The Paraguayan Senate has approved a resolution supporting selling the country’s energy surplus to crypto mining companies, given the price and guarantees that these institutions offer. The declaration criticizes the subpar agreements that sell energy to Brazil for 25% of the fees collected for mining activities, calling to direct this energy to 20 new contracts […]

The Paraguayan Senate has approved a resolution supporting selling the country’s energy surplus to crypto mining companies, given the price and guarantees that these institutions offer. The declaration criticizes the subpar agreements that sell energy to Brazil for 25% of the fees collected for mining activities, calling to direct this energy to 20 new contracts […]

Source link

Energy

NextEra Energy Partners Investors Should Be Watching This Acquisition Very Closely. Here’s Why.

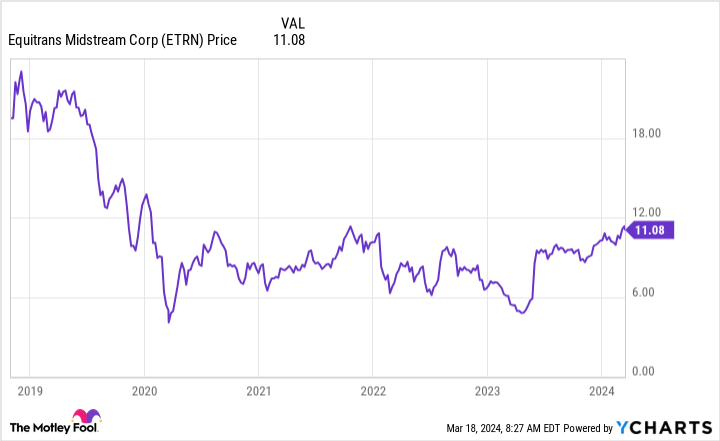

NextEra Energy Partners (NEP 1.29%) is showing up on high-yield screens today thanks to its huge 12%+ distribution yield. This wasn’t always the situation, noting that the yield was closer to 4% at the end of 2022. The steep unit price decline that pushed the yield higher is worth examining, but the potential fallout from that decline is also worth considering. To get an idea of why the latter consideration is important, just look at what’s happening with Equitrans Midstream (ETRN 1.31%) today.

What went wrong at NextEra Energy

NextEra Energy Partners was created by NextEra Energy (NEE 0.68%), one of the largest utilities in the United States. In addition to being a large regulated utility, NextEra Energy is also one of the largest producers of solar and wind power in the world. To take advantage of Wall Street’s once hot demand for anything related to clean energy, NextEra Energy created a master limited partnership (MLP) to own clean energy assets.

Image source: Getty Images.

NextEra Energy Partners is basically a funding vehicle for its parent, NextEra Energy. The parent sells clean energy assets, or “drops them down,” in industry lingo, to the MLP. The MLP buys the assets by issuing units and taking on debt. NextEra Energy uses the cash from the asset sales to fund future investments. NextEra Energy Partners uses the cash flow from the assets it buys to pay distributions to unitholders.

But investors have soured on the clean energy space, leading to a notable decline in the price of NextEra Energy Partners. That makes it more expensive to sell units. Making matters worse, rising interest rates increased the cost of debt capital, too. At this point, it isn’t nearly as attractive for NextEra Energy to sell assets to NextEra Energy Partners. And, as you might expect, NextEra Energy has announced plans to pull back on drop downs. That, in turn, will lead to slower growth at NextEra Energy Partners.

What does this have to do with Equitrans Midstream?

The big story for Equitrans Midstream is that EQT Corp. (EQT), the company that created the MLP, is buying it back. This isn’t the first time that a parent company of an MLP has bought back the MLP it created. The list includes utilities like Dominion Energy and pipeline operator Kinder Morgan, among others.

As you might expect, EQT is pitching its purchase of Equitrans Midstream as a positive. In fact it called the transaction “transformative,” even though it is, in many ways, just recreating the company as it was before Equitrans Midstream was spun off. The real story is that Equitrans Midstream is being bought back at a price that is far below the price at which it was spun off.

Now think back to NextEra Energy Partners. The purpose of that MLP is to be a funding vehicle for NextEra Energy, but it just isn’t as valuable as it once was on that front. With the unit price dramatically lower than it was, there’s a very real possibility that NextEra Energy simply buys the MLP back on the cheap.

To be fair, the runway for growth in the clean energy sector is more attractive than the growth opportunity in the pipeline sector. That suggests that NextEra Energy might want to wait longer to see what happens with NextEra Energy Partners before doing anything rash. But there are multiple examples of MLP spinoffs being bought back once they have outlived their usefulness. If you own NextEra Energy Partners you should keep the Equitrans Midstream situation in the back of your mind.

Buy with at least a little caution

The real concern here, however, should be for investors who are considering adding NextEra Energy Partners to their portfolio because of its hefty 12%+ distribution yield. While that yield is backed, to some degree, by a strong parent, NextEra Energy could just as easily decide to buy the MLP, effectively making what was an attractive yield quickly go away. Equitrans Midstream, among others, shows that this is, in fact, a very real possibility and a risk dividend investors shouldn’t ignore.

Reuben Gregg Brewer has positions in Dominion Energy. The Motley Fool has positions in and recommends EQT, Kinder Morgan, and NextEra Energy. The Motley Fool recommends Dominion Energy. The Motley Fool has a disclosure policy.

Bill Ackman, a well-regarded investor and CEO of Pershing Square Capital Management, outlined a hypothetical scenario that has sparked intense debate among crypto enthusiasts, economists, and environmentalists.

Ackman’s comments touched on several critical issues, including the sustainability of Bitcoin mining, its implications for global energy consumption, and the broader economic consequences of a rising reliance on cryptocurrencies.

He tweeted:

“A scenario: Bitcoin price rise leads to increased mining and greater energy use, driving up the cost of energy, causing inflation to rise and the dollar to decline, driving demand for Bitcoin and increased mining, driving demand for energy and the cycle continues. Bitcoin goes to infinity, energy prices skyrocket, and the economy collapses. Maybe I should buy some Bitcoin.”

He added that this could also work in “reverse.”

Ackman’s “scenario” prompted a spectrum of responses, ranging from defensive retorts to calls for a more nuanced understanding of Bitcoin’s energy use. The debate was further catalyzed by a comment highlighting the considerable energy consumption attributed to Bitcoin mining, likened to that of an entire country’s worth — Greece.

Critics argue that Bitcoin’s energy usage is an undeniable problem with significant environmental implications. In contrast, proponents argue that skeptics need to engage more deeply with the crypto community to understand the complexities of mining and its potential benefits for the energy sector.

Bitcoin is a bottom feeder

Experts in the field, including Michael Saylor, were cited for their views on the energy debate.

Saylor himself added to the debate and argued that Bitcoin mining could actually lead to more efficient energy solutions and drive the adoption of renewable energy sources by creating a demand for cheaper, more sustainable energy.

Alexander Leishman responded by emphasizing the competitive nature of Bitcoin mining, suggesting that the industry’s search for profitability naturally leads to the utilization of cheaper, often renewable, energy sources.

This perspective challenges the notion that Bitcoin mining exacerbates demand for conventional energy resources, arguing instead for its potential role in promoting energy efficiency and sustainability.

Troy Cross argued that increases in Bitcoin’s value do not necessarily lead to higher energy costs, pointing out the sophistication of mining technology and the strategic deployment of mining operations across the globe.

Cross said:

“The cheapest power is power no one else wants, stranded in time or space. Consuming that power is Bitcoin’s destiny. And while it may deviate in a short time frame during outrageous bitcoin price spikes, it will quickly and inevitably return to its rightful place as bottom feeder, not apex predator.”

Meanwhile, Alex Gladstein, known for his environmental advocacy, supported the argument that Bitcoin mining predominantly taps into excess or renewable energy sources. His stance reinforced the idea that the Bitcoin mining sector is contributing to the optimization of the global energy mix rather than detracting from it.

Self-regulating organism

Industry voices like Hunter Horsley and Muneeb Ali projected a future where the Bitcoin network’s energy demand could potentially decrease. They highlighted the blockchain’s halving events and the eventual reliance on transaction fees as mechanisms that will reduce the incentive for energy-intensive mining operations.

A notable argument likened Bitcoin’s ecosystem to a “self-regulating organism” governed by precise mathematical laws that contribute to economic stability. This viewpoint illustrates the inherent predictability and systemic resilience of Bitcoin, contrasting it with traditional financial assets.

By framing Bitcoin and similar technologies as self-regulating organisms, proponents argue for the robustness, adaptability, and innovative potential of these systems. They suggest that, much like living organisms, these systems are capable of evolving and self-correcting in response to challenges, thereby ensuring their survival and relevance in a constantly changing environment.

Mentioned in this article

Latest Alpha Market Report

Texas Blockchain Council challenges controversial Bitcoin mining energy survey

In the recent SlateCast episode, Texas Blockchain Council Chairman President Lee Bratcher discussed the controversial emergency survey recently issued by the Energy Information Administration (EIA) regarding Bitcoin mining energy usage. As Bratcher explained:

“[The EIA] created this farce of an emergency and rushed it through without the notice and comment period.”

He elaborated that the survey asked for proprietary information and failed to follow proper procedures, leading to a lawsuit from the Texas Blockchain Council.

Political Pressure Behind the Scenes

According to Bratcher, it was evident that Senator Elizabeth Warren heavily influenced the EIA’s decision to issue this Bitcoin mining survey. Warren had explicitly asked the Secretary of Energy to survey Bitcoin energy use and clarified that she expected data to be collected before the next briefing.

With this context, Bratcher believes the EIA faced undue and inappropriate political pressure that led it to skirt proper procedures and fairness, ultimately necessitating the lawsuit from the Texas Blockchain Council.

Though Warren may have had reasonable intentions around understanding Bitcoin’s climate impact, Bratcher argues her demands failed to acknowledge benefits and placed disproportionate scrutiny on Bitcoin miners.

Future Renewable Energy Usage

Bratcher does not believe Bitcoin mining will ever rely completely 100% on renewables but expects a future mix incorporating stranded or wasted gases. He points to projects already redirecting natural gas that would otherwise be flared into generators that power Bitcoin mining. This reuse provides environmental benefits compared to releasing unused gas.

Though likely not enough to fully power Bitcoin mining, these stranded energy sources, paired with growth in solar, wind, and other renewables, can significantly reduce the carbon footprint of mining while still leveraging fossil fuels when available.

Bratcher paints an optimistic view that with the right policies, much of Bitcoin’s energy could one day come from renewables and waste gas.

Bitcoin Mining in Texas

When asked about the benefits Texas offers Bitcoin mining companies, Bratcher emphasized:

“It’s really around our energy only marketplace…you’re able to create a power trading strategy that’s probably more important than your operating strategy, or at least have equal importance and, and that’s why Texas is the best place in the world to open up a business or mine Bitcoin specifically.”

He did warn new mining companies that “this is an extremely competitive industry, and people get wrecked, especially if you’re trying to jump in without experienced operators.”

Ideal Resolution with the EIA

Now that the EIA has rescinded the original emergency Bitcoin survey, Bratcher hopes they will take the opportunity to craft a fair and thorough data center survey. This would ideally ask standardized questions across industries about energy consumption, allowing equitable comparison and performance benchmarking.

Importantly, Bratcher stresses that the Texas Blockchain Council welcomes sharing energy usage information as long as proprietary or sensitive details are protected. He advocates that miner contributions to grid stability should be accounted for. An improved survey could enable miners to showcase their energy resilience and grid benefits.

Bratcher seeks collaborative transparency, not combative obscurity, to resolve the survey controversy. He added:

“We’re happy to share energy consumption information, and we’re happy to share. It’d be great if they ask a question about our performance on the grid, and we could give them some data about how we’re doing.”

The full SlateCast episode provides an in-depth look at the Bitcoin mining industry in Texas and the policy issues surrounding it. Bratcher makes a strong case for the benefits Bitcoin mining can provide while also acknowledging fair concerns.

With Bitcoin poised to remain a growing industry, debates like these will likely continue around its energy usage and impact on grids. Watch the full podcast below:

NEW PODCAST 🎙️ Texas Blockchain Council challenges controversial #Bitcoin mining energy survey

Featuring @lee_bratcher from @TXblockchain_ with co-hosts @akibablade and @NateWhitehill pic.twitter.com/k6kJqYALLW

— CryptoSlate (@CryptoSlate) February 29, 2024

The new frontier in Bitcoin mining: Stranded energy utilization and open hash power markets

In the latest episode of SlateCast, CryptoSlate’s Liam “Akiba” Wright and CEO Nate Whitehill welcomed Ryan Condron, CEO of Titan Mining and the creator of Lumerin Protocol, to discuss the current state of Bitcoin mining and the potential for hash power to become a valuable asset in the future.

How Titan Lightning streamlines the experience of mining

Titan Lightning, a new integration with the Lumerin hash power marketplace, aims to streamline the mining experience for users. As Condron explained, traditional mining setups often involved significant friction for newcomers:

“Previously, [new miners] had to set up an account with a mining pool, plug in the credentials — it was hard to onboard through that.”

Titan Lightning solves this by allowing users to simply provide a Lightning address when purchasing hash power through the Lumerin marketplace. The hash power then streams directly to the Titan Lightning pool, which pays users out in real-time on a “pay per share” basis.

Condron highlighted the powerful feeling of “purchasing hash power, which is essentially Bitcoin over time, and then you start receiving the stream of sats directly into your wallet.” This seamless integration removes barriers to entry, providing an instant and intuitive mining experience where users can see their rewards hit their Lightning wallet almost immediately after purchase.

Condron further explained:

“You can take a mining facility and put the hash power up for sale to the highest bidder. It’s an open market around hash power on a global decentralized anonymous scale.”

Why decentralizing hash power democratizes the Bitcoin network

Decentralizing hash power is crucial for maintaining the democratic nature of the Bitcoin network. As institutional investors and large mining pools increasingly dominate Bitcoin’s hash rate, there is a risk of centralization that could undermine the foundational principles of the network.

By enabling a global, decentralized marketplace for hash power like Lumerin, individual miners and smaller players can access and contribute computing resources without going through a centralized mining pool. This promotes a more evenly distributed hash rate and decision-making power over which transactions are included in blocks. Condron emphasized:

“Hash power needs to be accessible to everyone on earth if the Bitcoin network is going to stay democratized.”

A truly decentralized network, where no single entity controls a majority of the hash power, aligns with Bitcoin’s vision of monetary sovereignty for all participants. Initiatives focused on democratizing access to hash power are vital for upholding this ideal.

While acknowledging the potential for governments to regulate mining pools and on-ramps, Condron highlighted the need for a balanced approach:

“Governments really don’t like it when you mess with their money supply,” he said. “They’re going to look to regulate the ownership and control the transaction processing and interiors of the system.”

The future of Bitcoin mining: Embracing stranded energy

The future of Bitcoin mining lies in harnessing stranded energy resources worldwide. Many developing nations have abundant renewable energy potential that is underutilized due to infrastructure challenges or lack of local energy demand. Bitcoin mining presents an opportunity to monetize this stranded energy.

As Condron explained:

“With the advent of Bitcoin mining, you have miners coming in and actually government sponsoring mining build-out now because they realize that they can use up the electricity from these large production facilities to mine Bitcoin.”

Miners can establish operations near remote renewable energy sites, utilizing excess power that would otherwise be wasted. This facilitates Bitcoin’s sustainable growth and can drive economic development by bringing investment, jobs, and supplemental power to local communities with abundant but stranded energy resources.

The discussion with Ryan Condron offered insightful perspectives on the evolving landscape of Bitcoin mining and hash power. As the network grows, the democratization of hash power and the utilization of stranded energy resources will play pivotal roles in shaping the future of Bitcoin mining.

Watch the full podcast here.

The best-performing stock of the past three decades is not one of the tech titans you’d assume.

It’s actually an energy drink company: Monster Beverage.

Monster’s stock has climbed for decades, along with sales, which have grown consistently for 31 years straight.

Between Feb. 14, 1994, and Wednesday, Monster’s stock appreciated by about 200,000%. That means that if a consumer had invested $1,000 in 1994, the stake would be worth about $2 million today.

Analysts say several factors have driven Monster’s success. But a lot has to do with its leaders, co-CEOs and South African billionaires Rodney Sacks and Hilton Schlosberg, who capitalized early on a rather new market.

“Some of it is clearly right place, right time,” said Stifel consumer and retail managing director Mark Astrachan. “I think there’s an element to it as well of being really good at what you can do, because you can’t be as lucky as they’ve been for as long as they’ve been, without being really good at running a business.”

Monster Beverage is a holding company composed of subsidiaries that produce and manufacture drinks including energy, alcohol, teas and coffees.

In the third quarter of last year, the company posted net sales of $1.86 billion, a 14.3% increase from the same period a year prior. Its Monster Energy segment accounted for $1.71 billion of that.

Monster Beverage was founded as a family juice company, Hansen’s, in 1935. It was later named Hansen Natural Corporation.

Sacks and Schlosberg acquired it and took it public in 1990, after it had filed for bankruptcy in 1988. The company has since seen a complete transformation. Where it was trading for just pennies at that time, it closed at $55.02 a share on Friday.

Monster launched a few energy drinks in the 1990s under its previous name. But analysts said the company didn’t really take off until establishing an eponymously named drink in 2002.

“They built it the right way,” said RBC Capital Markets Managing Director Nik Modi. “They were very slow and methodical in how they built the distribution of the brand, making sure it was strong in every market that it was in, and every retailer that was in it was getting good velocity.”

Analysts said the leaders were good at knowing their customers, focusing on action sports and other events such as motocross, UFC, bullfighting and Nascar instead of traditional TV or magazine ads. It resonated with the younger blue-collar workers who attended those events.

“People are so passionate about this brand,” said Modi.

The company attracted the attention of beverage giant Coca-Cola, which entered into a strategic partnership with the company now called Monster Beverage in 2015.

At the time, Coke purchased a 16.7% stake in the company for more than $2 billion. That stake has grown to about 20% today.

Coke agreed to become Monster’s preferred global distribution partner, and the two companies traded the ownerships of several brands. Monster got energy drinks such as NOS, Full Throttle, Burn and Relentless, while Coke got Hansen’s Natural Sodas, Peace Tea and Hubert’s Lemonade.

“They’ve obviously been showing that they can grow globally,” said Modi. “And that’s effectively what they’ve been doing and what’s been driving most of the growth in the outperformance in the stock.”

Watch this video to learn more.

US EIA Starts Requiring Energy Consumption Data From Cryptocurrency Miners

The U.S. Energy Information Administration (EIA), a statistics agency of the U.S. Energy Department, has sent letters to cryptocurrency miners requiring data related to energy consumption and configuration of their mining sites. According to one of the letters posted on social media, miners have until February 23 to report the info regarding the activities carried […]

The U.S. Energy Information Administration (EIA), a statistics agency of the U.S. Energy Department, has sent letters to cryptocurrency miners requiring data related to energy consumption and configuration of their mining sites. According to one of the letters posted on social media, miners have until February 23 to report the info regarding the activities carried […]

Source link

David Einhorn’s Greenlight Capital adds Kenvue, ETFs and exits Southwestern Energy

David Einhorn’s hedge fund Greenlight Capital picked up a new stake in Kenvue Inc.

KVUE,

— formerly the consumer healthcare division of Johnson & Johnson

JNJ,

— in the fourth quarter, according to a public filing Wednesday.

Greenlight acquired about a $12 million stake in Kenvue in the fourth quarter, while also adding a nearly $2.7 million exposure to Israeli generic-drug giant Teva Pharmaceutical Industries Ltd.

TEVA,

according to a 13F quarterly filing with the U.S. Securities and Exchange Commission.

The hedge fund also added exposure to a smattering of exchange-traded funds, while keeping a roughly steady stake in the SPDR Gold shares fund

GLD

of about $74 million.

Gold prices

GC00,

closed at a record high of $2,093.10 an ounce in December, before slipping back to about $2,000 on Wednesday, according to FactSet.

Greenlight exited Activision Blizzard Inc. and Southwestern Energy Co.,

SWN,

according to the filing.

Einhorn founded Greenlight in 1996 and rose to prominence for shorting stocks, including shares of Lehman Brothers months before the company went bankrupt.

For more 13-F reports:

• George Soros’ fund bets on U.S. leisure travel, with fresh stakes in JetBlue, Spirit, Sun Country

• Berkshire Hathaway loads up on shares of Sirius XM and Chevron, exits home builder D.R. Horton

• Druckenmiller dumps Alphabet, Amazon and Broadcom but Nvidia remains largest holding

• Appaloosa takes new stakes in Oracle and GM, raises stakes in Alibaba and Microsoft

• Nvidia discloses positions in SoundHound AI, Arm — and these other stocks

If You Like Devon Energy, Then You’ll Love These High-Yield Oil Stocks

While the broader market continues to roar higher, the energy sector has taken a breather. In fact, it’s down 4.1% over the last year despite a 20% gain in the S&P 500.

As oil and gas companies report their Q4 and full-year 2023 earnings, it’s becoming increasingly clear that the industry is fundamentally sound and a great value now.

Here’s why Devon Energy (DVN -0.04%), ConocoPhillips (COP 0.66%), and Hess Midstream (HESM 0.40%) are three high-yield dividend stocks worth buying.

Image source: Getty Images.

Lower energy prices have created a buying opportunity in Devon Energy’s stock

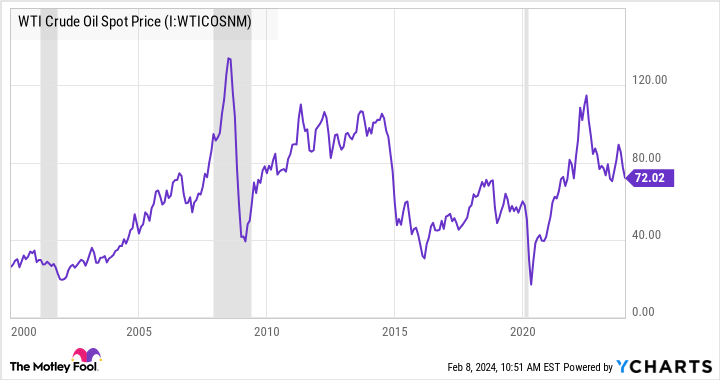

Lee Samaha (Devon Energy): Yes, the price of oil has declined from almost $94 a barrel in late September to around $75.5 at the time of writing. And yes, weaker oil demand and strong oil production have led to rising oil inventories (which are usually bearish for the price of oil). Therefore, it’s unsurprising that oil stocks have fallen since late September, including Devon Energy, down 12% since the end of September.

Still, there’s a need for some perspective here. The economy is passing through a weak period with the brakes put on by central bankers keen to subdue inflation. Yet the price of oil is significantly above where it’s been in previous slowdowns — the grey sections in the chart below indicate recessions.

WTI Crude Oil Spot Price data by YCharts

In addition, the price of oil is still at a level whereby Devon Energy can pay investors a hefty dividend. For example, on its third-quarter earnings call in early November, management gave a range of outcomes for its free-cash-flow (FCF) yield based on the price of oil and its share price on Nov. 3 (the stock closed at $47.34 on that day).

Based on a price of oil of $70 and a share price of $47.34, management predicts an FCF yield of 8% for 2024, implying an FCF per share of $3.79. Now, let’s estimate what that might mean for Devon’s dividend. The company pays a fixed dividend of $0.20 and a variable dividend of up to 50% of the excess FCF after the fixed dividend is paid.

The share price is now about $42. In this model, after the $0.20 fixed dividend is paid, Devon will have $3.59 per share in excess FCF, and 50% of that, the variable dividend, is about $1.80. Adding the fixed dividend of $0.20 to the variable dividend of $1.80 gives $2, provided that the current stock price is $42, equating to a dividend yield of nearly 4.8% for a price of oil of $70 a barrel in 2024. That would be fine for many income-seeking investors.

ConocoPhillips is ramping up production and raking in the cash flow

Daniel Foelber (ConocoPhillips): 2023 was a great year for ConocoPhillips. The company earned $9.06 in diluted earnings per share (EPS), not quite as good as 2022 but still the second-best year of earnings since 2005. One reason for the strong year was higher production volumes.

ConocoPhillips achieved record production of 1.826 million barrels of oil equivalent per day (boe/d). In 2024, the midpoint of its guidance calls for a 5.7% increase to 1.93 million boe/d. ConocoPhillips didn’t give a specific revenue or earnings target, but it did provide some information.

It expects 2024 full-year capital expenditures to be $11.25 billion at the midpoint — nearly identical to 2023. It forecasts full-year operating costs of $9 billion at the midpoint, higher than 2023 but not by much. Add it all up, and we should expect similar cash flows and earnings in 2024 as long as oil prices are around the same. That rarely happens, so let’s assume WTI averages $70 this year, or over 10% less than the 2023 maker price.

ConocoPhillips is unique because it conveniently supplies its cash flow sensitives based on the oil price. For 2024, it estimates a $120 million to $130 million change for every $1 change in WTI between $60 and $90 a barrel. So a 10% year-over-year drop in average oil prices would be close to $1 billion less in cash flow. It sounds like a lot, but ConocoPhillips generated a whopping $10.1 billion in FCF, which goes to show its margin of error in combating lower oil prices.

ConocoPhillips primarily used that FCF to pay $5.6 billion in ordinary and variable dividends and repurchase $5.4 billion in stock. If oil prices fall, ConocoPhillips would probably just pull back a little on its capital return program. In fact, its guidance assumes just that, as ConocoPhillips is forecasting $9 billion in capital returns in 2024 compared to $11 billion last year. In other words, it wants to make sure it can support its capital return program with cash.

Like Devon Energy, estimating ConocoPhillips’ exact dividend payout in 2024 is tricky because of the variable dividend. But given what we know from last year and the guidance in the Q4 earnings release, investors should expect a forward yield of around 3.5% to 4.5% from ConocoPhillips.

ConocoPhillips is generating a ton of cash, will keep generating a ton of cash even if oil prices fall, and has significant upside potential if oil prices rise, both in its performance and through the dividend. All told, it’s a top exploration and production stock to buy in 2024.

Hess Midstream generates strong cash flow from transporting oil, gas, and water

Scott Levine (Hess Midstream): It’s no wonder that income investors are attracted to Devon thanks to its generous dividend. But it’s not the only high-yield energy stock in town. Operating in the Bakken shale and Three Forks formation in the Williston Basin, Hess Midstream is another option for those looking to supplement their passive income streams with a stock found in the oil patch. The midstream company’s dividend is especially appealing right now, offering a forward dividend yield of 7.8%.

Part of the allure of Hess Midstream is that it inks long-term commercial contracts with customers. This affords management great insight into future cash flows. With this visibility into its potential future financials, management can plan accordingly to allocate capital responsibly. In 2024, for example, Hess Midstream projects oil and gas throughput volumes will rise about 10% compared to 2023, and it further expects annualized growth in gas throughput volumes of approximately 10% from 2024 through 2026. Oil throughput, on the other hand, is expected to grow 10% in 2025 and 5% in 2026.

With regards to cash flow, Hess Midstream anticipates continued adjusted free cash flow growth from which it will source its rising dividend. Hess Midstream generated adjusted free cash flow of $606 million in 2023. Addressing the company’s long-term guidance, management projects adjusted free cash flow will rise to $685 million to $735 million in 2024 and rise 10% further in both 2025 and 2026 — enough to completely fund the targeted dividend payments through 2026.

Enphase Energy‘s (ENPH 4.78%) earnings have been well received by the market, but the company’s recovery is still a long way off. In this video, Travis Hoium goes through results and what investors should expect from Enphase in the next few quarters.

*Stock prices used were end-of-day prices of Feb. 6, 2024. The video was published on Feb. 7, 2024.

Travis Hoium has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Enphase Energy. The Motley Fool has a disclosure policy. Travis Hoium is an affiliate of The Motley Fool and may be compensated for promoting its services. If you choose to subscribe through their link they will earn some extra money that supports their channel. Their opinions remain their own and are unaffected by The Motley Fool.