Two of China’s largest fund management firms have recently been reported to be filing applications for spot bitcoin exchange-traded funds (ETFs), according to regional sources on Monday. Harvest Global Investments and Southern Fund are seeking approval from Hong Kong’s Securities and Futures Commission (SFC), aiming to obtain authorization to introduce spot bitcoin ETFs. China’s Investment […]

Two of China’s largest fund management firms have recently been reported to be filing applications for spot bitcoin exchange-traded funds (ETFs), according to regional sources on Monday. Harvest Global Investments and Southern Fund are seeking approval from Hong Kong’s Securities and Futures Commission (SFC), aiming to obtain authorization to introduce spot bitcoin ETFs. China’s Investment […]

Source link

eye

Analysts eye MicroStrategy share price to Bitcoin holdings ratio closely as MSTR falls 11%

Quick Take

MicroStrategy (MSTR), the business intelligence firm renowned for its substantial Bitcoin holdings, experienced a significant share price decline of over 11% on March 28. The company’s shares are currently trading at $1,704, starkly contrasting the recently anticipated $2,000 mark reported by CryptoSlate just days earlier. Despite the recent setback, MSTR’s year-to-date performance remains impressive, with a remarkable 150% gain.

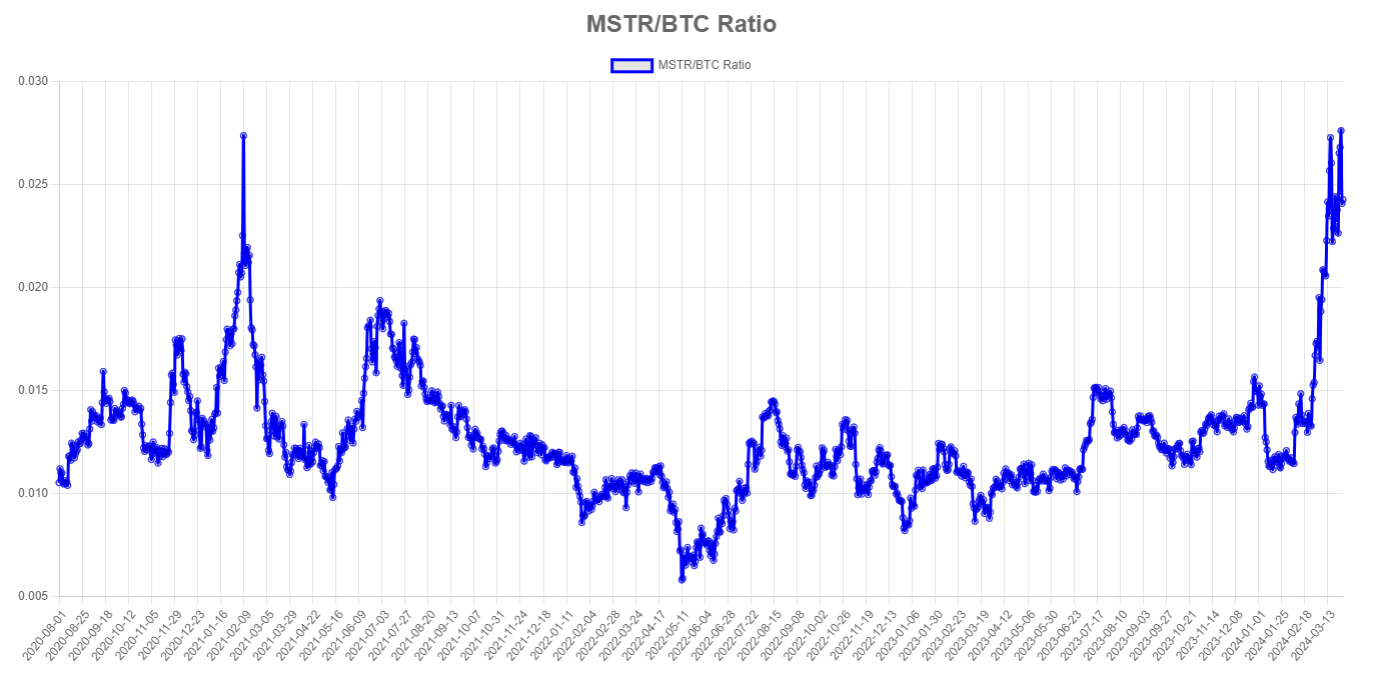

Analysts closely monitor the “MSTR/BTC Ratio,” a comparative value ratio between MicroStrategy’s stock price and the price of Bitcoin. This ratio illustrates how the company’s stock value trends in relation to Bitcoin’s market movements. Currently trading at 0.024, the ratio hit a recent high of 0.028, mirroring the levels observed in June 2021 at approximately 0.027, according to mstr-tracker.

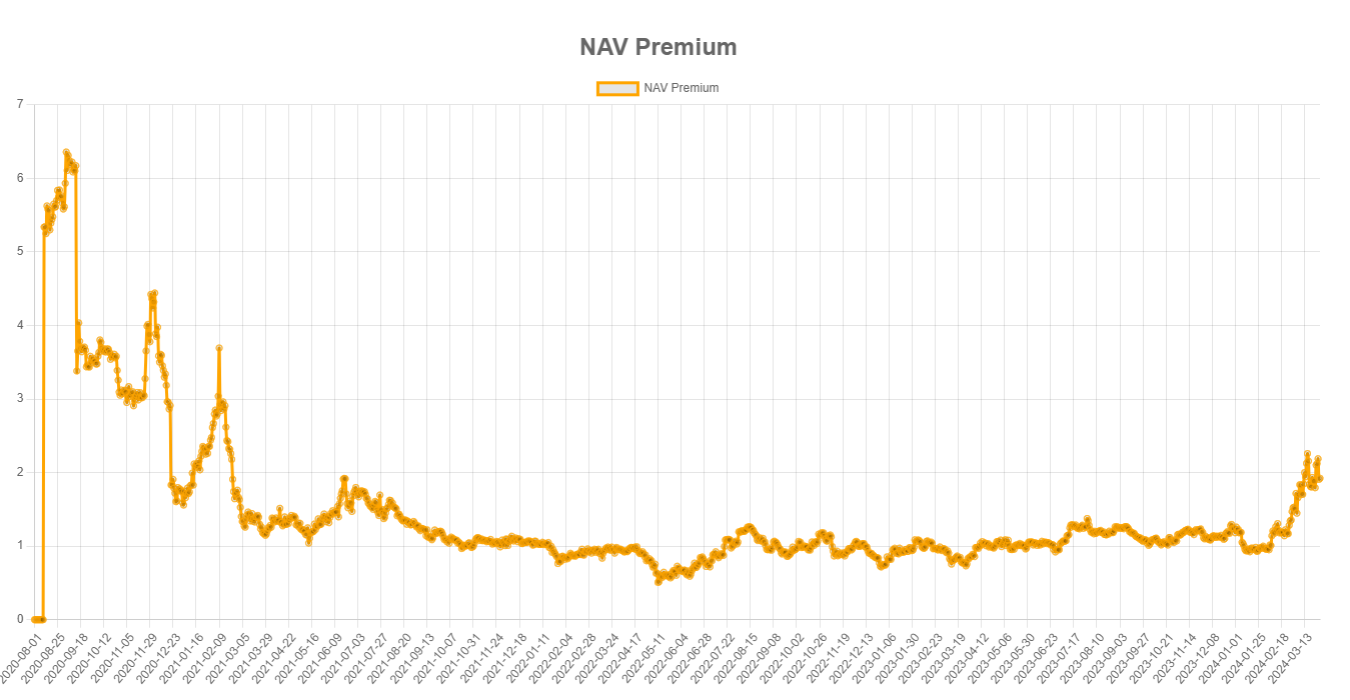

The “NAV Premium” chart, provided by mstr-tracker, which displays the premium of MicroStrategy’s stock over its proxy-NAV in Bitcoin, indicates that the market values the company’s stock at 1.92 times its Bitcoin holdings. The site has a unique methodology for defining an equivalent NAV for MicroStrategy, which considers its Bitcoin holdings, outstanding shares, share price, and market cap. Intriguingly, the current NAV figure matches the high observed in June 2021, when MSTR’s share price hovered around $500-$600, and Bitcoin traded at approximately $35,000.

The post Analysts eye MicroStrategy share price to Bitcoin holdings ratio closely as MSTR falls 11% appeared first on CryptoSlate.

Snowflake Isn’t Palantir’s Biggest Challenge in Artificial Intelligence (AI). Here Are 3 Other Companies to Keep an Eye On.

Two companies that can’t seem to stay out of the same conversation are Snowflake and Palantir Technologies (NYSE: PLTR). Each of these tech firms operates in the space of big data analytics. Following years operating as private companies bankrolled by some of Silicon Valley’s most prominent investors, Palantir and Snowflake debuted on the public markets within days of each other in late 2020.

For years, I’ve found the connection between Palantir and Snowflake perplexing. The main reason is that these companies don’t really compete with one another.

Snowflake is a data warehousing platform — a budding application within cloud computing. On the other hand, Palantir specializes in data aggregation across siloed software systems.

While Palantir competes head-to-head with many big tech businesses, the three companies explored here are arguably its fiercest competition at the moment. Let’s explore these companies and assess how each is giving Palantir a run for its money in the contested landscape of artificial intelligence (AI).

1. Microsoft

Microsoft really kicked off the AI arms race following its multibillion-dollar investment in ChatGPT developer OpenAI. Since partnering with the AI start-up in January 2023, Microsoft has swiftly integrated ChatGPT across its ecosystem. At the forefront of this integration is Microsoft’s leading cloud platform, Azure.

One of the company’s AI-powered software tools is called Fabric. The intention behind Microsoft Fabric is to unify data from disparate sources. By doing so, businesses can accelerate complex tasks in real time to make data-driven decisions. Global businesses, including Ferguson, T-Mobile, and Accenture, all use Microsoft Fabric for use cases including querying large data sets and logistics management.

During the company’s most recent earnings calls, management told investors that data stored in Fabric increased 46% quarter over quarter. While it’s hard to decipher what this translates to in terms of revenue, the general theme is that demand for Fabric is high — and with data becoming increasingly more important at the enterprise level, I suspect this is early innings for the product’s growth.

2. Databricks

One of the hottest start-ups on the planet is Databricks. In September, the company raised $500 million of funding at a cool $43 billion valuation. The round was led by T. Rowe Price Associates, famed venture capital (VC) firm Andreessen Horowitz, Baillie Gifford, Tiger Global, and Nvidia.

Prior to the funding, Databricks spent $1.3 billion in its acquisition of MosaicML — a generative AI platform developing large language models (LLMs).

Similar to Snowflake, Databricks also contains data warehousing functionality. But where the company begins to encroach on Palantir’s territory is when it comes to AI. Databricks focuses on machine learning applications as it pertains to real-time data analytics.

On the other hand, Palantir specializes more in data integration and visualizing these queries in something called an ontology — or a map which links your data together.

Just like Microsoft Fabric, Databricks has made impressive inroads with major companies across a variety of industries. Some of the company’s customers include Hershey, Rivian, and AT&T. These customers have deployed Databricks for a variety of solutions including analyzing consumer behaviors, threat detection, and honing capacity operations.

But as much of a threat as Databricks may present to Palantir, if you’re looking to invest in the company today, you’re out of luck. Databricks isn’t publicly traded, so don’t expect it to show up as a possible investment in your brokerage account right now. Regardless, tracking the progress of this company should continue to help inform investment decisions about Palantir stock moving forward.

3. Amazon

The last competitor on my list is Amazon. While e-commerce is what Amazon is best known for, the company’s cloud computing operation should not be overlooked. Amazon Web Services (AWS) is a major force in cloud operations, often competing with Microsoft, Alphabet, and Oracle. What makes AWS so unique is the sheer number of AI-powered applications develops can access.

I think one of the most underrated products in AWS is Neptune. Amazon Neptune is a graph database — essentially a tool that is layered on top of databases to help connect and query large volumes of data. Like Palantir, Neptune has complementing features including analytics tools that can help spot trends and derive insights.

According to IT research firm Gartner, the most popular alternative to Neptune is a start-up called Neo4j. Among the three companies examined in this article, Amazon is probably the most tangential competitor to Palantir, as opposed to a direct threat.

With that said, Amazon followed a similar path to Microsoft last year. Specifically, the company invested $4 billion into an OpenAI competitor called Anthropic. While there are a host of conditions attached to the deal, the underlying rationale behind the partnership is to bolster AWS.

It is still early days for Anthropic and its relationship with Amazon. But as data becomes an increasingly important asset for businesses of all sizes, software developers will continue to compete for customers expressing similar pain paints: connecting data from various systems in a centralized portal to help make decisions in the most efficient way. For this reason, I could easily see Amazon bolstering the Neptune platform beyond graph database management and competing as a more full-spectrum data analytics solution rooted in AI.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 11, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Alphabet, Amazon, Microsoft, Nvidia, and Palantir Technologies. The Motley Fool has positions in and recommends Accenture Plc, Alphabet, Amazon, Microsoft, Nvidia, Oracle, Palantir Technologies, and Snowflake. The Motley Fool recommends Gartner, Hershey, and T-Mobile US and recommends the following options: long January 2025 $290 calls on Accenture Plc, long January 2026 $395 calls on Microsoft, short January 2025 $310 calls on Accenture Plc, and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Snowflake Isn’t Palantir’s Biggest Challenge in Artificial Intelligence (AI). Here Are 3 Other Companies to Keep an Eye On. was originally published by The Motley Fool

Bitcoin rose above $57,000 on Monday to its highest level since November 2021, as exchange-traded funds investing directly in the cryptocurrency attract more capital into the space, while investors await the upcoming “halving” event, which has historically been bullish for bitcoin prices.

Bitcoin

BTCUSD,

rose almost 10% during the past 24 hours, according to CoinDesk data. It is roughly off 17% from its record high at $68,990, reached in November 2021.

Investors have seen significant inflows into bitcoin after the U.S. Securities and Exchange Commission approved 10 bitcoin ETFs for the first time in January.

They are also looking forward to the so-called “halving” event, which is expected to happen in April.

Halving is a mechanism written in the blockchain’s algorithm to control the supply of bitcoin, which has a cap of 21 million. At halvings, the reward for bitcoin mining is cut in half, meaning that miners will receive 50% fewer bitcoins for verifying transactions.

Halvings are scheduled to happen after every 210,000 blocks that are mined, or about every four years, until the maximum supply of 21 million bitcoins are all released. Historically, bitcoin has seen price appreciation months after halvings.

From the technical perspective, as bitcoin broke out of its sideways trading range that has been intact since Feb. 10, “this price gain should likely reach targets near $58.4 initially with a possibility of $62k which should be the last real area of resistance ahead of a possible challenge of former all-time highs,” Mark Newton, head of technical strategy at Fundstrat Global Advisors, wrote in a Monday note.

Bitcoin Technical Analysis: BTC Consolidates Gains as Traders Eye $53K Resistance Level

As bitcoin weaves through its dynamic trading patterns, its valuation on Feb. 16, 2024, reveals pronounced bullish indicators. Floating within a 24-hour trading window of $51,364 to $52,884, the digital currency’s market worth firmly grips the $1.02 trillion mark. Bitcoin The volume of bitcoin’s global trades is cruising at $29.86 billion, showcasing a medium-to-high engagement […]

As bitcoin weaves through its dynamic trading patterns, its valuation on Feb. 16, 2024, reveals pronounced bullish indicators. Floating within a 24-hour trading window of $51,364 to $52,884, the digital currency’s market worth firmly grips the $1.02 trillion mark. Bitcoin The volume of bitcoin’s global trades is cruising at $29.86 billion, showcasing a medium-to-high engagement […]

Source link

Consumers are casting a wary eye at their debt, New York Fed survey shows

U.S. consumers may be growing a bit more uneasy about their debts.

That’s according to a report released Tuesday by the Federal Reserve Bank of New York, which looked at Americans’ recent spending habits and how much they plan to spend in the near future.

The survey asks individuals how they would allocate an unexpected 10% increase in their income.

An average 38% of households said they would use that surprise pay bump to pay down debt, rather than spending or saving the funds.

That’s a jump of nearly a 5 percentage points from last year and the highest share of respondents who said they would set the money aside for debt payments since 2016.

Only 16% said they would spend or donate that money — the lowest percentage since the Fed started tracking the data nine years ago.

U.S. consumers have been racking up big debt balances over the past year, with consumer credit-card debt levels hitting record highs in recent months. Widespread use of buy-now-pay-later services during the holidays added to worries that so-called phantom debt may be weighing on Americans’ wallets without being documented on their credit reports.

Total consumer credit, a measure of how much money people have borrowed, topped $5 trillion for the first time in November, a trend that Sheila Bair, former chair of the Federal Deposit Insurance Corp., called “not good.”

What else the data showed

The New York Fed report showed that household spending continued to moderate at the end of 2023.

“The survey shows a continuation of the recent declining trend in monthly household spending growth,” the report said, “even though spending growth remains well above pre-pandemic levels.”

Expectations of growth in household spending for the year ahead reached the lowest level since December 2020, the report showed.

Survey respondents said they were less likely to make a large purchase such as a home appliance, furniture or home repairs over the next four months. However, consumers indicated they were more likely to purchase a home in the next four months than they were in August.

Disney launches NFT platform, eye issues at ApeFest and NFT sales rise: Nifty Newsletter

In this week’s newsletter, check out Disney’s plans to release a nonfungible token (NFT) platform by the end of 2023 and find out why NFT sales volumes will likely continue their upward trend in the coming months. Read about China’s stance on NFT theft and why the CEO of Roblox “dreams” of interoperability. In other news, find out what caused eye-related complaints at the recent ApeFest event in Hong Kong.

Disney launches NFT platform with Dapper Labs

Disney has partnered with NFT company Dapper Labs to launch a digital collectible platform called Disney Pinnacle. Using the platform, Disney will tokenize various characters from the Disney franchise, Pixar and Star Wars as digital collectibles.

Fans can trade and collect digital pins once the NFT platform is fully released on the Apple App Store, Google Play Store and for web browsers by the end of 2023.

Continue reading

NFT sales volume upward trend to continue, industry execs say

Following a recent consistent upward trend in NFT sales volume, Cointelegraph reached out to various professionals working in the industry to get their thoughts on the recent rise in sales. Jonathan Perkins, the co-founder of NFT marketplace SuperRare, said the trend will likely continue for the next six months. The executive believes the bear market is over, and things are finally turning around.

Meanwhile, NFT platform Enjin’s chief financial officer, Oscar Franklin Tan, made similar comments and argued that NFTs have already been established as a unique class of digital assets separate from crypto.

Continue reading

China declares stealing digital collections like NFTs liable for criminal theft sentence

In a statement published on Nov. 10, the Chinese government declared that those who steal digital collectibles like NFTs would be liable to face theft sentences. According to the announcement, stealing a digital collection intrudes upon the system, which means it also carries out the crime of illegally obtaining computer data and theft.

While China has banned many crypto-related activities, various parties have expressed interest in diving into the NFT space.

Continue reading

Roblox CEO “dreams” of in-game cross-platform NFTs and digital objects

Roblox CEO David Baszucki has recently expressed his dream of being able to move NFTs and objects across multiple platforms. The executive highlighted that he believes in this idea of users being able to move their collections to various non-native platforms.

The Roblox executive also highlighted that various celebrities could sign up on Roblox and create and sell collectibles for charity if this dream was made into reality. According to the Roblox CEO, these collectibles could also potentially be sold in other marketplaces.

Continue reading

Yuga Labs confirms UV lights likely cause of eye issues at ApeFest

Following complaints from attendees of the recent ApeFest event held in Hong Kong, NFT company Yuga Labs said that UV-A emitting lights set up in the event were “likely the cause of the reported issues.”

According to the official account of Yuga Labs’ Bored Ape Yacht Club collection, it determined the cause after a joint investigation with the agency that produced ApeFest.

Continue reading

CHECK OUT COINTELEGRAPH’S NFT STEEZ PODCAST

Thanks for reading this digest of the week’s most notable developments in the NFT space. Come again next Wednesday for more reports and insights into this actively evolving space.

Founder who suffered eye damage at Bored Ape Yacht Club event sends ‘formal legal notice’ to Yuga Labs

A founder who attended Yuga Labs’ recent Ape Fest in Hong Kong has sent legal notice to the company after suffering eye damage related to the event.

Asif Kamal, founder of the art-tech and NFT company Artfi, said that he fell ill to a “widespread eye infection outbreak” during the Bored Apes Yacht Club-themed event, which was held in Hong Kong between Nov. 3 and Nov. 5. In the hours following the event, several attendees reported eye pain, skin irritation, and other maladies associated with overexposure to UV light.

He also said that he was hospitalized after returning to Dubai after two days and added that the infection gradually spread to the skin on his face.

Kamal and ArtFi said in a press release:

“To ensure such an incident never repeats itself, Asif Kamal and his legal team have taken swift action by sending a formal legal notice to Yuga Labs, the organizers of the event. Mr. Kamal is dedicated to seeking justice for those who suffered and safeguarding the rights of the affected individuals.”

Kamal otherwise expressed concern and condemnation regarding Yuga Labs’ apparent failed security measures, as well as sympathy for other victims.

Condition is not infectious

Most other reports attribute the widespread eye condition to UV exposure from improper lighting. Several other attendees reported eye pain, vision problems, and burnt skin following the event.

In a petition on Change.org, Kamal similarly suggested that his condition was caused by exposure to UV radiation but maintained that this resulted in an infection.

Yuga Labs has acknowledged those reports. In a statement to Variety, the firm said that it was aware of “some attendees” reporting the above conditions (apart from infection). The company added that it was “distressed” by those reports and said that it was working with festival vendors and contractors to determine the cause of the incident.

In another statement to Verge, Yuga Labs said that 15 individuals, or less than 1% of the 2,250 people in attendance, had contacted it about the matter.

Piper Sandler Says the S&P 500 Could Still Surge 14% in 2023 — Here Are 2 Stocks to Keep an Eye On

In recent times, the markets have been hit by a combination of persistent headwinds that have been dragging it down. Elevated interest rates, surging oil prices, and geopolitical concerns have all played their part in keeping sentiment low.

But now, with the S&P 500 having retreated by 8% from the 52-week high of 4,607, Piper Sandler’s chief market technician Craig Johnson thinks various indicators are signaling that stocks are in oversold territory, positioning the benchmark index to push higher from here.

“You’re getting a lot of the bad stuff out of the way,” Johnson recently said. “The market is already sold off to a degree here. But I think once we get some clarity brought into what’s going to happen in Washington, get through the earnings seasons, these kinds of things, I think there’s a real meaningful pop. And we still think there’s still decent upside to go here.”

How much upside, exactly? With Johnson’s year-end target for the S&P 500 remaining at 4,850, there’s room for a 14% rally, he believes.

With that positive outlook in tow, the stock experts at Piper Sandler are pointing investors toward the equities they see as ready to ride the anticipated surge. They have homed in on two names and we decided to see what makes them good investment choices right now. For a fuller view of their prospects, we ran the pair through the TipRanks database. Here’s what we found.

Instacart (Maplebear, Inc.) (CART)

We’ll start with Instacart, the business name of Maplebear, Inc. This company, based in San Francisco, specializes in grocery delivery services through online and mobile apps. Instacart’s users can place their grocery orders through the service, and delivery can be scheduled for delivery or pick-up as early as the same day.

Instacart bases its service on a wide network of providers, including some 80,000 stores – everything from local grocers to large chains. Customers can select from more than 1 billion products available through the site, and the service is available in over 14,000 cities across the US and Canada.

This firm was founded back in 2012, but it’s a company new to the public markets; it held its IPO just this past September. The offering was priced at $30 per share, and the company put 22 million shares of common stock on the market, raising $660 million in the IPO. Since closing its first day’s trading at $33.70, the stock has retreated somewhat, and the company has a current market cap of $6.8 billion.

Covering this stock for Piper Sandler, 5-star analyst Alexander Potter outlines the contours of Instacart’s market and addressable opportunity, writing, “As a result of the COVID-19 pandemic, demand for grocery delivery surged, and Instacart’s gross transaction value (GTV) went from $5.1B in 2019, to $28.8B in 2022, a ~78% CAGR. Recently, due to a number of headwinds (a return to pre-COVID habits, disinflation, and the loss of EBT SNAP benefits), Instacart’s GTV growth has slowed to an expected 4% in 2023 and 4.5% in 2024; this compares to mid-teens growth at other gig platforms. This delta vs. peers may cause near-term valuation pressure – but ultimately, we think growth will re-accelerate. In the meantime, CART’s superior margins provide protection in a shaky macro.”

The analyst goes on to express his belief that Instacart will realize gains going forward: “Once transitory growth headwinds are overcome, we think CART’s superior profitability and thriving ads business may warrant a valuation similar to UBER.”

Potter gives CART shares an Overweight (Buy) rating, and his $36 price target implies the stock will gain 36% on the 12-month time horizon. (To watch Potter’s track record, click here)

This new stock has a Moderate Buy consensus rating from the Street, based on 14 recent reviews that include 9 Buys and 5 Holds. The stock is currently selling for $26.4 and its $36.27 average price target suggests it has room to gain 37% by this time next year. (See CART stock forecast)

Wintrust Financial (WTFC)

The second stock we’ll look at here is Wintrust Financial, a financial services holding company. Its eponymous Wintrust Community Bank operates 150 branch locations, centered in the Chicago area and spreading across Illinois, Indiana, and Wisconsin. Wintrust offers its customers full-service banking solutions, for both personal and commercial banking needs. Services include checking & savings accounts, mortgages & home equity credit, investment & insurance, and asset management, among others.

Through the third quarter of this year, Wintrust reported having $41.45 billion in total loans on the balance sheet. This was covered by the $44.99 billion that the company was holding in total deposits. The company had $418.1 million in cash assets on hand, and paid out a 40-cent-per-common-share dividend in August of this year. That payment annualized to $1.60 and gave a forward yield of 2.1%.

In its recent earnings report, from 3Q23, the company put in a strong showing. The top line figure came in at $574.8 million, improving on 2Q23’s $560.57 million, and up more than 14% year-over-year. Additionally, it was $4.7 million above analyst expectations. At the bottom line, the EPS figure of $2.53 beat the forecast by 12 cents per share. These beats were supported by strong gains in the banking company’s total deposits, which expanded by $1 billion, or 9%, y/y; and by the total loans, which expanded by $423 million, or 4%, from the prior year.

This midwestern bank holding company caught the eye of Piper Sandler’s Nathan Race, who sounded an upbeat note when he wrote of the stock, “WTFC is one of our favorite mid-caps following solid 3Q results given WTFC’s superior operating leverage prospects driven by its unique facets to generate an above average future NII trajectory partially via continued high-quality growth on both B/S sides. WTFC’s more measured operating expense growth outlook with its unique scale in Chicago should also contribute to superior future operating leverage.”

Race’s comments back up his Overweight (Buy) rating, while his $97.50 price target implies the shares will gain 32% over the coming year. (To watch Race’s track record, click here)

Turning now to the rest of the Street, where the stock holds a Strong Buy consensus rating, after picking up 10 reviews with a 9 to 1 breakdown of Buys over Holds. The trading price of $73.99 and the average target price of $91.56 together suggest a one-year upside potential of 24%. (See WTFC stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Two-year Treasury yields end at 3-month highs as investors eye approaching Fed decision

U.S. bond yields advanced on Friday, with the yield on the 2-year Treasury rising to its highest level since March 9.

Investor have been focused on what could be next for interest rates ahead of the Federal Reserve’s June 13-14 policy meeting.

What happened

-

The yield on the 2-year Treasury

TMUBMUSD02Y,

4.606%

advanced 8.7 basis points to 4.604% Friday, the highest since March 9. For the week, it was up 10.3 basis points, according to Dow Jones Market Data. -

The yield on the 10-year Treasury

TMUBMUSD10Y,

3.742%

gained 3 basis points to 3.744%, and it rose by 5.3 basis points this week. -

The yield on the 30-year Treasury

TMUBMUSD30Y,

3.883%

added less than 1 basis point to 3.886%. For the week, it rose 0.4 basis point, according to Dow Jones Market Data.

What drove markets

With no notable U.S. economic releases Friday, focus in the bond market was on next Tuesday’s inflation data for May and Wednesday’s Federal Reserve monetary policy decision.

Markets are pricing in a 71.2% probability that the Fed will leave interest rates unchanged at a range of 5.0% to 5.25% after its meeting on June 14, according to the CME FedWatch tool. The chances of a 25 basis point hike to 5.25% to 5.50% in July was priced at 53%.

The ICE BofAML MOVE index, which measures expected volatility in the Treasury market, settled at 115.77 on Friday, after logging its lowest close since Feb. 17 earlier this week, according to Dow Jones Market Data.

In March, the measure of bond-market volatility jumped to the highest levels since the 2008 financial crisis in the wake of regional bank failures.

What analysts said

While financial markets were betting the Federal Reserve will likely take a breather from its tightening campaign and “skip” an interest-rate hike when it meets next week, some market strategists still think a 25-basis-point rate hike is possible.

“Next week’s decision is likely to come down to the wire, but we maintain our long-held view that the Fed will tighten rates by a final 25 basis points in June to a range of 5.25%-5.50%,” said strategists at TD Securities led by Oscar Munoz, chief U.S. macro strategist.

“If the Fed decides to ‘skip’ the June meeting, we expect the decision to be accompanied by communication that leans hawkish, signaling a likely hike for July,” they added.

Treasurys are likely to bear flatten sharply in the event of a rate hike as the market pencils in the potential for more hikes in July, they said. However, if the Fed passes on a hike, Munoz and his team expect the curve to bull steepen sharply even if the Fed continues to insist that they are not finished tightening yet.