Data shows that U.S. spot bitcoin exchange-traded funds (ETFs) experienced negative outflows on Friday, totaling $55.1 million, with Grayscale’s Bitcoin Trust (GBTC) seeing another notable decrease. Metrics from Thursday reveal GBTC held 316,193.43 bitcoins, but after a decline of 2,048.23 bitcoins, the fund’s holdings reduced to 314,145.2 bitcoins. Blackrock and Fidelity Absorb Bitcoin Despite GBTC’s […]

Data shows that U.S. spot bitcoin exchange-traded funds (ETFs) experienced negative outflows on Friday, totaling $55.1 million, with Grayscale’s Bitcoin Trust (GBTC) seeing another notable decrease. Metrics from Thursday reveal GBTC held 316,193.43 bitcoins, but after a decline of 2,048.23 bitcoins, the fund’s holdings reduced to 314,145.2 bitcoins. Blackrock and Fidelity Absorb Bitcoin Despite GBTC’s […]

Source link

ETFs

In a recent analysis, Stanislas Bernard, the founder of Sinz 21st.Capital, delved into the complexities surrounding Hong Kong’s consideration to approve spot Bitcoin ETFs against the backdrop of China’s escalating economic crisis. With the nation grappling with a record debt-to-GDP ratio of 288% in 2023, and witnessing one of the most severe housing market collapses in three decades, the financial instability has triggered an unprecedented capital flight towards overseas markets.

The Perfect Timing For A Spot Bitcoin ETF?

Amidst these turbulent economic times, Hong Kong’s potential approval of spot Bitcoin ETFs stands out as a pivotal development that could not only be a safe haven for Chinese investors but also significantly influence Bitcoin’s valuation, potentially catapulting it to the elusive $100,000 mark.

China’s economic woes have been intensifying, marked by a towering debt ratio and a plummeting housing sector that has investors scrambling for alternatives. “China currently faces a significant economic downturn, exacerbated by soaring debt and malinvestments in real estate. The crisis, becoming well-known in 2021 with the default of Evergrande Group, has now spread, causing a ripple effect that will likely slow down the Chinese economy for years to come,” Bernard pointed out.

This backdrop of economic instability has incited a significant shift in investor behavior, notably among Chinese investors who, faced with stringent capital controls, have sought refuge in ETFs that offer exposure to foreign markets. Yet, this avenue has been fraught with its own challenges.

“Investors are paying premiums as high as 43% on certain US-focused ETFs due to quota limitations, which speaks volumes about the desperation to find safer investment harbors,” Bernard notes. Such premiums underscore the pervasive fear and uncertainty that have gripped the Chinese market, driving investors towards seemingly any available exit from the volatility of the domestic market.

The Role Of Hong Kong

Bernard believes that not only Hong Kongers but also Chinese mainlanders will flock to Bitcoin ETFs. “They are pretty integrated. Mainland is HK’s largest trading partner. Would not be possible to approve a spot ETF and then close it to mainland. They will enforce transaction limits instead,” the expert said.

In the midst of these developments, Hong Kong’ Securities and Futures Commission (SFC) is reportedly considering the approval of spot Bitcoin ETFs already by the end of April, as reported yesterday. This move is viewed as a strategic effort to capture a portion of the capital flowing into Bitcoin, especially in the wake of the SEC’s approval of similar ETFs in the US, which saw a meteoric rise with $12 billion of net flow.

“Hong Kong is scrambling for a change. The approval of spot Bitcoin ETFs could unlock a vast reservoir of stranded Chinese capital into Bitcoin, providing a much-needed life raft for investors,” Bernard explained.

The anticipated approval of spot Bitcoin ETFs by Hong Kong authorities has been met with significant enthusiasm within the crypto community. Influential figures such as Bitcoin Munger and Stack Hodler have been vocal about the potential impact of this development on Bitcoin’s price.

“Hong Kong ETFs approval have accelerated to next week. Most accounts on CT weren’t making a big deal about them, but they are a big deal. They are going to take us to $100k+ in due time. Tick tock!” stated popular Bitcoin analyst Bitcoin Munger (@bitcoinmunger). He refers to the regional yearly year-over-year supply change from West to East.

Stack Hodler (@stackhodler) further emphasized the urgency among Chinese investors to find secure investment avenues outside the traditional system, “Chinese investors were panic-buying a Gold fund at a 30% premium this month as they attempt to get their wealth into something outside the Chinese system. The approval of Hong Kong spot ETFs could be the turning point, offering a sanctioned avenue for wealth preservation amidst the crumbling real estate market.”

Overall, the potential approval of spot Bitcoin ETFs in Hong Kong is poised to be a landmark development, not just for the region but for the global market. By offering a secure and regulated channel for investment, it could serve as a catalyst for significant capital inflow into Bitcoin, reinforcing its status as a viable store of value.

“As we stand at the cusp of this historic development, the implications for Bitcoin and the broader cryptocurrency market could be profound. The approval of spot Bitcoin ETFs in Hong Kong could indeed be the harbinger of a new era, potentially driving Bitcoin’s value to new heights,” concluded Bernard.

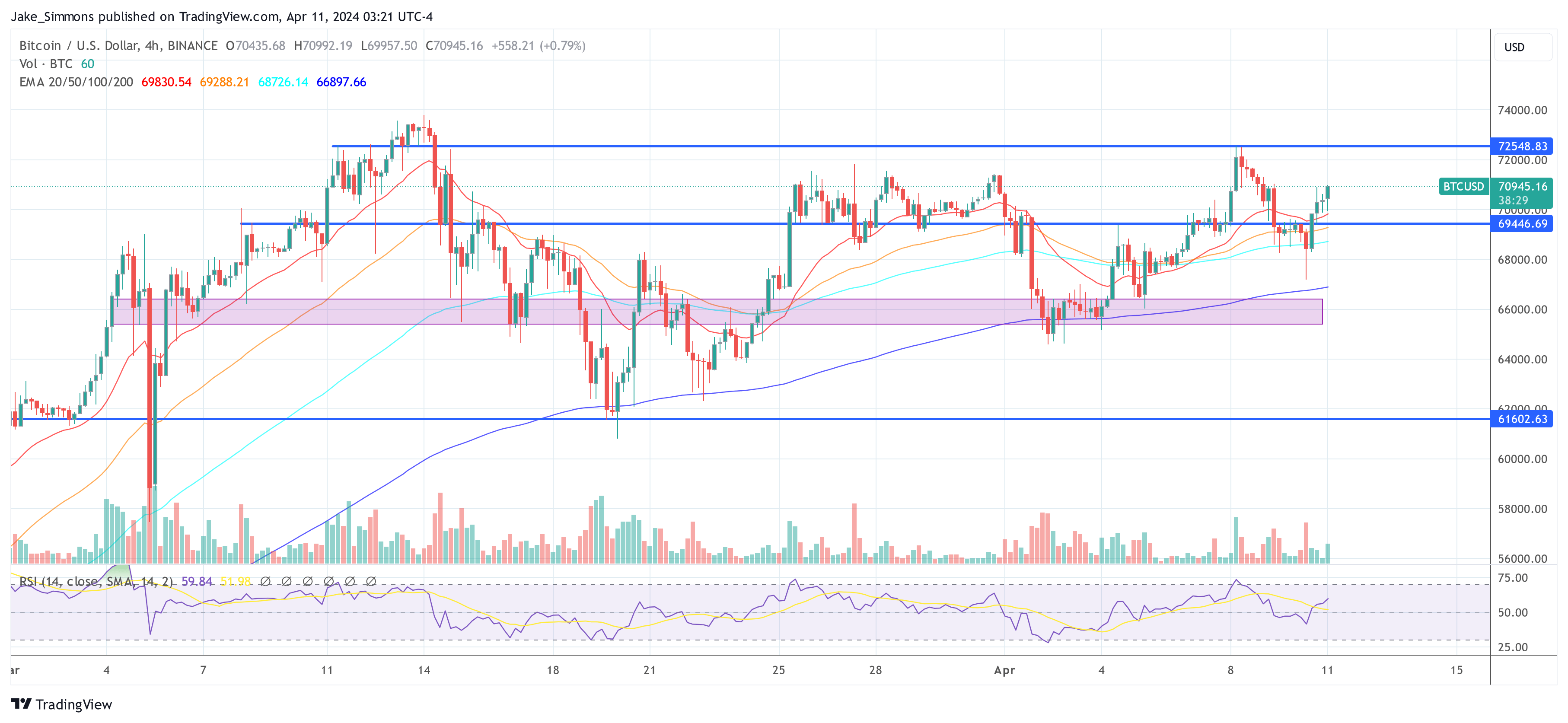

At press time, BTC traded at $70,945.

Featured image created with DALL·E, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

US Spot Bitcoin ETFs Record $19.4 Million in Outflows, GBTC Holdings Decline

U.S. spot bitcoin exchange-traded funds (ETFs) experienced another round of net withdrawals, documenting a $19.4 million decrease. The holdings of GBTC diminished from 322,697.17 bitcoins to 318,451.70. U.S. Spot Bitcoin ETF Landscape: Outflows Continue to Persist On April 8, 2024, the U.S. spot bitcoin ETFs saw a substantial $223.8 million in outflows, and on April […]

U.S. spot bitcoin exchange-traded funds (ETFs) experienced another round of net withdrawals, documenting a $19.4 million decrease. The holdings of GBTC diminished from 322,697.17 bitcoins to 318,451.70. U.S. Spot Bitcoin ETF Landscape: Outflows Continue to Persist On April 8, 2024, the U.S. spot bitcoin ETFs saw a substantial $223.8 million in outflows, and on April […]

Source link

Spot Bitcoin ETFs in Hong Kong could mark a regional first with April listings

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge, powered by Access Protocol. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Important: You must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.

10 US Bitcoin ETFs Amass Over 519,000 BTC, With Blackrock Leading at 50.81%

The latest data reveals that Blackrock’s spot bitcoin exchange-traded fund (ETF) has increased its bitcoin portfolio, now encompassing 263,937.48 bitcoins valued at $17.88 billion. Spot Bitcoin ETF Reserves Reach New Heights Several U.S. spot bitcoin ETFs have bolstered their bitcoin (BTC) holdings, bringing the total for ten ETFs, excluding Grayscale’s Bitcoin Trust (GBTC), to 519,440.22 […]

The latest data reveals that Blackrock’s spot bitcoin exchange-traded fund (ETF) has increased its bitcoin portfolio, now encompassing 263,937.48 bitcoins valued at $17.88 billion. Spot Bitcoin ETF Reserves Reach New Heights Several U.S. spot bitcoin ETFs have bolstered their bitcoin (BTC) holdings, bringing the total for ten ETFs, excluding Grayscale’s Bitcoin Trust (GBTC), to 519,440.22 […]

Source link

China’s Largest Fund Managers Eye Spot Bitcoin ETFs in Hong Kong’s Financial Markets

Two of China’s largest fund management firms have recently been reported to be filing applications for spot bitcoin exchange-traded funds (ETFs), according to regional sources on Monday. Harvest Global Investments and Southern Fund are seeking approval from Hong Kong’s Securities and Futures Commission (SFC), aiming to obtain authorization to introduce spot bitcoin ETFs. China’s Investment […]

Two of China’s largest fund management firms have recently been reported to be filing applications for spot bitcoin exchange-traded funds (ETFs), according to regional sources on Monday. Harvest Global Investments and Southern Fund are seeking approval from Hong Kong’s Securities and Futures Commission (SFC), aiming to obtain authorization to introduce spot bitcoin ETFs. China’s Investment […]

Source link

US Bitcoin ETFs Bounce Back With $569.4M in Net Inflows After Initial Dip

Spot bitcoin exchange-traded funds (ETFs) concluded the week on an upbeat note, securing $203 million in positive inflows on Friday, as per the latest data. Despite an initial setback of $84.7 million in net outflows on April 1, the ETFs have since rebounded, gathering $569.4 million in net inflows. Bitcoin ETFs Overcome Early April Setback […]

Spot bitcoin exchange-traded funds (ETFs) concluded the week on an upbeat note, securing $203 million in positive inflows on Friday, as per the latest data. Despite an initial setback of $84.7 million in net outflows on April 1, the ETFs have since rebounded, gathering $569.4 million in net inflows. Bitcoin ETFs Overcome Early April Setback […]

Source link

The recent approval of Bitcoin exchange-traded funds (ETFs) by the SEC sent jitters through the financial world. Initial concerns about fading demand seem unfounded as Bitcoin ETFs continue to shatter trading volume records. This is further bolstered by three consecutive sessions of net inflows into these investment vehicles.

Bitcoin ETF Inflows Signal Long-Term Investor Appetite

A recent dip in ETF activity sparked fears that the initial excitement might be short-lived. However, those fears have been quelled by a resurgence in inflows.

According to data from SoSoValue, yesterday saw a net inflow of $203 million into Bitcoin spot ETFs, marking the third straight day of positive inflow.

This sustained green streak suggests that investors remain interested in gaining exposure to the top crypto through ETFs, potentially anticipating a price surge due to the upcoming Bitcoin halving – a pre-programmed code update that cuts production in half, historically leading to price increases.

BlackRock’s Bitcoin ETF Leads The Pack

BlackRock, the world’s largest asset manager, has emerged as a frontrunner in the crypto ETF space. Their iShares Bitcoin Trust (IBIT) recorded the highest net inflow on a single day, exceeding $144 million.

BTC market cap currently at $1.3 trillion. Chart: TradingView.com

This impressive figure has pushed IBIT’s total net inflow over the past two weeks to over $14 billion. BlackRock’s commitment to Bitcoin ETFs is further underscored by their recent decision to include prominent Wall Street institutions like Goldman Sachs, Citigroup, Citadel Securities, and UBS as Authorized Participants (APs) in their spot Bitcoin ETF prospectus.

These additions position these banking giants as first-time participants in the ETF market, joining established players like JPMorgan and Jane Street.

The inclusion of such heavyweights is seen as a significant vote of confidence in the future of Bitcoin ETFs and a potential catalyst for further mainstream adoption.

Volatility On The Horizon For ETFs

While the recent surge in demand paints a bullish picture for Bitcoin ETFs, experts warn that volatility may be lurking on the horizon. CryptoQuant, a cryptocurrency analysis platform, points to signals in the futures market that suggest potential price swings in the near future.

A consistently high premium often signifies strong institutional buying pressure, particularly in light of the recent inflows witnessed in US Bitcoin ETFs. This increased institutional activity can contribute to price fluctuations, creating opportunities for both gains and losses.

Despite the potential for short-term volatility, the overall outlook for Bitcoin ETFs remains positive. The sustained demand, coupled with the backing of major financial institutions like BlackRock, suggests that these investment vehicles are poised to play a significant role in bridging the gap between traditional finance and the cryptocurrency world.

Featured image from Vegavid Technology, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.