New home sales at 662,000 annual rate in February versus 664,000 in the prior month.

Source link

February

Inflation rose again in February, keeping the Federal Reserve on course to wait at least until the summer before starting to lower interest rates.

The consumer price index, a broad measure of goods and services costs, increased 0.4% for the month and 3.2% from a year ago, the Labor Department’s Bureau of Labor Statistics reported Tuesday. The monthly gain was in line with expectations, but the annual rate was slightly ahead of the 3.1% forecast from the Dow Jones consensus.

Excluding volatile food and energy prices, the core CPI rose 0.4% on the month and was up 3.8% on the year. Both were one-tenth of a percentage point higher than forecast.

While the 12-month pace is off the inflation peak in mid-2022, it remains well above the Fed’s 2% goal as the central bank approaches its two-day policy meeting in a week.

A 2.3% increase in energy costs helped boost the headline inflation number. Food costs were flat on the month, while shelter rose another 0.4%.

The BLS reported that the increases in energy and shelter amounted to more than 60% of the total gain. Gasoline jumped 3.8% on the month while owners’ equivalent rent, a hypothetical gauge of what homeowners could get renting their properties, rose 0.4%.

“Inflation continues to churn above 3%, and once again shelter costs were the main villain. With home prices expected to rise this year and rents falling only slowly, the long-awaited fall in shelter prices isn’t coming to the rescue any time soon,” said Robert Frick, corporate economist at Navy Federal Credit Union. “Reports like January’s and February’s aren’t going to prompt the Fed to lower rates quickly.”

Fresh chicken breasts are displayed for sale in the meat area of a Sprouts Farmers Market grocery store in Redondo Beach, California on February 23, 2024.

Patrick T. Fallon | AFP | Getty Images

Airline fares posted a 3.6% increase, apparel prices rose 0.6% and used vehicles were up 0.5%. Medical care services, which helped feed a higher-than-expected CPI increase in January, decreased 0.1% last month.

The year-over-year increase for headline CPI was 0.1 percentage point higher than January, while core was one-tenth of a point lower.

Wall Street opened higher following the report, major stock averages as well as Treasury yields positive in early trading.

While the 12-month pace is off the inflation peak in mid-2022, it remains well above the Fed’s 2% goal as the central bank approaches its two-day policy meeting in a week.

Fed officials in recent weeks both have signaled that rate cuts are likely at some point this year and expressed caution about letting up too soon in the battle against high prices. The statement after the January meeting indicated that policymakers need “greater confidence” that inflation is moving back to target.

Chair Jerome Powell, in congressional testimony last week, echoed those concerns, though he did mention that the Fed is probably “not far” from the point where it can start easing up on monetary policy.

Tuesday’s report “leaves Fed officials some way from attaining the ‘greater confidence’ needed to begin cutting interest rates,” said Paul Ashworth, chief North America economist at Capital Economics.

For financial markets, the shift in the Fed stance from its apparent policy pivot in late 2023 has meant a repricing on the pace of rate cuts. Where futures traders entered the year expecting cuts to start coming in March, with six or seven total on the year, they have pushed out the first reduction to June, with two or three to follow, assuming cuts in quarter percentage point increments.

A bustling economy has helped the Fed focus on incoming data and allowed policymakers to avoid having to rush to lower rates. Gross domestic product expanded at a 2.5% annualized pace in 2023 and is on pace to increase at a 2.5% pace in the first quarter of 2024, according to the Atlanta Fed’s GDPNow tracker.

One key ingredient in that growth has been a resilient consumer boosted by a strong labor market. The economy added another 275,000 nonfarm jobs in February, though the increase skewed heavily to part-time positions and the unemployment rate rose to 3.9%.

Such strength can be a double-edged sword: While the growth in the face of aggressive rate hikes has bought the Fed time on policy, it also raises concerns that inflation could be more durable than expected.

Housing costs in particular have caused concern.

Shelter comprises about one-third of the CPI weighting and has been slow to decelerate, at least according to the BLS measure. Fed officials see rental prices coming down through the year, and other measures outside the CPI computation of owners-equivalent rent have shown easing price pressures.

Correction: The BLS reported that the increases in energy and shelter amounted to more than 60% of the total gain. An earlier version misstated a sector.

Don’t miss these stories from CNBC PRO:

A month after the U.S. stock market suffered its worst consumer-price index release day in over a year, investors are worrying about a reprise when the latest inflation data arrives on Tuesday morning — data that could shake up the Federal Reserve’s monetary-policy expectations and test stocks’ 2024 bull run.

Source link

Private sector job growth improved during February though growth was slightly less than expected, payrolls processing firm ADP reported Wednesday.

Companies added 140,000 positions for the month, an increase from the upwardly revised 111,000 in January but a bit below the Dow Jones estimate for 150,000.

Job gains came across multiple areas, led by leisure and hospitality with 41,000 and construction, which added 28,000 positions. Other industries showing solid gains included trade, transportation and utilities (24,000), finance (17,000), and the other services category (14,000).

Of the total, 110,000 came from the services sector while goods producers added 30,000. Growth was concentrated among larger companies, as establishments with fewer than 50 employees contributed just 13,000 to the total.

Along with the job growth, annual pay increased 5.1% for those staying in their jobs, which ADP said was the smallest rise since August 2021, a potential indication that inflation pressures are receding.

The report comes with the labor market getting added attention for signals of whether U.S. economic growth will stall this year after gross domestic product posted a solid 2.5% annualized gain in 2023.

“Job gains remain solid. Pay gains are trending lower but are still above inflation,” said ADP’s chief economist, Nela Richardson. “In short, the labor market is dynamic, but doesn’t tip the scales in terms of a Fed rate decision this year.”

ADP’s report precedes the Labor Department’s official nonfarm payrolls release, which is scheduled for Friday. In recent months, ADP has consistently undershot the closely watched report from the Bureau of Labor Statistics, which showed an increase of 353,000 in January, more than triple the ADP estimate.

Economists surveyed by Dow Jones are expecting Friday’s report to show a rise of 198,000.

Don’t miss these stories from CNBC PRO:

Peckshield: Cryptocurrency Hackers Stole Over $360 Million in February

Cryptocurrency hackers stole over $360 million during February, almost doubling the amount stolen in January. According to Peckshield, a cryptocurrency and blockchain security firm, the largest hack event in February involved a security breach in Playdapp, a Web3 gaming platform, that lost $290 million four days after being attacked. Fixedfloat, a cryptocurrency exchange, also lost […]

Cryptocurrency hackers stole over $360 million during February, almost doubling the amount stolen in January. According to Peckshield, a cryptocurrency and blockchain security firm, the largest hack event in February involved a security breach in Playdapp, a Web3 gaming platform, that lost $290 million four days after being attacked. Fixedfloat, a cryptocurrency exchange, also lost […]

Source link

February job report, Powell’s visit to Capitol Hill are on investors’ radar this week

It is a crucial week for economists and investors as key economic data will be released, along with two days of testimony from Fed Chairman Jerome Powell before Congress.

Powell testifies before Congress

Wednesday, Thursday at 10:00 a.m. Eastern

Fed officials have been singing from the same songbook over the past few weeks, stressing patience about potential interest-rate cuts. Fed Gov. Christopher Waller, summed it up best when he recently asked “what’s the rush?”

Powell may not have appreciated that question. He is going to spend two days this week with lawmakers on Capitol Hill, many of whom are more than likely to have an answer prepared for Waller’s question.

Remember, Senate Democrats already wanted the first rate cut in January, saying that the Fed’s tight monetary policy was damaging the housing market. Talk of patience might not be welcomed.

Democrats are eager for the Fed to cut rates and potentially give the economy a jolt going into the November elections. Republicans will likely stress the need for the Fed to stay the course to combat still-high inflation. It is a political year and the Fed’s actions will be seen in that light, no matter how often it swears to be apolitical.

February job report

Friday at 8:30 a.m. Eastern

Economists expect the labor market to cool after two “fiery” job gains the past two months, said Douglas Porter, chief economist at BMO Capital Markets. In December and January, the economy added an average of 268,000 net new jobs per month.

Economists surveyed by the Wall Street Journal expect the economy to add 210,000 jobs in February. The unemployment rate is expected to remain steady at 3.7%., nearly as low as it has been in 50 years. Average hourly wages are expected to moderate to a 0.2% gain from the strong 0.6% rise in the prior month.

“Even though we believe job growth will cool in February, we still see a number of signs that the labor market remains strong, Feroli of JPMorgan said.

Q1 GDP tracking estimate

Data not officially released until end of April

Economists are ratcheting up their forecasts for first-quarter gross domestic product based on recent data.

Michael Feroli, chief U.S. economist at JP Morgan Chase, said he raised his estimate to a 2.25% rate in the January-March quarter, from his prior forecast of 1.7%.

Aichi Amemiya, senior economist for the U.S. at Nomura Securities, said he’s raised his tracking estimate to 2.2% from 2.1%.

The Atlanta Fed’s GDPNow estimate is 2.1%, down from 3% previously.

The government revised its estimate for fourth quarter growth to 3.2% from 3.3% previously. The official first-quarter GDP data won’t be released until April 25.

So the economy “is still in the soft landing zone,” said Scott Anderson, chief U.S. economist at BMO.

The Dow Jones Just Hit a Record High in February: Should You Buy Stocks Now?

The stock market has been one of the best ways to build your nest egg, but it’s not always a smooth ride. As the Federal Reserve aggressively hiked rates in 2022, asset prices tanked. But 2023 was a turnaround year, and the optimism has carried over so far into 2024.

The Dow Jones Industrial Average, one of the most closely watched indexes, was up 12% in 2023. And on Feb. 23, it was up 2% for the year, and the popular index of 30 blue chip companies had hit a new all-time high.

Are you wondering if it’s time to buy stocks now?

Always play the long game

If you’ve been sitting on the sidelines watching the market keep rising, it may be discouraging knowing that you’re missing out on potential gains. You might assume that the smart strategy isn’t to buy right now but to wait until things cool off before jumping in.

This idea makes sense. Why would you put money into stocks when you think they could drop in the near future? No one likes to lose money.

This is a flawed approach, though. We all think we can correctly time the market, missing the worst days and taking advantage of the best days. But doing this profitably on a consistent basis is a losing game. You’re likely to do more damage to your portfolio by buying and selling at the worst times.

On the other hand, this means that it’s better to just buy and hold now. In the last 50 years, the Dow Jones has produced an average annual return of 8%. Even if you invested at a fresh peak, over the very long term, you’d still earn close to this average gain. That’s very encouraging.

By understanding this reality, investors can accept that the great advantage they have is time. The earlier you start putting money to work, the better off you’ll be — even if the market seemingly hits fresh all-time highs each day.

Ways to gain exposure

You’ve correctly decided that you don’t want to try and time the market. Now you have to figure out how you’d like to gain exposure to the stock market, one of the greatest wealth-building tools available.

Buying index funds is a strategy that even the great Warren Buffett suggests is what the vast majority of people should do. There is a top low-cost option that tracks the Dow directly, the SPDR Dow Jones Industrial ETF Trust (DIA 0.35%). If you want to gain exposure to the S&P 500 or the Nasdaq Composite index, there are numerous other choices that can give you access to the holdings in these indexes, as well.

If you believe that you have the time and the required skills to analyze individual securities, it might be a good idea to look at certain stocks to buy right now. As I mentioned earlier, the Dow Jones consists of 30 companies that are recognized leaders in their respective industries with long and successful operating histories. Among them, there are a few names that stand out.

Tech-giants Apple and Microsoft should be on every investor’s radar. They sell some of the most popular products and services in the world. Both companies are incredibly profitable and have seen their share prices skyrocket in the last decade.

But based on Apple’s and Microsoft’s forward price-to-earnings ratios of 35 and 28, I view their shares as being expensive today. Still, both stocks should be on your watch list because they are undoubtedly some of the most dominant companies on Earth.

Investors shouldn’t be discouraged that the market is hitting highs. Now is as good a time as ever to start putting some money to work.

Neil Patel and his clients have no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Open interest, the total number of outstanding derivative contracts that have not been settled, is an important metric for gauging market health and sentiment. An increase in open interest means new money entering the market, showing heightened trading activity and interest in Bitcoin. Conversely, a decline suggests closing positions, potentially indicating a change in market sentiment or a consolidation phase. Monitoring these trends is important for understanding the liquidity, volatility, and future price expectations in the market.

In a bullish market, an increase in open interest often correlates with rising prices, suggesting that new money is betting on further price appreciation. This scenario typically reflects a strong market sentiment and investor confidence in Bitcoin’s upward trajectory. On the other hand, in a bearish context, growing open interest might indicate that investors are hedging against expected price declines, revealing a more cautious or negative market outlook.

Furthermore, the balance between call and put options within the open interest provides deeper insights into market sentiment. A predominance of calls suggests a bullish market sentiment, with many investors expecting price rises, whereas a majority of puts can indicate bearish expectations.

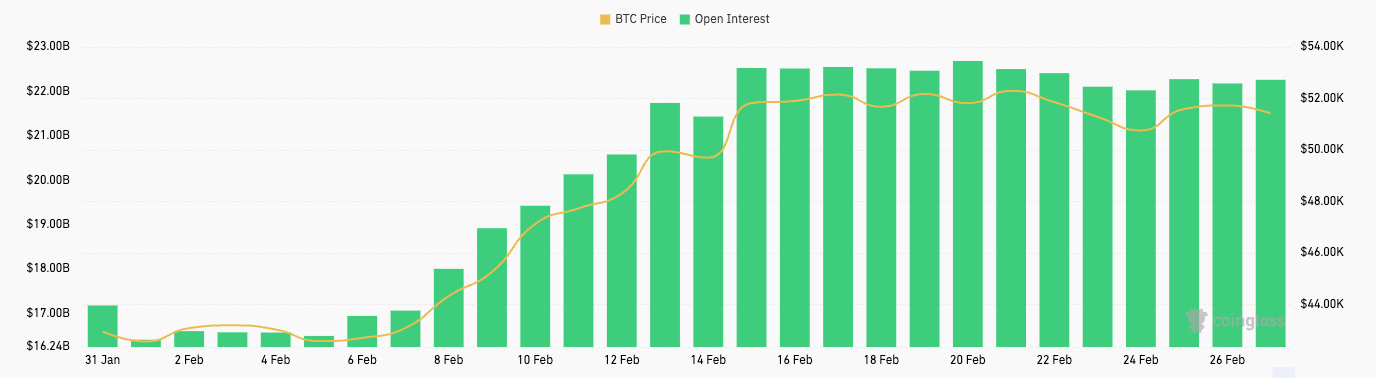

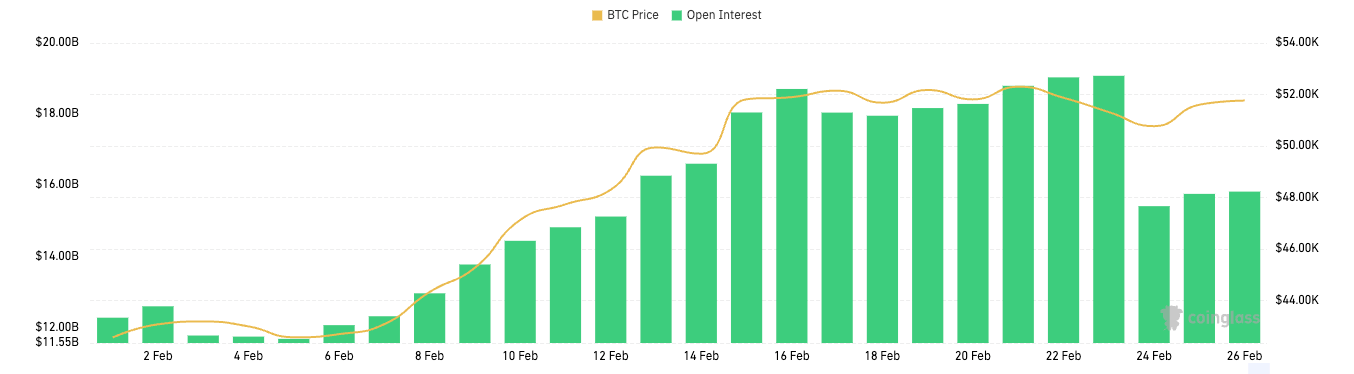

February saw a significant increase in open interest for Bitcoin futures and options.

From Feb. 1 to Feb. 20, Bitcoin futures open interest grew from $16.41 billion to $22.69 billion. This substantial rise suggests that traders were increasingly entering into futures contracts, anticipating higher volatility or making directional bets on Bitcoin’s price. Interestingly, this period aligns with a notable increase in Bitcoin’s price, from $42,560 to $52,303, suggesting a bullish sentiment among futures traders. The slight decrease in open interest by Feb.26 to $22.21 billion, alongside a marginal dip in Bitcoin’s price to $51,716, could indicate some traders taking profits or closing positions in anticipation of a consolidation phase or to reduce exposure ahead of potential volatility.

Similarly, Bitcoin options open interest saw a dramatic increase from $12.27 billion at the beginning of February to a peak of $19.08 billion by Feb.23 before dialing back to $15.82 billion towards the month’s end. Options provide the holder the right, but not the obligation, to buy (call option) or sell (put option) Bitcoin at a specified price, offering more complex strategies for traders to express bullish or bearish views or to hedge existing positions. The initial spike in options open interest reflects a robust engagement from investors, leveraging options for directional bets on Bitcoin’s price and protective measures against potential downturns.

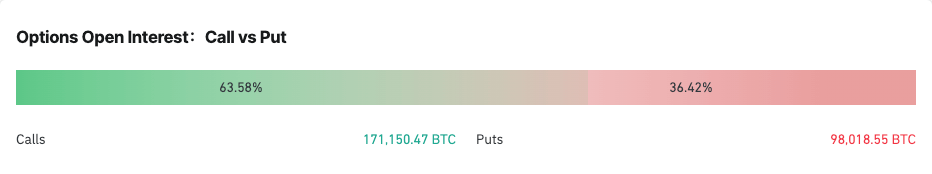

The ratio between calls and puts for Bitcoin options provides a deeper insight into market sentiment and potential expectations for Bitcoin’s price direction. The distribution between calls and puts is a direct indicator of the market’s bullish or bearish inclinations, with calls representing bets on rising prices and puts on falling prices.

As of Feb. 26, the open interest in Bitcoin options was skewed towards calls, comprising 63.76% of the total, compared to 36.24% for puts. This distribution reinforces the bullish sentiment observed through the increase in options open interest earlier in the month. A predominance of calls in the open interest suggests that a significant portion of market participants were expecting Bitcoin’s price to continue rising or were utilizing calls to hedge against other positions.

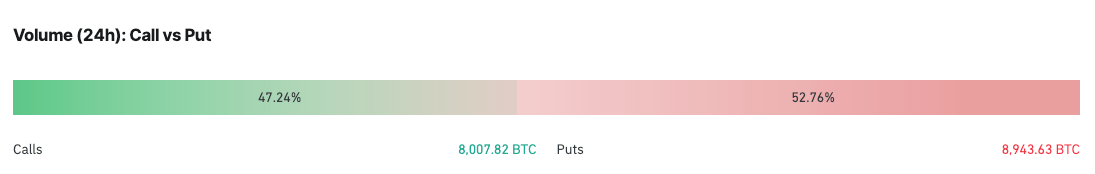

However, the 24-hour volume tells a slightly different story, with calls accounting for 47.24% and puts for 52.76%. Compared to the overall open interest, this shift towards puts in the daily trading volume might indicate a short-term increase in caution among traders. It suggests that within the last 24 hours, there was a noticeable pick-up in defensive strategies or bearish bets.

The immediate implication for Bitcoin’s price is a potential increase in volatility. The bullish sentiment, as evidenced by the growing open interest and high proportion of calls, supports a continued positive outlook among many market participants. However, the recent uptick in puts volume may signal upcoming price fluctuations as traders adjust their positions in anticipation of or in response to new information or market trends.

Considering these, the market appears to be at a crossroads, with a strong bullish sentiment tempered by short-term caution. This scenario often precedes periods of heightened volatility as conflicting expectations play out through trading activities.

Mystery Ethereum whale accumulates $411 million ETH in February amid ETF rumors

An unknown Ethereum whale has been accumulating ETH at a rapid pace since the start of February. Over the past 23 days, wallet 0x7a95c has acquired $411 million worth of ETH and stETH, mostly from Binance.

Data shared with CryptoSlate from Spotonchain traces the ETH inflows into the wallet throughout the month, showing persistent purchases of between 3,000 and 34,000 ETH.

CryptoSlate analysis tracing inflows and outflows from the wallet shows connections with multiple different exchanges and DEXs. Almost all funds into the wallet came from Binance with $21 million HTX and 1inch. However, in terms of outflows, a wide range of addresses are connected, including Wintermute, Uniswap, 1inch, AlphaLab Capital, Native Pool, and Paraswap, among others.

Digging into the transaction details on Spotonchain, the whale transferred a substantial amount of 7,915 ETH, valued at approximately $23.52 million, from Binance to their wallet. This transaction, recorded on Feb. 22 at 16:38, signifies the continuation of a notable pattern of accumulation by this entity. The transaction details indicate a deliberate strategy by the whale to increase their holdings in Ethereum.

Over the past four days, the whale has reportedly purchased a total of 112,923 ETH through Binance and 1inch, with an average acquisition cost of $2,892 per ETH, amounting to an investment of $326.5 million. Following these transactions, the whale’s Ethereum holdings now stand at 132,585 ETH, alongside 5,485 STETH, cumulatively valued at $411 million. This portfolio currently exhibits an unrealized profit of $21.13 million, highlighting the financial gains resulting from these strategic moves.

The pattern of accumulation includes several other significant transactions. Notably, 17,198 ETH were withdrawn from Binance in a prior transaction, contributing to the whale’s growing Ethereum reserves.

Furthermore, the whale’s activities extend beyond Ethereum purchases, as evidenced by a withdrawal of 40 million USDT from Binance. This suggests a broader strategy that potentially includes leveraging stablecoin reserves to further increase Ethereum holdings. The whale’s transactions and holdings, particularly the strategic use of both ETH and STETH, reflect a sophisticated approach to digital assets investment, emphasizing diversification and timing to capitalize on market movements.

Rumors of a potential spot Ethereum ETF being approved by the SEC have helped push Ethereum back over the $3,000 mark on two occasions this month. Concerns over theoretical issues with the centralization of staked Ethereum amid a spot ETF have been raised, though at present any potential approval is unclear.

Unconfirmed rumors of Justin Sun relationship

Earlier in the month, Lookonchain suggested the whale may be Justin Sun based on an analysis of similar transactions with a suspected wallet belonging to the investor. However, all information appears to be circumstantial, and the wallet has no equivalent active address on the Tron blockchain. Still, interestingly, the 0x7a95 wallet has never interacted with USDC and only appears to use USDT for stablecoin transactions. Circle stated that Justin Sun has no accounts with them in a 2023 letter to Senator Elizabeth Warren, yet wallets identified by Arkham Intelligence to belong to Sun transacted with USDC as recently as Feb. 22.

The only connection to Justin Sun that could be identified by CryptoSlate was a 1inch Settlement contract with two tangentially related wallets. Addresses 0x874d and 0x158B received $21 million from 0x7a95, and both transferred funds to the 1inch Settlement contract 0xA888. A Justin Sun-tagged wallet, 0x1387, received $58 million from the same 1inch contract a year ago. However, all transactions from 0x7a95 happened much more recently.

CryptoSlate is monitoring the wallet and related addresses should further information become apparent.

3 Warren Buffett Stocks That Are Screaming Buys in February (and Beyond)

Few, if any, investors are more revered on Wall Street than Berkshire Hathaway CEO Warren Buffett. The reason can be seen in the Oracle of Omaha’s returns since taking the reins in the mid-1960s.

The broad-based S&P 500 took until last year to top a cumulative 30,000% total return, including dividends. However, since Buffett became CEO of Berkshire Hathaway, the Oracle of Omaha has overseen a greater than 4,700,000% aggregate return in his company’s Class A shares (BRK.A) in under six decades (as of the close on Jan. 26, 2024). Returns like this are bound to draw a following from both professional and everyday investors.

The great thing about Warren Buffett and the $371 billion investment portfolio he oversees at Berkshire Hathaway is the transparency involved. Thanks to quarterly filed Form 13Fs with the Securities and Exchange Commission, investors have been able to effectively mirror Buffett’s trading activity for decades.

The other noteworthy aspect of Berkshire’s $371 billion portfolio is that it’s packed with profitable, time-tested companies. In other words, it’s a stomping ground for top-notch investment ideas.

As we power into the shortest month of the year, three Warren Buffett stocks stand out as screaming buys.

Sirius XM Holdings

The first Buffett stock that’s begging to be bought in February is satellite-radio operator Sirius XM Holdings (NASDAQ: SIRI). Berkshire’s portfolio added more shares of Sirius XM during the third quarter after a roughly two-year absence.

The biggest concern for radio companies is the health of the advertising market. Ad spending is highly cyclical, and businesses aren’t shy about paring back their ad budgets when the first signs of trouble become apparent. With a couple of predictive indicators and money-based metrics offering ominous warnings for the U.S. economy, there’s the potential for a challenging year.

On the other hand, Sirius XM Holdings is built differently than terrestrial and online radio operators, which gives the company a number of distinct competitive advantages in virtually any economic climate. To start with the most obvious difference, Sirius XM is the only legally authorized satellite-radio operator. Though this doesn’t mean it’s absolved from competition, it affords the company superior pricing power with its subscription services.

I’d argue that the most important differentiator between Sirius XM and traditional operators is how they generate revenue. Terrestrial and online-radio companies rely very heavily on advertising revenue. Meanwhile, Sirius XM generated only 19.2% of its net sales from advertising through the first nine months of 2023 — virtually all of which can be traced back to Pandora, which it purchased in February 2019. Subscriptions accounted for the bulk (77.2%) of its net sales.

As noted, businesses will quickly pare back their ad budgets at the first hint of economic disruption. But this isn’t the case with Sirius XM’s subscribers, who are far less likely to cancel their services than advertisers are to reduce their budgets. During economic downturns, Sirius XM would be in far better shape than its peers.

Another quick point is that some of Sirius XM’s expenses are highly predictable. Although royalty and talent acquisition costs vary from one quarter to the next, transmission and equipment costs are effectively stable. The company can continue adding subscribers without increasing these core expenses.

Lastly, Sirius XM’s forward price-to-earnings (P/E) ratio of 17 is at a decade low and represents about a 20% discount to its five-year average.

Bank of America

A second Warren Buffett stock that’s a screaming buy in February (and beyond) is banking giant Bank of America (NYSE: BAC). “BofA,” as the bank is more commonly known, is Berkshire Hathaway’s second-largest holding by market value.

The knock against bank stocks is that they’re cyclical. They’re going to ebb and flow with the health of the U.S. economy. If forecasts about a recession prove accurate in 2024, bank stocks like BofA would be expected to see an increase in loan losses and credit delinquencies.

If I can offer a bit of solace, it’s that the economic boom-bust cycle is disproportionate. While recessions are a normal and inevitable part of the economic cycle, they’re not long-lasting.

Only three of the 12 recessions since the end of World War II stuck around for at least 12 months, while none of the remaining three surpassed 18 months. Comparatively, two periods of expansion reached the decade mark over the past 78 years. Over long periods, bank stocks are perfectly positioned to grow their loan and lease portfolios.

One standout reason Bank of America has been such a slam-dunk investment is its interest-rate sensitivity. No U.S. money-center banks’ net interest income is more sensitive to changes in monetary policy than BofA. With the Federal Reserve undertaking its most aggressive rate-hiking cycle in four decades, Bank of America has benefited in the form of a higher net interest yield and billions of dollars in added net interest income each quarter.

When most investors think of Bank of America, they probably don’t associate it with technological advancement. However, 75% of all consumer households were banking digitally (online or via mobile app) during the fourth quarter of 2023. Further, just shy of half of all loan sales were completed via digital channels.

Online and mobile app-based transactions cost banks just a fraction of what in-person interactions run. As the percentage of digital users climbs, BofA has the option of consolidating some of its branches and reducing expenses.

Bank of America’s valuation also makes a lot of sense for long-term, value-oriented investors. Shares can be purchased for a shade below 10 times forward-year earnings and are right around their book value. Buying well-run bank stocks at or below book value has historically been a smart move for investors.

Coca-Cola

The third Warren Buffett stock that stands head and shoulders above its peers as a screaming buy in February (and more than likely for many years to come) is beverage giant Coca-Cola (NYSE: KO).

Every publicly traded company faces headwinds, and Coca-Cola is no exception. The biggest challenge for this 138-year-old business is contending with above-average rates of inflation. As labor, transportation, and even ingredient costs rise, there’s the possibility Coca-Cola’s operating margin could feel the pinch.

The good news here is that Coca-Cola also possesses exceptionally strong pricing power. According to Kantar’s annually published “Brand Footprint” report, Coke has been the most chosen brand on retail shelves for 10 consecutive years (as of 2022). The company has had little trouble outpacing the prevailing inflation rate with its pricing.

One of the not-so-subtle secrets to Coca-Cola’s success is its virtually unparalleled geographic diversity. It has operations in all but three countries (North Korea, Cuba, and Russia) and has more than two dozen brands in its portfolio that are generating in excess of $1 billion in annual sales. This means it’s bringing in predictable cash flow from developed markets while also enjoying an organic-growth boost from faster-growing emerging markets.

What’s more, the company views its addressable market as having doubled from $650 billion in 2017 to an estimated $1.3 trillion by 2022. Whereas established categories (e.g., sparkling soft drinks) offer mid-single-digit compound annual growth rates (CAGRs) through 2026, energy drinks and alcoholic ready-to-drink beverages can support a CAGR in the high single digits over the same stretch.

Don’t overlook Coca-Cola’s top-tier marketing, either. It’s devoted more than half of its advertising budget to digital channels and is relying on artificial intelligence (AI) to tailor ads to a younger audience. Conversely, it can rely on its former holiday tie-ins and well-known brand ambassadors to connect with mature consumers. Marketing is a big reason Coca-Cola is the most valuable consumer goods brand.

That leads to my next point: Consumer staples stocks provide predictable operating cash flow. Food and beverages are a basic necessity, which means Coke can deliver in any environment.

Shares of Coca-Cola can currently be purchased for 21 times forward-year earnings, which represents a six-year low and is modestly below its five-year average.

Should you invest $1,000 in Sirius XM right now?

Before you buy stock in Sirius XM, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Sirius XM wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 22, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Sean Williams has positions in Bank of America and Sirius XM. The Motley Fool has positions in and recommends Bank of America and Berkshire Hathaway. The Motley Fool has a disclosure policy.

3 Warren Buffett Stocks That Are Screaming Buys in February (and Beyond) was originally published by The Motley Fool