A new Deutsche Bank survey found that over half of respondents expect cryptocurrencies to become an important asset class and a method of payment. In addition, 10% of respondents expect the price of bitcoin to be above $75,000 by year-end. Deutsche Bank’s Crypto Survey A recent Deutsche Bank survey of over 3,600 consumers, published this […]

A new Deutsche Bank survey found that over half of respondents expect cryptocurrencies to become an important asset class and a method of payment. In addition, 10% of respondents expect the price of bitcoin to be above $75,000 by year-end. Deutsche Bank’s Crypto Survey A recent Deutsche Bank survey of over 3,600 consumers, published this […]

Source link

expect

Crypto Expert Reveals What To Expect For Bitcoin, Dogecoin, And XRP In 12-16 Months

Crypto expert Ash Crypto has outlined his price predictions for several crypto tokens, including Bitcoin (BTC), Dogecoin (DOGE), and XRP, heading into this bull run. He also suggested that these price levels could be attained in the next 12 to 16 months.

How High Will Bitcoin, Dogecoin, And XRP Rise?

Ash Crypto predicted in an X (formerly Twitter) that BTC would rise between $100,000 and $250,000 by 2025. This prediction aligns with those made by other notable crypto analysts. One of them is Skybridge Capital CEO Anthony Scaramucci, who predicted in January that Bitcoin would rise to $170,000 18 months after the Bitcoin Halving.

Source: X

Meanwhile, some other crypto analysts will argue that Bitcoin hitting $100,000 could even happen this year rather than 2025. This includes Tom Dunleavy, the Chief Investment Officer (CIO) at MV Capital, who claims that Bitcoin will rise to $100,000 by the end of this year. Tom Lee, Managing Partner and Head of Research at Fundstrat Global Advisors, also predicted that Bitcoin would rise to as high as $150,000 this year.

Regarding his price target for DOGE, Ash Crypto predicted that the meme coin would rise to $1 in the next 12 to 16 months. This prediction is also a common sentiment shared by several other crypto analysts and members of the crypto community. Specifically, crypto analyst DonAlt once mentioned that “it isn’t too unlikely for Dogecoin to go to $1,” while crypto analyst Altcoin Sherpa stated that DOGE could do “something silly like go to $1 this cycle eventually.”

Ash Crypto also shared his price target for XRP, stating that the crypto token could rise between $3 and $5. This price prediction, however, seems conservative, considering other predictions that crypto analysts have made for the XRP token.

Crypto analyst CrediBULL Crypto recently mentioned that XRP could rise to as high as $20 in this market cycle. Meanwhile, Crypto analyst Egrag Crypto has repeatedly stated that XRP hitting $27 is possible.

Undervalued Altcoins Make The List

Crypto expert Michaël van de Poppe recently included Chainlink (LINK), Celestia (TIA), and Polkadot (DOT) in a list of ten crypto tokens he believes are undervalued. Interestingly, these three altcoins also made their way into Ash Crypto’s list of coins, for which he outlined price targets.

For LINK, Ash Crypto predicted that the crypto token could rise to between $250 and $500 by next year. LINK’s rise to such levels would undoubtedly be massive, considering it currently trades at around $17. Ash Crypto also predicted a parabolic surge in TIA and DOT’s prices, as he believes they could rise to as high as $150 and $120, respectively.

DOGE price rises above $0.2 resistance | Source: DOGEUSDT on Tradingview.com

Featured image from CoinGape, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

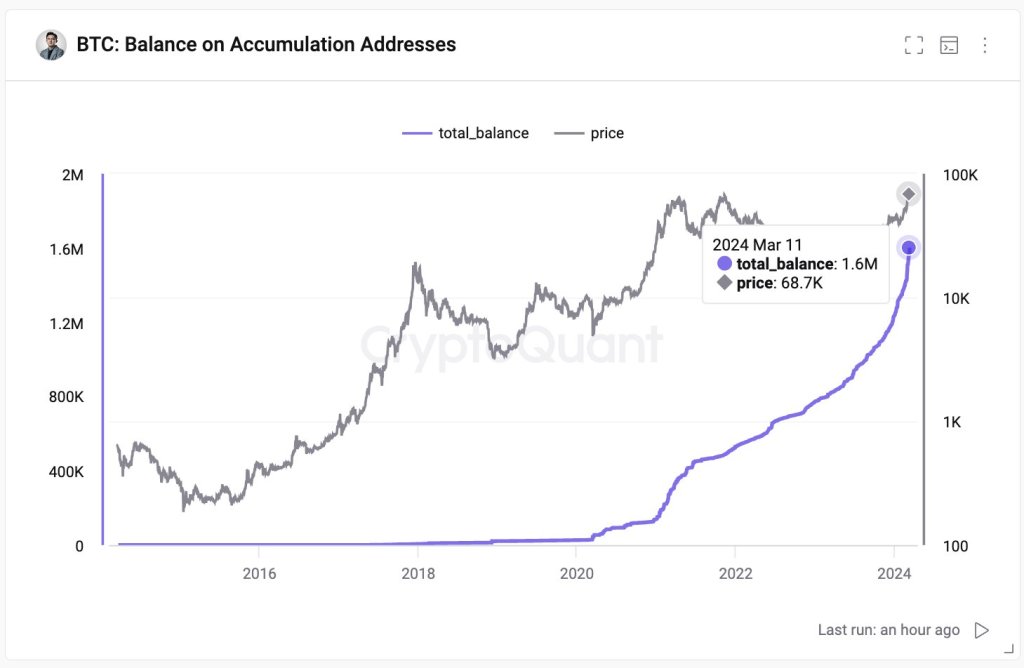

Ki Young Ju, the founder of CryptoQuant, a crypto analytics platform, predicts a severe Bitcoin “sell-side liquidity crisis” in the next six months. In this event, the founder thinks that not only will prices erupt to new levels, surpassing expectations, but the crisis will likely lead to a market disruption.

Bitcoin Records New All-Time Highs

Bitcoin is trading at around new all-time highs following sharp price gains on March 11. The coin roared to print new all-time highs of $72,800 before cooling off to spot levels.

Even though the upside momentum has waned as prices move horizontally when writing, the uptrend remains. Accordingly, more traders expect BTC to ease above yesterday’s highs as bulls target seven digits at $100,000. If bulls break above this psychological number, technical and fundamental analysts say it will be a crucial inflection point for Bitcoin.

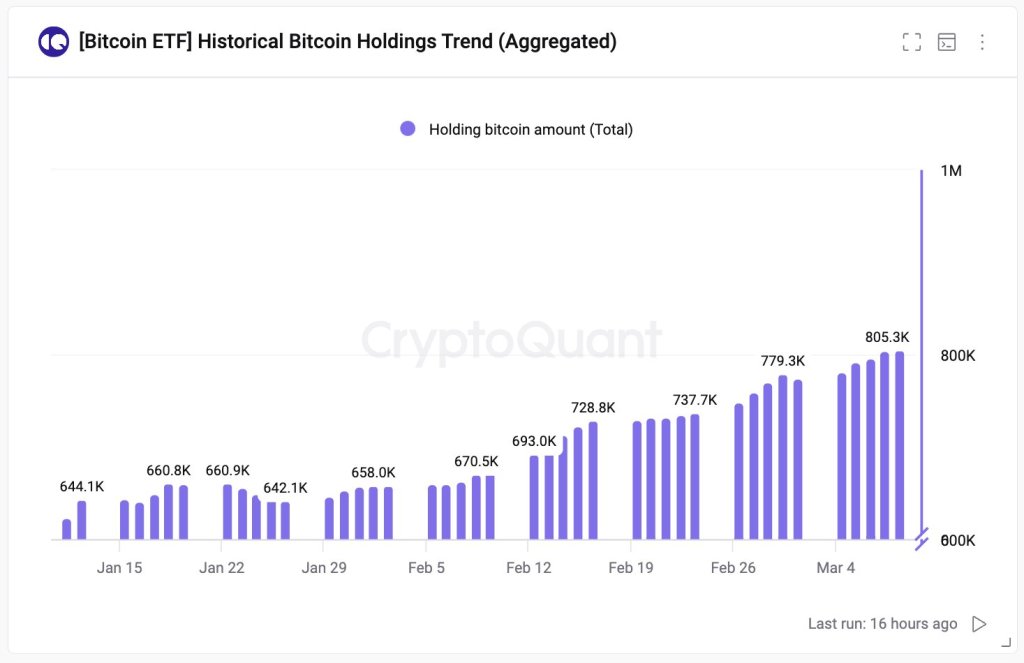

The founder expects Bitcoin prices to explode in the next six months primarily because of two factors. The first, Ju notes, is the massive influx of demand from institutions via spot Bitcoin exchange-traded funds (ETFs). So far, analysts have linked the current upswing in Bitcoin to institutional demand.

Last week, Ju observed a net inflow of over 30,000 BTC. This means that institutions are taking away more coins from circulation at an unprecedented level, contributing to scarcity. Institutions and wealthy individuals can gain exposure to BTC through spot ETFs without necessarily owning it directly.

Beyond this, the concern lies in the limited number of coins held across centralized exchanges and known entities, especially miners. The founder estimates that exchanges and miners own roughly 3 million BTC. Ju explains in the post that entities in the United States hold 1.5 million BTC.

BTC Scarcity Crisis Expected

The founder notes that rising demand from spot ETFs and a constrained supply will create a “sell-side liquidity crisis” within six months. This scenario could lead to a situation where there aren’t enough sellers to meet the high buyer demand, further lifting prices to fresh levels.

The Bitcoin network will slash miner rewards by half in April from the current 6.125 BTC. Because of this, BTC’s emissions will drop, meaning only small amounts of coins will be released into circulation, further worsening the situation.

As such, if the current level of demand remains and institutions continue to double down, the expected scarcity crisis may likely cause a major disruption in the market, benefiting coin holders.

Feature image from DALLE, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

GoPro Is Known for Making Some of the Best Action Cameras in the World. But It Makes Almost $100 Million per Year From Something That You Might Not Expect.

For more than a decade, action cameras from GoPro (GPRO) have enjoyed a market-leading position among adrenaline seekers. Surfers, bikers, skiers, divers, and more all capture their adventures with these durable devices.

And then there are time-constrained individuals like me who aspire to such a lifestyle and own a GoPro camera that mostly just sits there. But it’s ready for me whenever I finally get around to surfing Diamond Head.

Sales for GoPro devices are still holding strong after all these years. In 2023, the company sold 3 million cameras, which was a 6% jump from camera sales in 2022.

Unfortunately, the camera hardware business has proved to be a challenging venture for GoPro. Despite the brand’s popularity and ongoing strong sales, the company fails to consistently earn a profit and create shareholder value.

Several years ago, GoPro launched a new business that was supposed to be a better opportunity than hardware sales. Adoption of this product has been strong and now brings in nearly $100 million in annual revenue. But unfortunately it hasn’t been a catalyst for the stock, as I’ll explain.

GoPro’s other near-nine-figure business

GoPro offers a subscription service that provides unlimited cloud storage of pictures and videos, certain discounts on merchandise, and access to editing software. The company ended the fourth quarter of 2023 with 2.5 million subscribers, which was a healthy 12% year-over-year increase.

Thanks to this growth, GoPro generated subscription-and-services revenue of $97 million in 2023. It generated $82 million in 2022.

Many investors believed that this other business from GoPro would boost growth and improve profit margins. However, the chart below shows that this hasn’t been the case. Revenue is almost flat over the past five years, and the company’s gross margin has gone down.

GPRO Gross Profit Margin data by YCharts

The explanation for this is fairly simple. While $100 million is a big number, GoPro had revenue of $1 billion for the whole business. Therefore, revenue from subscriptions and services doesn’t meaningfully impact the overall numbers.

Moreover, cloud revenue should be high-margin in theory. But with only 2.5 million subscribers, GoPro lacks scale. Therefore, it’s not getting a boost here.

GoPro promises to grow its opportunity again

In 2024, GoPro is expanding its market opportunity by moving into motorcycle helmets. In January, the company acquired tech-enhanced helmet maker Forcite for an undisclosed amount. Management believes that it can service half of this market it estimates at $6 billion.

I’m skeptical that a move such as this moves the needle for GoPro. While the multibillion-dollar target is big, management left room for doubt. Founder and CEO Nick Woodman said, “There will be some cannibalization because you’re right, there are many motorcyclists who buy a GoPro to attach it to their helmet.”

In other words, GoPro can’t expect motorcyclists to buy both a camera and tech-enabled helmet. They’ll buy one or the other. Therefore, it’s questionable how much this acquisition really grows its long-term opportunity.

What should investors do now?

I believe that GoPro will continue to struggle with growth and profitability in coming years, which is why this is a stock I would avoid today.

Part of GoPro’s struggles making a profit have resulted from difficulties in predicting consumer demand. Sometimes it has too much inventory that doesn’t get sold. The problem is that it frequently updates its product lineup. If old inventory doesn’t sell before new cameras come out, old cameras must be marked down, hurting profits.

In Q4, this problem surfaced yet again for GoPro, demonstrating that it’s not a thing of the past. Management had guided for Q4 revenue of $325 million but only generated revenue of $295 million — that’s a big miss. And the reason is that it sold fewer of its lower-tier priced cameras than expected.

Over the next two years, GoPro intends to launch more products at even more price points. But this introduces a higher level of complexity in predicting consumer demand. And if GoPro gets it wrong, it could actually exacerbate its problems with profitability even more.

My GoPro camera is well loved even if it doesn’t see as much action as I’d like it to. I believe many consumers feel the same about the brand. But when it comes to the stock, revenue growth and profits matter. I don’t see either metric sustainably trending in the right direction right now, which is why GoPro stock doesn’t seem like a stock worth buying today.

Palantir Reports Earnings Today. This Is What Investors Should Expect

In this video, I will talk about Palantir (PLTR -1.76%), a recent big partnership the company announced, and what the market is expecting the company to report for the fourth quarter and full fiscal year of 2024.

*Stock prices used were from the trading day of Feb. 2, 2024. The video was published on Feb. 4, 2024.

Neil Rozenbaum has positions in Palantir Technologies. The Motley Fool has positions in and recommends Palantir Technologies. The Motley Fool has a disclosure policy. Neil is an affiliate of The Motley Fool and may be compensated for promoting its services. If you choose to subscribe through his link, he will earn some extra money that supports his channel. His opinions remain his own and are unaffected by The Motley Fool.

Stay away from US stocks, expect the AI bubble to burst, and brace for a recession, elite investor Jeremy Grantham says

-

US stocks are heavily overvalued, a recession is coming, and AI is overhyped, Jeremy Grantham said.

-

Stocks would have plunged another 20% or 30% in 2023 if not for the AI craze, the investor said.

-

Grantham said he’s worried about foreign wars, especially when asset prices are at record highs.

Stocks are absurdly expensive and likely to struggle, artificial intelligence is a bubble destined to burst, and the economy will suffer a minor recession or worse, Jeremy Grantham has warned.

The cofounder and long-term strategist of fund manager GMO recommended avoiding US stocks in a recent ThinkAdvisor interview. “They’re almost ridiculously higher priced than the rest of the world,” he said.

“The stock market will have a tough year,” he continued. American companies’ profit margins are at historic highs relative to foreign rivals, creating a “double jeopardy” situation for stocks where both earnings and multiples could fall, he added.

Grantham, a market historian who rang the alarm on a multi-asset “superbubble” at the start of 2022, said it burst that year when the S&P 500 tumbled 19% and the tech-heavy Nasdaq Composite plunged 33%.

Stocks would have slumped another 20% or 30%, he said, but the sell-off was “rudely interrupted” by the AI frenzy in early 2023 that “changed the flight path of the entire stock market.”

The veteran investor said that “AI isn’t a hoax, as bitcoin basically is,” but predicted the “incredible euphoria” around it wouldn’t last. Still, he suggested it could prove to be as revolutionary as the internet over the next few decades.

Grantham also issued a grim forecast for the US economy, despite solid GDP growth of 3.3% in the fourth quarter, unemployment and annualized inflation below 4% in December, and the prospect of several cuts to interest rates this year. On the other hand, the inverted yield curve and prolonged declines in leading economic indicators point to trouble ahead.

“The economy will get weaker,” he said. “We’ll have, at least, a mild recession.”

Grantham also flagged the threat posed by conflicts in Ukraine and the Middle East, warning that wars can foster a geopolitical backdrop that’s “scary as hell and in which bad things can happen.” The backdrop is especially worrying when assets are at record highs, he added.

“What I specialize in other than bubbles are long-term, underrated negatives,” Grantham said. “And my God, there’s a rich collection of negatives right now.”

The bubble guru urged investors to be careful, and recommended they seek out undervalued assets in emerging markets like Japan, depressed sectors like natural resources, and growth areas like climate-change solutions.

It’s worth emphasizing that Grantham’s dire forecasts haven’t hit the mark in recent years. For example, he suggested in April that the S&P 500 could be cut in half to around 2,000 points in a worse-case scenario, but the benchmark stock index has surged to an all-time high of over 4,900 points since then.

Read the original article on Business Insider

Costco Sells Everything From Gas to Gold Bars. But It Gets 73% of Its Profit From Somewhere You Wouldn’t Expect.

Costco Wholesale (NASDAQ: COST) has become one of the world’s most successful retailers. Shareholders have reaped huge rewards over time, as Costco stock has soared 72,600% since going public in the early 1980s.

A big part of Costco’s popularity has come from the fact that you can get just about anything you want there. The warehouse retailer is probably best known for its cost-conscious rotisserie chickens and hot dog meals. Customers also like to stock up on essentials like toilet paper while they’re shopping, and the company’s outside gas stations offer an inexpensive way to fuel up after making the drive.

Yet much of the fun of shopping at Costco comes from the wide assortment of product releases you’ll find. Everything from furniture to gold bullion is finding a place online and on warehouse floors.

It’s natural to assume that Costco’s profits come from its decisions to stock popular merchandise. Yet retailers across the industry know how hard it is to keep margins wide, especially on commodity items that are easy to get anywhere. That’s why the true secret of Costco’s success comes from one simple decision that nearly all of its customers take for granted — yet which contributes the vast majority of its profits each and every quarter.

Selling stuff doesn’t make Costco much money

Costco sells massive amounts of products every year. Once you add up a billion rolls of Kirkland Signature Bath Tissue, hundreds of millions of chickens, more than a ton-and-a-half of gold bars, and the rest of the company’s sales, Costco brought in $237.7 billion in product sales in fiscal 2023.

Yet Costco’s business strategy isn’t to make a huge amount of money on selling products. Instead, it sets prices low in order to encourage volume purchases, even though it means settling for razor-thin margins.

Adjusted gross margin at Costco was just 10.6% in fiscal 2023 when you look solely at merchandise sales and costs. When you include marketing and general overhead expenses, plus Uncle Sam’s cut in income taxes, Costco’s profit margin last year was just 2.6%.

Paying to get in the door

Of course, given how much Costco sells, 2.6% of a big number is nothing to shake a stick at. Costco’s profits in fiscal 2023 amounted to $6.29 billion.

As it turns out, though, $4.58 billion of that profit — 73% of the total — had nothing to do with product sales. That money came from the membership fees that customers pay just to enter Costco’s retail warehouse locations.

Costco currently charges $60 annually for a regular Gold Star membership. This includes two membership cards for access to members of your household, along with the right to make purchases at the retailer’s Costco.com e-commerce website. Alternatively, an executive membership is available for $120 per year, which includes benefits and discounts on a number of services, as well as a 2% annual reward on most purchases.

Costco has held the line on its membership fees for over six years now, and many now anticipate a further increase. In the past, the warehouse retailer has typically implemented price increases every five years or so. The key is to ensure that any price increase properly balances extra revenue from a higher fee against the risk of having customers choose not to renew their memberships at an elevated cost.

Using what you pay for

Costco’s membership model was innovative when it first started. But it makes sense: Once customers shell out for access, they’re going to want to make the best use of it they can. Together with all the other tactics Costco uses to get customers in the door and keep them there to make big purchases, membership has proven to be the key driver of the warehouse retailer’s competitive advantage and a big part of the reason for its impressive share-price gains over the decades.

Should you invest $1,000 in Costco Wholesale right now?

Before you buy stock in Costco Wholesale, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Costco Wholesale wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 18, 2023

Dan Caplinger has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Costco Wholesale. The Motley Fool has a disclosure policy.

Costco Sells Everything From Gas to Gold Bars. But It Gets 73% of Its Profit From Somewhere You Wouldn’t Expect. was originally published by The Motley Fool

French fries arranged at a McDonald’s Corp. fast food restaurant in Louisville, Kentucky, U.S., on Friday, Oct. 22, 2021.

Luke Sharrett | Bloomberg | Getty Images

McDonald’s is expected to share new details about its accelerated expansion plans, a new spinoff brand called CosMc’s and digital strategy at its investor day on Wednesday.

At its last investor presentation three years ago, McDonald’s rolled out a strategy that planned to grow sales by improving and marketing its core menu items, launching a loyalty program, and leaning into chicken and coffee. The company also projected mid-single-digit sales growth in 2021 and 2022.

Wall Street analysts aren’t expecting any major shifts in strategy, but they are predicting that McDonald’s will release another near-term forecast for sales growth and new unit development during Wednesday’s presentation.

However, the company’s predictions may be conservative, given business leaders’ and experts’ worries about the economy. Although inflation has cooled, consumers are still watching their wallets. Fast-food chains like McDonald’s typically outperform the broader restaurant industry during economic downturns.

McDonald’s stock has risen about 8% this year, trailing the S&P 500’s 19% gains. Shares of the company, which has a market value of about $207 billion, have struggled as investors worry about sales potentially weakening because of the economy and weight loss drugs.

Here’s what McDonald’s will likely address during its investor day:

Corporate restructuring

Earlier this year, the company announced it would be refocusing its priorities and accelerating restaurant expansion. Tied to that announcement, McDonald’s reorganized its corporate structure and laid off hundreds of workers.

CEO Chris Kempczinski said the restructuring was needed to streamline the organization and avoid silos. But since then, the company has shared relatively little information about how the restructuring will affect its decision-making and broader business.

Plans for its U.S. footprint

An illuminated lofo of McDonald’s corporation in front of an American flag in the storefront at Broadway avenue in New York City, USA. McDonalds is a multinational fast food chain with thousands or restaurants over the world with headquarters in Chicago Illinois. It is the world’s largest fast food restaurant chain famous for the burgers and fries. Manhattan, New York, USA on May 10, 2023 (Photo by Nicolas Economou/NurPhoto via Getty Images)

Nurphoto | Nurphoto | Getty Images

Before the Covid pandemic, McDonald’s priorities for its U.S. stores dealt with remodels and store upgrades, like self-order kiosks. Then came lockdowns and a massive shift in how diners bought and ate their food. While some customers have returned to McDonald’s dining rooms, many others have maintained their new habits, like ordering on the McDonald’s app.

The chain has already announced some small tweaks coming to U.S. restaurants. For example, it’s phasing out self-serve soda stations, which allowed customers to refill their soft drinks.

But McDonald’s also seems to have bigger plans in mind. The chain has already said it wants to accelerate its restaurant development in the U.S. to meet today’s higher demand for its Big Macs and McNuggets.

While the U.S. may seem saturated with McDonald’s locations, executives have said that its current footprint doesn’t reflect where consumers currently live, including the shift to the South and Southeast.

“Our footprint reflects what the population looked like probably 20 or 30 years ago,” Kempczinski said on the company’s conference call in July.

The chain is now also ready to experiment with fresh restaurant formats and features for those new locations. It opened a location in Texas that’s mostly automated. Executives have teased the launch of CosMc’s, a spinoff brand of small-format locations inspired by an old McDonaldland character. Some McDonald’s locations have also tested using artificial intelligence to take drive-thru orders.

Expansion abroad

McDonald’s plans to accelerate growth also include building more locations in its international operated markets, a segment that includes Canada, Germany, Australia and France. Kempczinski said in July that the growth in those markets has been “pretty anemic” compared with the opportunity available.

McDonald’s also recently bought back a minority stake in its China business for a reported $1.8 billion. China is now the company’s second-largest market by number of locations, but investors will be looking for more on why McDonald’s did the deal and management’s long-term hopes for the market.

Technology

McDonald’s operates roughly 5% of its U.S. restaurants, giving the company little insight about who its customers are and what they want. But its growing digital business, from self-order kiosks to its mobile app, has given the company more access to its franchisees’ customer bases.

Take its loyalty program, for example. McDonald’s hadn’t launched its loyalty program nationwide at the time of its last investor day. Since then, the chain has shared some comments on the program, including that it drives a 15% increase in visits from members. But investors are eager to hear more about what McDonald’s has learned about its customers, how it plans to implement those takeaways and what other digital innovations could unlock.

Don’t miss these stories from CNBC PRO:

Nvidia earnings: What to expect from the chip maker riding the AI boom

No company thus far has been able to capitalize on the artificial-intelligence revolution quite like Nvidia Corp., and Wall Street is once again about to see how that AI frenzy has translated into serious money.

Nvidia NVDA has stunned Wall Street with the sheer growth of its business this year and it’s set up to post more staggering numbers after the closing bell Tuesday. The company’s data-center business is expected to log a near 240% jump in revenue relative to a year earlier, while overall revenue is projected to more…

Master your money.

Subscribe to MarketWatch.

Get this article and all of MarketWatch.

Access from any device. Anywhere. Anytime.

Already a subscriber?

Log In

Partner at the Venture Capital firm Placeholder Capital and prominent figure in the crypto community, Chris Burniske, has given an instance where assets like Bitcoin and Ethereum could see a repeat of what happened in mid-2019.

New Highs Before A “Final Wipeout”

In a post shared on his X (formerly Twitter) platform, Burniske mentioned that a repeat of mid-2019 could happen if the top two cryptocurrencies, Bitcoin and Ethereum, were to “rip” from their current levels. If that happens, the crypto founder believes that the broader crypto market could follow suit.

As to how these crypto tokens could go, he noted that they could rise enough to make people believe that they could hit new all-time highs soon, but that may not be the case as these investors could endure a “final wipeout” soon after (possibly in the first quarter of next year) with these tokens steady declining to higher lows.

To drive home his point, Burniske suggested that Bitcoin and Ethereum’s current price action shared similarities to the period between December 2019 and January 2019 before the “painful descent into March 2020 lows.” According to him, although that period was the COVID era, “everything is also the same about the actors on the stage.”

Burniske seemed to be certain about his assertions. In a subsequent post, he warned investors that the rollercoaster “could get extreme” in relation to what he had said earlier and urged them to have their seatbelts on.

ETH price sitting at $1,844 | Source: ETHUSD on Tradingview.com

Market Cycle And Macro Factors Affecting Bitcoin And Ethereum

Many didn’t seem to react well to Burniske’s projections, considering that it could mean that the crypto market and everyone in it could be in more pain, even if a massive rally (as the crypto founder predicts) is likely to happen before that.

A particular X user, however, seemed to agree with his position as he stated that Burniske’s prediction makes so much sense as that is how the “cycle psychology” works, just that this time, it happens to line up “perfectly” with some highly likely macro scenarios. Burniske responded to the post as he agreed that those were the points he was trying to drive home.

One of these macro scenarios, which was alluded to, could be the rising inflation and how the Federal Reserve and other authorities globally are increasing interest rates to battle the economic downturn. Bloomberg analyst Mike McGlone had once mentioned how Bitcoin could crash to $10,000, with inflation being one of the factors that could lead to the decline.

Another crypto analyst, Nicholas Merten, had also noted that Bitcoin could decline further if the Feds do not do enough to curb the rising inflation.

Featured image from The Street, chart from Tradingview.com