Galaxy Digital CEO Michael Novogratz says he doesn’t believe the price of bitcoin will fall back down to the $50K-$55K level. “I think that’s the new floor unless something dramatic happens,” he described. “This has been a wild ride of an asset,” he added, noting that we’re in price discovery mode and if you look […]

Galaxy Digital CEO Michael Novogratz says he doesn’t believe the price of bitcoin will fall back down to the $50K-$55K level. “I think that’s the new floor unless something dramatic happens,” he described. “This has been a wild ride of an asset,” he added, noting that we’re in price discovery mode and if you look […]

Source link

Floor

Bitcoin Unbreakable Floor? Analyst Predicts BTC Won’t Fall Below $35,000 Ever Again

Controversial Stock-to-Flow (S2F) model creator PlanB has recently made a bold prediction about Bitcoin (BTC) that’s captured the crypto community’s attention.

Via his social media handle X, PlanB stated that Bitcoin’s price would never plummet below the $35,000 threshold again. PlanB supported his claim with a chart illustrating Bitcoin’s valuation trend about its intrinsic hash rate. According to PlanB, this relationship is a critical indicator of the digital currency’s enduring value.

Despite acknowledging potential black swan events or short-term market volatility, PlanB insists that based on the current fundamentals, particularly the cost of electricity ($/kWh) used in mining Bitcoin, the asset’s market value is “unlikely” to retract below the mentioned support level – $35,000.

Mining And Market Arbitrage: A Key Factor

The crux of PlanB’s argument lies in the unique arbitrage opportunity that exists between Bitcoin miners and everyday users. Miners, who invest heavily in electricity to mine the digital asset, and users, who typically purchase Bitcoin with fiat currency on exchanges, create a dynamic market environment.

According to PlanB, this arbitrage might become even more pronounced with the advent of a potential launch of a spot Bitcoin Exchange-Traded Fund (ETF) in the US.

🚨BREAKING: Bitcoin valuation based on difficulty (hashrate) increased to $35k yesterday. IMO this could mean that, apart from possible black swans or short term volatility, based on $/kWh-arbitrage fundamentals … BTC will never go below $35k ever again. pic.twitter.com/JPLkXieQAP

— PlanB (@100trillionUSD) November 27, 2023

PlanB suggests that miners, equipped with specialized knowledge about the market and the actual cost of producing Bitcoin, might begin to demand a premium when selling the cryptocurrency. This shift could fundamentally alter the way Bitcoin is traded and its perceived value.

The introduction of BTC spot ETFs, in particular, is expected to bring a new level of mainstream acceptance and investment into Bitcoin, potentially solidifying its price floor as predicted by PlanB.

Bitcoin Hash Rate And Market Dynamics

Delving deeper into the concept of Bitcoin’s hash rate, it’s essential to understand its role in securing the network and validating transactions. The hash rate basically measures the computational power being used to mine and process transactions on the blockchain.

A higher hash rate indicates more robust security and efficiency in the network, often correlating with increased investor confidence and, consequently, a higher asset valuation.

PlanB’s analysis posits that Bitcoin’s valuation will follow suit as the hash rate continues to rise, driven by technological advancements and increased mining activities. This relationship forms the basis of his prediction that Bitcoin will maintain a strong market position, unlikely to fall below the $35,000 mark.

Currently, BTC is trading above $37,000, marking an increase of over $2,000 from the support level PlanB mentioned. Specifically, at the time of writing, Bitcoin’s price stands at $37,605, reflecting a 2% rise in the last 24 hours.

Featured image from Unsplash, Chart from TradingView

Rep. Tom Emmer roasts Gary Gensler in fiery speech on the House floor

Rep. Tom Emmer (R-MN) sharply criticized Securities and Exchange Commission (SEC) Chair Gary Gensler in a speech on the House floor that condemned the agency’s approach to regulating digital assets.

Emmer said Gensler had “proven himself to be ineffective and incompetent” through his aggressive enforcement actions while stressing that regulation was the preview of Congress.

Rep. Emmer claimed that under Gensler’s leadership, the SEC has “pursued dozens of enforcement actions against the digital asset industry, despite never finalizing a single rule or regulation for the industry to follow.” He contended that by refusing to provide clear criteria on which digital assets would be considered securities, Gensler and the SEC have left the industry unable to comply with rules that do not exist.

Overreach

Rep. Emmer has been a vocal supporter of the crypto industry and critic of the SEC’s approach to regulation under Gensler. The congressman has repeatedly accused the SEC of overreach by pursuing enforcement actions against crypto firms without providing clear guidance.

Emmer contrasted the SEC’s enforcement actions against companies like Coinbase, a publicly traded crypto exchange operating in the U.S., with its failure to stop “bad actors like FTX and Terra-Luna” stating this demonstrated ineffective leadership. He asserted that as Congress works on legislation to establish a crypto asset framework, Gensler should not be allowed to “crush American innovation and capital formation” through overreaching enforcement.

To curb the SEC’s overreach, Emmer plans to introduce an amendment prohibiting the agency from using taxpayer funds for crypto enforcement until legislative guidelines are in place. However, while this would restrict Gensler, Emmer stressed it would not prevent prosecuting criminal fraud and abuse, citing the authority and resources of the Justice and Treasury Departments to prosecute wrongdoers.

While Emmer’s proposal faces challenges passing the Democrat-controlled House, his speech signals Republican lawmakers plan to pressure the SEC over crypto regulation. Gensler has defended the SEC’s actions as protecting investors from unregistered securities offerings.

The post Rep. Tom Emmer roasts Gary Gensler in fiery speech on the House floor appeared first on CryptoSlate.

Next cycle’s hypothetical $36k Bitcoin floor, exploring historical data to project future benchmarks

Quick Take

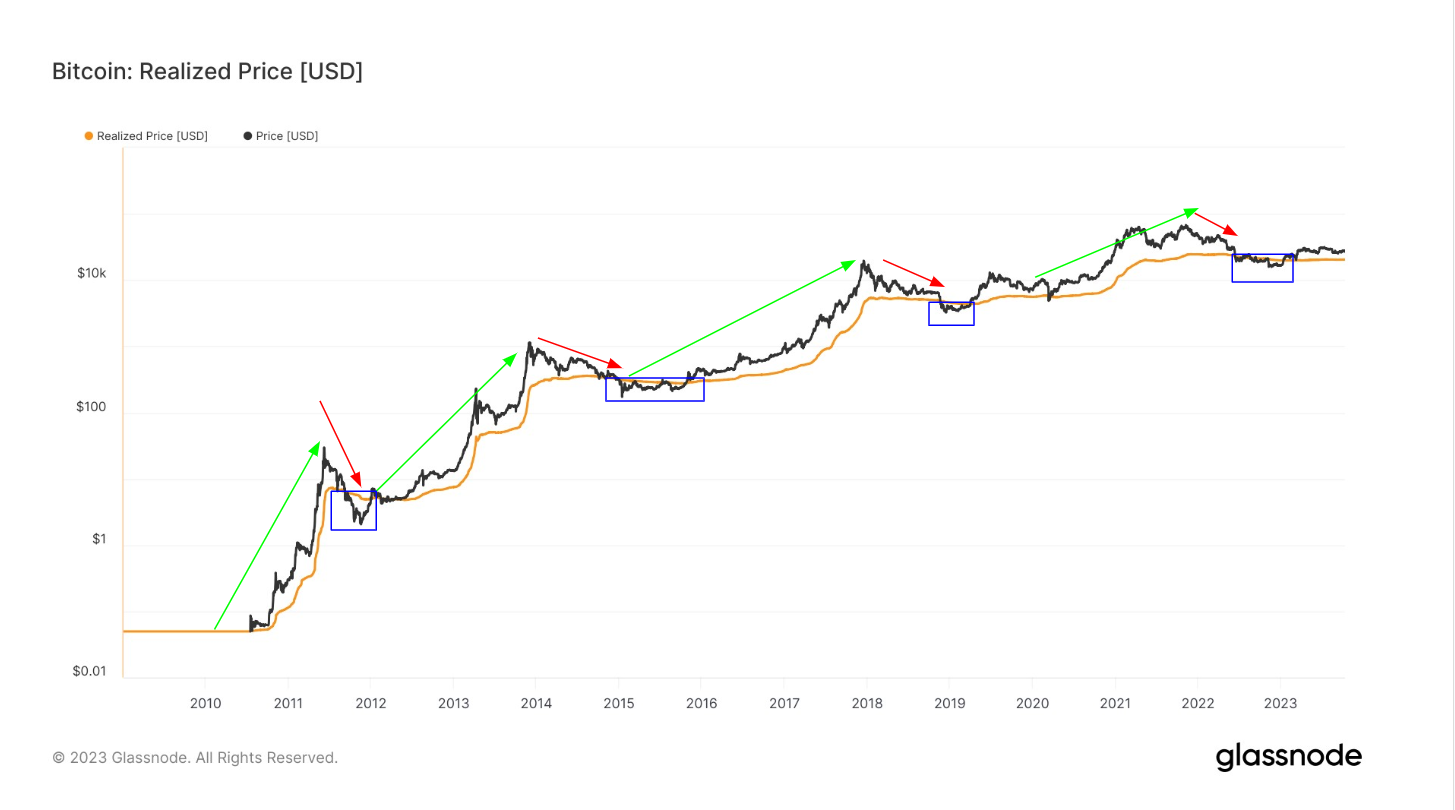

Bitcoin’s valuation, often viewed as speculative, can be dissected more accurately through the lens of the ‘realized price‘ metric.

This measure, reflecting the average cost at which all current Bitcoin holders purchased their coins, negates the impacts of volatility, thus offering a more realistic view of Bitcoin’s value over time.

Historical data reveals distinct cycles wherein Bitcoin’s market price traded beneath its realized price, as shown by the blue boxes in the chart below.

Specifically, it saw significant drops in value during the following periods:

- September to December 2011 – Price fell as low as $2.33

- January to October 2015 – Price plunged to $310

- December 2018 to March 2019 – Price dropped to a low of $3,500

- June 2022 to December 2022 – Price reached a low of $15,500

Following these periods, Bitcoin has consistently traded above the realized price, illustrating a robust rebound pattern.

As of 2023, Bitcoin’s price at $26,800 is considered fair against the realized price of $20,300. This continual pattern of ‘higher highs’ demonstrates the inherent resilience of this digital asset.

Historical Bitcoin Realized Price Projections.

Projecting the next bottom cycle based on Bitcoin’s realized price presents an intriguing thought experiment. While historical performance cannot conclusively predict future price action, understanding cycle patterns allows for a more holistic view of the Bitcoin market.

Historical data shows that in 2011, the bottom realized price was $4.50, which surged 55x to $250 in the 2015 bottom cycle.

Subsequently, the bottom in 2019 saw a 22x increase to $5,500.

The 2022 cycle bottomed at $20,000, marking a 3.6x increase.

If we follow this pattern of halving the multiplier with each cycle, the next bottom, hypothetically, could be around $36,000, reflecting a 1.8x increase compared to the 2022 bottom.

Ultimately, this exercise allows us to envision what Bitcoin’s valuation could look like should it follow similar patterns as previous cycles after the upcoming 2024 halving. While the future remains uncertain, contextualizing Bitcoin’s current position relative to past realized price data provides a more explicit framework to anticipate possibilities.

The post Next cycle’s hypothetical $36k Bitcoin floor, exploring historical data to project future benchmarks appeared first on CryptoSlate.