The president and CEO of the Federal Reserve Bank of Minneapolis, Neel Kashkari, has expressed concern about consumer risk due to “fraud, hype, and confusion” surrounding bitcoin. Moreover, he said the cryptocurrency has been around for more than a decade but “there’s still no legitimate use case in an advanced democracy.” ‘I Am Worried From […]

The president and CEO of the Federal Reserve Bank of Minneapolis, Neel Kashkari, has expressed concern about consumer risk due to “fraud, hype, and confusion” surrounding bitcoin. Moreover, he said the cryptocurrency has been around for more than a decade but “there’s still no legitimate use case in an advanced democracy.” ‘I Am Worried From […]

Source link

federal

The amount you pay in taxes is determined by your income and filing status, which determine your tax rates and tax brackets. Your tax rate is the percentage of income you pay in taxes, but it isn’t the same for all the money you earn. Different portions of income you earn are taxed at specific rates called tax brackets.

For tax years 2023 and 2024, there are seven different tax brackets: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. These tax brackets were put in place by the Tax Cuts and Jobs Act of 2017 and will remain in effect through tax year 2025. The Internal Revenue Service (IRS) provides annual inflation adjustments to the income ranges within each bracket.

Note that capital gains tax brackets are different from the federal income tax rates listed above. Most capital gains are taxed at rates of 0%, 15%, or 20%, depending on your overall taxable income.

How tax brackets work

The U.S. has a progressive tax system. Essentially, that means that as your income rises, the total tax you pay is also supposed to increase.

Because Americans with higher incomes are taxed at a higher rate, some taxpayers worry that getting a pay raise will put them in a higher tax bracket. However, this concern reflects a common misconception about how tax brackets and tax rates work.

There are two basic types of tax rates.

-

Marginal tax rate: Your marginal tax rate is the percentage of income tax you owe on the last dollar earned.

-

Effective tax rate: The percentage of your income that you actually pay to the Internal Revenue Service (IRS) in taxes.

Your marginal tax rate is different from your effective tax rate because your income is taxed at different rates. Think of tax brackets as a series of buckets. When one bucket reaches the tipping point, the extra amount flows over into the next.

For example, suppose you’re a single taxpayer who has taxable income of $40,000 in 2023. As you can see from the federal income tax brackets, your marginal tax rate would be 12%.

But calculating your effective tax rate is a little more complicated. Here’s how your income would be taxed:

-

You’d owe 10% in taxes on the first $11,000 you earned, or $1,100.

-

You’d owe 12% in taxes on the next $29,000 ($40,000-$11,000) you earned, or $3,480.

Your total tax bill would be $4,580. Since your total income is $40,000, your effective tax rate is 11.4%.

Now imagine your boss gives you a $10,000 pay raise, bringing your income to $50,000. Your marginal rate would shoot up to 22% to 12%, which sounds like a pretty steep hike. But since different portions of your income are taxed at different rates, the impact isn’t so bad. Here’s how your tax bill would break down:

-

You’d owe 10% in taxes on the first $11,000 you earned, or $1,100.

-

You’d owe 12% in taxes on the next $33,725 ($44,725-$11,000) you earned, or about $4,047.

-

You’d owe 22% in taxes on the remaining $5,725 ($50,000-$44,275) you earned, or about $1,160.

Your total tax liability is $6,307, which is an effective tax rate of about 12.6%. Even though you’re in a higher tax bracket, your effective tax rate only increases slightly because only a small portion of your income is subject to the higher tax rate. You owe an additional $1,727 in taxes, but you get to keep $8,273 of your $10,000 raise.

Of course, the example above is a bit oversimplified because federal income taxes aren’t the only taxes you pay. Most people pay the first 7.65% of their income toward Social Security and Medicare taxes — or 15.3% if you’re self-employed. It also doesn’t account for state and local taxes, sales taxes, or property taxes.

But the bottom line is, even if you’re pushed into a higher federal tax bracket, it’s not a bad thing. You may owe more in taxes, but you’ll get even more extra money in your paycheck.

Read more: Here are

How to get in a lower bracket and reduce your taxes

No one likes paying taxes, so you generally want your taxable income to be as low as possible. We’ll explain some steps you can take to lower your tax liability.

Weigh the standard deduction vs. itemized deductions

When you file your taxes, you’ll need to figure out whether the will provide a larger reduction to your taxable income.

The standard deduction is $13,850 for single filers and $27,700 if you’re married filing jointly in tax year 2023. If you opt for the standard deduction, you can subtract the full deduction for your tax filing status from your taxable income.

But itemizing could yield a bigger amount of tax savings if you paid substantial mortgage interest, made large charitable contributions, or had unreimbursed medical expenses above 7.5% of your adjusted gross income. Consult with a tax professional to determine which option is best for your situation.

Increase your 401(k) contributions

You can lower your taxable income if you like a 401(k) or 403(b). Note that only contributions to pre-tax accounts will reduce your taxes, and withdrawals will be taxed as ordinary income later on. If you contribute to a Roth account, you won’t get a tax break for the current year, but you can take tax-free withdrawals in retirement.

Look for above-the-line tax deductions

A tax deduction lowers your taxable income. Some tax deductions are known as above-the-line deductions, which means you can take them even if you don’t itemize your return. Some common above-the-line deductions you can take include:

-

Traditional IRA contributions: You may be able to deduct , though income thresholds apply if you or your spouse are covered by a retirement plan at work. You have until Tax Day to fund an IRA for any given tax year, so funding a traditional IRA before April 15, 2024, could lower your 2023 tax bill.

-

Student loan interest: If you paid interest on your student loans, you can deduct up to $2,500 of interest payments, though income limits apply.

-

Health savings account (HSA) contributions: You can deduct even if you don’t itemize your return. Your withdrawals will never be taxable either, as long as you use them for qualifying medical expenses. As with IRA contributions, you can make a contribution until Tax Day, so you can still make 2023 HSA contributions up until April 15, 2024.

If you’re self-employed, you may be eligible for additional .

Maximize your tax credits

Tax credits are even more valuable than tax deductions because they reduce the amount you owe in taxes dollar-for-dollar. If the credit is refundable, you can get any amount that exceeds your tax liability as a tax refund. Here are some popular tax credits you could qualify for in the 2023 tax year:

-

Child tax credit: The is worth up to $2,000 per qualifying dependent child under age 17. There’s a refundable portion of the credit called the additional child tax credit that’s worth up to $1,600.

-

Child and dependent care credit: If you paid someone to care for your child younger than 13 or a qualifying tax dependent who was unable to care for themselves — and you needed to do so because you were working or looking for work — you could qualify for the child and dependent care credit. The credit is worth between 20% and 35% of your expenses, with a cap of $3,000 for one dependent or $6,000 for two or more dependents.

-

Earned income tax credit: The (EITC) provides a tax break to lower- and middle-income families who earned money from working during the year. The maximum value ranges from $600 for those with no qualifying children to $7,430 for families with three or more qualifying children.

-

Education tax credits: If you paid for higher education expenses for yourself or your dependent, you may be able to take one of two education tax credits: the American Opportunity Tax Credit, worth up to $2,500 per qualifying student, or the Lifetime Learning Credit, worth up to $2,000 per income tax return. You can claim both on the same return, but you can only claim one for the same student or expense.

-

EV credit: You may qualify for a tax credit of up to $7,500 if you bought a new electric vehicle in 2023. A credit of up to $4,000 is also available to those who purchased a used EV for less than $25,000 from a dealership.

-

Saver’s credit: The is available to low- and middle-income workers who save for their retirement in an account like a 401(k) or an IRA. The maximum credit is $2,000 for single couples or $3,000 for married couples filing jointly.

Frequently asked questions (FAQs)

Is taxable income the same as gross income?

No, but gross income is the starting point for determining . You take your gross income and subtract any above-the-line deductions, like pre-tax retirement contributions and student loan payments, to arrive at your adjusted gross income. Then, you apply the either standard deduction or your itemized deduction, which gives you your taxable income.

How do I get in a lower tax bracket?

To get in a lower tax bracket, contribute as much as you can to tax-advantaged accounts like 401(k)s, IRAs, and HSAs, and look for any tax deductions and credits you may qualify for. Check with your tax preparer about whether you’ll save more from itemizing or claiming the standard deduction.

What states have the highest taxes?

According to TurboTax, the states with the highest taxes in 2023 were California, Hawaii, New York, New Jersey, and Washington, D.C.

SEC Inspector General investigating crypto conflicts of interest within federal agency

The US Security and Exchange Commission’s (SEC) Office of Inspector General (OIG) is investigating cryptocurrency-related financial conflicts of interest identified by the accountability group Empower Oversight.

In a Feb. 15 statement, Empower Oversight disclosed that the SEC’s division was in the “final stages of completing” an open investigation into matters relating to the failures of the SEC’s Ethics Office and a former official, William Hinman.

Hinman is accused of participating in matters where he held a financial stake, notably delivering a contentious speech asserting that specific digital assets, such as Ethereum, were not subject to SEC regulation as securities.

Critics within the Ripple XRP community contend that Hinman’s speech unfairly favored Ethereum, potentially giving it an edge over other digital assets in the market.

Empower Oversight emphasized its concerns by presenting documentation indicating that key figures from Ethereum, including co-founders Joseph Lubin and Vitalik Buterin, were involved in drafting the infamous speech.

In addition, the watchdog group also declared that Hinman “blatantly disregarded” instructions not to meet with specific individuals while working at the SEC, such as his former employer, Simpson Thacher, a member of the Ethereum Enterprise Alliance (EEA.)

“When Hinman departed the SEC in December 2020, he returned to Simpson Thacher as a partner. That same month the SEC sued Ripple, alleging XRP was an unregistered security,” Tristan Leavitt, president of Empower Oversight wrote.

This matter was officially brought to the attention of the OIG in May 2022.

Threatens Lawsuit

Empower Oversight has threatened the financial regulator with a lawsuit if it fails to provide information regarding its investigations by Feb. 23.

The group noted that the SEC has failed to provide information about the case since it filed a Freedom of Information Act (FOIA) in May 2023.

Leavitt said:

“The silver lining is that now we know one reason for the stonewalling is that there actually is an active inquiry by the inspector general, which is almost done. However, whether the OIG report thoroughly addresses all the issues we raised remains to be seen because we don’t know the exact scope of the inquiry. The SEC’s OIG needs to get this right and help prevent similar conflicts of interest from undermining public faith in the SEC’s work in the future.”

As Donald Trump made his victory speech after Iowa’s caucuses, the front-runner in the 2024 Republican presidential primary couldn’t resist taking a shot at electric vehicles while praising a supporter from Missouri.

That supporter “comes all the way from Missouri, which isn’t that far. You can’t drive an electric car that far, though,” the former president said Monday night, drawing laughs from his audience in Des Moines.

It’s the type of criticism of EVs that Trump has offered often during his 2024 White House campaign, breaking sharply with President Joe Biden’s approach. The Democratic incumbent has made support for EVs

DRIV

KARS

a key part of his speeches and his economic policies, saying the car industry’s future “is electric, and there’s no turning back.”

From the archives (September 2023): Trump attacks Biden over EVs as he makes pitch to auto workers

So the result of the 2024 presidential race, which looks increasingly likely to be a Biden-Trump rematch, is expected to have an outsize impact on the Biden administration’s incentives and regulations that aim to boost adoption of EVs. The election has been described as a “referendum” on EVs by analysts at Beacon Policy Advisers, even as they acknowledge the issue won’t drive voters as much as top-tier topics such as inflation or abortion rights.

“It’s not necessarily what people are going to be voting on, but the future of EVs is nevertheless very election-dependent on what happens in 2024,” Beacon analyst Maxwell Shulman said.

There are expectations that widely used tax credits that can take as much as $7,500 off the cost of a new EV will be targeted by Trump or any Republican president — especially if the GOP keeps its grip on the U.S. House of Representatives and takes control of the Senate. The credits already have been pared back as of Jan. 1, with some car models losing out due to new anti-China rules for battery materials. They could be reduced further after the 2024 elections, as even Democratic-run chambers of Congress might support closing a “leasing loophole.”

Washington will have to decide in 2025 how much of the Republican tax overhaul of 2017 should be extended vs. being allowed to expire. If Republicans are in control of the White House and both chambers of Congress, they’re likely to look during that process at the EV credits, established by Biden’s Inflation Reduction Act, according to Beacon’s Shulman.

“If you’re going to do tax cuts, you need the revenue offset from somewhere, and what’s better than the marquee legislative package that your opponents passed the prior term?” he said.

Related: As Biden touts his Inflation Reduction Act, analysts size up how Trump might repeal it

Courtney Rosenberger Gelman, managing director of policy research at Strategas Securities, said the EV tax credits are “the most at risk” part of the Inflation Reduction Act, if Republicans score wins in the 2024 elections. She said she thinks it’s going too far to say this fall’s voting in the U.S. looks like a referendum on EVs, but it does have the potential to have an impact on the growing industry.

Democratic control of one chamber of Congress probably would prevent a full rollback of the EV tax credit, but there still could be changes, according to Gelman. “Even with Democrats, because of how bipartisan going after China is,” there could be additional sourcing requirements, she said. And with “continuously building populist momentum on both sides of the aisle, things like the leasing loophole could be targeted,” she said.

That loophole refers to how it’s possible to get $7,500 off any EV at any price if it’s leased, with no limits on the driver’s income level. For buying rather than leasing, the subsidy comes with more rules, such as an income cap of $150,000 for individual tax filers buying new vehicles, as well as North American sourcing.

Beyond the EV tax credit, Beacon’s Shulman expects a Republican administration would aim to roll back Biden regulations such as a proposed tailpipe-emissions rule that’s intended to push all-electric options to making up as many as two out of every three new passenger vehicles sold in the U.S. by 2032.

The GOP-run House passed a bill in December on that exact issue, with Republican lawmakers describing Biden’s rule as an EV mandate, but it’s not expected to find any traction this year in the Democratic-controlled Senate.

Forecasts for the EV industry’s growth would have to be reduced if such regulations were nixed in 2025, because it’s not only carrots, or subsidies, that would go away, “but also because the sticks forcing industry in that way are sort of getting removed as well,” Shulman said.

Companies ‘can’t make a long-term investment plan’

The share of U.S. car sales that are EVs is likely to be 8% in 2024, up from 6.9% in the first 11 months of 2023, according to Jessica Caldwell, head of insights at Edmunds. She describes the market for the vehicles as experiencing a “wake-up call” after earlier projections proved too optimistic, with some of the struggles coming from elevated interest rates for car loans.

Losing the $7,500 EV tax credit would be a hit to the industry, especially as buyers now are no longer as likely to be early adopters, she said. “It definitely would affect it, just because if we are going to more of a mass-market consumer, that person has a lower income level than an early adopter, generally speaking.”

Related: Hertz cites weak demand, high damage costs in decision to downsize EV fleet

Car makers and their allies have indicated they’re tracking the political risks. The CEO of Chrysler and Fiat parent Stellantis

STLA,

Carlos Tavares, recently told Automobilwoche that the U.S. elections are important, and his company may have to change its strategy “if political and public opinion tends toward fewer EVs.” In a similar vein, executives from General Motors

GM,

and Nissan

7201,

told the Financial Times that eliminating incentives would hurt EV sales.

“What I worry about the most on behalf of American business is just the lack of certainty,” said the U.S. Chamber of Commerce’s president, Suzanne Clark, during a news conference last week when she was asked about repealing parts of the Inflation Reduction Act.

“This every two or four years having a big guardrail-to-guardrail shift means we’re seeing companies say, ‘I don’t know how to invest in the United States. I can’t make a long-term investment plan.’ “

Related: Both Trump and Biden ‘threatening for the markets’, says Ray Dalio

Voters show big partisan divide on EVs

While there’s a war of words over EVs between Biden and Trump, there also appears to be a partisan divide over these products between rank-and-file Democrats and Republicans.

Some 71% of GOP voters say they would not buy an EV, according to a Gallup poll conducted last year. Among Democrats, only 17% feel that way. Among independent voters, it’s 38%.

To be sure, Gallup has noted that Americans aren’t the best forecasters of what they’ll end up buying, as nearly a quarter of respondents to a 2000 survey said they would never buy a cellphone. What’s more, while an E&E News tally last year showed that members of Congress with EVs are overwhelmingly Democrats, GOP Rep. Thomas Massie of Kentucky has said he was the first U.S. lawmaker to have a Tesla

TSLA,

on Capitol Hill, as he got one of Elon Musk’s products a decade ago.

Still, what gives with the party split on EVs?

“I think it comes down to partisan viewpoints on energy

XLE

generally, where Republicans are generally more pro–fossil fuel

RB00,

and Democrats have been generally viewed as anti-drilling, anti-oil

CL00,

anti-coal,” said Gelman at Strategas.

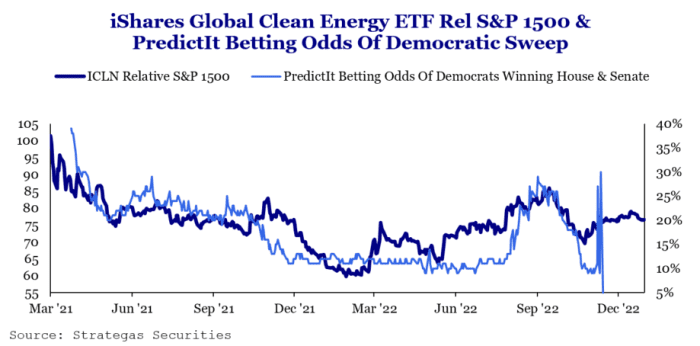

Green-energy stocks

ICLN

could end up tracking Democratic prospects in the 2024 elections, according to Gelman.

“You’re going to see EVs and other renewable-energy names potentially trading off of the odds of Republicans vs. Democrats doing well in the election,” she said. She noted that her shop found that type of relationship ahead of the 2022 midterm elections, as shown in the chart above.

Now read: Want to buy a new car? You should probably be making $100,000 a year.

Federal Reserve accelerates balance sheet reduction with $46 billion cut in a week

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Oops…you must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.

Federal Reserve issues cease and desist letter to Bitcoin Magazine alleging IP infringement

The Federal Reserve Bank of Chicago has issued a cease and desist letter to Bitcoin Magazine, alleging it to have used a trademarked term IP — ‘FEDNOW’ — without its consent.

According to the letter, dated Oct. 27, 2023, the Federal Reserve confronted Bitcoin Magazine regarding its merchandise bearing the ‘FEDNOW’ mark, which they claim is likely to cause confusion and deception among consumers. The Fed believes people may misinterpret these items as being affiliated with or endorsed by the Federal Reserve.

The Federal Reserve, as per the trademark registration, owns all rights to the ‘FEDNOW’ service mark, which it uses to facilitate the electronic transfer of funds among financial institutions. Notably, the ‘FEDNOW’ mark was first used in commerce in Aug. 2019 and officially registered as a service mark in May 2023.

Bitcoin Magazine, in its defense, argues that its use of ‘FEDNOW’ is parodic and a form of political criticism directed at the Federal Reserve. In a reply letter dated Nov. 2, 2023, the magazine’s legal counsel, Zachary Shapiro, asserts that the design in question is a commentary on the “digital panopticon” symbolized by the Federal Reserve’s ‘FedNow’ platform, which enables 24/7 digital surveillance of transactions.

Shapiro wrote that given Bitcoin Magazine’s consistent critique of centralized financial entities, including the Federal Reserve, “any claim of consumer confusion concerning an endorsement or affiliation between its merchandise and the Federal Reserve seems rather far-fetched.” He also highlighted the perilous intersection of trademark law and free speech, suggesting that the Federal Reserve’s attempt to silence political critique raises concerns about First Amendment rights.

Mark Goodwin, the Editor in Chief of Bitcoin Magazine, has also issued an open letter to the Federal Reserve, asserting that the magazine refuses to comply with the cease-and-desist request and will not be silenced. Goodwin emphasizes that Bitcoin Magazine is merely exercising its First Amendment rights to social commentary and parody and is committed to defending its right to sell merchandise that critiques the FedNow system.

Clearly, this unfolding dispute presents another instance of the tension between traditional financial institutions and the emerging cryptocurrency industry. It remains to be seen how this legal face-off will conclude and what implications it might have for the broader discourse on financial systems, privacy, and the First Amendment.

Opinion: Opinion: Most investors can ignore whatever the Federal Reserve does today

The Federal Reserve’s moves — or lack thereof — will affect everyone. And almost no one.

The Fed made no rate changes on Wednesday, holding back on at least one more hike before year’s end. There are plenty of experts who believe the central bank will then let rates sit until it turns around and starts to cut rates late in 2024.

MarketWatch…

FedNow Service has no relation with CBDCs, Federal Reserve clarifies

The United States Federal Reserve clarified that its new service for instant payments between organizations — the FedNow Service — has no relation with central bank digital currencies (CBDCs).

The Fed certified the FedNow Service as “ready” after it onboarded 41 financial institutions, 15 service providers and the U.S. Department of the Treasury to test the system before its launch by the end of July 2023. However, the central bank had to clarify that the promise of instant fiat payments and real-time gross settlement (RTGS) is not powered by a CBDC.

#FedFAQ: Is the FedNow Service replacing cash? Is it a central bank digital currency?

Learn more about the #FedNow Service: pic.twitter.com/7CUaYZYyM9

— Federal Reserve (@federalreserve) July 19, 2023

In a tweet, the Fed stated that FedNow Service is similar to other payment services, such as Fedwire and FedACH, which work within the boundaries of the fiat ecosystem. It said:

“The FedNow Service is not related to a digital currency. The FedNow Service is a payment service the Federal Reserve is making available for banks and credit unions to transfer funds for their customers.”

The Federal Reserve further confirmed that it has not yet decided on issuing the highly anticipated CBDC and “would only proceed with the issuance of a CBDC with an authorizing law.”

The table above highlights the initial list of participants. However, the Federal Reserve plans to onboard all 10,000 U.S. financial institutions in time to come.

Related: Major US banks get passing grade in ‘severe recession’ stress test

On May 11, the Fed announced the integration of Metal Blockchain into the FedNow Service.

Metal Blockchain is a crypto network developed by Metallicus based on a fork of Avalanche’s code. According to its documents, the network features a subnet called X-Chain that allows developers to enact rules for transferring assets. For example, a token can be issued with the rule that it “can only be sent to US citizens” or “can’t be traded until tomorrow.”

Collect this article as an NFT to preserve this moment in history and show your support for independent journalism in the crypto space.

Magazine: Tokenizing music royalties as NFTs could help the next Taylor Swift

What the Federal Reserve’s expected interest rate pause means for you

damircudic | E+ | Getty Images

The Federal Reserve is likely to temporarily pause its aggressive interest rate hikes when it meets next week, experts predict. But consumers may not see any relief.

The central bank has raised interest rates 10 times since last year — the fastest pace of tightening since the early 1980s — only to see inflation stay well above its 2% target.

“We are living in uncharted territory,” said Charlie Wise, senior vice president and head of global research and consulting at TransUnion. “The combination of rising interest rates and elevated inflation, while not uncommon from a historical perspective, is an unfamiliar experience for many consumers.”

“A pause is not going to make things better,” he added.

More from Personal Finance:

Even as inflation rate subsides, prices may stay higher

Here’s the inflation breakdown for April 2023, in one chart

Who does inflation hit hardest? Experts weigh in

Although the Fed’s rate-hiking cycle has started to cool inflation, higher prices have caused real wages to decline. That’s squeezed household budgets, pushing more people into debt just when borrowing rates reach record highs.

Even with a pause, “interest rates are the highest they’ve been in years, borrowing costs have gone up dramatically and that isn’t going to change,” said Greg McBride, chief financial analyst at Bankrate.com.

Here’s a breakdown of how the benchmark rate has already impacted the rates consumers pay:

Credit card rates top 20%

The federal funds rate, which is set by the U.S. central bank, is the interest rate at which banks borrow and lend to one another overnight. Although that’s not the rate consumers pay, the Fed’s moves still affect the borrowing and savings rates they see every day.

For starters, most credit cards come with a variable rate, which has a direct connection to the Fed’s benchmark rate.

After the previous rate hikes, the average credit card rate is now more than 20% — an all-time high, while balances are higher and nearly half of credit card holders carry the debt from month to month, according to a Bankrate report.

Mortgage rates are near 7%

Although 15-year and 30-year mortgage rates are fixed, and tied to Treasury yields and the economy, anyone shopping for a new home has lost considerable purchasing power, partly because of inflation and the Fed’s policy moves.

The average rate for a 30-year, fixed-rate mortgage currently sits at 6.9%, according to Bankrate, up from 5.27% one year ago and only slightly below October’s high of 7.12%.

Now, the average rate for a HELOC is up to 8.3%, the highest in 22 years, according to Bankrate. “While typically thought of as a low-cost way to borrow, it no longer is,” McBride said.

Auto loan rates are close to 7%

The average rate on a five-year new car loan is now 6.87%, the highest since 2010, according to Bankrate.

Keeping up with the higher cost has become a challenge, research shows, with more borrowers falling behind on their monthly loan payments.

Federal student loans are set to rise to 5.5%

For now, anyone with existing federal education debt will benefit from rates at 0% until the payment pause ends, which the U.S. Department of Education expects could happen in the fall.

Private student loans tend to have a variable rate tied to the Libor, prime or Treasury bill rates — and that means that those borrowers are already paying more in interest. How much more, however, varies with the benchmark.

Deposit rates at some banks are up to 5%

While the Fed has no direct influence on deposit rates, the yields tend to be correlated to changes in the target federal funds rate. The savings account rates at some of the largest retail banks, which were near rock bottom during most of the Covid pandemic, are currently up to 0.4%, on average.

Thanks, in part, to lower overhead expenses, top-yielding online savings account rates are now over 5%, the highest since 2008’s financial crisis, according to Bankrate.

However, if the Fed skips a rate hike at its June meeting, then those deposit rate increases are likely to slow, according to Ken Tumin, founder of DepositAccounts.com.