The Houthi attacks on cargo ships in the Red Sea, which started last year, sparked concern about the impact on retailers confronted with increased shipping rates and longer journey times as freight is rerouted from the troubled region.

Source link

Fears

Gold miner Polymetal looks to sell Russian operations for $3.69 billion amid nationalization fears

Gold miner Polymetal International on Monday said it had struck a deal to sell the entirety of its Russian mining business for $3.69 billion, with a view to fully exiting the Russian Federation due to the combined threats of Western sanctions and nationalization by Putin’s government.

If approved by shareholders, Polymetal will sell the business to Russian mining company JSC Mangazeya Plus, with a view to re-focusing its operations towards Kazakhstan where it currently runs two mines that account for around one-third of its total production.

The Anglo-Russian gold miner, which was founded in St Petersburg in 1998, said the sanctions-compliant agreement would see JSC Mangazeya Plus pay it $1.48 billion in cash and also agree to settle the Russian segment’s $2.21 billion debts.

Shares in Polymetal International fell 6% on Monday in Moscow, having lost 11% of their value over the past 12 months and 66% of their value since the start of the Russia’s invasion of Ukraine in early 2022.

In August 2023, the company abandoned its London listing and re-domiciled from Jersey to Kazakhstan’s capital Astana, with a view to avoiding Russia imposed rules that designated Jersey an “unfriendly jurisdiction” in response to Western sanctions.

Polymetal said it will let shareholders vote on the agreement at its upcoming annual general meeting on 7 March, as the company said the sell-off would help avoid risks including those posed by the operations being expropriated or nationalized by the Russian government.

In a statement, Polymetal said it believes a deal to sell its Russian operations “presents the most viable opportunity for the Group to restore shareholder value by removing or substantially mitigating critical political, legal, financial and operational risks.”

The striking of the deal marks the end of an arduous process faced by Polymetal in finding a sanctions-compliant buyer for its Russian operations, after it vowed to exit that country following the outbreak of war.

Polymetal’s push to divest from Russia was made more urgent by the U.S. Department of State’s decision to impose sanctions on its Russian subsidiary in May 2023, which blocked U.S. citizens from interacting with that unit.

The process of selling off its Russian assets has been more difficult due to stringent rules imposed by authorities in both Moscow and Washington on any company looking to exit Russia.

Polymetal said it had received confirmation from the U.S. Office of Foreign Assets Control (OFAC) that those involved in the sale to JSC Mangazeya would not be subject to sanctions, and made clear that any payment would be made via sanctions-compliant financial institutions.

JSC Mangazeya Plus is the mining subsidiary of the Mangazeya commodities conglomerate, which is controlled by Russian billionaire Sergey Yanchukov, who started his career as an oil trader in Ukraine.

If completed, the deal will see Polymetal retain its position as the second largest gold miner in Kazakhstan, in controlling two mines with an estimated 11.3 million ounces of gold.

BitMEX Co-Founder Backs Solana Amidst Fears of Another US Bank Collapse

In a post on X, Arthur Hayes, the co-founder of the derivatives crypto exchange BitMEX, said it might be time for traders to double down on Solana (SOL) and altcoins in general. Hayes’s comments come at a time of heightened volatility in the broader crypto market, with Bitcoin (BTC) struggling to regain its footing and altcoins, including Ethereum (ETH), posting mixed results.

Time To Switch To Solana?

The co-founder noted that it could be time to get back on the Solana “train.” With this preview, Hayes is convinced that Solana and other altcoins could outperform Bitcoin in the days ahead.

The outlook could be anchored on the possibility of altcoins and Bitcoin rising in the coming sessions. Specifically, Hayes warns that a “few” major banks in the United States could “bite the dust.”

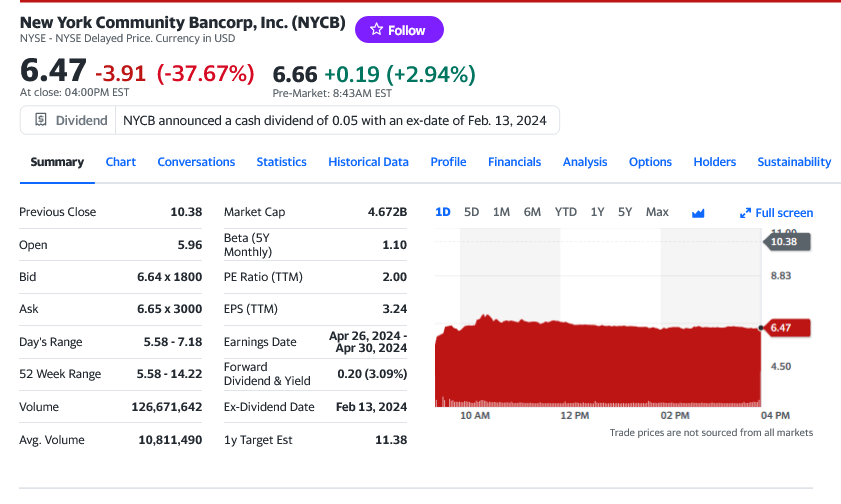

This comment also comes at a critical position in the United States banking landscape. On January 31, market analysts noted that NY Community Bancorp’s stock price plummeted 45% following a surprise quarterly loss and dividend reduction.

NY Community Bancorp is crucial in the United States regional banking sector. It also acquired assets from Signature Bank when it collapsed in March 2023.

Analysts say the bank’s decision to expand harmed its balance sheet. The acquisition of Signature Bank increased its regulatory capital requirements, impacting its dividends and provisions, as seen in its latest earnings report.

A Bank Crisis Is A Boon For Bitcoin, Altcoins

While Hayes’ comments are likely to fuel further speculation about the potential for another banking crisis in the United States, it is not immediately clear whether this might spark a crypto rally.

However, reading from past events, if indeed a major bank in the United States collapses and files for bankruptcy in the next few days, Bitcoin will likely rally. In March 2023, following the collapse of Signature Bank, among others, Bitcoin initiated a crypto rally that saw Ethereum and Solana record gains.

Considering the significant shift in Solana investor sentiment over the past few months, it is likely that SOL might snap back to trend. In that case, the altcoin might break above $125, extending 2023 gains.

When writing, SOL is pinned below $100 and under pressure. The local resistance is at $105. A break out might lift the coin towards $125 in a buy trend continuation pattern.

Feature image from Canva, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Despite ETF rotation fears, mining stocks recover as Bitcoin crosses $42k

Bitcoin regained the psychologically important $40,000 level during the weekend after spending last week struggling to surpass $39,500. As of press time, it stands at just above $42,000, showing solid resilience at this level. This recovery positively affected the broader crypto market and the performance of public Bitcoin mining companies.

Despite being listed and traded on stock exchanges like Nasdaq, public Bitcoin mining companies are susceptible to changes in Bitcoin’s spot price and other developments in the crypto market. As most TradFi investors involved with the stocks see them as a proxy for trading and owning Bitcoin, increases in Bitcoin’s price automatically translate into increases in the stock value of these companies. Conversely, a decrease in the price of BTC leads to a reduction in revenues, adversely affecting their stock performance.

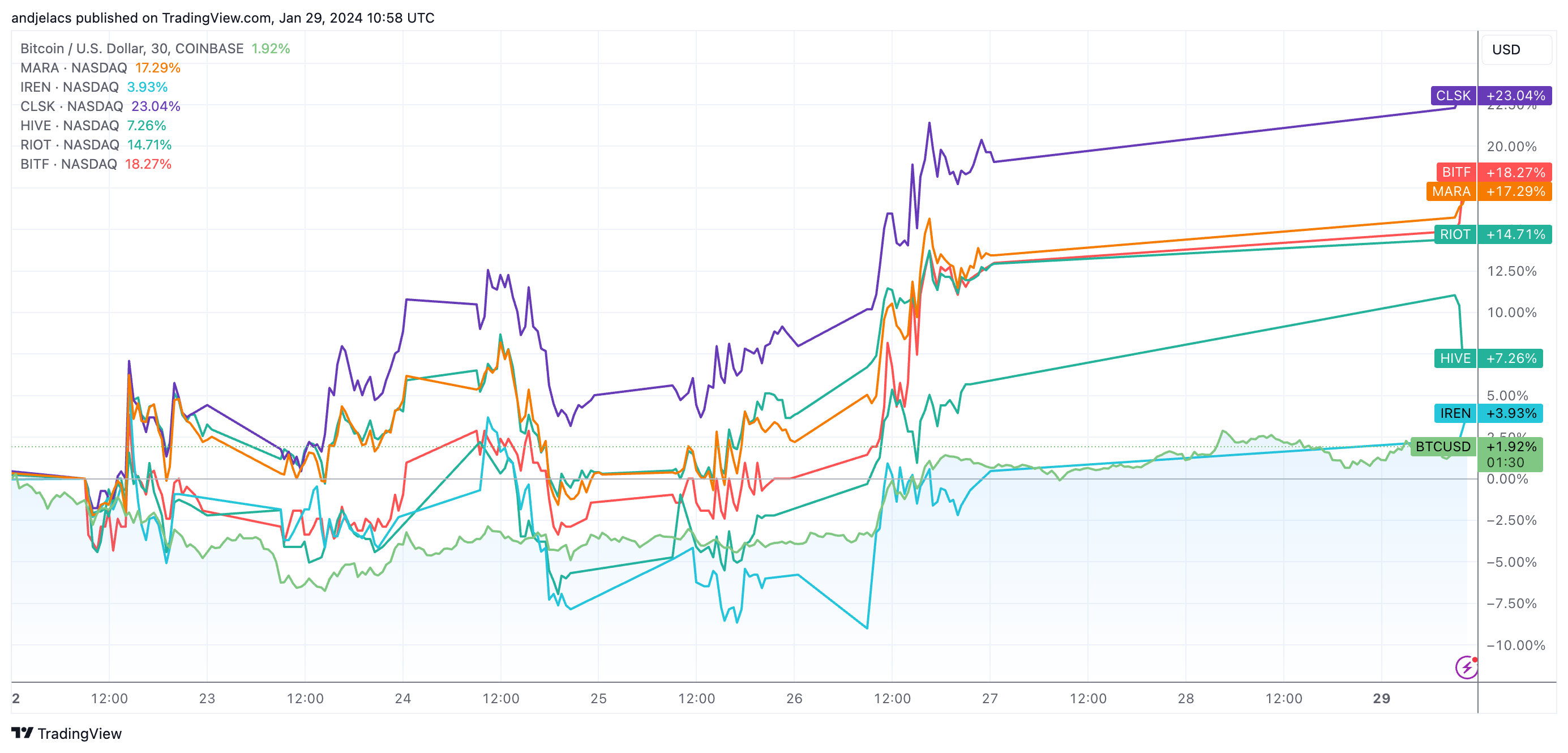

After experiencing a sharp slump in the first two weeks of January, public miners seem to have recovered most of their losses. Between Jan. 22 and Jan. 29, CleanSpark (CLSK) led the pack with a 23% increase, with Bitfarms (BITF) close behind with 18.27%. Marathon Digital (MARA), Riot (RIOT), and Hive (HIVE) grew by 17.29%, 14.71%, and 7.26%, respectively, with Iris Energy (IREN) posting the slightest growth of 3.93% during the period.

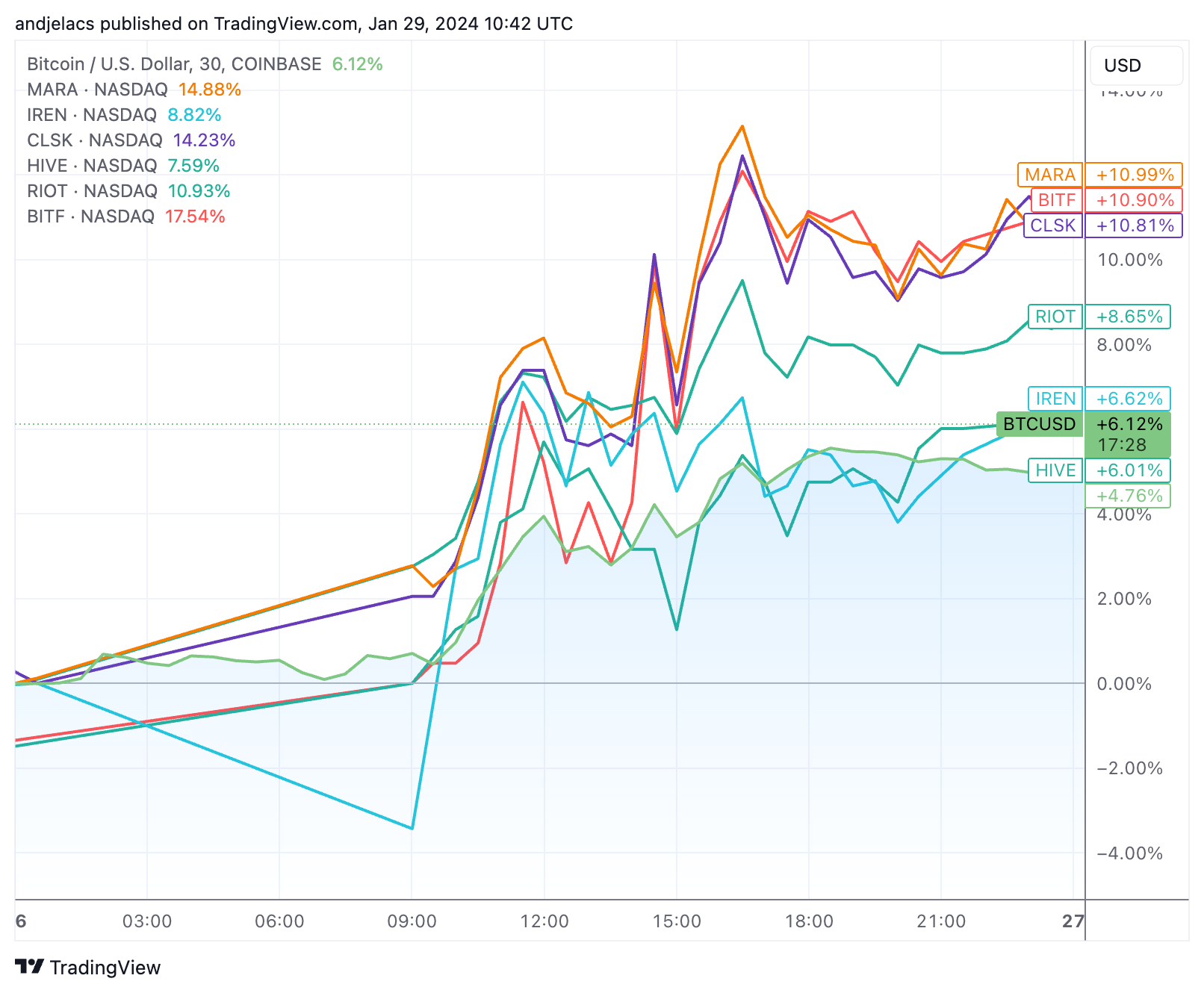

This upward trend was extremely pronounced on Friday, Jan. 26, when almost all of the mentioned stocks outperformed Bitcoin’s growth of 6.12%, with MARA, BITF, and CLSK all showing increases of over 10.80%.

On Jan. 29, as of press time, there has been a lack of response from Bitcoin mining stocks to Bitcoin’s price movement. This lag is due to the different trading hours between the crypto market, which operates 24/7, and traditional stock exchanges like Nasdaq, which operates only on weekdays and where most of the mining stocks are listed. This discrepancy often results in a delayed reaction in mining stock prices to Bitcoin’s weekend price movements. Given Bitcoin’s rise past $42,000 over the weekend, we could see further growth in mining stocks as the market opens on Jan. 29 and adjusts to the development in the coming week. Stocks such as RIOT, MARA, and CLSK are up 3%, 3.9%, and 4.2%, respectively, so far in pre-market trading.

The performance of these stocks also reflects the slightly increased miner revenue, which was volatile last week but showed an overall positive uptrend. According to data from Glassnode, the total daily USD revenue paid to miners fluctuated between $39 million and $47 million, following Bitcoin’s price volatility. Miner revenue is a critical benchmark for assessing the health and performance of mining stocks, and revenue increases are one of the most significant factors pushing stock prices up.

The post Despite ETF rotation fears, mining stocks recover as Bitcoin crosses $42k appeared first on CryptoSlate.

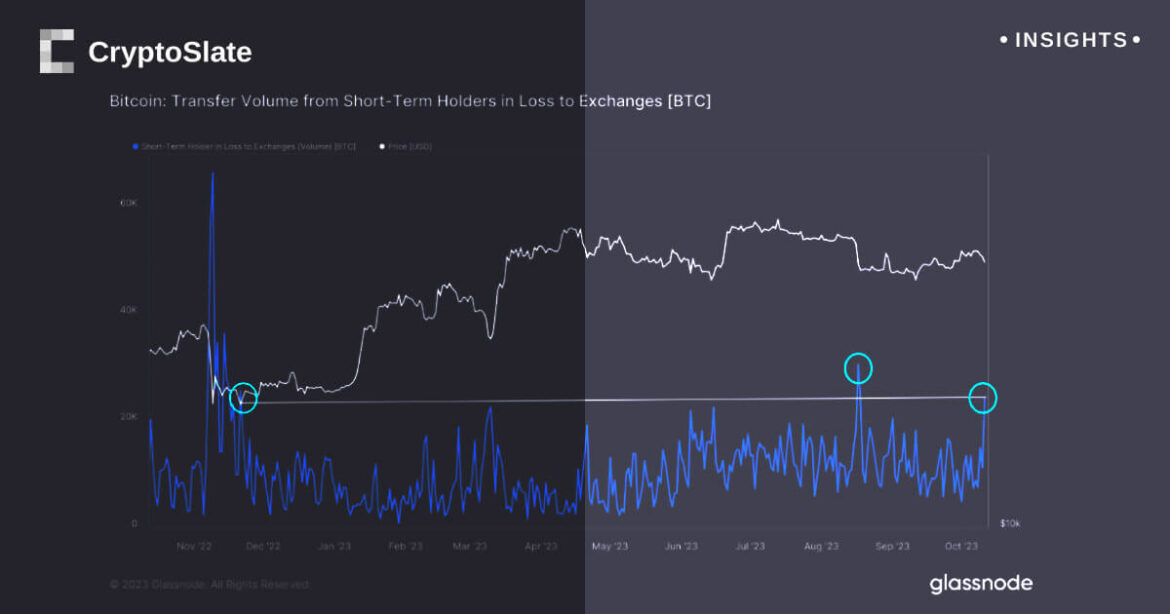

Bitcoin selloff by short-term holders spikes amid market fears, data shows high volume of losses in 2023

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Oops…you must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.

Stocks shake off Israel-Gaza war fears to end higher after remarks by Fed officials

U.S. stocks ended higher Monday, shaking off early losses that followed the weekend attack by Hamas on Israel, as investors focused on remarks by Federal Reserve officials

What happened

-

The Dow Jones Industrial Average

DJIA

rose 197.07 points, or 0.6%, to close at 33,604.65. -

The S&P 500

SPX

finished with a gain of 27.16 points, or 0.6%, at 4,335.66. -

The Nasdaq Composite

COMP

ended at 13,484.24, up 52.90 points, or 0.4%.

Stocks bounced Friday after a stronger-than-expected September jobs report, allowing the S&P 500 to rise 0.5% for the week and break a streak of four straight weekly declines. The Dow saw a 0.3% weekly decline, while the Nasdaq Composite rose 1.6%.

What drove markets

Declines for equities were pared in morning trade after remarks by Dallas Federal Reserve Bank President Lorie Logan were seen as indicating a surge in long-term Treasury yields may mean the central bank has less need to further raise interest rates. Stocks extended early afternoon gains after remarks by Fed Vice Chair Philip Jefferson that also highlighted a rise in long-term yields.

Jefferson said that a sharp rise in long-term yields could be the result of investors concluding that the underlying momentum of the economy was stronger than previously thought and the Fed would need to keep rates higher for longer. But it could also arise from changes in investor attitudes toward risk and uncertainty.

“Looking ahead, I will remain cognizant of the tightening in financial conditions through higher bond yields and will keep that in mind as I assess the future path of policy. I will be taking financial market developments into account along with the totality of incoming data in assessing the economic outlook and the risks surrounding the outlook and in judging the appropriate future course of policy,” Jefferson said.

Logan, in a speech, said that if interest rates “remain elevated because of higher term premiums, there may be less need to raise the fed-funds rate. However, to the extent that strength in the economy is behind the increase in long-term interest rates, the FOMC may need to do more.”

Jefferson’s call to proceed carefully in a sensitive period for risk management “conveys no urgency to hike again,” said Krishna Guha, economist at Evercore ISI, in a Monday afternoon note.

Still, it was defense stocks that led the rebound. The iShares U.S. Aerospace & Defense ETF

ITA

rose 4.5% to close at $108.72.

The attack by Hamas on Israel raised fears of a broader conflict, sending crude prices higher and spurring haven-related support for gold, the dollar and U.S. Treasury futures.

The cash Treasury market was closed on Monday for Columbus Day and Indigenous Peoples’ Day, but futures

TY00,

indicated falling benchmark yields.

See: Gold, U.S. dollar rally as investors flock to havens as Israel-Hamas war escalates

U.S. stocks saw only modest pressure, however.

“Global risks have clearly risen but in the short term, the U.S. remains the global safe haven, given the weakness in the economies of China and Europe, and should result in funds flows in our direction, though it may make things more vulnerable to earnings disappointments and subdue the rally on positive earnings surprises,” said Louis Navellier, founder of Navellier & Associates

Commodities Corner: Here’s what will drive oil prices as Israel-Hamas war continues

The price of Brent crude

BRN00,

the global energy benchmark, rose 4.2% amid concerns that oil supplies from the region may be compromised. Crude fell back significantly last week, however, after trading near $100 a barrel in September.

Read: Tom Lee points to uncomfortable upside for U.S. stocks of Israel-Hamas conflict

Meanwhile, the U.S. producer and consumer prices data for September will be published on Wednesday and Thursday, respectively, with further evidence of easing price pressure required to cement no more rate increases by the Federal Reserve this year.

Then Friday sees the start proper of the third-quarter company-earnings season, when big banks such as JPMorgan Chase

JPM,

Citigroup

C,

and Wells Fargo

WFC,

present their results.

Earnings Watch: Q3 earnings are here: S&P 500 heads toward year of profit declines as JPMorgan, and Delta report this week

Companies in focus

-

Shares of defense contractors, including RTX Corp.

RTX,

+4.62%

and Lockheed Martin Corp.

LMT,

+8.93% ,

rose after the surprise attack on Israel by Hamas over the weekend. -

Energy companies, including Marathon Petroleum Corp.

MPC,

+2.37%

and Occidental Petroleum Corp.

OXY,

+4.53% ,

saw shares rise as crude prices rallied. -

Walt Disney Co.

DIS,

+2.12%

was in focus after The Wall Street Journal reported, citing sources, that activist investor Nelson Peltz’s Trian Fund Management has upped its stake in a bid to get several more seats on the company’s board. Shares rose 2.1%.

Just a few months ago, investors appeared relatively sanguine about the dreaded prospect of stagnant economic activity and rising inflation.

Oil prices surging to the brink of $100 per barrel and the specter of higher-for-longer inflation have renewed concern about stagflation risks, however.

“I think that the big bogeyman out there is stagflation, that we get into this spirit of high inflation and low growth,” Mel Lagomasino, CEO of WE Family Offices, told CNBC’s “Squawk Box” on Wednesday.

Lagomasino cited comments from Minneapolis Fed President Neel Kashkari, who said in an essay earlier this week that U.S. interest rates may have to go “meaningfully higher” to bring down stubbornly sticky inflation.

Kashkari reaffirmed this message when speaking to CNBC on Wednesday, saying that he was not sure if interest rates have been raised enough to successfully fight price growth.

“It looks like they might not just be higher for longer, they might be quite a bit higher for longer,” Lagomasino said, before adding that she believes a recession is “definitely” on the horizon.

Federal Reserve Board Chairman Jerome Powell speaks during a news conference after a Federal Open Market Committee meeting on September 20, 2023 at the Federal Reserve in Washington, DC.

Chip Somodevilla | Getty Images News | Getty Images

Stagflation was first recognized in the 1970s, when an oil shock prompted an extended period of higher prices but sharply falling economic growth.

The phenomenon is characterized by slow growth, high unemployment and soaring inflation. The one ingredient currently missing is the high unemployment, still relatively low at 3.8% — although there are fears that mounting layoffs may mean this could soon change.

Market participants are worried that surging oil prices could keep inflation higher for longer, amplifying the risk of stagflation.

Brent crude futures have jumped more than $20 a barrel in the three months to late September, a rally that has put a return to $100 sharply into focus. The international benchmark was last seen trading at $96.12 on Friday, up 0.8% for the session. U.S. West Texas Intermediate futures, meanwhile, rose 1.4% to trade at $92.96.

The price rally comes amid growing expectations of tighter supply, after Saudi Arabia, leader of OPEC, and non-OPEC heavyweight Russia moved to draw down global inventories and extend some of their voluntary oil supply cuts through to the end of the year. Together, OPEC and non-OPEC producers are known as OPEC+.

“By early summer, investors looked increasingly confident that the global economy was escaping the plague of stagflation,” analysts at Generali Investments said in a research note published Thursday.

“They are having a second thought – rightly so.”

‘A real worry’

Looking ahead to the fourth quarter, analysts at Generali Investments said the oil price surge was “most unwelcome” because this would likely keep headline U.S. inflation higher and hurt economic growth.

“The price pressure reflects a shortage of supply, after OPEC+ cut production targets, under the leadership of Saudi Arabia and Russia. This must be seen in the context of a moving geopolitical environment, with Saudi Arabia recently joining the BRICS group,” they added.

The BRICS economic coalition of emerging markets last month invited six countries to become members.

The alliance — which is currently composed of Brazil, Russia, India, China and South Africa — asked Argentina, Egypt, Iran, Ethiopia, Saudi Arabia and the United Arab Emirates to become new members of the bloc, with membership to take effect from Jan. 1, 2024.

Paul Gambles, co-founder and managing partner at MBMG Family Office Group, said Friday that rising oil prices could keep inflation higher for longer. He also suggested that policymakers appeared determined to bring the risk of stagflation back into the picture.

“The oil price is still really a wild card. And what we are seeing now is we can get into a situation where we do end up with softer demand for oil and yet the prices can still keep going higher because of the fact that there is this ability to constrain supply,” Gambles told CNBC’s “Squawk Box Europe.”

He cited Germany, Europe’s traditional growth engine, as one notable example where the mix of high inflation and low growth seems to have taken hold.

“Germany looks like it is on the precipice of a really significant slowdown combined with a potential inflation spike because of energy prices,” Gambles said.

“If you look at the premiums that are being charged on U.S. oil that is being shipped to Europe right now because of the low inventories in the states then it suggests that policymakers — aided by OPEC and the other oil suppliers — are doing everything they can to create the potential for stagflation. And that’s a real worry.”

The Jackson Hole Effect? Powell’s Speech Sparks Bitcoin Fears Amid Similar 2022 Price Action

As Jerome Powell, the Federal Reserve (Fed) Chair, prepares to return to Jackson Hole this Friday, the Bitcoin (BTC) market is experiencing a sense of anticipation due to the similarities in the current price action compared to the period leading up to last year’s speech.

Key moving averages have been tested and lost over the past two weeks, followed by a period of consolidation, reminiscent of previous events.

However, it is important to note that these similarities do not guarantee a repeat of the past, as market conditions and Powell’s stance have since evolved.

Déjà Vu In The Bitcoin Market?

According to Keith Alan, co-founder of analysis and crypto research firm Material Indicator, last year, in the two weeks preceding Powell’s speech, BTC’s price broke through crucial technical support levels represented by the 21-day, 50-day, 100-day, and 200-week Moving Averages (MA).

Subsequently, a period of consolidation ensued, followed by a significant price drop in response to Powell’s hawkish tone during the speech. Alan stated:

Remember when Fed Chair Powell spoke from Jackson Hole last year and his hawkish tone triggered a 29% BTC dump that took 5 months to recover?

Notably, the recent price action in the Bitcoin market has displayed similarities to last year’s pattern. Over the past two weeks, Bitcoin has tested and lost these same key moving averages, and it is currently undergoing a phase of consolidation, mirroring the events leading up to Powell’s previous address.

Keith Alan emphasizes that since last year’s Jackson Hole event, there have been notable changes. Core inflation has decreased, and Powell’s approach to communication has become more “measured”.

It is uncertain whether Powell will adopt a hawkish or dovish stance in his upcoming speech, making it challenging to predict the market’s reaction with certainty. What is evident, however, is that the market is primed for a significant move.

Additionally, Alan suggests that the formation of a lower low in price increases the likelihood of an extension of the existing downtrend. Market participants should be prepared for the possibility of further testing of support levels.

As the Bitcoin market awaits Powell’s speech, market sentiment remains dynamic. Traders and investors are anticipating potential market-moving cues from the event.

As the date of Jerome Powell’s return to Jackson Hole approaches, Bitcoin has displayed a notable recovery of 2.1% within the past 24 hours, marking a positive upward movement that brings it closer to the $27,000 threshold.

However, it is crucial to note that if the outcome of Jerome Powell’s speech on Friday proves favorable for crypto investors and propels Bitcoin’s price to higher levels, the cryptocurrency may encounter a significant obstacle in the form of its 200-day moving average positioned at $27,200.

Featured image from iStock, chart from TradingView.com

Bitcoin headed toward a “crucial area” after the June 16 Wall Street open, as a recovery from three-month lows continued.

Bitcoin reinforces rebound from multi-month lows

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD nearing $26,000 on Bitstamp.

The Bitcoin (BTC) price built on an overnight rebound from its lowest levels since early March amid ongoing regulatory and macroeconomic pressures.

For Michaël van de Poppe, founder and CEO of trading firm Eight, $26,000 represented a key level for bulls to flip next.

“Long weekend is coming up with the bank holiday on Monday,” he told Twitter followers, referencing the Juneteenth holiday in the United States.

“For Bitcoin, crucial area to break is $26K. If that breaks, we’ll have some acceleration. I’m still long, would still long if we reach $24.4K too.”

That $24,400 downside area of interest was already in focus for various popular traders.

Among them was Daan Crypto Trades, who predicted a return closer to $26,000 as part of a narrowing wedge structure in place on lower timeframes.

#Bitcoin Low timeframe:

Struggling to break the Weekly VWAP so far.

You can clearly see how it’s rejecting price every time we’ve touched it.

A break above, should lead to a next leg into the May lows around 25.8-25.9K.

Support sits at $25.3K. pic.twitter.com/kIjeRdaMiN

— Daan Crypto Trades (@DaanCrypto) June 16, 2023

“This dip into $24,000 is a great opportunity,” fellow trader Jelle wrote in part of the day’s tweets, adding that the Twitter user was “ready for the bull market.”

My game plan remains unchanged.

I started buying around $16,500, and so long as we trade below $30,000 – I will continue to buy on pullbacks.

This dip into $24,000 is a great opportunity.

Bought more #Bitcoin – ready for the bull market. pic.twitter.com/R78ZUu7SPI

— Jelle (@CryptoJelleNL) June 16, 2023

Market joins Binance CEO in dismissing France “FUD”

June 16, meanwhile, marked another test for major exchange Binance, with France launching investigative proceedings hours after an announcement that Binance would quit the Netherlands altogether over regulatory difficulties.

Related: 3 Bitcoin price metrics showing ‘insane’ similarities to 2020 breakout

Markets appeared immune to the news, however, and in characteristic fashion, Binance CEO Changpeng Zhao, known as CZ, called the France episode “FUD” — fear, uncertainty and doubt.

“France, surprise (no advanced notice) on-site inspections of regulated businesses are the norm, for banks, and now for crypto too. The surprise visit for Binance France happened a couple of weeks ago. It’s not ‘news.’ Binance France cooperated fully,” he tweeted on the day.

“Binance also isn’t the only crypto business inspected. This happened to other well known crypto businesses in Paris too. Binance France continues to be our flagship center in Europe.”

Binance’s in-house token, BNB (BNB), appeared similarly resilient, climbing to $240 on the day.

Magazine: Bitcoin is on a collision course with ‘Net Zero’ promises

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.