On Friday, March 29, 2024, the combined open interest in bitcoin futures reached a new all-time peak of $37.55 billion. This uptick occurs amid buoyant bitcoin markets and a growing attraction from institutional investors. Bitcoin Futures Open Interest Reaches Unprecedented $37.55 Billion Since the close of 2023, interest in bitcoin (BTC) derivatives has escalated, reaching […]

On Friday, March 29, 2024, the combined open interest in bitcoin futures reached a new all-time peak of $37.55 billion. This uptick occurs amid buoyant bitcoin markets and a growing attraction from institutional investors. Bitcoin Futures Open Interest Reaches Unprecedented $37.55 Billion Since the close of 2023, interest in bitcoin (BTC) derivatives has escalated, reaching […]

Source link

futures

Bitcoin Cash (BCH) has registered a sharp 15% rally in the past 24 hours after plans of a futures listing on Coinbase have surfaced for the asset.

Coinbase Plans To Launch Bitcoin Cash Futures Product On 1 April

As an X user has pointed out, the cryptocurrency exchange Coinbase appears to have filed certifications with the Commodity Futures Trading Commission (CFTC) to list futures products for three coins on its platform: Bitcoin Cash (BCH), Dogecoin (DOGE), and Litecoin (LTC).

Coinbase Derivatives LLC quietly filed certifications with CFTC to list US regulated futures for Dogecoin, Litecoin and Bitcoin Cash.

They filed them on March 7 and surprisingly nobody seemed to notice.

Futures are set to start trading on April 1 if there are no objections from… pic.twitter.com/DYbWjuS6G2

— Summers (@SummersThings) March 20, 2024

As per the CFTC filing, all of these products were certified on March 7, and they are set to go live on trading on the first of the month.

The BCH, LTC, and DOGE futures contracts were all certified earlier in the month | Source: CFTC

Interestingly, all three of these digital assets happen to be based on the original cryptocurrency: Bitcoin. Bloomberg analyst James Seyffart has hinted that this may be why Coinbase has chosen them.

This is interesting… wonder if the SEC objects to these being classified ‘commodities futures’ vs ‘securities futures’. These all forked from Bitcoin so “these are securities” claims would be hard to make after spot #Bitcoin ETF approvals. Might be why Coinbase chose them🤔

— James Seyffart (@JSeyff) March 20, 2024

Unlike LTC and DOGE, which are based initially on BTC’s code, BCH is a direct fork of the cryptocurrency made to fulfill BTC’s original purpose as a fast and cheap form of currency that may be used for regular purposes (hence the name).

The filling made by Coinbase on Bitcoin Cash reads:

The market position of Bitcoin Cash reflects its role as an alternative to Bitcoin that prioritizes transaction efficiency. While it has not matched Bitcoin in terms of market capitalization or price, Bitcoin Cash has established itself as a significant player in the cryptocurrency space, with a dedicated user base and ecosystem.

BCH Has Enjoyed A 14% Surge During The Last 24 Hours

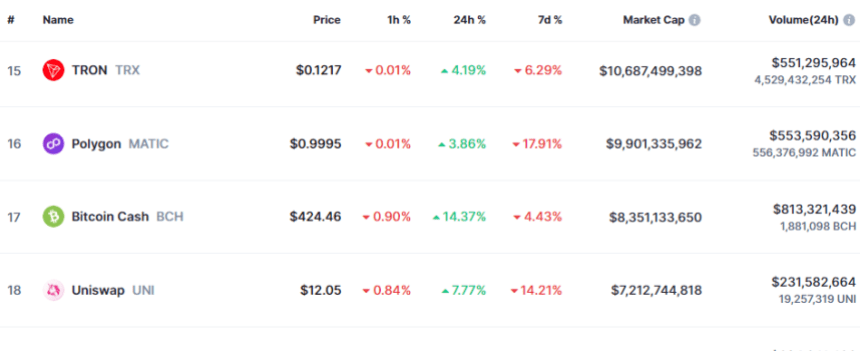

The cryptocurrency sector has been up in the past day, but two coins in particular have stood out among the top 20 assets by market cap: Bitcoin Cash and Dogecoin.

Both of these have managed more than 14% returns in this period, notably outperforming their peers. Bitcoin itself has only been able to put together a rally of about 6%.

Given that the Coinbase filling has been making the rounds in this window, it would appear likely that it was at least partially responsible for the extraordinary surges of these coins.

Even though Litecoin is also planned to see its futures contract launch on the same day as the other two, its price performance has been more or less in line with the rest of the market with its profits sitting at just 4%.

Following the sharp rally, Bitcoin Cash has now arrived at the $424 level. The chart below shows how the cryptocurrency’s trajectory has looked in the last few days.

Looks like price of the asset has shot up over the past day | Source: BCHUSD on TradingView

Regarding the market cap, Bitcoin Cash is currently the 17th largest asset. While there is some distance to Polygon (MATIC) in 16th place, LTC may be able to catch it if it can keep up this rally.

The BCH market cap seems to be $8.3 billion at the moment | Source: CoinMarketCap

Featured image from Shutterstock.com, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Bitcoin Futures Market Attracts Unprecedented Open Interest as Derivatives Appetite Grows

The latest bitcoin derivatives data indicates a continued climb in bitcoin futures open interest, hitting all-time peaks. Over the last day, statistics reveal an open interest of $32.30 billion across fourteen distinct bitcoin futures markets. Soaring Open Interest in BTC Futures Signals Growing Derivatives Market Friday, March 8, 2024, marked a notable day when BTC […]

The latest bitcoin derivatives data indicates a continued climb in bitcoin futures open interest, hitting all-time peaks. Over the last day, statistics reveal an open interest of $32.30 billion across fourteen distinct bitcoin futures markets. Soaring Open Interest in BTC Futures Signals Growing Derivatives Market Friday, March 8, 2024, marked a notable day when BTC […]

Source link

Data shows the cryptocurrency futures market has seen liquidations amounting to $700 million in the past day as Bitcoin has gone through its volatility.

Bitcoin Has Seen Intense Price Action In Past 24 Hours

The past day has been a bit of a rollercoaster for Bitcoin, with the asset registering sharp price action in both directions but ultimately going up as the bulls win out.

The chart below shows what the price action for the cryptocurrency has looked like recently.

The price of the asset seems to have enjoyed sharp bullish momentum recently | Source: BTCUSD on TradingView

From the graph, it’s visible that Bitcoin initially witnessed some sharp bullish momentum, in which the coin not only broke above the $60,000 level, but went up to touch the $64,000 mark.

This high, which is the peak for the year so far, only lasted briefly, however, as BTC crashed down spectacularly to under the $59,000 mark. The asset has since recovered to higher levels, now floating around $62,700.

The rest of the cryptocurrency sector has also gone through its volatility, with prices fluctuating across the coins. As is usually the case with such sharp price action, the futures market has suffered many liquidations.

Crypto Futures Market Has Gone Through A Squeeze In The Past Day

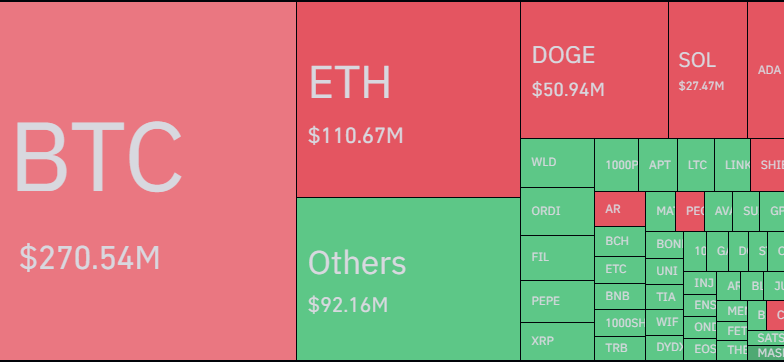

According to data from CoinGlass, the cryptocurrency futures market has witnessed the liquidation of contracts worth more than $700 million in the last 24 hours.

The table below displays the relevant information about the liquidations.

A massive amount of liquidations appear to have occurred in the past day | Source: CoinGlass

It would appear that only $131 million of the liquidations came within twelve hours, suggesting that most of the flush was situated inside the preceding half-day period. This makes sense, as Bitcoin was most volatile inside this window.

It also seems that the long-to-short ratio in this liquidation event has been quite balanced, even though the price has increased in the past day. This would suggest that some aggressive longing occurred as Bitcoin approached $64,000, and the subsequent pullback wiped these top buyers.

The table below shows how the distribution has looked for the various symbols.

Looks like BTC has topped the charts once more | Source: CoinGlass

As is generally the case, Bitcoin futures contracts have again been responsible for the largest portion of the total market liquidations, contributing around $270 million.

What’s different this time, however, is that this share, although the largest, isn’t even half the total liquidations. This could come down to the fact that speculators may now be playing around with altcoin positions after gaining confidence from the BTC price surge.

Dogecoin, the best performer among the top coins with its 34% jump, has occupied the largest share among the alts, with almost $51 million in liquidations.

Featured image from André François McKenzie on Unsplash.com, CoinGlass.com, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Bitcoin Futures’ Open Interest Reaches Lifetime High, Surpassing 2021 Bull Run

Bitcoin’s value has been on an impressive rise over the past month, and by the start of the week, the leading digital currency surpassed the $57,000 range for the first time since Nov. 2021. This upward trend in value has stimulated bitcoin-based derivatives, causing open interest in bitcoin futures to hit an unprecedented level, exceeding […]

Bitcoin’s value has been on an impressive rise over the past month, and by the start of the week, the leading digital currency surpassed the $57,000 range for the first time since Nov. 2021. This upward trend in value has stimulated bitcoin-based derivatives, causing open interest in bitcoin futures to hit an unprecedented level, exceeding […]

Source link

Open interest, the total number of outstanding derivative contracts that have not been settled, is an important metric for gauging market health and sentiment. An increase in open interest means new money entering the market, showing heightened trading activity and interest in Bitcoin. Conversely, a decline suggests closing positions, potentially indicating a change in market sentiment or a consolidation phase. Monitoring these trends is important for understanding the liquidity, volatility, and future price expectations in the market.

In a bullish market, an increase in open interest often correlates with rising prices, suggesting that new money is betting on further price appreciation. This scenario typically reflects a strong market sentiment and investor confidence in Bitcoin’s upward trajectory. On the other hand, in a bearish context, growing open interest might indicate that investors are hedging against expected price declines, revealing a more cautious or negative market outlook.

Furthermore, the balance between call and put options within the open interest provides deeper insights into market sentiment. A predominance of calls suggests a bullish market sentiment, with many investors expecting price rises, whereas a majority of puts can indicate bearish expectations.

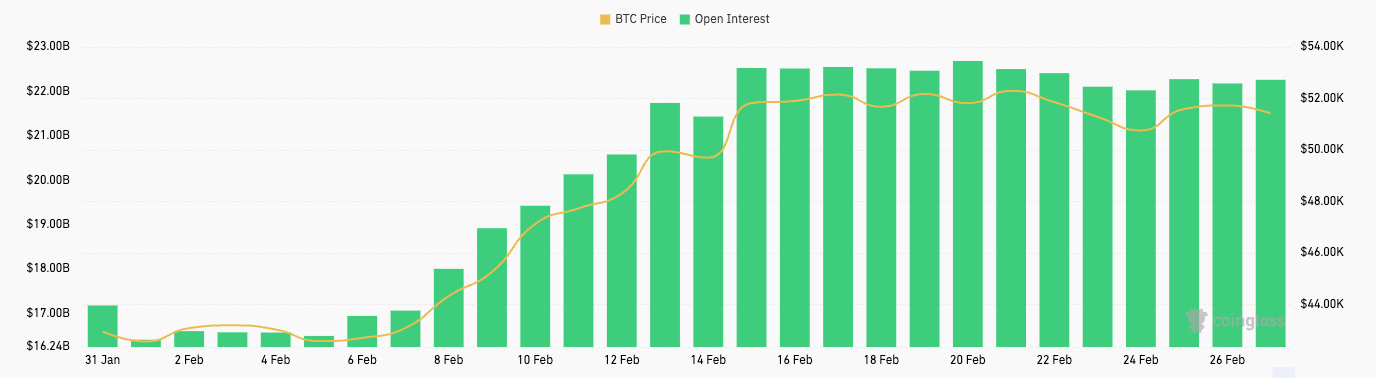

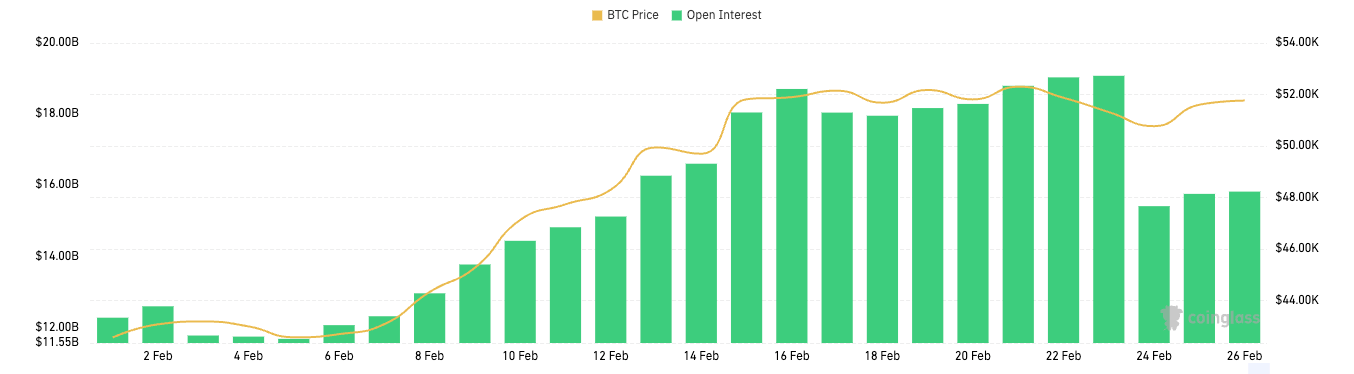

February saw a significant increase in open interest for Bitcoin futures and options.

From Feb. 1 to Feb. 20, Bitcoin futures open interest grew from $16.41 billion to $22.69 billion. This substantial rise suggests that traders were increasingly entering into futures contracts, anticipating higher volatility or making directional bets on Bitcoin’s price. Interestingly, this period aligns with a notable increase in Bitcoin’s price, from $42,560 to $52,303, suggesting a bullish sentiment among futures traders. The slight decrease in open interest by Feb.26 to $22.21 billion, alongside a marginal dip in Bitcoin’s price to $51,716, could indicate some traders taking profits or closing positions in anticipation of a consolidation phase or to reduce exposure ahead of potential volatility.

Similarly, Bitcoin options open interest saw a dramatic increase from $12.27 billion at the beginning of February to a peak of $19.08 billion by Feb.23 before dialing back to $15.82 billion towards the month’s end. Options provide the holder the right, but not the obligation, to buy (call option) or sell (put option) Bitcoin at a specified price, offering more complex strategies for traders to express bullish or bearish views or to hedge existing positions. The initial spike in options open interest reflects a robust engagement from investors, leveraging options for directional bets on Bitcoin’s price and protective measures against potential downturns.

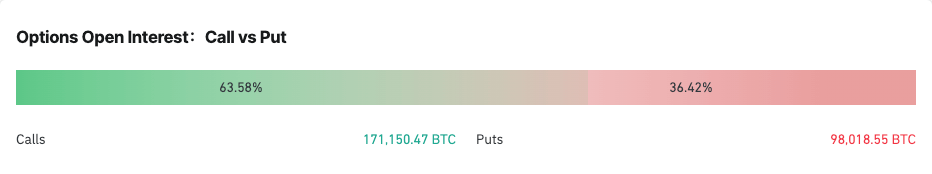

The ratio between calls and puts for Bitcoin options provides a deeper insight into market sentiment and potential expectations for Bitcoin’s price direction. The distribution between calls and puts is a direct indicator of the market’s bullish or bearish inclinations, with calls representing bets on rising prices and puts on falling prices.

As of Feb. 26, the open interest in Bitcoin options was skewed towards calls, comprising 63.76% of the total, compared to 36.24% for puts. This distribution reinforces the bullish sentiment observed through the increase in options open interest earlier in the month. A predominance of calls in the open interest suggests that a significant portion of market participants were expecting Bitcoin’s price to continue rising or were utilizing calls to hedge against other positions.

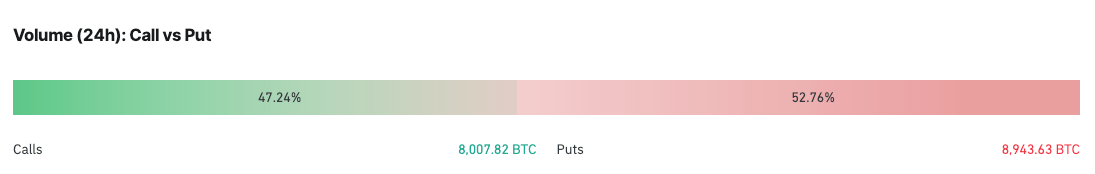

However, the 24-hour volume tells a slightly different story, with calls accounting for 47.24% and puts for 52.76%. Compared to the overall open interest, this shift towards puts in the daily trading volume might indicate a short-term increase in caution among traders. It suggests that within the last 24 hours, there was a noticeable pick-up in defensive strategies or bearish bets.

The immediate implication for Bitcoin’s price is a potential increase in volatility. The bullish sentiment, as evidenced by the growing open interest and high proportion of calls, supports a continued positive outlook among many market participants. However, the recent uptick in puts volume may signal upcoming price fluctuations as traders adjust their positions in anticipation of or in response to new information or market trends.

Considering these, the market appears to be at a crossroads, with a strong bullish sentiment tempered by short-term caution. This scenario often precedes periods of heightened volatility as conflicting expectations play out through trading activities.

An analyst has explained that the latest cooldown in the Ethereum futures market could suggest there is potential for a price rise to resume for ETH.

Ethereum Funding Rates Have Seen A Decline Recently

An analyst in a CryptoQuant Quicktake post explained that the ETH funding rates have seen a cooldown from their previously overheated levels. The “funding rate” refers to the periodic fees that futures contract holders on derivative platforms currently exchange with each other.

When the value of this metric is positive, it means that the long contract holders are paying a premium to the shorts to hold onto their positions. Such a trend implies that most traders share a bullish sentiment right now.

On the other hand, the under zero indicates that a bearish sentiment is currently dominant in the futures market, as the short traders are overwhelming the longs.

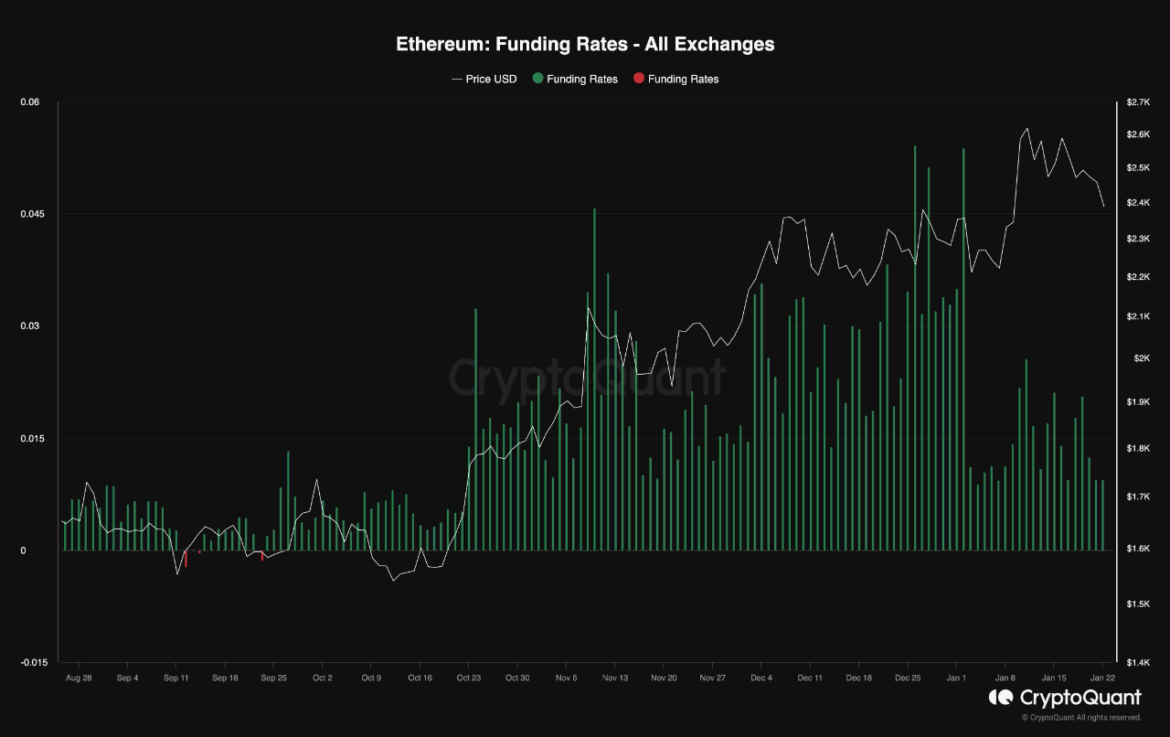

Now, here is a chart that shows the trend in the Ethereum funding rates over the last few months:

The value of the metric seems to have been low in recent days | Source: CryptoQuant

As displayed in the above graph, the Ethereum funding rates have been mostly positive during the last few months, implying that traders on the futures side of the market have mostly been bullish about the asset.

The few times that the metric did dip into the negative inside this period didn’t turn out to be anything major, as the indicator only attained low red values and rebounded back inside the green territory without too much wait.

The chart shows that during some phases of this lasting period of bullish sentiment, the metric attained particularly high values. “However, it’s crucial to note that elevated values in funding rates raise concerns about a potential overheated state in the perpetual markets, signaling the possibility of an impending long-squeeze event,” notes the quant.

A “squeeze” is an event in which a sharp swing in the price triggers a large number of liquidations, which in turn feed into this price move, elongating it and causing further liquidations.

When such a cascade of liquidations affects the long side of the market (that is, the price move in question is a rapid drawdown), the event is known as a “long squeeze.”

Generally, the side of the futures market most heavily dominated by traders is likelier to fall prey to a squeeze. Thus, when the funding rates are highly positive, a long squeeze can be more probable.

Recently, though, as Ethereum has gone through its latest correction, so have the funding rates. Although they are still positive, their magnitude may no longer be associated with an overheated market, and the risk of a long squeeze would have thus fallen.

“Consequently, there exists the potential for the price to resume its upward trajectory following the completion of the ongoing correction stage,” explains the analyst.

ETH Price

Ethereum has declined by around 5% during the past week as its price has now fallen under $2,400.

Looks like the price of the coin has been sliding off recently | Source: ETHUSD on TradingView

Featured image from Kanchanara on Unsplash.com, charts from TradingView.com, CryptoQuant.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Gold futures look to score their biggest daily gain since mid-December

Gold futures rallied Friday, prompting prices to turn higher for the week, as U.S. and U.K. airstrikes in Yemen, in response to Houthi rebel attacks on ships in the Red Sea, raised the precious metal’s appeal as a safe-haven investment.

The U.S.-U.K. strikes on Yemen “clearly raise the threat of wider tensions, if not [a] major power conflict,” Adrian Ash, director of research at BullionVault, told MarketWatch.

In Friday dealings, gold for February delivery

GCG24,

GC00,

climbed $38, or 1.9%, to $2,057.20 an ounce on Comex. Most-active gold futures haven’t tallied a daily dollar and percentage climb that big since Dec. 14, FactSet data show.

The U.S. and British forces carried out joint strikes Thursday on targets in Yemen used by Iran-backed Houthis, in response to the rebels attacks on shipping vessels in the Red Sea.

“Risk aversion is keen late this week” following those strikes, with gold pries sparking sharply higher, said Jim Wyckoff, senior analyst at Kitco.com.

Still, with global stock markets also rising alongside bond prices Friday, gold looks to be taking its cue from weak U.S. and Chinese inflation data, rather than from the latest geopolitical violence, said Ash.

China’s producer price index fell 2.7% in December, down for a 15th straight month. In the U.S., the producer price index fell by 0.1% last month for a third consecutive month.

Gold prices had fallen to four-week lows Thursday after data that day revealed a 0.3% rise in the U.S. consumer consumer price index in December, the biggest gain in three months. But prices have now rallied towards a record-high weekly finish on the PPI miss, said Ash. “That shows just how sensitive gold remains to Fed rate-cut expectations.”

“Despite oil prices jumping on the U.S.-led action in the Red Sea, bond traders continue to see inflationary pressures easing further in 2024,” he said.

The yield on the 10-year Treasury

BX:TMUBMUSD10Y

traded at 3.951%, down from 2.974% on Thursday. Bond prices and bond yields are inversely related.

“While gold is rising to price that in, it looks as vulnerable as stocks and bonds to a turnaround in sentiment,” said Ash.

He said fed funds futures are now priced for six rate cuts 2024, “twice as many as the Fed itself has predicted.”

Given that, “expect more push-back from Fed officials, plus more volatility in gold and other rate-sensitive markets, ahead of the Fed’s January meeting,” he said. The next meeting is scheduled for Jan. 30 to 31.

Bitcoin futures margined in BTC hit historic lows as cash options prevail

Quick Take

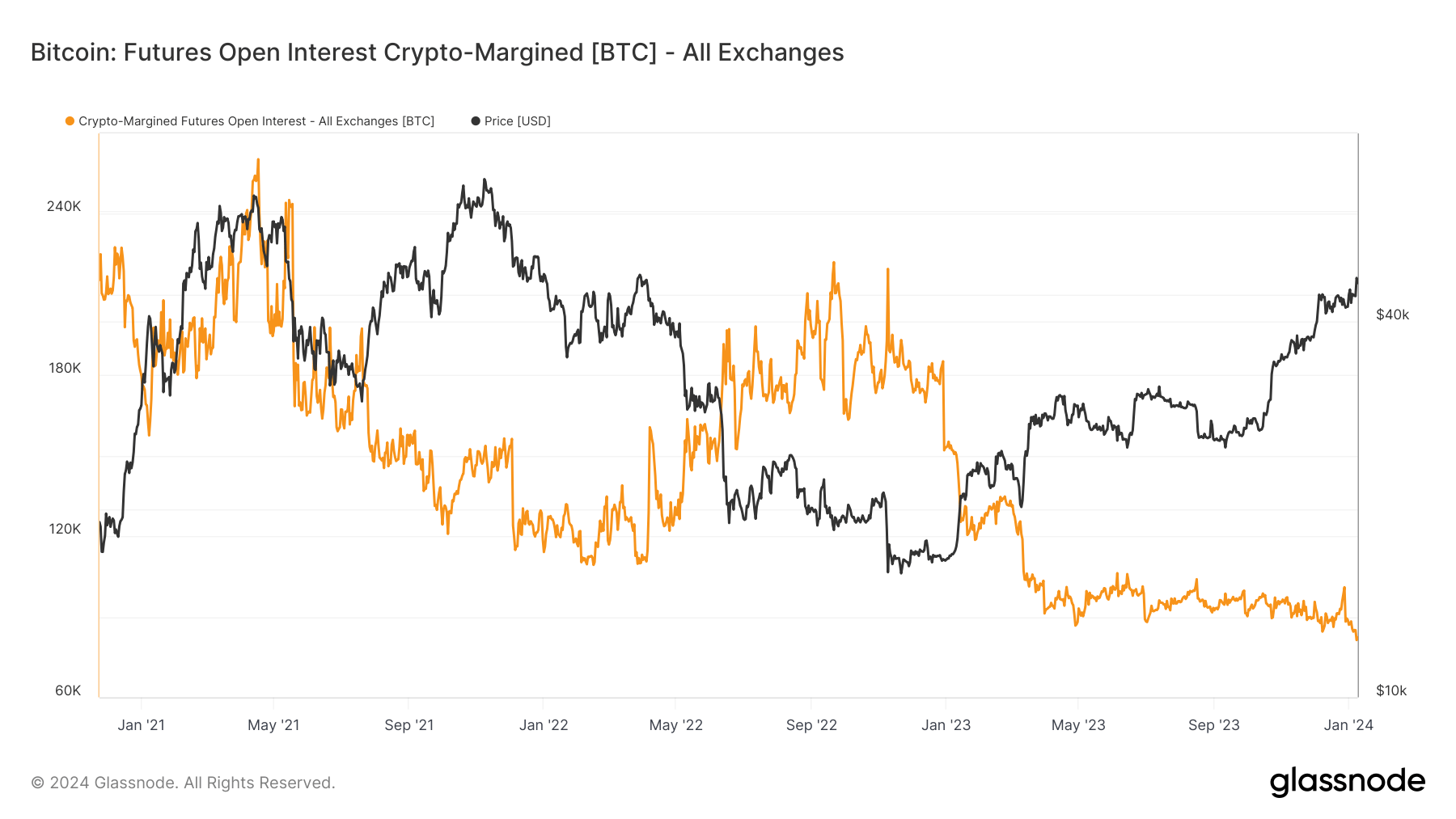

A noteworthy shift is visible in the landscape of Bitcoin futures contracts, as evidenced by the current state of open interest margined in native Bitcoin (BTC). There has been a significant fall in BTC-margined futures contracts, down from a peak of 240,000 BTC during the 2021 bull market to an all-time low of 82,000 BTC. Multiple exchanges mirror this trend. Binance currently holds 21,500 BTC, nearing a new low.

Similarly, Bitmex and Bybit are at all-time lows with holdings of 6,000 and 14,500 BTC, respectively. Deribit, while not at its lowest, has seen a significant reduction from its December high of 34,000 BTC, now sitting at 22,000 BTC. OKX’s holding has stagnated at 15,000 BTC since April 2023, while Kraken and Huobi hold a few thousand BTC each.

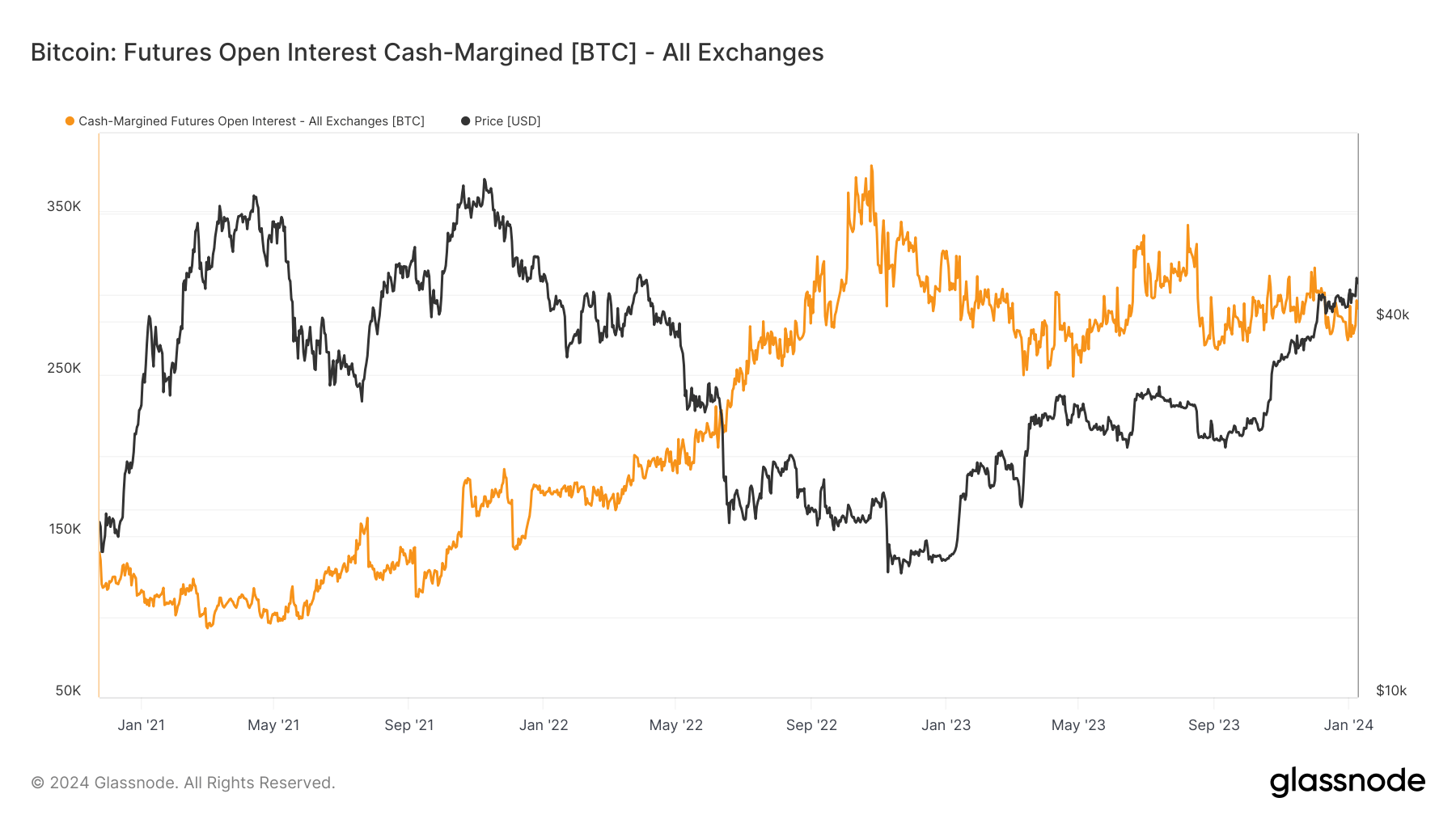

The Bitcoin futures market sees fewer contracts margined in native coins; roughly 22% of all futures contracts use crypto-margin. Meanwhile, cash-margin remains steady at around 300,000 Bitcoin. Bitcoin’s shift from volatile futures to more stable cash margins could signal reduced market volatility.

The post Bitcoin futures margined in BTC hit historic lows as cash options prevail appeared first on CryptoSlate.

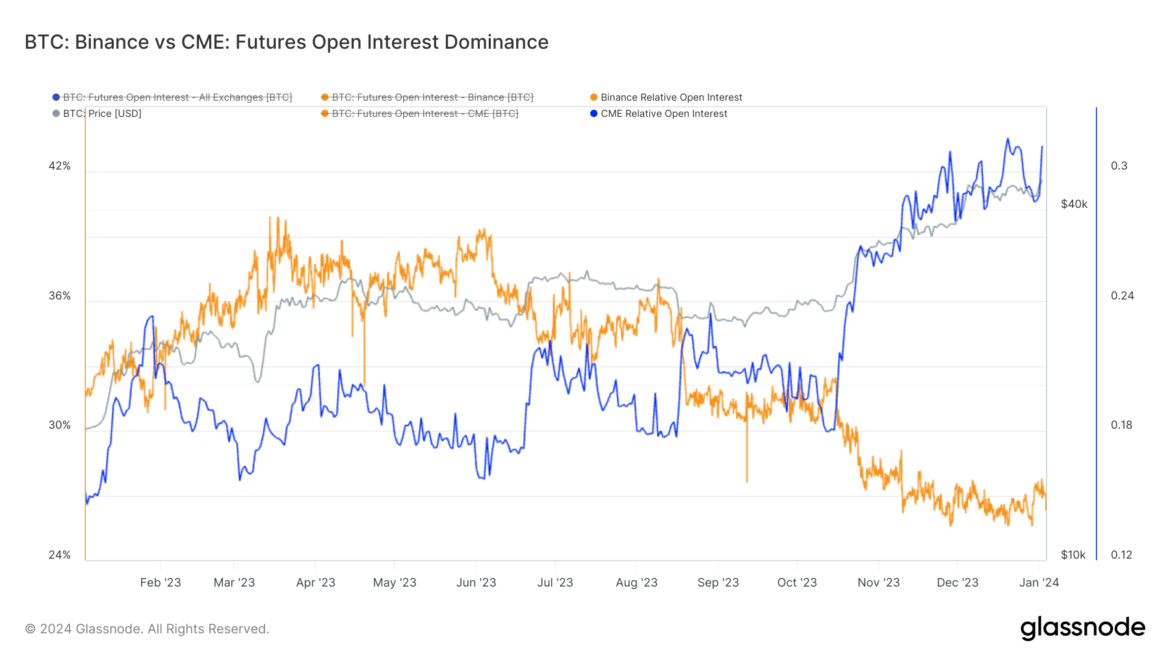

Binance sees 18% Open Interest drop as CME Bitcoin futures hit record levels

Quick Take

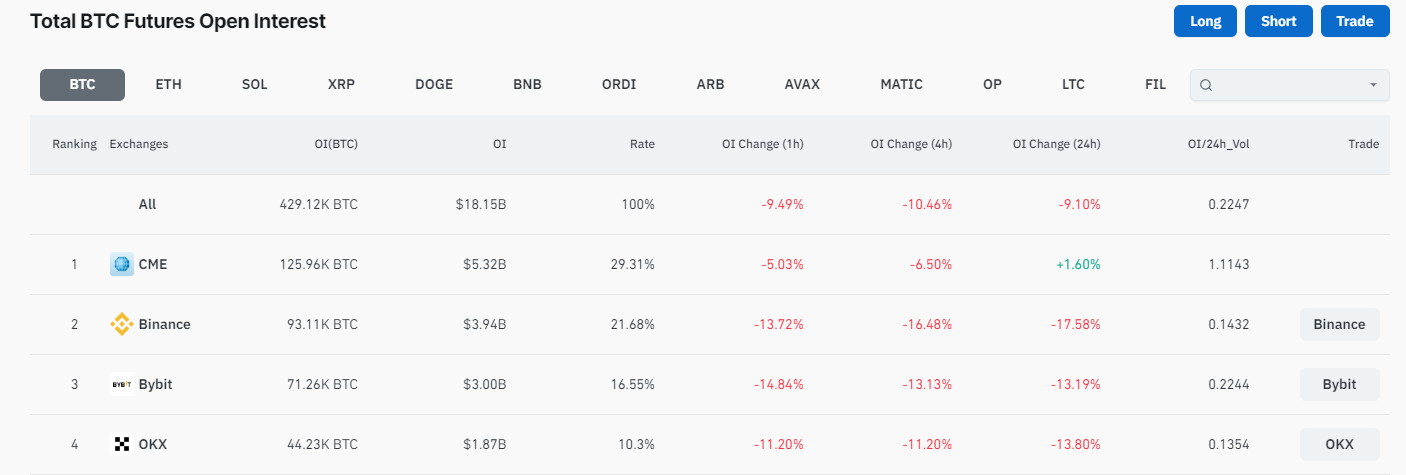

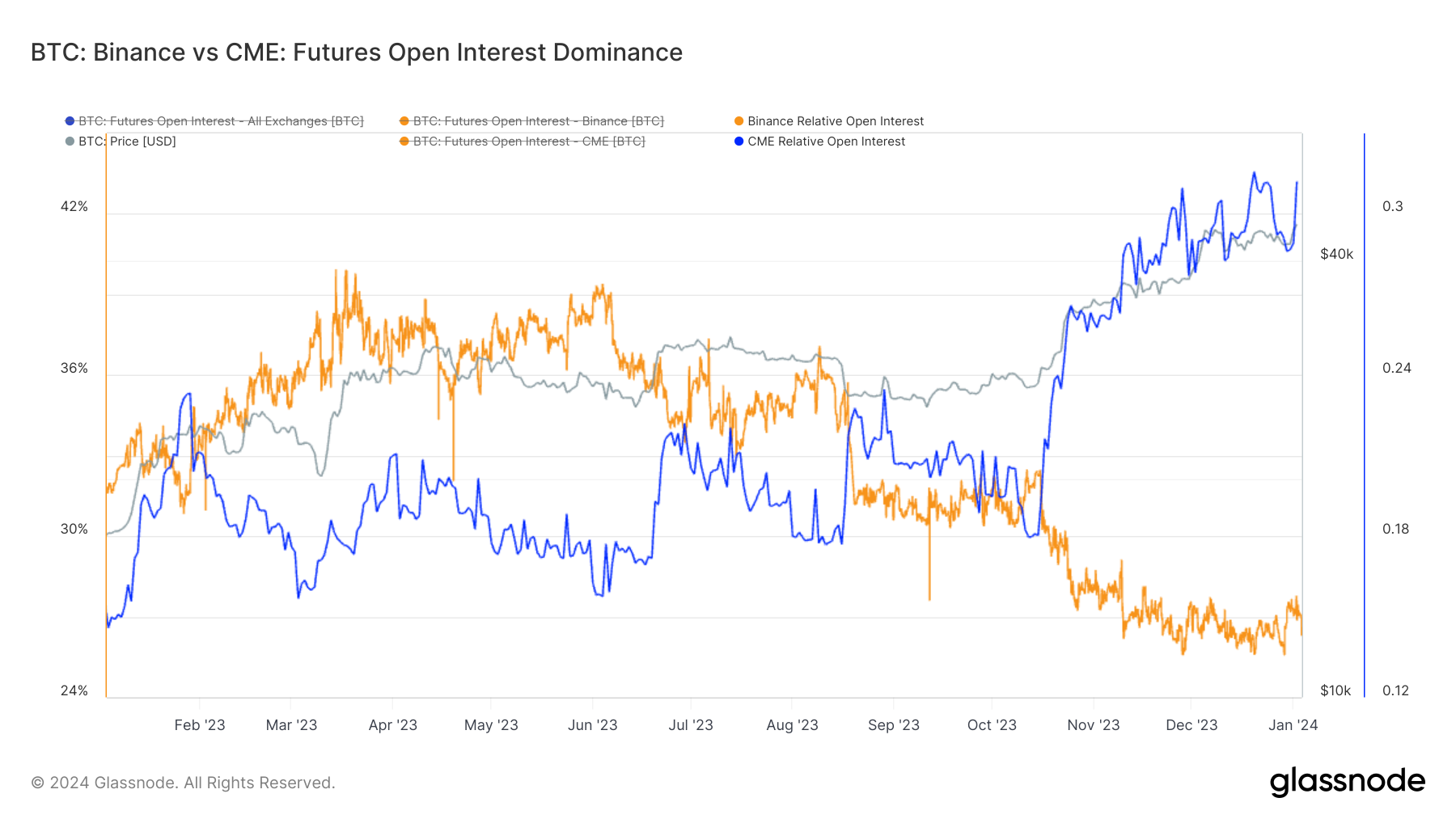

CryptoSlate’s recent analysis paints a vivid picture of Bitcoin futures’ open interest across key exchanges.

The past 24 hours have seen a significant repositioning of open interest in Bitcoin, with a notable surge and subsequent drop of around 10%. The primary contributor to this fluctuation was Binance, which saw an 18% open interest decrease in the past 24 hours.

This shift has further widened the gap between Binance and the Chicago Mercantile Exchange (CME), the latter experiencing a contrary trend with a 2% increase in open interest in the past 24 hours. Consequently, CME recorded an all-time high of 126,000 Bitcoin in open interest, while Binance has 93,000 BTC.

Amid these dynamics, Coinglass noted a sizable wipeout of nearly $3 billion in Bitcoin open interest, marking the largest long liquidation event in a year, coinciding with Bitcoin’s hovering around the $42,200 mark.

The post Binance sees 18% Open Interest drop as CME Bitcoin futures hit record levels appeared first on CryptoSlate.