The symbiotic relationship between AI and crypto is still in its nascent stages, according to tech execs.

In a recent meeting with the European Parliament’s Committee on Economic and Monetary Affairs, Piero Cipollone, a member of the ECB Executive Board, discussed the forthcoming digital euro, specifically its privacy features, infrastructure procurement, and operational standards.

Cipollone’s presentation emphasized the ECB’s proactive approach to collaborating with EU-based entities for the digital currency’s infrastructure. He added that all these entities are registered within the EU and controlled by an EU national.

Privacy considerations were a key focus of Cipollone’s remarks. He assured the Parliament that the digital euro would feature superior privacy protections compared to existing commercial payment solutions and include anonymous offline payment transactions.

The ECB executive detailed the planned privacy features of the digital euro, stating that it would collect only a minimal set of pseudonymized data necessary for operations such as settlement. This approach is intended to enhance online payment privacy, addressing public concerns over data protection in digital transactions.

For online transactions, the ECB would access only a necessary, pseudonymized data set for operational purposes like settlement, promising users greater data control than current private payment systems offer.

Moreover, according to Cipollone, the digital euro is designed with top-tier cybersecurity measures to safeguard user data and transactions.

Cipollone said the digital euro has been designed to mirror the accessibility and reliability of cash, thereby reducing reliance on global payment processors and ensuring uniform service across the eurozone. He added:

“Cash and a digital euro have the same objective: ensuring that everyone, regardless of their income, can pay in any situation of daily life. This is a fundamental right. And it should be protected in the same way in all parts of the euro area.”

He likened the digital euro’s infrastructure to public railways, suggesting it would be state-owned yet accessible to various private operators.

Cipollone also touched on the importance of a digital euro rulebook to ensure consistent implementation across the eurozone, aiming to reduce dependency on international payment processors by providing a uniform set of rules, standards, and procedures.

Addressing financial stability, the ECB executive outlined measures to prevent the digital euro from competing with traditional savings accounts, including interest-free holdings and restrictions on the digital euro’s accumulation by corporations and financial institutions.

He also mentioned plans to facilitate seamless transactions by linking CBDC wallets with bank accounts, circumventing the need for wallet pre-funding.

The dialogue between the ECB and the European Parliament is part of the preparatory phase for the digital euro, with the ECB providing technical input to co-legislators. The ECB’s efforts aim to prepare for a potential digital euro launch within a framework that prioritizes privacy, operational readiness, and financial stability.

Head of Digital Assets at Goldman Sachs, Matthew McDermott, has projected a massive growth in the cryptocurrency market in 2024. McDermott shared these positive predictions in a recent interview with Fox Business, expressing much optimism in the future of digital assets.

Speaking to Fox Business, McDermott has backed the continuous growth of cryptocurrencies as he foresees a rise in the institutional adoption of these assets.

Notably, the Goldman executive shares popular sentiment with many crypto enthusiasts that the approval of a Bitcoin or Ethereum spot ETF will open up the digital asset ecosystem to more institutional investors who are weary of the market volatility attached to direct crypto investments.

McDermott said:

One, it broadens and deepens the liquidity in the market. And why does it do that? It does that because you’re actually creating institutional products that can be traded by institutions that don’t need to touch the bare assets. And I think that, to me, that opens up the universe of the pensions, insurers, etc.

However, McDermott has cautioned crypto enthusiasts against expecting a sudden impact of crypto spot ETFs. He believes the anticipated increased demand and price rise will be a gradual process that will occur over the course of 2024.

The US Securities and Exchange Commission (SEC) is expected to grant approval orders to several Bitcoin spot ETF applications in the coming weeks following discussions between the regulator and multiple asset managers. Bloomberg analyst Eric Balchunas has set a potential decision window of January 8 – January 10, stating there is a 90% chance the SEC finally delivers a verdict on these various applications putting an end to the 6-months chronicle.

In addition to potential crypto spot ETFs, McDermott also mentioned a potential increase in commercial blockchain application as another contributing factor to his projected rise in institutional demand for digital assets.

Particularly, he spoke about an improvement in existing tokenization systems, which can lead to the creation of secondary liquidity on blockchains.

He said:

When I think about tokenization, which is obviously a topic that’s kind of talked about quite extensively, I think for me next year what we’ll start to see is the development of marketplaces. So where we start to see scale adoption, particularly across the buy side in the context of investors. And that’s because we’ll start to see the emergence of secondary liquidity on chain, and that’s a key enabler. So for me, that’s one of the key developments for next year.”

At the time of writing, the entire crypto ecosystem is valued at $1.602 trillion, with a 15.09% gain in the last month. The market’s leader Bitcoin currently trades at $42,082, having declined by 1% in the past day.

Total crypto market valued at $1.602 trillion on the daily chart | Source: TOTAL chart on Tradingview.com

Featured image from Money, chart from Tradingview

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

He tried to ride off into the sunset with $40 million in ill-gotten gains, but all he got was a one-way trip to prison.

A slick-talking, phony-business executive has been sentenced to 17 ½ in prison for ripping off hundreds of investors in a sham trucking company that federal prosecutors say turned out to be a $40 million Ponzi scheme.

Franklin…

Already a subscriber?

Log In

Cryptocurrency hardware wallet provider Trezor is investigating a recent phishing campaign, as users have reported receiving phishing emails.

The anonymous blockchain sleuth ZachXBT took to his Telegram channel on Oct. 26 to alert users to a phishing attack targeting Trezor customers.

ZachXBT referred to an X (formerly Twitter) post from the account JHDN, which alleged that Trezor may have been breached after receiving phishing emails on the email account used specifically for buying the wallet.

In a similar manner to some Trezor-related phishing attacks in the past, the phishing email invites users to download the “latest firmware update” to users’ Trezor devices in order to “fix an issue in software.” According to the poster, the malicious email was sent from the email amministrazione@sideagroup.com.

It looks like Trezor may have been breached? @Trezor @zachxbt #Trezor pic.twitter.com/4lmjZE1Quk

— j (@JHDN) October 26, 2023

“Be careful this person just received a phishing email to the email address associated with their Trezor purchase,” ZachXBT wrote, adding that the social media report could point to a potential data breach for Trezor or Evri, the United Kingdom delivery company that ships Trezor devices.

ZachXBT mentioned that two other people on Reddit complained about the same Trezor phishing email today.

According to Trezor’s brand ambassador, Josef Tetek, the firm is aware of the ongoing phishing campaign and is actively looking into it.

“We continuously report fake websites, contact domain registrars, and educate and warn our customers of known risks,” Tetek said, referring to multiple articles aiming to help users deal with phishing attacks. One such article says that phishing emails often redirect to download a Trezor Suite lookalike app that will ask users to connect their wallet and enter their seed.

Related: Scammers create Blockworks clone site to drain crypto wallets

“The seed is compromised once you enter it into the app, and your funds will then be immediately transferred to the attacker’s wallet,” the page reads.

Tetek emphasized that Trezor never asks for users’ recovery seed, PIN or passphrase, adding:

“Users should never enter their recovery seed directly into any website, or mobile app or type it into a computer. The only safe way to work with the recovery seed is as per the instructions shown on a connected Trezor hardware wallet.”

Cryptocurrency investors have been suffering from multiple phishing attacks despite many efforts to curb such scams. In September, a large crypto investor reportedly fell victim to a massive phishing campaign, losing $24 million worth of crypto assets. According to some cybersecurity reports, the number of cryptocurrency phishing attacks saw a 40% increase in 2022.

Additional reporting by Cointelegraph author Felix Ng.

Magazine: How to protect your crypto in a volatile market — Bitcoin OGs and experts weigh in

Nonfungible token (NFT) platform OpenSea says it is unaware of any evidence pointing to a former employee being involved in the infamous AnubisDAO rug pull in 2021 following new accusations on social media.

In an Oct. 6 thread on X (formerly Twitter), the anonymous account NFT Ethics tagged OpenSea, asking it to respond to accusations that its former head of ventures, Kevin Pawlak, is linked to the pseudonymous identity “0xSisyphus” and was involved in “various dubious business dealings.“

1/ Dear @OpenSea, what do you think of the fact that your Head of Ventures, Kevin Pawlak, has been involved in various very dubious business dealings (e.g. Anubis) and pump & dump schemes under his pseudonymous identity @0xSisyphus (& 0xMagellan)? pic.twitter.com/GzIVLJirLE

— NFT Ethics (@NFTethics) October 6, 2023

Both NFT Ethics and blockchain analytics account Lookonchain alleged that 0xSisyphus, and thus Pawlak, played a key role in hyping the AnubisDAO project to investors shortly before the project transferred the freshly raised funds to a series of external wallets.

The thread by NFT Ethics attempted to explain that Pawlak’s alleged role in the AnubisDAO rug pull was premeditated with other developers and laundered the proceeds through the memecoin Pepe (PEPE).

However, an OpenSea spokesperson told Cointelegraph that it was unaware of Pawlak’s involvement in any such activities but also noted that Palwak had a “limited scope” while working there.

“Kevin is a former employee who left the company in June 2023. He had a limited scope while at OpenSea — where he worked in a non-management position. We have no awareness of his involvement with the projects in question.”

“Furthermore, we have no connection to, or information about, the projects in question, as they took place before his time at OpenSea,” said the company representative.

In October 2021, AnubisDAO raised 13,556 Ether (ETH) — worth $60 million at the time — from crypto investors. However, some 20 hours later, the funds were sent to several different wallet addresses, resulting in an instant loss for the investors.

Blockchain sleuth ZachXBT also appeared to throw cold water on the accusations, saying the thread was “one of the most mid-curve” things he’d read.

He added that much of the thread seemed to base many assumptions about 0xSisyphus’ role in the alleged rug pull using “unrelated events without facts.”

That thread is one of the most midcurve things I have read. They make many assumptions off unrelated events without facts.

FixedFloat does tons in volume and same with the other exchanges mentioned. Here is the source address of the April 2023 FixedFloat insider PEPE buys I… https://t.co/0kG2M7DNVi

— ZachXBT (@zachxbt) September 29, 2023

0xSisyphus is also understood to have once offered a 1,000 ETH bounty to anyone who could identify the wallet address that drained the pool and engaged law enforcement in both the United States and Hong Kong, further raising doubts about the new accusations.

Related: AnubisDAO’s rug-pulled 13.5K ETH washes away on Tornado Cash

“Is Sisyphus at fault for gross negligence for lying about the Anubis team multisig? Absolutely 100%. Probably a civil case possible for victims,” wrote ZachXBT.

ZachXBT noted that negligence, in this case, is very different from stealing money from one’s own project. “[As far as I know,] Sisyphus was the only team member speaking with the [Department of Homeland Security].”

“You really think they did not look at him first and monitor his activity?” asked ZachXBT.

He also explained that the two actors most likely responsible for the loss of funds during the AnubisDAO scandal were two pseudonymous users known only as “Beerus” and “Ersan.”

Magazine: NFT collapse and monster egos feature in new Murakami exhibition

As malicious actors continue their attempts to steal users’ crypto assets, wallet provider MetaMask has developed a way to give users more insights into the transactions and interactions within the application.

In an interview with Cointelegraph, Francesco Andreoli, developer community head at ConsenSys, spoke about ensuring that the recently released MetaMask Snaps is secure for users. The executive highlighted the importance of consent and ensuring that users know each step of their journey across various chains and decentralized applications.

As a wallet containing various users’ crypto assets, the security of MetaMask Snaps could be a concern for users before trying out the new feature. However, Andreoli noted that user consent is one of its main priorities, and it has designed Snaps to provide full transparency around how each Snap interacts with the MetaMask wallet extension.

He said the new update shows users more data points to give them insights into their transactions: “So for security, one big category of our allow list is transaction insights. Basically, what is happening with transaction insights is you really get more data points on what the extension does today.”

Related: MetaMask Snaps to let users interact with Solana DApps through Solflare

In his keynote presentation, Andreoli also demonstrated how one Snap called Wallet Guard can help protect users from malicious transactions. The executive further explained to Cointelegraph that before signing and approving transactions, users would be shown various information about what they are about to perform:

“Basically, what is happening is that before you’re signing and approving a transaction, you will have different data points. Like if you are interacting with a malicious contract or have a specific interaction. This happens before you’re actually approving the transaction.”

He stressed users would be “fully conscious” of what is happening. According to Andreoli, this is a function to which it gave added attention as it developed MetaMask Snaps.

Magazine: Joe Lubin: The truth about ETH founders split and ‘Crypto Google’

While some areas of the crypto space focus on privacy and anonymity, others focus on raising the standards within the space and on bringing in traditional players and more capital in the world of digital assets.

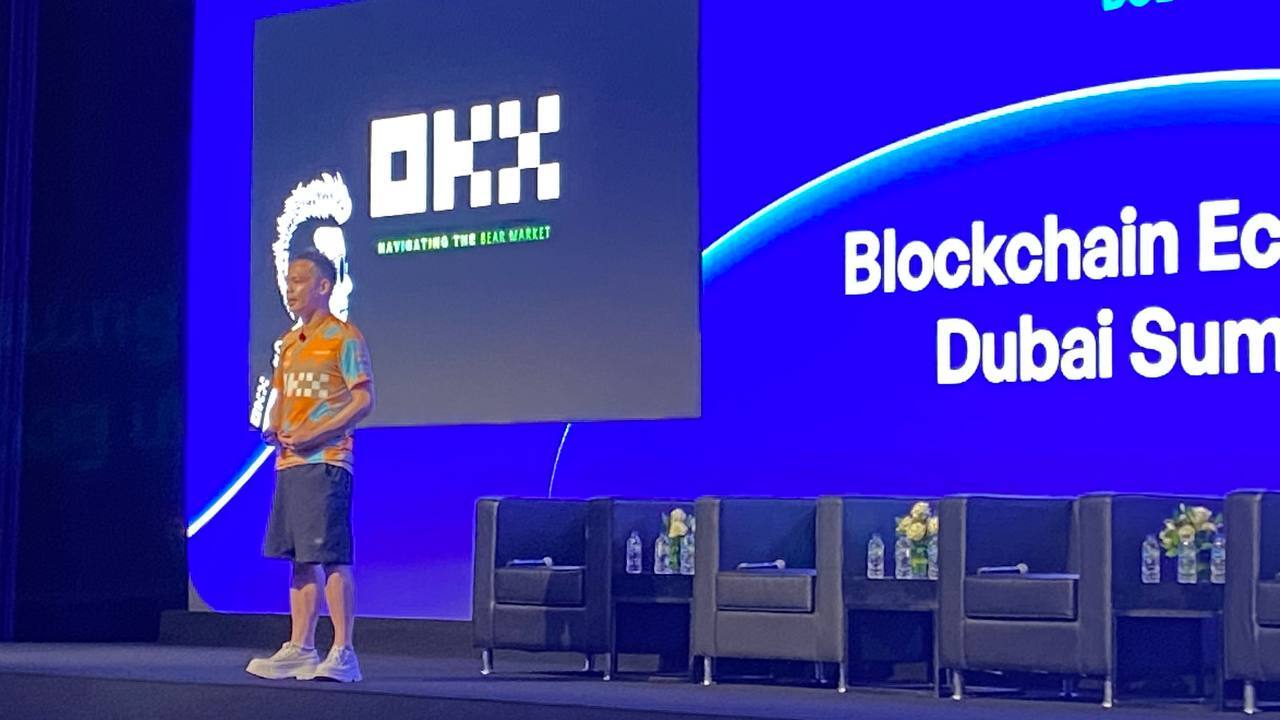

At the recent Blockchain Economy Summit held in Dubai, Cointelegraph spoke with Lennix Lai, the global chief commercial officer at crypto exchange OKX. During the interview, the executive discussed several topics, including the differences between working in traditional finance and crypto, how OKX handled the wave of exchanges implementing mandatory Know Your Customer (KYC) checks and how the exchange navigates the rapidly changing regulatory landscape.

Lai and Cointelegraph’s Ezra Reguerra at the Blockchain Economy Summit in Dubai. Source: Joanna Alhambra

According to Lai, crypto is “a lot more fun” than traditional finance. Lai, who previously worked in traditional firms, said there are many processes in the old finance world that he believes are inefficient. He explained:

“It’s relatively difficult to innovate in traditional finance. In crypto, it’s a lot better and more efficient. And in terms of cost, it is a lot more cheap. So, you can see the pace is a lot faster, and we can serve an even bigger audience than traditional finance right now.”

When problems arose, the executive said that there was lots of internal and external friction before being able to fix problems in traditional finance, even when the solutions were obvious. Furthermore, Lai said there are also regulatory aspects to consider before coming up with solutions.

When it comes to crypto, Lai told Cointelegraph that regulators share almost the same guidelines and expectations as they share the goal of protecting the consumer. The executive said that navigating different regulations from various jurisdictions across the world requires extensive research and mapping out the different requirements.

Lai delivering his keynote speech at the Blockchain Economy Summit Dubai event. Source: Cointelegraph

“Different level of requirement, different level of regulation. But I think all the regulators share similar guidelines and expectations. For example, they want to protect the customer, they want to monitor the trade, they want customer segregation,” he said.

Related: How OKX convinced F1 star Daniel Ricciardo it’s safe to promote crypto

When asked about OKX following the trend of bringing mandatory KYC to its exchange, Lai said there is a need to “raise the bar” in crypto, similar to traditional finance. According to the executive, this will bring what he described as “the real capital and the main money” to the space. He explained:

“That’s how we grow the real market, because if ever your compliance standard cannot meet or somehow talking in the same language with traditional finance, they can never, despite of their interest, despite of our innovation, invest or bring in capital to the space.”

According to Lai, KYC is the first level and the first step to trying to raise the compliance standard in the space so that it can welcome other players in the world of finance.

Magazine: $3M OKX airdrop, 1-hour due diligence on 3AC, Binance AI — Asia Express

Eddy Cue, senior vice president of services at Apple Inc.

David Paul Morris | Bloomberg | Getty Images

Apple senior vice president of services Eddy Cue is expected to testify all day Tuesday in federal court where the U.S. Department of Justice is accusing Google of using licensing agreements to monopolize online search.

Under scrutiny is a deal in which Google pays Apple billions of dollars to be the default search engine on the iPhone’s browser and other settings. Google could pay Apple as much as $19 billion this year, according to an estimate from Bernstein.

Cue, who negotiated the deal with Google from Apple’s side, is expected to testify that Apple picked the Google search engine as an iPhone default because it was the best product. He’s also expected to say that Apple doesn’t see a reason to create a new Apple search engine because Google already exists, according to a person familiar with Cue’s anticipated testimony.

Cue will also say that Apple has revenue-sharing agreements with competing search engines Yahoo, Microsoft Bing, DuckDuckGo and Ecosia, and that Apple users can change their default search engines, according to a person familiar with Cue’s anticipated testimony.

The testimony could shed some light on one of the highest-profile deals in the technology industry, which has been shrouded in secrecy for the past decade. The money Google pays to Apple for default placement is one of its biggest costs, and the advertising revenue Apple collects from Google is a major part of Apple’s profits.

Apple reports its payments from Google as advertising revenue, reported in its services business, which totaled $78.1 billion in sales in Apple’s fiscal 2022.

“I think their search engine is the best,” Apple CEO Tim Cook said when asked about using Google as the iPhone’s default search engine in 2018.

Much of Cue’s testimony and related financial documents could remain under seal, which means they won’t be released to the public.

Last week, Apple machine learning executive John Giannandrea testified. Before Apple, he worked at Google on its search engine.

The D.C. District Court judge, Amit Mehta, has said he wants to be conservative about how many documents are released to the public, and last week’s Giannandrea testimony was entirely sealed except for 15 minutes, where Giannandrea revealed a new search engine setting on the most recent iPhone operating system.

The DOJ previously had a page on its website where it would post documents and exhibits from the trial, and it was taken down last week on Google’s request.

The Google trial, expected to last 10 weeks, is the biggest technology monopoly trial since the DOJ took on Microsoft more than 20 years ago. The DOJ alleges Google has violated anti-monopoly law by striking exclusive agreements with mobile phone makers for its Android operating system and browser companies for default placement. The government alleges that the practice creates barriers to entry for competing search engines.

“This case is about the future of the internet and whether Google’s search engine will ever face meaningful competition,” the DOJ’s lawyer, Kenneth Dintzer, told the court in opening statements. He alleged that Google has more than 89% of the market for general search.

Google said before the trial kicked off earlier this month that it sees licensing agreements as a standard business practice that brings its products to consumers and creates a better experience for users. Google also argues that consumers can easily change default search engines on Android and Apple phones.

The DOJ is expected to present its case for about four weeks, then a coalition of attorneys general will present their case, followed by Google. Google CEO Sundar Pichai is also expected to testify, the DOJ said.

CNBC’s Steve Kovach contributed to this story.