housing inflation has been stubbornly high for months, according to CPI data. But economists think it has peaked and is on the precipice of a reversal.

“I know this with about as high a degree of confidence as one could have,” Mark Zandi, chief economist at Moody’s Analytics, said of falling housing inflation being near at hand.

How ‘shelter’ prices have changed

Price changes in “shelter” were generally muted before the pandemic, economists said.

For example, Americans saw rents grow by 4.8% in May from a year earlier, to about $2,048 a month on average nationally, according to Zillow Observed Rent Index data. That’s a significant slowdown from 15.7% growth during the prior year, from May 2021 to May 2022.

CPI isn’t ‘a particularly accurate gauge’ for housing

Here’s the problem: The CPI doesn’t capture those price trends in real time.

It operates with a substantial lag, meaning it can take six months to a year for a decline (or increase) in current housing prices to fully feed through to inflation data, economists said.

“It’s not necessarily a particularly accurate gauge of what’s going on in the housing market right now,” Andrew Hunter, deputy chief U.S. economist at Capital Economics, previously told CNBC.

More from Personal Finance:

Social Security cost-of-living adjustment may be 2.7% in 2024

Here’s the inflation breakdown for May 2023, in one chart

The rich often misjudge the potency of their retirement savings

Here’s the reason for the lag: The U.S. Bureau of Labor Statistics collects rent data from sample households every six months. The BLS also divides these sample households into six different subgroups (called “panels”) and staggers when it collects data for each. Per the BLS, rents for Panel 1 are collected in January and July; Panel 2, in February and August, and so on.

That means it can take a year or so to collect data from all the subgroups.

Why economists think housing inflation is poised to fall

“Shelter is still playing a big role in inflation but that should be slowing in the second half of the year,” Jason Furman, an economist at Harvard University and former chair of the White House Council of Economic Advisers during the Obama administration, wrote Tuesday on Twitter.

The latest CPI reading, issued Tuesday, showed a monthly increase in shelter inflation, to 0.6% in May from 0.4% in April. The most recent figure is on par with the monthly figure notched a year earlier, in May 2022.

But a decline in CPI housing inflation is “almost as much of a certainty as you can get, really,” Hunter said.

There’s an additional measurement quirk relative to housing inflation: The BLS tries to assess price changes for homeowners as well as renters, in a subcategory called “owners’ equivalent rent.”

The measure is essentially a survey that reflects the price homeowners believe they could get if they were to rent their home.

While somewhat tied to market rents, homeowners aren’t necessarily feeling those inflationary pressures — especially those who have a fixed mortgage (meaning their monthly payment doesn’t change) or own their home (meaning they don’t have a housing payment), Zandi said.