A Nigerian court has postponed the tax evasion case of the detained Binance executive to April 19, while the hearing for the cryptocurrency exchange itself is scheduled for April 8. The court also ordered that the executive Tigran Gambaryan be held in the custody of the Economic and Financial Crimes Commission. Tigran Gambaryan Accused of […]

A Nigerian court has postponed the tax evasion case of the detained Binance executive to April 19, while the hearing for the cryptocurrency exchange itself is scheduled for April 8. The court also ordered that the executive Tigran Gambaryan be held in the custody of the Economic and Financial Crimes Commission. Tigran Gambaryan Accused of […]

Source link

executives

Disney‘s ESPN is at a crossroads.

For more than 40 years, the world’s largest all-sports network has grown annual revenue by increasing cable subscription fees. ESPN first charged pay-TV distributors less than $1 per month per subscriber in the 1980s. In 2023, ESPN’s monthly carriage fee was $9.42 per subscriber, according to data from S&P Global Market Intelligence.

That business model is eroding. Since 2013, tens of millions of Americans have canceled their cable TV subscriptions, raising questions about ESPN’s future in an increasingly fragmented media landscape. CNBC spoke with multiple current and former Disney and ESPN executives about the network’s path ahead as part of the digital documentary “ESPN’s Fight for Dominance.”

ESPN reported domestic and international revenue grew just 1% to $4.4 billion in its most recent fiscal quarter. The network can no longer rely on price increases to make up the difference as the number of cable customers declines.

The company has a new two-part streaming plan to reinvigorate growth. First, this fall, Disney will make ESPN available outside the traditional cable TV bundle for the first time as part of a joint venture with Warner Bros. Discovery and Fox. The service, which does not yet have a price, will target noncable customers who want to watch sports but don’t want to pay $80 or $100 a month for a full bundle of networks.

Second, in fall 2025 ESPN will launch its flagship streaming service that will include everything ESPN has to offer, both live and on demand. It will include unprecedented personalization and will interact with ESPN Bet, the company’s licensed online sportsbook, and fantasy sports to cater to younger fans. The product will go well beyond ESPN+, which exists as a $10.99 streaming service that doesn’t include ESPN’s most expensive programming, such as all of “Monday Night Football.”

ESPN Chairman Jimmy Pitaro

Steve Zak Photography | FilmMagic | Getty Images

“The industry is in a transition phase right now,” ESPN Chairman Jimmy Pitaro said in an interview as part of CNBC’s documentary.

“We’re seeing declines in the traditional ecosystem, cable and satellite universe,” Pitaro said. “There’s a transition to digital. That is by far the biggest component of our future.”

Pitaro and head of programming Roz Durant defended ESPN’s growth plan to CNBC, while former Disney and ESPN executives Bob Chapek, John Skipper and Mark Shapiro noted the so-called Worldwide Leader in Sports faces multiple potential obstacles while it charts its path forward.

Watch the documentary for the full story.

Don’t miss these stories from CNBC PRO:

Nigeria’s Binance Impasse: Senior Executives Detained at Government ‘Guesthouse’ for 14 Days

Tigran Gambaryan, a former U.S. federal agent, is one of two Binance executives being held without charge by Nigerian authorities. A local court approved the executives’ 14-day detention. Recent media reports suggest that Nigerian officials have requested Binance to disclose the identities and transaction histories of its top 100 users. Detained Executives’ Families Demand Their […]

Tigran Gambaryan, a former U.S. federal agent, is one of two Binance executives being held without charge by Nigerian authorities. A local court approved the executives’ 14-day detention. Recent media reports suggest that Nigerian officials have requested Binance to disclose the identities and transaction histories of its top 100 users. Detained Executives’ Families Demand Their […]

Source link

Amid tightening global crypto regulations, Backpack, a crypto exchange founded by former FTX executives, has broadened its reach to 11 US states, including California, Colorado, Indiana, Missouri, Wyoming, and others.

In a Feb. 21 announcement on the social media platform X (formerly Twitter), the company disclosed its availability to residents within the states above, with CEO Armani Ferrante outlining plans to consolidate the exchange’s presence in the US, saying:

“Today, we beginning our journey to bring Backpack Exchange into the USA. It’ll be slow. It’ll be steady. It’ll be hard. But it’ll be worth it. If we don’t support your state yet, hold on. We’ll get there. This is something that will take years to complete. But we’re committed to doing it right.”

The exchange, currently in its beta phase, facilitates spot trading activities and intends to diversify into derivatives, margin trading, and more as it secures additional licenses globally. It reportedly aims to offer non-custodial-based trading to differentiate itself from traditional crypto exchanges. On Feb. 18, the platform reported $1 billion in daily trading volume.

Backpack was co-founded by Can Sun, former general counsel at FTX, and Ferrante, previously a software developer at Alameda Research.

Sun played a pivotal role as a witness in Sam Bankman-Fried’s trial, revealing that he had no idea the former billionaire was misusing customers’ funds. Ferrante’s crypto infrastructure company, Coral, suffered a loss of $14.5 million due to FTX’s abrupt collapse. FTX Venture reportedly spearheaded a $20 million funding round for Coral mere weeks before the collapse.

Backpack’s licensing

The Backpack Exchange platform boasts multiple licenses across global jurisdictions, including the United Arab Emirates (UAE), Lithuania, Australia, and the United States.

The US Financial Crimes Enforcement Network’s records indicate its initial registration as a Money Services Business (MSB) in numerous US states. Furthermore, it’s duly registered with the Australian Transaction Reports and Analysis Centre (AUSTRAC) as a Digital Currency Exchange (DCE) provider.

In the UAE, it holds accreditation from the Dubai Virtual Assets Regulatory Authority (VARA) as a Virtual Asset Service Provider (VASP). Additionally, it’s registered as a Virtual Currency Exchange Operator and Deposit Virtual Currency Monetary Operator with the Lithuanian Financial Crime Investigation Service (FCIS).

Grayscale Investments’ Top Executives Barry Silbert and Mark Murphy Resign from Board of Directors

In addition to top executives stepping aside from the board of directors, Grayscale Investments also filed an updated spot Bitcoin ETF application with the SEC on Tuesday.

Top cryptocurrency investor Grayscale Investments LLC has been preparing to offer spot Bitcoin exchange-traded funds (ETF) in a bid to widen its market share. On Tuesday, the company made several moves to ensure an imminent approval of spot BTC ETF, which is anticipated to happen in the next few weeks. Grayscale Investments announced on Tuesday that its chairman and founder of Digital Currency Group Barry Silbert and DCG president Mark Murphy had resigned from the board of directors effective January 1, 2024.

Notably, the company highlighted that Mark Shifke has replaced Silbert, whereby Mathew Kummell and Edward McGee are the new appointees of the board of directors, who join Michael Sonnenshein.

The three new appointees of the board of members bring immense experience to fund management. For instance, the 64-year-old Shifke has been working as the Chief Financial Officer of Digital Currency Group Inc (DCG). Since March 2021, Shifke has served on the board of directors of Dock Ltd., a pay and digital banking platform. In the past, Shifke has also served as CFO of Green Dot (NYSE: GDOT) and led teams at JPMorgan Chase & Co (NYSE: JPM) and Goldman Sachs Group Inc (NYSE: GS).

Kummel, on the other hand, has been working as the senior vice president of operations at Digital Currency Group. The 47-year-old has served on the board of directors at Coindesk, among other notable roles. As for McGee, he has been working on the company’s audit committee in addition to the CFO role since January 2022. Notably, McGee has also served at Goldman Sachs as VP of accounting policy.

Grayscale Investments Prepares for SEC’s Approval of Spot Bitcoin ETFs

Grayscale Investments has been at the forefront of pushing the United States Securities and Exchange Commission (SEC) to approve the spot Bitcoin ETFs. Earlier this year, the US SEC was compelled by the court to relook into the spot Bitcoin ETFs applications from a similar angle as Bitcoin futures ETPs that were previously approved. Since then, the US SEC has significantly changed its approach to crypto firms, with ETF experts forecasting imminent approval in early January.

Grayscale Investments holds more than $25 billion in its GBTC trust and wants the SEC’s approval to convert it to a spot Bitcoin ETF. On Tuesday, Grayscale Investments filed another amended S-3 to comply with the SEC’s demand for cash-only redemption, which has been a similar case with other fund managers seeking to offer spot Bitcoin ETFs.

Even @Grayscale is accepting the SEC’s Cash-only creation/redemption edict. Looks like they’re bending the knee. pic.twitter.com/BtbyE5XQv0

— James Seyffart (@JSeyff) December 26, 2023

Market Outlook

Despite the heightened speculation of spot BTC ETF approval in the United States, Bitcoin price has struggled to rally beyond $44.5k. With a few days to the end of the year, the altcoin market has been preparing for further breakout as Bitcoin whale accounts accelerate profit taking and diversification to the alternative crypto coins.

next

Cryptocurrency News, News

You have successfully joined our subscriber list.

Bulgarian authorities drop money laundering investigation into Nexo executives

Sofia City Prosecutor’s Office has concluded a high-profile investigation into the activities of four individuals linked to the Nexo online platform.

The investigation, initiated on September 29, 2022, focused on allegations of participation in an organized criminal group and unauthorized banking activities through Nexo. Four individuals were accused of operating an organized criminal group from 2018 to January 2023 under Art. 321 of the Criminal Code.

Additionally, two of the individuals faced charges for conducting unlicensed banking transactions from June 2018 to January 2023, which involved lending and deposit raising in various currencies on the Nexo platform without appropriate authorization under the Law on Credit Institutions (CLI).

The investigation entailed extensive procedural and investigative actions, including witness interviews with a secret identity, technical and banking expertise, and analysis of payment account movements. International cooperation was also evident, with European Investigation Orders and their subsequent responses playing a crucial role.

The technicality defense

Despite an elaborate investigation and international scrutiny, including administrative actions against Nexo in various US states, the supervising prosecutors concluded that the evidence did not substantiate the charges. No proof of a criminal association, banking activity without a permit, money laundering, tax crimes, or computer fraud was found against the defendants.

A key aspect of the investigation’s conclusion was the legal status of virtual currencies in Bulgaria and the EU. As per the European Banking Authority’s report and the current legal framework, crypto-assets are not recognized as legal means of payment or regulated financial instruments in Bulgaria and the EU. This lack of regulation was pivotal in determining that Nexo’s activities, which were primarily conducted online and likely managed outside Bulgaria, did not constitute financial crimes.

The settlement between Nexo and various US regulatory authorities further substantiated the absence of fraud or misleading practices in Nexo’s operations. This comprehensive analysis led to the termination of criminal proceedings, with the supervising prosecutors concluding that no crime had been committed under the current legal regime for crypto assets and financial services.

Whether squashed between two strangers on an airplane, roped into an argument, or sandwiched between your older and younger siblings, being in the middle isn’t always considered prime real estate. There’s no need to ask Malcom if it’s any fun—you can just ask your manager.

The past year was a turning (and at times tipping) point in the white-collar workforce, which was rife with layoffs and return-to-office mandates. At the center of it all: the middle manager. The burned out second rung of leadership is the least satisfied with their job right now, according to Glassdoor’s 2024 Workplace Trends report.

The strain that 2023 placed on middle management becomes starkly evident when looking at Glassdoor’s work-life balance ratings. While junior and senior employees reported consistent results, there was a “sharp drop” when it came to middle managers working for larger employers.

Part of it is a swing-back from a golden era a couple years ago, Glassdoor chief economist Aaron Terrazas tells Fortune. “Middle management was targeted in a wide range of layoff announcements in 2023, as companies sought to flatten their org structure—in tech, in finance, in consumer goods, and in healthcare,” he says. Consider Meta’s culling off the layers of managers as part of its “Year of Efficiency” or Intel slashing managers’ pay.

It’s all happening in the shadow of a pandemic-era boom of management roles that Terrazas says was a “result of the tight labor market of 2021 and 2022, as companies sought to reward upwardly mobile employees with promotions in lieu of within-role raises.”

Indeed, there’s been a rise of “accidental managers” or bosses who were promoted without adequate training—82% of bosses fall into this group, per a U.K. survey of 4,500 workers and managers conducted by The Chartered Management Institute. Workers who think their manager is ineffective reported lower satisfaction in their job as well as lowers feelings of being valued and motivated than those who thought their bosses were competent. That could leave these managers floundering even more as tensions remain high between upper-level management and employees who are debating what the future of work should look like.

Middle managers are at the precipice of leaving

No wonder middle managers (accidental or not) feel incredibly stressed out. Being the middle manager has never had a great rep; dealing with lower pay and more interpersonal conflicts than higher-ups, they’re often isolated from the rest of the staff. And return-to-office mandates have made this middle ground all the more shaky, as they struggle to implement such policies from the top and keep their direct reports happy. Middle managers in hybrid workforces feel the most disconnected from their company since they’re tasked with monitoring and catering to multiple individual needs, per a 2022 Gallup survey.

They might also be caught in the middle of executives’ fixation with monitoring employee output and a disenchanted workforce still reeling from their waning flexibility and stagnant wages. “By mid-2023, middle managers were clearly starting to feel the heat—both from above as senior leaders sought to increase worker productivity and from below as frontline employees increasingly felt overextended,” Terrazas explains.

While middle managers might be touted as the key to solving burnout among their workers since they’re the ones often in charge of setting expectations and a supportive culture, many of them feel they’re at the end of their rope themselves. Nearly half (46%) of middle managers reported that they were likely to quit within the year due to stress, according to a global survey of 3,400 people from the Workforce Institute at UKG conducted in early 2023.

Glassdoor warns that the sharpening crisis doesn’t seem to be reversing in the coming year, which it deems a “risk” for employers.

“At many companies, good middle managers play a vital role: Taking high level corporate vision and translating it into tangible actions while channeling critical feedback across organizations,” says Terrazas. “In 2024, senior business leaders will need to focus on addressing these new stresses on middle managers—or risk losing them.”

This story was originally featured on Fortune.com

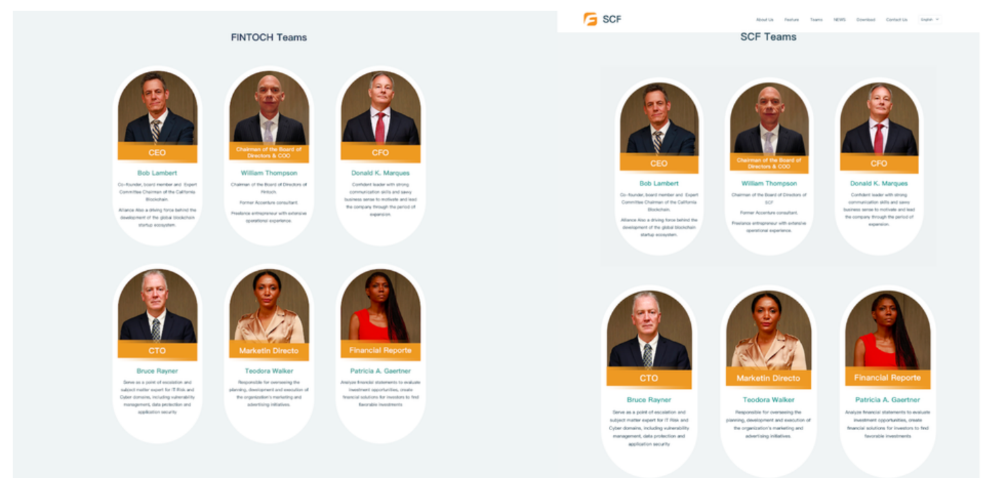

Web3 game project allegedly hired actors to pose as executives in $1.6M exit scam

On Oct. 10, the development team for gaming project FinSoul carried out an alleged exit scam, siphoning away $1.6 million from investors through market manipulation, according to a recent report from blockchain security platform CertiK shared with Cointelegraph.

The FinSoul team allegedly hired paid actors to pretend to be its executives, then raised funds for the sole purpose of developing a gaming platform. However, instead of actually creating the platform, the FinSoul team allegedly transferred $1.6 million in bridged Tether (USDT) from investors to itself. Blockchain data indicates developers then laundered the funds through cryptocurrency mixer Tornado Cash. Surprisingly, this was not the first allegation of misconduct against FinSoul’s developers.

On May 23, decentralized finance (DeFi) project Fintoch published a press release claiming it had adopted “advanced technology to develop the FinSoul U.S.-based metaverse platform” and had gone “live.” The announcement stated that the company was using “advanced technologies such as Unreal Engine 5 and Cocos 2D” to develop “sandbox worlds, multiplayer sports, leisure experiences, player socializing, MMORPG” and other types of gaming content.

The same day, on-chain sleuth ZachXBT reported that the original Fintoch DeFi project had performed an exit scam. The team had seemingly stolen $31.6 million and bridged it to Tron blockchain in an attempt to launder the funds, ZachXBT claimed.

In response, CertiK claims that the team “rebranded” in August, changing its name and social channels. “Fintoch” became “Standard Cross Finance (SCF).” CertiK produced an image showing the key executives of both Fintoch and Standard Cross Finance, who appear to be identical.

CertiK claims to have verified the real names of the persons listed as the CEO, chief operating officer and chief financial officer of the project. According to it, these “executives” are actually actors who work in the entertainment industry. In addition, CertiK claims that the project’s chief technology officer was listed on a promotional poster for an entertainment company, providing evidence that he is also a paid actor. It could not determine the identities of the other two people claimed to be “executives.”

The rebranded “Standard Cross Finance” team continued to promote FinSoul on YouTube and Telegram, the report states. Its marketing efforts included a video depicting an alleged “R&D Headquarters,” later revealed to be an office building on East Hamilton Avenue in Campbell, California. It also produced a video of an alleged promotional event in Vietnam.

The team page on the Fintoch website names “Bobby Lambert” as the CEO when in reality he does not exist and is a paid actor.

Previously both the Singapore Government and Morgan Stanley issued warnings about this investment scheme. pic.twitter.com/SLxvOCPj1s

— ZachXBT (@zachxbt) May 23, 2023

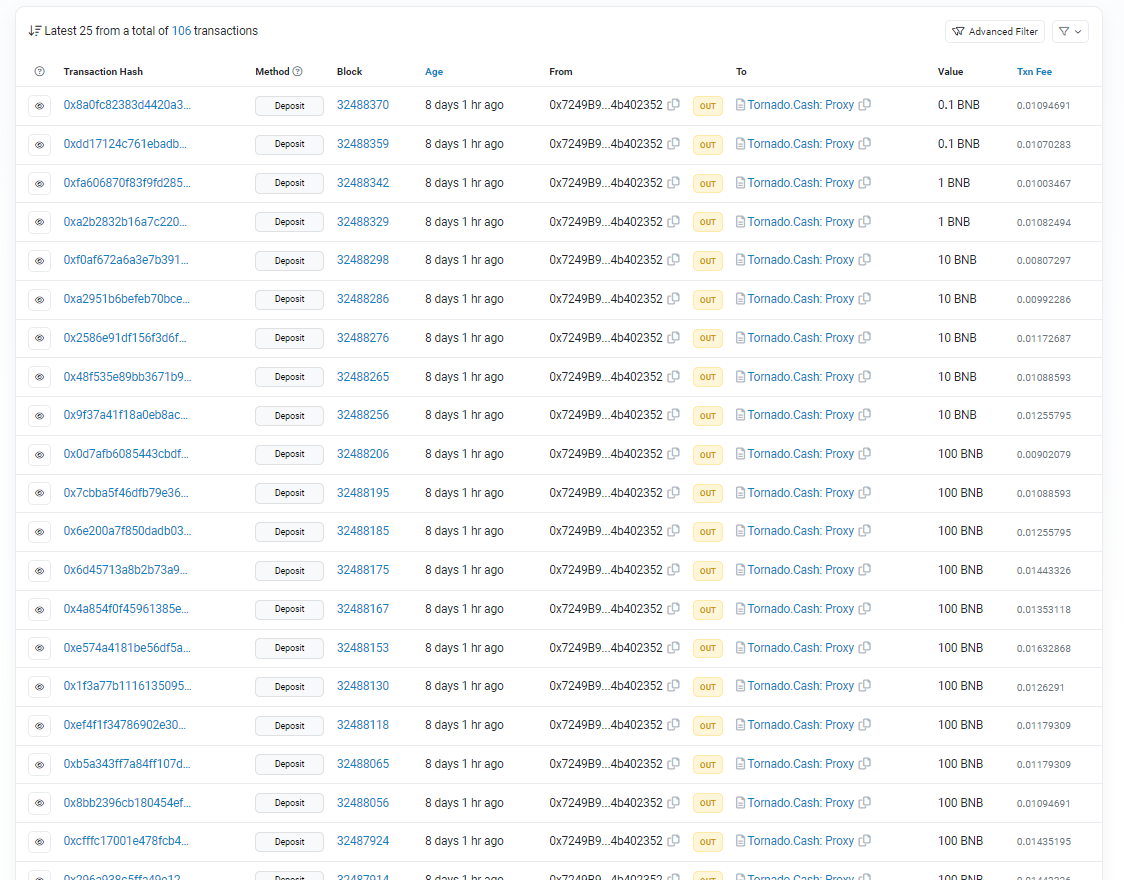

According to blockchain data, the project deployed its token contract to the BNB Smart Chain network on Oct. 10. At the time of deployment, 100 million FinSoul (FSL) tokens were minted and transferred into the deployer account. The deployer then sent 3 million FSL to other accounts through multiple transactions, leaving 97 million remaining in its possession. One of the transfers was for 210,000 FSL to an address that subsequently used the tokens to create a liquidity pool for FSL on PancakeSwap. From that point on, this pool was used by traders to buy and sell FSL.

Related: Cardano stablecoin project gambled away investors’ money before rug: Report

Data from DEX Screener shows that the price of FSL was initially set at $0.3911 per token on Oct. 10 at 6:30 am UTC. Over the next few hours, it rose to $17.5774, then retreated from this peak and came to stabilize at around $5 for the next few hours. Then, between 4:30 pm and 5:00 pm UTC, the price suddenly collapsed, falling from approximately $5 to near zero.

The two events appear to have occurred between 4:25 pm and 4:35 pm UTC on Oct. 10, which may explain the sudden price decline. At 4:25 pm, the FSL deployer account transferred the remaining 97 million FSL to another address. At 4:35 pm, this account sold all 97 million tokens into the liquidity pool, moving $1.6 million worth of Binance-pegged USDT from the liquidity pool into this account. This sale represented 32.33x the amount of FSL coins that had previously been circulating. This account subsequently transferred the drained funds to Tornado Cash through a series of transactions.

According to CertiK, the Standard Cross Finance team has managed to convince investors to once again invest in its project, despite twice draining funds from investors. It has now relaunched FSL with a new token contract. At the time of writing, DEX Screener shows that the new version of FSL is valued at $1.29 per coin.

Cointelegraph contacted the Standard Cross Finance team but did not receive a response by the time of publication.

The story of FinSoul serves as a cautionary reminder that crypto investors should investigate new projects before committing funds to them. If CertiK’s report is to be believed, it implies that a scam team was able to trick investors, not just once, but twice, and is currently attempting a third fraud. Investors should remember to exercise due diligence before investing in projects that do not have a functioning blockchain project.

Related: Pond0x DEX claims $100M in trading volume as critics allege it’s a scam

“Rug pulls,” or exit scams, have posed a continuing problem in the world of decentralized finance. Arbitrum-based protocol Xirtam allegedly stole over $3 million from investors using a token sale over the summer. In this instance, Binance managed to freeze the funds and return them to users via a smart contract beginning on Sept. 6.

However, most rug-pull victims are not so lucky. In June, DeFi project Chibi Finance removed over $1 million of its users’ funds through a “panic” function, and these funds have yet to be recovered. In 2021, the PopcornSwap exit scam resulted in over $11 million in losses to investors and led to criticism of the BNB Chain development team that still continues to this day.

Collect this article as an NFT to preserve this moment in history and show your support for independent journalism in the crypto space.

Bitstamp executives says exchange to partner with three ‘household name banks’ in Europe

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Oops…you must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.

Two more Binance.US executives leave the company as mass exodus continues

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Oops…you must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.