After the sentencing of Sam Bankman-Fried to nearly 25 years in prison for his role in FTX’s financial mismanagement, attention shifts to his former associates. The cryptocurrency world eyes the upcoming Bitcoin halving, expected between April 18 to April 22, 2024. Blackrock’s Ishares Bitcoin Trust (IBIT) sees its holdings skyrocket past 252,011 BTC. Ethena announces […]

After the sentencing of Sam Bankman-Fried to nearly 25 years in prison for his role in FTX’s financial mismanagement, attention shifts to his former associates. The cryptocurrency world eyes the upcoming Bitcoin halving, expected between April 18 to April 22, 2024. Blackrock’s Ishares Bitcoin Trust (IBIT) sees its holdings skyrocket past 252,011 BTC. Ethena announces […]

Source link

FTX

Caroline Ellison, SBF ex-girlfriend, helped put FTX founder in prison

Caroline Ellison, former chief executive officer of Alameda Research LLC, center, arrives at court in New York, US, on Tuesday, Oct. 10, 2023.

Yuki Iwamura | Bloomberg | Getty Images

In sentencing FTX founder Sam Bankman-Fried to a 25-year prison sentence on Thursday, Judge Lewis Kaplan cited testimony from Caroline Ellison, an ex-girlfriend of the defendant and early recruit into his crypto enterprise.

“I keep coming back to Ms. Ellison’s testimony that he knew it was wrong,” Kaplan said at the sentencing hearing in downtown Manhattan. “He knew it was criminal.”

Ellison was the star witness for the Department of Justice in its prosecution of Bankman-Fried. She agreed to a plea deal in December 2022, a month after FTX spiraled into bankruptcy.

As part of her testimony at the criminal trial late last year, Ellison supplied the government and the jury with text messages, documents and secret recordings that ultimately helped lead to Bankman-Fried’s conviction on all seven charges against him.

Manhattan U.S. Attorney Damian Williams said in a statement after the sentencing on Thursday that Bankman-Fried’s “deliberate and ongoing lies demonstrated a brazen disregard for his customers’ expectations and disrespect for the rule of law, all so that he could secretly use his customers’ money to expand his own power and influence.”

Ellison, who ran FTX’s sister hedge fund Alameda Research, pleaded guilty to two counts of wire fraud, two counts of conspiracy to commit wire fraud, conspiracy to commit commodities fraud, conspiracy to commit securities fraud and conspiracy to commit money laundering.

Though Ellison faces similar sentencing guidelines to Bankman-Fried, she’s expected to receive a far more lenient sentence due to her role as a cooperating witness.

Caroline Ellison is questioned as Sam Bankman-Fried watches during his fraud trial before U.S. District Judge Lewis Kaplan over the collapse of FTX, the bankrupt cryptocurrency exchange, at Federal Court in New York City, October 11, 2023 in this courtroom sketch.

Jane Rosenberg | Reuters

Ellison’s complicated ties to SBF

Ellison jumped into Bankman-Fried’s crypto orbit in 2017.

She’d been working as a trader at Jane Street, where Bankman-Fried got his start in finance. Bankman-Fried had reportedly convinced the Stanford graduate to ditch her Wall Street gig and join Alameda, when the hedge fund was still in its original Bay Area office.

Ellison spent years as Bankman-Fried’s on-again, off-again girlfriend and, at times, his roommate. She followed Bankman-Fried from California to Hong Kong and ultimately to the Bahamas, as Bankman-Fried repeatedly shifted headquarters for his crypto companies.

Michael Lewis wrote about Ellison in his book, “Going Infinite,” which covered Bankman-Fried’s rise and fall. In 2021, Ellison was promoted to CEO of Alameda, a job for which, according to Lewis’s reporting, neither Ellison nor Bankman-Fried found her particularly well suited.

“Caroline sensed that, even as Sam promoted her to CEO of Alameda Research, he disapproved of her job performance — and she shared his opinion,” Lewis wrote.

Lewis shared an excerpt from one of the memos that Ellison had sent Bankman-Fried. “It feels like I’m doing a much worse job managing Alameda than you would if you were working on it full-time,” she wrote.

In April 2021, Ellison tweeted about “regular amphetamine use” in a thread that also talked about the “herculean” effort it took for her to get off of her couch and go for a hike.

Court filings show that Ellison’s compensation paled in comparison to other top executives. Of the $3.2 billion in payouts to the exchange’s founders and other senior employees, FTX’s head of engineering, Nishad Singh, received $587 million, co-founder Gary Wang got $246 million and $2.2 billion went to Bankman-Fried. Ellison received $6 million.

Some of Ellison’s private diary entries were leaked by Bankman-Fried to The New York Times, which published a report about them last July, months before the trial. The act ultimately landed Bankman-Fried back in jail after Kaplan revoked his bail for alleged witness tampering.

In a Google document from February 2022 shared with the Times, Ellison wrote, “I have been feeling pretty unhappy and overwhelmed with my job. … At the end of the day I can’t wait to go home and turn off my phone and have a drink and get away from it all.”

She added, “It doesn’t really feel like there’s an end in sight.”

‘Trying to fix problems’

But it was in the courtroom that jurors got to hear Ellison for the first time.

U.S. Attorney Thane Rehn said during the trial that Bankman-Fried “was using her as a front” when “in reality, he was still calling the shots at Alameda.” Over the course of her multi-day testimony, Ellison helped prosecutors build a narrative that she was acting at the direction of Bankman-Fried in helping him steal customer money from FTX and using it to help prop up Alameda, which was suffering in the wake of the crypto winter.

Ellison said Bankman-Fried was still CEO of Alameda when the funneling of money began. She said she was under the impression that it was FTX customer money because the sums exceeded the exchange’s profits and the amount of capital it had raised.

In mid-2021, when FTX bought equity in the company back from rival exchange and early investor Binance, FTX used $1 billion in customer funds for the transaction, Ellison testified.

Ellison said she considered resigning from Alameda at various points from 2019 to November 2022.

On one of her Google Docs, Ellison had a section entitled “limiting factors in scaling,” which she said referred to things that were holding back Alameda. The first thing she listed was management, including a comment on her former co-CEO Sam Trabucco.

“I feel like neither Trabucco nor I has been doing a great job of pushing on stuff,” she wrote. “We’re in the mode of maintaining status quo and trying to fix problems.”

In terms of the commingling of operations between FTX and Alameda, Ellison admitted on the witness stand that the two firms didn’t have a proper “Chinese wall” separating the businesses.

During her testimony, Ellison mostly avoided eye contact with Bankman-Fried, staring down at her hands between questions and frequently flipping her hair over her left shoulder. Bankman-Fried also often looked away, with hands clenched.

Ellison told the jury that her breakup with Bankman-Fried in the spring of 2022 affected communications between the two of them. They would talk mostly over Signal despite living in the same apartment, and they largely avoided each other outside of work.

Danielle Sassoon, the assistant U.S. attorney representing the government, told Kaplan several times “the defendant has laughed, visibly shaken his head, and scoffed,” which she said could be having an effect on Ellison “given the history of this relationship, the prior attempts to intimidate her, the power dynamic, their romantic relationship.”

Caroline Ellison, former chief executive officer of Alameda Research LLC, arrives to court in New York, US, on Thursday, Oct. 12, 2023.

Bloomberg | Bloomberg | Getty Images

Secret recordings and texts

Of the hundreds of items entered into evidence during the trial, a bank of messages on encrypted app Signal was among the most calamitous for Bankman-Fried.

The government presented a series of Signal exchanges involving Bankman-Fried, Ellison, Wang and other top execs. In one such exchange, from Nov. 8, 2022, Ellison appealed to Bankman-Fried and other members of the inner circle, asking for help on optics and public messaging.

Prosecutors relied heavily on text messages sent among FTX and Alameda Research executives in the case against Sam Bankman-Fried.

Source: SDNY

She wrote, “multiple people internally asking me whether they should continue to make statements to external parties like ‘Alameda is solvent.’ should i suggest they stall instead? just stall on responding to their messages? or what?”

That day, FTX issued a pause on all customer withdrawals.

The following day, Ellison again looked to the group for guidance about how to handle an all-hands meeting for Alameda’s roughly 30 employees.

Ellison’s proposal was to tell them, “Alameda is probably going to wind down” and that there was “no pressure” to stay but help with “stuff like making sure our lenders get paid” would be “super appreciated.”

Bankman-Fried suggested she say something about there “being a future of some sort for those who are excited.”

Prosecutors relied heavily on text messages sent among FTX and Alameda Research executives in the case against Sam Bankman-Fried.

Source: SDNY

Ellison ended up divulging a lot more than that in the staff meeting, a secret recording of which was played for the jury.

“Alameda borrowed a bunch of money,” which it used to make investments, Ellison said at the meeting. But as crypto prices fell, “FTX had a shortfall of user funds” and then “users started withdrawing their funds” and they “realized they would not be able to continue.”

When she was asked by a staffer whose idea it was to plug Alameda’s loan losses with FTX customer money, she said, “Um, Sam, I guess,” and giggled.

“FTX basically always allowed Alameda to, like, borrow user funds, as far as I know,” Ellison said.

Don’t miss these stories from CNBC PRO:

Former FTX CEO Sam Bankman-Fried sentenced to 25 years in landmark fraud case

Sam Bankman-Fried, the former CEO of FTX, was sentenced to 25 years in jail today in a packed courtroom, marking a significant moment in the legal scrutiny of the crypto industry. He will be 57 years old when he is released. The sentencing, as detailed by Inner City Press, comes after a series of legal proceedings that shed light on the complexities and potential vulnerabilities within the digital asset space.

Bankman-Fried, dressed in a light brown jail uniform from MDC-Brooklyn, faced the judgment of Judge Lewis A. Kaplan, who, after considering the pre-sentence report and the guidelines disputes, delivered a sentence that reflects the gravity of the crimes committed. The courtroom, filled with prosecutors, defense lawyers, and an FBI agent, bore witness to the culmination of a case that has been closely followed by both the crypto community and the general public.

The legal proceedings highlighted the extensive financial losses incurred by investors, lenders, and customers, with Judge Kaplan rejecting the defense’s argument about the loss amount. The court found that investors lost $1.7 billion, lenders lost $1.3 billion, and customers faced an $8 billion shortfall. These figures underscore the scale of the fraud and the impact on the victims involved.

The defense had previously sought leniency, citing Bankman-Fried’s autism diagnosis and arguing for a reduced sentence of 63 to 78 months. However, the prosecution argued for a substantial prison term of 50 years.

Judge Kaplan’s decision to vary downward from the Guidelines range while still acknowledging the significant number of victims and the use of sophisticated means emphasizes the complexity of sentencing in cases involving emerging technologies and financial structures. The finding of obstruction of justice, including attempted witness tampering and perjury, further emphasized the deliberate actions taken by Bankman-Fried to mislead and defraud.

Human cost of FTX collapse

During the sentencing hearing, a poignant moment unfolded as victims were given the opportunity to address the court. One such victim, Sunil Kavuri, who traveled from London specifically for this purpose, shared his experiences and the impact of the FTX collapse on him and others. Kavuri highlighted the ongoing struggles faced by victims, challenging the narrative that the loss was zero and criticizing the handling of the bankruptcy estate. He pointed out the significant discrepancies in the valuation and sale of assets, including a token that significantly appreciated in value after being sold at a discount and the sale of Solana tokens at a 70% discount.

Kavuri’s testimony underscored the real and continuing harm suffered by those affected, including the tragic note that at least three individuals had committed suicide as a result of the fraud. Judge Kaplan acknowledged Kavuri’s points, reinforcing the gravity of the situation and the inaccuracies in claims that customers would be made whole. This victim’s statement added a deeply personal dimension to the proceedings, emphasizing the human cost of financial crimes and the need for accountability beyond the sentencing of Bankman-Fried.

SBF lawyer describes him as ‘misunderstood’

In a heartfelt defense of his client, Sam Bankman-Fried’s attorney, Mark Mukasey, presented a contrasting image of the former FTX CEO to the court. Mukasey argued that Bankman-Fried’s actions, while resulting in significant financial fallout, were not driven by the same malice or predatory intent that characterized other high-profile financial criminals, such as those who stole from Holocaust survivors. He emphasized that Bankman-Fried was not a “ruthless financial serial killer” but rather someone who made decisions based on mathematical calculations, not with the intention to cause personal pain.

Mukasey also relayed personal insights from Bankman-Fried’s mother, who described her son as misunderstood and not fitting the mold of a “greedy swindler.” According to Mukasey, Bankman-Fried did not abscond with funds but remained engaged until the end, with a genuine desire to see people repaid. This narrative was allowed to be presented in court partly due to Judge Kaplan’s decision to depart from the usual practice of enumerating the papers considered for sentencing, acknowledging the overwhelming volume of last-minute submissions from both the defense and the prosecution.

The defense’s portrayal of Bankman-Fried aimed to humanize him and differentiate his case from other financial frauds, suggesting that while the consequences of his actions were severe, his motivations were not inherently malicious. Mukasey’s statement also served as an acknowledgment of the victims’ suffering, expressing an understanding of their pain and a commitment to appeal, while maintaining respect for the jury’s verdict.

In a plea to the court, speaking directly Bankman-Fried admitted,

“I made a lot of mistakes. But that’s not how the story ended. Customers weren’t paid back. FTX didn’t survive that. Yeah, customers have been given conflicting claims. That’s caused a lot of damage. They could have been paid back.”

In a moment of candor, Sam Bankman-Fried expressed a somber reflection on his future, acknowledging the likelihood that his ability to contribute meaningfully to society may be irreparably diminished. He admitted to the court that his capacity to make an impact is severely limited by incarceration and that the length of his sentence, whether it be 5 or 40 years, is beyond his control. He stated,

“My useful life is probably over. I’ve long since given what I had to give. I can’t do it from prison.”

Bankman-Fried also addressed the perception of his actions, recognizing the stark contrast between his alleged intentions and how prosecutors, the court, and the media interpreted them. He also said he now expects customers to be repaid. He commented, “I think I failed at that. I’m not sure why, but I do think I did.” He also referred to a specific instance involving a text to the general counsel, which he claimed was an attempt to assist, though it was not viewed as such by others. Even on the day of his sentencing, Bankman-Fried continues to assert that he did not steal user funds maliciously.

However, in his judgment, Judge Kaplan asserted that he believed much of Bankman-Fried’s public rhetoric “was an act” designed to obtain power and influence.

According to Inner City Press, before the sentence was issued, the government argued,

“The defendant is not a monster but he committed gravely serious crimes that harmed many people – and he would consider doing it again. So, 40 to 50 years.”

In announcing the sentence, Judge Kaplan proclaimed that Bankman-Fried was nothing short of a “performer.”

“When not lying, he was evasive, hair splitting, trying to get the prosecutors to rephrase questions for him. I’ve been doing this job for close for 30 years. I’ve never seen a performance like that.”

His sentencing was reported by Inner City Press as follows,

“It is the judgment of the court that you are sentenced to 240 months then consecutive 60 [etc] for a total of 300 months [25 years].”

The implications of today’s sentencing extend beyond the immediate legal consequences for Bankman-Fried. They touch on broader questions about the regulation of digital assets, the protection of investors, and the future of digital asset markets. As the industry grapples with these challenges, the outcome of this case will likely influence discussions and decisions on how best to navigate the complex intersection of technology, finance, and law.

This article will be updated with additional details as they become available.

Mentioned in this article

Latest Alpha Market Report

Amid tightening global crypto regulations, Backpack, a crypto exchange founded by former FTX executives, has broadened its reach to 11 US states, including California, Colorado, Indiana, Missouri, Wyoming, and others.

In a Feb. 21 announcement on the social media platform X (formerly Twitter), the company disclosed its availability to residents within the states above, with CEO Armani Ferrante outlining plans to consolidate the exchange’s presence in the US, saying:

“Today, we beginning our journey to bring Backpack Exchange into the USA. It’ll be slow. It’ll be steady. It’ll be hard. But it’ll be worth it. If we don’t support your state yet, hold on. We’ll get there. This is something that will take years to complete. But we’re committed to doing it right.”

The exchange, currently in its beta phase, facilitates spot trading activities and intends to diversify into derivatives, margin trading, and more as it secures additional licenses globally. It reportedly aims to offer non-custodial-based trading to differentiate itself from traditional crypto exchanges. On Feb. 18, the platform reported $1 billion in daily trading volume.

Backpack was co-founded by Can Sun, former general counsel at FTX, and Ferrante, previously a software developer at Alameda Research.

Sun played a pivotal role as a witness in Sam Bankman-Fried’s trial, revealing that he had no idea the former billionaire was misusing customers’ funds. Ferrante’s crypto infrastructure company, Coral, suffered a loss of $14.5 million due to FTX’s abrupt collapse. FTX Venture reportedly spearheaded a $20 million funding round for Coral mere weeks before the collapse.

Backpack’s licensing

The Backpack Exchange platform boasts multiple licenses across global jurisdictions, including the United Arab Emirates (UAE), Lithuania, Australia, and the United States.

The US Financial Crimes Enforcement Network’s records indicate its initial registration as a Money Services Business (MSB) in numerous US states. Furthermore, it’s duly registered with the Australian Transaction Reports and Analysis Centre (AUSTRAC) as a Digital Currency Exchange (DCE) provider.

In the UAE, it holds accreditation from the Dubai Virtual Assets Regulatory Authority (VARA) as a Virtual Asset Service Provider (VASP). Additionally, it’s registered as a Virtual Currency Exchange Operator and Deposit Virtual Currency Monetary Operator with the Lithuanian Financial Crime Investigation Service (FCIS).

Gaunt photos of FTX founder Sam Bankman-Fried in prison emerge online

The first photos of Sam Bankman-Fried, the convicted founder of the bankrupt FTX exchange, at New York’s Metropolitan Detention Centre, have emerged online from crypto influencer Tiffany Fong.

Fong shared the exclusive images of SBF on Feb. 20 via the social media platform X (formerly Twitter), describing it as the “first and only” photos of him since he was convicted.

In the picture, the disgraced FTX founder was sporting a beard while standing alongside five other inmates, including a figure known as G Lock, who Fong described as her “new inmate friend.” The picture was reportedly taken on Dec. 17, 2023.

Meanwhile, several crypto community members pointed out that the disgraced founder had lost weight, with Fong asserting that:

“[SBF’s] obviously lost some weight, and I’ve heard he’s not showering very much. He’s not as clean-shaven as he used to be, but he’s obviously going through a lot right now.”

SBF has been held at the Metropolitan Detention Center since August 2023 after Judge Lewis Kaplan remanded him on suspicions of attempting to influence witnesses.

CryptoSlate, citing federal inmate records, reported that the New York center was one of the most notorious prisons in the US because of its poor conditions like staffing shortages, corruption among staff, power outages, cockroach and rodent infestations, poor food, and malfunctioning toilets.

Awaiting sentence

Despite his conviction, Bankman-Fried’s sentencing remains pending until March 28, with the judge expected to weigh multiple factors, including the nature of his offenses and his personal background.

SBF faces up to 110 years in prison, having been found guilty on all seven charges. However, speculation persists regarding a potentially reduced sentence, partly stemming from FTX’s commitment to reimburse creditors fully.

Meanwhile, the likelihood of defrauded FTX clients receiving restitution before SBF’s sentencing appears slim as the firm bankruptcy proceedings continue.

Swiss prosecutors raid Tyr Capital over allegations of mishandling FTX exposure

Swiss authorities are investigating Tyr Capital, a crypto hedge fund, following accusations of disregarding risk warnings associated with the bankrupt FTX exchange before its November 2022 collapse, the Financial Times reported, citing legal documents filed in the Cayman Islands.

According to the report, the investigations emanated from complaints of “criminal” mismanagement lodged by TGT, one of Tyr’s clients, prompting a raid on Tyr’s offices by Swiss prosecutors. TGT seeks to close its account with Tyr and recoup assets, including a $22 million claim against the bankrupt crypto firm.

Tyr has refuted these allegations, asserting that it operated within legal bounds and did not mishandle its client funds.

Legal actions

Court documents reveal that TGT raised concerns about Tyr’s exposure to FTX days before the firm collapsed. However, the crypto hedge fund allegedly only attempted to withdraw funds on Nov. 11, coinciding with the day FTX filed for bankruptcy.

TGT escalated matters by filing a criminal complaint against Tyr in April 2023 with the Geneva prosecutor’s office, citing suspicions of misconduct and requesting a search of Tyr’s premises.

In addition, TGT accused Tyr of failing to adhere to its risk mitigation measures, citing a breach where more than 15% of its assets were held with a single counterparty.

TGT reportedly said, “There has been a serious and demonstrable lack of probity in the conduct of the fund’s affairs,” expressing a loss of trust and calling for an independent investigation into Tyr’s operations.

FTX bankruptcy update

FTX’s bankruptcy proceedings persist, with the failed firm management abandoning revival plans and opting to liquidate assets to refund customers based on the digital asset values at the time of the exchange collapse in 2022.

The move has drawn severe criticisms from several FTX creditors who are also pursuing legal action against the law firm Sullivan and Cromwell, LLP (S&C). The creditors alleged the law firm was complicit in the exchange’s downfall by supporting the crypto exchange in its deceptive practices.

FTX to Sell Subsidiary Acquired for $10M to Coinlist for $500K Amid Bankruptcy Proceedings

FTX Trading Ltd. and its affiliates have announced a plan to sell a subsidiary it acquired for $10 million to Coinlist for $500,000, court documents filed on Feb. 9, 2024 show. The latest motion, filed in the United States Bankruptcy Court for the District of Delaware, details the proposed sale in order to maximize the […]

FTX Trading Ltd. and its affiliates have announced a plan to sell a subsidiary it acquired for $10 million to Coinlist for $500,000, court documents filed on Feb. 9, 2024 show. The latest motion, filed in the United States Bankruptcy Court for the District of Delaware, details the proposed sale in order to maximize the […]

Source link

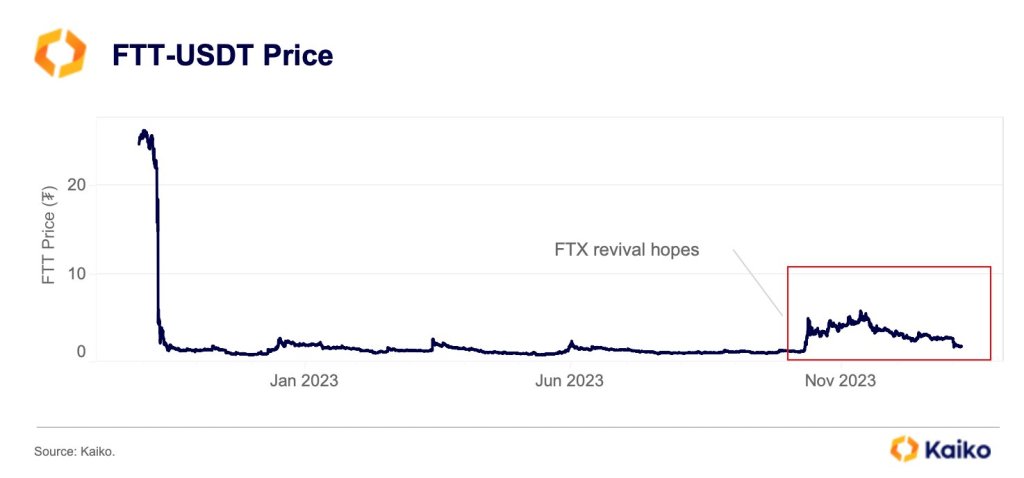

The dream of a revived FTX exchange evaporates, triggering a massive sell-off of its native token, FTT. According to Kaiko, on February 5, FTT, the now utility-free currency of the defunct exchange, plummeted over 30% last week, erasing much of its recent gains fueled by speculation of an FTX comeback.

FTX Won’t Resume Operations

The worrying drop follows reports that the bankrupt exchange, once led by Sam Bankman-Fried, is unlikely to resume operations. Notably, the news comes despite a glimmer of hope for FTX customers.

At a recent court hearing, the exchange’s representatives claimed it expects to repay its users fully. However, repayments would be based on the worth of their assets during FTX’s bankruptcy.

It should be noted that by the time FTX went bankrupt in late 2022, crypto assets were at the last phase of a bear market, with prices plunging to multi-month lows. Bitcoin, the world’s largest crypto asset, was trading below $20,000. After FTX collapsed, prices crashed below $16,000 before bouncing back strongly.

Following a court hearing in late January, FTX lawyer Andrew Dietderich, in a now-deleted YouTube video, said the exchange wouldn’t be looking to relaunch due to the absence of buyers. For this reason, the exchange is looking at allowing creditors to obtain approvals from investors seeking repayments.

Claimants impacted, given the new conditions and trajectory the exchange plans to take, have to provide sufficient proof that they held assets in FTX before it collapsed.

This new detail raises concerns for thousands, if not hundreds of thousands, of claimants, who argue that the actual value of their assets lies at the pre-crash level. On average, Bitcoin and top coins were roughly double digits higher than the November 2022 lows.

FTT Is Free Falling, Reverses November Gains

For the better part of 2023, FTT prices recovered steadily. To demonstrate, since November 2023, FTT prices have risen by over 300%. The encouraging surge was fueled solely by the possibility of FTX 2.0 launching and implementing a new management model.

With that hope fading, FTT appears to be facing a harsh reality check. Questions about its utility are being asked since FTT served as a critical cog in the FTX ecosystem when the exchange operated normally.

When writing on February 5, FTT changes hands at around $1.7. Looking at price charts, bears are in control, completely reversing the gains of November 2023. As it is, $0.95 remains to be a key support line.

Feature image from iStock, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Bankrupt FTX wants to sell $175 million claim against Genesis to aid creditor repayment

FTX bankruptcy estate intends to sell its $175 million general unsecured claim against the collapsed crypto lender Genesis, according to a Feb. 2 court filing.

FTX proposed to divest these claims through public auctions or private transactions, either in entirety or in parts, with single or multiple purchasers. The generated funds would be used to facilitate debt repayment and also restructure its financial obligations to creditors.

This development aligns with FTX’s recent commitment to not resurrecting the platform, opting to liquidate assets as part of the ongoing efforts to compensate customers affected by its 2022 collapse.

Data from Claims Market showed that over $1 million in customer claims were trading at over 65 cents on the dollar as of the end of January.

FTX creditors have until Feb. 15 to voice objections to this proposed claim sale.

Genesis filed for Chapter 11 bankruptcy protection in January after the failure of FTX triggered mass customer withdrawals on its platform.

Genesis and FTX, initially engaged in substantial reciprocal claims, eventually settled with the failed exchange, holding a $175 million claim against the collapsed lender. Under the settlement agreement, both parties also relinquished other claims held against each other. Genesis Global Capital, the crypto lending arm of Genesis, had previously extended loans exceeding $2.8 billion to Alameda.

Genesis settles SEC lawsuit.

A recent court filing revealed that Genesis reached a $21 million settlement with the U.S. Securities and Exchange Commission (SEC) concerning the now-defunct Gemini Earn investment product.

“The proposed settlement will, among other benefits to the Debtors’ estates, resolve the Civil Action Claim filed by the SEC in these Chapter 11 Cases and eliminate the risks, expenses, and uncertainty associated with protracted litigation against the SEC,” the filing stated.

The filing further explained that the $21 million settlement would be disbursed after Genesis fully pays “all other allowed administrative expense, secured, priority, and general unsecured claims.”

The SEC had alleged that Gemini and Genesis violated U.S. securities laws through the crypto lending program.

Meanwhile, the company is still embroiled in a lawsuit filed by the New York Attorney General, which also involves DCG and Gemini, over allegations of fraud.

DOJ charges trio in sim-swap scheme potentially linked to $400 million FTX crypto heist

The United States Department of Justice (DOJ) has taken legal action against three individuals—Robert Powell, Carter Rohn, and Emily Hernandez—for their involvement in a Sim-swapping scam in November 2022. The charges brought against them include fraud and identity theft.

This case has raised eyebrows due to its potential connection to the 2022 FTX hack, where the crypto exchange suffered a significant $400 million loss around the period it declared bankruptcy. Initial suspicions pointed towards the possibility of an insider job, with founder Sam Bankman-Fried (SBF) even facing accusations.

The indictment reveals that Powell, Rohn, and Hernandez obtained personal information from approximately 50 individuals. Subsequently, they manipulated service providers into transferring the victims’ details to their own devices. Armed with this information, the trio accessed authentication codes for financial accounts and crypto wallets.

Notably, Hernandez employed a fake ID belonging to an FTX employee to impersonate the individual at AT&T, successfully gaining access to their account. This move allowed them to obtain verification codes for accessing FTX’s crypto wallets and transferring over $400 million in digital assets.

While the indictment did not explicitly mention FTX, it highlighted that the $400 million theft took place between November 11 and 12, 2022—coinciding with the timeline of the FTX incident.

Blockchain analytical firm Elliptic stated that “FTX is [likely] the ‘Victim Company-1′” named in the indictment, adding that the recent movements of the stolen crypto assets may indicate they are no longer in the possession of the accused trio.

FTX bankruptcy managers have yet to respond to CryptoSlate’s request for comment as of press time.

This indictment emerges at a time when sim swap attacks are on the rise, mainly targeting prominent entities within the cryptocurrency space. Threat actors use these attacks to exploit social media accounts to promote phishing campaigns.

“It’s 2024 and we are still seeing far too many teams getting SIM swapped or phished on a regular basis resulting in millions stolen,” blockchain investigator ZachXBT said.

More recently, the U.S. Securities and Exchange Commission (SEC) experienced a sim-swap incident, leading to an exploit on its X account just last month.