Cross Finance is a next-generation digital ecosystem of cutting-edge payment solutions, bridging the worlds of banking and blockchain. CrossFi seamlessly integrates these two pivotal segments of the global economy into a unified ecosystem, offering unparalleled scalability and processing speed of up to 1 million transactions per second through the core of the CrossFi Chain—a modular […]

Cross Finance is a next-generation digital ecosystem of cutting-edge payment solutions, bridging the worlds of banking and blockchain. CrossFi seamlessly integrates these two pivotal segments of the global economy into a unified ecosystem, offering unparalleled scalability and processing speed of up to 1 million transactions per second through the core of the CrossFi Chain—a modular […]

Source link

Exploring

The Docusign Inc. application for download in the Apple App Store on a smartphone arranged in Dobbs Ferry, New York, U.S., on Thursday, April 1, 2021.

Tiffany Hagler-Geard | Bloomberg | Getty Images

DocuSign shares rose as much as 15% and closed up 12% on Friday after the Wall Street Journal reported the e-signature software company tapped advisors about a possible sale.

Talks are still preliminary, the Journal reported, citing people familiar with the matter. A DocuSign representative didn’t immediately respond to a request for comment on the report.

After losing almost two-thirds of its value last year, DocuSign’s rebound this year has been less dramatic than many of its tech peers. The stock is up 16% in 2023, while the Nasdaq Composite has gained 41%. The company has a market cap of about $13 billion.

DocuSign went public in 2018 and saw business boom during the pandemic as demand soared for technology that allowed people to work together on documents remotely. But growth has slowed dramatically since the economy reopened, and competition remains from Adobe and Dropbox.

A year ago, DocuSign hired former Google executive Allan Thygesen to replace Dan Springer as CEO. Layoffs followed days later.

The stock plummeted 22% on March 10, after the company said finance chief Cynthia Gaylor would leave and told investors to expect a single-digit quarterly revenue increase, down from growth above 50% during Covid.

WATCH: DocuSign CEO on Q3 earnings beat

Next cycle’s hypothetical $36k Bitcoin floor, exploring historical data to project future benchmarks

Quick Take

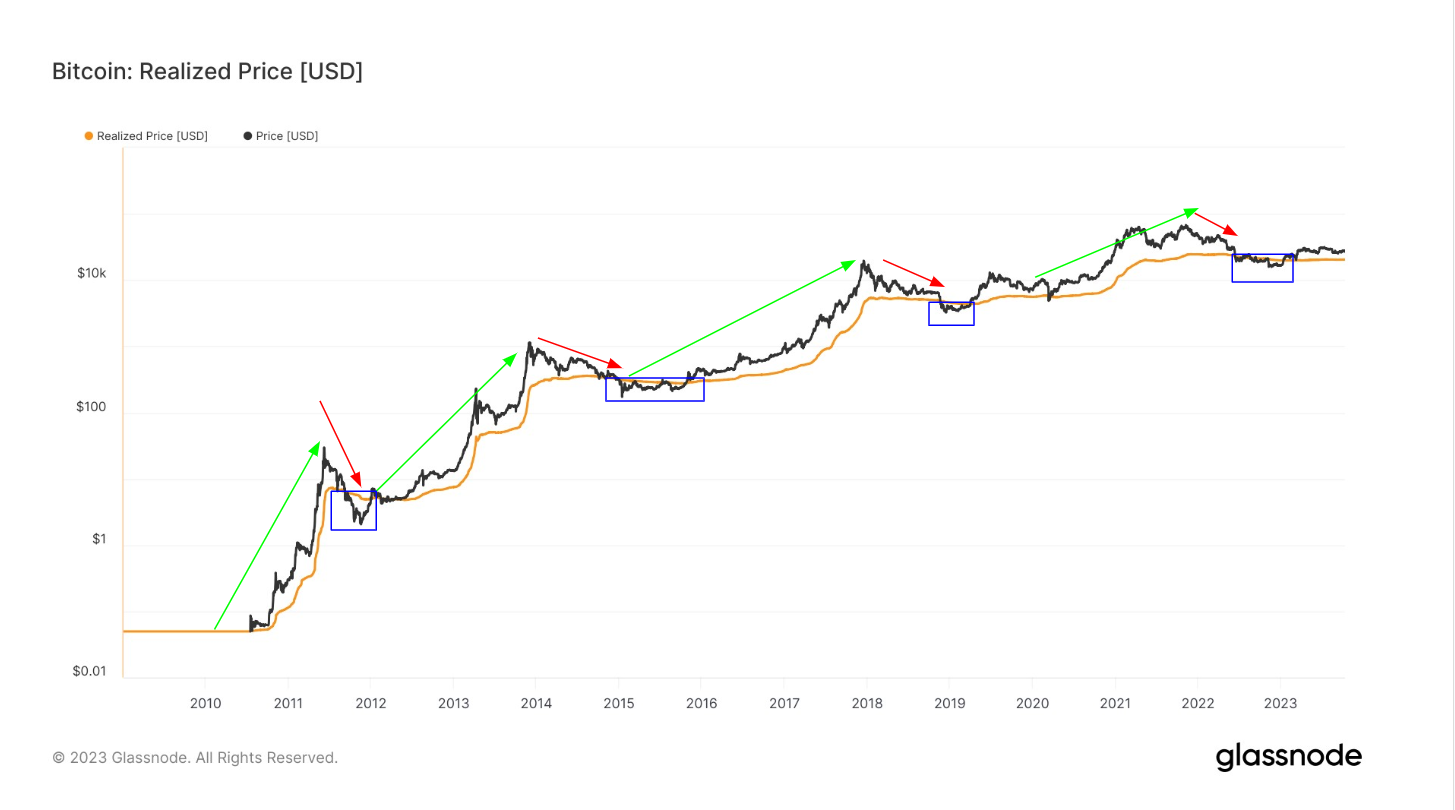

Bitcoin’s valuation, often viewed as speculative, can be dissected more accurately through the lens of the ‘realized price‘ metric.

This measure, reflecting the average cost at which all current Bitcoin holders purchased their coins, negates the impacts of volatility, thus offering a more realistic view of Bitcoin’s value over time.

Historical data reveals distinct cycles wherein Bitcoin’s market price traded beneath its realized price, as shown by the blue boxes in the chart below.

Specifically, it saw significant drops in value during the following periods:

- September to December 2011 – Price fell as low as $2.33

- January to October 2015 – Price plunged to $310

- December 2018 to March 2019 – Price dropped to a low of $3,500

- June 2022 to December 2022 – Price reached a low of $15,500

Following these periods, Bitcoin has consistently traded above the realized price, illustrating a robust rebound pattern.

As of 2023, Bitcoin’s price at $26,800 is considered fair against the realized price of $20,300. This continual pattern of ‘higher highs’ demonstrates the inherent resilience of this digital asset.

Historical Bitcoin Realized Price Projections.

Projecting the next bottom cycle based on Bitcoin’s realized price presents an intriguing thought experiment. While historical performance cannot conclusively predict future price action, understanding cycle patterns allows for a more holistic view of the Bitcoin market.

Historical data shows that in 2011, the bottom realized price was $4.50, which surged 55x to $250 in the 2015 bottom cycle.

Subsequently, the bottom in 2019 saw a 22x increase to $5,500.

The 2022 cycle bottomed at $20,000, marking a 3.6x increase.

If we follow this pattern of halving the multiplier with each cycle, the next bottom, hypothetically, could be around $36,000, reflecting a 1.8x increase compared to the 2022 bottom.

Ultimately, this exercise allows us to envision what Bitcoin’s valuation could look like should it follow similar patterns as previous cycles after the upcoming 2024 halving. While the future remains uncertain, contextualizing Bitcoin’s current position relative to past realized price data provides a more explicit framework to anticipate possibilities.

The post Next cycle’s hypothetical $36k Bitcoin floor, exploring historical data to project future benchmarks appeared first on CryptoSlate.

OpenAI gears up to combat AI chip shortages by exploring in-house production

OpenAI, the company behind ChatGPT, is exploring the possibility of producing its artificial intelligence (AI) chips to address the persistent shortage it has been grappling with, Reuters reported on Oct. 6.

OpenAI has reportedly conducted comprehensive market assessments, including possibly acquiring an undisclosed chip manufacturer. However, this plan is still in the process of being finalized, with internal discussions ongoing.

Last year, OpenAI CEO Sam Altman highlighted the importance of acquiring more chips for its operations as the shortages impeded the company’s short-term objectives.

A now-deleted blog post from Raza Habib, the CEO of AI firm Humanloop, said:

“A common theme that came up throughout the discussion was that currently OpenAI is extremely GPU-limited and this is delaying a lot of their short-term plans. The biggest customer complaint was about the reliability and speed of the API. Sam acknowledged their concern and explained that most of the issue was a result of GPU shortages.

AI chips have become a hot commodity since ChatGPT launched to much acclaim. These chips are designed to make building AI systems faster and cheaper. However, with the proliferation of several AI startups, it has become much more difficult for OpenAI to acquire these chips for its chatbot.

Due to this, OpenAI began considering solutions to combat the scarcity issues it faces. Some solutions the company is reportedly considering include the development of proprietary chips, strengthening its partnerships with Nvidia, which dominates more than 70% of the market, and exploring alternative chip suppliers.

Meanwhile, if OpenAI were to begin manufacturing its chip, it would join a small band of tech firms, like Google and Amazon, that produce their chip themselves.

OpenAI has yet to respond to CryptoSlate’s request for comment as of press time.

The post OpenAI gears up to combat AI chip shortages by exploring in-house production appeared first on CryptoSlate.

Quick Take

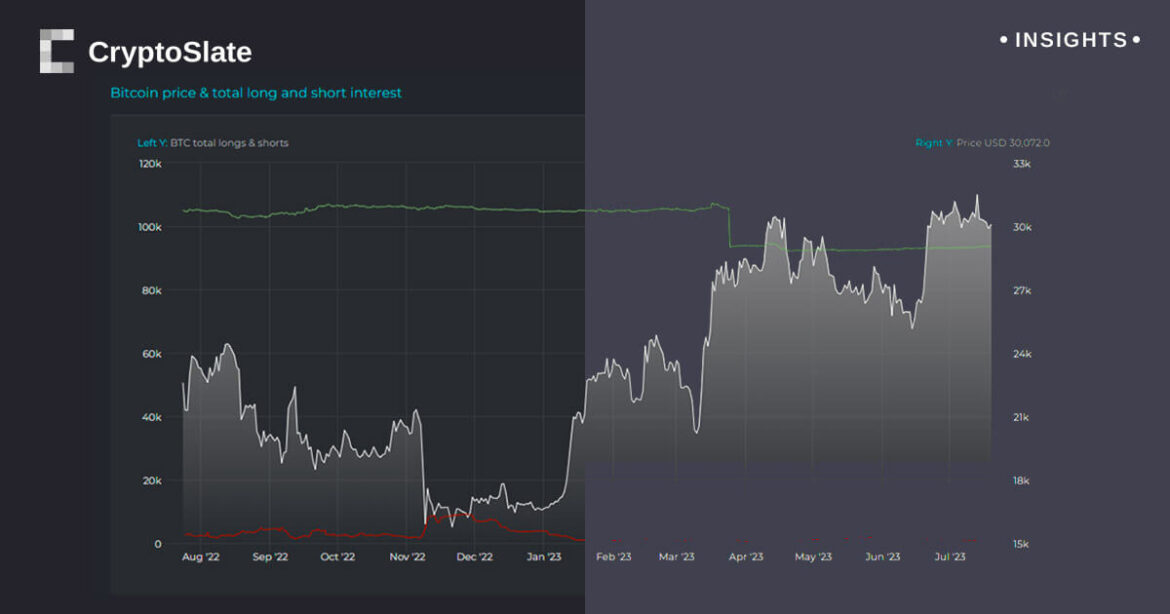

Diving into the complex world of Bitcoin (BTC) shorts, both hedged and unhedged, we are presented with an in-depth data visualization by Datamish, an in-depth look into the dynamics of hedged and unhedged Bitcoin (BTC) shorts. Here is a breakdown of what the chart illustrates:

- The yellow line represents the quantity of BTC shorts confirmed to be hedged.

- The red line illustrates the volume of unhedged BTC shorts or, to be more precise, not verifiably hedged.

Datamish calculates shorts by adding hedged and unhedged shorts to calculate the total volume.

There might be instances where a significant and sudden drop in the overall volume of shorts is observed that does not result in a consequential effect on the price. This might be perplexing, considering the completion of a trade typically follows the closing of a short position.

However, the rationale behind this is closing a hedged short position. This signifies that the trader who closed the position didn’t have to enter the market to buy coverage when the position was closed, as defined by Datamish.

As of the current year-to-date data, the combined total of shorts is at a low of 696, consistently diminishing throughout the past year. On the other hand, the sum of longs is approximately 93,581.

This can be perceived positively as investors exhibit reduced risk behavior towards shorting Bitcoin or don’t foresee a significant downside. Moreover, hedged shorts have surpassed unhedged shorts, demonstrating that investors are removing risk from their trading decisions.

The post Exploring Bitcoin’s hedged and unhedged shorts dynamics appeared first on CryptoSlate.

The inclusion of Nvidia, Tesla, and Microsoft expands the reach of the MAANG stocks, encompassing electric vehicles, Graphic Processing Units (GPUs), and software.

The United States stock market has been captivated by the remarkable performance of technology giants, collectively known as the MAANG stocks: Meta Platforms Inc (NASDAQ: META), Apple Inc (NASDAQ: AAPL), Amazon.com Inc (NASDAQ: AMZN), Netflix Inc (NASDAQ: NFLX), and Google’s parent company Alphabet Inc (NASDAQ: GOOGL).

These companies have consistently demonstrated their prowess in the industry, driving innovation and generating substantial returns for investors. However, new contenders have emerged, expanding the MAANG acronym to MANATAM, which includes Microsoft Corp (NASDAQ: MSFT), Apple, Nvidia Corp (NASDAQ: NVDA), Alphabet, Tesla Inc (NASDAQ: TSLA), Amazon, and Meta.

A Reign of Technological Dominance

Meta previously known as Facebook, has evolved into a metaverse-focused company. By investing heavily in virtual and augmented reality technologies, Meta aims to reshape the way people connect, communicate, and experience digital content.

The company’s projected earnings growth is estimated at 24.96%, suggesting that Meta is expected to experience a significant increase in earnings per share, from $11.94 to $14.92.

Apple on the other hand is currently the biggest company in the world in terms of market capitalization. The current stock price of $193.99 values the company at $2.84 trillion. Despite the worsening macroeconomic conditions, Apple’s stock price forecast is highly bullish.

According to recent Apple news, the company launched its Vision Pro AR headset in June 2023. This is the company’s first completely new hardware release in nearly a decade.

Amazon, with its dominant presence in e-commerce and cloud services, is a formidable force. Revenue for the corporation continues to rise, spurred by greater online purchasing and broad use of Amazon Web Services (AWS). On June 30th, the closing price of Amazon stock on NASDAQ was $130.36. On the same day, the opening price was $129.50, indicating a gain of about 0.66%.

Netflix being the fourth on the MAANG list, has revolutionized the entertainment industry, becoming synonymous with streaming services. According to current data, Netflix’s market capitalization is pegged at $196.01 billion with the current stock closing at $440.09.

As part of Alphabet, Google remains a dominant force in the tech and digital realm. Google’s search engine and advertising platforms generate substantial revenue, while investments in artificial intelligence and autonomous vehicles position the company for future success. Google Cloud, its cloud services division, is also gaining traction as a significant revenue stream.

The Emergence of MANATAM

The inclusion of Nvidia, Tesla, and Microsoft expands the reach of the MAANG stocks, encompassing electric vehicles, Graphic Processing Units (GPUs), and software.

NVIDIA, a pioneer in GPUs and artificial intelligence (AI) technology, has seen its stock price climb by 159% in 2023. Nvidia’s technological advancements and strategic partnerships position it as a leader in GPU innovation and drive its continued growth.

With a market capitalization of $830.52 billion, Tesla, an innovative electric vehicle company, has transformed the automobile sector. The company’s commitment to sustainable transportation, along with its cutting-edge electric vehicle technology has garnered immense popularity among consumers and investors.

Furthermore, Microsoft, a technology industry titan, has proven its tenacity with a 38% increase in stock value this year. On Friday, the closing price of Microsoft stock was pegged at $340.54. Notably, Microsoft’s entry into cloud computing with Azure has been critical to the company’s sustained growth. As the demand for cloud solutions intensifies, Microsoft’s position in MANATAM strengthens.

next

Business News, Market News, News, Stocks, Wall Street

Benjamin Godfrey is a blockchain enthusiast and journalists who relish writing about the real life applications of blockchain technology and innovations to drive general acceptance and worldwide integration of the emerging technology. His desires to educate people about cryptocurrencies inspires his contributions to renowned blockchain based media and sites. Benjamin Godfrey is a lover of sports and agriculture.

You have successfully joined our subscriber list.