In recent weeks, Bitcoin.com News has chronicled the significant number of dormant bitcoin addresses that have sprung to life in March after years, if not a decade, of inactivity. Similarly, we’ve observed a resurgence of activity from older ethereum addresses. This Saturday highlighted a noteworthy event: an individual who took part in the Ethereum initial […]

In recent weeks, Bitcoin.com News has chronicled the significant number of dormant bitcoin addresses that have sprung to life in March after years, if not a decade, of inactivity. Similarly, we’ve observed a resurgence of activity from older ethereum addresses. This Saturday highlighted a noteworthy event: an individual who took part in the Ethereum initial […]

Source link

ETH

Ethereum Price Uptrend To Continue? These Factors Could Send ETH To $4,300

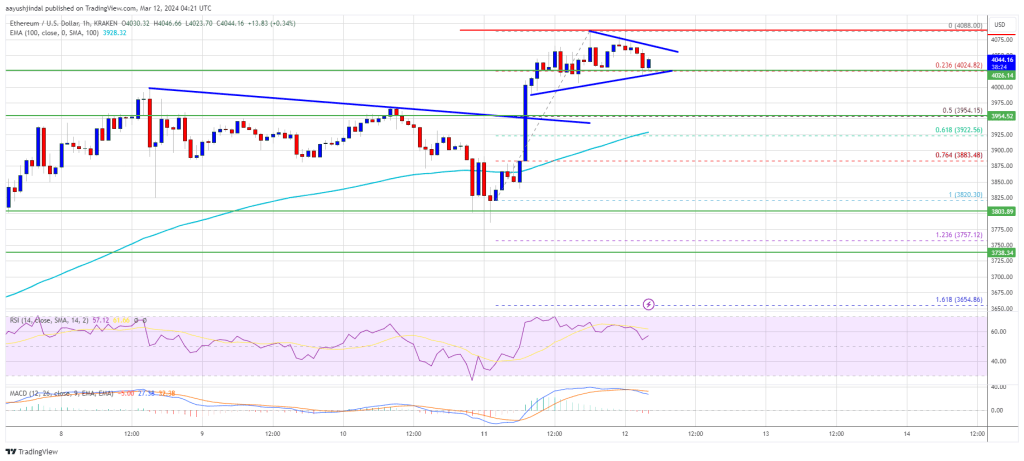

Ethereum price cleared the $4,000 resistance zone. ETH is now consolidating gains and might extend its increase above the $4,100 zone.

- Ethereum traded to a new multi-month high above $4,050.

- The price is trading above $4,000 and the 100-hourly Simple Moving Average.

- There is a short-term breakout pattern forming with resistance at $4,060 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could resume its increase if it clears the $4,080 resistance zone.

Ethereum Price Reclaims $4K

Ethereum price remained well-bid above the $3,880 level and extended its increase, like Bitcoin. ETH was able to clear the key $4,000 resistance to move further into a positive zone.

The price settled above the $4,000 level. It traded to a new multi-month high above $4,000 and recently started a consolidation phase. There was a pullback below the $4,050 level. The price tested the 23.6% Fib retracement level of the recent increase from the $3,820 swing low to the $4,088 high.

Ethereum price is now consolidating above $4,000 and the 100-hourly Simple Moving Average. There is also a short-term breakout pattern forming with resistance at $4,060 on the hourly chart of ETH/USD.

If the pair stays above the $4,000 level, it could attempt another increase. Immediate resistance on the upside is near the $4,060 level. The first major resistance is near the $4,080 level.

Source: ETHUSD on TradingView.com

The next major resistance is near $4,120, above which the price might gain bullish momentum. In the stated case, Ether could rally toward the $4,220 level. If there is a move above the $4,220 resistance, Ethereum could even rise toward the $4,300 resistance. Any more gains might call for a test of $4,350.

Are Dips Supported In ETH?

If Ethereum fails to clear the $4,060 resistance, it could start a downside correction. Initial support on the downside is near the $4,020 level.

The first major support is near the $3,950 zone or the 50% Fib retracement level of the recent increase from the $3,820 swing low to the $4,088 high. The next key support could be the $3,920 zone. A clear move below the $3,920 support might send the price toward $3,880. Any more losses might send the price toward the $3,780 level.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is losing momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 level.

Major Support Level – $3,950

Major Resistance Level – $4,080

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Vitalik Buterin’s ENS Address Trades $100K Worth of ETH for Stablecoins Amid Market Uptick

According to blockchain analytics, the Ethereum Name Service (ENS) domain “vitalik.eth” has engaged in a transaction of $100,000 worth of ether, converting it into an equal amount of stablecoins on the Base blockchain. The address, purportedly belonging to Ethereum’s co-founder Vitalik Buterin, currently possesses 955.58 ether, estimated at $3.64 million. ‘Vitalik.eth’ Wallet Makes Strategic $100K […]

According to blockchain analytics, the Ethereum Name Service (ENS) domain “vitalik.eth” has engaged in a transaction of $100,000 worth of ether, converting it into an equal amount of stablecoins on the Base blockchain. The address, purportedly belonging to Ethereum’s co-founder Vitalik Buterin, currently possesses 955.58 ether, estimated at $3.64 million. ‘Vitalik.eth’ Wallet Makes Strategic $100K […]

Source link

After Bitcoin (BTC) recorded a new all-time high (ATH), Ethereum (ETH) rallied above $3,800 before the price crashed over 10%. The second-largest cryptocurrency has recovered from the dip and reached $3,900 momentarily for the first time in over two years.

Ethereum Recovers And Rallies to $3,900

On Thursday, Bitcoin reached a crucial milestone after breaking above $69,000 and recording a new all-time high (ATH). Before the euphoria was over, the flagship cryptocurrency’s price started to drop, trading as low as $60,000. Since then, BTC’s price has recovered to hover between the $66,000-$67,000 price range.

Fueled by the bullish sentiment, Ethereum rallied above $3,800 before suffering a considerable price drop. The ‘king of altcoins’ lost momentum and shredded about 12% of its price to trade at a price as low as $3,360, according to CoinMarketCap data.

After the dip was done, ETH started to show a recovery alongside Bitcoin. As reported by NewsBTC, a crucial resistance level to clear during this recovery was $3,600. Ethereum surpassed this support level and has maintained its price above the $3,800 range during the last 4 hours.

JUST IN: $3,900 $ETH

— Watcher.Guru (@WatcherGuru) March 6, 2024

Ethereum reached the $3,800 support level twice in the last 24 hours. This price range was not seen since January 2022, and the regained bullish momentum propelled the token’s price to a higher milestone.

Ethereum hit $3,900 for the first time since December of 2021. The biggest altcoin briefly soared to $3,901 before falling to the $3,850 price range.

At the time of writing, ETH is trading at $3,834, representing a 1.6% price drop in the last hour and a 2% increase from 24 hours ago. Similarly, the token exhibits green numbers on longer timeframes.

ETH price performance in the 4-hour chart. Source: ETHUSDT on TradingView.com

Ethereum’s price performance has surged almost 16% in the past week, 65% in the last month, and an impressive 145% in one year.

ETH’s market capitalization increased 1.55% to $459.7 million on the last day. Its daily trading volume has increased by 58%, with $52.16 billion in market activity in the previous 24 hours.

What’s Next For ETH’s Price?

Many analysts have forecasted that ETH’s rally is far from over. Analyst Altcoin Sherpa predicted that Ethereum could reach $4,000 when it breaks through the $3,000 price barrier.

Ethereum’s rally seems to be fueled not only by Bitcoin’s momentum but also by the general market dynamics. The date for the Dencun upgrade is approaching, and this update is expected to bring several technical improvements to Ethereum’s infrastructure,

Moreover, the possibility of Ether-based spot exchange-traded funds (ETF) being approved by the US Securities and Exchange Commission (SEC) in May has built expectations for Ether and the blockchain’s ecosystem.

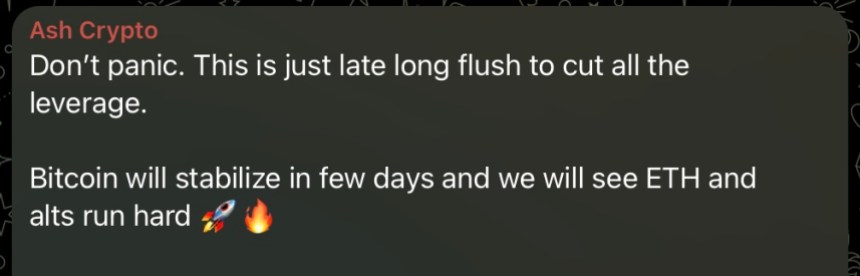

Pseudonym trader Ash Crypto suggested to his Telegram subscribers that the price correction experienced after Bitcoin’s new ATH was not a “reason to panic.”

Message from Ash Crypto to his Telegram Subscribers. Source: Ash Crypto on Telegram

Related Reading: Ethereum Price Follows Bitcoin Surge, Why $4K Is Just A Matter of Time

The trader considers that the “late long flush to cut all the leverage” was expected and that a soon-to-come stabilization in BTC’s price will propel the run of ETH and all altcoins. Similarly, he announced the ‘incoming alt season’ after the price of ETH hit $3,900 and suggested that Ethereum’s next support level will be $4,200.

$ETH JUST MADE A NEW HIGH 🔥

$4,200 IS COMING NEXT !

GET READY FOR ALTSEASON pic.twitter.com/ZLirlerVDJ

— Ash Crypto (@Ashcryptoreal) March 6, 2024

Cover image from Unsplash, chart from Tradingview

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Ethereum Technical Analysis: Bullish Market Sentiment Keeps ETH Above $3,500

Ethereum’s price experienced a turbulent trading session on March 4, 2024, with significant intraday fluctuations marking the landscape. Despite the short-term volatility, underlying indicators and moving averages suggest a strong bullish trend over the long term. Ethereum The last 24 hours saw ethereum’s (ETH) price swing from $3,411 to $3,537, encapsulating the volatile nature of […]

Ethereum’s price experienced a turbulent trading session on March 4, 2024, with significant intraday fluctuations marking the landscape. Despite the short-term volatility, underlying indicators and moving averages suggest a strong bullish trend over the long term. Ethereum The last 24 hours saw ethereum’s (ETH) price swing from $3,411 to $3,537, encapsulating the volatile nature of […]

Source link

Can Ethereum Touch $4,000? Crypto Analyst Says ETH Rally Far From Over

Like Bitcoin, Ethereum has also picked up steam, with the second-largest crypto token crossing the $3,000 resistance level for the first time since 2021. Interestingly, this crypto analyst believes the rally is far from over, as he highlighted a key price level that ETH could hit soon enough.

Ethereum Could Rise To As High As $4,000

Crypto analyst Altcoin Sherpa suggested in an X (formerly Twitter) post that Ethereum could rise to as high as $4,000. His prediction looks feasible when one considers crypto analyst Bitcoin Ape’s recent analysis of Ethereum from a technical analysis perspective.

In his X post, Bitcoin Ape noted that the ADX (average directional index) indicator is currently “very high,” signalling that ETH’s bullish trend is strong. Indeed, this bullish momentum might be very strong as the crypto token has since crossed the $3,130 price level, which Bitcoin Ape highlighted in his post as ETH’s new resistance level.

Interestingly, the analyst noted that Ethereum had already faced four resistance levels in February alone and has so far broken all of them, having also crossed the $3,130 mark. Although Bitcoin Ape failed to give his short-term prediction for ETH, he expects the crypto token to hit its all-time high (ATH) of $4,891 when the bull run returns in full force.

Meanwhile, Altcoin Sherpa isn’t the only one who believes that ETH could rise to $4,000 soon enough. Standard Chartered Bank had also predicted that the crypto token would hit this price level by the time the Spot Ethereum ETF is approved in May.

Crypto analyst Rager also recently gave a bullish prediction for ETH’s price, although he put his short-term target at $3,500. However, he added that this price level is only the beginning, stating that it isn’t the “peak high by any means.”

Ethereum’s Rally Not Hinged On Bitcoin’s Success

There is reason to believe Ethereum’s current bullish momentum isn’t due to Bitcoin’s price surge, as the Ethereum ecosystem also has narratives that may be driving ETH’s rally. For one, the Ethereum network’s ‘Dencun’ upgrade is set to take place on March 13. This much-anticipated event is significant as it would usher in advancements in the scalability, security, and usability of the Ethereum network.

Meanwhile, talks about a Spot Ethereum ETF likely being approved in May have created a lot of excitement for investors who have chosen to double down on their investments in the second-largest crypto token in anticipation of this happening.

The increased interest in ETH is expected to spark significant rallies in its price ahead of the May deadline, when the SEC will have to approve or deny VanEck’s Spot Ethereum ETF application.

ETH bulls maintain hold above $3,200 | Source: ETHUSD on Tradingview.com

Featured image from Bitcoinist, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Ethereum Outperforms Bitcoin As Institutional Investors Clamor For ETH Exposure

Reports have revealed that institutional investors are shifting their focus to Ethereum, displaying a preference compared to the largest cryptocurrency, Bitcoin. Despite Bitcoin’s recent rally to over $55,000, Ethereum’s unique features and potential developmental capabilities continue to capture institutional players’ interest.

Institutions Favor Ethereum Over Bitcoin

On February 24, cryptocurrency exchange, Bybit, published a research report on its users’ asset allocation. The research examined investors’ hodling and trading behaviours, covering the period from July 2023 to January 2024. Bybit’s report also provided valuable insights into investors’ asset allocation across cryptocurrencies such as altcoins, stablecoins and meme coins, shedding light on the specific coins users are currently bullish or bearish on.

According to the research report, Ethereum has unexpectedly emerged as the primary cryptocurrency choice for institutional investors. The report revealed that “institutions are betting big on Ethereum,” allocating more of their funds to ETH compared to BTC.

Bybit has disclosed that the recent rise in interest in Ethereum began in September 2023, when ETH was still trading around $2,000. Subsequently, Ethereum’s market sentiment became more bullish, experiencing a surge in investor interest to about 40% by January 2024. The crypto exchange has confirmed that, as of January 31, ETH has become the single largest cryptocurrency held by institutions.

Bybit’s report also revealed that institutional investors’ interest in Bitcoin began to wane following the United States Securities and Exchange Commission (SEC) approval of Spot Bitcoin ETFs on January 10, 2024. At the time, Bitcoin had experienced massive selling pressures, resulting in investors trimming their BTC holdings to favour other cryptocurrencies.

The excessive allocation of Ethereum is reportedly attributed to investors anticipating a favourable outcome from Ethereum’s upcoming Decun Upgrade, slated to launch in March 2024.

Notably, Bybit has disclosed that it is still being determined if the recent shift to Ethereum is a short-term manoeuvre or a more prolonged move. However, the approaching Bitcoin halving in April potentially adds a layer of bearish risks, as projections indicate Bitcoin’s significant rise in value to new all-time highs during the halving phase.

ETH price rises to $3,230 | Source: ETHUSD on Tradingview.com

Retail Investors Think Otherwise

Bybit’s research report also examines the asset allocation trend for retail investors on the cryptocurrency exchange. The report revealed that retail investors are significantly more bullish on Bitcoin than Ethereum, allocating more funds into BTC than ETH despite Ethereum’s recent surge in value.

Over the past week, Ethereum has experienced a substantial hike in its price, jumping over 7% and outpacing Bitcoin, suggesting a potential for a more extensive upward trajectory. At the time of writing, Ethereum is trading at $3,227, reflecting a 4.05% increase in the last 24 hours, according to CoinMarketCap.

While Ethereum’s massive rally has successfully elevated the sentiment among institutional investors, retail investors remain less swayed, opting to hold onto or incorporate additional Bitcoin into their diversified portfolio of digital assets.

Featured image from Cointribune, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

According to data from Lookonchain, an on-chain analytics platform, Ethereum (ETH), whales have withdrawn roughly $64.2 million worth of ETH from major exchanges.

This significant movement of funds coincides with a notable uptick in the price of ETH, indicating an increasing interest in the asset.

Ethereum Whales Movement Signals Confidence

According to Lookonchain’s findings, much of the ETH supply has been shifted from exchange wallets to custodial wallets. The on-chain analytics platform reported that an Ethereum address labeled 0x8B94 had withdrawn an amount of 14,632 ETH, valued at approximately $45.5 million, from Binance.

Lookonchain states these funds have been actively staked within six days, indicating a deliberate move towards adopting long-term investment strategies.

The analysis from the platform also points out that another two fresh whale wallets have transferred 6,000 ETH, amounting to $18.7 million, from Kraken to undisclosed wallet addresses over the last two days.

Whales are accumulating $ETH!

0x8B94 withdrew 14,632 $ETH($45.5M) from #Binance and staked it in the past 6 days.

2 fresh whale wallets withdrew 6K $ETH($18.7M) from #Kraken in the past 2 days.https://t.co/0kEvOmiv3hhttps://t.co/90fqjJXsSu pic.twitter.com/J0ewl8S3OX

— Lookonchain (@lookonchain) February 26, 2024

This trend suggests an increase in major investors to secure substantial amounts of Ethereum away from exchange platforms, potentially as a means of positioning for long-term asset appreciation.

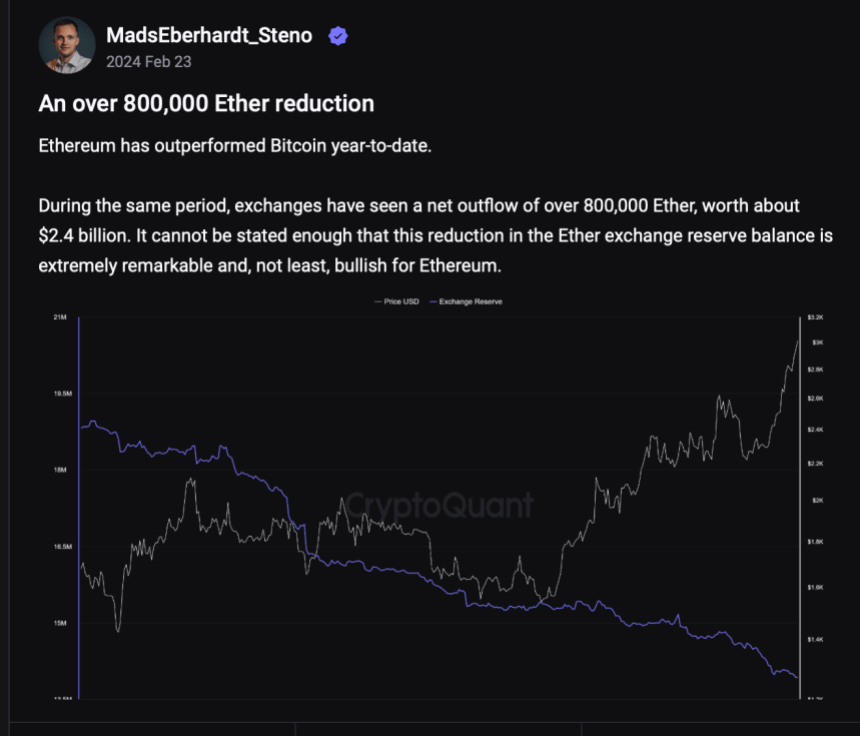

Further echoing this is a recent analysis from CryptoQuant’s Quicktake, which underscores a notable trend regarding Ethereum withdrawals from exchanges over the past few weeks. This observation relies on the “Exchange Reserve” metric, which monitors the quantity of ETH tokens held in the wallets of all centralized exchanges.

When the value of this metric increases, it signifies that investors are depositing more assets than withdrawing them from centralized exchanges, indicating a buildup of Ethereum reserves. Conversely, a decline in the metric suggests a net outflow of assets from these platforms.

According to data from CryptoQuant, over 800,000 ETH, equivalent to roughly $2.4 billion, has exited cryptocurrency exchanges since the beginning of the year. Such substantial outflows from these platforms typically indicate a surge in investor confidence in the Ethereum network and its native token.

Ethereum’s Price Momentum And Potential For A Significant Breakout

Meanwhile, Ethereum’s price has displayed bullish momentum, witnessing a 5.5% increase in the past week and reclaiming the crucial $3,000 mark.

Financial guru Raoul Pal has drawn attention to Ethereum’s potential for a major breakout, pointing to a “dual-chart pattern” observed on the ETH/BTC chart.

The ETH/BTC chart is an absolute stunner…and ready for the next big move the break of the mega wedge…lets see how is pans out… pic.twitter.com/5x4tJLjtJy

— Raoul Pal (@RaoulGMI) February 25, 2024

Pal highlights a “mega wedge” pattern alongside an inner descending channel, indicating a consolidation phase with bullish potential.

Featured image from Unsplash, Chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Kyberswap Hack: Blockchain Security Firm Reports Movement of 800 ETH From Exploiter’s Address

Blockchain security firm Peckshield revealed on Feb. 26 that an exploiter labeled address associated with the Kyberswap hack had bridged approximately 800 ether tokens from Arbitrum to the Ethereum blockchain. On the same day, the Kyberswap team unveiled revised dates for reimbursing users impacted by the hacking. Kyberswap Hacker Starts Moving Funds Peckshield Alert, a […]

Blockchain security firm Peckshield revealed on Feb. 26 that an exploiter labeled address associated with the Kyberswap hack had bridged approximately 800 ether tokens from Arbitrum to the Ethereum blockchain. On the same day, the Kyberswap team unveiled revised dates for reimbursing users impacted by the hacking. Kyberswap Hacker Starts Moving Funds Peckshield Alert, a […]

Source link

Coinbase on Grayscale Ethereum Spot ETF Application: ‘ETH Is a Commodity, Not a Security’

Coinbase has answered the SEC request for comments on the proposed rule change to list the ETH Grayscale Fund as a spot ETF. Coinbase stated that ether was a commodity, and its status has been publicly recognized in a variety of circumstances by U.S. agencies and courts. Coinbase Supports Ethereum Grayscale Fund Conversion as a […]

Coinbase has answered the SEC request for comments on the proposed rule change to list the ETH Grayscale Fund as a spot ETF. Coinbase stated that ether was a commodity, and its status has been publicly recognized in a variety of circumstances by U.S. agencies and courts. Coinbase Supports Ethereum Grayscale Fund Conversion as a […]

Source link