Cetera Financial Group, a platform with $475 billion in assets under administration and $190 billion in assets under management, has approved four U.S. spot bitcoin exchange-traded funds (ETFs) for use in brokerage accounts on its platform. “We are prudently embracing bitcoin ETFs and we prioritized developing this important guidance to help our financial professionals implement […]

Cetera Financial Group, a platform with $475 billion in assets under administration and $190 billion in assets under management, has approved four U.S. spot bitcoin exchange-traded funds (ETFs) for use in brokerage accounts on its platform. “We are prudently embracing bitcoin ETFs and we prioritized developing this important guidance to help our financial professionals implement […]

Source link

ETFs

US Senators Push SEC to Stop Approving Spot Crypto ETFs — Say Other Crypto Markets Risker Than Bitcoin

Two U.S. senators have urged U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler to refrain from approving additional crypto exchange-traded fund (ETF) applications. The lawmakers cautioned: “However vulnerable bitcoin may be to fraud and manipulation, markets for other cryptocurrencies are far more exposed to misconduct.” Lawmakers Say SEC Should Not Approve Spot Crypto ETFs […]

Two U.S. senators have urged U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler to refrain from approving additional crypto exchange-traded fund (ETF) applications. The lawmakers cautioned: “However vulnerable bitcoin may be to fraud and manipulation, markets for other cryptocurrencies are far more exposed to misconduct.” Lawmakers Say SEC Should Not Approve Spot Crypto ETFs […]

Source link

Vanguard CEO says Bitcoin ETFs do not ‘belong in a long-term portfolio’

Vanguard CEO Tim Buckley said Bitcoin needs to “change as an asset class” for the investment firm to consider it as a viable option and has no intention of changing its mind about spot Bitcoin ETFs until that happens.

Buckley made the statement in a preview clip of an upcoming webcast posted on March 15. The full conversation with CIO Greg Davis will be published on March 19.

Too volatile

Buckley said that Vanguard does not intend to change its stance toward the spot Bitcoin ETFs, primarily because it does not believe they belong in long-term and retirement portfolios. He added:

“Something like bitcoin is just too volatile and it’s not a store of value — it hasn’t been… It is speculative, really tough to think about how it belongs in a long-term portfolio.”

The Vanguard CEO said that Bitcoin prices recently fell alongside stock prices, and it is difficult to predict the flagship crypto’s growth. These factors make it difficult to determine how to include Bitcoin ETFs in portfolios.

Buckley said the firm focuses on investing in asset classes with underlying cash flows, such as stocks or bonds, which are easier to value and model.

Buckley plans to retire before the end of 2024 but his departure is unlikely to change Vanguard’s stance as the beliefs are part of the firm’s investment philosophy.

Vanguard’s past complaints

Vanguard previously confirmed that it would not offer access to spot Bitcoin ETFs shortly after the funds gained approval in January 2024. The company commented more extensively on its concerns later in the month and said that Bitcoin was an “immature asset class.”

Vanguard’s Global Head of ETF Capital Markets and Broker and Index Relations, Janel Jackson, notably commented that crypto “can create havoc within a portfolio” due to its short history and lack of inherent value and cash flow.

Meanwhile, the firm’s Head of Brokerage & Investments, Andrew Kadjeski, explained that the firm aims to serve long-term, buy-and-hold investors.

The company’s history of avoiding short-term market trends, including steering clear of internet funds in the 1990s and removing access to leveraged and inverse funds and ETFs in 2019 and over-the-counter stocks in 2022, illustrates a historic strategy of prioritizing long-term stability over short-term gains.

Vanguard’s stance has generated significant discussion within the investment community, with some clients expressing frustration over the firm’s reluctance to include Bitcoin in its investment offerings.

Despite the controversy and potential market pressure, Vanguard remains steadfast in its traditional investment approach, focusing on asset classes it deems fundamental for sustained investment success.

Latest Alpha Market Report

There may be a stronger case to invest in single stocks over exchange-traded funds in the weight loss space.

Amplify ETFs and Roundhill Investments each filed a prospectus last week to launch funds focused on weight loss companies, a move that Strategas ETF and technical strategist Todd Sohn believes hinges on the performance of two dominant stocks: Novo Nordisk (NVO) and Eli Lilly (LLY).

“The main holdings are going to be Lilly and Novo Nordisk, and probably one or two other big names … along with some of the manufacturers down the supply chain,” he told CNBC’s “ETF Edge” this week. “Ultimately, it’s up to those big behemoths that are playing those drugs.”

With just two players currently at the forefront of the U.S. obesity drug market, ProShares’ Simeon Hyman questions the relevance of weight loss ETFs for investors looking to buy into the industry.

“I think that’s one of the challenges whenever you see an innovation like this,” the firm’s global investment strategist said in the same interview. “If the benefits are going to incumbents, then maybe there isn’t a theme per se that needs to be exploited.”

Strategas’ Sohn also suggested that ETFs based on themes, rather than sectors or indices, might be falling out of favor with investors.

“I think thematics are a little bit on the backburner right now, especially the way they performed the last couple of years. I think there’s room for them, but more than one, it’s gonna be tough,” he said.

So far in 2024, Novo Nordisk has gained 29% and Eli Lilly is up 30%, as of Wednesday’s close. The broader Health Care Select Sector SPDR (XLV) is 7% higher during the same period.

Disclaimer

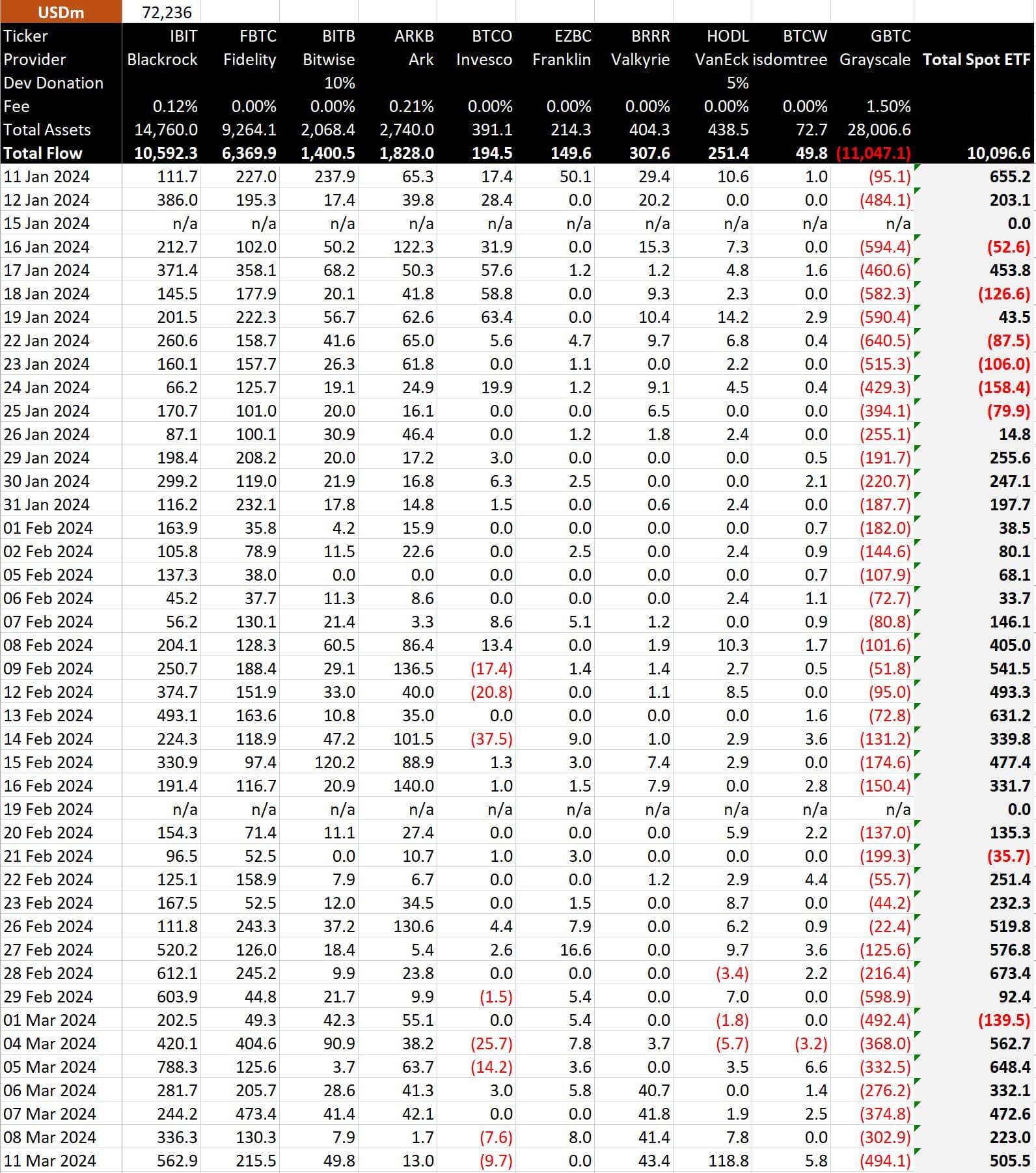

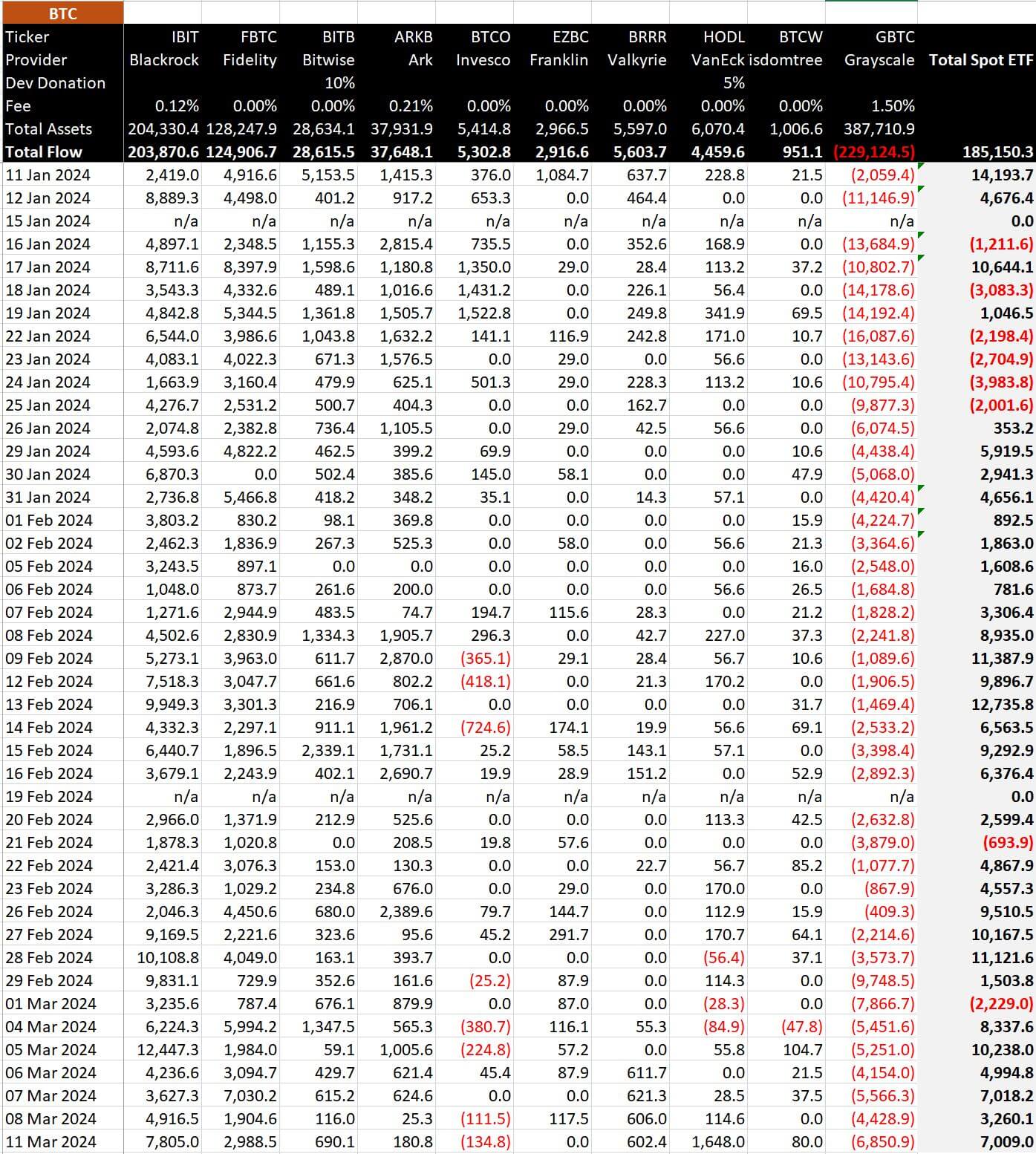

Bitcoin ETFs see $505 million total inflows led by BlackRock as VanEck breaks record

Bitcoin ETF inflows surged on March 11, 2024, with a net gain of $505.5 million, according to data from Bitmex Research. The strong performance was led by BlackRock’s iShares Bitcoin ETF (IBIT), which saw inflows of $562.9 million, representing a 0.12% increase in total assets. Fidelity’s FBTC fund also contributed to the positive momentum, attracting $215.5 million in new investments.

Other notable Newborn Nine ETFs with inflows included Bitwise’s BITB fund ($49.8 million), ARK Invest’s ARKB fund ($13.0 million), and VanEck’s BRRR fund ($118.8 million). VanEck’s announcement to waive fees until 2025 led to its strongest day by far. Previously, the fund had not seen more than $14.2 million in a single day. However, not all Newborn Nine funds experienced gains, with Invesco’s BTCO ETF reporting an outflow of $9.7 million.

Further, Grayscale continued its outflows, with $494 million leaving the fund, the highest level since Feb. 29. Yet, the inflows into Newborn Nine ETFs significantly outweighed the Grayscale outflow for the sixth consecutive day. Only two days since Jan. 26 have total outflows surpassed inflows.

In terms of Bitcoin, the net inflow amounted to 7,009 BTC, with BlackRock’s IBIT fund accounting for 7,805 BTC of the total. Fidelity’s FBTC fund added 2,988 BTC, while Bitwise’s BITB fund saw an inflow of 690 BTC. ARK Invest’s ARKB fund and VanEck’s BRRR fund gained 180 BTC and 1,648 BTC, respectively.

The strong performance of Bitcoin ETFs on March 11, 2024, affirms the growing interest in Bitcoin investments among institutional and retail investors alike.

The post Bitcoin ETFs see $505 million total inflows led by BlackRock as VanEck breaks record appeared first on CryptoSlate.

Semiconductor ETFs are generating scorching returns as stocks like Nvidia (NASDAQ:NVDA) reach new heights. However, not all semiconductor ETFs are the same. Two funds can both focus on semiconductors, but there may be vast differences in the types of semiconductor stocks they hold, the weightings of these stocks within their portfolios, their returns over time, fees, and more that investors must take into account.

Let’s take a look at two popular semiconductor ETFs, the iShares Semiconductor ETF (NASDAQ:SOXX) and the First Trust Nasdaq Semiconductor ETF (NASDAQ:FTXL). They both invest in the space but take different approaches and have generated different returns over time. I’m bullish on both ETFs, but one is the superior choice based on several factors that we’ll evaluate in this article.

What Is the SOXX ETF’s Strategy?

SOXX is an index ETF from BlackRock’s (NYSE:BLK) iShares that, according to the fund, gives investors “exposure to U.S. companies that design, manufacture, and distribute semiconductors” by investing in “an index composed of U.S.-listed equities in the semiconductor sector.” SOXX essentially invests in the 30 largest U.S. stocks classified as semiconductor companies by ICE.

SOXX launched in 2001 and has $12.8 billion in assets under management (AUM).

What Is the FTXL ETF’s Strategy?

Meanwhile, FTXL invests in an index called the Nasdaq US Smart Semiconductor Index. First Trust describes this index as a “modified factor weighted index created and administered by Nasdaq, Inc (NASDAQ:NDAQ). designed to provide exposure to US companies within the semiconductor industry.”

The stocks within this index are ranked based on three factors; their trailing 12-month return on assets, trailing 12-month gross income, and momentum based on their three-, six-, nine-, and 12-month price appreciation.

The lowest-scoring 25% of stocks from this universe based on these scores are then eliminated from the index, leaving it with a remaining group of 30-50 stocks that FTXL can potentially invest in. These remaining stocks are weighted based on their trailing 12-month cash flow and can have a weighting of up to 8% and a minimum of 0.50%.

The index is then reconstituted and rebalanced on a semiannual basis. As we’ll discuss below, these different approaches create two portfolios that have some overlap but also some key differences.

How Do Their Portfolios Compare?

SOXX owns 30 stocks, and its top 10 holdings make up 61.7% of the fund. Below is an overview of SOXX’s top 10 holdings using TipRanks’ holdings tool.

Meanwhile, FTXL owns 32 stocks, and its top 10 holdings make up 65.9% of holdings, so the two funds are very similar when it comes to diversification. Below is an overview of FTXL’s top 10 holdings using TipRanks’ holdings tool.

As you can see, SOXX has large positions with double-digit weightings in its top two holdings, Nvidia and Advanced Micro Devices (NASDAQ:AMD). These large positions have served SOXX well, as Nvidia is up 283.4% over the past year, while Advanced Micro Devices is up 147.6%.

At the same time, FTXL has a large 9.2% position in its top holding, Qualcomm (NASDAQ:QCOM). This stock has generated a 44.5% gain over the past year, which is great but is behind the astronomical returns of Nvidia and Advanced Micro Devices. Note that FTXL owns these stocks, too, but at smaller weightings of 5.7% and 6.1%, respectively.

Both funds have large positions in Broadcom (NASDAQ:AVGO), another major winner in the chip space, which has gained 127.6% over the past year.

TipRanks’ Smart Score system gives a resounding nine of SOXX’s top 10 holdings Outperform-equivalent Smart Scores of 8 or higher, and it gives eight of FTXL’s top 10 holdings Smart Scores of 8 or higher. The Smart Score is a proprietary quantitative stock scoring system created by TipRanks. It gives stocks a score from 1 to 10 based on eight market key factors. A score of 8 or above is equivalent to an Outperform rating.

Both ETFs receive Outperform-equivalent ETF Smart Scores of 8. These are both strong portfolios but Smart Score rates SOXX’s top holdings a bit more favorably, and SOXX’s top holdings have helped it outperform FTXL, as we’ll get to in the next section.

Head-to-Head Performance

When it comes to performance, these two ETFs have been long-term winners. As of February 29, FTXL has generated an impressive three-year annualized return of 11.8% and a five-year return of 24.5%.

Meanwhile, as of the same date, SOXX has generated an even more impressive three-year annualized return of 17.2% and a stunning five-year annualized return of 30.3%.

FTXL launched in 2016, so we can’t yet compare the two ETFs on a 10-year timeframe, but SOXX’s 10-year return of 25.3% over the past decade is excellent.

FTXL’s returns are good, but SOXX’s are even better, and it has a longer track record of excellence, giving SOXX a clear edge in this category. Both ETFs have sound strategies, but it seems that SOXX’s strategy of simply investing in the largest 30 U.S. semiconductor equities has generated a stronger performance than FTXL’s more nuanced strategy over time.

Is SOXX Stock a Buy, According to Analysts?

Turning to Wall Street, SOXX earns a Moderate Buy consensus rating based on 24 Buys, six Holds, and one Sell rating assigned in the past three months. The average SOXX stock price target of $671.72 implies 191% upside potential from current levels.

Is FTXL Stock a Buy, According to Analysts?

Turning to Wall Street, FTXL earns a Moderate Buy consensus rating based on 25 Buys, seven Holds, and one Sell rating assigned in the past three months. The average FTXL stock price target of $90.59 implies 2% downside potential from current levels.

Cost Comparison

In terms of fees, SOXX’s expense ratio of 0.35% is a better bargain than FTXL’s expense ratio of 0.60%. An investor putting $10,000 into SOXX will pay $35 in annual fees, while an investor putting $10,000 into FTXL will pay $60.

The differences in these fees compound and become more apparent over time. For example, assuming each ETF returns 5% per year from here, the investor putting $10,000 into SOXX will pay $443 in fees over the next 10 years, while the investor putting the same amount into FTXL will pay $750.

Adding It All Up

These are both good ETFs that invest in strong stocks, and they have generated sizable returns for investors. However, the returns that SOXX has generated are substantially better than those of FTXL, and it charges significantly less in fees, making SOXX the clear winner here. Furthermore, TipRanks’ Smart Score system has a slightly more favorable outlook on SOXX’s top holdings, and analysts also see SOXX as having more potential upside, adding to SOXX’s edge.

New Bitcoin ETFs and Grayscale Control a Combined 4% of BTC Supply, Valued at $53 Billion

The latest figures reveal that the nine new spot bitcoin exchange-traded funds (ETFs) now control 390,525.3 bitcoins, valued at just over $26 billion at current market rates. These nine ETFs are rapidly approaching the holdings of Grayscale’s Bitcoin Trust (GBTC), which presently has 405,713.31 bitcoins in its possession. Emerging Bitcoin ETFs Challenge Grayscale’s Reign Collectively, […]

The latest figures reveal that the nine new spot bitcoin exchange-traded funds (ETFs) now control 390,525.3 bitcoins, valued at just over $26 billion at current market rates. These nine ETFs are rapidly approaching the holdings of Grayscale’s Bitcoin Trust (GBTC), which presently has 405,713.31 bitcoins in its possession. Emerging Bitcoin ETFs Challenge Grayscale’s Reign Collectively, […]

Source link

Latam Insights: El Salvador Won’t Sell Its Bitcoin, Bitcoin Spot ETFs Land In Brazil and Peru

Welcome to Latam Insights, a compendium of Latin America’s most relevant crypto and economic news during the last week. In this issue: President Bukele states El Salvador will not sell its bitcoin, Bitcoin ETFs land in Brazil and Peru, and Argentine President Javier Milei aims to criminalize central bank money issuance. El Salvador Won’t Sell […]

Welcome to Latam Insights, a compendium of Latin America’s most relevant crypto and economic news during the last week. In this issue: President Bukele states El Salvador will not sell its bitcoin, Bitcoin ETFs land in Brazil and Peru, and Argentine President Javier Milei aims to criminalize central bank money issuance. El Salvador Won’t Sell […]

Source link

Grayscale lobbying for regulatory approval of options for spot Bitcoin ETFs

Grayscale is lobbying for the US SEC to approve options on its spot Bitcoin exchange-traded fund (ETF), Reuters reported on Feb. 29.

Grayscale CEO Michael Sonnenshein said:

“It is vital to the interests of GBTC and all spot Bitcoin [exchange-traded product] investors to access exchange-listed options on GBTC and other spot Bitcoin ETPs.”

The SEC approved Grayscale’s spot Bitcoin ETF (GBTC) in January. Unlike most of the other newly approved spot Bitcoin ETFs, GBTC was converted to an ETF from an existing fund.

Options could enhance regulation

According to Sonnsenshein, the SEC’s rejection of options on GBTC would unfairly discriminate against shareholders because the regulator has approved options on Bitcoin futures ETFs.

He added that options could also support spot Bitcoin ETF investment more broadly as they could provide price discovery, assist market condition navigation, and support hedging and income generation.

Furthermore, options would bring BTC within the regulatory perimeter, allowing more market participants, including contract merchants and broker-dealers, to trade the funds.

Grayscale’s letter was reportedly prompted by the SEC’s decision to open comments on options for its ETF on Feb. 23. The regulator’s notice also opened comments on Bitwise’s equivalent ETF and other NYSE-listed trusts that hold Bitcoin.

Previously, in January, the SEC opened comments on options for BlackRock’s Nasdaq-listed spot Bitcoin ETF and various Cboe-listed spot Bitcoin ETFs.

Grayscale is a key ETF player

Grayscale’s communications with the SEC are critical because its past efforts have contributed to approvals. After the SEC dismissed Grayscale’s spot Bitcoin ETF application, the firm initiated a legal case against the regulator and won a victory that compelled the SEC to re-address the matter.

SEC chair Gary Gensler cited that outcome in his agency’s approval of spot Bitcoin ETFs, noting that the legal result made approval the “most sustainable path forward.”

The company and other asset managers have also applied for spot Ethereum ETFs. Grayscale’s application recently gained support from Coinbase on Feb. 21.

While Grayscale’s latest letter does not compel the SEC to act in any way, the company’s past significance means that its comment could influence future outcomes.

Ten new U.S. spot bitcoin exchange-traded funds (ETFs) have shattered both inflow and trading volume records. The 10 funds took in $673.4 million, with Blackrock’s Ishares Bitcoin Trust (IBIT) accounting for $612.1 million of the total inflow. The 10 bitcoin ETFs also set a new record for total trading volume. Spot Bitcoin ETFs Set New […]

Ten new U.S. spot bitcoin exchange-traded funds (ETFs) have shattered both inflow and trading volume records. The 10 funds took in $673.4 million, with Blackrock’s Ishares Bitcoin Trust (IBIT) accounting for $612.1 million of the total inflow. The 10 bitcoin ETFs also set a new record for total trading volume. Spot Bitcoin ETFs Set New […]

Source link