Rich Dad Poor Dad author Robert Kiyosaki has predicted that bitcoin and silver will take off while gold will crash below $1,200. He urges investors to prepare for the “biggest crash in history” which he forecasted in his book years ago. Emphasizing that the Federal Reserve is “destroying” the U.S. economy, he advised: “Rather than […]

Rich Dad Poor Dad author Robert Kiyosaki has predicted that bitcoin and silver will take off while gold will crash below $1,200. He urges investors to prepare for the “biggest crash in history” which he forecasted in his book years ago. Emphasizing that the Federal Reserve is “destroying” the U.S. economy, he advised: “Rather than […]

Source link

foresees

Bitcoin (BTC)’s Price Faces Threat As Analyst Foresees $54.73 Million Liquidation

According to data from CoinMarketCap, Bitcoin (BTC) has maintained its upward price trajectory over the last day, gaining by 4.04% to briefly trade above the $48,000 mark. As BTC now hovers around the $47,100 price zone, investors and market experts remain highly speculative about the token’s next action. On that note, popular analyst Ali Martinez has called a major prediction that could spell weighty losses for many investors.

Liquidity Hunters Target $45,810 In Potential Bitcoin Price Manipulation Plot

In an X post on Friday, Martinez predicted an incoming dip in Bitcoin’s price driven by a planned liquidation. Using data from the cryptocurrency futures trading platform, CoinGlass, the analyst stated the Bitcoin liquidation heatmap indicated that there is potential strategic liquidation in play.

According to the #Bitcoin liquidation heatmap, there’s a potential strategy unfolding where liquidity hunters could drive the price of $BTC down to $45,810. This move is aimed at triggering liquidations amounting to $54.73 million! pic.twitter.com/monFlZmvQ6

— Ali (@ali_charts) February 9, 2024

Martinez stated that liquidity hunters in the BTC market could be looking to push the token’s price as low as $45,810 for personal benefits. For context, liquidity hunters are traders or investors who actively seek opportunities in the financial markets to exploit changes in liquidity.

This set of market players often targets specific price levels where there is a concentration of stop-loss orders or where market liquidity is expected to be thin. By triggering liquidations or capitalizing on price movements, liquidity hunters aim to profit from short-term market inefficiencies.

According to Martinez, the liquidity hunters in the BTC market are currently looking to induce an estimated 3% decline in the token’s price. While this change may seem minimal, it represents an astounding $54.73 million in liquidations. Based on these numbers, BTC traders and investors should be wary of potentially significant losses in the coming days.

BTC Price Overview

The premier cryptocurrency has recently taken flight, gaining by 8.6% in the last two days after a flat period of consolidation stretching to the beginning of February. Interestingly, the asset’s pathway to higher gains appears more confident with recent developments in the Bitcoin spot ETF market, which recorded a total net flow of $403 million on February 8 – the highest value of that metric since January 17.

At the time of writing, Bitcoin trades at $47,238, with a 0.26% gain in the last hour. Meanwhile, the coin’s daily trading volume has soared by 56.33% and is now valued at $39.42 billion. In addition, BTC maintains its top spot in the crypto market with a total market cap of $924.67 billion.

BTC trading at $47,229 on the daily chart | Source: BTCUSDT chart on Tradingview.com

Featured image from Nairametrics, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Cantor CEO Makes Gold And Bitcoin ETFs Comparison, Foresees True Rally With Halving

In a highly anticipated development, the United States Securities and Exchange Commission (SEC) granted regulatory approval for 11 spot Bitcoin ETFs, sparking excitement within the crypto community.

However, despite initial expectations of a significant price surge, the Bitcoin market has experienced an 8% price drop since the ETFs began trading.

Bitcoin ETFs To Unfold Impact Over Time?

Drawing a comparison with the launch of the first Gold ETF, Cantor Fitzgerald Asset Management CEO, Howard Lutnick, noted that the immediate rush to buy the asset did not materialize.

Lutnick remarks that historical data from the launch of the Gold ETF, SPDR Gold Shares (GLD), reveals that substantial price appreciation took place over several years.

When GLD was introduced in November 2004, the price of gold stood at around $700. By December 2023, it had surged to an all-time high of $2,145. The gold market capitalization, estimated at $1 trillion to $2 trillion pre-ETF approval, ballooned to $16 trillion within a few years.

Likewise, despite the initial hype surrounding the spot Bitcoin ETFs, experts suggest that the true impact of these ETFs will unfold over an extended period.

As reported by NewsBTC, market analysts at CoinShares estimate that the United States possesses around $14.4 trillion in addressable assets.

Assuming a conservative scenario where 10% of these assets invest in a spot Bitcoin ETF with an average allocation of 1%, it could potentially result in approximately $14.4 billion inflows within the first year.

These significant inflows have the potential to propel the Bitcoin price to new highs and initiate a notable price uptrend. However, as Cantor CEO Howard Lutnick predicted, the halving event, expected to occur in April, remains the primary catalyst for Bitcoin’s growth.

Dual Catalysts For Crypto Market Enthusiasm

As the Bitcoin halving event approaches, analysis of past halvings reveals a pattern of substantial rallies leading up to the event, followed by a brief correction and consolidation period before a major bull run and peak. The peak typically occurs approximately 18 months after each halving, showcasing a consistent trend.

The first halving occurred on November 28, 2012, reducing the block reward from 50 BTC to 25 BTC. At the time of the halving, the Bitcoin price was around $13.

However, within a year, it reached a peak of $1,152. Despite a subsequent fall in price to nearly $200 in 2015, critics declared the bursting of a bubble and the demise of Bitcoin. Yet, this trend would repeat in subsequent halving cycles.

The second halving occurred on July 16, 2016, reducing the block reward to 12.5 BTC. At the time, Bitcoin was valued at $664.

The following year saw a peak of $17,760. Similarly, the third halving occurred on May 11, 2020, lowering the block reward to 6.25 BTC. Bitcoin was priced at $9,734 during the halving and peaked at $69,000 the following year.

Based on the historical cycles, it is evident that the upcoming halving scheduled for April 2024 will be a significant catalyst for Bitcoin. However, it is important to note that Bitcoin ETFs will also play a crucial role.

These ETFs are expected to positively impact the cryptocurrency’s price and bring new inflows and interest to the crypto market.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

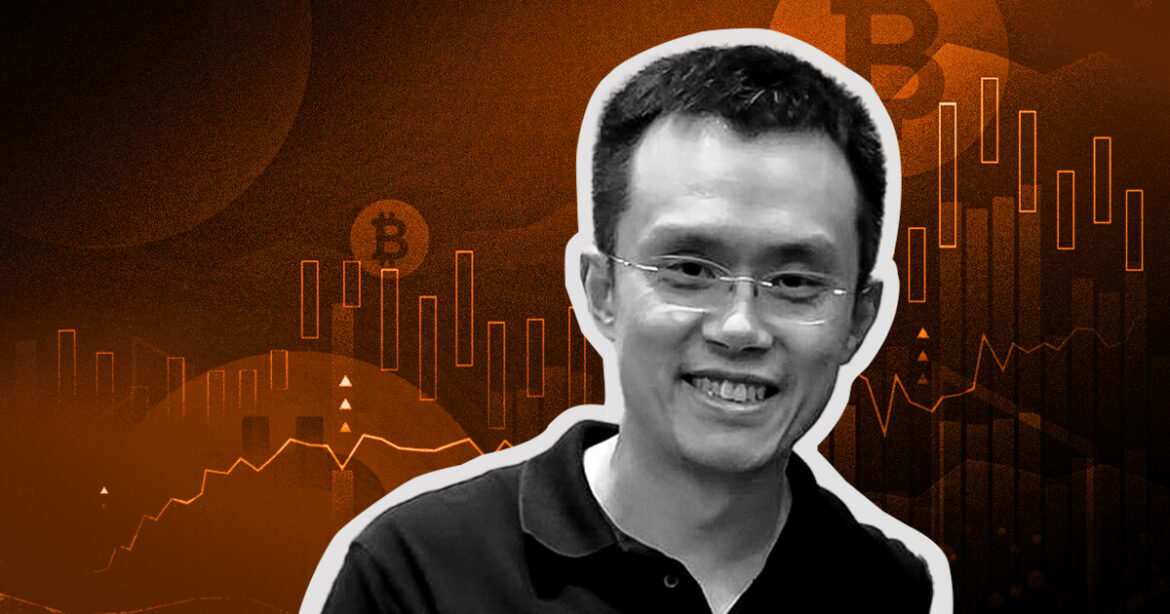

Binance CEO foresees DeFi outgrowing CeFi in 6 years, despite regulatory hurdles

Binance CEO Changpeng ‘CZ‘ Zhao predicted that decentralized finance (DeFi) would become more prominent than centralized finance (CeFi) within the next six years in a July 14 statement to celebrate the exchange’s sixth anniversary.

According to Zhao, DeFi activities will continue accelerating as more people use DeFi products and interact directly with blockchain networks. He added that DeFi would offer financial access to people who lack access to traditional financial institutions like banks.

Zhao further noted that the recent wave of institutional interest in crypto validates the industry and its technology. CZ said these firms would ease institutional adoption of crypto, adding that:

“As institutional investors own the majority of the equity market, with hundreds of trillions of dollars, even a single digit % conversion into crypto will easily multiply the size of the current crypto market.”

Binance ready to collaborate with regulators

Meanwhile, Zhao revealed that Binance was ready to comply with regulators despite its recent regulatory struggles around the world.

Over the past month, Binance has faced increased regulatory scrutiny on multiple fronts. The exchange is under investigation in Australia and has been sued by U.S. financial regulators. It has also exited Canada and several European markets.

Zhao stated that regulation was a “cornerstone of a robust, safe, and secure crypto landscape.” He said:

“Globally, we have shown that compliance and innovation can exist hand in hand. We take pride in our licenses and registrations across 17 countries, a testament to our pro-regulation stance and the extensive efforts we have made in compliance and regulatory space.”

Zhao added that regulatory clarity and regulated exchanges would continue to grow, highlighting Ripple‘s recent victory as an indication of how much progress has been made in the industry.

CZ touts Binance’s minimal exposure to last year’s market downturn

Zhao highlighted Binance’s minimal exposure to the “catastrophic” events of the past year, noting how its initial $3 million investment in Terra 2018 turned into $1.6 billion at 2021’s market peak and crashed to zero following its collapse.

Zhao also stated that Binance had no exposure to bankrupt crypto firms, including Three Arrows Capital, FTX crypto exchange, crypto lenders Genesis, and Celsius.

The Binance CEO added that Binance.US’s attempt to save bankrupt Voyager failed despite a $10 million deposit payment that the exchange never got back.

Also today, The Wall Street Journal reported that Binance had laid off roughly 1,000 employees in recent weeks.

The post Binance CEO foresees DeFi outgrowing CeFi in 6 years, despite regulatory hurdles appeared first on CryptoSlate.