‘When I married my husband, he sold his house, which was valued at about $100,000 more than mine, but he had no equity in it.’

Source link

Fair

Crypto Analyst Says Bitcoin Is Heavily Undervalued Despite ATH, What’s The Fair Value?

Despite Bitcoin recently hitting a new all-time high (ATH) of over $70,000, crypto analyst Michaël van de Poppe believes that there is still more room for significant moves to the upside. Interestingly, he also expects that this bull cycle will be one like no other.

Bitcoin Still Heavily Undervalued

Michaël van de Poppe mentioned in an X (formerly Twitter) post that Bitcoin was still “heavily undervalued” despite hitting a new ATH. He added that the value is “way higher” and noted how the flagship crypto can help hedge against inflation and keep one’s purchasing power alive. Meanwhile, the crypto analyst believes there will be “way higher numbers” in this cycle.

Michaël van de Poppe had previously hinted at Bitcoin rising to as high as $150,000 in this bull run. Other analysts have also given similar price predictions, with the consensus that BTC will surely rise above $100,000. Other crypto analysts, including MacronautBTC, have even gone as far as predicting that Bitcoin could rise above $200,000.

There is a growing belief that this bull cycle will be the mother of all past cycles, which could be the reason for such ambitious predictions. Moreover, this cycle has the Spot Bitcoin ETFs, something past bull runs didn’t have. These ETFs have ushered in more institutional demand for the flagship crypto, which has led to an overall increase in the demand for Bitcoin.

Interestingly, NewsBTC previously reported that the demand for Bitcoin is significantly exceeding Miners’ supply. This development is coming at a time when miners’ rewards are set to be cut in half during the Bitcoin Halving. This would likely lead to more imbalance between the demand and supply curve, potentially leading to an exponential surge in Bitcoin’s price.

BTC Still Has Enough Time To Hit New Highs

Bitcoin hitting a new ATH of $70,000 is just the beginning of this bull run, as there is reason to believe this bullish momentum could run into next year. Crypto analyst Ali Martinez noted in an X post that Bitcoin has “consistently taken about 8 to 11 months to hit a market top” whenever it has shattered its previous ATH.

With Bitcoin currently hitting new highs, the analyst added that historical patterns suggest that the next BTC market top “will be sometime between November 2024 and February 2025.” However, Alex Thorn, Head of Research at Galaxy Digital, has warned that “bull markets are not straight lines up” and that sharp corrections should be expected along the way.

At the time of writing, Bitcoin is trading at around $68,300, up over 2% in the last 24 hours according to data from CoinMarketCap.

BTC price drops $68,400 | Source: BTCUSD on Tradingview.com

Featured image from CNBC, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

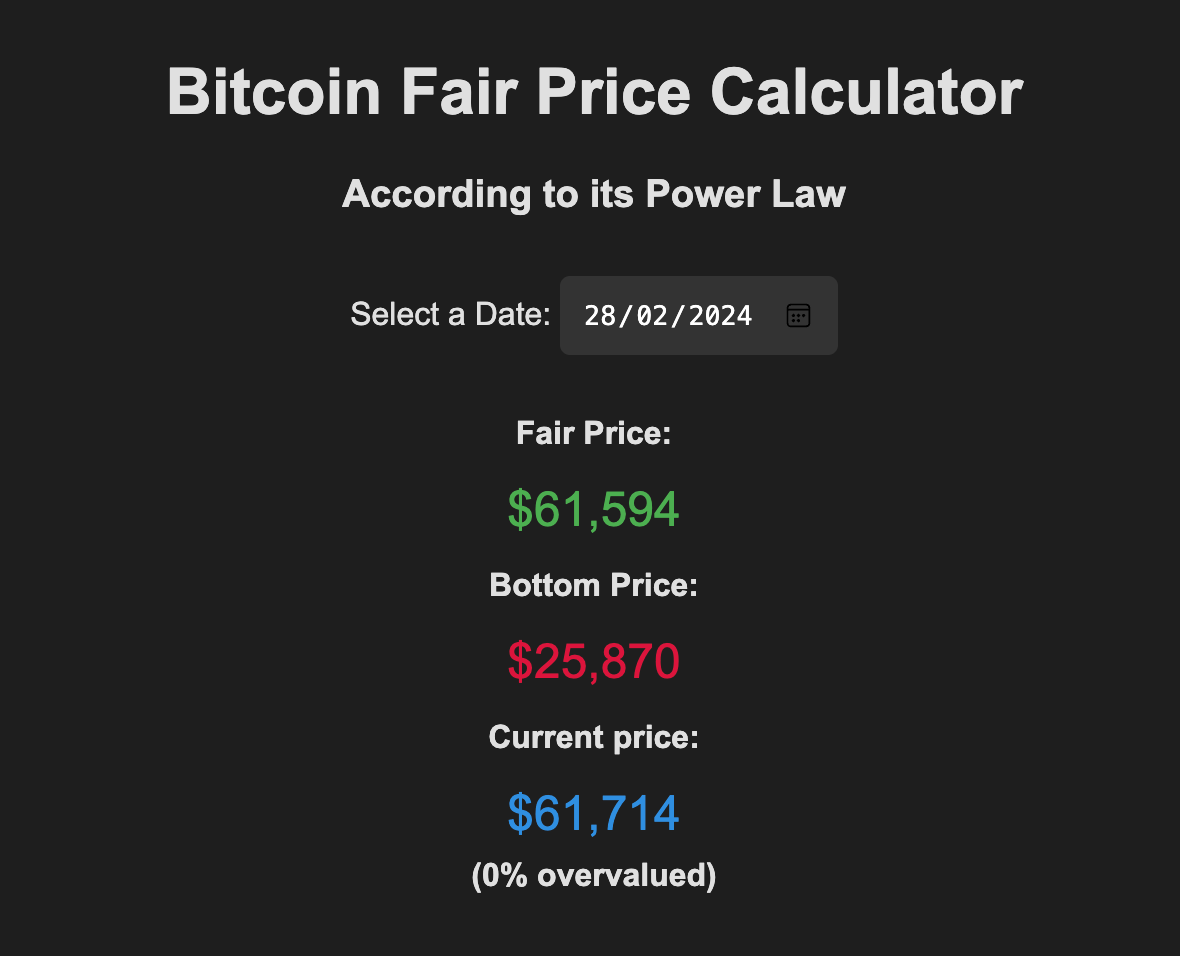

At $61,594 Bitcoin is at fair market price according to the power law model

On a monumental day for Bitcoin, where it opened at $56,900, the flagship digital asset has officially exited the bear market according to the Bitcoin Power Law model. After surpassing $61,000, it has now reached the ‘fair price’ of $61,594, aligning with the projected power law price.

First posited by Giovanni Santostasi, the Bitcoin Power Law is a model that attempts to predict Bitcoin’s long-term price trajectory based on its historical tendency to follow a roughly straight line when plotted on a logarithmic scale. This pattern suggests an underlying pattern to Bitcoin’s growth.

The model distinguishes between “fair price” (the trend line representing an average valuation) and “bottom price” (historically about 58% below the fair price, indicating a potential floor). These values are calculated using a formula based on the number of days since Bitcoin’s creation (Genesis Block) and a specific exponent:

Fair Price = 1.0117e-17*(days since Genesis Block)^5.82.

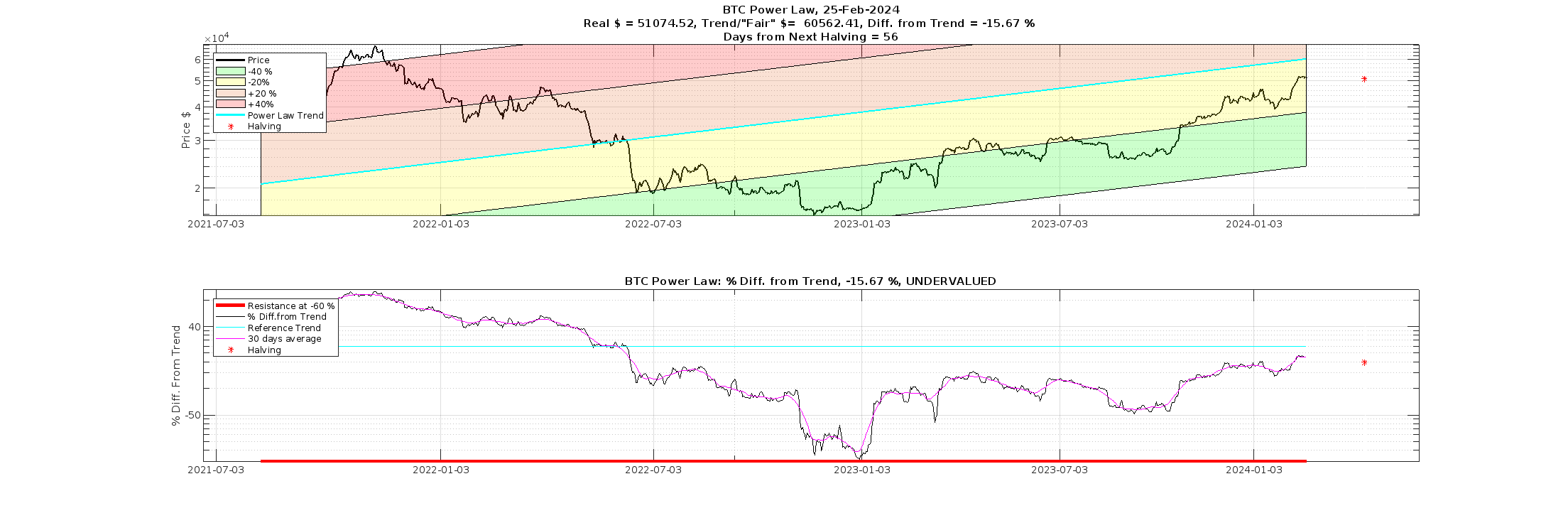

The chart below shows a section of the power law model and its relative fair price as shared by Santostasi on Feb. 25. Bitcoin has since passed the current ‘fair price,’ indicating it is heading toward the bull market ‘bubble’ identified as a key component of each Bitcoin halving cycle within the power model.

Within the power law model, the price deviates from the ‘fair value’ above and below during bull and bear markets but ultimately returns to the fair value over time. Historically, the model has been highly accurate. However, it’s important to note that this is a model, and while it has held up surprisingly well at times, market forces can change, and the model cannot account for all factors potentially influencing Bitcoin’s price.

The post At $61,594 Bitcoin is at fair market price according to the power law model appeared first on CryptoSlate.

ECB Economists: Bitcoin Fails to Become Global Decentralized Digital Currency, BTC’s Fair Value Is Still Zero

The European Central Bank (ECB) has published a blog post claiming that “bitcoin has failed to fulfill its original promise to become a global decentralized digital currency.” The ECB economists who authored the post added that bitcoin’s fair value is still zero and bitcoin transactions are “still inconvenient, slow, and costly.” Moreover, they asserted that […]

The European Central Bank (ECB) has published a blog post claiming that “bitcoin has failed to fulfill its original promise to become a global decentralized digital currency.” The ECB economists who authored the post added that bitcoin’s fair value is still zero and bitcoin transactions are “still inconvenient, slow, and costly.” Moreover, they asserted that […]

Source link

How to make sure you pay a fair price for the financial advice you need.

When shopping for a financial planner, it’s natural to ask, “How much do you charge?” If you expect a simple, one-sentence answer, think again.

There are many ways that advisers get paid and it can get complicated. Their fee structure reflects the type of practice they want to run and the business model that reinforces their brand.

One of the best ways to vet an adviser is to ask how they arrived at their fee structure and why they chose it. What motivates them to charge the way they do?

“Every adviser loves to argue about which way [of getting paid] is the best and which is the worst,” said Chris Cybulsky, a certified financial planner in Austin, Texas.

Many advisers base their pay on a percentage of assets under management (AUM). The percentage, traditionally 1%, often varies based on the amount of a client’s investable assets.

Other popular options include charging an hourly fee or flat per-project fee (perhaps to craft a customized financial plan). In recent years, some advisers have adopted subscription pricing that offers tiers of ongoing service with different monthly or annual retainer fees.

If you want to hire an adviser for both financial planning and investment management, you might encounter a hybrid fee structure. That means you’ll pay a percentage of AUM for portfolio management plus a flat or hourly rate for financial planning (which could include help with household budgeting, retirement planning, estate or tax planning, etc.).

More advisers are favoring this hybrid approach because it stabilizes their income when markets plummet and clients’ investable assets shrink. It also gives them flexibility to serve a broader range of clients.

For instance, many early and mid-career professionals lack significant investments to manage or their assets are tied up in a tax-advantaged retirement account like a 401(k). But they may be willing to pay an adviser a flat fee for targeted financial advice and planning.

There are also advisers who earn commissions when they buy and sell certain financial products (such as annuities or mutual funds) or insurance policies on the client’s behalf. “Fee-only” refers to advisers who do not charge commissions and generate all their income from fees.

An adviser’s fee structure is revealing in itself. Those who prefer financial planning to portfolio management tend to charge flat or per-project fees that reflect the relative complexity of the client’s needs.

“You can tell how they think about the value of their service offering from the clarity and logic of how they present their fees,” said Sara Grillo, a New York City-based marketing consultant. “If they say they’re focused on financial planning, yet they are charging a fee on assets under management, you should be skeptical of any claims that the planning is robust.”

Indeed, it may indicate that the adviser wants to oversee as much of your assets as possible. The more assets you transfer to the adviser’s firm, the higher the adviser’s AUM fee.

“Their main concern might be to grow your assets and make sure those assets stay with them,” Grillo said. “I’m an advocate for flat fees because they promote more clarity and transparency.”

Advisers who work for big financial services companies are more apt to charge for AUM or collect commissions for selling specific products. That’s not necessarily a red flag: You can benefit if you want active investment management and the firm boasts top asset managers, proprietary research or access to alternative investments that can diversify your portfolio.

“If advisers charge an hourly rate or use a flat-fee model, they’re probably a smaller firm or sole practitioner,” said DJ Hunt, a certified financial planner in Melbourne, Fla. “So you may not get staff, just one set of eyes on everything.”

Know what you want

As long as you don’t need investment management — either because you’re a do-it-yourself investor or you don’t have much investable assets — then paying fees solely for financial planning expertise can make sense.

It’s easier to evaluate an adviser’s pricing if you know what you need from the outset. Asking a wealth manager to take your $300,000 or $1 million portfolio and make investment decisions that produce reasonable returns and reflect your risk tolerance is one thing. But if you’re more intent on learning whether to rent or buy a home, how to save for a child’s tuition or how to tell if you can afford to retire, you’re better off paying a fee for a skilled, credentialed financial planner.

“Assessing your needs can get tricky,” Hunt said. “When you first meet with an adviser, you may think you need help in just one area. That can lead to a broader discussion of other interrelated needs. Then you say, ‘I hadn’t thought of that’ and you realize it’s just the tip of the iceberg as your needs expand.”

More: Saving too little? Spending too much? How to know if your money worries are rational (or not).

Also read: How AI will change the ways financial advisers manage your money

New FASB rules pave the way for Bitcoin on corporate balance sheets at ‘fair value’

The Financial Accounting Standards Board (FASB) has officially adopted new accounting rules for Bitcoin, marking a significant shift in the financial landscape for corporations. This change, effective for fiscal years beginning after Dec. 15, 2024, introduces fair value accounting for Bitcoin, aligning its treatment with other financial assets.

The recent announcement by the FASB to apply fair value accounting to Bitcoin represents a watershed moment in integrating digital assets into mainstream corporate finance. Michael Saylor, CEO of MicroStrategy, lauded this development, noting its potential to catalyze global corporations’ adoption of Bitcoin as a treasury reserve asset. This sentiment echoes the broader expectation that these changes will enhance the appeal and practicality of holding Bitcoin on corporate balance sheets.

Fred Thiel, CEO of Marathon Digital, emphasized the significance of this move, highlighting the impact of full market-to-market accounting for institutions and corporations holding Bitcoin. This shift suggests a more dynamic and responsive approach to valuing digital assets, potentially transforming how companies manage and report their Bitcoin holdings.

In a conversation with Bloomberg Tax, Marathon CFO Salman Khan of Marathon Digital Holdings expressed optimism about the new rules. He pointed out that standardizing accounting practices for Bitcoin will boost investor confidence and lend legitimacy to the cryptocurrency as a corporate asset.

FASB fair value accounting for Bitcoin.

The FASB’s Accounting Standards Update (ASU) aims to refine specific crypto assets’ accounting and disclosure procedures. FASB Chair Richard R. Jones underlined the urgency of improving these practices, a sentiment reflecting digital assets’ growing relevance in the financial world. As per the FASB, the new standard seeks to offer more pertinent information that aligns with the economic realities of specific crypto assets and a company’s financial position. It also aims to streamline the complexity associated with current accounting practices.

Under the new amendments, entities are required to measure qualifying crypto assets at their fair value each reporting period, with any changes recognized in net income. This approach ensures that the valuation of these assets remains current and accurate, reflecting market conditions. The amendments also call for detailed disclosures about significant crypto asset holdings, contractual sale restrictions, and transactional changes during the reporting period.

The scope of these amendments applies to all assets that fulfill several criteria, including being an intangible asset as defined in the FASB Accounting Standards Codification, secured through cryptography, and residing on a distributed ledger or similar technology. Notably, these assets must not be issued by the reporting entity or its affiliates and should be fungible. Specifically, the guidelines state qualifying digital assets must:

- Meet the definition of intangible asset as defined in the FASB Accounting Standards Codification®

- Do not provide the asset holder with enforceable rights to or claims on underlying goods, services, or other assets

- Are created or reside on a distributed ledger based on blockchain or similar technology

- Are secured through cryptography

- Are fungible

- Are not created or issued by the reporting entity or its related parties.

This change in accounting standards by the FASB signifies a broader acceptance and integration of digital assets like Bitcoin into the formal financial reporting framework. It reflects the evolving corporate finance landscape, where digital assets are increasingly viewed as legitimate and valuable components of a company’s asset portfolio.

The implications of this shift are far-reaching, potentially influencing investment strategies, financial reporting, and the overall perception of cryptocurrency in the corporate world. Further, following the updated guidelines, the potential designation as a security for any digital asset becomes more pertinent for corporations interested in crypto projects outside of Bitcoin.

The Bitcoin price experienced a notable downturn as selling pressure intensified, resulting in a decline of over 4% from its annual peak of $44,500. This downturn was further exacerbated by the loss of the crucial $42,000 support level.

However, the largest cryptocurrency in the market received a substantial uplift from the US Financial Accounting Standards Board (FASB), which has spurred a rapid 1.8% surge in BTC’s value within the past two hours. As a result, Bitcoin has successfully recovered the $42,000 support level.

FASB’s Fair Value Recognition Brings Clarity To BTC?

In a significant development for the cryptocurrency industry, the FASB has announced new accounting rules that require companies, including prominent entities like MicroStrategy, Tesla, and Block, to measure their cryptocurrency holdings at fair value.

These rules, set to go into effect in 2025, allow businesses to capture the real-time highs and lows of their Bitcoin and Ethereum (ETH) assets, providing a more accurate representation of their holdings.

Under the previous accounting practices, companies were only allowed to record the lows, resulting in a one-sided accounting treatment that often led to reduced valuations and diminished earnings for businesses holding cryptocurrencies. The highly volatile nature of crypto values further exacerbated the issue.

The FASB’s new rules address these concerns by mandating the recording of cryptocurrencies at fair value, a measurement technique aimed at reflecting the most up-to-date value of these assets.

Changes in fair value will now be recorded in net income, allowing companies to account for fluctuations in the value of their crypto holdings more comprehensively.

The positive news for BTC lies in the fact that the new FASB rules provide greater transparency and accuracy in assessing the true value of cryptocurrency assets. By capturing fluctuations in fair value, companies will have a more realistic representation of their holdings, enabling better decision-making and financial reporting.

Bitcoin, being the most widely recognized and valuable cryptocurrency, stands to benefit significantly from these changes. The recognition of its fair value allows companies to showcase the true worth of their BTC holdings, potentially boosting investor confidence and attracting further institutional interest.

Turbulent Times Ahead For Bitcoin Price

Following these recent developments, the Bitcoin price has successfully rebounded to previously lost levels, demonstrating heightened volatility after a brief consolidation phase just below $42,000.

However, according to CoinGlass’ liquidation heatmap, Bitcoin’s price may be facing further volatility that could lead to a significant amount of liquidation of both long and short positions.

The liquidation heatmap from CoinGlass highlights substantial indications of liquidation leverage exceeding $200 million both above and below the current Bitcoin price.

Of particular concern is the thick liquidation leverage below $41,000, as seen in the chart above, which, combined with the prevailing trend, could become a probable target for the Bitcoin price in the coming days.

Conversely, following BTC’s correction, additional liquidation leverage has emerged in CoinGlass’s heatmap, particularly in the $42,000 and $43,000 range of short positions. This added selling pressure has contributed to the retracement of the Bitcoin price.

This potential scenario suggests a potential price swing up and down before a stable continuation of either the downward or upward momentum. The outcome remains uncertain as to which side will give way first and what prevailing trend will shape the latter part of the year.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

The market hasn’t exactly been firing on all cylinders recently. As of the latest look, the S&P 500 (^GSPC -0.48%) is down 8% from its late-July peak, mostly on fears that persistent inflation will push the world into a recession. And maybe it will.

We’re now into the third quarter’s earnings season with all of September’s economic reports in hand, however, and so far the numbers aren’t too bad. They’re pretty good, in fact, with the analyst community still calling for earnings growth rather than an earnings contraction. This leaves the market’s past and projected valuation in line with long-term norms.

Translation: You may want to stick with your stocks right now if you’ve been thinking about an exit here. Or, if you’re already out, you might want to use the recent sell-off as a reentry opportunity.

By the numbers

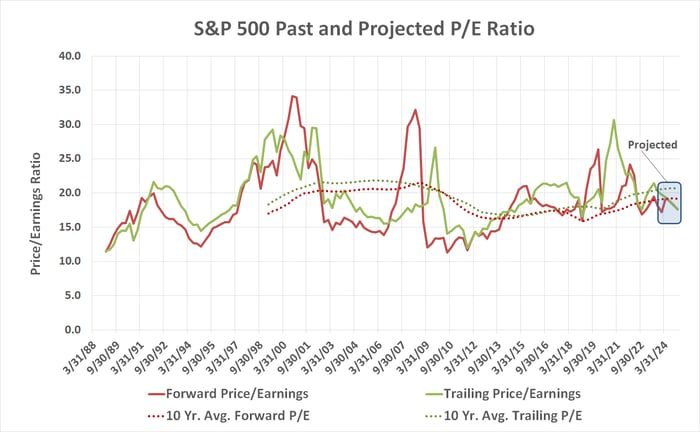

Cutting straight to the chase, the S&P 500 is currently valued at 20.2 times its trailing per-share profits, and right around 18.1 times its 12-month earnings projections. Both numbers are below their respective 10-year average price-to-earnings ratios, albeit just barely.

Data source: Standard & Poor’s. Chart by author.

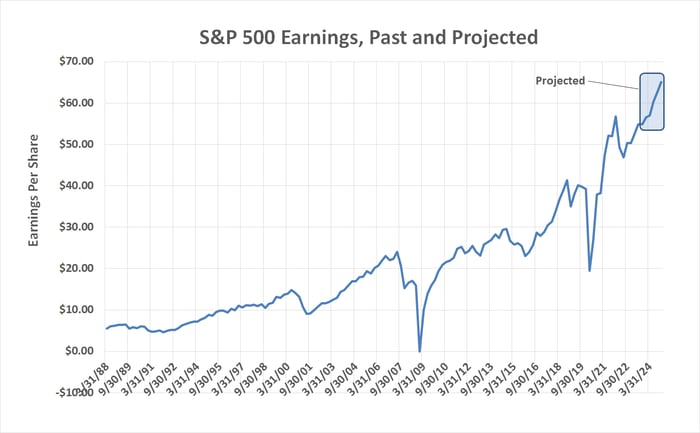

Surprised? The explanation is simple enough — earnings are growing rather than falling. The S&P 500’s earnings are projected to roll in at $54.82 per share for the third quarter, up 8.8% from its collective bottom line from the same quarter a year earlier, en route to new record levels next year.

Data source: Standard & Poor’s. Chart by author.

There’s no fortuitous accounting causing artificially elevated profitability levels, either. All sectors are turning about as much of their revenue into net income as they normally would (although the energy sector is doing measurably better than its average in this regard, thanks to frothy oil prices). All told, 11.8% of the S&P 500’s third-quarter revenue is expected to become net income, in line with long-term norms.

This reality doesn’t exactly jibe with the prevailing narrative, does it? Consumers are supposed to be buckling under the weight of rampant inflation. For-profit corporations are presumed to be struggling with sky-high borrowing costs. Everyone’s supposed to be unable to cope with this challenging economy. Ergo, stocks are supposed to be dangerously overvalued.

Except… they’re not.

It’s a bigger-picture, forward-looking kind of thing

There is one reasonable argument that the S&P 500’s trailing and forward-looking price-to-earnings ratios are still too frothy at their current levels. That’s interest rates.

See, the market tends to support steeper valuations when interest rates are low and borrowing is cheap, which was the case for years between 2008’s subprime mortgage meltdown and 2022’s end to the COVID-19 pandemic. Conversely, when interest rates reach multiyear highs as they have this year, valuations could be expected to slump. That’s because the reward for holding fixed-income investments like Treasury bonds and bills is higher in these environments, so the relative attractiveness in holding stocks is lowered. That means valuation figures could — and some say should — contract.

Be careful when it comes to making decisions based on such valuation models, though. They’re complex, and yet incomplete in that they don’t consider and then quantify every factor that might impact a stock’s or a broad market’s fair valuation. More often than not a simpler approach to stock-picking is a superior solution if only because it’s easier to implement and maintain.

In other words, don’t get bogged down by details that may or may not matter. Rather, take note of the fact that earnings have been consistently rising since last year, and are expected to continue growing at least through 2024 against a backdrop of waning inflation. That dials back much of any risk linked to excessive valuations.

That’s according to JPMorgan Chase‘s U.S. Head of Investment Strategy Jacob Manoukian, anyway. He noted in early October: “Earnings expectations are still climbing, while the drawdown has brought valuations back in line with the 10-year average level. From here, we think … positive seasonal trends and stabilizing bond yields will help equities start to rally again.” Manoukian concludes, “Looking out, we think the chances are better than not that the S&P 500 makes a new all-time high by the middle of next year due to decent earnings growth and valuation expansion as inflation fades further.”

And Manoukian is hardly alone in his optimism. David Lefkowitz, chief of UBS‘ U.S. equity investing, penned in mid-October, “While valuations are high relative to history, they are reasonable in the context of low unemployment and falling inflation.” Lefkowitz is calling for “a soft-ish landing in the U.S. economy, which should drive a recovery in earnings growth and close to a double-digit total return in U.S. large-cap stocks over the coming year.”

Don’t overthink it

Will the S&P 500 make a straight-line move to UBS’ mid-2024 target of 4,500? Not likely. The index could even lose more ground before starting to make its way to that level, which is 7% higher than its present price. It’s also sure to remain volatile between now and then no matter what’s in the cards.

If you’re still on the sidelines because you fear stocks can’t justify their current and forward-looking valuations in the shadow of inflation, fear not. Actual earnings still justify the S&P 500’s present price, and most of its stocks’ prices too. There’s even room for some near-term upside.

JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends JPMorgan Chase. The Motley Fool has a disclosure policy.

Bitcoin energy value metric puts BTC’s ‘fair value’ at $47K — Analyst

Bitcoin’s price is trading in a frustratingly tight range between $25,500 and $26,500, leaving traders unsure of the next direction that the asset could take.

However, Charles Edwards, founder of Capriole Investments, believes that Bitcoin’s (BTC) current price presents a low-risk long-term buying opportunity. Edwards’ view is based on Bitcoin’s production cost and energy value.

Capriole Investments energy value theory gives a fair value price of $47,200, and Edwards reiterated his bullish stance by saying that Bitcoin’s production cost gives a floor price estimation of around $23,000 with a 100% hit ratio.

The trade has a risk-reward ratio of 1:5, with the potential for even higher price targets, but Edwards added it is based on the assumption that the rally price “would stop at fair value, which it never has.”

My favorite Bitcoin chart right now. The relative distance between Bitcoin’s price, the historical price floor (Bitcoin Electrical Cost) and fair value (Bitcoin Energy Value). That’s a 5:1 risk-reward assuming no-hype and that price would stop at fair value, which it never has. pic.twitter.com/J2yuGcNX9q

— Charles Edwards (@caprioleio) September 7, 2023

Bullish energy value theory

Edwards proposed Bitcoin’s energy value theory in December 2019. According to the theory, the fair value of Bitcoin can be estimated by the amount of energy it takes to produce it.

The model assumes that the more work that has been put into something, the more valuable it is.

In 2023, the amount of energy spent in Bitcoin mining has been on the rise as mining companies increased their capacity and share of hash rate with the installation of new ASICs and by preparing for the halving in April 2024.

According to Edwards, the Bitcoin energy value reflects its fair value.

Bitcoin’s energy value has shown a strong correlation with Bitcoin’s spot price and this suggests that the theory is at least somewhat valid. However, there are some caveats to the theory.

One limitation is that Bitcoin’s energy value is not always accurate. This is because the mining energy efficiency can vary over time.

Related: Cambridge Bitcoin Electricity Consumption Index updated to reflect hardware distribution and hash rate increases

Additionally, the theory does not take into account other factors that can affect the price of Bitcoin, such as the market’s current demand and supply and the steps taken by miners ahead of the halving next year.

Bitcoin looks primed for further downside

Bitcoin’s spot liquidity data on Binance indicates that buyers are looking at the $24,600 level for support. However, the bullish momentum appears to be fading as most traders are crowding around the yearly low levels and hoping that these hold.

The liquidation levels of futures orders from CoinGlass show that buyers are expecting downside to $24,600, with smaller liquidations extending toward $23,000.

Notably, the price range between $25,000 and $25,500 has the most leveraged orders in significantly high volumes, making them hot targets for traders.

Should the price drop down to the $23,000 level, the buyer’s conviction will be tested. A drop below $23,000 would target the $21,451 and $19,549 levels from 2022.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Elon Musk Mocks Joe Biden’s Tweet Calling On The Super Rich To Pay ‘Their Fair Share.’ Here’s How Some Billionaires Pay Less Income Tax Than You

The fairness of the U.S. tax system has long been debated.

President Joe Biden recently tweeted, “It’s about time the super-wealthy start paying their fair share.”

The message caught the attention of Tesla Inc. CEO and Twitter Inc. owner Elon Musk.

“Please give him the password, so he can do his own tweets,” Musk replied, implying that the tweet wasn’t written by the commander in chief himself.

But the billionaire business tycoon actually agrees with Biden’s view.

“In all seriousness, I agree that we should make elaborate tax-avoidance schemes illegal,” Musk later tweeted. “But acting upon that would upset a lot of donors, so we will see words but no action.”

The reality is that billionaires build their wealth largely from assets. Their net worth goes up when their assets increase in value over time. But the U.S. tax system is not designed to capture the gains from assets: Capital gains are typically taxed at lower rates than wages and salaries.

“Those who will actually be forced to carry the burden of excess government spending are lower- to middle-income wage earners, as they cannot escape payroll tax,” Musk said.

Check out:

Some Billionaires Pay Less Income Tax Than You

According to a report from ProPublica, some billionaires in the U.S. paid little or no income tax relative to the vast amount of wealth they have accumulated over the years.

The report noted that Amazon.com Inc. Founder Jeff Bezos “did not pay a penny in federal income taxes” in 2007 and 2011. It also pointed out that Musk paid no federal income tax in 2018, and investing legend George Soros did the same “three years in a row.”

Billionaires do pay taxes — it’s just that the amount is rather small compared to how much money they actually make. For instance, ProPublica’s report showed that between 2014 and 2018, Bezos paid $972 million in total taxes on $4.22 billion of income. Meanwhile, his wealth grew by $99 billion, meaning the true tax rate was only 0.98% during this period.

The good news? You don’t need to be in the three-comma club to invest in the assets that made these people wealthy.

Billionaire Tax Hacks

For many well-known billionaires, the bulk of their wealth is tied to the companies they helped create.

If these companies are publicly traded, retail investors can hop on the bandwagon by purchasing shares. For those who want to follow Bezos, check out Amazon. If you want to bet on Musk, look into Tesla.

Here’s the neat part: When stocks go up in value, investors only pay tax on realized gains. In other words, if investors don’t sell anything, they don’t have to pay capital gains tax — even if their stock holdings have skyrocketed in value — because the gains are not realized.

According to ProPublica, that’s why some billionaires choose to borrow against their assets instead of selling them. Doing so gives the ultra-wealthy money to spend while deferring taxes on capital gains indefinitely.

That said, when they do sell their shares, they can still get hit with a substantial tax bill. After Musk sold a ton of Tesla shares in 2021, he tweeted that he would pay over $11 billion in taxes that year.

Another popular option for billionaires is real estate, which comes with plenty of tax advantages as well.

When you earn rental income from an investment property, you can claim deductions. These include expenses such as mortgage interest, property taxes, property insurance and ongoing maintenance and repairs.

There’s also depreciation, which refers to the incremental loss of a property’s value as a result of wear and tear. Real estate investors can claim depreciation for many years and accumulate significant tax savings over time.

The best part? It’s easy for retail investors to invest in housing — and you don’t need to buy a house to do it. You can invest in publicly traded real estate investment trusts (REITs) that own income-producing properties and pay dividends to shareholders. And if you don’t like the stock market’s volatility, there are options to invest directly in rental properties with as little as $100 through the private market.

Read next:

Send To MSN: 0

Don’t miss real-time alerts on your stocks – join Benzinga Pro for free! Try the tool that will help you invest smarter, faster, and better.

This article It’ll ‘Upset A Lot Of Donors’: Elon Musk Mocks Joe Biden’s Tweet Calling On The Super Rich To Pay ‘Their Fair Share.’ Here’s How Some Billionaires Pay Less Income Tax Than You originally appeared on Benzinga.com

.

© 2023 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.