On April 8, 2024, bitcoin reached an impressive 24-hour peak of $72,573, marking a significant uptrend. With a 24-hour trading volume of $29.64 billion and a market capitalization soaring to $1.41 trillion, the cryptocurrency showcases strong market growth. Bitcoin Analyzing the daily chart, bitcoin (BTC) displays a bullish pattern with consistently higher lows and higher […]

On April 8, 2024, bitcoin reached an impressive 24-hour peak of $72,573, marking a significant uptrend. With a 24-hour trading volume of $29.64 billion and a market capitalization soaring to $1.41 trillion, the cryptocurrency showcases strong market growth. Bitcoin Analyzing the daily chart, bitcoin (BTC) displays a bullish pattern with consistently higher lows and higher […]

Source link

eyes

Google is reportedly considering the introduction of paid “premium” features powered by generative AI to its search engine, The Financial Times reported on April 2.

Sources close to the matter told the newspaper that Google is exploring the possibility of incorporating AI-enhanced search capabilities into its existing suite of premium subscription services.

The suite already includes access to Google’s latest AI innovations, such as the Gemini AI assistant integrated within Gmail and Google Docs.

While the technological infrastructure for these premium features is under development, Google’s executive team has yet to make a final decision on the launch and its specifics.

Shifting away from ad revenue

Despite the proposed changes, Google’s traditional search functionalities are expected to remain freely accessible, with advertisements continuing to accompany search results — even for subscribers.

The potential shift to a paid model will be a significant departure for Google, which has historically provided consumer services free of charge, relying solely on advertising revenues.

According to the report, the company is not considering an ad-free search experience but is committed to developing new premium capabilities and services to enhance its subscription offerings.

The tech giant highlighted its ongoing efforts to reinvent search to meet evolving user needs through generative AI, indicating substantial query growth in major markets without confirming any specific plans for the future.

Google’s search and related advertising ventures generated $175 billion during 2023, accounting for over half of its total revenue. This poses a strategic dilemma for the company: adopting cutting-edge AI innovations without jeopardizing its most lucrative revenue source.

Experimental SGE services

The strategic consideration comes at a time when Google’s advertising business faces potential disruption from advanced AI technologies, nearly a year and a half following the launch of OpenAI’s ChatGPT.

In response, Google launched an experimental AI-powered search service in May 2023, aiming to offer more detailed answers while maintaining the provision of links and advertisements. However, it has been slow to adopt features from its “Search Generative Experience” (SGE) into the main search engine.

The use of generative AI in search results requires significantly more computing resources, making these advanced features more costly for Google to provide. Currently, access to SGE is limited to a select group of users, including some subscribers to the Google One service.

SGE provides various features, including the ability to ask more complex questions, receive topic snapshots, and follow up on results, plus creative tools. The service introduced AI image generation in October 2023, providing functionality similar to a Midjourney and other apps.

Regardless of how Google’s AI-powered services develop, the company will inevitably compete with OpenAI’s ChatGPT and Microsoft’s Bing AI, both of which have established revenue models combining free and premium access to content.

Mentioned in this article

Latest Alpha Market Report

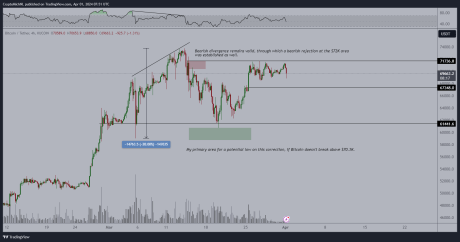

Once again, there is hope for Bitcoin (BTC) as Michael Van De Poppe, a cryptocurrency expert, has spotlighted the potential for the crypto asset’s price to reach a new all-time high before the highly anticipated Halving event commences.

One Final All-Time High For Bitcoin Before Halving

The price of Bitcoin is presently exhibiting new bearish activity, which might trigger negative sentiments in the market over the next few days. Despite the notable decline, Michael Van De Poppe is optimistic that BTC will attain a new height prior to Bitcoin Halving expected to occur this month’s end.

According to the analyst, the digital asset is currently in a consolidation zone. He further identified two distinct crucial levels within the lower timeframes such as the $67,000 threshold as a support level and the $71,700 mark as a final break out towards the peak.

It is worth noting that Michael Van De Poppe previously forecasted that Tuesday is probably when the real moves are expected to begin as Bitcoin consolidates. Thus, if the coin holds the $67,000 level, he will propose a one-last peak test ahead of the halving.

Poppe seems to be confident about his prediction now as he asserts that if one of the two aforementioned crucial levels develops, it will determine the direction of Bitcoin. Due to this, he believes BTC will experience one final pre-halving all-time high.

The post read:

Bitcoin is calmly consolidating. Crucial levels (lower timeframes): $67,000 to hold for support, $71,700 for a final breakout towards the ATH. If either of the two happens, probably direction is chosen. I think we will have one final ATH test before halving happens.

Following the recent decline, Poppe has issued a warning to the crypto community on how to interact with the price action. “You do not want to chase those massive green candles,” he stated.

He advocates entering the market when BTC‘s price is down by 15% to 40%. Additionally, he addressed those considering investing in altcoins, urging them to invest when altcoins are down by 25% to 60%.

Possible Triggers For The Correction

As of press time, Bitcoin’s price is trading at $65,843, demonstrating a decline of over 5% in the daily timeframe. Its trading volume has seen a significant uptick of 66% in the past day, while its market cap has decreased by 5%.

Since its peak of $73,000, achieved in early March, the price of Bitcoin has dropped by nearly 10%. One factor considered to have contributed to the retracement was the influx of funds into US Spot Bitcoin Exchange-Traded funds (ETFs), which has since started to calm down gradually.

Data from Wu Blockchain revealed that the products saw an overall net outflow of $85.84 million on Monday. BlackRock ETF IBIT recorded a net inflow of $165 million, while Grayscale ETF GBTC experienced a single-day net outflow of $302 million. Presently, the historical cumulative net inflow for the BTC spot ETFs is pegged at $12.04 billion.

Featured image from iStock, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Mogo Takes a Further Leap Into BTC, Eyes Long-Term Gains With $5M Bitcoin Reserve Investment

In a statement released on March 7, the Canadian fintech entity Mogo disclosed its strategy to diversify its portfolio by investing in bitcoin and bitcoin exchange-traded funds (ETFs), earmarking an initial outlay of as much as $5 million. Canadian Fintech Mogo Dives Deeper Into Bitcoin The publicly traded Canadian enterprise Mogo (Nasdaq: MOGO) (TSX: MOGO) […]

In a statement released on March 7, the Canadian fintech entity Mogo disclosed its strategy to diversify its portfolio by investing in bitcoin and bitcoin exchange-traded funds (ETFs), earmarking an initial outlay of as much as $5 million. Canadian Fintech Mogo Dives Deeper Into Bitcoin The publicly traded Canadian enterprise Mogo (Nasdaq: MOGO) (TSX: MOGO) […]

Source link

Bitcoin Cash Soars 40% in 24 Hours as Market Eyes Upcoming Halving and Adaptive Block Size Upgrade

On Saturday, March 2, the valuation of bitcoin cash witnessed a significant increase, climbing over 40% within a 24-hour span to reach a peak of $451 each. This upward trend is attributed to the anticipated halving event, set to happen in 16 days, and the forthcoming 2024 upgrade, which is expected to implement an adaptive […]

On Saturday, March 2, the valuation of bitcoin cash witnessed a significant increase, climbing over 40% within a 24-hour span to reach a peak of $451 each. This upward trend is attributed to the anticipated halving event, set to happen in 16 days, and the forthcoming 2024 upgrade, which is expected to implement an adaptive […]

Source link

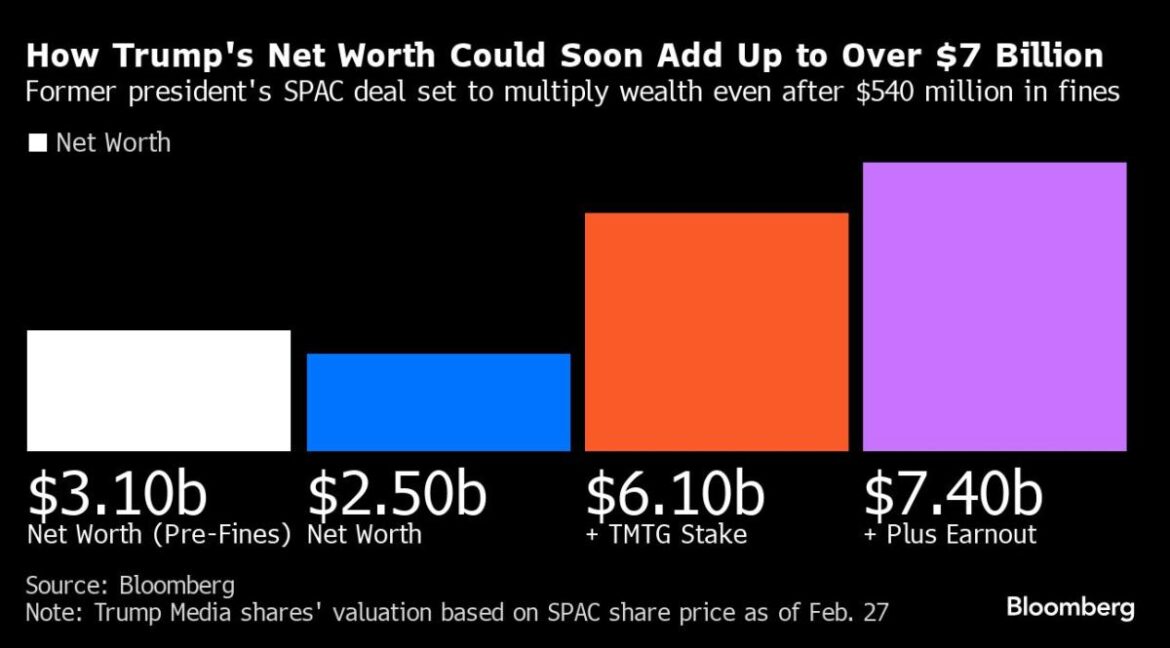

(Bloomberg) — On the financial front, the news has appeared dire for former president Donald Trump this year. Within a span of just a month, two judges in two separate cases ordered him to pay about $540 million in total — a sum so great that pundits have speculated it could erode his campaign finances.

Most Read from Bloomberg

What’s gotten far less attention, though, is this: A frenetic rally in a stock tied to Trump Media & Technology Group — which operates the Truth Social platform he posts on daily — has minted a nearly $4 billion windfall for him.

There are any number of caveats to this figure, including how it’s only a paper profit for now that he’ll have to wait months to monetize, and yet the stock’s surge is a potentially huge financial boost for a billionaire candidate suddenly short on cash.

The type of transaction — known as a de-SPAC or blank-check deal — that would hand Trump this new-found wealth is a complex one that briefly became popular on Wall Street during the stock mania unleashed by pandemic-era stimulus. In this particular deal, Truth Social’s owner would enter the stock market by merging with a publicly traded company called Digital World Acquisition Corp.

Shares of DWAC, as the company is known, have soared 161% this year in anticipation of the merger, which has been green-lit by the Securities and Exchange Commission and is now slated to go to a shareholder vote next month. If it’s approved, Trump will hold a greater than 58% stake. At DWAC’s current price — it closed Tuesday at $45.63 per share — that stake is worth $3.6 billion. Trump could get even more — close to an additional $1.3 billion worth, if the shares meet certain performance targets.

It seems improbable to many analysts that a stake in a money-losing social media company with little revenue and a fraction of its rivals’ user bases could potentially more than double Trump’s net worth. But as Trump began to steamroll his Republican rivals in January, setting up a likely rematch with President Joe Biden in November, retail investors frantically bid DWAC shares up. And when a group on Wall Street known as momentum traders joined the buying frenzy, the conditions for an epic rally were in place. In just six days, the stock jumped 200%.

“This is a meme stock, it’s not the type of thing where you bust out P/E ratios — you can throw that out the window,” said Matthew Tuttle, the chief executive and chief investment officer at Tuttle Capital Management. “DWAC has now become the de facto way to bet on or against Trump,” he added.

But if Trump’s rebound carries him back to the White House — and many polls currently make him the favorite to win — there could be value, in theory, at least, in owning a cut of the mouthpiece that will carry his message.

“The fundamental bull case is that he confines his tweets to the Truth Social platform, which means if you want to see them or interact with them, you need to sign up as well, making advertising all the more profitable,” Tuttle said.

Penalties and Fees

While Trump’s windfall would more than cover the penalties and legal fees he faces — he is appealing New York state’s $454 million civil fraud verdict — he would need to wait at least five months before cashing in shares, unless the company files to expedite that timing.

“He needs the money but he can’t sell too much at once without risking tanking the stock,” said Usha Rodrigues, a professor at the University of Georgia School of Law. “Once the lockup is expired, he could use the shares as collateral for loans in order to access cash without selling the shares.”

And it’s unlikely a bank would lend him a large sum of money against the locked-up shares, according to industry watchers like University of Florida finance professor Jay Ritter.

Read More: Trump’s $540 Million Court Loss Tests His ‘King of Debt’ Claim

Representatives for DWAC, Trump Media and the Trump Organization didn’t immediately respond to requests for comment.

Even the so-called earnout would more than cover it. After the deal closes, if the stock trades above $17.50 for 20 of 30 days, Trump Media holders would be entitled to receive as many as an additional 40 million shares filings show — with the majority earmarked for Trump.

A more troubling question for Trump is whether shareholders will keep the faith for more than five months after the merger is complete. As recently as April, Trump assigned the company a $5 million to $25 million value in a financial disclosure filed with the Federal Election Commission, a fraction of its valuation in the SPAC deal terms as well as in the market.

Read More: Trump Fuels Meme-Like Rallies in Stocks Tied to 2024 Bid

The business has struggled, with Trump Media losing $49 million in the nine months through September while generating just $3.4 million in revenue, according to regulatory filings. As such, the company has warned that it may run out of cash without the merger, filings show.

Trump Media “hasn’t been able to turn the corner and it’s not clear how the company is going to succeed in monetizing its business,” said Ritter.

The deal’s anticipated completion is a feat in itself after more than two years of starts and stops. Skeptics questioned whether Trump Media’s merger could clear a litany of shareholder votes, as well as investigations from the Justice Department and the SEC.

After the completion and during the lockup, the share price – and Trump’s potential windfall – will hinge on how successful he is politically, industry watchers agree. Trump Media has been aiming to “rival the liberal media consortium” and fight against big tech companies like Meta Platforms Inc., Netflix Inc., and Elon Musk’s X.

Shareholders may even choose to hold onto their shares in the hope that because of Trump Media’s alignment with his campaign message, Trump would have a strong incentive not to add Truth Social to the long list of ventures he’s endorsed, then exited from.

“The majority of people who are buying and holding this thing are Trump supporters, “ Tuttle said. “I don’t think it’d be smart for him to entirely blow out of his position and leave them holding the bag.”

–With assistance from Tom Maloney.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Bitget, a top 15 cryptocurrency exchange, is seeking to expand its operations in Latin America, a market traditionally dominated by incumbents like Binance and Bitso. Maximiliano Hinz, Bitget’s growth director for Latam, believes that the exchange can differentiate by focusing on serving beginner investors with tools like its copy-trading feature. Bitget Aims to Gain Traction […]

Bitget, a top 15 cryptocurrency exchange, is seeking to expand its operations in Latin America, a market traditionally dominated by incumbents like Binance and Bitso. Maximiliano Hinz, Bitget’s growth director for Latam, believes that the exchange can differentiate by focusing on serving beginner investors with tools like its copy-trading feature. Bitget Aims to Gain Traction […]

Source link

In the dynamic realm of cryptocurrencies, Avalanche (AVAX) is causing a stir, riding the waves of a recovery rally that commenced last month. As the broader spectrum of alternative coins experiences a resurgence, AVAX stands at the forefront, ready to extend its ascent, with whispers in the market hinting at a potential surge towards the coveted $50 mark.

Avalanche Booms: Durango Upgrade Ushers Growth

Presently, the AVAX price confidently stands above the 50% retracement level at $39.91, signaling a robust support level within the market range spanning from $28.00 to $49. Technical indicators add to the positive sentiment, with the Simple Moving Averages (SMA) gracefully trending upwards. This suggests that the path of least resistance favors continued price appreciation, creating an optimistic atmosphere among market observers.

This is a big opportunity for Avalanche builders and validators to learn all the ins and outs of Durango 🌀

Going live right here on X or on YouTube this Wed. at 12pm ET 👇

— Avalanche 🔺 (@avax) February 12, 2024

The buzz surrounding AVAX reaches a crescendo as the eagerly anticipated AVAX Durango upgrade gears up for implementation on the 13th of February. The community’s anticipation has been steadily building since the pre-release of the upgrade’s code on February 2.

This upgrade brings forth a suite of exciting features, including the Avalanche Warp Messaging (AWM) functionality. The AWM is poised to revolutionize communication capabilities on-chain and across chains, promising a more interconnected and resilient network. This enhancement is set to facilitate seamless interoperability of protocols on the ever-evolving Avalanche platform.

AVAX currently trading at $41.31 on the daily chart: TradingView.com

Market analysts, fueled by the palpable excitement, predict that the mounting buying pressure could propel a substantial 20% surge, potentially propelling AVAX to $49.95, effectively filling the current market range.

In a more bullish scenario, the gains might extend to $54.92, marking levels not witnessed since the bloom of May 2022 and showcasing an impressive 35% climb from current valuation.

AVAX social dominance volume. Source: Santiment

AVAX: On-Chain Metrics Signal Sustained Growth

Examining the coin’s on-chain metrics, an additional layer of support for this positive outlook can be seen. Both social dominance and social volume metrics for AVAX have gracefully eased, painting a picture of serenity in the market. This tranquility often lays the foundation for sustained price growth, steering clear of premature topping out fueled by heightened volatility from mainstream attention.

As the imminent AVAX Durango upgrade takes center stage, traders and investors are on the edge of their seats, eagerly awaiting the potential surge that might unfold. With technical indicators, on-chain metrics, and market sentiment aligning favorably for AVAX, the cryptocurrency seems poised to continue its upward trajectory, potentially scaling new heights in the unfolding weeks.

Featured image from Pixabay, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Since the Shiba Inu (SHIB) reached a local high of $0.00001193 on December 16 last year, the price has been in a downtrend characterized by a series of lower highs and lower lows. However, renowned crypto analyst Ali Martinez has now discovered a rare bullish signal that could end this trend.

Shiba Inu Price Flashes Rare Bullish Signal

A recent analysis by Martinez (@ali_charts) indicates a potential bullish movement for Shiba Inu (SHIB) based on the TD Sequential indicator. Martinez’s chart, shared via X (formerly Twitter), shows SHIB in a 3-day timeframe against Tether (USDT) on the Binance exchange.

The TD Sequential indicator is a tool used to identify potential price points where an asset’s price is likely to experience an inflection – either a reversal or a continuation of the current trend. On Martinez’s chart, the indicator has presented a “buy signal,” specifically showing a green nine. This suggests the possibility that the current bearish trend could pause, and a bullish trend may ensue.

The chart exhibits a series of green and red candlesticks representing the price movements of SHIB over time. Green candlesticks indicate periods where the closing price was higher than the opening price, while red candlesticks show the opposite. The presence of a green nine suggests that after a succession of price declines over nine periods, the trend may be exhausted, and buyers may soon enter the market.

Martinez points out that the SHIB price is currently hovering around a Fibonacci retracement level of 0.5, at approximately $0.009281. Fibonacci retracement levels are horizontal lines that indicate where possible support and resistance levels might be located.

These are critical because they can indicate areas where the price of an asset may experience pullbacks or continuations. The chart also shows Fibonacci retracement levels at 0.236 ($0.010696), 0.382 ($0.009913), 0.618 ($0.008648), and 0.786 ($0.007747).

The chart analysis by Martinez highlights the potential for SHIB to rise to the $0.010 mark or even extend gains toward $0.011. These price levels are significant as they align with the 0.236 and 0.382 Fibonacci retracement levels, respectively, which may act as resistance points. A breach above these levels could validate the bullish signal provided by the TD Sequential indicator.

Marinez stated, “The TD Sequential indicator has proven remarkably precise in predicting Shiba Inu price movements. Currently, it’s flashing a buy signal, hinting that SHIB could be gearing up for an upswing. Keep an eye out, as SHIB could climb to $0.010 or potentially even reach $0.011!”

More Confirmation Needed

As the crypto market watches closely, the bullish signal for Shiba Inu at this juncture is noteworthy. However, as with any market prediction, it’s important to note that technical indicators are not infallible and should be considered as part of a broader strategy that includes fundamental analysis, market sentiment, and other technical indicators.

A look at the 4-hour chart of SHIB/USD shows that the price is still in a descending parallel trend channel. Yesterday, Tuesday, the Shiba Inu price was again rejected at the top of the trend channel. A breakout (at around $0.00000930) could be crucial to reinforce the TD9 signal.

Featured image created with DALL·E, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Shiba Inu marketing lead Lucie has ignited the community’s excitement with a teaser about the project’s future. On X, the platform that has taken the place of Twitter, Lucie dropped a tantalizing hint about what’s to come for the Shiba Inu ecosystem. Her message, shrouded in mystery, suggests a bullish future while details remain undisclosed.

Lucie teased, “I can’t disclose specifics, but if you possess basic blockchain skills and understand the Shibarium process, you can anticipate what’s ahead.” Lucie continued by highlighting the interest from significant investors: “Big investors are now putting their money into the next big thing.” She also shared an intriguing viewpoint on investment, “A fun fact: real art is finding the gem before anyone else.”

She also expressed her confidence in the project’s trajectory, emphasizing the commitment of the team: “I believe in our hard work and persistence; winning is the only option.” She mentioned Shibarium (BONE), LEASH and SHIB in reference to the tokens within the Shiba Inu ecosystem, suggesting that one or more of these tokens will be central to what’s coming next.

In conclusion to her message, Lucie reminded the community of the personal nature of investment goals and the relationship between investment and potential returns: “But remember, each of us has different goals, and how much you invest determines how much profit you collect.”

She encouraged realistic goal setting and wished everyone luck: “Set your bar realistically, and let’s see how it goes. Good luck to everyone on their journey with Shiba Ecosystem or any other project!”

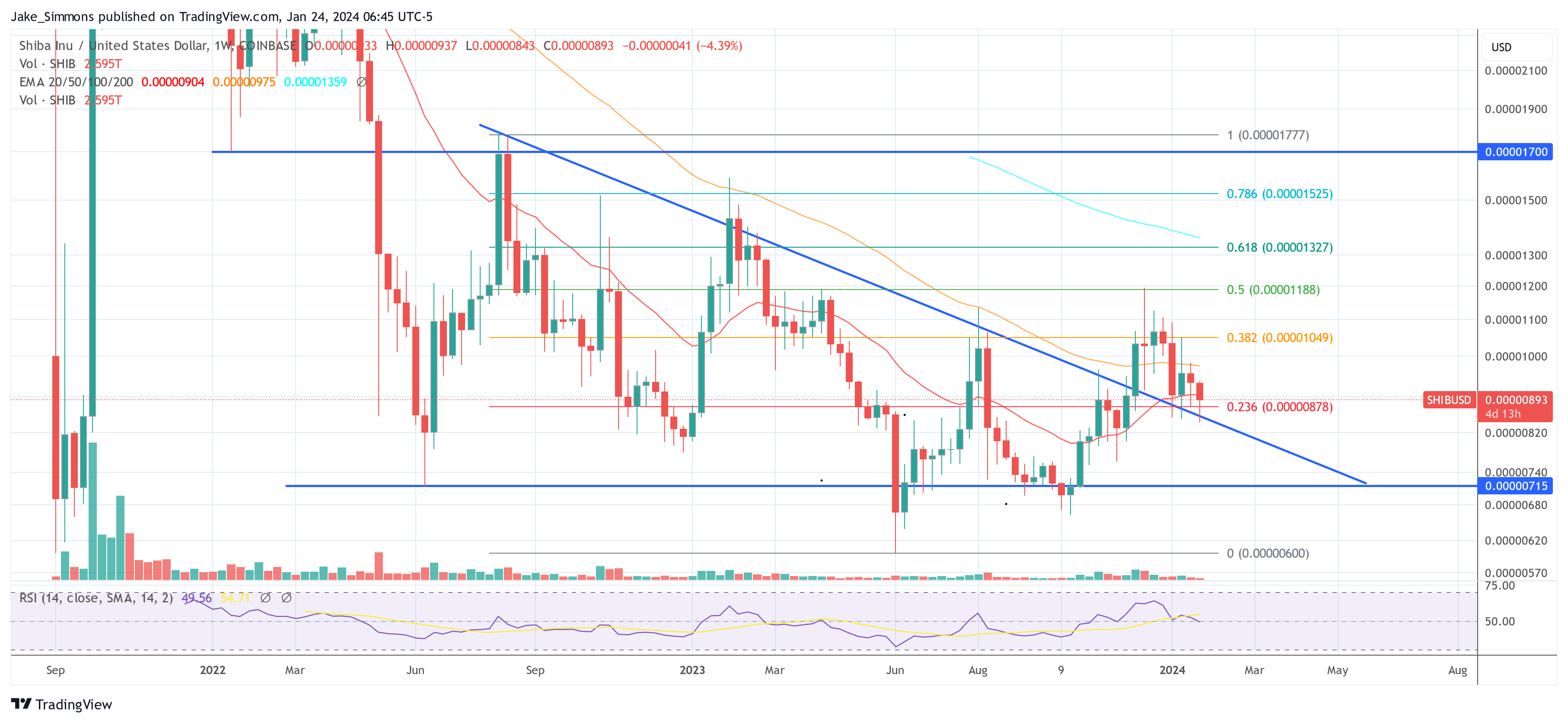

Shiba Inu Price Holds Key Support

Transitioning to the technical analysis of Shiba Inu’s price action, the weekly chart reveals a number of critical insights. The chart below displays the SHIB/USD pair on a weekly timeframe, offering a broad view of market sentiment and price trends.

The price is currently hovering above a crucial support level, as indicated by the recent candles sitting atop the Fibonacci retracement level of 0.236, priced at $0.00000878. This zone is pivotal as it represents a potential reversal area where buyers have previously stepped in.

The descending trend line, drawn from the highs of August 2022, was broken in December 2023, suggesting a shift in the market structure. However, the price has since retested this line, now acting as support.

The EMA (Exponential Moving Average) lines — 20 (red) and 50 (orange) — are of particular interest. Within the last three weeks, SHIB couldn’t close above the EMA50 ($0.00000975) and is currently trading below the EMA50 ($0.00000904). A weekly close above the latter could be a bullish sign.

Notably, the price has been making lower highs, indicative of a downtrend, but the recent support hold above the blue trend line and the 0.236 Fib could be a sign of potential bullish momentum.

The volume profile shows no significant spikes, indicating a lack of strong buying or selling pressure at the current levels. The RSI (Relative Strength Index) sits just above the midline at 54.71, which does not denote an overbought or oversold market, aligning with the consolidation narrative.

Key resistance levels to watch are the Fibonacci levels of 0.382 ($0.00001049) and 0.5 ($0.00001188). A break above these could signal a stronger recovery. Conversely, if the price falls below the current support, the next level to watch would be $0.0000715.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.