In a recent announcement by Binance on April 4, 2024, the firm disclosed its decision to halt support for Bitcoin-based Ordinal non-fungible token (NFT) collectibles within its NFT marketplace. The directive from Binance calls for users of its NFT marketplace to withdraw their Ordinal inscriptions by May 18, 2024. Binance NFT Marketplace to End Ordinal […]

In a recent announcement by Binance on April 4, 2024, the firm disclosed its decision to halt support for Bitcoin-based Ordinal non-fungible token (NFT) collectibles within its NFT marketplace. The directive from Binance calls for users of its NFT marketplace to withdraw their Ordinal inscriptions by May 18, 2024. Binance NFT Marketplace to End Ordinal […]

Source link

Focus

Warren Buffett Thinks Berkshire Hathaway’s Earnings Figures Are “Worse Than Useless.” So What Should Investors Focus On?

Berkshire Hathaway (BRK.A -0.30%) (BRK.B 0.11%) reported a profit of $96.2 billion last year. The result reflected an impressive improvement over the net loss of nearly $22.8 billion in 2022. Or did it?

Warren Buffett doesn’t think highly of his company’s bottom line. In his latest letter to Berkshire Hathaway shareholders, Buffett wrote that the conglomerate’s earnings figures are “worse than useless.” Why is he so negative about earnings? And what should investors focus on instead?

Why Buffett dislikes Berkshire’s earnings numbers

It didn’t take long for Buffett to bring up Berkshire’s financial results for 2023 in his recent shareholder letter. He acknowledged that many people gravitate to the bottom-line numbers on the company’s income statement. The legendary investor specifically called attention to the big swings from 2021 (with net earnings of nearly $90 billion) to the loss posted in 2022 to the huge aforementioned profit in 2023.

With Buffett’s famous acerbic wit, he wrote:

You seek guidance and are told the procedures for calculating these “earnings” are promulgated by a sober and credentialed Financial Accounting Standards Board (“FASB”), mandated by a dedicated and hard-working Securities and Exchange Commission (“SEC”) and audited by the world-class professionals at Deloitte & Touche (“D&T”).

He added, “So sanctified, this worse-than-useless ‘net income’ figure quickly gets transmitted throughout the world via the internet and media. All parties believe they have done their job — and legally, they have.”

Why does Buffett dislike Berkshire’s earnings numbers so much? Because the figures must adhere to generally accepted accounting principles (GAAP), they include unrealized capital gains and losses. He noted that Berkshire’s unrealized capital gains and losses can sometimes top $5 billion in just one day.

Buffett believes that capital gains are important. He emphasized that Berkshire wouldn’t invest so heavily in stocks if they weren’t. However, including capital gains and losses in the conglomerate’s bottom line doesn’t provide shareholders the information they need to truly gauge how well Berkshire is performing. In Buffett’s words: “It is more than silly, however, to make judgments about Berkshire’s investment value based on ‘earnings’ that incorporate the capricious day-by-day and, yes, even year-by-year movements of the stock market.”

The metric Buffett recommends investors watch

Since Berkshire’s GAAP earnings aren’t especially helpful, another metric is needed to evaluate how the company is performing. Buffett recommended that investors pay attention instead to Berkshire’s operating earnings.

The main difference between GAAP earnings and operating earnings is that the latter excludes the volatile unrealized capital gains and losses. Unsurprisingly, the year-to-year changes with operating earnings aren’t nearly as big as the swings with GAAP earnings.

In 2021, Berkshire generated operating earnings of $27.6 billion. Operating earnings rose to $30.9 billion in 2022. The company delivered operating earnings of $37.4 billion last year. The trend is steadily upward, just as Buffett likes to see.

You won’t find Berkshire’s operating earnings in its 10-K filings. However, the company has included them in its annual report to shareholders since 2018 when GAAP reporting was changed to reflect unrealized capital gains and losses in earnings as well as realized gains and losses.

What about companies other than Berkshire?

It’s important to note that Buffett’s disparagement of GAAP earnings was limited to Berkshire’s case. He didn’t argue that investors should disregard the GAAP earnings of other publicly traded companies in evaluating their performance.

However, any company with a significant investment portfolio faces the same issues with GAAP earnings as Berkshire does. For example, Markel, which was in Berkshire’s portfolio for a while, invests a lot of money in other stocks. As a result, its GAAP earnings are more likely to fluctuate quite a bit.

There are also some drawbacks to GAAP earnings even with companies that don’t have large investment portfolios. Non-cash items such as depreciation and amortization can distort earnings. One-time events can make a company’s earnings look much better or worse as well.

Perhaps the best advice for investors concerning using GAAP earnings comes from Buffett himself. He wrote to Berkshire Hathaway shareholders that the GAAP metric should be only “a starting point” in evaluating businesses.

Keith Speights has positions in Berkshire Hathaway. The Motley Fool has positions in and recommends Berkshire Hathaway and Markel Group. The Motley Fool has a disclosure policy.

McDonald’s CEO says fast food chain will focus on affordability amid outrage over menu hikes

The CEO of McDonald’s admitted Monday that the sales for the fast food giant have dipped amid increased menu prices that have not gone unnoticed by customers.

The Chicago-based chain has taken heavy criticism over its Big Mac combo that is priced at nearly $18, among other menu hikes, and has promised to focus on affordability, the New York Post reported.

“I think what you’re going to see as you head into 2024 is probably more attention to what I would describe as affordability,” McDonald’s CEO Chris Kempczinski said on an earnings call with analysts.

Some global same-store sales grew by 3.4%, short of the 4.7% that was expected by Wall Street. In addition, some low-income customers have stopped patronizing the chain as inflation has caused prices to jump, Kempczinski said.

BURGER KING OWNER RESTAURANT BRANDS BUYS FRANCHISEE CARROLS FOR $1 BILLION

“Eating at home has become more affordable,” Kempczinski said. “The battleground is certainly with that low-income consumer.”

Prices at McDonald’s are still expected to increase at a slower pace, restaurant analyst Mark Kalinowski told The Post.

Last week, a McDonald’s location in Connecticut was criticized after a customer was charged $7.29 for an Egg McMuffin and nearly $5.69 for a side of hash browns. The franchise in Darien, Connecticut was called out for charging $17.59 for a Big Mac combo.

Fast food prices in general could climb even higher as minimum wage hikes go into effect across the country. In California, many fast food workers will earn $20 per hour beginning April 1.

McDonald’s and Chipotle have signaled that prices will have to increase in response to the high labor costs.

Original article source: McDonald’s CEO says fast food chain will focus on affordability amid outrage over menu hikes

A recent ‘Navigating Narratives’ report by K33 Research provided insights on how to trade altcoins. Interestingly, as part of their analysis, they highlighted Solana (not ETH) as the main focus and elaborated on why this was so.

Why Solana Is The Main Focus

The report, written by DeFi Analyst David Zimmerman, stated that they were focusing primarily on buying SOL if there was an opportunity to buy lower. They claim the reason for this is that “SOL has solidified its place in the market as one of the market leaders.” They also expect that SOL’s outperformance of ETH will continue in this market cycle.

Meanwhile, Zimmerman highlighted how SOL’s on-chain activity has continued to flourish and noted that the narrative of SOL being ETH’s main competitor was still intact. The Solana network has long been dubbed the “Ethereum Killer,” with the belief that the former will dethrone the latter at some point.

Indeed, Solana has gone toe-to-toe with Ethereum in recent times, momentarily surpassing it in significant metrics. Back in December, Solana ranked above Ethereum in seven-day DEX volume for the first time in history and outperformed it in NFT trading volume during that same period. More recently, Solana’s Jupiter outranked Ethereum’s Uniswap in daily trading volume.

Solana currently trading at $98.9700 on the daily chart: TradingView.com

SOL also outperformed ETH last year, with the former seeing a gain of about 1000%. Crypto analyst Santiago Santos also recently gave his opinion on Solana and Ethereum’s fight for dominance. Comparing Ethereum’s run during the ICO boom to Solana’s current run, he noted that Solana had an edge since it has “applications seeing meaningful usage and growth.”

This happens to be one of the reasons he believes that Solana will “converge on Ethereum faster than most believe.”

What Price Levels Present Buying Opportunities For SOL

Having explained why SOL was the main focus among altcoins, the Navigating Narratives report highlighted price levels they were eyeing in case in case the market gives deeper pullbacks for SOL. These levels include the $70, $50 and $30 price range.

However, they noted that they weren’t expecting the $30 buy order to be filled since it would require a crash like the one that happened in March 2020. This was the period when Bitcoin lost almost half of its value in a two-day plunge. Other crypto tokens also experienced similar pain then.

Meanwhile, if SOL continues to rally, K33 Research highlighted the $115 and $140 price ranges as ideal areas for selling and taking profits.

At the time of writing, SOL is trading at around $99, up in the last 24 hours according to data from CoinMarketCap.

Featured image from Adobe Stock, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

The Bank for International Settlements (BIS) has revealed its strategic priorities for 2024, with a particular emphasis on Central Bank Digital Currencies (CBDCs) and tokenization.

The 2024 roadmap points to a continuation of the watchdog’s engagement with digital financial technologies. The BIS has taken a heavily pro-CBDC stance and has published a comprehensive framework for countries looking to create their own localized digital currencies.

Exploring tokenization

One of the most ambitious undertakings in the BIS’s 2024 agenda is Project Promissa, which aims to revolutionize financial instruments by digitizing promissory notes using blockchain technology.

Promissory notes are still paper-based despite their integral role in the financial system. According to the regulator, their digitization could greatly enhance efficiency and transparency in financial transactions.

Project Promissa is a collaborative venture between BIS, the Swiss National Bank, and the World Bank. The proof-of-concept phase for the project is scheduled for completion by early 2025.

Project Aurum

Complementing the tokenization efforts is Project Aurum, a joint initiative with the Hong Kong Monetary Authority (HKMA), which completed its initial pilot testing phase in 2022.

Project Aurum will focus on privacy in retail payments using CBDCs. Following its initial phase in 2022, the project aims to delve deeper into privacy issues related to CBDCs.

Project Aurum’s exploration of CBDC privacy is crucial, considering the growing global interest in digital currencies and the need for secure, private transactions. The project aligns with the broader strategy of the watchdog, highlighting the increasing importance of CBDCs in reshaping the financial sector.

The BIS’s 2024 agenda includes four other projects: Project Leap, Project Symbiosis, Project Hertha, and Project NGFS Data Directory 2.0. These projects cover cybersecurity, green finance, and financial crime. This diversified approach indicates BIS’s broad engagement with various aspects of financial technology.

Historically, BIS has maintained a prudent approach towards digital currencies, with a particular focus on the implications of stablecoins. In late 2023, Agustín Carstens, general manager of BIS, highlighted the importance of central banks in digital currency innovation, with a focus on CBDCs.

Opinion: U.S. companies should look past politics and focus on selling products in China

China’s crackdown on domestic dissent, paranoia about espionage, persecution of private executives and harassment of foreign businesses have instigated widespread fear, pessimism and deflation.

However, China is not Japan in the 1990s. It has a formidable export machine that is not simply based on a cheap currency, inexpensive labor and subsidies. Otherwise, China’s consumer spending growth would be negative rather than just growing less rapidly owing to a lack of real income, not simple apprehension about the property sector,…

Master your money.

Subscribe to MarketWatch.

Get this article and all of MarketWatch.

Access from any device. Anywhere. Anytime.

Already a subscriber?

Log In

Christine Lagarde, president of the European Central Bank (ECB).

Bloomberg | Bloomberg | Getty Images

FRANKFURT — The European Central Bank meets this week with investors closely monitoring to see when the Frankfurt institution might start to cut interest rates.

It will be too early to declare victory in the battle against inflation, but with inflation at a two-year low, it certainly gives the ECB’s Governing Council breathing space to focus on another important issue: its gigantic balance sheet.

“Having reached its policy rate plateau at a 4% deposit rate, the ECB can now shrink its balance sheet at a faster pace without risking too much of a blowout in yield spreads within the euro zone,” said Holger Schmieding of Berenberg in a research note to clients.

“Nonetheless, markets will probably have to correct some of their overoptimistic rate cut expectations once the ECB has spoken this Thursday.”

Inflation plunge

Inflation declined to 2.4% in November and core inflation also has gone down. With inflation falling faster than expected, investors have increased their bets for ECB rate cuts next year, especially after one of the more hawkish members of the board, Isabel Schnabel, called the consume price slowdown “remarkable” and “a pleasant surprise,” according to a transcript of a Dec. 1 interview with Reuters.

Money markets are currently pricing in almost 150 basis points of rate cuts next year. The bank’s key deposit rate is at a record high of 4%, after 10 consecutive hikes that began in July 2022 and pushed rates back into positive territory for the first time since 2011.

“The risk is now earlier and larger cuts, and an ECB more capable of decoupling from the Fed,” said Mark Wall, an ECB watcher with Deutsche Bank.

But he believes the ECB will most likely keep its cards close to its chest: “We expect the ECB to keep the guidance that maintaining restrictive rates for sufficiently long will bring inflation back to target in a timely manner.”

PEPP roll-off

Looking ahead, there will be a new round of staff projections for inflation and economic growth in March, which will give the central bank more data to back their data-dependent policy approach and possibly give it room for rate cuts.

But this week, the main policy change at the conclusion of the ECB’s meeting on Thursday might come in the form of a shift in forward guidance — specifically when it will end reinvestments of its PEPP program.

The PEPP, or the Pandemic Emergency Purchase Program, is a flexible bond purchase program introduced during the coronavirus pandemic. The ECB reinvests any maturing securities it gets from its PEPP portfolio but that could soon change.

“We have indicated that we would continue reinvesting until at least 2024,” ECB President Christine Lagarde told European Parliament lawmakers on Nov. 27.

“This is a matter which will come probably for discussion and consideration within the Governing Council in the not-too-distant future, and we will reexamine possibly this proposal.”

Deutsche Bank’s Wall explained that “if rate cuts are moving forward, the ECB might accelerate the preliminary steps in the exit from PEPP reinvestments.”

Dubai, UNITED ARAB EMIRATES — Exxon Mobil CEO Darren Woods on Saturday said the “problem statement” that countries need to focus on at the COP28 climate summit is reducing emissions, in contrast to calls for a collective commitment to phase out all fossil fuels.

For many at the summit, which is being held in the United Arab Emirates, COP28 can only be recognized as a success if it results in a deal to “phase out” all fossil fuels, whose burning is the chief driver of the climate crisis.

The language of the final agreement, expected by or around the Dec. 12 end of the conference, will be closely monitored. A “phase out” commitment would likely require a shift away from fossil fuels until their use is eliminated, while a “phase down” could indicate a reduction in their use — but not an absolute end.

There’s also an ongoing debate about whether an agreement should center on “abated” fossil fuels, which are trapped and stocked with carbon capture and storage technologies, or “unabated” fossil fuels, which are largely understood to be produced and used without substantial reductions in the amount of emitted greenhouse gases.

Asked by CNBC’s Steve Sedgwick at COP28 whether it would be the wrong scenario for countries to agree to the phase out of abated fossil fuels, Woods replied, “I think what society ought to focus on is the true problem here, which is emissions.”

“The challenge here is eliminating emissions,” he continued. “How we do that will be a function of where the technology goes, and what the circumstances are, and where those emissions are being emitted.”

‘Keep your mind open’

In a speech delivered to world leaders on Friday, U.N. Secretary-General António Guterres was unequivocal in his call for the burning of fossil fuels to be stopped outright, in order to prevent the worst effects of the climate crisis.

“We cannot save a burning planet with a firehose of fossil fuels,” Guterres said. “The 1.5-degree limit is only possible if we ultimately stop burning all fossil fuels. Not reduce. Not abate. Phaseout — with a clear timeframe aligned with 1.5 degrees.”

Not everyone is on board with calls to phase out fossil fuels, however. Russia has previously said it would oppose this language being used in the final agreement, while COP28 host the United Arab Emirates has instead signaled its preference for a “phase down.”

Darren Woods, chairman and chief executive officer of Exxon Mobil Corp, during the Asia-Pacific Economic Cooperation (APEC) CEO Summit in San Francisco, California, US, on Wednesday, Nov. 15, 2023. Executives from large multinationals are converging on the sidelines of APEC in San Francisco this week for an audience with the Chinese president and other Asian leaders as long-frosty US-China relations show only tentative signs of warming. Photographer: David Paul Morris/Bloomberg via Getty Images

Bloomberg | Bloomberg | Getty Images

“I don’t think there is a one-size fits all. I actually think that part of the thing that has slowed us down is this focus on making a step change and getting out of our existing energy system and starting something brand new. That is going to be a long, costly process that is going to be very, very expensive,” Exxon Mobil’s Woods said.

“Instead, what we ought to be looking at is how do we get from where we’re at today to a future with lower emissions, and that involves step changes in some areas. It certainly involves wind, solar and [electric vehicles], but it also involves decarbonizing what we currently have.”

Woods said that there are currently options to start reducing the carbon intensity of existing technologies “at a much lower cost.”

“So, stay focused on the problem statement of emissions. Keep your mind open to a variety of different solutions and make sure that the work that everybody is putting into this is focused on the areas of strength that we can make the most reduction the quickest,” he added.

Big Oil executives have previously sought to defend their core business model from climate criticism, saying it is not possible to keep everyone happy during the transition away from fossil fuels. Officials of large oil producing nations, including of the UAE, have likewise advocated for the energy security and affordability of using fossil fuels while transitioning toward the exclusive use of green energy.

Tengku Muhammad Taufik, president and group CEO of Malaysia’s state energy firm Petronas, said in early October, “So, the debate has always been posed here, I’m reminded of an old saying: ‘If you want to keep everyone happy, sell ice cream.’ We are not in the business of ice cream — and, I’m reminded, there are people who are lactose intolerant.”

‘Win-win-win’

Asked about criticism the U.S. oil giant has received from climate campaigners over the Pioneer deal, Woods said, “Well, the way we’re looking at this is, there is a demand for oil and gas today, and there will be demand for oil and gas going forward in the future.”

An Exxon Mobil gas station in Washington, DC, US, on Tuesday, Nov. 28, 203.

Bloomberg | Bloomberg | Getty Images

“What exactly that level is, we all have our different views on, but as long as there is demand out there, I think what society wants are the most responsible operators meeting that demand. And what we’re committing to do is [to] be the most responsible operator,” he added.

“We will basically produce more oil at a lower cost, more efficiently with less environmental footprint. That’s a win-win-win. And we’re improving U.S. energy security so there’s a lot to like about that deal,” Woods said.

Garlinghouse emphasized the need for the SEC to reassess its regulatory approach, moving away from a pattern of enforcement through lawsuits.

During the just-concluded Ripple’s Swell conference in Dubai, the company’s CEO Brad Garlinghouse shared his views regarding the United States Securities and Exchange Commission’s (SEC) role in protecting consumers against bad actors.

In an interview with CNBC’s Dan Murphy, Garlinghouse stated that, in his opinion, the SEC has strayed from its commitment to investor protection, questioning the agency’s priorities in the process.

“I think the SEC, in my opinion, has lost sight of their mission to protect investors. And the question is, who are they protecting in this journey?” Garlinghouse told CNBC.

Ripple’s Win Is a Positive Step for the Industry

Garlinghouse’s opinion stemmed from the SEC’s enforcement actions against the crypto industry, as the agency has chosen a litigious approach to regulating the emerging economy instead of working with Congress to introduce befitting regulations for the crypto space.

In 2020, the financial watchdog sued Ripple alongside two executives, including the CEO, for orchestrating a $1.3 billion securities fraud by selling XRP to retail investors in the US.

The lawsuit centered around Ripple’s failure to register the continuous sale of XRP tokens, leaving investors without essential information about the digital asset and Ripple’s business activities.

After over two years of court battles between the SEC and Ripple, US District Judge Analisa Torres in Manhattan finally ruled in July that XRP is not a security and possesses no qualities of a security token.

The SEC’s request for an interlocutory appeal was subsequently denied, and in October, the agency dropped securities law violation charges against Garlinghouse and another Ripple executive, Chris Larsen.

Garlinghouse, reflecting on the developments, expressed optimism not only for Ripple but for the entire industry. He sees the SEC being put in check as a positive step, hoping it will pave the way for the crypto industry to flourish in the United States.

“I think it is a positive step for the industry, not just for Ripple, not just for Chris and Brad, but for the whole industry, that the SEC has been put in check in the United States. And I’m hopeful this will be a thawing of the permafrost in the United States for really seeing an amazing industry that has immense potential to thrive in the largest economy in the world,” Garlinghouse told CNBC.

Ripple to Hire 80% of Employees Outside the US

In criticizing the SEC’s regulatory strategy, Garlinghouse drew parallels with other legal battles in the industry. The Ripple CEO referenced Grayscale’s victory regarding a Bitcoin exchange-traded fund (ETF), where a federal judge accused the SEC of being “arbitrary and capricious.”

Garlinghouse emphasized the need for the SEC to reassess its regulatory approach, moving away from a pattern of enforcement through lawsuits.

“Generally, judges tend to be pretty down the middle and try not to be dramatic — those are damning words. So I think at some point the SEC has to step back and realize that their regulatory approach through enforcement, let’s bring lawsuits, has to break,” said he.

Garlinghouse, influenced by the SEC’s regulatory style against the industry, asserted that Ripple had redirected its recruitment focus to other jurisdictions.

During a September interview at the Token2049 conference in Singapore, he outlined the company’s strategy to recruit 80% of its workforce from countries he deemed more proficient in crypto regulation.

Expressing his dissatisfaction, Garlinghouse pointed out the contrast in markets like Singapore, where governments collaborate with the industry, provide explicit regulations, and witness substantial growth.

“It’s super frustrating to see markets like we have here in Singapore … where the governments are partnering with the industry, and you’re seeing leadership providing clear rules and growth. And frankly, that’s why Ripple is hiring there,” explained the CEO.

next

Blockchain News, Cryptocurrency News, News

You have successfully joined our subscriber list.

Maine state treasurer to focus on handling abandoned cryptocurrency accounts

A report issued by the Office of the Maine State Treasurer highlighted the U.S. state’s interest in officially managing the abandoned and recovered crypto assets.

The program evaluation report of Maine uncovered the state’s lack of preparedness when it comes to handling cryptocurrencies. It read:

“Our office does not currently handle cryptocurrency, but programs like Unclaimed Property may need to start addressing the situation of abandoned cryptocurrency accounts.”

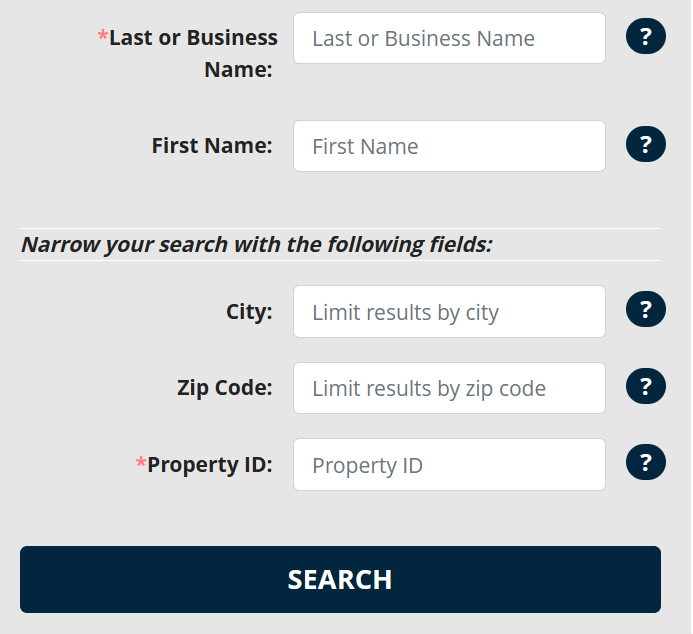

According to official data, the state of Maine currently holds over $328 million in unclaimed property. The website requires the name, address and property ID information of claimants searching for an unclaimed property.

The report also uncovered the state treasurer’s interest in implementing reforms for emerging issues entailing technology, automated clearing house payments and cryptocurrencies. It stated:

“While our current statutes and precedent elsewhere leave us without clear authority to hold our recovered crypto assets, we may want to do so in the future.”

The issue around unclaimed cryptocurrencies is a phenomenon well-known across the Ethereum ecosystem as well. In the summer of 2014, 8,893 people participated in an Ether (ETH) presale event. However, nearly a decade later, millions of dollars in ETH lie unclaimed in those presale wallets.

Related: Illinois Can Claim ‘Abandoned’ Cryptocurrency Under New Bill

Recently, Maine Wire reported that members of the Maine Democratic Party refused to return a donation of $100,000 they had received from Sam Bankman-Fried. The U.S. attorney for the Southern District of New York demanded that political committees return the donations received from FTX after winning seven guilty verdicts in the FTX-SBF case.

In 2022, crypto exchange Coinbase launched a tool capable of recovering unsupported ERC-20 tokens that were “mistakenly sent” to the exchange’s address.

“Our recovery tool is able to move unsupported assets directly from your inbound address to your self-custodial wallet without exposing private keys at any point,” said Coinbase. “We did this by using patent pending technology to send the funds directly from your inbound address without processing the funds through our centralized exchange infrastructure.”

The inability to recover the cryptocurrencies sent to unsupported wallets contributes to the ever-growing pile of unclaimed cryptocurrencies. Coinbase changes this by providing “the Ethereum TXID for the transaction where the asset was lost and the contract address of the lost asset,” which can then be used to recover the lost funds.

Magazine: Exclusive: 2 years after John McAfee’s death, widow Janice is broke and needs answers