Selling covered calls against your stock positions is a solid options strategy.

Source link

edge

10-year Treasury yields edge lower, add to weekly slide ahead of short Thanksgiving week

Long U.S. bond yields edged lower Friday, with the 30-year Treasury rate logging its sharpest 4-week drop of the year, as recent data pointed to a slowing economy and investors braced for a shortened Thanksgiving holiday week.

What happened

What drove markets

Traders in longer U.S. government bonds took a breather Friday, after an explosive rally in the first half of November pushed yields down by more than 50 basis points from a 16-year high.

The…

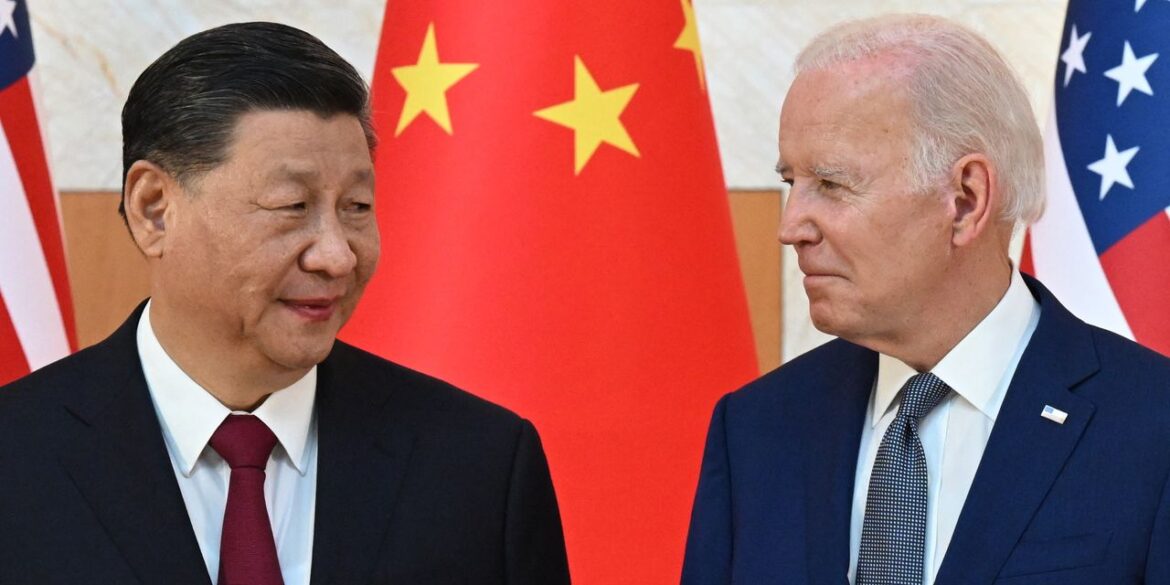

Opinion: The world needs Biden and Xi to lead, even with U.S.-China relations on the edge

All eyes are on the upcoming leaders’ meeting of the Asia-Pacific Economic Cooperation (APEC), to be held in San Francisco Nov. 11-17. And with good reason: there is a distinct possibility that U.S. President Joe Biden and Chinese President Xi Jinping will meet on the sidelines of this pan-regional gathering, exactly one year after their last summit in Bali on the eve of the annual G20 summit.

The Bali meeting accomplished little. While Biden and Xi agreed to set a “floor” for the deteriorating Sino-American relationship, the outcome has been anything but stable. Less than three months after the Bali summit, the U.S. downing of a Chinese surveillance balloon was followed by a temporary freeze in diplomatic engagement, additional sanctions on Chinese technology, and several close calls between the world’s two most powerful militaries. Meanwhile, the U.S. Congress has turned up the heat on China over Taiwan, and Xi accused the United States of implementing “all-around containment.” Some floor!

A Biden-Xi summit now could be a sorely needed second chance. Both sides appear to be hard at work preparing. Unlike the Bali meeting, the San Francisco summit must be scripted for success. With the U.S.-China relationship in serious trouble, and a war-torn world in urgent need of leadership, this summit should pursue three key objectives.

The first is deliverables. Notwithstanding America’s revisionist aversion to engagement with China — in effect, blaming the current conflict on decades of “appeasement” that began when China joined the World Trade Organization in 2001 — it is critical to find common ground on which to re-establish constructive dialogue.

The focus should be less on sloganeering — last year’s “floor” or this year’s “de-risking” — and more on clear and achievable objectives. This could include reopening closed consulates (for example, the U.S. consulate in Chengdu and the Chinese consulate in Houston), relaxing visa requirements, increasing direct air flights (now 24 per week, compared to more than 150 pre-COVID), and restarting popular student exchanges (such as the Fulbright Program).

Improving people-to-people ties — which the two presidents can easily address if they are serious about re-engagement — often leads to reduced political animosity. By reaching for the low-hanging fruit, Biden and Xi could open the door to talks on more contentious topics, such as relaxing constraints on NGOs, the glue that holds societies together, or tackling the fentanyl crisis, in which both countries play a key role.

“The U.S. and China could make a real difference by brokering peace agreements in Ukraine and the Middle East.”

But the most urgent deliverable would be a resumption of regular military-to-military communications, which the Chinese suspended after former U.S. House Speaker Nancy Pelosi visited Taiwan in August 2022. The danger posed by this breakdown in military contacts was glaringly obvious during the balloon fiasco in early February, as well as in recent near-misses between the two superpowers’ warships in the Taiwan Strait and aircraft over the South China Sea. As tensions escalate between two uncommunicative militaries, the risks of accidental conflict are high and rising.

Second, it is also necessary to articulate aspirational goals. A joint statement from Biden and Xi should underscore their shared recognition of two existential threats facing both countries: climate change and global health. Even though U.S. Special Presidential Envoy for Climate John Kerry has met with senior Chinese officials several times this year, collaboration on clean energy has stalled, owing to alleged national-security concerns on both sides. Moreover, progress on global health continues to be stymied by the political theater of the charged debate over the origins of COVID-19.

Of course, a Biden-Xi summit can hardly be expected to resolve these existential problems. But naming them is an important symbolic gesture, evidence of a shared commitment to the collective stewardship of an increasingly precarious world. That is especially the case with the outbreak of the Israel-Hamas war, which risks spilling over into a major regional conflict at the same time that the Ukraine war is at a pivotal moment. The U.S. and China could make a real difference by brokering peace agreements in both wars.

Third, Sino-American relations need a new architecture of engagement. A Biden-Xi meeting at APEC would certainly be a positive development. But annual summits aren’t enough to resolve deep-rooted conflicts between two superpowers.

I have long favored a shift from the personalized diplomacy that occurs during infrequent leader-to-leader meetings to an institutionalized model of engagement that provides a permanent, robust framework for continuous trouble-shooting and problem solving.

My proposal for a U.S.-China Secretariat is one such possibility. Despite the generally positive reception to this idea in China and elsewhere in Asia, American policymakers have shown no interest. In fact, U.S. Representative Mike Gallagher, the Republican Chairman of the new House Select Committee on China, is beating the drum of “zombie engagement,” warning that efforts to reconnect with the Chinese could lead to America’s demise.

At the same time, I am encouraged by the establishment of four new U.S.-Chinese working groups — a result of recent diplomatic efforts. But this is not nearly enough, especially when compared with the 16 active working groups that were established under the umbrella of the Joint Commission on Commerce and Trade, which the Trump administration disbanded in 2017.

Summits between national leaders are often nothing more than media events. Unfortunately, that was the case last year in Bali. Neither the U.S. nor China, to say nothing for the rest of the world, can afford a similarly vacuous outcome this year in San Francisco. The time for collective action is growing short. Any opportunity for Biden and Xi to agree on realistic deliverables, underscore aspirational goals and lay the foundations for a new architecture of engagement must not be squandered.

Stephen S. Roach, a faculty member at Yale University and former chairman of Morgan Stanley Asia, is the author of Unbalanced: The Codependency of America and China (Yale University Press, 2014) and Accidental Conflict: America, China, and the Clash of False Narratives (Yale University Press, 2022).

This commentary was published with the permission of Project Syndicate — A Better Biden-Xi Summit?

Also read: Financial markets worldwide now face a higher chance of extreme events, El-Erian warns

More: Israel-Hamas war could be the tipping point for a fragile financial system

U.S. stocks see losses accelerate as traders on edge ahead of Friday jobs report

U.S. stocks saw their losses accelerate on Thursday, reversing most of the S&P 500’s gains from its best session in three weeks a day earlier, as Treasury yields whipsawed, keeping investors on edge ahead of Friday’s monthly jobs report from the Labor Department.

What’s happening

-

The S&P 500

SPX

was off by 30 points, or 0.7%, at 4,233. -

The Dow Jones Industrial Average

DJIA

fell by 111 points, or 0.4%, to 33,011. -

The Nasdaq Composite

COMP

declined by 138 points, or 1%, to 13,098.

On Wednesday, the Dow Jones Industrial Average rose 127 points, or 0.39%, to 33,130, snapping a three-day losing streak, while the S&P 500 gained 34 points, or 0.81%, to 4,264 for its biggest percentage-point gain in three weeks, FactSet data show.

What’s driving markets

Treasury yields were volatile in early trade on Thursday, which added to pressure on U.S. stocks as investors digested a batch of fresh economic data ahead of Friday’s all-important September jobs report.

The yield on the 10-year Treasury note

BX:TMUBMUSD10Y

was last pegged at 4.73%, near a 16-year high reached earlier this week. Bond yields move inversely to prices.

“I think the momentum is still on the down side,” said Liz Ann Sonders, chief investment strategist at Charles Schwab, in a phone interview with MarketWatch. “There’s nothing specific that you could point to today.”

A weekly report on jobless-claims data showed no sign that layoffs have been increasing. Rising layoffs are seen as a necessary prerequisite for the Federal Reserve to start easing its monetary policy, which has weighed on both stocks and bonds since early 2022. Government data showed the number of Americans who applied for unemployment benefits last week rose slightly to 207,000, but remained near pandemic-era lows.

See: U.S. jobs report forecast: 170,000 new workers and 3.7% unemployment

Investors also received data on the U.S. international trade deficit which suggested some weakness in consumer spending, but analysts chiefly blamed the jobless claims numbers for the impact on yields and stocks.

Rising Treasury yields, particularly on the long end of the yield curve, have been widely blamed for driving the selloff in stocks that has taken place since early August. But as stocks continued to fall on Thursday with no obvious driver in sight, equity strategists see signs of investors simply following the latest trend.

“Financial markets have been rattled in the last few days,” said Bill Adams, Chief Economist for Comerica Bank. “The yield on the 10-year Treasury note has jumped about 0.6 percentage points since the beginning of September, extending a steady march higher since the early summer.”

“There are competing explanations for the surge in interest rates and they have very different implications. Treasury issuance is way up this year with a higher deficit, and the Fed is no longer a buyer; rising interest rates would be the classic warning that the deficit is starting to crowd out private-sector access to capital. But Treasury yields rose in August, too, even though the Federal government ran a monthly surplus in the month.”

“On net the increase in long Treasury yields makes the Fed more likely to choose an earlier peak in short-term interest rates and an earlier pivot to rate cuts in 2024.”

Several senior Fed officials are set to speak on Thursday, including Cleveland Fed President Loretta Mester, who spoke at the Chicago Payments Symposium at 9 a.m., and San Francisco Fed President Mary Daly, who is set to speak in New York at noon. Richmond Fed President Thomas Barkin is set to speak in North Carolina at 11:30 a.m. Eastern.

Choppy trading in recent days sent the Cboe VIX index

VIX,

a gauge of expected equity-market volatility, to 20 for the first time in four months as stocks tumbled. Some analysts see a near-term rebound ahead, but many argue the direction of bond yields remains critical for stocks.

Looking ahead to Friday, economists polled by The Wall Street Journal expect 170,000 jobs were created last month, which would be lower than the 187,000 created during the month prior.

Companies in focus

-

Exxon Mobil‘s

XOM,

-1.70%

shares fell after the company said rising crude prices are likely to boost its third-quarter profit by $1 billion, but thinner margins from chemicals will hurt profits by as much as $600 million. Analysts at RBC say that the update from Exxon is likely to result in earnings above consensus expectations but roughly in line with investor expectations. -

Rivian Automotive Inc.

RIVN,

-19.92%

shares dropped after the EV maker said it plans to offer $1.5 billion worth of “green” convertible senior notes due in 2030, and issued preliminary sales estimates that met Wall Street’s expectations. Rivian stock rose by 9% on Wednesday. -

Clorox Co. shares

CLX,

-7.38%

fell after the company cut its outlook following disruptions caused by a cyberattack first reported in August.