Some exchange-traded funds rallied Wednesday even as stocks and bonds broadly fell, as hot inflation data stoked fears that interest rates will stay elevated for longer than anticipated.

Source link

Fell

This Tiny Space Stock Just Tripled in 2 Weeks — and Then Fell. Is It Still a Buy?

I am a value investor. That means two things: First and most obviously, I like stocks that sell for reasonable prices relative to their growth prospects. And second, I’m extremely suspicious of buying into hot growth stocks that are “going up” a lot — stocks like Intuitive Machines (LUNR -0.66%).

Why Intuitive Machines stock is going to the moon

Two weeks ago, if you recall, Intuitive Machines launched a Nova-C class lunar lander named Odysseus on a course to the moon. On Thursday last week, Odysseus conducted a mostly successful soft landing on the moon — the first American spacecraft to accomplish this feat in more than 50 years.

— Intuitive Machines (@Int_Machines) February 22, 2024

No sooner had this news been announced than Intuitive Machines stock exploded 25% higher. And now, I’m giving serious thought to buying Intuitive Machines stock for myself.

Value investor’s dilemma

Why would I consider doing this — and seemingly breaking a cardinal rule of value investing in the process? Well, let me explain first why I might not buy Intuitive Machines stock.

Intuitive Machines went public in the middle of the space SPAC frenzy back in February 2023. IPO’ing at $10 a share, the stock surged past $80 in a matter of days, before turning tail and giving back all its gains. By April 2023, the stock was back trading below its IPO price — and didn’t return to that IPO price until just this month.

But what an exciting month it has been!

From Feb. 7, about a week before the launch, to Feb. 21, a few days after the launch took place, Intuitive Machines stock roughly tripled in price, surging from just $3.50 per share to well over $10. Pulling back just a bit as investors held their breath and awaited the landing attempt, Intuitive Machines surged ahead 16% on Friday, closing the week just below $10 a share. And then on Monday, the stock gave back a lot of those gains, falling to just over $6.25.

At its last recorded stock price, Intuitive Machines sells for less than 2 times trailing sales, which sounds cheap. Problem is, the company is still racking up operating losses (negative $37 million over the last 12 months), burning cash (negative $25 million in free cash flow), and according to data from S&P Global Market Intelligence, is expected to keep on losing money and burning cash for at least the next four years.

Is Intuitive Machines stock a buy?

But what if it doesn’t?

Few value investors would give a stock like Intuitive Machines a second glance. It’s burning cash. It’s not profitable today. It’s not (supposed to be) profitable anytime soon. It lacks either a trailing P/E ratio or even a forward P/E ratio on which to value the shares.

And yet, this tiny space stock just became the first American company to ever land a spacecraft on the moon. Granted, the landing wasn’t a 100% success. Post-landing reports indicate that Odysseus probably landed sideways, tripping over a rock and toppling over. Intuitive Machines will definitely want to tweak future attempts to prevent this from happening. Quibbles with the quality of the landing aside, though, Intuitive Machines is still unique among space companies. It’s also in a uniquely advantageous position to keep on winning contracts from NASA and other companies wanting to put payloads on the moon – especially as it works the bugs out of its landing procedure.

Indeed, over the next 10 months, Intuitive Machines plans to launch and land two more spacecraft on the moon for NASA. Its 2024 revenue looks likely to nearly quadruple in comparison to 2023, and forecasts for outlying years — which don’t yet figure in the effects of last week’s lunar success — are probably conservative relative to the contracts Intuitive Machines might now win. If revenue rises fast enough, there’s the potential for Intuitive Machines to turn profitable sooner than anyone thinks.

While there’s no guarantee the stock will be a winner, at a valuation of less than 2 times sales — which is toward the low end of what space stocks have been selling for lately — I believe Intuitive Machines stock is cheap enough to buy.

Yes, even for value investors.

Rich Smith has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

U.S. trade deficit fell in 2023 to the lowest level in 3 years and boosted GDP

The numbers: The U.S. trade deficit rose slightly in December, but the annual gap still fell to the lowest level in three years and added to economy’s strong performance in 2023.

Record deficits in 2021 and 2022, by contrast, acted as a big drag on gross domestic product, the official scorecard of the U.S. economy.

In December, the trade gap widened by 0.5% to $62.2 billion. It was sharply lower compared to the same month a year earlier, however.

Key details: Imports fell 1.3% in December to $320.4 billion, the government said Wednesday.

For the full year, imports declined 3.6% from a record $3.65 trillion in 2022.

The drop in imports mostly reflected two things: The lower cost of oil and less household demand for consumer goods such as computers and cell phones.

Instead Americans have been spending more on services such as travel and recreation.

U.S. exports also rose 1.2% in December to a $258.2 billion, clinching a record high in 2023. That also gave a boost to the economy.

A weaker dollar and rising U.S. oil shipments helped deliver last year’s record exports, but weaker economic growth around the world could exert a negative influence in 2024.

“Export growth is surely likely to moderate soon,” said deputy chief U.S. economist Andrew Hunter of Capital Economics.

Big picture: The U.S. trade deficit was driven to record highs during the pandemic because of seismic shifts in the global economy.

Now the deficit has tapered off to more normal — though still high — levels as the lingering effects of the pandemic fade away. It’s unlikely to contribute much to GDP in 2024.

Market reaction: In premarket trades, the Dow Jones Industrial Average

DJIA,

and S&P 500

SPX,

rose in Wednesday trades.

The Solana price growth for the past few months seems to have hit a barrier just above the $120 price level. The price of Solana (SOL) fell around 8% on Thursday to about $98, showing the sheer volatile nature of the crypto market.

As a result, Solana slipped below BNB in market cap rankings, as the latter rallied 9% to take back the fourth spot. According to on-chain data, there’s been an increase in transfers of what looks like profit-taking from Solana whales.

Large Whale Sells $38.2 Million in SOL Tokens

When whales move a lot of crypto, they can really shake things up. According to Lookonchain, an anonymous investor deposited 303,756 SOL tokens worth approximately $38.2 million on Binance, possibly as part of a selloff. Further details show this particular whale has made strategic SOL trades in the past, making huge profits.

The whale withdrew 19,704 SOL from Binance on Sept 29. Solana was trading at $20 during this time, making the transfer worth approximately $394,000. The whale would then deposit it into Binance at $43 per token on Nov 8, making $453,000, a 115% profit. Data from Lookonchain shows that the address still has 119,998 SOL tokens worth $12.44 million staked, and is sitting on over $17 million unrealized profit.

A whale deposited 303,756 $SOL($32.8M) to #Binance today, possibly selling it for profit.

The whale withdrew 423,754 $SOL($28.18M) at $66.5 from #Binance in the past 1 month.

And still has 119,998 $SOL ($12.44M) staked, the profit exceeding $17M!

This whale also withdrew… pic.twitter.com/Sptfj7uUIa

— Lookonchain (@lookonchain) December 28, 2023

Speculation that other large holders of SOL, known as “whales,” sold off portions of their holdings recently may have contributed to the recent price dip. Similar social media posts from whale transaction tracker whale alerts have shown various large SOL transfers from private wallets into crypto exchanges on Thursday, suggesting whales locking in profits or reducing their exposure to the token.

Two of the most notable transactions were the transfer of 1,832,958 SOL worth $182.9 million from an unknown wallet to Coinbase and the transfer of 114,046 SOL worth $11.5 million from another private wallet to Coinbase.

🚨 🚨 🚨 🚨 🚨 🚨 🚨 🚨 1,832,958 #SOL (182,951,373 USD) transferred from unknown wallet to #Coinbase

— Whale Alert (@whale_alert) December 28, 2023

🚨 114,046 #SOL (11,536,447 USD) transferred from unknown wallet to #Coinbase

— Whale Alert (@whale_alert) December 28, 2023

Trading data also suggests traders were moving funds out of SOL to stablecoins. As a result, Solana’s price cascaded and fell from $110 to $98 in 24 hours.

SOL price recovers to $107 | Source: SOLUSD on Tradingview.com

Current State Of Solana

The SOL community and ecosystem have witnessed one of the best price growth this year. Over the past 24 hours, around $18.6 million worth of Solana positions were liquidated, with $10.42 million coming from leveraged long positions, data from CoinGlass shows. This profit-taking sentiment seems to have rolled over into BONK, Solana’s first dog-themed meme token, which is now 50% down from its all-time high.

Solana has since recovered some of the loss, and is now trading at $108, showing the crypto hasn’t lost all of its bullish momentum. Solana recently reached a yearly high of $123.76 on December 25, its highest point in 20 months.

Featured image from CNBC, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Consumer spending fell in October, according to new CNBC/NRF Retail Monitor tracking card transactions

The consumer took a spending break ahead of the holiday season, with October retail sales, excluding autos and gas, falling by 0.08%, and core retail, which also removes restaurants, declining by 0.03%, according to the new CNBC/NRF Retail Monitor.

The new Retail Monitor, debuting Monday, is a joint product of CNBC and the National Retail Federation based on data from Affinity Solutions, a leading consumer purchase insights company. The data is sourced from more than 9 billion annual credit and debit card transactions collected and anonymized by Affinity and accounting for more than $500 billion in sales. The cards are issued by more than 1,400 financial institutions.

The data differs from the Census Bureau’s retail sales report as it is the result of actual consumer purchases, while the Census relies on survey data. The government data is frequently revised as additional survey data becomes available. The CNBC/NRF Retail Monitor is not revised as it’s calculated from actual transactions during the month. It is, however, seasonally adjusted, using the same program employed by Census.

“The CNBC/NRF Retail Monitor will modernize how retail sales are tracked and measured, and Affinity Solutions’ vast dataset of how, what and where the consumer is spending will identify how key demographics and channels are performing for the industry generally and for specific retail sectors,” said NRF President and CEO Matthew Shay.

“Our audience, investors and executives alike, will now be armed with dynamic insights that go beyond headline numbers to show emerging trends and critical detail,” CNBC Senior Vice President of Business News Dan Colarusso said.

Weakness in electronics and furniture

The October data shows a cooling of consumer spending, in line with the consensus of Wall Street forecasts. Year over year, overall retail and core retail sales are both up 2.6%.

The October data showed weakness in gas station sales, electronics and appliances, and furniture and home stores. There was strength in sporting goods and hobby stores and nonstore retails, or internet sales, along with health and personal care.

Starting modestly before the Covid pandemic, and accelerating amid the outbreak, economists turned to real and high-frequency private sector data to gauge the economy. In some cases, it was due to the absence of government data, with some agencies unable to gather information and others finding response rates limited. In other cases, economists looked to data that was not readily available from government sources, like subway ridership data or how much consumer spending occurred “with card not present” to gauge whether Americans continued to shun shopping in person.

While the pandemic passed, the move toward actual, high-frequency and private sector data has continued to expand.

“The Retail Monitor heralds a new era of retail intelligence, where data isn’t just a resource – it’s a roadmap to understanding and engaging with the modern consumer,” Affinity Solutions founder and CEO Jonathan Silver said. Affinity is also a leading provider of data to Wall Street.

In coming months, the Retail Monitor will provide demographic breakdowns of spending by age, income and geography.

Don’t miss these stories from CNBC PRO:

It’s been a tough year for finance stocks. The banking crisis in March put an unwanted spotlight on the sector, and financial stocks across the board have suffered. The looming recession threat also makes investors hesitant about consumer finance stocks. One blue-chip, Warren Buffett-backed stock that has fallen 20% since its recent high in July is American Express (AXP -1.42%).

Buffett’s Berkshire Hathaway owns nearly 152 million shares of American Express, making it the third-largest holding in its investment portfolio. This long-term Buffett holding, which has been in Berkshire’s portfolio since 1993, has taken a hit this year and recently fell over 4% in the days following its quarterly earnings announcement.

Is this a buyable dip for investors? Let’s dive into its results to find out.

American Express’ record quarter

American Express posted solid third-quarter earnings when it reported last week. Its revenue came in just above analysts’ estimates, while its earnings per share (EPS) of $3.30 came in well above forecasts of $2.96. Company management also backed its full-year EPS and revenue growth guidance.

By all measures, American Express posted a solid quarter. Total network volume of $420 billion was up 7%, while total revenue and net income grew 13% and 30%, respectively, compared to the same quarter last year. The record quarter from the payments company was driven by robust spending by its premium customer base, led by travel and entertainment spending.

Image source: Getty Images.

An uptick in write-offs has affected sentiment

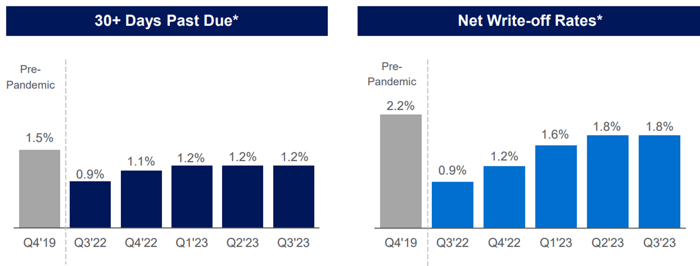

American Express posted a solid quarterly earnings report, so it was interesting that that stock dropped so much in the following days. The sell-off could be due to the storm clouds over the financial sector. In recent quarters, consumer finance companies have seen an uptick in write-offs and past-due accounts. In response, these companies have built up reserves for credit losses to cover potential future losses.

Earlier this year, consumer credit card debt surpassed $1 trillion for the first time, according to the Federal Reserve Bank of New York. Also, the second quarter’s delinquency rates on credit card loans at the largest banks are now above pre-pandemic levels from 2019.

In the third quarter, American Express recorded a $1.2 billion provision for credit losses, up from $778 million last year. The net write-off rate on its card member loans and receivables also increased, up from 0.9% last year to 1.8% in the most recent quarter.

Amex’s credit quality is the best in class

American Express operates the third-largest credit card network in the world, but what makes it stand out is its strong brand. The company offers high-end card products and has a brand that is frequently associated with luxury. This strong brand attracts a premium customer base that can better withstand economic downturns.

Card Member Loans and Card Member Receivables Credit Metrics. Source: American Express.

Compared to competitors, American Express’s credit metrics are solid. Its net write-off rate on card member loans of 1.8% remained below the industry average rate of 2.6%. Additionally, Discover Financial Services, with its not-as-premium customer base, recently reported a charge-off rate of over 4% on its credit card loans.

Should investors buy the dip?

The recent re-steepening of the yield curve has market participants cautious about a possible recession. Consumer finance companies would be vulnerable to a potential economic slowdown, which could impact consumers’ spending and ability to repay debts. If that were the case, American Express and its premium customer base are well-positioned to ride out such a scenario. Other consumer banks that cater to those less-than-premium customers would be more vulnerable in this case.

American Express is a solid stock with a strong brand, and its recent dip is worth buying. An economic slowdown would undoubtedly impact the business, but it’s capable of riding out the storm (if it happens at all). And if the Federal Reserve achieves the coveted soft landing and keeps the economy out of a recession, then this dip is an excellent opportunity to get ahead of that moment.

American Express is an advertising partner of The Ascent, a Motley Fool company. Discover Financial Services is an advertising partner of The Ascent, a Motley Fool company. Courtney Carlsen has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway. The Motley Fool recommends Discover Financial Services. The Motley Fool has a disclosure policy.

Here’s the Average Social Security Benefit for Retirees Aged 62 to 70

The Social Security COLA Countdown Is On: Here’s How Much Your Increase Is Likely Going to Be

Should You Take Social Security at Age 62, 65, or 70? A Comprehensive Analysis Offers a Very Clear Answer

3 Stocks to Hold for the Next 20 Years

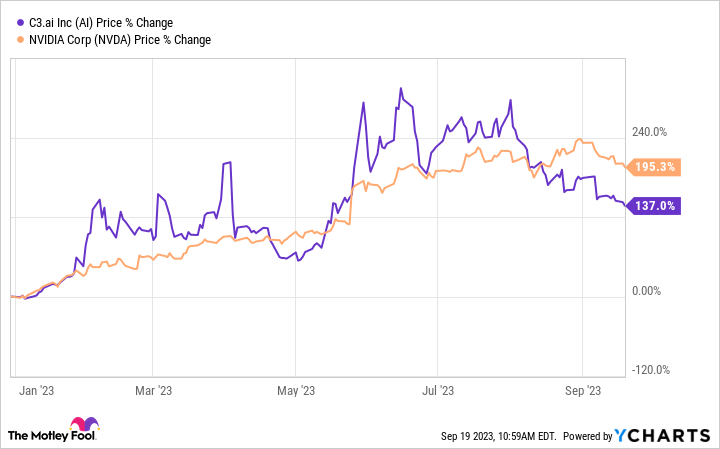

At the beginning of 2023, few people would have accurately predicted how C3.ai (AI -4.41%) stock was going to perform this year. After booking a year-to-date rise of more than 300% at one point, it trended in the other direction. Since early August, it has dropped by about 40%.

After a summer when the stock looked overvalued, the AI stock has dipped to a more reasonable level. Considering the world’s continued focus on AI, has that decline made C3.ai a buy, or should investors still avoid this stock?

The state of C3.ai

A growing recognition of the power and potential of artificial intelligence stoked broad investor interest in AI stocks across the board, and at one point, C3.ai stock was generously rewarding shareholders. For much of the year, it was outperforming the stock many consider the leading light of the AI industry — Nvidia.

C3.ai specializes in AI-powered enterprise software for clients in a variety of industries. Its top customer is the U.S. Department of Defense, which accounted for 67% of total bookings in the company’s fiscal 2024 first quarter (which ended July 31). Shell and Bank of America are some of its other prominent clients.

Indeed, C3.ai emphasizes generative AI, the type of natural language processing software that supports OpenAI’s ChatGPT and other applications.

Financial struggles

Nonetheless, one might wonder whether the “AI” in the company’s name was the biggest factor in its recent stock rally. Investors seem increasingly aware that its revenue growth has lagged that of its peers despite its role in the AI industry. For fiscal Q1, its revenues increased by a comparatively modest 11% year over year to $72.4 million.

That was an improvement from its fiscal 2023 (which ended April 30), when its revenue grew by only 6%. Still, it significantly lagged the 38% growth rate of fiscal 2022.

Also, the company lost $64 million in its fiscal Q1. That was a slight improvement from its $72 million loss in the prior-year quarter, but that result was arguably not enough to sustain the stock’s gains from the first half of the calendar year.

The company’s guidance points to higher revenue increases. C3.ai estimates between $295 million and $320 million in fiscal 2024 revenue. That would be a 15% gain at the midpoint.

However, the company also forecasts a non-GAAP loss from operations of between $70 million and $100 million. That indicates that GAAP profitability is not likely for the foreseeable future.

Since C3.ai still claims around $750 million in liquidity, it can sustain its current pace of losses for years. Still, such a performance could make it more challenging to attract investors.

Also, it sells at a price-to-sales ratio of 11, well below its peak ratio of 85 in December 2020. Nonetheless, C3.ai began 2023 with a price-to-sales ratio of 4, and with no end in sight to the losses, investors may think twice about paying the current sales multiple, even after the pullback.

What to do about C3.ai stock

Even in the wake of its considerable retrenchment, investors should probably stay on the sidelines. Yes, the company’s AI-driven software and client base would indicate significant growth potential, and the price of the stock has fallen significantly from its 52-week peak. However, the market was likely overvaluing the AI stock when the share price was growing faster than Nvidia’s.

Moreover, even with its slight improvements in revenue growth, C3.ai has not come close to matching its growth rates of fiscal 2022. Given the revenue growth in the low double-digit percentages and losses that will likely persist into the foreseeable future, C3.ai’s business does not appear to justify its current sales multiple.

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Will Healy has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bank of America and Nvidia. The Motley Fool recommends C3.ai. The Motley Fool has a disclosure policy.

What happened

Week to date, shares of Rumble (RUM -3.04%) were down 11.9% through Thursday’s market close, according to data provided by S&P Global Market Intelligence.

The video streamer’s second-quarter earnings report revealed a wider net loss than expected. Improving monetization of users is growing revenue, but investors are still waiting for Rumble to prove it can sustain profitable growth. This is why the stock is down 57% since the company went public last year.

So what

Rumble reported a 468% year-over-year increase in revenue for the second quarter. The platform has been successful in bringing new creators to the platform to attract viewers, especially in markets known to attract young viewers, such as gaming, culture, and lifestyle. This has bolstered the company’s monetization efforts with advertising.

Engagement is trending in a positive direction, with minutes watched per month up 46% to 11.8 billion. This followed a 48% increase in hours of uploaded video per day.

The content strategy is working to grow revenue, which is important, but one problem is a lack of growth in users. Monthly active users were 44 million in the quarter, down from 48 million in the first quarter.

Management blamed the dip on the recent slowdown in news and political coverage but also credited increased competition, which is a red flag.

Now what

Rumble is making progress to bring content to the platform that resonates with a younger audience. This is a valuable demographics to advertisers. Rumble can use that to its advantage to grow ad spending.

However, these efforts will only take the company so far until it grows monthly active users and profits. Costs of hosting and content was $40.8 million in the quarter, well above the $24.9 million in revenue. This led to a loss of $0.15 per share compared to $0.03 in the year-ago quarter. Rumble will need to turn that around to send the stock higher.

John Ballard has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

What happened

Week to date, shares of Palantir Technologies (PLTR) are down 15% through Thursday’s market close, according to data provided by S&P Global Market Intelligence.

The stock has more than doubled year to date, but it tumbled following a disappointing second-quarter earnings report earlier this week that didn’t meet revenue growth expectations.

So what

After falling to new lows last year, the stock took off following a better-than-expected first-quarter earnings report in May. But the stock might have gotten ahead of itself over the last few months. The provider of artificial intelligence (AI) software reported that revenue grew 13% year over year. Growth came in below estimates, despite strong customer demand for the company’s AI platform.

Palantir reported it has already gained users from over 100 organizations, including some of the largest companies across healthcare, finance, automotive, and energy. But investors were concerned about weak growth from commercial and government markets. Commercial revenue grew just 10% year over year, while government revenue reported a 15% increase. Lower-than-expected growth adds uncertainty about the company’s long-term growth trajectory.

Now what

Wall Street has been in a frenzy over AI stocks this year, but Palantir’s relatively low growth shows how important it is for investors to be cautious with some of these stocks.

Palantir may get the ball rolling at some point, but it will need to grow much faster to justify its high price-to-sales ratio of 16 right now. Its second-quarter revenue growth was only marginally better than the corporate average.

On a positive note, management mentioned on the earnings call that it has significant deals in the pipeline and has opportunities to grow existing contracts with the government. Assuming Palantir can convert those deals, growth could accelerate again.

John Ballard has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Palantir Technologies. The Motley Fool has a disclosure policy.