Fluidkey has announced it has opened its Optimism-based alpha to more users, allowing them to test their private solutions. Fluidkey seeks to solve the transaction privacy problem in EVM chains by leveraging ENS and stealth addresses, allowing users to use a new self-custodial asset for each payment, and segregating these movements to avoid linkability. Fluidkey […]

Fluidkey has announced it has opened its Optimism-based alpha to more users, allowing them to test their private solutions. Fluidkey seeks to solve the transaction privacy problem in EVM chains by leveraging ENS and stealth addresses, allowing users to use a new self-custodial asset for each payment, and segregating these movements to avoid linkability. Fluidkey […]

Source link

EVM

Vibrant Finance leverages Neon EVM for groundbreaking DeFi exchange innovation

Decentralized exchange (DEX) Vibrant Finance has launched on Neon EVM, a Solana-based platform, marking its foray into the non-Ethereum DeFi landscape, according to a Feb. 23 press release.

The DEX utilizes the Discretized-Liquidity Automated Market Maker (DL-AMM) model to overcome existing limitations within traditional DeFi exchanges.

Vibrant Finance CEO Jimmy Yin expressed enthusiasm about this deployment on Neon, emphasizing its potential to bridge Ethereum’s vibrant DeFi ecosystem with Solana’s robust liquidity and transactional efficiency.

“With our latest deployment on Neon EVM, we aim to make liquidity more efficient and foster cooperation between chains and ecosystems,” Yin remarked.

The DL-AMM model, renowned for offering discrete liquidity for each price movement, facilitates precise liquidity allocation at specific fixed prices. This innovative approach addresses challenges in DeFi exchanges and optimizes liquidity management for users. Additionally, it introduces advanced trading features such as limit orders, enriching the trading experience for users.

Vibrant Finance is supported by iZumi, a multi-chain DeFi protocol that provides DEX-as-a-Service (DaaS).

Neon EVM growing ecosystem

Neon EVM facilitates scaling Ethereum decentralized applications (dApp) on Solana, making it an ideal choice for Vibrant Finance to expand beyond Ethereum.

Neon essentially simplifies the deployment of EVM-compatible dApps with minimal code adjustments. The platform operates as a smart contract on Solana and processes requests through public PRC endpoints.

Several DeFi protocols, including deBridge and MeredianFi, have integrated with Neon, showcasing its growing success in the industry, primarily on the back of Ethereum and Solana’s rising prominence.

DeFillama data shows that Ethereum is the largest DeFi blockchain, with $45.87 billion in total value locked (TVL) on the network, while Solana’s TVL recently climbed above the $2 billion mark.

In the rapidly evolving landscape of blockchain technology, Neon EVM, a smart contract on Solana (SOL) has emerged as a frontrunner by introducing a landmark parallel processing architecture on its mainnet.

This approach has enabled Neon EVM to achieve an increase in performance, scalability, and efficiency, according to a press release share with NewsBTC.

Neon EVM Dominates Transaction Processing

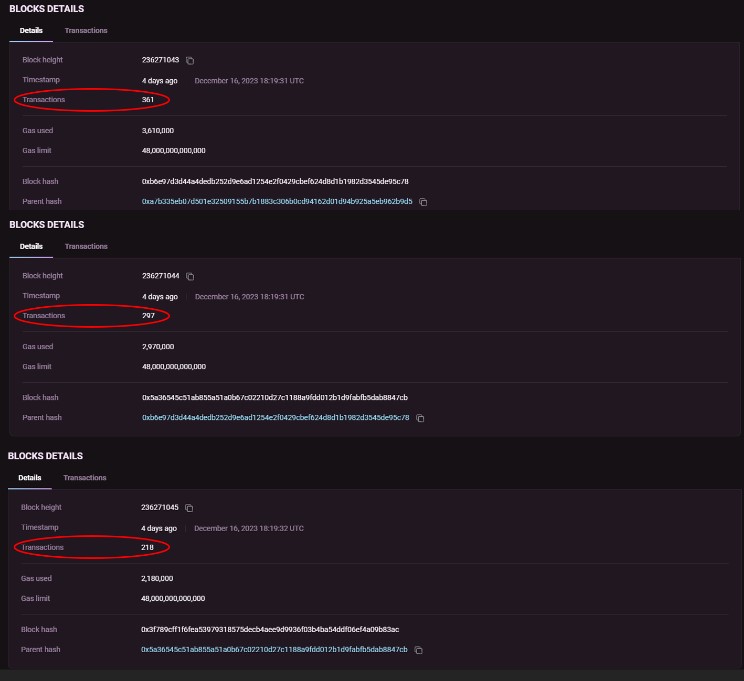

Neon EVM, the first parallel Ethereum Virtual Machine (EVM) on mainnet, has achieved a record-breaking 730 Transactions Per Second (TPS) on its mainnet. Notably, this is the first time such high tps has been achieved on an EVM mainnet.

The milestone was reached on December 16, 2023, when Neon EVM’s mainnet showcased its transaction processing capabilities. While many blockchains demonstrate high tps on testnets, Neon EVM’s has standout by improving its scalability.

Neon EVM, which went live on the mainnet in July 2023, operates as a fully Ethereum-compatible environment on the Solana blockchain. Since its launch, Neon EVM has garnered investor interest, resulting in multiple listings on platforms such as ByBit, Crypto.com, and Gate.io.

Given these developments, the utility token NEON has experienced remarkable growth, with its value surging from $0.67 to $1.45 in just three days, representing a 116% increase.

Neon EVM’s success comes when there is growing interest in high-speed, parallelized processing blockchains. Currently, Neon EVM stands as the only parallel processing EVM live on the mainnet, showcasing its tps capabilities compared to other blockchain networks.

Outshining Ethereum’s Transaction Speed

The fundamental difference between Neon EVM and blockchains like Bitcoin and Ethereum lies in their transaction processing approach. While Bitcoin and Ethereum process transactions sequentially, Neon EVM allows for simultaneous processing of multiple transactions, facilitating increased throughput and reducing the likelihood of congestion during periods of high demand.

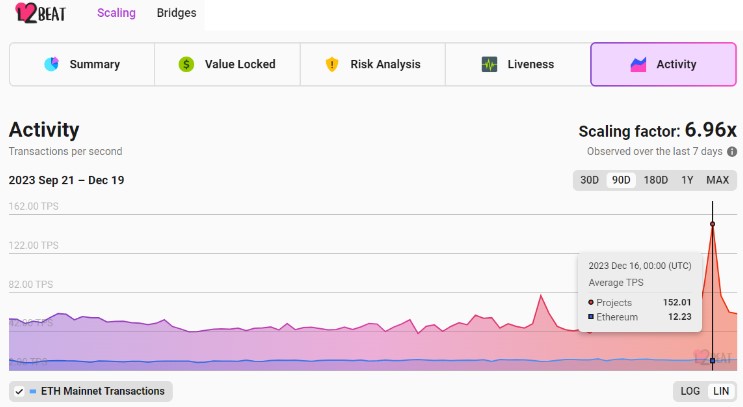

In a notable comparison, Neon EVM’s parallel processing architecture outperformed the combined tps of the entire Ethereum ecosystem on December 16, as reported by L2Beat.

The project’s commitment to Ethereum compatibility on the Solana blockchain and its high-speed transactions and low-cost benefits positions Neon EVM as an interesting project as a new Bull Cycle emerges.

Layer 2 Scaling Solutions On The Rise

Polygon, the layer 2 scaling solution that operates alongside the Ethereum blockchain, has also demonstrated its transaction processing speed capabilities.

In a recent post on X (formerly Twitter), Sandeep Nailwal, the founder of Polygon, shared notable statistics highlighting the network’s performance. According to Nailwal’s post, Polygon’s Proof of Stake (PoS) chain seamlessly handled over 16 million transactions in a single day, showcasing its scalability and efficiency.

During the peak period, the Polygon PoS chain achieved a throughput of 255 tps. This figure is approximately 2-3 times higher than the combined throughput of the entire Ethereum ecosystem.

Moreover, the validators on the Polygon network generated approximately 1 million in transaction fees in a single day, reflecting the network’s high level of activity. However, it is worth noting that gas fees experienced a spike during this period, which is a broader issue impacting the entire Ethereum ecosystem.

In terms of rewards for validators, the block rewards on the Polygon network amounted to over 155,000 MATIC tokens. This translates to substantial revenue for validators, totaling around 1.2 million in a single day. These rewards incentivize validators and contribute to the overall security and stability of the PoS chain.

The spike in transactions in both of these Layer-2 networks showcase the growing importance of scalability solutions. In the coming months, hundred of new users could onboard the crypto market via either of these solutions hinting at a potential benefit for their underlying tokens.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Fhenix unveils first confidential blockchain offering EVM data processing with unbroken encrypted transactions

Fhenix has released its whitepaper following its recent announcement of securing $7 million in seed funding for developing the first confidential blockchain platform using fully homomorphic encryption (FHE). The whitepaper “FHE-Rollups: Scaling Confidential Smart Contracts on Ethereum and Beyond” outlines the novel scalable solution for executing confidential smart contracts.

The Innovation of FHE Rollups

FHE Rollups mark a pivotal shift in blockchain technology, offering a scalable solution for executing confidential smart contracts. By leveraging the power of Fully Homomorphic Encryption, FHE Rollups address a fundamental challenge in blockchain transactions: maintaining confidentiality without compromising scalability. This breakthrough is particularly crucial in an era where data privacy is paramount and the demand for secure, decentralized solutions is at an all-time high.

Homomorphic refers to a type of advanced encryption that allows computations to be performed on data while it remains encrypted. This means that complex operations can be carried out on the encrypted data without needing to decrypt it first, which is a significant breakthrough in terms of maintaining data privacy and security.

In simple terms, it’s like being able to perform calculations on a locked safe’s contents without ever needing to open it. This ensures that the data stays secure throughout the process, addressing major privacy and security concerns in data handling, especially in sensitive areas like finance or personal data.

At the heart of FHE Rollups is adopting an optimistic rollup approach. This strategy balances efficiency and security, circumventing the computational burdens typically associated with verifiable FHE techniques. Optimistic rollups facilitate encrypted computations in a manner that is more efficient and adaptable to the existing Ethereum network, underscoring the potential of FHE Rollups to enhance Ethereum’s capabilities significantly.

Seamless Integration with Ethereum

One of the most notable aspects of FHE Rollups is their ability to integrate seamlessly with Ethereum without necessitating any base-layer changes. This feature ensures that FHE Rollups can be adopted and utilized within the current Ethereum infrastructure, potentially leading to widespread acceptance and implementation. Such compatibility underscores the practicality and forward-thinking design of FHE Rollups.

The Threshold Services Network (TSN) is a critical component in the FHE rollup architecture. TSN’s role in handling tasks like threshold decryption and re-encryption is indispensable for the security and functionality of the rollup ecosystem. This component ensures the rollups operate smoothly while maintaining the highest security standards.

FHE Rollups are not just about scaling and confidentiality; they also bring robust security mechanisms, mainly by implementing fraud proofs. These proofs are essential for maintaining the integrity of transactions within the FHE Rollups framework, offering a reliable method to detect and prevent fraudulent activities.

The implications of FHE Rollups extend far beyond just technical enhancements. They open new avenues for privacy-centric decentralized applications and smart contracts, offering possibilities for private and secure transactions on Ethereum and other EVM-compatible chains. Fhenix believes this technology sets the stage for a new era of blockchain applications where confidentiality and scalability coexist harmoniously.

Disclaimer: Sora Ventures is an investor in CryptoSlate and Fhenix.

Starknet moves closer to EVM compatibility with upcoming ‘Kakarot’ testnet

Starknet, a zero-knowledge layer-2 scaling solution for Ethereum, is one step closer to becoming fully Ethereum Virtual Machine (EVM) compatible, pending an August testnet launch of Kakarot, a new zkEVM.

On June 3, the Kakarot team announced it had received new backing from Ethereum co-founder Vitalik Buterin, Ledger co-founder Nicholas Bacca and Starkware.

We have powered up and entered Super Saiyan mode⚡. Kakarot Labs has officially been incorporated and closed a pre-seed round with top-tier investors.

Let’s unpack our vision, current standing, and the exciting future ahead. pic.twitter.com/VI8QRdPLfw

— Kakarot zkEVM (@KakarotZkEvm) June 2, 2023

In an interview with Cointelegraph, Kakarot CEO and co-founder Elias Tazartes explained that while Starknet stands as a leading Zero Knowledge roll-up in the Ethereum ecosystem, it’s not EVM compatible, so there’s “kind of a barrier to entry.”

Starknet is used by developers to scale decentralized applications, transactions and computation on Ethereum but uses its own native language, Cairo. According to Starknet, the use of Cairo makes it easier and faster to develop, review and maintain new code.

The downside is that it isn’t EVM compatible, which could dissuade some developers.

“The greatest impact that Kakarot can have is to make Starknet EVM compatible.”

“Kakarot right now is like a Solidity or any language engine. Eventually you will be able to put that engine within Starknet to make it EVM compatible.”

At present, Starknet runs its own custom smart contract Virtual Machine, dubbed “Cairo VM,” which leverages Cairo. This means that Starknet doesn’t have direct EVM compatibility out of the box, something that could prove to be a significant hurdle for overall rollup performance.

“Some teams really need to be able to use Solidity. For example, if someone wrote a DEX or an AMM for the Ethereum ecosystem and now has 60,000 lines of code already audited, ready to go, but it’s only on EVM chains.”

If these developers wanted to start using Starknet, they would have to hire a whole new dev team, write in, audit the code again and maintain two code bases — which Tazartes describes as “prohibitively expensive.”

Related: More TPS, less gas: Ethereum L2 Starknet outlines performance upgrades

According to Tazartes, the idea for the zkEVM was first floated during a Starkware conference in July 2022. By October, the development team was able to together for a week during a hacker house event in Lisbon, Portugal, to get cracking on the new zkEVM.

Two months and 20 days later, in December, the coding for the project was complete, ready to create a fully functional execution layer — all of which was achieved without any venture funding.

Notably, Tazartes said that Buteirn later invested in Kakarot due to his enthusiasm over a multiple-zkEVM approach to building out the Ethereum ecosystem.

“For Vitalik, the more zkEVMs the better, because as long as you have a wide diversity of architecture and diversity of approaches…then this is really good for the space as a whole.”

Tazartes shared that the testnet version of Kakarot will be launched for public use this August.

Magazine: Tornado Cash 2.0 — The race to build safe and legal coin mixers