Consensys has told the U.S. Securities and Exchange Commission that Ethereum’s proof of stake implementation “meets and even exceeds the security of Bitcoin’s Proof of Work (PoW).” The blockchain software company said the commission should recognize the advanced safeguards inherent in Ethereum’s design which exceed the “security and resilience safeguards underlying bitcoin-based exchange-traded products.” The […]

Consensys has told the U.S. Securities and Exchange Commission that Ethereum’s proof of stake implementation “meets and even exceeds the security of Bitcoin’s Proof of Work (PoW).” The blockchain software company said the commission should recognize the advanced safeguards inherent in Ethereum’s design which exceed the “security and resilience safeguards underlying bitcoin-based exchange-traded products.” The […]

Source link

Ethereums

Unlocking Crypto History: 2,000 ETH From Ethereum’s Genesis Days Suddenly Moved

In recent weeks, Bitcoin.com News has chronicled the significant number of dormant bitcoin addresses that have sprung to life in March after years, if not a decade, of inactivity. Similarly, we’ve observed a resurgence of activity from older ethereum addresses. This Saturday highlighted a noteworthy event: an individual who took part in the Ethereum initial […]

In recent weeks, Bitcoin.com News has chronicled the significant number of dormant bitcoin addresses that have sprung to life in March after years, if not a decade, of inactivity. Similarly, we’ve observed a resurgence of activity from older ethereum addresses. This Saturday highlighted a noteworthy event: an individual who took part in the Ethereum initial […]

Source link

As the Ethereum ecosystem braces for the much-anticipated Dencun upgrade, renowned crypto analyst Miles Deutscher provides an in-depth look at the altcoins poised for significant growth.

Scheduled for March 13, the Dencun upgrade is a critical hard fork aimed at enhancing Ethereum’s scalability, security, and usability. Deutscher’s insights reveal how specific Layer 2 (L2) solutions are uniquely positioned to benefit from the upgrade’s introduction of Proto-Danksharding and other key enhancements.

Deutscher explains, “The Dencun upgrade, especially with EIP-4844, represents a paradigm shift in how Ethereum will handle transactions. By drastically lowering gas fees and increasing throughput, we’re looking at a more accessible, efficient blockchain.” This upgrade is part of Ethereum’s broader roadmap, known as “The Surge,” focusing on scalability improvements.

Top-6 Altcoins To Watch Prior To Dencun

#1 Polygon (MATIC/POL): With its impending rebrand and investment in zk-technology, Polygon is at a pivotal juncture. Deutscher notes, “Polygon’s deep dive into zk-rollups could redefine its position in the L2 landscape, making MATIC an attractive asset for forward-looking investors.”

#2 Arbitrum (ARB): As the leading L2 by TVL and transaction volume, Arbitrum’s robustness is undisputed. “Arbitrum has cemented its position as a powerhouse in the L2 space, and the Dencun upgrade will only amplify its strengths,” Deutscher remarks.

#3 Optimism (OP): Positioned as a strong contender in the L2 space, Optimism’s ecosystem is set to expand. “The announcement of Optimism’s fourth airdrop is not just a reward for its community but a strategic move to bolster its ecosystem’s vibrancy,” says Deutscher.

#4 COTI Network (COTI): With the launch of V2 and its innovative ‘Garbled Circuits,’ COTI introduces a groundbreaking privacy solution. Deutscher observes, “COTI’s approach to privacy on the blockchain through ‘Garbled Circuits’ is a game-changer, potentially setting a new standard for private transactions.”

#5 Mantle (MNT): Highlighting Mantle’s rapid growth, Deutscher points out, “With $1.5 billion in ETH now staked as mETH, Mantle is not just growing; it’s thriving, supported by strategic airdrops that reward its community.”

#6 Metis (METIS): Identified as a potentially undervalued project, Metis’s upcoming initiatives are a beacon for investors. “Metis’s decentralized sequencer and the substantial METIS Ecosystem Fund are laying the groundwork for a robust, decentralized future, making it an intriguing prospect post-Dencun,” Deutscher explains.

Broader Implications For Ethereum

Deutscher also casts a spotlight on Manta Network, Starknet, zkSync, and Linea as projects to watch, emphasizing the widespread impact of the Dencun upgrade. He advises, “The ETH/L2 trade is increasingly compelling as we approach the Dencun upgrade. Shifting a significant portion of one’s portfolio into the Ethereum ecosystem seems prudent, given the transformative potential of the upcoming changes.”

At press time, ETH still traded just below the $3,000 mark.

Featured image from Shutterstock chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Ethereum developers have tentatively decided on Jan. 17, 2024, for the upcoming “Dencun” upgrade’s first testnet deployment during the latest bi-weekly dev meeting on Dec. 21.

Originally slated for the last quarter of 2023, the ‘Dencun upgrade was pushed to 2024 due to the engineering complexities involved.

Tim Beiko, the protocol support lead at the Ethereum Foundation, noted that the date is not set in stone and could change if major issues arise. The team aims to release a blog post detailing the fork during the week of Jan. 8, 2024 — giving stakeholders a week to prepare for the update.

Dencun upgrade timeline

The meeting set out a draft timeline for the testing phase of the Dencun upgrade.

Following the Goerli testnet on Jan. 17, 2024, developers plan to run tests on other networks — Sepolia on Jan. 31, 2024, and Holesky on Feb. 7, 2024.

The developers aim to deploy the changes on the mainnet by the end of February 2024 if everything goes smoothly. However, these dates are subject to change based on the results of the testnet forks.

Dencun will be Ethereum’s first major upgrade since ‘Shapella’ earlier this year, which was a significant milestone in itself, enabling staked ether (ETH) withdrawals from the blockchain.

Similarly, a major aspect of the Dencun upgrade is the implementation of “proto-danksharding.” This new process is designed to enhance Ethereum’s capacity for data storage, a move that is expected to reduce fees for Layer 2 rollups and scale the blockchain by increasing space for “blobs” of data.

By improving data handling capabilities and efficiency, it aims to enhance the performance of rollups and, consequently, the overall throughput and affordability of the Ethereum network.

“Layer 3 app-chains”

In addition to the Dencun upgrade, the meeting also highlighted a collaboration between Avail and StarkWare. The partnership aims to augment data availability for appchains within the Starknet Layer 2 network. Leveraging Madara, a customizable sequencer, this initiative seeks to develop app-chains that will function as Layer 3 solutions within the Starknet ecosystem.

These Layer 3 app-chains, powered by the combined efforts of Avail and StarkWare, aim to revolutionize data availability modes, including validium and sovereign rollups. This, in turn, will help optimize transaction processing efficiency and finality, which is crucial for blockchain scalability.

The developers also touched upon Ethereum’s role in the broader context of decentralized finance (DeFi) and blockchain technology. They reiterated their commitment to maintaining Ethereum’s position as a leader in the space, emphasizing the need for continuous innovation and adaptation to meet the ever-evolving demands of the market.

The meeting also provided a platform for developers to discuss the challenges and opportunities that lie ahead for Ethereum. From addressing network congestion issues to enhancing user experience, the developers explored a range of topics that are critical to Ethereum’s roadmap and its users’ needs.

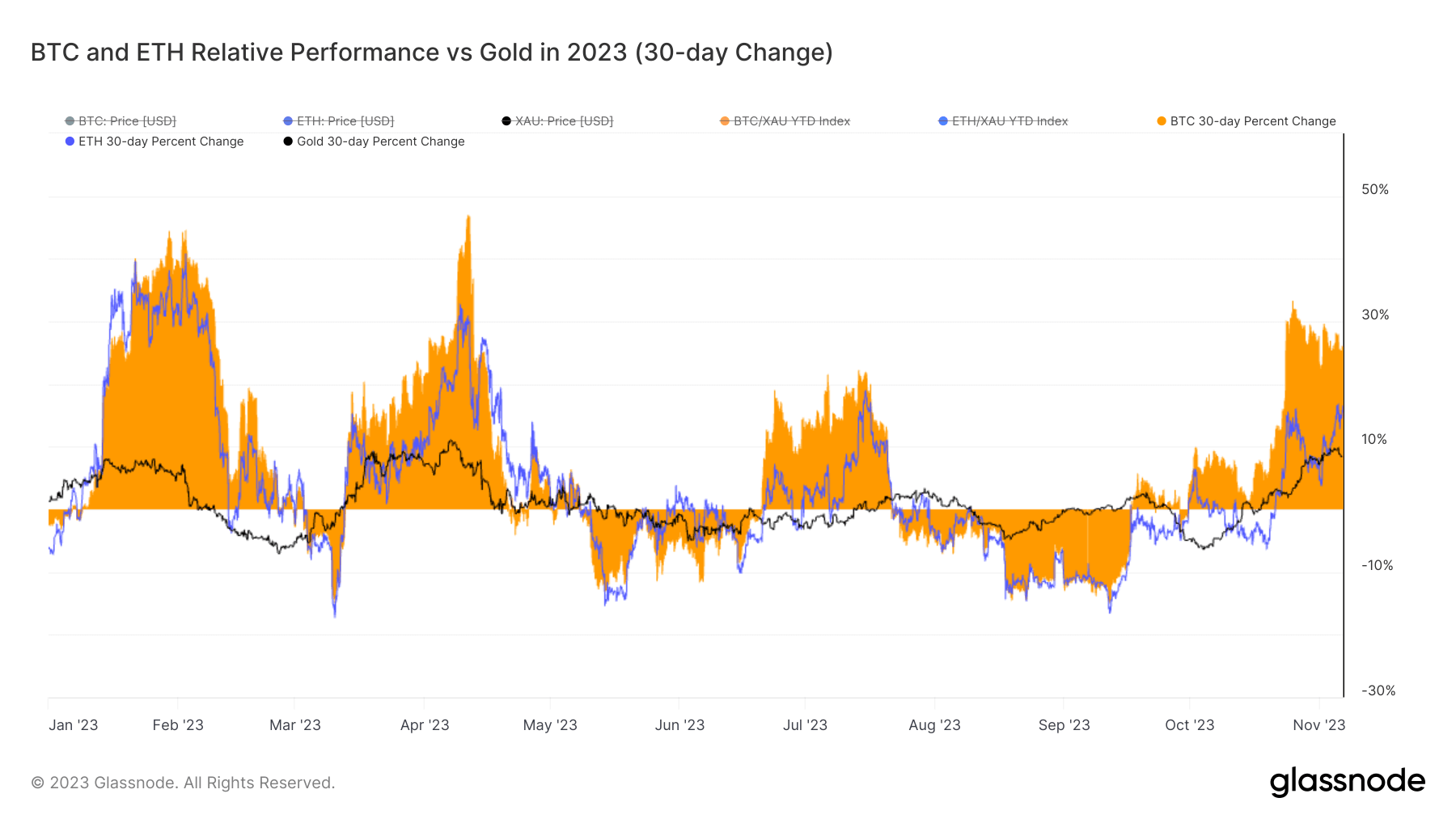

Gold remains stable while volatility rocks Bitcoin and Ethereum’s 2023

Gold, historically viewed as a store of value and a hedge against economic turbulence, is often the benchmark asset against which many others are gauged. In the crypto age, Bitcoin (BTC) and Ethereum (ETH) have emerged as contenders to gold’s throne, not as direct replacements but as modern alternatives representing a new breed of digital assets.

Evaluating their performance against gold provides insights into market sentiment, the evolving landscape of investment, and the potential risks and rewards associated with both traditional and digital assets. In 2023, the trajectories of Bitcoin, Ethereum, and gold were notably distinct.

Bitcoin showed its volatile nature throughout the year. On average, BTC grew by 6.90% monthly. In April, it reached a remarkable peak performance of 46.99%, but the winds shifted in June, pushing it to a dip of 14.99%. Ethereum followed a similar pattern, albeit with slightly subdued fluctuations. Ethereum’s monthly average ascent was 3.70%. Its peak was in May, touching 40.82%, but by July, it faced a decline of 17.34%.

Contrasting sharply with the two leading cryptocurrencies, gold moved with more predictability. Across 2023, its average monthly price adjustment was a modest 0.87%. March witnessed its highest surge, hitting 11.04%, while September observed a dip of 7.09%.

Reflecting on the entire year, Bitcoin’s assertive presence in the crypto market was undeniable. By November, it surged 111.76%. Ethereum, while not mirroring Bitcoin’s meteoric rise, still recorded a year-to-date growth of 58.72%. Gold, ever the steady performer, increased by 8.84% since the beginning of the year.

These dynamics underscore several pivotal market narratives. Firstly, the pronounced volatility in cryptocurrencies underscores both their potential for significant returns and their susceptibility to sharp declines. This dual-edged nature of digital assets is a testament to their nascent stage in the financial ecosystem, influenced by factors ranging from regulatory developments to technological advancements.

Gold’s modest yet steady performance reinforces its reputation as a stabilizing asset, one less susceptible to the rapid market movements often associated with cryptocurrencies. It remains a favored choice for investors seeking a hedge against broader market uncertainties, even as its returns are overshadowed by the more aggressive growth trajectories of digital assets.

The post Gold remains stable while volatility rocks Bitcoin and Ethereum’s 2023 appeared first on CryptoSlate.

Ethereum’s proto-danksharding to make rollups 10x cheaper — Consensys zkEVM Linea head

Zero-knowledge (ZK) proof solutions have proved critical in helping scale the Ethereum ecosystem, but proto-danksharding is expected to drastically reduce the cost of rollups, according to Consensys’ zkEVM Linea head Nicolas Liochon.

Speaking exclusively to Cointelegraph Magazine editor Andrew Fenton during Korea Blockchain Week, Liochon estimated that proto-danksharding could further reduce rollup costs by 10 times.

Proto-danksharding, also known by its Ethereum Improvement Proposal (EIP) identifier EIP-4844, is aimed at reducing the cost of rollups, which typically batch transactions and data off-chain and submit computational proof to the Ethereum blockchain.

The Ethereum Foundation has yet to nail down an expected launch date for proto-danksharding, but development and testing are still ongoing.

As Liochon explained, Linea delivers 15 times cheaper transactions compared to those made on Ethereum’s layer 1, but rollups are still limited by the fact that transactions are posted in call data in Ethereum blocks.

According to Ethereum’s documentation, rollups are still expensive in terms of their potential because call data is processed by all Ethereum nodes and the data is stored on-chain indefinitely despite the fact that the data only needs to be available for a short period of time.

EIP-4844 will introduce data blocks that can be sent and attached to blocks. The data stored in blocks is not accessible to the Ethereum Virtual Machine and will be deleted after a certain time period, which is touted to drastically reduce transaction costs.

“In reality, the cost of rollups is down to data availability. We are writing all the data to layer 1, which is why we have exactly the same security. But it’s expensive; it represents 95% of the cost.”

Liochon said that Linea’s prover, which essentially handles the off-chain computation that verifies, bundles, and then creates a cryptographic proof of the combined transactions, only represents a fifth of the cost.

This highlights the major hurdle in making ZK-rollups the go-to scaling solution for the Ethereum ecosystem as opposed to other solutions like Optimistic Rollups.

Liochon also said that Linea aims to be a general-purpose ZK-rollup that will be used for a variety of decentralized applications and solutions within the Ethereum ecosystem.

“We are a generic rollup. We don’t want to have a specific use case or specific domain. It’s quite important to support all types of applications, including DeFi, gaming and social.”

As Cointelegraph previously reported, Consensys completed the launch of Linea in August 2023, having onboarding over 150 partners and bridging more than $26 million in Ether (ETH).

Magazine: Here’s how Ethereum’s ZK-rollups can become interoperable

StarkWare, Herodotus launch tech to verify data from any point in Ethereum’s history

A new zero-knowledge proof (ZK-proof) technology is set to improve the ability to access and verify historical data from the Ethereum blockchain, with deep chain validation cited as a usability barrier of the network.

Technology firm Herodotus has released its on-chain accumulator, which uses storage-proof cryptography, allowing users to verify data from any point of Ethereum’s blockchain without needing a third party. The solution makes use of StarkWare’s STARK proofs, the ZK-proof technology co-invented by mathematician Eli Ben-Sasson.

StarkWare presented Herodotus with a custom-built instance of its shared prover service SHARP, which enables advanced scaling efficiency using recursive proofs. The latter allows a virtual machine to provide “proofs of proofs” by generating proofs of transactions or blocks in parallel and real-time, batching them into a subsequent proof.

Related: More TPS, less gas: Ethereum L2 Starknet outlines performance upgrades

At a slightly more technical level, the accumulator acts as a cache that stores block headers. If the accumulator has a header in its cache, the respective storage-proof computation can use it for validation.

If the header is not cached, the prover has to generate a proof to cover the requested block range, add the block header to the accumulator and then complete the requested storage proof computation.

As the name suggests, the on-chain accumulator essentially accumulates proofs that rollup prior proofs, drastically reducing the time it takes to verify the Ethereum blockchain and associated data at any point in the network’s history.

Herodotus chief technology officer Marcello Bardus notes that the technology removes the need to traverse the entire blockchain on the blockchain itself:

“We can do it off chain, generate an accumulator and just cherrypick one specific block without iterating from the entire chain on the chain itself.”

StarkWare notes that Storage proofs could prove groundbreaking as an alternative to cross-chain bridges that rely on third-party oracles to track and verify data.

Related: StarkNet overhauls Cairo programming language to drive developer adoption

Herodotus co-founder Kacper Koziol added that the accumulator is an innovation that Ethereum has long needed to align with blockchain principles of transparency and accessibility. The technology will essentially allow any user to access any point in Ethereum’s history.

“This will be very powerful. For the first time in the history of blockchains, people are going to be able to prove the correctness of any aspect of anyone’s on-chain information.”

The two teams highlight the potential for storage proofs to build “Web2 equivalent applications,” tapping into the pioneering ability to access and verify Ethereum blockchain data autonomously.

Account recovery is touted as one potential use case, where the ability to verify on-chain data could trigger a proverbial dead man’s switch or automate insurance protocols that use historical on-chain events to trigger smart contract payouts.

Collect this article as an NFT to preserve this moment in history and show your support for independent journalism in the crypto space.

Magazine: Recursive inscriptions: Bitcoin ‘supercomputer’ and BTC DeFi coming soon