A former security engineer, who stole digital assets valued at more than $12 million from two decentralized exchanges, has received a three-year prison sentence. In what has been characterized as the “first-ever” conviction for a smart contract hack, the U.S. Judge also ordered the ex-engineer to forfeit roughly $12.3 million. Ex-Engineer Sentenced to Three Years […]

A former security engineer, who stole digital assets valued at more than $12 million from two decentralized exchanges, has received a three-year prison sentence. In what has been characterized as the “first-ever” conviction for a smart contract hack, the U.S. Judge also ordered the ex-engineer to forfeit roughly $12.3 million. Ex-Engineer Sentenced to Three Years […]

Source link

exchanges

‘Trust in Authority’ Sustains Popularity of Centralized Exchanges in Latin America, Says Ricardo Da Ros

According to Ricardo Da Ros, CEO of the crypto platform Patex, many crypto users in Latin America (LATAM) seem to prefer using centralized exchanges (CEXs) over decentralized ones. He attributes this preference to a culture in the region that “has been built on trust in authority.” Da Ros suggests that this culture, combined with the […]

According to Ricardo Da Ros, CEO of the crypto platform Patex, many crypto users in Latin America (LATAM) seem to prefer using centralized exchanges (CEXs) over decentralized ones. He attributes this preference to a culture in the region that “has been built on trust in authority.” Da Ros suggests that this culture, combined with the […]

Source link

March Sees Nearly $1 Billion In Ethereum Netflow To Centralized Exchanges

The price of Ethereum has not exactly lived up to its promise as the month has gone on, despite a stellar start to the month. While this bearish pressure has been widespread in the general cryptocurrency market, regulation uncertainty has been an additional concern for ETH, igniting a negative sentiment around the “king of altcoins.”

Interestingly, the latest on-chain revelation shows a substantial amount of Ethereum has made its way to exchanges so far in March, suggesting that investors might be losing confidence in the long-term promise of the cryptocurrency.

Are Investors Losing Confidence In Ethereum?

According to data from CryptoQuant, more than $913 million has been recorded in net ETH transfers to centralized exchanges so far in March. This on-chain information was revealed via a quicktake post on the data analytics platform.

This net fund movement represents the largest volume of Ethereum transferred to centralized exchanges in a single month since June 2022. Even though March is still a week from being over, this exchange inflow appears to be a complete deviation from the pattern observed over the past few months.

Chart showing total monthly netflow of ETH on centralized exchanges | Sources: CryptoQuant

As shown in the chart above, October 2023 was the last time cryptocurrency exchanges witnessed a positive net flow. It is worth noting that there was significant movement of Ethereum tokens out of the centralized platforms in subsequent months up until this month.

Meanwhile, a separate data point that supports the massive exodus of ETH to centralized exchanges has come to light. Popular crypto analyst Ali Martinez revealed on X nearly 420,000 Ethereum tokens (equivalent to $1.47 billion) have been transferred to cryptocurrency exchanges in the past three weeks.

The flow of large amounts of cryptocurrency to centralized exchanges is often considered a bearish sign, as it can be an indication that investors may be willing to sell their assets. Ultimately, this can put downward pressure on the cryptocurrency’s price.

Substantial fund movements to trading platforms could also represent a shift in investor sentiment. It could be a sign that investors are losing faith in a particular asset (ETH, in this case).

Moreover, the recent regulatory headwind surrounding Ethereum specifically accentuates this hypothesis. According to the latest report, the United States Securities and Exchange Commission is considering a probe to classify the ETH token as a security.

ETH Price

As of this writing, the Ethereum token is valued at $3,343, reflecting a 4% price decline over the past /4 hours. According to data from CoinGecko, ETH is down by 11% in the past week.

Ethereum loses the $3,400 level again on the daily timeframe | Source: ETHUSDT chart on TradingView

Featured image from Unsplash, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

According to data from Lookonchain, an on-chain analytics platform, Ethereum (ETH), whales have withdrawn roughly $64.2 million worth of ETH from major exchanges.

This significant movement of funds coincides with a notable uptick in the price of ETH, indicating an increasing interest in the asset.

Ethereum Whales Movement Signals Confidence

According to Lookonchain’s findings, much of the ETH supply has been shifted from exchange wallets to custodial wallets. The on-chain analytics platform reported that an Ethereum address labeled 0x8B94 had withdrawn an amount of 14,632 ETH, valued at approximately $45.5 million, from Binance.

Lookonchain states these funds have been actively staked within six days, indicating a deliberate move towards adopting long-term investment strategies.

The analysis from the platform also points out that another two fresh whale wallets have transferred 6,000 ETH, amounting to $18.7 million, from Kraken to undisclosed wallet addresses over the last two days.

Whales are accumulating $ETH!

0x8B94 withdrew 14,632 $ETH($45.5M) from #Binance and staked it in the past 6 days.

2 fresh whale wallets withdrew 6K $ETH($18.7M) from #Kraken in the past 2 days.https://t.co/0kEvOmiv3hhttps://t.co/90fqjJXsSu pic.twitter.com/J0ewl8S3OX

— Lookonchain (@lookonchain) February 26, 2024

This trend suggests an increase in major investors to secure substantial amounts of Ethereum away from exchange platforms, potentially as a means of positioning for long-term asset appreciation.

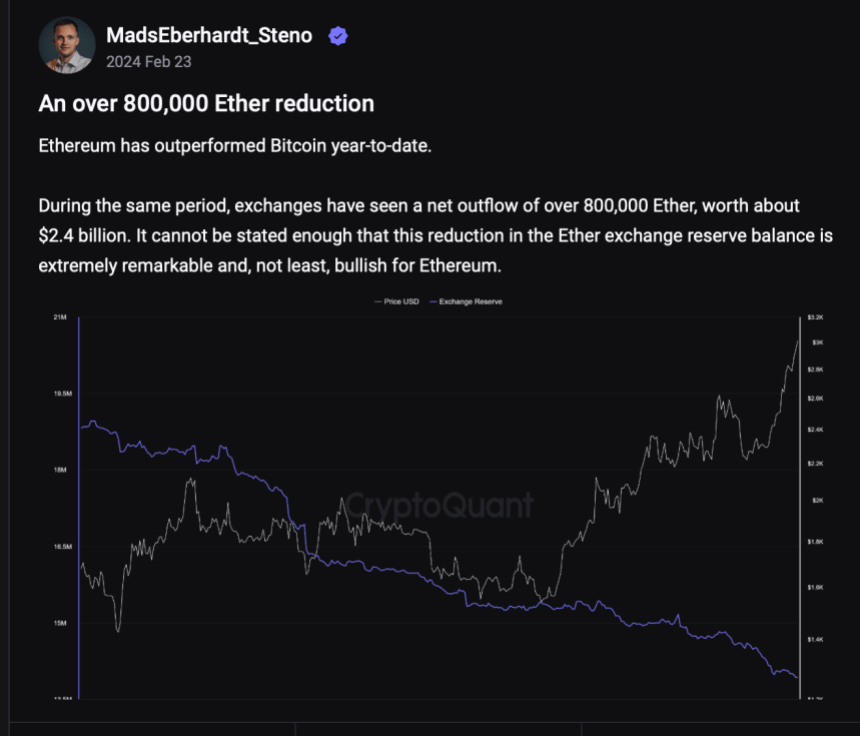

Further echoing this is a recent analysis from CryptoQuant’s Quicktake, which underscores a notable trend regarding Ethereum withdrawals from exchanges over the past few weeks. This observation relies on the “Exchange Reserve” metric, which monitors the quantity of ETH tokens held in the wallets of all centralized exchanges.

When the value of this metric increases, it signifies that investors are depositing more assets than withdrawing them from centralized exchanges, indicating a buildup of Ethereum reserves. Conversely, a decline in the metric suggests a net outflow of assets from these platforms.

According to data from CryptoQuant, over 800,000 ETH, equivalent to roughly $2.4 billion, has exited cryptocurrency exchanges since the beginning of the year. Such substantial outflows from these platforms typically indicate a surge in investor confidence in the Ethereum network and its native token.

Ethereum’s Price Momentum And Potential For A Significant Breakout

Meanwhile, Ethereum’s price has displayed bullish momentum, witnessing a 5.5% increase in the past week and reclaiming the crucial $3,000 mark.

Financial guru Raoul Pal has drawn attention to Ethereum’s potential for a major breakout, pointing to a “dual-chart pattern” observed on the ETH/BTC chart.

The ETH/BTC chart is an absolute stunner…and ready for the next big move the break of the mega wedge…lets see how is pans out… pic.twitter.com/5x4tJLjtJy

— Raoul Pal (@RaoulGMI) February 25, 2024

Pal highlights a “mega wedge” pattern alongside an inner descending channel, indicating a consolidation phase with bullish potential.

Featured image from Unsplash, Chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Ping Exchange’s hybrid cold storage redefines standards for crypto exchange custody

The launch of Ping Exchange signals a potential new stage in digital assets trading. The hybrid platform merges robust security protocols with user-focused asset control, setting a high bar for how exchanges should safeguard user assets. Ping’s standout feature is an unconventional model using a hybrid custodial cold storage to redefine crypto exchange security.

Ping leverages the unique CorePass ID application for streamlined user authentication. Traditional username and password vulnerabilities and cumbersome two-factor authentication (2FA) methods are gone. Instead, CorePass utilizes blockchain-secured identity information, rapid QR code scanning, and Core Blockchain encryption for secure, decentralized login and withdrawals.

Furthermore, while assets deposited onto the platform are placed into Ping’s custody, withdrawal of any assets remains tied to the user’s CorePass ID. Ping cannot withdraw deposited funds without authorization from the user, only allowing trading of assets within the exchange. This streamlined, self-custodial approach places an unprecedented level of access control into users’ hands, merging the benefits of DeFi and CeFi into a new opportunity for users.

So much exchange-focused content references the failures of FTX, Celsius, BlockFi, etc., while claiming to “do better” by offering more secure custody methodologies and promising not to comingle funds. Proof-of-reserve attestations are a fantastic first step; however, Ping’s model puts a flag in the ground in a different, much more substantial way.

With Ping, the CoDeTech team is offering a way to trade digital assets in an exchange environment without signing away the rights to your assets or your identity. Using CorePass, you, the user, remain in control of the data attached to your KYC verification and can revoke it from the exchange at any time. Further, the assets you deposit can be traded across any of the supported trading pairs with other users through a standard exchange order book. Yet, the exchange cannot withdraw your funds without your permission. While not impossible, an FTX scenario would be much more complex with Ping when compared to many traditional exchanges.

In order to facilitate trades Ping has the ability to swap assets between users. Ping also is required to retain the ability to freeze assets to be compliant with AML/KYC regulations. Like traditional exchanges, when it creates the deposit wallet it retains the associated private keys. However, these keys are then required to do anything with deposited funds not already approved by the user.

I’ve often touted that FTX wasn’t a crypto problem but a people problem. Many exchanges don’t rely enough on blockchain technology for their day-to-day operation. I’m so excited to see products like Ping come to market, which put blockchain verification and validation at its core.

Balancing Speed with Uncompromising Security

Moreover, Ping’s focus on cold storage is a cornerstone of its security framework. While many centralized exchanges rely on a less secure mix of hot and cold wallets, Ping’s air-gapped CorePass ID wallets isolate crypto holdings. CorePass ID allows for offline signing through QR codes, creating an air-gapped approach to custody. This strategy significantly reduces the surface area for hackers, minimizing the risk of costly breaches.

The meticulous offline transaction creation and signing process on these air-gapped devices demonstrates Ping’s commitment to safeguarding user funds. Moreover, integrating the ICAN standard with crypto wallets helps prevent sending and receiving errors while supporting various blockchains through network prefixes.

Despite this uncompromising stance on security, Ping also offers exceptional transaction speeds, particularly on the Core Blockchain, with confirmation times as low as a few seconds. This speed comes without sacrificing security. Additionally, near-instant withdrawal processing, typically achievable in under a minute, aligns with Ping Exchange’s pledge to enhance the user experience.

Innovation in Compliance

Ping’s technology also improves transaction security and compliance standards through its automated Know Your Customer (KYC) process. As mentioned in Core Corner Issue 1, CorePass ID allows users to complete a KYC process for their wallet and then essentially sell this data to any third parties, such as Ping, at a later date. This puts the power back in the hands of the user, giving them greater control over their data and who has access.

Ping aligns document submission with a tiered access system to streamline the process further, granting users personalized permissions appropriate to their verification level. This approach simplifies compliance with global regulations such as GDPR and CCPA, enhancing the overall security posture of the platform. Ping’s approach to compliance aims to be accepted as ‘best standard’ by regulators, according to people familiar with the matter.

More Than Just an Exchange

Beyond these novel custody methodologies, Ping Exchange offers real-time notifications, an AntiBot trading system, and multi-language support to cater to a wide spectrum of users, promoting broader inclusion.

While this innovative exchange showcases many groundbreaking features, it’s essential to exercise caution, as with any new platform. Time will ultimately determine its ability to deliver long-term stability and attract a significant user base. Nevertheless, with its innovative solutions to common exchange vulnerabilities, Ping Exchange warrants consideration from anyone seeking a new trading platform offering security and convenience.

In its first month of trading, it has processed volumes comparable to the top 200 DeFi platforms from CryptoSlate analysis. Further, thus far, it has done so without market makers adding liquidity. Instead, all trading through the platform has been peer-to-peer among the nascent Core Blockchain community.

Ping provides unparalleled access to these assets as the world’s first exchange to feature markets for Core Coin (XCB) and Core Token (CTN). Ping users enjoy unique trading opportunities while at the forefront of Core Blockchain developments. Other assets such as Ethereum, Bitcoin, Litecoin, and USDC are also actively tradeable.

The digital assets world is one of perpetual innovation. Ping Exchange’s novel approach to custody, compliance, and user experience could shape the future of exchanges and elevate the industry’s security standards.

Bitcoin Supply On Exchanges Has Dropped To A 6-Year Low, What This Means For Price

Bitcoin broke over the $46,000 level twice in the past 24 hours for the first time since the approval of spot Bitcoin ETFs by the SEC, signaling a bullish return into most cryptocurrencies spearheaded by BTC. In particular, Bitcoin investors seem to be gearing up for action as the next Bitcoin halving approaches with an interesting time of withdrawal from exchanges.

Serious money has been on the move from exchanges in the past 30 days, as shown by on-chain data. As a result, the Bitcoin balance across various exchanges has seen a drastic drop to the lowest level in six years.

Percentage Of Bitcoin Supply On Exchanges Drops To Lowest Level Since 2017

A large portion of Bitcoin holders have been holding onto their coins for the long haul. According to IntoTheBlock data, about 69% of Bitcoin holders have been holding their coins for longer than one year.

Data from the on-chain analytics platform Santiment also showed that the supply of Bitcoin on exchanges recently dropped to 5.3% of the total circulating supply for the first time since December 2017, indicating 94.7% of the supply is currently in private custody. This metric is particularly interesting, considering BTC’s total circulating supply has grown by 2.84 million since December 2017.

As shown in Santiment’s chart, the supply on exchanges has been on a free fall since January 10, around when the first spot Bitcoin ETFs went live in the US. This isn’t surprising, as the sentiment around Bitcoin turned fully bullish during this period despite a prolonged price struggle.

📈 #Bitcoin‘s price dominance has continued to grow over #altcoins, as its market value surged as high as $45.5K today. Traders remain skeptical toward the asset for a 3rd straight week. This is the lowest ratio of $BTC on exchanges since December, 2017. pic.twitter.com/4MwvXE28RC

— Santiment (@santimentfeed) February 8, 2024

In a similar manner, whale transaction tracker Whale Alerts has disclosed large bouts of BTC exiting crypto exchanges to private wallets in the past month. Notably, Bitcoin’s dominance over altcoins has gained ground, with the institutional demand for Bitcoin post-ETF approval also surging.

🚨 🚨 🚨 1,150 #BTC (51,452,847 USD) transferred from #Coinbase to unknown wallet

— Whale Alert (@whale_alert) February 8, 2024

This mass BTC exodus from crypto exchanges signals that long-term holders feel more comfortable keeping their coins in self-custody rather than on exchanges.

The total Bitcoin withdrawals from exchanges in the past seven days were to the tune of $8.64 billion, outpacing a $8.42 billion inflow by $220 million. Wallets holding more than 1,000 BTC have also accumulated 1.03% of the total circulating supply in the past month.

Withdrawals from exchanges are generally a good phenomenon for crypto assets, as they reduce the amount of cryptocurrencies readily available for sale. Fewer BTC available means less selling pressure and the opportunity for the value to go up based on supply and demand.

At the time of writing, Bitcoin is trading at $46,250, up by 4% in the past 24 hours and 7.15% in the past seven days. The cryptocurrency is currently aiming for the $50,000 mark, which it can reach very soon if the accumulation strategy continues.

BTC price crosses $47,000 | Source: BTCUSD on Tradingview.com

Featured image from Forbes, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

What Bitcoin’s trading patterns on centralized exchanges tell us about the market

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Oops…you must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.

Korean FSC mandates crypto exchanges keep 80% in cold storage, criminals face up to life in prison

The Financial Services Commission of South Korea has announced that the implementation date of its Virtual Asset User Protection Law is July 19, 2024.

Last year, the law was established to safeguard users in the digital asset market and instill a regulated environment. This legislation embodies provisions aimed at curtailing unfair trading practices and enforcing financial authorities’ supervisory and sanctioning powers over the virtual asset market and its operators.

In preparation, the Financial Services Commission has prepared the draft detailing the enforcement decree and notices, setting the stage for a comprehensive legislative framework. Central to the new law is the obligation placed on virtual asset operators to ensure the safety of users’ assets. This includes the mandate for deposits and virtual assets to be managed by credible institutions, with banks identified in the draft decree as the managing bodies due to their stability and reliability.

Rules and consequences of violations of new laws.

The decree mandates that a significant portion of digital assets, precisely 80% or more of their economic value, must be stored in cold storage to safeguard against cyber threats. Additionally, operators must engage in measures like insurance, mutual aid, or reserves to cover incidents such as hacking, with a set compensation limit pegged at a minimum of 5% of the offline-stored virtual assets’ economic value.

The law also takes a firm stance against the misuse of undisclosed information, market manipulation, and fraudulent trading, prescribing criminal penalties or fines for such violations. The enforcement framework allows fines ranging from three to five times the amount of undue gains, with severe offenses potentially leading to life imprisonment for gains exceeding 50 billion won.

The FSC asserts that, given the virtual asset market’s susceptibility to high volatility and the potential for significant user harm, the legislation advocates for stringent penalties and active collaboration with law enforcement to deter illegal activities. The reorganization of the Financial Supervisory Service’s reporting center into the “Virtual Asset Unfair Trading and Investment Fraud Reporting Center” demonstrates measures to monitor and address unfair trading practices.

Digital asset service providers such as exchanges and other crypto services are being provided with a monthly regulatory compliance roadmap and checklists to facilitate their preparation for the law’s requirements.

Korean authorities have undergone a crackdown on digital asset providers over the past months. Earlier this week, HaruInvest executives were arrested after halting withdrawals from its crypto deposit service last year.

The Korean FSC stated that feedback received during the legislation’s advance notice period is being actively reviewed. Furthermore, the “Virtual Asset Investigation Business Regulations,” due for announcement later this month, will outline detailed procedures for the surveillance of transactions, investigations, and the imposition of fines, fortifying the legal landscape against market manipulation and unfair trading practices.

Bitcoin dips below $42k, liquidates majority of long positions across exchanges

Bitcoin (BTC) fell below $42,000 for the second time over the weekend after failing to break above $43,100 amid subdued trading volumes after the ETF hype at the end of last week.

As of press time, BTC was trading at $41,870 on most of the large exchanges. The price is still above the key support level of $40,250; however, sell pressure continues to mount before the Asian markets open for trading.

The flagship crypto experienced $23.68 million in liquidations over the past 24 hours, roughly 85% of which were longs — equating to $20.11 million, according to CoinGlass data.

The liquidations largely affected traders on prominent exchanges, with Binance and OKX bearing the brunt, witnessing liquidations of $7.51 million and $5.26 million, respectively.

Sell the news

The approval and launch of spot Bitcoin ETFs initially led to a surge in Bitcoin’s price, reaching around $49,000. However, following the excitement, there has been a notable downturn in the price, partly due to market reactions typical of “sell the news” events.

This kind of market behavior often occurs when there is a build-up of anticipation for an event (like the launch of ETFs), followed by a quick sell-off after the actual event.

From a technical analysis perspective, Bitcoin was showing signs of buyer exhaustion and increased selling pressure. Analysts observing indicators like the Exponential Moving Average (EMA) noted that Bitcoin was trading at key resistance levels, suggesting a potential price correction.

These technical signals can often lead to a self-fulfilling prophecy as traders and investors react to them.

ETF issuers buying the dip

Meanwhile, the ETF issuers have reportedly bought 23,000 BTC amid the downturn, with BlackRock accounting for 11,500 Bitcoin. It is unclear whether the interest in these products will continue to gain traction or if the weekend lull is a precursor to the coming days.

Experts believe that if these institutions continue scooping up Bitcoin at similar levels, it will likely lead to a supply crunch within a few months and could push the price to new highs.

However, the market has been wary of outflows from Grayscale’s GBTC ETF, whose holders have been underwater since 2022 and are likely looking for an opportunity to sell as they are made whole.

At the time of press, Bitcoin is ranked #1 by market cap and the BTC price is down 2.04% over the past 24 hours. BTC has a market capitalization of $822.13 billion with a 24-hour trading volume of $17.72 billion. Learn more about BTC ›

Market summary

At the time of press, the global cryptocurrency market is valued at at $1.65 trillion with a 24-hour volume of $48.87 billion. Bitcoin dominance is currently at 49.71%. Learn more ›

Will spot Bitcoin ETFs be cheaper than crypto exchanges to purchase BTC?

Bloomberg analyst Eric Balchunas posited whether crypto exchanges would be forced to revisit their pricing structures should a spot Bitcoin ETF be approved, given the seemingly low fees charged by some of the most prominent players.

However, regarding the issuers offering lower fees, Caitlin Long of digital asset custody platform Custodia Bank raised concerns that low ETF fees could indicate problems for issuers regarding covering costs. While seemingly a direct competitor for Custodia, Long warned that ETF issuers who offer fees that are not high enough to cover their costs may resort to lending securities to offset losses.

According to the filed prospectuses of the ETF applicants, Bitcoin in custody will not be being lent in such a manner but instead held in cold storage. However, it is possible for ETF shares to be lent out with collateral backing the transaction.

We analyzed some of the top crypto exchanges to compare how low these fees are. The chart below shows the transaction fees for some of the most popular crypto platforms for traders making a market order with no promotional benefits such as staking, holding native tokens, or high trading volume.

| Exchange | Trading Fees | $100 | $200 | $2000 |

|---|---|---|---|---|

| Kraken | 0.26% | $0.26 | $0.52 | $5.20 |

| Coinbase | 0.60% | $0.60 | $1.20 | $12.00 |

| Crypto.com | 0.075% | $0.075 | $0.15 | $1.50 |

| Gemini | $0.99, 1.49% for >$199 | $0.99 | $2.98 | $29.80 |

| Cash App | 3%, 1.75% for >$199, 1.25% for >$1999 | $3.00 | $3.50 | $25.00 |

| Binance | 0.1% | $0.10 | $0.20 | $2.00 |

The chart below shows the cost of holding the equivalent values of Bitcoin for 1 year within the proposed Bitcoin ETFs currently awaiting approval.

| ETF Issuer | Fees (bps) | $100 | $200 | $2000 |

|---|---|---|---|---|

| Invesco / Galaxy | 59 bps | $0.59 | $1.18 | $11.80 |

| Blackrock | 30 bps | $0.30 | $0.60 | $6.00 |

| Bitwise | 24 bps | $0.24 | $0.48 | $4.80 |

| Ark | 25 bps | $0.25 | $0.50 | $5.00 |

| Fidelity | 39 bps | $0.39 | $0.78 | $7.80 |

| Valkyrie | 80 bps | $0.80 | $1.60 | $16.00 |

| Grayscale | 150 bps | $1.50 | $3.00 | $30.00 |

| WisdomTree | 50 bps | $0.50 | $1.00 | $10.00 |

| VanEck | 25 bps | $0.25 | $0.50 | $5.00 |

It is worth noting that to acquire any shares in the above Bitcoin ETFs, users must use a broker to make the purchase. Some brokers charge fees for custodying shares, while others charge no fees. For instance, exchanges such as Webull, eToro, and Robinhood offer zero-commission trading. In contrast, others such as Hargreaves Lansdown, BestInvest, Interactive Investor, and ig.com charge a fixed fee for U.S. ETF purchases, with some offering zero commission after a set number of fees.

This analysis will assume zero-commission trading for the proposed spot Bitcoin ETFs.

Taking this into account, it would appear that crypto.com is the cheapest exchange to purchase Bitcoin, coming at just $1.50 for a $2,000 purchase compared with the lowest ETF fee of $4.80 if held for 1 year.

However, several of the crypto exchanges above also charge withdrawal fees. Crypto.com has a 0.0006 BTC withdrawal fee of $27 as of press time. The current average network fee on Bitcoin is 0.0002 ($9.45.) Other exchanges, such as Binance, only charge the network withdrawal fee.

The chart below shows the cost to purchase and withdraw the respective amounts of Bitcoin to self-custodial using the average transaction fee as of press time.

| Exchange | Trading Fees | $100 | $200 | $2000 | Withdrawal Fees |

|---|---|---|---|---|---|

| Kraken | 0.26% | $18.26 | $18.52 | $23.20 | $18 |

| Coinbase | 0.60% | $10.45 | $10.65 | $21.45 | Network fee |

| Crypto.com | 0.075% | $27.07 | $27.15 | $28.50 | $27 |

| Gemini | $0.99 or 1.49% for >$200 | $10.44 | $12.43 | $39.30 | Network fee |

| Cash App | 3% or 1.75% for >$200 or 1.25% for >$1999 | $12.45 | $12.95 | $34.45 | Network fee |

| Binance | 0.1% | $9.55 | $9.75 | $9.75 | Network fee |

However, there is a critical difference between buying Bitcoin through an ETF or exchange. With a spot Bitcoin ETF, you would be exposed to the underlying Bitcoin, which is essentially custodied for you through the issuer and its Bitcoin custodian (for most cases, Coinbase Custody.) However, when you exit the ETF, you can do so only in cash, not in Bitcoin. That Bitcoin is held in custody for you only while you hold the shares of the ETF.

With a crypto exchange, you are again purchasing Bitcoin, which is held in custody by a third party. Yet, you can then either withdraw the Bitcoin directly to a self-custody wallet or convert it into FIAT and withdraw in cash. The difference in custody, however, is potentially significant. Should the spot Bitcoin ETFs be approved, they have come under much closer and more direct regulatory scrutiny than many crypto exchanges. The FTX debacle of 2022 highlighted how important knowing where your crypto is custodied can be.

Therefore, as of press time, of the examined services, Binance is the cheapest exchange with which to purchase Bitcoin and withdraw into self-custody. Bitwise is the cheapest ETF to buy and hold custodied Bitcoin through an exchange-traded product, and crypto.com is the cheapest crypto exchange to purchase and custody Bitcoin without withdrawal.

The top providers to purchase Bitcoin and have it held in custody on your behalf are crypto.com, Binance, Bitwise, and Ark/VanEck.

It is also important to remember that this analysis is based on a single purchase using an account with no special privileges or volume bonuses. Many exchanges offer discounts on fees for active traders, thus reducing the cost of buying and holding Bitcoin.