A failed business left a family with debts to the IRS, the Small Business Administration and others.

Source link

failed

Why did Tim Cook’s pay package hold up in court while Elon’s failed?

Just a week after Elon Musk’s $55 billion Tesla payday was struck down by a Delaware judge, a New York court dismissed a challenge to Apple CEO Tim Cook’s compensation package, which clocked in at under $100 million. Some coincidence.

At face value, the two cases seem to have a lot in common. Both were shareholder suits waged against some of the highest-paid superstar tech CEOs in the world. And both were filed amid a backdrop of increased public scrutiny over executive compensation in recent years, which is near all-time highs across S&P 500 companies.

But for all their similarities, from a legal standpoint the two cases are apples and oranges—and Cook was always going to stand a better chance of holding on to his paycheck.

Elon Musk’s $55 billion compensation package at Tesla made headlines last month after Delaware chancellor Kathaleen McCormick ruled in favor of a shareholder who argued that Tesla was paying its CEO an unfairly high amount with the moonshot grant. Plaintiff Richard Tornetta argued that because Musk wields so much power at Tesla and maintains close relationships with his board members, the supposedly independent board of directors’ vote approving his massive pay scheme was anything but.

“Chancellor McCormick found that the process for setting Elon Musk’s pay was essentially controlled by Elon Musk,” said Tulane University law professor Ann M. Lipton in an interview with Fortune. “The board didn’t engage in any kind of pushback or real bargaining.”

In response, Musk has threatened to relocate Tesla from Delaware (where almost 70% of Fortune 500 companies are incorporated) to Texas, where a more favorable political climate could leave him less exposed to these types of challenges.

While the Musk case was focused on a broad, more abstract legal question related to the Tesla board of directors’ degree of independence, the Cook case resolved yesterday was much simpler.

“The question before Delaware [in the Musk case] was simply, ‘Was the pay substantively unfair?’ whereas the question in the Tim Cook case was solely, ‘Was the proxy statement misleading?’” said Lipton.

The Teamsters’ pension fund sued Apple last year, arguing that the company had misled investors by misrepresenting Cook’s 2021 and 2022 pay in its proxy statements and paying him more than it had initially proposed.

Because Cook and other Apple executives are primarily paid in equity known as RSUs, the company enlists financial models to estimate what Cook’s actual pay will be for shareholders’ approval each year.

(For CEOs, being compensated primarily with stock isn’t uncommon. Mark Zuckerberg famously earns just $1 in annual salary, but he’s made billions through Meta stock grants included in his compensation package. The Economic Policy Institute found in a report last year that stock-related pay accounts for over 80% of CEO compensation.)

The pension fund that sued Cook argued that Apple misrepresented its CEO’s actual compensation package by downplaying the value of his equity. Cook and other Apple executives netted over $90 million in compensation for 2021 and 2022, higher than the $77.5 million estimate the company initially asked shareholders to vote on for approval.

(Both of those figures are well below Cook’s current annual compensation; at his own request, the Apple CEO took a 40% pay cut last year. That change was approved by shareholders and the Apple board’s compensation committee, which counts former Vice President Al Gore as one of its members.)

The plaintiffs claimed that Apple used an unusual financial model to artificially deflate Cook’s pay estimate, and also buried the compensation tables in a drab, gray section of the proxy statement, where shareholders would be less likely to notice it before casting their Say-on-Pay votes. The court didn’t buy it.

“What happened with Tim Cook is very common in public companies,” said Marc Hodak, partner at executive compensation consultancy Farient Advisors. “They award performance shares based on the face value of the stock. And each of those performance share units has a market value that’s higher than the face value stock at the time of grant.”

One key difference between the two cases was the size of the contested pay package. Musk’s $55 billion award from Tesla was part of the largest compensation plan in corporate history. While Cook’s $100 million annual pay is by no means a small sum, it’s on par with his peers. In fact, Apple uses a group of its competitors, including Meta, Netflix, Visa, and Cisco, to benchmark its executives’ compensation. (Notably, it added Tesla to that peer group last year.)

“I don’t have any question that the size and scale of [Musk’s] pay package was a driver, both in terms of the litigation and the decision that we saw,” said Hodak. “[$55 billion] is automatically going to attract an unusual amount of scrutiny.”

Taken together, these two cases do seem to hint at a broader trend toward greater scrutiny of bloated CEO pay—but Lipton advised against reading the tea leaves prematurely.

“Elon Musk is beating this drum that everyone should leave Delaware, to suggest that somehow this is a trend,” said Lipton. “I think this is an Elon Musk problem. That Tim Cook thing, it was a different law. It was a different argument.”

Representatives from Apple did not immediately respond to a request for comment.

This story was originally featured on Fortune.com

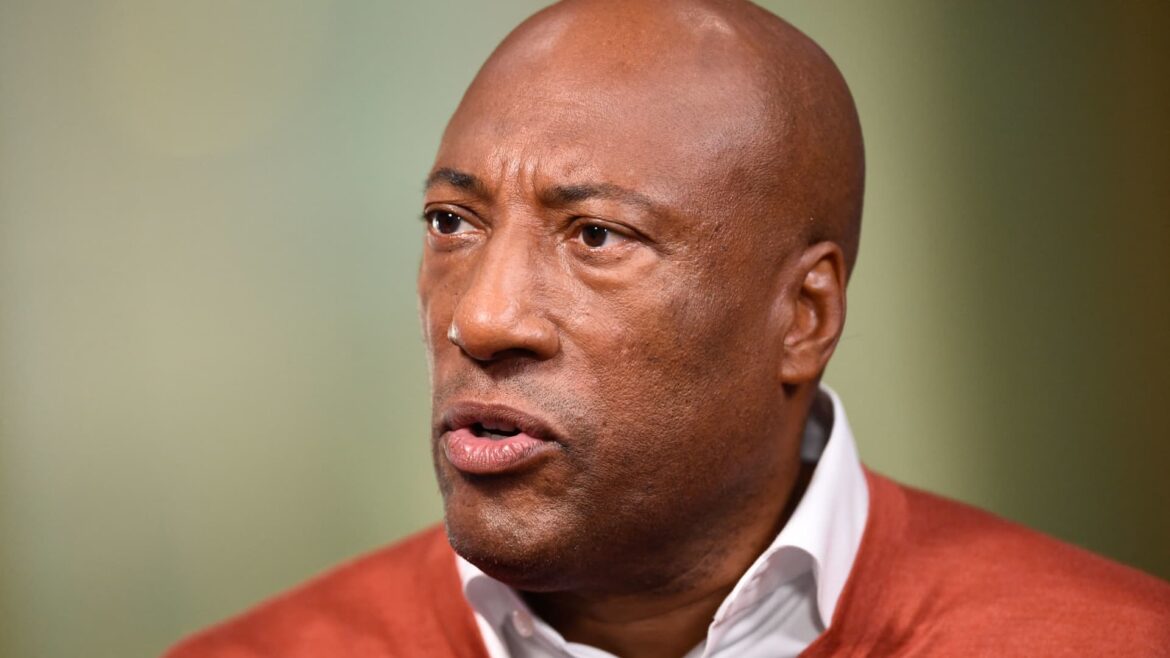

Byron Allen, founder, chairman and CEO of the Allen Media Group, speaks during the Milken Institute Global Conference in Beverly Hills, California, on May 2, 2022.

Patrick T. Fallon | AFP | Getty Images

Byron Allen, the media mogul offering $14 billion for Paramount Global, told CNBC on Wednesday that he has the money to finance a deal, despite skepticism around his deal-making.

“We have more than enough capital available to us. The real challenge is certainty of close,” Allen said.

“This deal lives or dies at the [Federal Communications Commission],” he added.

Allen, the founder and CEO of a media group that owns dozens of television networks across the U.S., offered $30 billion for all of Paramount’s outstanding shares, including debt and equity.

The Allen Media Group said in a statement the offer “is the best solution for all of the Paramount Global shareholders, and the bid should be taken seriously and pursued.”

Allen has a long history of making offers on major media assets. But bidding doesn’t mean buying.

His recent media buyout offers have failed to materialize into sales. The Wall Street Journal reported Wednesday that Allen last year offered $18.5 billion for Paramount, and was rejected.

Allen told CNBC he hasn’t received a response from Paramount to his most recent offer.

Shari Redstone, who controls Paramount through her company National Amusements, has been open to deal-making in recent months in an effort to either merge or sell the company that’s home to brands such as CBS, Showtime, Nickelodeon and its namesake movie studio.

CNBC reported last week that David Ellison’s Skydance Media and its backers were exploring a deal to take Paramount Pictures or the entire media company private.

In December, CNBC also reported Paramount had entered preliminary talks with Warner Bros. Discovery to merge the two media giants in a deal that could have faced regulatory hurdles.

Allen’s bid for Paramount is the most ambitious of the deals the media mogul has tried to complete. Here are some of his recent deal attempts:

- In December, Allen renewed an attempt to buy Paramount-owned Black Entertainment Television and VH1 for a combined $3.5 billion.

- In November, Bloomberg reported, he was weighing a bid to buy television stations from E.W. Scripps.

- In September, Allen made an offer to buy ABC and several other networks from Disney for $10 billion after Disney CEO Bob Iger opened the door to selling the company’s linear TV assets.

- In 2022, he explored a bid to buy the National Football League’s Washington Commanders.

- In March 2020, he offered $8.5 billion to buy television stations owner Tegna.

Allen told CNBC via phone Wednesday that he lost out on several deals because ownership changed course on wanting to sell. He highlighted his acquisition of The Weather Channel in 2018 for a reported $300 million and broadly defended his track record, invoking baseball Hall of Famer Babe Ruth.

“Let’s talk about Babe Ruth. Does he go down as one of the greatest baseball players of all time? And he struck out half the time,” Allen said. In actuality, Ruth struck out 1,300 times in 8,399 at bats — a 15% strikeout rate.

Allen’s bids for linear TV assets come as the media landscape shifts away from traditional TV toward streaming. Almost all the major media companies have launched services to compete with streaming giant Netflix.

Paramount reported in its third-quarter earnings report that its streaming platform, Paramount+, increased its subscriber count to 63 million. However, Paramount’s direct-to-consumer products have failed to turn a profit like Netflix has. The division reported adjusted losses of $238 million for the third quarter.

Paramount will release its fourth-quarter earnings Feb. 28.

Allen told CNBC he wants to buy Paramount for its linear networks, what he says is the most challenging part of the company.

“These are still great businesses if you know how to manage them properly,” Allen said.

Shares of Paramount were up almost 7% Wednesday and have risen more than 35% in the past three months as talks of a deal have ramped up. However, the stock is more than 40% off its 52-week high of $25.93 a share reached in February 2023.

— CNBC’s Alex Sherman and Julia Boorstin contributed to this report.

Don’t miss these stories from CNBC PRO:

Failed ‘$175 M’ real estate token raise draws ire of Texas regulators

The Texas State Securities Board has accused a network of companies under the “GS” brand and operating from Germany of fraudulent activities “tied to digital assets, investments in a staking pool in a proprietary metaverse.” The network of companies is controlled by Josip Dortmund Heit.

As described by regulators on Nov. 16, respondents GS Partners, GS Smart Finance and GS Wealth allegedly held three rounds of metaverse property sales beginning September 2021. At the time, investors were informed that they could purchase XLT Vouchers, or BNB Chain tokens representing ownership of one square inch of a unit in the company’s G999 Tower metaverse, at 9.63 USDT (USDT) per voucher. However, the token rapidly lost its value, to less than 0.0000049 USDT apiece on decentralized exchange PancakeSwap, after the respondents failed to reach its $175 million raise target for the offering.

“Respondents have not been registered with the Securities Commissioner as dealers or agents at any time material hereto.”

Regulators allege that other investment products created by GSB — such as its Lydian World metaverse tokens, gold tokens, G999 coin and Elemental Certificates — also constituted unregistered security offerings. The Texas State Securities Board has filed an emergency enforcement action for the GSB group of companies to cease and desist from such activities in the state.

On Aug. 15, the Ontario Securities Commission issued a warning that GS Partners was not registered to do business in the Canadian province of Ontario. Previous warnings regarding the firm were also published by securities regulators in the Canadian provinces of Saskatchewan, British Columbia, Alberta and Quebec.

Related: Texas lawmaker introduces resolution to protect Bitcoin miners and HODLers

Ethereum price is trading at roughly $1,550 after failing to get back above $2,000 throughout the entirety of 2023 thus far. Increasingly higher lows during the year and a horizontal resistance zone had formed an ascending triangle – a potentially bullish chart pattern.

This pattern, however, is possibly failing. A busted pattern target could send the price per ETH sub-$1,000.

Is the bullish chart pattern breaking down? | ETHUSD on TradingView.com

Ethereum Ascending Triangle Begins Breakdown: Target $700

Ethereum put in its bear market low back in June of 2022 while Bitcoin and other coins kept falling through the end of the year. Despite the early lead in a bear market recovery, ETH has underperformed against BTC in 2023. Now it is at risk of falling to a new low with a target of deep below $1,000 if a presumed bullish pattern breaks down instead of up.

ETHUSD has been trading in what appears to be a textbook ascending triangle pattern since its 2022 local low. A series of increasingly higher highs has created an upward slowing trend line. A horizontal resistance zone across $2,000 has kept price action at bay. Volume has been trending downward throughout the course of the pattern. Price is at roughly two-thirds to the triangle apex.

Ether even had positive news at its back: the launch of the first Ethereum Futures ETFs. Yet it has failed to produce any meaningful upside, and is now trying to move back down causing the bullish pattern to bust. If the pattern does break downward, it would have a target of around $700 per ETH based on the measure rule.

Or is the a bearish barrier triangle anyway? | ETHUSD on TradingView.com

Elliott Wave Explained: Golden Fibonacci Extension Targets $300 ETH

Although the ascending triangle is considered a bullish chart pattern, it only has a roughly 63% probability of breaking out, per the Encyclopedia of Chart Patterns by Thomas Bulkowski. The remaining 37% of the time break down. But technical analysis is a broad study. An ascending triangle to one trader, could be barrier triangle to another.

A barrier triangle is simply an ascending or descending triangle as defined by Elliott Wave Principle. In Elliott Wave Principle, triangles are especially telling. They only appear before the final move in a sequence. Because Elliott Wave labels waves with the trend as 1 through 5, triangles are corrective and appear only in the wave 4 place – just prior to wave 5 which ends the sequence.

In a bear market, corrective structures are labeled ABC. Triangles themselves can appear during a B wave, which once again, is ahead of the final move in the ABC count. C wave targets are often found by projecting the 1.618 Fibonacci ratio from the A wave. This makes the target of the busted pattern somewhere around $300 per ETH. Between the measure rule and the Fibonacci extension target, Ethereum could be facing sub-$1,000 prices in the future.

Could Ether fall sub-$1000? | ETHUSD on TradingView.com

Gemini’s Cameron Winklevoss slams DCG for denying involvement in failed Earn program

Gemini co-founder Cameron Winklevoss criticized Digital Currency Group (DCG) on Aug. 11 as part of an ongoing dispute between the two firms.

On Twitter, Winklevoss said:

“[DCG’s] response [to Gemini’s lawsuit] … is filled with carefully crafted statements that are incredibly revealing … It completely ignores the reality of the situation in a comical way.”

Gemini once offered its Earn product in partnership with Genesis, a subsidiary of DCG. Genesis halted withdrawals in November 2022 and later filed for bankruptcy; Gemini also halted Earn withdrawals in November as a result of the broader Genesis halt.

Later, in July 2023, Gemini filed a lawsuit against DCG and its CEO Barry Silbert alleging that the Earn offer was built on fraud and deception. On Aug. 10, DCG filed a response to Gemini in which it accused Gemini of attempting to avoid responsibility for the failure of Earn. DCG’s latest filing also serves as a motion to dismiss Genesis’ case.

Now, Winklevoss has contested several statements within DCG’s filing and motion to dismiss. On Aug. 11, Winklevoss highlighted DCG’s claim that it “had virtually nothing to do with the Gemini Earn program.” DCG argued in its latest filing that it and other Genesis affiliates were excluded from liability under earlier agreements around Earn.

Winklevoss argued that this denial — seemingly only a partial one — is in fact a “direct admission” that DCG played some role in the Gemini Earn program.

Gemini says DCG misrepresented $1.1B of finances

DCG also claimed that it had no duty to Gemini to correct statements that were made by its subsidiary, Genesis. Winklevoss contested that claim, writing:

“When a company you own [Genesis] says you [DCG] wrote a $1.1 billion dollar check that you know you didn’t write, yes, you have a duty to correct this.”

That statement concerns the fact that DCG owes $1.1 billion to Genesis to cover Genesis’ loan with the failed crypto firm Three Arrows Capital (3AC). This issue in part led Genesis to freeze withdrawals in November, which in turn led to a halt of Gemini Earn. Much of Gemini’s case revolves around the allegation that DCG did not accurately represent Genesis’ financial situation, including the status of the above loan.

Winklevoss concluded by alleging that DCG’s legal defenses were created “in a vacuum” and accused the company of attempting to evade responsibility. He reiterated that the two companies will go to court over the issue.

Gemini’s ongoing lawsuit against DCG is just one part of legal proceedings involving the two firms. Genesis is also engaged with its broader bankruptcy case, where it owes over $3.5 billion to creditors including Gemini and FTX.

The U.S. SEC also sued Gemini and Genesis over the failed Earn product in January. As of May, both companies sought for those charges to be dismissed. Various class action lawsuits related to the failed product are also underway.

The post Gemini’s Cameron Winklevoss slams DCG for denying involvement in failed Earn program appeared first on CryptoSlate.

Foxconn failed India chip effort shows how hard it is for new players

This month, Foxconn pulled out of its joint venture with Vedanta. The two sides “mutually agreed to part ways,” Foxconn said in a statement at the time.

Sopa Images | Lightrocket | Getty Images

Foxconn is best known as the main assembler of Apple’s iPhones. But in last couple of years, the Taiwanese firm has made a push into semiconductors, betting that the rise of technologies like artificial intelligence will boost demand for these chips.

But Foxconn’s semiconductor foray has had a tough start, highlighting the difficulty for new players to enter a market dominated by established firms with huge experience and a highly intricate supply chain.

“The industry presents newcomers with high barriers to entry, mainly high levels of capital intensity and access to coveted intellectual property,” Gabriel Perez, ICT analyst at BMI, a unit at Fitch Group, told CNBC via email.

“Established players such as TSMC, Samsung or Micron count with several decades of R&D (research and development), process engineering and trillions of dollars in investment to reach their current capabilities.”

Why is Foxconn getting into semiconductors?

Foxconn, officially known as Hon Hai Technology Group, is a contract electronics manufacturer that assembles consumer products like iPhones. But in the last two years, it has stepped up its presence in semiconductors.

In May 2021, it formed a joint venture with Yageo Corporation, which makes various types of electronic components. That same year, Foxconn bought a chip plant from Taiwanese chipmaker Macronix.

The biggest ramp-up in effort came last year when Foxconn agreed with Indian metals-to-oil conglomerate Vedanta to set up a semiconductor and display production plant in India as part of a $19.5 billion joint venture.

Read more about tech and crypto from CNBC Pro

Neil Shah, vice president of research at Counterpoint Research, said Foxconn’s push into semiconductors is about diversifying its business, and the company’s decision to launch an electric car unit is part of that plan. Its aim is to become a “one stop shop” for electronics and automotive companies, Shah said.

If Foxconn could assemble electronics and manufacture chips, it would be a very unique and competitive business.

Why India?

Foxconn looked to India for its joint venture with Vedanta because the country’s government is looking to boost its domestic semiconductor industry and bring manufacturing on shore.

“Foxconn’s decision to establish a JV in India responds to two key trends – one of them being the market’s growing role as a consumer electronics manufacturing hub, the second one being India’s ambitions – mirroring other major markets such as the US, the EU and Mainland China – to develop its domestic semiconductor industry through public subsidies and regulatory incentives,” BMI’s Perez said.

What went wrong for Foxconn?

This month, Foxconn pulled out of its joint venture with Vedanta. The two sides “mutually agreed to part ways,” Foxconn said in a statement at the time.

“There was recognition from both sides that the project was not moving fast enough, there were challenging gaps we were not able to smoothly overcome, as well as external issues unrelated to the project,” Foxconn said.

Deadlocked talks with European chipmaker STMicroelectronics, which was the technology partner for the project, was one major reason for the venture’s failure, Reuters reported this month.

Foxconn and Vedanta wanted to license the technology from STMicro and India wanted the firm to have a stake in the joint venture, but the European chipmaker did not, Reuters reported.

It’s hard to break into chipmaking

Foxconn’s hurdles point to a broader issue — it’s hard for newcomers to get into semiconductor manufacturing.

The manufacturing of chips is dominated by one player — Taiwan Semiconductor Manufacturing Company, better known as TSMC — which has a 59% market share in the foundry segment, according to Counterpoint Research.

TSMC doesn’t design its own chips. Instead, it makes these components for other companies like Apple. TSMC has had more than two decades of experience and billions of dollars of investment to get to where it is.

TSMC also relies on a complex supply chain of companies that make critical tools to allow it to manufacture the most advanced chips in the world.

Foxconn and Vedanta’s effort appeared to rely heavily on STMicro, but once the European company bailed, the joint venture was without much expertise in semiconductors.

“Both companies … lacked the core competency of manufacturing a chip,” Counterpoint Research’s Shah said, adding that they were dependent on third-party technology and intellectual property.

Foxconn’s attempts to crack the semiconductor space highlight how difficult it is for a new entrant to do so — even for a $47.9 billion giant.

“The semiconductor market is highly concentrated with few players which have taken more than two decades to evolve to this point,” Shah said, adding that there are high barriers to entry, such as large amounts of investment and specialized labor.

“On an average, it takes more than two decades to be at the level of skill and scale to be a successful semiconductor manufacturing (fab) company.”

Senators make headway on clawing back pay from failed banks’ CEOs, as key committee advances bill

U.S. lawmakers made further progress Wednesday in a bipartisan push to take back pay from executives at failed banks, as the Senate Banking Committee advanced a bill that would permit regulators to claw back compensation received in the two years before a failure.

The measure — dubbed the Recoup Act — was rolled out last week by the committee’s chairman, Democratic Sen. Sherrod Brown of Ohio, and Republican Sen. Tim Scott of South Carolina, a presidential candidate. It was backed by the Senate Banking Committee in a 21-2 vote on Wednesday.

Ahead of Wednesday’s vote, Capital Alpha Partners analyst Ian Katz suggested in a note that the bill’s backers had “some negotiating left to do with Sen. Elizabeth Warren,” as the Massachusetts Democrat “has pushed for a harsher bill.”

The Brown-Scott measure then ended up getting amended, and Warren voted for it, describing the bill as a “reasonable compromise.”

Warren’s bill, called the Failed Bank Executives Clawback Act, would require that regulators take back all or part of the compensation that execs received in the three years before their bank’s failure. It had drawn support from Republicans such as Ohio Sen. J.D. Vance and Missouri Sen. Josh Hawley.

See: Elizabeth Warren, J.D. Vance team up to claw back failed banker pay

The Recoup Act’s prospects in the Republican-run House aren’t clear, but President Joe Biden has expressed support for clawbacks. He urged Congress in a March speech to make it easier for regulators to take back compensation from execs after the failures of Silicon Valley Bank

SIVBQ,

and New York’s Signature Bank

SBNY,

A bill aimed at bankers’ pay has a chance of becoming law, but it isn’t likely to rock the sector

KBE,

according to Capital Alpha’s Katz.

“While this is headline-grabbing legislation and has the potential to pass both chambers of Congress and become law, we don’t expect it to change much in the way banks operate, since no bank executive goes into the job expecting his/her bank to fail,” the analyst said.

Now read: Justice Department to weigh updating banking competition rules