Following the debut of the Dencun upgrade and Ethereum blobs, enthusiasts have devised methods to embed data akin to how Ordinal inscriptions operate. Since this development, inscription-based activities now account for over 40% of blob transactions, leading to a significant increase in network activity. This uptick has resulted in a congestion of blob transactions, pushing […]

Following the debut of the Dencun upgrade and Ethereum blobs, enthusiasts have devised methods to embed data akin to how Ordinal inscriptions operate. Since this development, inscription-based activities now account for over 40% of blob transactions, leading to a significant increase in network activity. This uptick has resulted in a congestion of blob transactions, pushing […]

Source link

Exceed

Magnificent 7 profits now exceed almost every country in the world. Should we be worried?

Traders work on the floor of the New York Stock Exchange during morning trading on January 31, 2024 in New York City.

Michael M. Santiago | Getty Images

The so-called “Magnificent 7” now wields greater financial might than almost every other major country in the world, according to new Deutsche Bank research.

The meteoric rise in the profits and market capitalizations of the Magnificent 7 U.S. tech behemoths — Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia and Tesla — outstrip those of all listed companies in almost every G20 country, the bank said in a research note Tuesday. Of the non-U.S. G20 countries, only China and Japan (and the latter, only just) have greater profits when their listed companies are combined.

Deutsche Bank analysts highlighted that the Magnificent 7’s combined market cap alone would make it the second-largest country stock exchange in the world, double that of Japan in fourth. Microsoft and Apple, individually, have similar market caps to all combined listed companies in each of France, Saudi Arabia and the U.K, they added.

However, this level of concentration has led some analysts to voice concerns over related risks in the U.S. and global stock market.

Jim Reid, Deutsche Bank’s head of global economics and thematic research, cautioned in a follow-up note last week that the U.S. stock market is “rivalling 2000 and 1929 in terms of being its most concentrated in history.”

Deutsche analyzed the trajectories of all 36 companies that have been in the top five most valuable in the S&P 500 since the mid-1960s.

Reid noted that while big companies eventually tended to drop out of the top five as investment trends and profit outlooks evolved, 20 of the 36 that have populated that upper bracket are still in the top 50 today.

“Of the Mag 7 in the current top 5, Microsoft has been there for all but 4 months since 1997. Apple ever present since December 2009, Alphabet for all but two months since August 2012 and Amazon since January 2017. The newest entrant has been Nvidia which has been there since H1 last year,” he said.

Tesla had a run of 13 months in the top five most valuable companies in 2021/22 but is now down to 10th, with the share price having fallen by around 20% since the start of 2024. By contrast, Nvidia’s stock has continued to surge, adding almost 47% since the turn of the year.

“So, at the edges the Mag 7 have some volatility around the position of its members, and you can question their overall valuations, but the core of the group have been the largest and most successful companies in the US and with it the world for many years now,” Reid added.

Could the gains broaden out?

Despite a muted global economic outlook at the start of 2023, stock market returns on Wall Street were impressive, but heavily concentrated among the Magnificent Seven, which benefitted strongly from the AI hype and rate cut expectations.

In a research note last week, wealth manager Evelyn Partners highlighted that the Magnificent 7 returned an incredible 107% over 2023, far outpacing the broader MSCI USA index, which delivered a still healthy but relatively paltry 27% to investors.

Daniel Casali, chief investment strategist at Evelyn Partners, suggested that signs are emerging that opportunities in U.S. stocks could broaden out beyond the 7 megacaps this year for two reasons, the first of which is the resilience of the U.S. economy.

“Despite rising interest rates, company sales and earnings have been resilient. This can be attributed to businesses being more disciplined on managing their costs and households having higher levels of savings built up during the pandemic. In addition, the U.S. labour market is healthy with nearly three million jobs added during 2023,” Casali said.

The second factor is improving margins, which Casali said indicates that companies have adeptly raised prices and passed the impact of higher inflation onto customers.

“Although wages have risen, they haven’t kept pace with those price rises, leading to a decline in employment costs as a proportion of the price of goods and services,” Casali said.

“Factors, including China joining the World Trade Organisation and technological advances, have enabled an increased supply of labour and accessibility to overseas job markets. This has contributed to improving profit margins, supporting earnings growth. We see this trend continuing.”

When the market is so heavily weighted toward a small number of stocks and one particular theme — notably AI — there is a risk of missed investment opportunities, Casali said.

Many of the 493 other S&P 500 stocks have struggled over the past year, but he suggested that some could start to participate in the rally if the two aforementioned factors continue to fuel the economy.

“Given AI-led stocks’ stellar performance in 2023 and the beginning of this year, investors may feel inclined to continue to back them,” he said.

“But, if the rally starts to widen, investors could miss out on other opportunities beyond the Magnificent Seven stocks.”

Crypto Exchange CoinEX Reportedly Hit By Massive Hack, Losses Exceed $27 Million

In a concerning development, popular crypto exchange CoinEx is believed to have fallen victim to a suspected hack, resulting in significant losses from its Ethereum (ETH), TRON (TRX), and Polygon (MATIC) hot wallets. The incident, which unfolded on Tuesday, has sparked an ongoing investigation into the security breach.

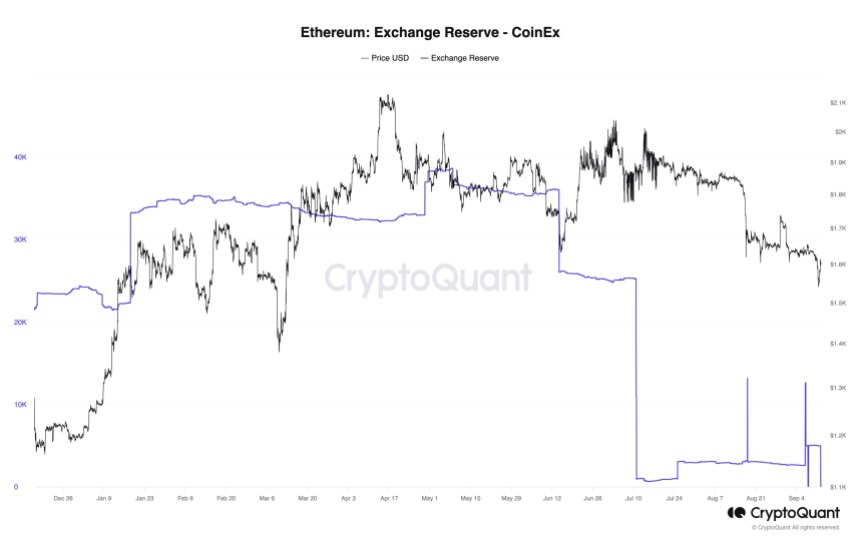

Alarming Depletion Of CoinEx ETH Reserves

According to reports by Colin Wu, a prominent cryptocurrency journalist, CoinEx reportedly lost a staggering 4,946 ETH and 354,762 TRX as part of the ongoing drain from the exchange’s wallets.

The total value of the funds lost surpasses $27.8 million, adding to the growing list of high-profile cryptocurrency exchange breaches. In his latest update, Colin Wu stated:

CoinEX is moving the affected hot wallet assets to the cold wallet address 0xf54…7E5d. CoinEX wallets currently hold $97.83 million in assets, of which $89 million are stored in the cold wallet address 0xf54…7E5d, mainly ETH worth $51.7 million and USDT $18.23 million.

What’s more, In a concerning revelation, Julio Moreno, the Head of Research at CryptoQuant, has shed light on the peculiar behavior surrounding CoinEx’s Ethereum reserves.

The exchange has experienced a staggering depletion of its ETH holdings, with almost 5,000 ETH mysteriously vanishing within a single hour and a total loss of approximately 40,000 ETH since May. As a result, CoinEx’s ETH reserves now stand at virtually zero.

CoinEx, however, has remained silent on the matter, refraining from issuing an official statement regarding the suspected hack.

The depletion of CoinEx’s ETH reserves indicates a potentially grave situation, as it suggests a significant outflow of funds from the exchange. Such a rapid decline in ETH holdings may have severe implications for CoinEx’s liquidity and ability to meet customer withdrawal demands.

CoinEx’s stakeholders and the wider cryptocurrency community will closely watch how the exchange responds to these developments. Complemented by transparent communication, swift and decisive action will be vital in navigating this challenging situation and working towards a resolution.

Featured image from iStock, chart from TradingView.com