On Tuesday, Proshares introduced two new offerings: the Ultra Bitcoin exchange-traded fund, sporting the ticker BITU, and the Ultrashort Bitcoin exchange-traded fund (ETF), known as SBIT. While BITU is designed to deliver two times the daily returns of bitcoin, SBIT is structured to produce double the inverse of bitcoin’s daily returns. Proshares Introduces Leveraged and […]

On Tuesday, Proshares introduced two new offerings: the Ultra Bitcoin exchange-traded fund, sporting the ticker BITU, and the Ultrashort Bitcoin exchange-traded fund (ETF), known as SBIT. While BITU is designed to deliver two times the daily returns of bitcoin, SBIT is structured to produce double the inverse of bitcoin’s daily returns. Proshares Introduces Leveraged and […]

Source link

ETFs

US Bitcoin ETFs See $85.7M Outflow After 4 Days of Gains; Grayscale’s GBTC Leads the Dip

After four days of consecutive inflows, the U.S. spot bitcoin exchange-traded funds (ETFs) experienced a downturn, with $85.7 million flowing out during Monday’s trading hours. U.S. Spot Bitcoin ETFs’ Momentum Halted With $85.7M in Outflows, Spotlight on GBTC Between March 25 and March 28, 2024, the U.S. spot bitcoin ETFs enjoyed an upward trend, amassing […]

After four days of consecutive inflows, the U.S. spot bitcoin exchange-traded funds (ETFs) experienced a downturn, with $85.7 million flowing out during Monday’s trading hours. U.S. Spot Bitcoin ETFs’ Momentum Halted With $85.7M in Outflows, Spotlight on GBTC Between March 25 and March 28, 2024, the U.S. spot bitcoin ETFs enjoyed an upward trend, amassing […]

Source link

Burkett Financial Services, a South Carolina-based financial planner, disclosed investments in two Bitcoin exchange-traded funds (ETFs) on April 1.

Burkett’s latest Form 13F filing indicates it holds 602 shares of BlackRock’s iShares Bitcoin Trust (IBIT), a spot Bitcoin ETF. The firm’s holdings are valued at $24,363.

The company also holds 630 shares of ProShares’ Bitcoin Strategy ETF (BITO), which invests in Bitcoin futures. Its BITO shares are valued at $20,344 in total.

Burkett’s two crypto-related holdings comprise just a small portion of the $194 million of investments it disclosed in its 13F filing. The firm’s other holdings include traditional exchange-traded funds (ETFs) and large-cap stocks such as Microsoft and Apple, among other investments.

Burkett is the first traditional financial institution to gain exposure to Bitcoin via the ETFs.

ETF growth

News of Burkett’s investment comes shortly after other discussions around spot Bitcoin ETFs that suggest that the investment category will gain traction.

Some commentators expect Bitcoin ETFs to see more significant inflows in the future. Bitwise CIO Matt Hougan said that Bitcoin spot ETFs could experience $1 trillion in inflows if global wealth managers allocate 1% of their portfolios to Bitcoin.

Those inflows could also improve the price of Bitcoin. Ark Invest CIO and CEO Cathie Wood has stated that Bitcoin could be worth significantly more than $1.5 million if institutions allocate more than 5% of their portfolios to Bitcoin, building on an earlier prediction for 2030.

As of April 1, spot Bitcoin ETFs held $74 billion in assets under management (AUM). This comprises over 5% of Bitcoin’s circulating supply, assuming a market cap of $1.48 trillion.

Bitcoin ETFs saw over $800 million in inflows during the week leading up to April 1, according to a report from CoinShares head of research James Butterfill.

The post Burkett Financial Services buys Bitcoin via ETFs appeared first on CryptoSlate.

Fidelity Investments is planning to charge investors a $100 servicing fee when placing buy orders on exchange-traded funds issued by nine firms.

Most Read from MarketWatch

The new servicing charge — which may be imposed on ETFs issued by Simplify Asset Management, AXS Investments, Day Hagan, Sterling Capital, Cambiar, Regents Park, Rayliant, Adaptive and Running Oak — is set to take effect on June 3, according to a Bloomberg News report. A Fidelity spokesperson confirmed that the report is accurate.

The new fee will apply to ETFs issued by a small group of asset managers that don’t participate in a maintenance arrangement with Fidelity, according to Bloomberg.

“We remain committed to providing clients choice with an open-architecture investment platform,” the Fidelity spokesperson told MarketWatch in an email Monday. “Support fees help maintain the technology and service operations needed to ensure a secure and positive experience for investors.”

Fidelity may periodically update its “Surcharge-Eligible ETF” list, which could change again before June 3, according to the Bloomberg report.

At the end of March, U.S.-listed ETFs had a total $8.9 trillion of assets under management, according to a research note from Citigroup on Monday. Last month, investors poured more capital into domestic equity ETFs as the S&P 500 index SPX broke past 5,200 points, Citi Research said.

ETFs managed by State Street, Vanguard and BlackRock attracted the biggest inflows last month — including the SPDR S&P 500 ETF Trust SPY, Vanguard S&P 500 ETF VOO and iShares S&P 500 Growth ETFIVW, according to the Citi note.

Read: ETF flows in first quarter reflect investor hopes for ‘soft landing’

Most Read from MarketWatch

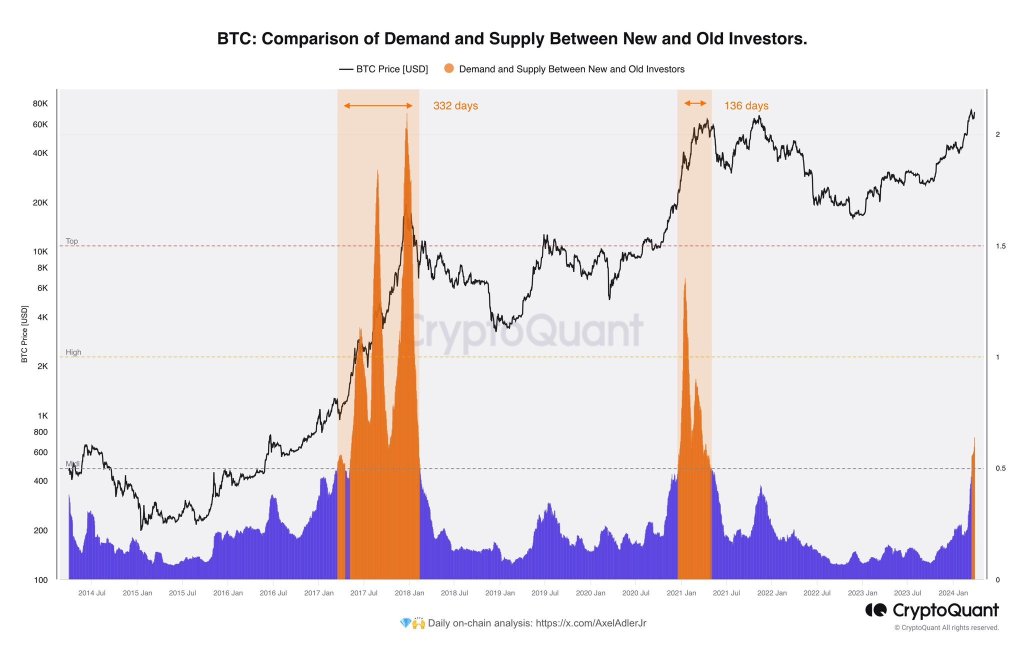

Are Old Bitcoin Whales Selling Or Mitigating Risks Using Spot BTC ETFs?

Ki Young Ju, the founder of CryptoQuant, a blockchain analytics firm, has noticed a curious trend. In a post on X, the founder shared a snapshot suggesting that Bitcoin “old whales” might be shifting their holdings to “new whales,” mainly traditional finance heavyweights like Fidelity and BlackRock.

The United States Securities and Exchange Commission (SEC) recently approved these new whales to list spot Bitcoin exchange-traded funds (ETFs) for all investors.

“Old Whales” Moving Coins: Selling Or Risk Mitigation?

While a definitive sell-off isn’t confirmed, commentators replying to the founder’s post believe these “old whales” could be mitigating risk. In their assessment, moving their Bitcoin stash from self-custody to a regulated investment vehicle like spot Bitcoin ETFs is a better measure of covering unexpected eventualities.

If this is the approach, then it could prove strategic. Bitcoin holders can transact without depending on a third party. Notably, this development coincides with a significant drop in BTC inventory on major exchanges like Coinbase and Binance, as well as at GBTC.

The decline has accelerated since the introduction of spot Bitcoin ETFs, hinting at a potential departure from exchanges. Meanwhile, the operators of GBTC are unwinding the product and converting it to a spot Bitcoin ETF following a court decision.

Will Spot BTC ETFs Gain Traction?

Even so, that “old whales” are moving their coins to centralized products like ETFs contradicts the core philosophy of BTC as a tool for financial self-sovereignty. Whether more users, mainly retailers, will choose to own spot Bitcoin ETF shares rather than the underlying coins directly remains to be seen.

Institutions might be obliged by law to use a regulated product if they need to be exposed to BTC. However, retailers can choose to buy directly from exchanges or mine. This freedom might lead to more retailers opting to buy BTC.

This trend emerges ahead of the highly anticipated Bitcoin halving. This event is set for mid-April 2024 and will further reduce BTC’s circulating supply, potentially driving higher prices. Before then, BTC prices are firm, steady above $70,000 at the time of writing.

Feature image from DALLE, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

On Monday, the U.S. spot bitcoin exchange-traded funds (ETFs) experienced their first positive inflows, breaking a streak of five consecutive days of outflows totaling $887.6 million. The momentum continued into Tuesday, with the ETFs amassing $418 million in inflows, building on the $15.4 million gained the previous day. Bitcoin ETFs’ Fortunes Flip The week prior […]

On Monday, the U.S. spot bitcoin exchange-traded funds (ETFs) experienced their first positive inflows, breaking a streak of five consecutive days of outflows totaling $887.6 million. The momentum continued into Tuesday, with the ETFs amassing $418 million in inflows, building on the $15.4 million gained the previous day. Bitcoin ETFs’ Fortunes Flip The week prior […]

Source link

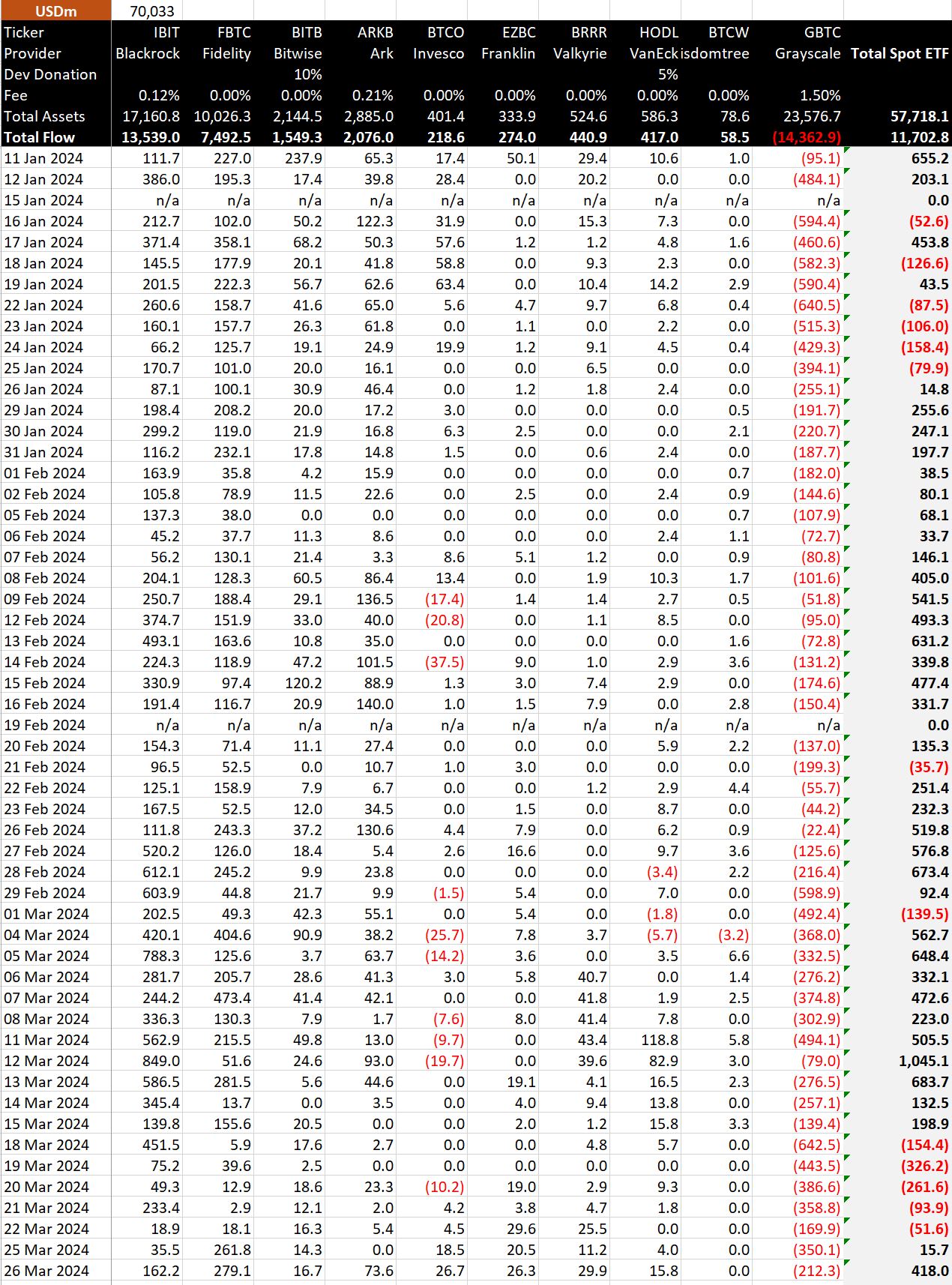

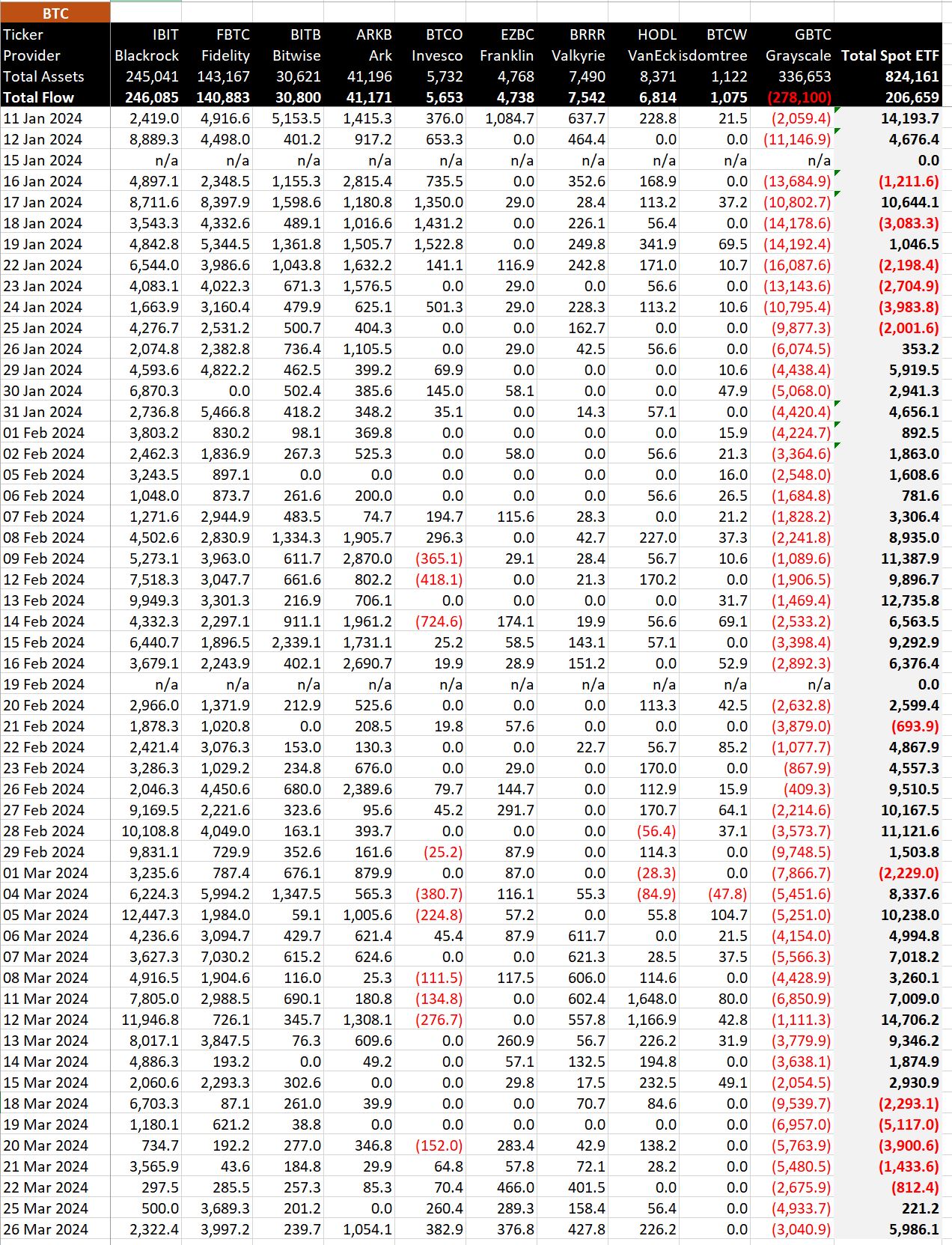

Quick Take

BitMEX’s recent data highlights a substantial inflow in Bitcoin (BTC) Exchange-Traded Funds (ETFs), showcasing their most significant day of inflows since March 13, with a total of $418.0 million, equivalent to 5,986.1 BTC. Notably, Fidelity’s FBTC ETF led the surge with an exceptional $279.1 million in net inflows, equivalent to 3,997.2 BTC, maintaining its strong sequence of consecutive inflow days. This increase has elevated their total net inflows to an impressive $7,492.5 billion, translating to 140,883 BTC.

BitMEX’s data reveals that BlackRock’s IBIT also experienced a solid inflow of $162.2 million, equal to 2,322.4 BTC, marking its best performance since March 21. This contribution boosted their total net inflows to $13,539 billion, corresponding to 246,085 BTC. Conversely, GBTC faced substantial outflows amounting to $212.3 million, or 3,040.9 BTC, leading to a cumulative net outflow of $14,362.9 billion and a net loss of 278,100 BTC.

Following five outflow data, the Bitcoin ETF sector continues a robust influx, with total net inflows reaching $11,702.8 billion, equivalent to a significant 206,659 BTC this year.

The post Fidelity and BlackRock ETFs lead massive Bitcoin inflow day appeared first on CryptoSlate.

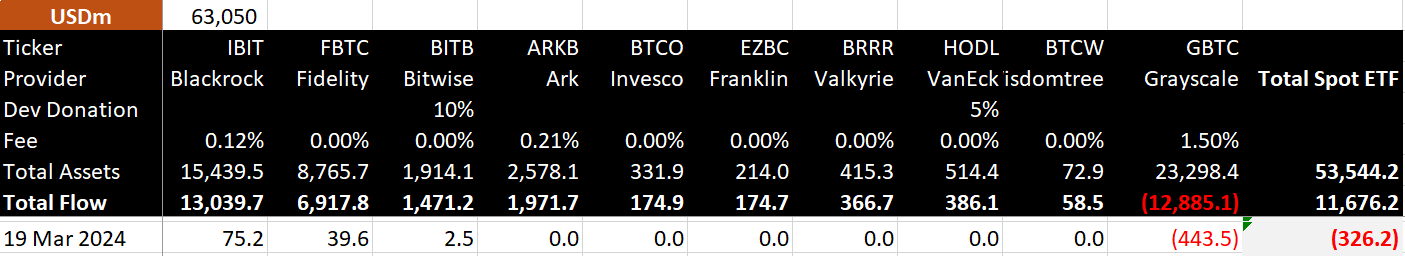

First back-to-back net outflows for Bitcoin ETFs since late January due to $443 million GBTC outflow

Bitcoin ETFs saw a second day of outflows on March 19, the first instances of back-to-back outflows since Jan 25. Net outflows totaled $362 million, with Grayscale accounting for all outflows at $443 million. Most funds saw no net movement, with BlackRock, Fidelity, and Bitwise seeing inflows, according to Bitmex Research.

BlackRock recorded just $75 million, Fidelity $39 million, and Bitwise $2.5 million in inflows on a rare poor performance day for the record-breaking Newborn Nine.

On a positive note, while Bitcoin fell approximately 9% on the day, the net outflows amounted to only 2.7% of total inflows since launch and 0.6% of total assets under management.

Further, $117 million was added to funds on a confidently ‘red’ day for Bitcoin. BlackRock, Fidelity, Bitwise, Ark Invest, Franklin Templeton, and Valkyrie are yet to post a single day of net outflows from their funds, regardless of volatility.

The lack of outflows from many funds can be seen as a bullish indicator, as authorized participants appear reluctant to sell Bitcoin even at prices above $60,000.

The post First back-to-back net outflows for Bitcoin ETFs since late January due to $443 million GBTC outflow appeared first on CryptoSlate.

Goldman Sachs Sees More Institutions Diving Into Crypto — Says Bitcoin ETFs Prompt a ‘Psychological Shift’

Goldman Sachs is seeing more institutions diving into crypto, the global investment bank’s head of digital assets has revealed, noting that until now the bitcoin price action has been driven primarily by retail investors. “But it’s the institutions that we’ve started to see come in,” he stressed, adding that the appetite has “transformed.” Bitcoin ETFs […]

Goldman Sachs is seeing more institutions diving into crypto, the global investment bank’s head of digital assets has revealed, noting that until now the bitcoin price action has been driven primarily by retail investors. “But it’s the institutions that we’ve started to see come in,” he stressed, adding that the appetite has “transformed.” Bitcoin ETFs […]

Source link

9 New Bitcoin ETFs Surpass GBTC by Accumulating 450,000 BTC Worth Over $30B

The latest statistics on bitcoin reserves from the nine new spot bitcoin exchange-traded funds (ETFs) reveal they currently possess 453,503.98 bitcoins, valued at approximately $30.29 billion based on the current exchange rates. The 9 New ETFs Hold Nearly a Half Million Bitcoin Since their inception on Jan. 11, 2024, these nine spot bitcoin ETFs have […]

The latest statistics on bitcoin reserves from the nine new spot bitcoin exchange-traded funds (ETFs) reveal they currently possess 453,503.98 bitcoins, valued at approximately $30.29 billion based on the current exchange rates. The 9 New ETFs Hold Nearly a Half Million Bitcoin Since their inception on Jan. 11, 2024, these nine spot bitcoin ETFs have […]

Source link