Nicholas Mui, 22, from Grand Haven, Michigan, has pleaded guilty in the 17th Circuit Court in Kent County to conducting a criminal enterprise, involving the theft and sale of Mperks account access information. Mui is required to forfeit his computer tower and approximately $630,000 in frozen cryptocurrency and cash. He compromised Mperks, a loyalty program […]

Nicholas Mui, 22, from Grand Haven, Michigan, has pleaded guilty in the 17th Circuit Court in Kent County to conducting a criminal enterprise, involving the theft and sale of Mperks account access information. Mui is required to forfeit his computer tower and approximately $630,000 in frozen cryptocurrency and cash. He compromised Mperks, a loyalty program […]

Source link

fraud

NY state is demanding more information on Trump’s $175 million appeal bond in civil fraud case

NEW YORK (AP) — Days after former President Donald Trump posted a $175 million bond to block New York state from imminently collecting on a huge civil fraud judgment, state lawyers Thursday called for more information on the bond’s bona fides.

State Attorney General Letitia James’ office filed papers giving Trump’s lawyers or the bond underwriter 10 days to “justify” the bond — essentially, to show that the company can make good on it. That could mean disclosing more about the collateral Trump provided.

A hearing was set for April 22.

One of Trump’s lawyers, Christopher Kise, said James was trying to provoke a “baseless public quarrel in a desperate effort to regain relevance” after an appeals court last month significantly cut the amount of the bond needed to hold off collection.

“Yet another witch hunt!” Kise wrote in an email.

A message seeking comment was left for the underwriter, Knight Specialty Insurance Co.

The bond, posted Monday, at least temporarily stopped the state from potentially seizing Trump’s assets to satisfy the more than $454 million that he owes after losing a lawsuit trial. The case, brought by the Democratic attorney general, alleged that Trump, along with his company and key executives, defrauded bankers and insurers by lying about his wealth.

The ex-president and presumptive Republican nominee denies the claims and is appealing the judgment.

By posting the bond, Trump aimed to stop the clock on enforcement of the judgment during his appeal. But it hasn’t gone entirely smoothly.

First, the court system kicked back Monday’s filing for more paperwork, including a financial statement from Knight Specialty Insurance. That was filed Thursday, showing that the company has over $539 million in assets and related reinsurer Knight Insurance Co. Ltd. has over $2.1 billion.

Then James’ office filed notice that it “takes exception to the sufficiency” of the bond — a move that judgment winners can make to get more information from out-of-state underwriters, in some circumstances.

Knight Specialty Insurance is a Wilmington, Delaware-based part of the Los Angeles-based Knight Insurance Group.

The attorney general’s notice doesn’t request specific information. But “justifying” generally means demonstrating that the underwriter is financially sound and able to pay the bond amount if the judgment is upheld.

A state appeals court also has held, in an unrelated case, that there needed to be a showing that a bond was “sufficiently collateralized by identifiable assets.”

Knight Insurance Group Chairman Don Hankey told The Associated Press Monday that cash and bonds were used as collateral for Trump’s appellate bond.

Eric Trump, a son of the former president and a top executive in his company, said in a social media post Thursday that the bond was backed entirely by cash.

The attorney general’s objection “is just another example of the absurdity and foolishness that have been the underlying theme throughout this circus of a case,” the younger Trump wrote on X, former Twitter.

He and his brother, a fellow Trump Organization executive vice president, Donald Trump Jr. were also defendants in the fraud suit. They were found liable and ordered to pay $4 million apiece.

All told, the judgment against Trump, the sons and other defendants totals more than $467 million, growing daily with interest.

___

Associated Press writers Michael R. Sisak in New York and Brian Slodysko in Washington contributed.

Former FTX CEO Sam Bankman-Fried sentenced to 25 years in landmark fraud case

Sam Bankman-Fried, the former CEO of FTX, was sentenced to 25 years in jail today in a packed courtroom, marking a significant moment in the legal scrutiny of the crypto industry. He will be 57 years old when he is released. The sentencing, as detailed by Inner City Press, comes after a series of legal proceedings that shed light on the complexities and potential vulnerabilities within the digital asset space.

Bankman-Fried, dressed in a light brown jail uniform from MDC-Brooklyn, faced the judgment of Judge Lewis A. Kaplan, who, after considering the pre-sentence report and the guidelines disputes, delivered a sentence that reflects the gravity of the crimes committed. The courtroom, filled with prosecutors, defense lawyers, and an FBI agent, bore witness to the culmination of a case that has been closely followed by both the crypto community and the general public.

The legal proceedings highlighted the extensive financial losses incurred by investors, lenders, and customers, with Judge Kaplan rejecting the defense’s argument about the loss amount. The court found that investors lost $1.7 billion, lenders lost $1.3 billion, and customers faced an $8 billion shortfall. These figures underscore the scale of the fraud and the impact on the victims involved.

The defense had previously sought leniency, citing Bankman-Fried’s autism diagnosis and arguing for a reduced sentence of 63 to 78 months. However, the prosecution argued for a substantial prison term of 50 years.

Judge Kaplan’s decision to vary downward from the Guidelines range while still acknowledging the significant number of victims and the use of sophisticated means emphasizes the complexity of sentencing in cases involving emerging technologies and financial structures. The finding of obstruction of justice, including attempted witness tampering and perjury, further emphasized the deliberate actions taken by Bankman-Fried to mislead and defraud.

Human cost of FTX collapse

During the sentencing hearing, a poignant moment unfolded as victims were given the opportunity to address the court. One such victim, Sunil Kavuri, who traveled from London specifically for this purpose, shared his experiences and the impact of the FTX collapse on him and others. Kavuri highlighted the ongoing struggles faced by victims, challenging the narrative that the loss was zero and criticizing the handling of the bankruptcy estate. He pointed out the significant discrepancies in the valuation and sale of assets, including a token that significantly appreciated in value after being sold at a discount and the sale of Solana tokens at a 70% discount.

Kavuri’s testimony underscored the real and continuing harm suffered by those affected, including the tragic note that at least three individuals had committed suicide as a result of the fraud. Judge Kaplan acknowledged Kavuri’s points, reinforcing the gravity of the situation and the inaccuracies in claims that customers would be made whole. This victim’s statement added a deeply personal dimension to the proceedings, emphasizing the human cost of financial crimes and the need for accountability beyond the sentencing of Bankman-Fried.

SBF lawyer describes him as ‘misunderstood’

In a heartfelt defense of his client, Sam Bankman-Fried’s attorney, Mark Mukasey, presented a contrasting image of the former FTX CEO to the court. Mukasey argued that Bankman-Fried’s actions, while resulting in significant financial fallout, were not driven by the same malice or predatory intent that characterized other high-profile financial criminals, such as those who stole from Holocaust survivors. He emphasized that Bankman-Fried was not a “ruthless financial serial killer” but rather someone who made decisions based on mathematical calculations, not with the intention to cause personal pain.

Mukasey also relayed personal insights from Bankman-Fried’s mother, who described her son as misunderstood and not fitting the mold of a “greedy swindler.” According to Mukasey, Bankman-Fried did not abscond with funds but remained engaged until the end, with a genuine desire to see people repaid. This narrative was allowed to be presented in court partly due to Judge Kaplan’s decision to depart from the usual practice of enumerating the papers considered for sentencing, acknowledging the overwhelming volume of last-minute submissions from both the defense and the prosecution.

The defense’s portrayal of Bankman-Fried aimed to humanize him and differentiate his case from other financial frauds, suggesting that while the consequences of his actions were severe, his motivations were not inherently malicious. Mukasey’s statement also served as an acknowledgment of the victims’ suffering, expressing an understanding of their pain and a commitment to appeal, while maintaining respect for the jury’s verdict.

In a plea to the court, speaking directly Bankman-Fried admitted,

“I made a lot of mistakes. But that’s not how the story ended. Customers weren’t paid back. FTX didn’t survive that. Yeah, customers have been given conflicting claims. That’s caused a lot of damage. They could have been paid back.”

In a moment of candor, Sam Bankman-Fried expressed a somber reflection on his future, acknowledging the likelihood that his ability to contribute meaningfully to society may be irreparably diminished. He admitted to the court that his capacity to make an impact is severely limited by incarceration and that the length of his sentence, whether it be 5 or 40 years, is beyond his control. He stated,

“My useful life is probably over. I’ve long since given what I had to give. I can’t do it from prison.”

Bankman-Fried also addressed the perception of his actions, recognizing the stark contrast between his alleged intentions and how prosecutors, the court, and the media interpreted them. He also said he now expects customers to be repaid. He commented, “I think I failed at that. I’m not sure why, but I do think I did.” He also referred to a specific instance involving a text to the general counsel, which he claimed was an attempt to assist, though it was not viewed as such by others. Even on the day of his sentencing, Bankman-Fried continues to assert that he did not steal user funds maliciously.

However, in his judgment, Judge Kaplan asserted that he believed much of Bankman-Fried’s public rhetoric “was an act” designed to obtain power and influence.

According to Inner City Press, before the sentence was issued, the government argued,

“The defendant is not a monster but he committed gravely serious crimes that harmed many people – and he would consider doing it again. So, 40 to 50 years.”

In announcing the sentence, Judge Kaplan proclaimed that Bankman-Fried was nothing short of a “performer.”

“When not lying, he was evasive, hair splitting, trying to get the prosecutors to rephrase questions for him. I’ve been doing this job for close for 30 years. I’ve never seen a performance like that.”

His sentencing was reported by Inner City Press as follows,

“It is the judgment of the court that you are sentenced to 240 months then consecutive 60 [etc] for a total of 300 months [25 years].”

The implications of today’s sentencing extend beyond the immediate legal consequences for Bankman-Fried. They touch on broader questions about the regulation of digital assets, the protection of investors, and the future of digital asset markets. As the industry grapples with these challenges, the outcome of this case will likely influence discussions and decisions on how best to navigate the complex intersection of technology, finance, and law.

This article will be updated with additional details as they become available.

Mentioned in this article

Latest Alpha Market Report

SEC begins multi-billion dollar fraud trial against Terraform Labs, Do Kwon

In a dramatic opening to a much-anticipated trial, the US SEC cast Terraform Labs and its co-founder, Do Kwon, as central figures in a vast financial deception that left investors nearly destitute following its collapse, Reuters reported on March 26.

The trial, unfolding in the US District Court for the Southern District of New York, marks a significant moment in closing the chapter on one of the biggest black swan events in the crypto industry.

The SEC accused Terraform Labs and Kwon of conducting a multi-billion dollar crypto asset securities fraud, leading to the lawsuit filed in February 2023.

House of cards

The SEC’s legal team, led by attorney Devon Staren, did not mince words, describing Terra as a “house of cards” that inevitably toppled, erasing vast amounts of investor capital.

Central to the SEC’s allegations is the claim that Terraform Labs and Kwon deliberately misled investors regarding the stability of Terra USD (USTC).

The algorithmic stablecoin dramatically failed to maintain its peg to the US dollar, resulting in billions of dollars being wiped from the network within hours. This failure is cited as a catalyst for broader turbulence in the crypto market during 2022, leading to a cascade of bankruptcies among various crypto enterprises.

Originally slated to begin in January, the legal saga was postponed to March, partially due to expectations that Kwon would attend in person to mount a defense. However, Kwon remains in Montenegro after the country overturned a previous ruling to extradite him to the US.

In a December 2023 development, Judge Jed Rakoff issued a summary judgment favoring the SEC’s stance on Terra’s dealings with unregistered securities while siding with Kwon and the platform on charges related to the offer and sale of security-based swaps.

Terra’s side of the story

In a poignant message released just before the trial, Terraform Labs broke its recent silence, expressing the gravity of the situation.

CEO Chris Amani acknowledged the intense preparation that preceded the trial and the company’s strategic decision to limit public communication during the proceedings.

Amani wrote:

“The next couple of weeks will determine the future of TFL. There have been a lot of allegations and this is our chance to finally tell our side of the story.”

The statement urged followers and observers to keep an open mind and assess the facts as they unfold in court.

Gratitude was a recurring theme in the message, with heartfelt thanks directed toward the Terra community, which has stood by the company through tumultuous times. The acknowledgment extended to developers who continued to build on the Terra platform and partners who maintained their collaborations, illustrating a steadfast support network.

Mentioned in this article

Latest Alpha Market Report

I lost $11,300 to identity fraud. What I learned: Usual safeguards don’t work.

“Looks like someone is trying to take more than $10,000 from us.”

That’s the message my husband typed to me on a Monday morning in October. By the time I wrote back, he was on the phone with our bank. The weekend before, someone walked into a bank branch, pretended to be one of us, and took thousands of dollars from our checking account.

We joined the tens of millions of Americans who each year are victims of identity fraud, where criminals steal a bank or credit card number and use the personal information to achieve illegal financial gain.

We were lucky in so many ways, most notably that our bank reimbursed our losses within 36 hours.

What we learned is this: The many steps we take to safeguard our personal data don’t always work.

Experts suggest creating strong passwords with extra layers of authentication, changing them often, and not using the same one on multiple accounts.

Having text alerts on your credit and debit cards for all transactions can also thwart illegal activity in real time, as can email alerts when someone tries to change an email or address associated with your account.

You should do all these — and we did — but they wouldn’t have prevented the fraud we experienced. Our data was already out there for the picking.

Hacks that expose the personal financial information of Americans soared to a record high of 3,205 in 2023, according to the nonprofit Identity Theft Resource Center. That total includes breaches of companies across many industries such as healthcare, utilities, financial services, and transportation.

A well-known example of this was the massive Equifax data breach in 2017 that affected 147 million Americans — including us. That motivated us to freeze our credit reports at Equifax, Experian, and TransUnion.

“At this point, all of our information is out on the dark web,” Suzanne Sando, senior analyst for fraud and security at Javelin Strategy & Research, told me. “It’s now just a matter of when is it going to be used against me.”

‘Huge time suck’

Here’s what else we learned: Knowing how to respond to one of these frauds after they happen is also crucial — and time consuming.

Because of my past reporting on this subject, I knew we needed to act quickly. We checked our other accounts — bank, credit, and retirement — for any suspicious activity. There was none. We then met up at our local bank branch to shut down the old account, establish another, and identify which upcoming transactions to allow to go through.

It took more than two hours, and we weren’t close to done.

“Fixing a run-in with identity fraud, it’s a huge time suck,” Sando said, “and people don’t necessarily have the time to do it.”

My husband fortunately was able to take the day off and spent the afternoon undoing automatic transactions from the old account and rerouting them to the new one. I also took off the day from work and headed to our local police precinct to file a report to provide to other financial institutions if the fraud followed us elsewhere.

Our local precinct took our report immediately. That’s not often the case for identity theft, according to Identity Theft Resource Center CEO Eva Velasquez, because it’s so hard to solve these cases.

Several factors worked in our favor, she said. In New York, the total amount stolen — which ended up being $11,300 — made the crime a Class D felony, which includes thefts of more than $3,000 but less than $50,000.

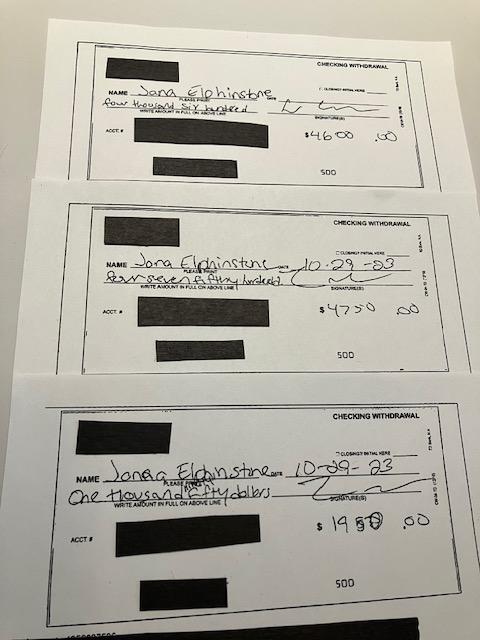

The bank also gave me copies of the withdrawal slips, which became critical evidence. The criminal made the withdrawals under my maiden name, albeit misspelled on each slip. It’s a name that hadn’t appeared on my checking account for well over a decade.

The slips also showed where the withdrawals occurred: three bank branches in south New Jersey — nowhere near New York City, where we bank regularly. That meant the perpetrator was likely captured on surveillance tape at the bank.

“I’m sure that played into their increased willingness to give you the report,” Velasquez said of the police, “and to make that a priority.”

Getting that report was more than many fraud victims receive. But five months later we still don’t know how this happened or who did it.

A detective assigned to the case told me about a month ago that the police department was working on issuing a subpoena for the security cameras in the bank branches. When I visited the precinct on Friday for another update, the detective was in court and unavailable.

“We need more streamlined processes so that people know where to start,” Velasquez said, “and they don’t have to relive this nightmare over and over.”

It’s a nightmare that more and more people are forced to face. Almost 7 in 10 people said they had previously been the victim of an identity crime, according to a general population survey of 1,048 people that ITRC conducted last year.

A survey of 144 ID theft victims who reached out to the nonprofit in 2022 found that almost two-thirds said their issues were still unresolved months after discovering the fraud.

The lasting impact of identity fraud

Like so many things in life, the impact of identity fraud often depends on the resources available to you.

“Some people will look at a $100 loss and go, ‘That sucks, but it’s not that big of a deal’… and other people will say, ‘This is going to derail everything, that was all that I had left after I paid my bills to buy groceries. I can’t feed my family. I can’t keep the lights on,'” said Velasquez, the ITRC CEO.

We were fortunate. We had a financial cushion to fall back on if we had not gotten our money back as quickly as we did.

Still, we encountered hassles. We spent the next weeks getting late fees and interest charges waived because some bill payments were denied. We also had to scramble to make sure a maturing CD was deposited into the new checking account, rather than the old one.

But the financial fallout was largely limited.

That’s not how it always is for many people who have their credit histories ruined, loans denied, and employment opportunities lost due to the lingering effects of fraud. After all, the type of fraud I experienced cost 15 million Americans $24 billion in losses in 2021, according to Javelin’s latest data.

And there’s the emotional side, too. For me, it’s unnerving to think that someone is walking around impersonating me. Could it happen again? Possibly.

The ID theft victims ITRC surveyed often reported feeling violated and having trust issues — and 16% considered suicide, up by double since 2021.

“The emotional impacts are increasing,” Velasquez said. “People are feeling even more vulnerable and unable to recover.”

Janna Herron is a Senior Columnist at Yahoo Finance. Follow her on Twitter @JannaHerron.

Former U.S. President Donald Trump gestures on the day of a court hearing on charges of falsifying business records to cover up a hush money payment to a porn star before the 2016 election, in New York State Supreme Court in Manhattan, New York, on Feb. 15, 2024.

Andrew Kelly | Reuters

Former President Donald Trump is gearing up to fight a massive fine in the New York business fraud case that threatens to erase most of the cash he says he has on hand.

But first, he has to secure a bond — and that might not be so easy.

Trump on Friday was ordered to pay about $355 million in penalties, plus more than $98 million in interest after a judge found the former president liable for fraud for manipulating financial statements given to lenders. Every day, the accruing interest adds $87,502 to Trump’s bill.

Unless he wants to pay the entire penalty while his expected appeal is considered, Trump will need to post an appeal bond. This is typically up to 120% of the judgment plus the current interest.

At that rate, Trump’s original ruling with interest would indicate he will need to secure a bond worth more than $540 million. But it’s unlikely that the real estate baron will be able to use his properties as collateral.

It’s “not very attractive to take real estate as collateral,” said Neil Pedersen, owner of New York-based surety bond agency Pedersen & Sons.

Trump could have to liquidate some assets to secure a bond, said Pedersen. The bond company will also charge a fee that could total millions of dollars.

An appeal of Judge Arthur Engoron’s ruling could take years to play out.

A flag supporting former U.S. President Donald Trump outside Trump Tower in New York on Oct. 1, 2023.

Yuki Iwamura | Bloomberg | Getty Images

Another complicating factor: Trump’s status as a presidential front-runner.

It’s an “unprecedented” situation for a potential bond company to commit to, Pedersen said.

“No one’s ever had to enforce an indemnity agreement against what could very well be the next U.S. president,” he said.

Trump has vowed to appeal Engoron’s ruling, which threatens not just his bottom line, but his entire persona as a mega-rich business genius, one that he has carefully cultivated for decades.

But bond agents may have reservations about working with Trump, whose business practices and claims about his wealth have been successfully challenged in court.

Appeal bonds are used to ensure that a person ordered to pay a judgment cannot misuse the courts to delay or avoid making that payment.

“Whoever is going to bond [Trump] is committing that they’re going to make good on that judgment,” said New York business attorney David Slarskey. “Who’s going to do that?”

Trump, who said in a deposition last year that he had “substantially in excess of $400 million in cash,” could technically deposit the full judgment against him, plus interest, as he challenges the judgment. But his lawyer has already said that he will secure a bond.

“We have to post the bond, which is the full amount and some,” Trump attorney Alina Habba told Fox News on Monday.

“We will be prepared to do that,” she said.

Habba said she expects to post a roughly $400 million bond within a 30-day window to file a notice of appeal, which begins after a court clerk enters Engoron’s final judgment.

Engoron also barred Trump for three years from running a business in New York or applying for loans from financial institutions registered with the state.

Habba also appeared to dismiss a question about whether Trump will have to sell off his New York real estate assets as his legal troubles mount.

But Pedersen warned that doing so could cause its own “headache.”

Those assets are not liquid, so if Trump loses the appeal, the process of converting them to cash could be difficult — perhaps even more so in a case that was centered around disputes about the value of Trump’s properties.

Habba did not immediately respond to questions from CNBC about the process of securing an appeal bond.

Read more CNBC politics coverage

Engoron’s judgment in Manhattan Supreme Court came weeks after a jury in a separate civil case in New York federal court ordered Trump to pay $83.3 million for defaming writer E. Jean Carroll. That’s on top of the $5 million that Trump has already been ordered to pay in a separate defamation case brought by Carroll.

After that case was adjudicated, the former president took the unusual step of setting aside a cash deposit of $5.6 million while he pursued an appeal.

Trump critic and attorney George Conway suggested that Trump was unable to secure an appeal bond from a third party. Trump’s lawyers denied this, saying he merely wanted to avoid additional fees that would be charged by a bond company.

But as Trump’s legal penalties soar past the half-billion-dollar mark, Slarskey and others have predicted that Trump may soon declare bankruptcy.

Forbes estimated Trump’s net worth to be roughly $2.6 billion as of February.

Don’t miss these stories from CNBC PRO:

How not to get scammed like the financial-advice writer who lost $50K to fraud

A financial-advice writer is drawing intense criticism and sympathy after revealing that she was scammed into putting $50,000 in cash in a shoebox and giving it to a stranger. But her story is far from unusual, and falling for such scams is increasingly common.

Charlotte Cowles, a columnist for New York magazine, was tricked into believing she was a victim of identity theft and under investigation for federal crimes, and was pressured to withdraw cash for living expenses before her bank accounts would allegedly be frozen. Over the course of several hours on the phone, she was transferred by a fraudster claiming to be from Amazon

AMZN,

to one claiming to be from the Federal Trade Commission to one claiming to be from the Central Intelligence Agency.

She recounted her story in an article that highlighted how even a well-informed, “maddeningly rational” person can get caught up in the panic stirred up by skilled con artists.

After X users roasted Cowles and questioned her authority as a personal-finance writer, she deleted her X account. But experts say that rather than criticizing the victim, the public could take away some important lessons from her story.

“For every person who’s called me an idiot in public, there’s been another one emailing me in private to say that a similar thing happened to them,” Cowles said in an email to MarketWatch.

Last year, American consumers reported losing more than $10 billion to fraud, according to the latest numbers from the FTC, up 14% from the previous year. A significant share, $2.7 billion, was lost to impostor scams like the one Cowles got mixed up in.

There were moments during her experience in which she felt something was wrong, and questioned the criminals on the other end of the phone. “How do I know you’re not just spoofing this?” she asked about the alleged FTC number the criminal was using. Yet she still complied with their requests.

MarketWatch spoke to privacy and identity-theft experts about what to do if you find yourself caught up in a transaction that you feel, somewhere in your gut, might not be legitimate.

1. Get off the phone

It’s essential to interrupt the surge of adrenaline that leads people to make decisions based on impulse rather than reason. Get off the phone — politely, if that helps — and tell the person you’ll call them back after you’ve thought about it.

Cowles’s con started off with someone claiming to be from Amazon checking on some suspicious activity on her account. She could have hung up the phone at many points, and wrote in hindsight, “Were my tendencies toward people-pleasing, rule following, and conflict aversion far worse than I’d ever thought?”

It can feel unnatural to stop engaging with people who are trying very hard to captivate your attention, said James Lee, the chief operating officer of the nonprofit Identity Theft Resource Center. One way to get off the phone, he advised: “Say, ‘OK, you’re calling from Amazon, I’m going to contact you. Thank you very much for bringing this to my attention.’ That’s the end of the conversation. There’s no reason to go further until you have verified that this is a real circumstance.”

The same is true for anyone claiming to be a relative or friend needing money urgently, as there are programs that can clone voices and spoof phone numbers now, too. Tell them you’ll call back.

Take your time after that. Breathe. Calm down and don’t rush.

2. Verify the identity of the caller

Next, tell someone what’s going on. Don’t handle this alone.

“Scammers often try to isolate you by asking you not to speak with other people, and such a request is a major red flag,” said Michael Steinbach, global head of financial crimes and fraud prevention at Citi.

“In retrospect, there are a million things I wish I had done differently,” Cowles told MarketWatch. “I think the most effective thing anyone can do if they’re caught in the midst of a bad situation is tell someone they trust what’s going on. More than anything, that’s what I wish I’d done. But these scammers were very effective in making me feel like I couldn’t tell anyone. I’ve since learned that this technique is known as ‘blocking the exits.’”

If a friend or relative seems to be calling you for money, hang up and call them back from your phone at the number you usually use for them. Or find the real customer-service phone number of the entity claiming to contact you. Ask if they have initiated contact with you for whatever the stated issue was.

Amazon said in a statement that customers should be wary of false urgency, and “if you’re ever unsure, it’s safest to stop engaging with potential scammers and contact us directly through the Amazon app or website.” “Do not call numbers sent over text or email or found in online search results,” the company said. “Remember Amazon will not ask you to download or install any software to connect with customer service nor will we request payment for any customer service support.”

By initiating the call to a real and trustworthy phone number, you are seizing back control of the situation. Cowles, on the other hand, was transferred from the fake Amazon agent to someone claiming to be an FTC investigator, who transferred her to someone claiming to be a CIA investigator.

These are not agencies most people have any interaction with, so it can be hard to discern whether the interaction is suspicious. But there’s one important thing to know: These investigators will not call you out of the blue, and Amazon will not transfer you to a government agency.

After the story was published, FTC chair Lina Kahn said in post on X, “A reminder that nobody from @FTC will ever give you a badge number, ask you to confirm your Social Security number, ask how much money you have in your bank account, transfer you to a CIA agent, or send you texts out of the blue.”

The FTC also offered guidance on when the agency would and wouldn’t reach out to consumers, saying, “The FTC won’t demand money, threaten you, or promise you a prize.”

While tax scammers often say they are calling from the Internal Revenue Service, the agency specifically says on its website it “doesn’t initiate contact with taxpayers by email, text messages or social media channels to request personal or financial information.” In general, the IRS initiates contact “through regular mail delivered by the United States Postal Service.”

“If I’m really under investigation, someone’s going to come to my house and show a badge and have paperwork. They’re not doing this over the phone and texting you,” said Mark Kapczynski, a privacy expert at OneRep, a company that removes clients’ private information from the web. If a scammer is threatening action against you, “Wait for them to show up at your doorstep. They just don’t operate that way.”

And while it may seem obvious, a government agency or law enforcement will not pressure you to transfer money to them in a hurry.

3. Maintain zero trust

If you’re somehow still on the phone, maintain zero trust: Hang up and verify with a legitimate and known entity at every stage. Scammers exert pressure and make you feel like you have to act immediately. You don’t.

Every step along the way “is another opportunity for you to take back control, and say, ‘I don’t know anything about that. I’m going to have to get back to you,’” Lee said. Especially if these are entities you don’t do business with, or people you’ve never spoken to before, requests for money are a huge red flag. Stop there.

Say, “I’m going to go find an independent person at my bank, at some other institution that I trust, and I’m going to have them tell me this is how this works,” Lee said. The person on the other end of the phone may sound angry, but remember, their anger is not a real threat.

Cowles wrote about what she learned from this experience and shared her own tips in a separate post.

Montenegro deports former Terraform Labs CFO to South Korea amid fraud allegations

Montenegro has reportedly deported the former financial officer of Terraform Labs, Han Chang-Joon, back to South Korea to face criminal proceedings.

According to reports, law enforcement agencies referred to him as J.C.H. He was “handed over to the competent judicial and police authorities in South Korea today in order to conduct criminal proceedings for more criminal offenses related to financial investment fraud services.”

Daniel Shin, Terraform Labs co-founder, is facing a similar trial in Seoul for fraud, illegal fundraising, and violation of capital market laws. However, he has denied all charges and involvement in the collapse of the crypto company.

The deportation announcement closely follows Terraform Labs’ recent filing for bankruptcy protection in the United States. The company stated that this strategic move aims to safeguard its business, allowing for financial restructuring in anticipation of potential enforcement actions by the U.S. Securities and Exchange Commission (SEC.).

What next for Do Kwon

Meanwhile, the latest update on the fate of Do Kwon, the founder of Terraform Labs, remains elusive, with no new information provided by Montenegrin authorities.

CryptoSlate reported that Kwon and Han were apprehended in Montenegro for attempting to travel to Dubai using forged Costa Rican passports. Subsequently, the Montenegrin authorities charged them with forgery and the use of false passports, leading to their incarceration.

Kwon is facing fraud charges in both the United States and South Korea. The charges are linked to the collapse of the algorithmic TerraUSD stablecoin, which resulted in approximately $40 billion in losses for investors and triggered broader setbacks in the global crypto market.

Montenegro’s court has signaled Kwon’s extradition to either the U.S. or South Korea, pending a decision by the country’s minister of justice. Recent developments, however, indicate a potential journey to the U.S. Kwon has requested a trial delay until mid-March, suggesting an intention to participate in the proceedings on American soil.

Owners of famous Philly cheesesteak chain sentenced in $8M tax fraud scheme

The owners of the famous Philadelphia Cheesesteak restaurant Tony Luke’s were sentenced to prison for tax fraud on Thursday after concealing over $8 million over the course of a decade.

The U.S. Department of Justice announced the owners, 57-year-old Nicholas Lucidonio, and 84-year-old Anthony Lucidonio Sr. were each sentenced to 20 months in prison plus three years of supervised release.

The Lucidonios owned and operated Tony Lukes, which is a popular cheesesteak and sandwich shop in South Philadelphia.

Between 2006 and 2016, court documents show, the two men hid over $8 million in cash receipts from the Internal Revenue Service (IRS), and only deposited a portion of the cash they received into restaurant business accounts.

MCDONALD’S SPINOFF COSMC’S SAW TWICE AS MANY VISITS AS REGULAR RESTAURANT IN FIRST MONTH: REPORT

By only depositing a portion of the cash, the DOJ said, the company’s accountant was provided incomplete information, resulting in the accountant filing false tax returns.

The DOJ also said the Lucidonios were also convicted of employment tax fraud, which was committed when the two men paid employees “off the books” in cash.

SOCIAL SECURITY RECIPIENTS COULD GET HIT WITH A SURPRISE TAX BILL THIS YEAR

Most employees were paid a portion of their wages on the books to evade being caught, and the rest of the wages were paid in cash without things like federal income tax, Social Security and Medicare taxes being paid to the IRS.

The Lucidonios did not report the cash wages to their accountant, the DOJ said, causing the accountant to prepare false quarterly employment tax returns with the IRS.

REMOTE WORKERS FACE A DOUBLE TAXATION THREAT

The issue became known in 2015, when the Lucidonios and another individual got into a dispute over Tony Luke’s franchising rights.

During the dispute, the Lucidonios became concerned their tax fraud scheme would be exposed, so they had the prior year’s tax returns be amended to show higher reported sales, the DOJ said.

Still, the two men continued hiding their payroll tax scheme, which resulted in a loss of $1,321,042 to the U.S.

Original article source: Owners of famous Philly cheesesteak chain sentenced in $8M tax fraud scheme

NY seeks $370 million in penalties in Trump’s civil fraud trial. His response: ‘They should pay me’

NEW YORK (AP) — New York state lawyers increased their request for penalties to over $370 million Friday in Donald Trump’s civil business fraud trial. He retorted, “They should pay me.”

The exchange came as lawyers for both sides filed papers highlighting their takeaways from the trial in court filings ahead of closing arguments, set for next Thursday. Trump is expected to attend, though plans could change.

It will be the final chance for state and defense lawyers to make their cases. The civil lawsuit, which accuses the leading Republican presidential hopeful of deceiving banks and insurers by vastly inflating his net worth, is consequential for him even while he fights four criminal cases in various courts.

The New York civil case could end up barring him from doing business in the state where he built his real estate empire. On top of that, state Attorney General Letitia James is seeking the $370 million penalty, plus interest — up from a pretrial figure of $250 million, nudged to over $300 million during the proceeding.

The state says the new sum reflects windfalls from wrongdoing, chiefly $199 million in profits from property sales and $169 million in savings on interest rates, as calculated by an investment banking expert hired by James’ office.

Trump bristled at the proposed penalty, calling it “a disgrace” at a campaign stop in Sioux Center, Iowa.

“There was no victim. There was no default. There was no damages. No nothing,” he said. In an all-caps post hours earlier on his Truth Social platform, he complained that the attorney general was seeking $370 million and instead “should pay me,” asserting that businesses are fleeing New York.

(According to the state Labor Department, the number of private sector jobs in New York increased 1% in the year that ended this past November, compared to 1.6% nationally.)

James’ office argued in a filing Friday that Trump, his company and executives clearly intended to defraud people.

“The myriad deceptive schemes they employed to inflate asset values and conceal facts were so outrageous that they belie innocent explanation,” state lawyer Kevin Wallace wrote.

The state alleges Trump and his company ginned up exorbitant values for golf courses, hotels, and more, including Trump’s former home in his namesake tower in New York and his current home at the Mar-a-Lago club in Palm Beach, Florida. The numbers were listed on personal financial statements that netted him attractive rates on loans and insurance, leaving him money to invest in other projects and even his 2016 presidential campaign, James’ office says.

The defendants, including Trump’s sons Donald Jr. and Eric, deny any wrongdoing. The former president has painted the case as a political maneuver by James, Judge Arthur Engoron and other Democrats, saying they’re abusing the legal system to try to cut off his chances of winning back the White House this year.

He asserts that his financial statements actually came in billions of dollars low, and that any overestimations — such as valuing his Trump Tower penthouse at nearly three times its actual size — were mere mistakes and made no difference in the overall picture of his fortune.

He also says the documents are essentially legally bulletproof because they said the numbers weren’t audited, among other caveats. Recipients understood them as simply starting points for their own analyses, the defense says.

None of Trump’s lenders testified that they wouldn’t have made the loans or would have charged more interest if his financial statements had shown different numbers, and 10-plus weeks of testimony produced “no factual evidence from any witness that the gains were ill-gotten,” attorneys Michael Madaio and Christopher Kise wrote in a filing Friday. Nor, they said, was there proof that insurers were ripped off.

Separately, defense lawyers argued that claims against Executive Vice Presidents Eric Trump and Donald Trump Jr. should be dismissed because they never had “anything more than a peripheral knowledge or involvement in the creation, preparation, or use of” their father’s financial statements.

The sons relied on the work of other Trump Organization executives and an outside accounting firm that prepared those documents, attorneys Clifford Robert and Michael Farina said, echoing the scions’ own testimony.

Their father also took the stand, disputing the allegations, decrying the case as political and criticizing the judge and the attorney general. James’ office argued in its filing Friday that Trump was “not a credible witness.”

“He was evasive, gave irrelevant speeches and was incapable of answering questions in a direct and credible manner,” Wallace wrote.

The verdict is up to the judge because James brought the case under a state law that doesn’t allow for a jury. Engoron has said he hopes to decide by the end of this month.

He will weigh claims of conspiracy, insurance fraud and falsifying business records. But he ruled before trial on the lawsuit’s top claim, finding that Trump and other defendants engaged in fraud for years. With that ruling, the judge ordered that a receiver take control of some of the ex-president’s properties, but an appeals court has frozen that order for now.

During the trial, Engoron fined Trump a total of $15,000 after finding that he violated a gag order. The order, imposed after Trump maligned a law clerk, barred all trial participants from commenting publicly on the judge’s staff.

Trump’s lawyers are appealing the gag order.

___

Contributing were Associated Press writers Michael R. Sisak and Jill Colvin in New York and Hannah Fingerhut in Sioux Center, Iowa.