Investors pile into a currency-hedged Japan ETF on Thursday for protection as the Japanese yen falls on a historic BOJ policy shift.

Source link

Falling

Bank of England set to hold rates, but falling inflation brings cuts into view

The Bank of England in the City of London, after figures showed Britain’s economy slipped into a recession at the end of 2023.

Yui Mok | Pa Images | Getty Images

LONDON — The Bank of England is widely expected to keep interest rates unchanged at 5.25% on Thursday, but economists are divided on when the first cut will come.

Headline inflation slid by more than expected to an annual 3.4% in February, hitting its lowest level since September 2021, data showed Wednesday. The central bank expects the consumer price index to return to its 2% target in the second quarter, as the household energy price cap is once again lowered in April.

The larger-than-expected fall in both the headline and core figures was welcome news for policymakers ahead of this week’s interest rate decision, though the Monetary Policy Committee has so far been reluctant to offer strong guidance on the timing of its first reduction.

The U.K. economy slid into a technical recession in the final quarter of 2023 and has endured two years of stagnation, following a huge gas supply shock in the wake of Russia’s invasion of Ukraine. Berenberg Senior Economist Kallum Pickering said that the Bank will likely hope to loosen policy soon in order to support a burgeoning economic recovery.

Pickering suggested that, in light of the inflation data of Wednesday, the MPC may “give a nod to current market expectations for a first cut in June,” which it can then cement in the updated economic projections of May.

“A further dovish tweak at the March meeting would be in line with the trend in recent meetings of policymakers gradually losing their hawkish bias and turning instead towards the question of when to cut rates,” he added.

At the February meeting, two of the nine MPC decision-makers still voted to hike the main Bank rate by another 25 basis points to 5.5%, while another voted to cut by 25 basis points. Pickering suggested both hawks may opt to hold rates this week, or that one more member may favor a cut, and noted that “the early moves of dissenters have often signalled upcoming turning points” in the Bank’s rate cycles.

Berenberg expects headline annual inflation to fall to 2% in the spring and remain close to that level for the remainder of the year. It is anticipating five 25 basis point cuts from the Bank to take its main rate to 4% by the end of the year, before a further 50 basis points of cuts to 3.5% in early 2025. This would still mean interest rates would exceed inflation through at least the next two years.

“The risks to our call are tilted towards fewer cuts in 2025 – especially if the economic recovery builds a head of steam and policymakers begin to worry that strong growth could reignite wage pressures in already tight labour markets,” Pickering added.

Heading the right way, but not ‘home and dry’

A key focus for the MPC has been the U.K.’s tight labor market, which it feared risked entrenching inflationary risks in the economy.

January data published last week showed a weaker picture across all labor market metrics, with wage growth slowing, unemployment rising and vacancy numbers slipping for the 20th consecutive month.

Victoria Clarke, U.K. chief economist at Santander CIB, said that, after last week’s softer labor market figures, the inflation reading of Wednesday was a further indication that embedded risks have reduced and that inflation is on a path towards a sustainable return to target.

“Nevertheless, services inflation is largely tracking the BoE forecast since February, and remains elevated. As such, we do not expect the BoE to conclude it is ‘home and dry’, especially with April being a critical point for U.K. inflation, with the near 10% National Living Wage rise and many firms already having announced, and some implemented, their living wage-linked pay increases,” Clarke said by email.

“The BoE needs data on how broad an uplift this delivers to pay-setting, and hard information on how much is passed through to price-setting over the months that follow.”

Santander judges that the Bank could decide it has seen enough data to cut rates in June, but Clarke argued that an August trim would be “more prudent” given the “month-to-month noise” in labor market figures.

This sentiment was echoed by Moody’s Analytics on Wednesday, with Senior Economist David Muir also suggesting that the MPC will need more evidence to be satisfied that inflationary pressures are contained.

“In particular, services inflation, and wage growth, need to moderate further. We expect this necessary easing to unfold through the first half of the year, allowing a cut in interest rates to be announced in August. That said, uncertainty is high around the timing and the extent of rate cuts this year,” Muir added.

Industrial component manufacturer Enpro (NPO -8.74%) fell short of expectations in the most recent quarter and provided tepid guidance for 2024. Investors were disappointed, sending Enpro shares down as much as 15.4% for the day and down 7.3% as of 12:45 p.m. ET.

Sluggish results in key end markets

Enpro makes engineered components for the semiconductor, power, aerospace, food and pharma, and transportation sectors. The company earned $1.19 per share in the fourth quarter on revenue of $249.1 million, falling short of the $1.44 per share on sales of $264 million that was the Wall Street consensus.

Sales were down 8.4% for the quarter and 3.6% for all of 2024, and adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) fell 12.2% and 7.5% for the quarter and full year, respectively. The company saw strength in its sealing technologies unit, but weakness in areas including semiconductors and commercial vehicles.

CEO Eric Vaillancourt said in a statement that he was pleased with the performance of sealing and sees other bright spots, but there remains uncertainty about when other areas will recover.

“While the timing of a broader semiconductor capital equipment recovery remains uncertain, the industry is showing early signs of an uptick, and we remain focused on driving growth and value in our semiconductor business over a multiyear period,” Vaillancourt said. “Our ability to navigate through any market environment with our solid execution and disciplined cost mitigation efforts underscores the resiliency of our business.”

Enpro sees full-year 2024 adjusted earnings coming in at between $7 and $7.80 per share, implying some downside to the consensus $7.65-per-share estimate.

Is Enpro a buy after its earnings miss?

The business isn’t broken, but Enpro will struggle to outperform while some of its more cyclical end markets bottom out.

The question for investors is how long will the rebound take, and Enpro’s cautious view on 2024 implies things are unlikely to change overnight. Even with Tuesday’s declines, Enpro has still been a market beater over the past five years, up 115% compared to the S&P 500‘s 78% gain, implying it is far too early to go bargain hunting today.

For those willing to wait out the cycle in semis and commercial vehicles, Enpro is an attractive, diversified industrial business. But given the outlook, there is no reason for investors to stampede into the stock right now.

Lou Whiteman has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

LUNC Price Rally Is Far From Over Following Falling Wedge Breakout, Analyst Says

Over the weekend, the LUNC price saw some of the most bullish price action that sent its price soaring over 20%. This rally eventually brought the price above $0.0001 after struggling around $0.00009 for the last two weeks. However, the tides seem to be completely changing for the altcoin, as one analyst expects the rally to continue.

Prepare For The LUNC Price To Double

The LUNC price, despite having risen so much, is still showing signs of a continuation. This is evident in the Falling Wedge Breakout that was confirmed by crypto analyst Ava Cryptoo on TradingView. This Falling Wedge Breakout is significant as it often precedes some of the most significant rallies in cryptocurrencies, such as LUNC.

The price of the altcoin is currently retesting the significant resistance at $0.000115. Now, this level is significant because rejection from this level had initially stopped the LUNC price breakout on Saturday. Now that the price is starting to retest it again, it shows that the bulls are far from done with this altcoin.

Source: Tradingview.com

In a scenario where the LUNC price successfully retests and breaks above this level, then the crypto analyst expects that the price will more than double from its current level. They put the price target for the altcoin as high as $0.00022, and the timeline for this is shown to be a matter of days. However, all of this hinges on the fact that the price makes a “Perfect Retest” and breaks out completely.

Token price climbs to $0.000114 | Source: LUNCUSDT on Tradingview.com

Why Is The Altcoin Rallying Amid Low Market Sentiment?

The LUNC price breaking out during such slow market movements suggests an end to the accumulation that happened below $0.0001. In addition to this, Binance carrying out its scheduled LUNC burn contributed to the rise in price that was seen this weekend.

Binance, the largest crypto exchange in the world, has been committed to burning LUNC tokens realized from fees in an effort to help reduce its vast supply. The latest burn which took place on February 1 saw approximately 2.1 billion tokens performantly removed from circulation.

This is the 18th burn that the crypto exchange has carried out, each time removing hundreds of millions to billions of tokens from circulation. Following this burn, the crypto exchange has helped the LUNC burn figure cross the 51 billion threshold.

A wave of excitement naturally followed the monthly burn as the price started to rise rapidly. The LUNC trading volume reportedly surged more than 700% at the time, at first triggering a 10% increase in price. By the time the weekend was over, the LUNC price had already risen more than 20%, and continues to hold on to the majority of its gains.

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

This Top AI Start-Up Stock Is Falling Again to Start 2024 — Why Most Investors Should Steer Clear

Generative AI training infrastructure remains white hot as an investment. Numerous start-ups have appeared to address the need. Given the end-to-end solution Nvidia created that spans chip design, algorithms, and software, this AI infrastructure consisting of data centers filled with accelerated computing systems (primary using Nvidia technology) is arguably easier to build than “traditional” cloud computing infrastructure. That has been rocket fuel for these specialized data center builder-operators in the last year.

One of those specialists is Applied Digital (APLD -1.42%), formerly Applied Blockchain. Applied Digital raced higher in 2023, fell hard, then started to rally again at the end of the year. But to kick off 2024, shares are falling again as the market comes to terms with the cadence of future profitability for the business. Here’s why most individual investors should steer clear.

Growth starts to moderate for AI infrastructure

We’re a long way from the “chip shortage” of 2021 when pandemic-disrupted supply chains paired with skyrocketing consumer demand for all things electronic wreaked havoc on the semiconductor industry. But new supply shortages struck last year, affecting the electrical components used to network GPUs (graphics processing units, chip systems used to accelerate computing work) and turn data centers into massive computing units that can train AI algorithms.

In its latest update, Q2 fiscal 2024 (the three months ended in November 2023), Applied said some of these component shortages have begun to improve. However, the shortage is still bad enough that it led management to significantly downgrade its full fiscal-year guidance from the outlook provided three months ago.

|

Applied Digital Financial Metric |

New Fiscal 2024 Guidance (as of Jan. 16, 2024) |

Old Fiscal 2024 Guidance (as of Oct. 9, 2023) |

|---|---|---|

|

Revenue |

Exit fiscal 2024 with annualized revenue run rate of approximately $500 million |

$385 million to $405 million |

|

Adjusted EBITDA |

Exit fiscal 2024 with annualized adjusted EBITDA run rate of approximately $250 million |

$195 million to $205 million |

Data source: Applied Digital.

Component shortages happen, it’s something outside of Applied’s control. But there’s one annoying issue here: a switch from providing explicit guidance on what to expect for the current full-year period, to providing an annualized rate of revenue and adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) at the end of the year. What does that mean?

Basically, in Q4 fiscal 2024, Applied is expecting revenue of $125 million ($500 million in “annualized revenue” divided by four). Adjusted EBITDA should now be about $62.5 million (the $250 million annualized figure divided by four). With Applied’s first-half fiscal 2024 revenue and adjusted EBITDA at a respective $78.5 million and $20.2 million after the latest update, suffice to say the original full-year guidance (again, see chart above) was an overestimate.

Focus on profitability, and how losses are paid for

I’ve been skeptical of this company since it first landed on investors’ radars as a “top AI start-up,” and the downward revision in guidance certainly doesn’t help.

But besides my issues with the way the business itself is structured, some investors may still be looking at the high rate of “adjusted EBITDA” as a reason for optimism. I think it best to look past this metric. On all other metrics — GAAP net income and loss, unadjusted EBITDA, free cash flow, etc. — Applied is still losing money.

- First-half fiscal 2024 GAAP net loss was $22 million.

- First-half fiscal 2024 EBITDA loss was $22.4 million.

- First-half fiscal 2024 free cash flow was negative $36.8 million.

Suffice to say this is still a high-risk start-up, with only a potential high reward.

Adding fuzziness to the long-term thesis is the fact that Applied is also borrowing money from one of its key shareholders, B. Riley Financial, and it’s also raising additional cash by selling new shares (which dilutes ownership of existing shareholders).

All of these issues added up to a big 20%-plus decline in share price immediately following the earnings release. The AI hype is moderating again, and for the average investor, there are far safer options to invest in AI right now.

Time to buy? Why the prices of Rolex and other luxury Swiss watches keep falling.

If you are in the market for a luxury Swiss watch now might be your best time to buy — just in time for the holidays.

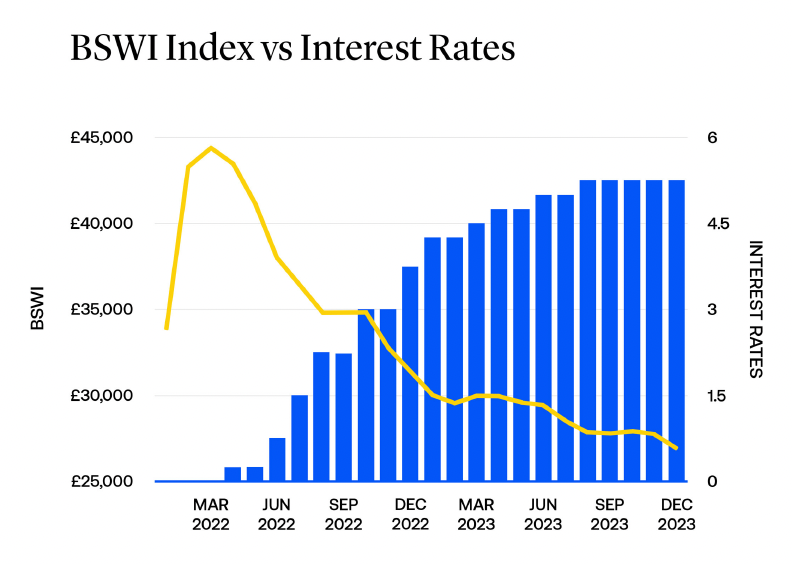

Subdial, a watch industry data provider, reported that its Bloomberg Subdial Watch Index fell again for the month of November, down 3% from the prior month and 10% from a year ago to £26,912, or $33,740 — a new two-year low.

The Bloomberg Subdial Index tracks a basket of the 50 most sought-after watches by value in the secondhand or used market, representing brands like Rolex, Patek Philippe (MC.PA), and Audemars Piguet.

According to the index, the Rolex Submariner with green bezel (the “Kermit”) was the biggest loser, down 4.6% for the month. The yellow gold Rolex Day Date was one of the few gainers, up an index best of 1.3%.

While Subdial noted that the index fell a whopping 40% in the same time period last year, the 10% decline here should not be ignored.

“A 10% decline in a market in the course of a year is significant. While there is relative calm compared to the previous year, to claim that we have stability feels a bit overly optimistic, not to say that it couldn’t be around the corner,” the report said.

Subdial’s insights also reflect what’s happening in the market for new Swiss watches, which had remained strong in 2023. Bloomberg reported Swiss watch exports declined in July for the first time in more than two years, and average growth since then has been trailing the first half of 2023.

That being said, the Subdial team believes there might be a silver lining. Despite falling prices in the secondhand market, there is still volume in terms of transactions, meaning watches are being bought and sold at the same clip — just with declining prices.

This is a far cry from the heady days during and shortly after the pandemic when supply was low — and factors like social media influencers, crypto’s massive rise, and the feeling that life was too short led to frenzied buying in the luxury watch market across the globe.

That’s to blame for the Bloomberg Subdial Index dropping 42% from its peak in April 2022.

A potential positive catalyst for the watch market? The future interest rate environment. Subdial found that the slide in the watch market “perfectly” correlated with the Federal Reserve’s rate hikes.

“The period between April and August saw larger rate increases — and steeper declines in the watch market. There was then a brief respite in both before another period of rate increases (and corresponding price declines) going into the end of the year,” Subdial said.

Subdial believes that, with the likelihood of rate hikes in the rearview mirror, there’s “reason for optimism in the market.”

But with traders already pricing in the first Fed rate cut in May of 2024 per Bloomberg, there’s still a long way to go for watch dealers looking for a respite.

For watch buyers, however, it might be time to check in on your local Rolex dealer, even if its watches are likely sold out. You never know: Perhaps there’s a two-tone Rolex Explorer suddenly in stock, because a buyer backed out.

Pras Subramanian is a reporter for Yahoo Finance. You can follow him on Twitter and on Instagram.

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance

Wall Street has generally had a pretty good response to earnings season thus far. Even though stock market indexes have wrestled with pressure from high interest rates, corporate financial performance has generally been resilient in many cases.

However, just because businesses perform well doesn’t always mean that their share prices will go up after quarterly financial reports. Indeed, both Alphabet (GOOGL -9.51%) (GOOG -9.60%) and Visa (V 0.94%) suffered modest declines on Wednesday morning despite reporting solid results in their most recent quarters. Here are the details you’ll want to see.

Alphabet sinks despite strong profits

Shares of Alphabet were down 6% early Wednesday. The move lower came despite what appeared to be strong performance across much of the Google parent’s business segments.

Overall, Alphabet’s numbers were impressive. Revenue climbed 11% year over year to $76.7 billion. Net income of $19.7 billion grew at an even faster 42% pace compared to year-ago levels. Earnings of $1.55 per share beat the consensus forecast among those following the stock by more than a dime.

However, a closer look showed two disparate elements of Alphabet’s success. On one hand, the company’s core advertising business, which comes largely from its Google search engine and its YouTube streaming video platform, rebounded from recent weakness and had better results than many had anticipated. Yet perhaps more importantly, the 22% growth in sales from Alphabet’s cloud services segment was weaker than most had expected.

Some investors perceive that Alphabet has had to play catch-up with Amazon and Microsoft in the cloud computing arena. In past quarters, Alphabet’s cloud segment performance gave shareholders hope that the company could indeed get itself on the same playing field as its two cloud stock rivals. With this quarter, though, some doubts crept back in, and Alphabet will have to redouble its efforts to get itself back on track.

Visa still sees strong travel spending

Meanwhile, shares of Visa were down almost 2% early Wednesday. The credit card and digital payments giant reported fiscal fourth-quarter financial results for the period ended Sept. 30, and the numbers showed the continued strength of consumers around the world despite macroeconomic pressures.

Visa reported quarterly revenue of $8.6 billion, up 11% year over year. The company pointed to rises in payment volume, particularly in cross-border payments, as well as a higher processed transaction count. That helped push net income up by 19% to $4.7 billion, which worked out to adjusted earnings of $2.33 per share.

Visa also continued to make shareholder-friendly capital moves. It boosted its quarterly dividend by 16% to $0.52 per share, and it also authorized a new stock buyback program worth up to $25 billion. Given Visa’s current share price, the dividend is still a relative pittance, but the card giant has been consistent in steadily boosting its quarterly payout over time.

Yet CEO Ryan McInerney did raise the specter of ongoing macroeconomic and geopolitical uncertainty as a potential factor affecting Visa’s performance in the coming fiscal year. The company projected high-single-digit- to low-double-digit-percentage growth in revenue for fiscal 2024, with earnings likely climbing in the low teens on an adjusted basis. That’s healthy, but it’s not quite as strong on the bottom line as investors have seen lately. That might explain the modest drop in the stock price, showing that shareholders really are focusing on profit growth in the current environment.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Dan Caplinger has positions in Alphabet, Amazon.com, and Microsoft. The Motley Fool has positions in and recommends Alphabet, Amazon.com, Microsoft, and Visa. The Motley Fool has a disclosure policy.

Bitcoin news for traders and investors is showing positive signs as the cryptocurrency managed to stay above critical levels. The current trading environment remains uncertain as sideways price action persists, but new data points to potential gains.

As of this writing, Bitcoin trades at $27,700 with sideways movement in the last 24 hours. On higher timeframes, the cryptocurrency records profits; the previous week, BTC experienced a 4.4% rally, according to data from Coingecko.

Bitcoin News And Data Point To Favorable Price Action?

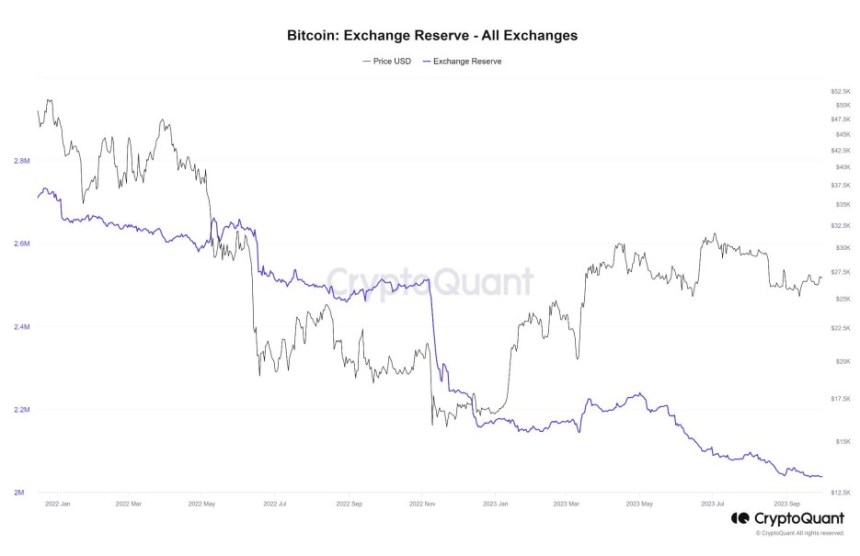

A report from Bitfinex Alpha indicates that the current Bitcoin supply on exchanges has been dropping since May 2023. This metric stands at its lowest in five years, or since 2018, when the price of Bitcoin was in the early stages of a new investment cycle.

The report indicates around 2.03 million BTC on crypto trading venues, as seen in the image below. The decline of BTC supply in the market represents good Bitcoin news due to its potential to ignite another bull market. The report claims:

As the bull market began to take off, reserves on exchanges dropped, as crypto prices soared. This seemed to imply that as investors moved their Bitcoin off exchanges, its scarcity on the platform might have driven its price up.

The chart above also shows that the cryptocurrency’s price reacts to spikes in BTC supply on crypto exchanges. Each bull market has its peculiarities, but they all need a decline in supply to enter price discovery.

Moreover, the report points out that a minority of long-term investors capitulated during this crypto winter. These investors continue to hold their coins and exert a more significant influence on the supply/demand dynamics as short-term investors get shaken off the market.

Less Selling Pressure For Bitcoin

The status quo in the Bitcoin market continues to evolve, and recent data points to a potential change in short-term holders. The Coin Days Destroyed (CDD) metric, used to measure supply/demand dynamics, indicates that both long-term and short-term holders are more inclined to hold “their Bitcoin holdings for longer periods of time.”

Furthermore, the new market dynamics hint at the formation of the early stages of a bull market. The report stated:

The 12-18 month supply holders are now in a position to make a profit on some of their holdings. While this is normal for early bull markets, it is key to note that long term holder supply remains inactive and even short-term holder supply that has been acquired mostly during the bear market at sub $20,000 price or even early 2023 at slightly higher prices remains inactive. This shows investor confidence across multiple cohorts (…).

Cover image from Unsplash, chart from Tradingview

1 Spectacular Stock Poised to Join Microsoft, Alphabet, Amazon, Nvidia, and Apple in the $1 Trillion Club

3 No-Brainer Stocks to Buy With $300 Right Now

Forget Amazon: 1 Top Growth Stock to Buy Hand Over First in September

Here’s My Top AI Stock to Buy in September

Last week, Bitcoin’s price dropped from $29,400 to a low of $25,000. While this decline might appear modest given Bitcoin’s historical volatility, it signifies a notable departure from the tight trading range observed over the past two months.

Yet, even amidst this volatility, the confidence of long-term holders remains unshaken, a sentiment that is crucial to monitor as it often serves as a barometer for the market’s underlying health.

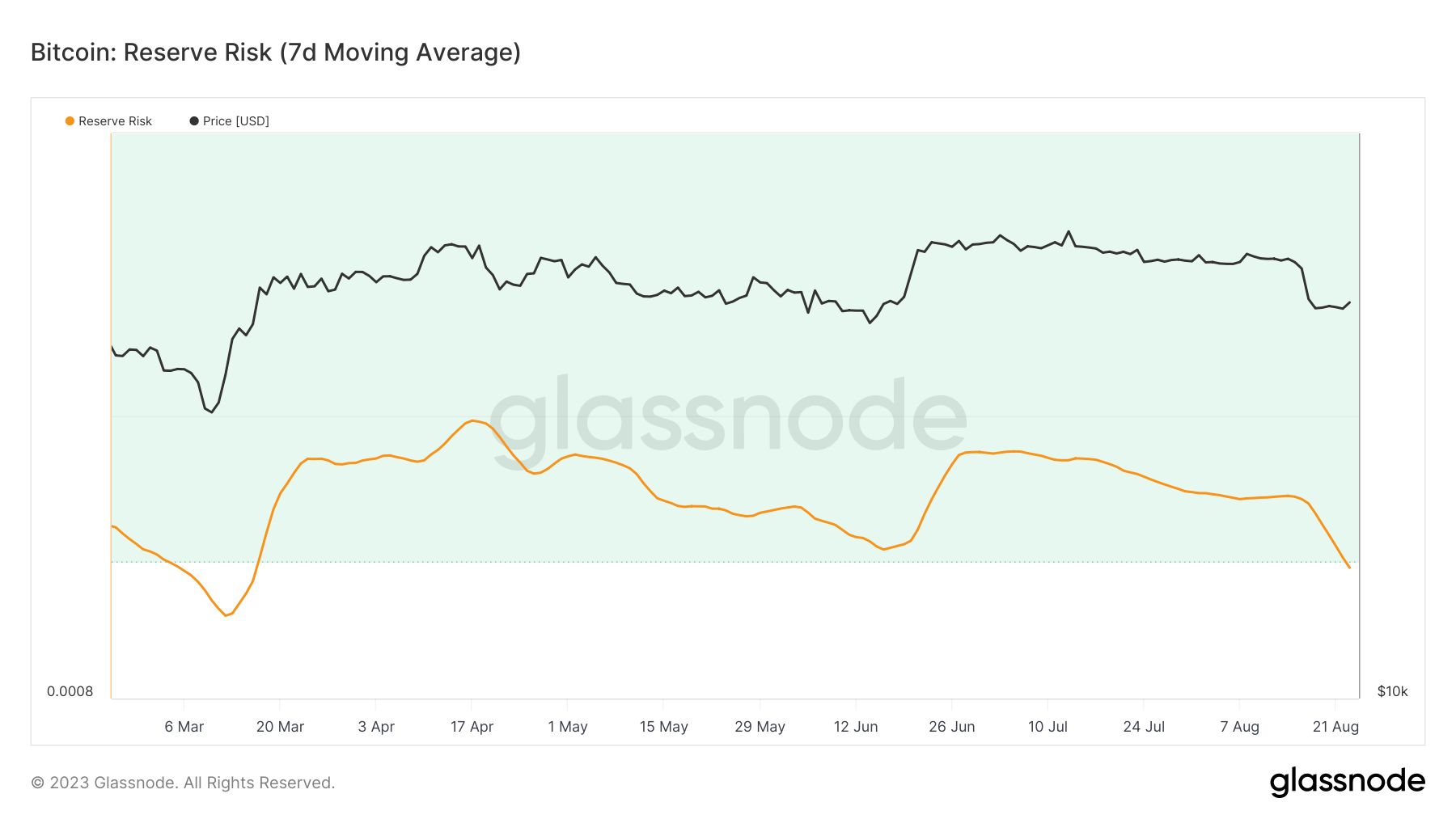

This unwavering confidence is seen in Bitcoin’s reserve risk, an often underutilized on-chain metric.

Reserve risk is a metric used to evaluate the risk/reward ratio of investing in Bitcoin at any given point in time. It’s calculated by dividing the price of Bitcoin by the HODL Bank. The HODL bank represents the value of all coins in terms of their age (i.e., how long they have been held without being spent). The more coins are being held for longer periods, the higher the HODL Bank.

The metric essentially gauges the confidence of long-term holders in relation to the coin’s current price. A low Reserve Risk indicates that long-term holders are confident in the asset, and the current price is seen as attractive for investment. Conversely, a high Reserve Risk suggests that long-term holders might be less confident, and the price might be considered high relative to that confidence.

From Aug. 14 to Aug. 23, Bitcoin’s reserve risk plummeted from 0.0011 to 0.00098. Bitcoin’s price also decreased during this same period, moving from $29,400 to $26,400. To put this in perspective, the last instance when Bitcoin’s reserve risk touched these levels was on March 15, with the price at $25,050.

The drop in both Bitcoin’s price and reserve risk implies that even as the price dipped, the confidence of long-term holders surged. This can be interpreted as long-term holders perceiving the price drop as a lucrative buying window, reinforcing their belief in Bitcoin’s long-term value.

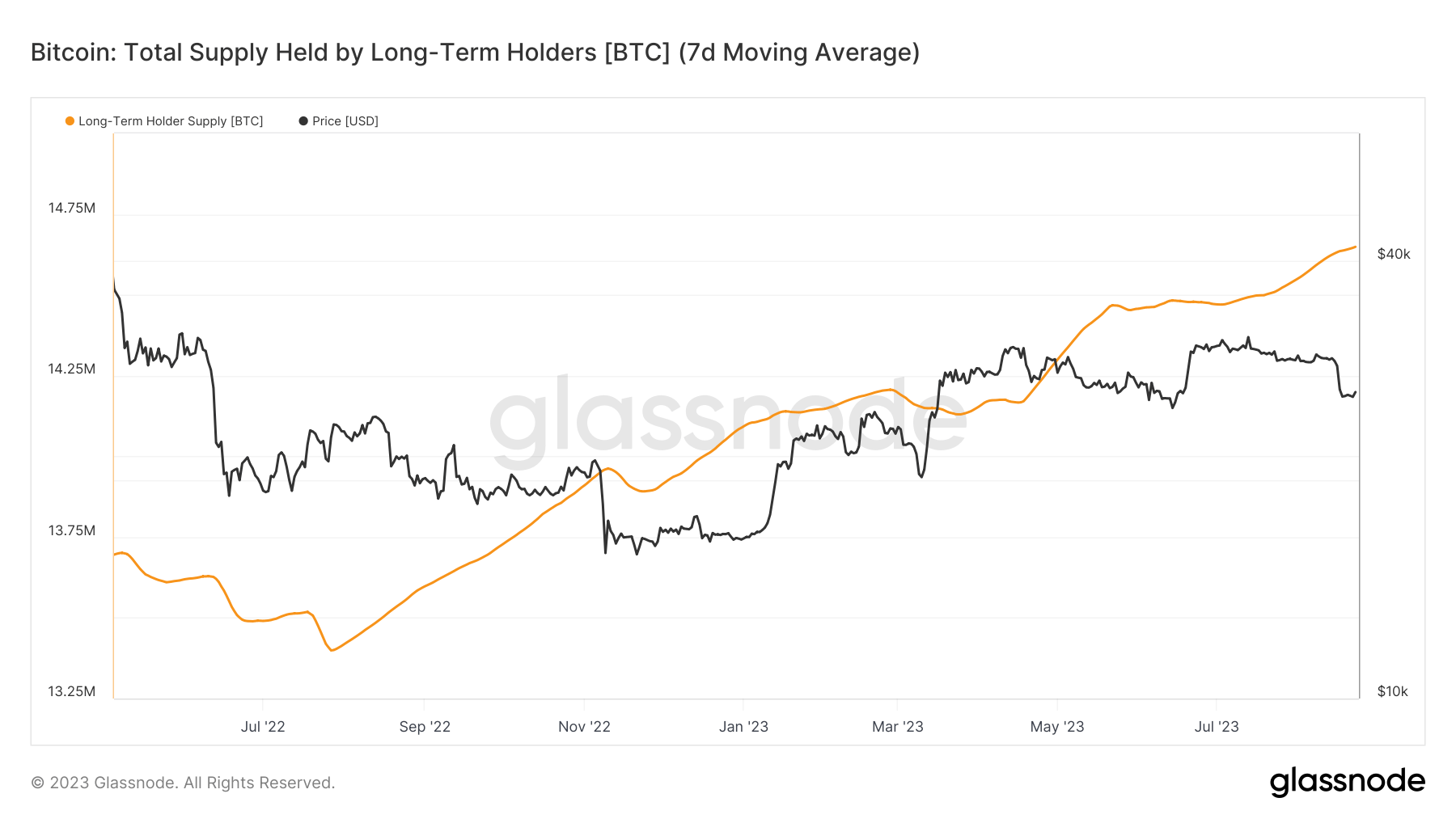

Other on-chain data further supports this, most notably the supply of Bitcoin held by long-term holders.

Despite the price slump, the number of Bitcoins held by long-term holders has increased, growing from 14.62 million to 14.64 in the past week. It’s important to note that this uptick continues an upward trend that began in July 2022.

The diminished reserve risk and the increased long-term supply indicate a prevailing sentiment that the current price offers a favorable risk/reward balance for investment.

While market fluctuations are inherent to the volatile nature of cryptocurrencies, metrics like reserve risk offer a deeper dive into the underlying sentiments. The recent data underscores a bullish outlook for Bitcoin, showing that its long-term holders remain steadfast in their belief in its long-term value, even during short-term price declines.

The post How Bitcoin’s falling reserve risk counters its price decline appeared first on CryptoSlate.