GameStop’s stock ended Monday’s session up 15.4%, registering its largest daily percentage increase since Dec.13, 2023.

Source link

gain

Microstrategy’s Bitcoin Portfolio Value Soars to $13.2 Billion, Marking a 116% Gain

According to the latest figures, Microstrategy’s investment in bitcoin has doubled, showing a 116% increase after the cryptocurrency’s value experienced a significant rise this past week. The company, specializing in business intelligence, has acquired a total of 193,000 bitcoins at an expenditure of $6.122 billion, with the current market value of their holdings soaring to […]

According to the latest figures, Microstrategy’s investment in bitcoin has doubled, showing a 116% increase after the cryptocurrency’s value experienced a significant rise this past week. The company, specializing in business intelligence, has acquired a total of 193,000 bitcoins at an expenditure of $6.122 billion, with the current market value of their holdings soaring to […]

Source link

Quick Take

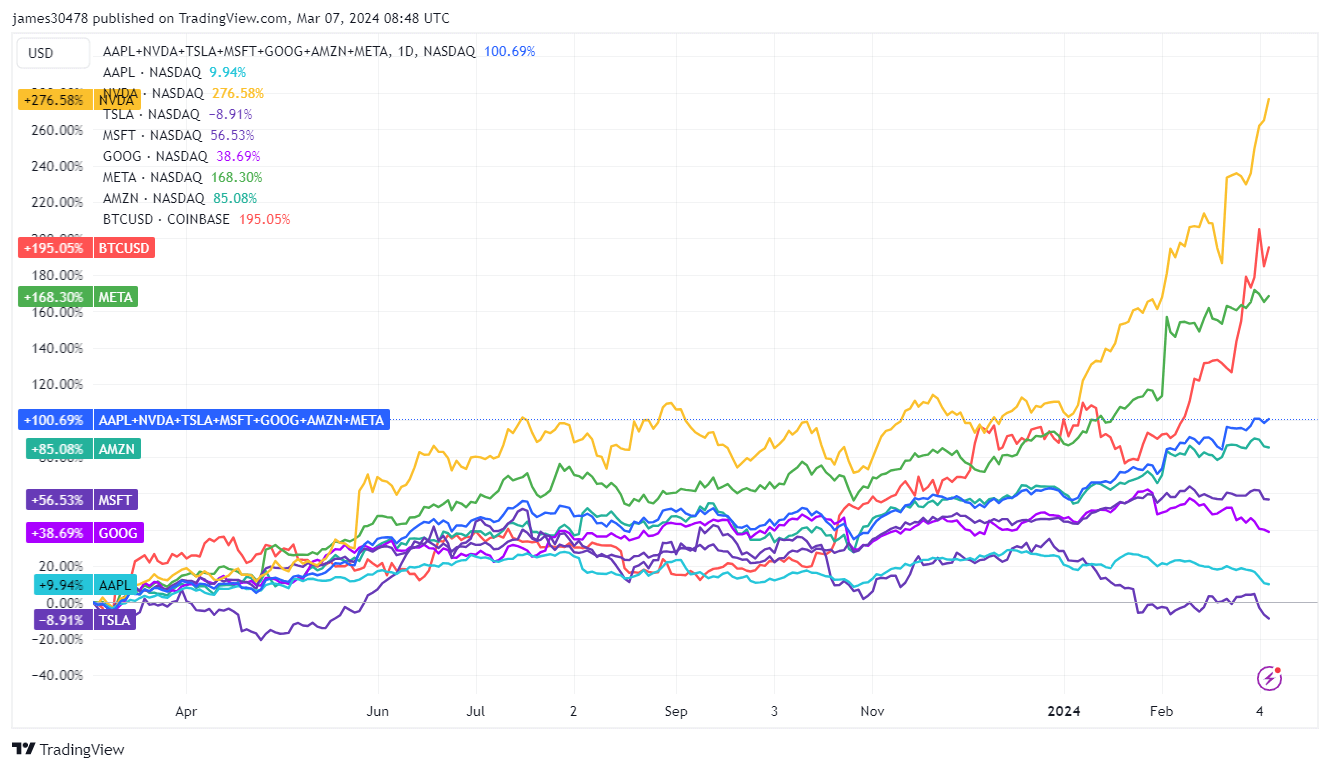

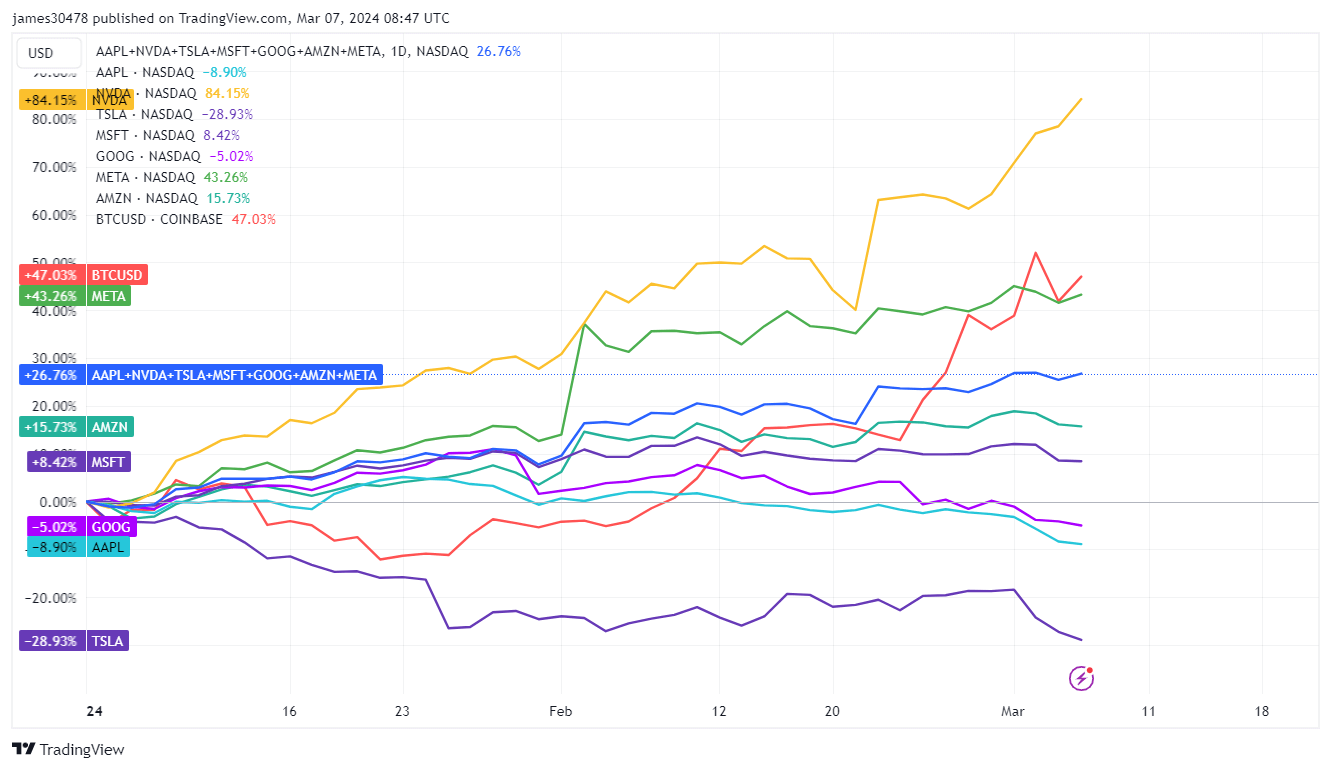

Comparing the performance of the ‘Magnificent 7’ tech stocks—Nvidia, Meta, Microsoft, Amazon, Google, Tesla, and Apple—to Bitcoin shows that the coveted group of assets is seeing significant competition from Bitcoin. A one-year comparison reveals Bitcoin’s superior performance, posting a 195% increase compared to the Mag 7’s average rise of 101%. Although the two were fairly correlated, Bitcoin’s surge since late February led to a noticeable decoupling.

Over the past year, Nvidia stands as the sole tech stock among its peers to have exceeded Bitcoin’s performance, achieving a remarkable increase of 277%.

Bitcoin, up 47% year-to-date (YTD), would be second only to Nvidia, which is up 84% since the beginning of the year. Three out of the seven tech stocks are showing negative YTD returns — Tesla is down 29%, while Apple and Google are down 9% and 5%, respectively.

Bitcoin’s performance nearly doubles the Mag 7 average of 27%. This leads to speculation on whether sustained BTC growth could trigger a financial shift from these tech stocks into Bitcoin.

The post Bitcoin’s 195% gain overshadows the tech sector’s ‘Magnificent 7’ appeared first on CryptoSlate.

Filecoin (FIL) continues to enjoy investors’ interest following a 10.28% gain in the last day, according to data from CoinMarketCap. The altcoin has recently been the center of attention following a gradual price rise in the past week culminating in a 15.34% price gain. Interestingly, the spike in FIL’s price over the 24 hours appears to be fueled by exciting developments in the project’s ecosystem.

Filecoin Meets Solana

In an X post on February 16, Filecoin announced an integration with the popular Ethereum rival, Solana. Launched in March 2020, Solana is regarded as one of the most prominent smart contract-compatible platforms offering fast transactions and almost non-existent fees.

Solana’s integration with #Filecoin is a significant move away from centralized storage solutions and a remarkable step towards enhancing the reliability and scalability of the Solana blockchain.@solana is utilizing Filecoin to make its block history more accessible and usable… pic.twitter.com/1NcuaLNYT5

— Filecoin (@Filecoin) February 16, 2024

Ranked as the fifth-largest crypto project with a market cap value of $47.97 billion, Solana’s integration with Filecoin is aimed at migrating from its widely criticized centralized storage system to decentralized storage solutions, with the aim of improving its existing scalability and integrity.

Through this integration, Filecoin’s network will assist Solana in enhancing access to its blockchain history, which will be beneficial to developers, explorers, indexers, and other network users. In addition, Filecoin’s decentralized storage solutions will allow Solana to experience data redundancy, scalability, and a higher level of security while operating as a decentralized network.

Interestingly, this development created much excitement in the Filecoin user community as FIL surged by over 10%, reaching a value of $6.36. Meanwhile, FIL’s daily trading volume stands at $497.78 million, having recorded an astounding 178.42% gain.

FIL Price Prediction

FIL began 2024 on a turbulent note losing about 40% of its value between January 1 and January 23. However, in the last few weeks, the token has experienced a steady price recovery which is further aided by its most recent boost in price.

If the bulls are able to sustain the current buying momentum, FIL may hit the $8 price mark representing a return to the levels seen at the start of 2024. However, according to the token’s daily chart, the relative strength index has now crossed into the overbought zone. This indicates that there might be an incoming trend reversal. In that case, FIL’s price may fall as low as $4.90, which represents its next support level and a 23.71% decline from the current market price.

Filecoin (FIL) trading at $6.341 on the daily chart | Source: FILUSDT chart on Tradingview.com

Filecoin (FIL) trading at $6.341 on the daily chart | Source: FILUSDT chart on Tradingview.com

Featured image from Filecoin, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Bitcoin ETFs Threaten Gold’s Dominance As Digitalization Trends Gain Momentum

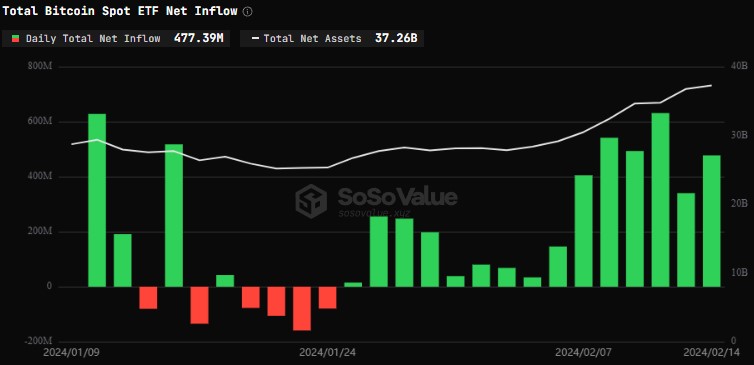

In just over a month since their approval by the US Securities and Exchange Commission (SEC), Bitcoin ETFs have swiftly gained traction in the market, posing a formidable challenge to the long-standing dominance of gold ETFs.

Bitcoin ETFs Gain Ground on Gold ETFs

The rapid rise of Bitcoin ETFs has led to a convergence in asset values, with BTC ETFs closing the gap with gold ETFs. Bitcoin ETFs hold approximately $37 billion in assets after only 25 trading days, while gold ETFs have accumulated $93 billion in over 20 years of trading.

In this regard, Bloomberg’s Senior Commodity Strategist, Mike McGlone, emphasizes the shifting landscape, stating, “Tangible Gold is Losing Luster to Intangible Bitcoin.”

According to McGlone, the US stock market’s continued resilience, the US currency’s strength, and 5% interest rates have presented headwinds for gold. Moreover, as the world increasingly embraces digitalization, the emergence of Bitcoin ETFs in the United States adds further competition to the precious metal.

McGlone further states that while the bias for gold prices remains upward, investors who solely focus on gold may risk falling behind potential paradigm-shifting digitalization trends.

Ultimately, McGlone suggests that investors should consider diversifying their portfolios by incorporating Bitcoin or other digital assets to stay ahead in the evolving investment landscape.

Bitcoin Rally Driven By Institutional Demand

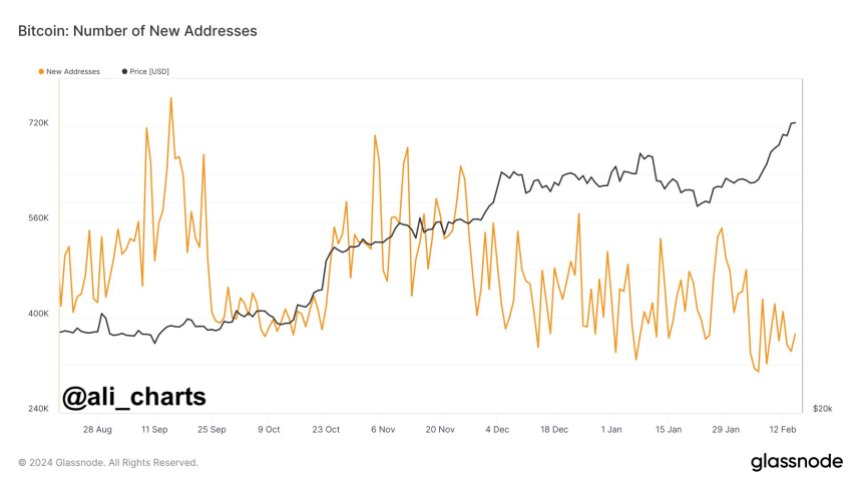

The success of Bitcoin ETFs is further demonstrated by recent data suggesting that the upward trend in Bitcoin prices is driven primarily by institutional demand. At the same time, retail participation appears to be declining.

According to analyst Ali Martinez, as the price of Bitcoin continues to hover between $51,800 and $52,100, there has been a noticeable decrease in the creation of new Bitcoin addresses daily, indicating a lack of retail participation in the current bull rally and highlighting the growing influence of institutional investors in the cryptocurrency market.

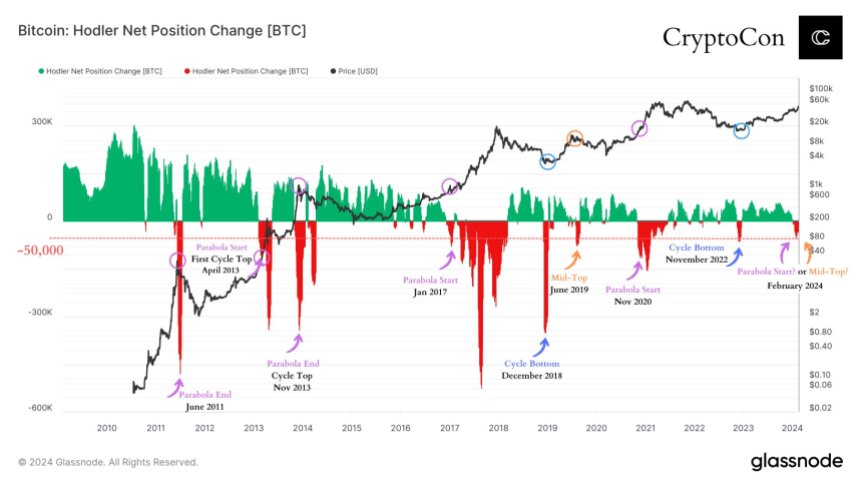

However, market expert Crypto Con points out a significant shift in Long-Term Bitcoin holder positions, signaling a potential downside movement.

As seen in the chart below shared by Crypto Con, the position change line crossed below -50.00 for the first time in over a year, a pattern that has historically occurred at critical moments in Bitcoin’s market cycles. These moments include the cycle bottom, mid-top (which occurred only once), and the start/end of a cycle top parabola (which occurred most frequently).

According to Crypto Con, this recent shift in long-term holder positions raises two possible scenarios: a mid-top or an imminent parabolic movement. Such a movement at this stage in the cycle is considered unusual.

Primarily, it indicates that long-term Bitcoin holders are exiting their positions in significant numbers, possibly anticipating a market correction or a change in the overall trend.

Overall, the shift in Bitcoin holder positions and the decline in retail participation present contrasting dynamics in the current market landscape. While institutional demand continues to drive the price of Bitcoin higher, long-term holders appear to be taking profit or adjusting their positions.

While BTC is currently trading at $51,800, it remains to be seen what the direction of the next move will be and how institutions will continue to influence the price action of the largest cryptocurrency as spot Bitcoin ETFs gain traction.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

1 Stock Down 57% From Its 52-Week High That This Wall Street Analyst Expects to Gain 426% in 2024

With a bull market in full swing, is it finally time to dip into some of those high-risk, high-reward stocks that usually soar when investors are enthusiastic? It’s certainly time to consider buying some, as long as you do your due diligence and understand the risks and opportunities.

Wall Street is excited about many of the artificial intelligence (AI) stocks that abound and are changing the way consumers shop, pay, stream, and more. Pagaya Technologies (NASDAQ: PGY) uses AI to assess credit risk and create more lending opportunities, and Wall Street is predicting great things from this relative newcomer.

What does Pagaya do?

Pagaya operates a credit evaluation platform powered by AI that helps lenders of all kinds assess consumer credit risk. Pagaya has relationships with many top brands you know and use, including Visa for its credit card risk management, as well as banks like Ally Financial and SoFi Technologies. For example, it works with Ally, which has been expanding its consumer lending business, to identify pre-qualified credit card customers.

Many lenders are feeling the pinch of high interest rates and are reporting lower sales and margins. But Pagaya continues to demonstrate strength, with increasing sales and improving profits. In the 2023 third quarter, revenue increased 4% year over year, and network volume was up 10%. That may not sound impressive unless you understand that competitors are reporting significant declines. Revenue from fees less production costs (FRLPC), its baseline profitability metric, rose 29% and expanded as a percentage of revenue. Adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) turned positive after a loss the year before, and adjusted net income was $14 million.

Pagaya has been attracting new business as it demonstrates its value, and it recently recruited an unnamed top-five U.S. bank by assets for a personal lending product. It also onboarded a large auto retailer, a real estate company, and more. Management says that 80% of the top 25 U.S. banks are in its pipeline. Between expected interest rate cuts that could trigger an increase in lending and all of this new business, 2024 could be an incredible year for Pagaya.

Two-sided model

Pagaya sells its loans to financial institutions as asset-backed securities (ABS), gaining money to use for new loans. It has been able to source and obtain pre-funding rounds from varied investors. It got $6.6 billion in funding in 2023, and it already announced a new round of $400 billion in funding so far in 2024. Pagaya is the top issuer of ABS loans in the U.S.

Pagaya might be looking to expand into new territory, which could increase its market opportunity. According to The Wall Street Journal, it bid to acquire a company called GreenSky that provides loans for home improvement after Goldman Sachs sold it off in October. It didn’t win the bid, but it might be looking for alternative acquisitions.

Risk vs. reward

Pagaya is a young company in a risky business. It’s highly vulnerable by interest rate changes and fluctuations in the economy. It’s faring quite well under current circumstances, which indicates resilience. But there are still unknowns, and it’s still not profitable on a generally accepted accounting principles (GAAP) basis.

Pagaya stock is down 81% from its first-day opening price and 57% from its 52-week high. That’s partially for the above-mentioned reasons but also because investors are still wary of companies highly connected to interest rate trends.

However, the future looks very bright. The average Wall Street consensus is for Pagaya stock to gain 163% during the next 12 to 18 months, and five of six analysts covering it recommend to buying it. One analyst, Michael Legg from Benchmark, set his price target to $6, implying a 426% gain. He sees the company’s resilience in the current, challenging conditions, as well as its opportunity, as justifying a much higher valuation. At the current price, Pagaya stock trades at a price-to-sales ratio of less than 1.3, which is a bargain for a high-growth stock. While not all analysts agree here, his case looks compelling.

Management gave a recent update that it plans to relocate its headquarters from Tel Aviv to New York because most of its business and all of its lending partners are in the U.S. It also plans to authorize a reverse stock split. Pagaya stock trades for just over $1 as of this writing, and it hopes that a higher price and U.S. base will afford it and shareholders better opportunities, such as the chance for inclusion in certain indexes and to be considered for investment by institutions.

Should you buy Pagaya stock today? If you have an appetite for risk, you may want to open a small position. Even if you don’t, you should keep Pagaya stock on your watch list.

Should you invest $1,000 in Pagaya Technologies right now?

Before you buy stock in Pagaya Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Pagaya Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 22, 2024

Ally is an advertising partner of The Ascent, a Motley Fool company. Jennifer Saibil has positions in SoFi Technologies. The Motley Fool has positions in and recommends Goldman Sachs Group and Visa. The Motley Fool recommends Pagaya Technologies. The Motley Fool has a disclosure policy.

1 Stock Down 57% From Its 52-Week High That This Wall Street Analyst Expects to Gain 426% in 2024 was originally published by The Motley Fool

Gold futures look to score their biggest daily gain since mid-December

Gold futures rallied Friday, prompting prices to turn higher for the week, as U.S. and U.K. airstrikes in Yemen, in response to Houthi rebel attacks on ships in the Red Sea, raised the precious metal’s appeal as a safe-haven investment.

The U.S.-U.K. strikes on Yemen “clearly raise the threat of wider tensions, if not [a] major power conflict,” Adrian Ash, director of research at BullionVault, told MarketWatch.

In Friday dealings, gold for February delivery

GCG24,

GC00,

climbed $38, or 1.9%, to $2,057.20 an ounce on Comex. Most-active gold futures haven’t tallied a daily dollar and percentage climb that big since Dec. 14, FactSet data show.

The U.S. and British forces carried out joint strikes Thursday on targets in Yemen used by Iran-backed Houthis, in response to the rebels attacks on shipping vessels in the Red Sea.

“Risk aversion is keen late this week” following those strikes, with gold pries sparking sharply higher, said Jim Wyckoff, senior analyst at Kitco.com.

Still, with global stock markets also rising alongside bond prices Friday, gold looks to be taking its cue from weak U.S. and Chinese inflation data, rather than from the latest geopolitical violence, said Ash.

China’s producer price index fell 2.7% in December, down for a 15th straight month. In the U.S., the producer price index fell by 0.1% last month for a third consecutive month.

Gold prices had fallen to four-week lows Thursday after data that day revealed a 0.3% rise in the U.S. consumer consumer price index in December, the biggest gain in three months. But prices have now rallied towards a record-high weekly finish on the PPI miss, said Ash. “That shows just how sensitive gold remains to Fed rate-cut expectations.”

“Despite oil prices jumping on the U.S.-led action in the Red Sea, bond traders continue to see inflationary pressures easing further in 2024,” he said.

The yield on the 10-year Treasury

BX:TMUBMUSD10Y

traded at 3.951%, down from 2.974% on Thursday. Bond prices and bond yields are inversely related.

“While gold is rising to price that in, it looks as vulnerable as stocks and bonds to a turnaround in sentiment,” said Ash.

He said fed funds futures are now priced for six rate cuts 2024, “twice as many as the Fed itself has predicted.”

Given that, “expect more push-back from Fed officials, plus more volatility in gold and other rate-sensitive markets, ahead of the Fed’s January meeting,” he said. The next meeting is scheduled for Jan. 30 to 31.

Oil futures tally a third straight gain on Red Sea shipping disruptions

Oil futures tallied a third straight climb on Wednesday, buoyed by tensions in the Red Sea that have led to disruptions to global trade.

Meanwhile, data from the U.S. government revealed weekly increases for domestic crude and petroleum-product supplies.

Price action

-

West Texas Intermediate crude for February delivery

CL.1,

-0.20% CL00,

-0.20% CLG24,

-0.20%

edged up by 28 cents, or 0.4%, to settle at $74.22 a barrel on the New York Mercantile Exchange. -

February Brent crude

BRN00,

-0.65% BRNG24,

-0.65% ,

the global benchmark, added 47 cents, or 0.6%, at $79.70 a barrel on ICE Futures Europe after trading as high as $80.60. Brent and WTI oil each saw their highest finish since Nov. 30. -

January gasoline

RBF24,

-0.77%

settled flat at $2.20 a gallon, while January heating oil

HOF24,

-0.75%

shed 0.3% to $2.71 a gallon. -

Natural gas for January delivery

NGF24,

-3.01%

settled at $2.45 per million British thermal units, down 1.8%.

Red Sea shipping woes

Several shippers have suspended shipments through the Red Sea after a series of drone and missile attacks by Iran-backed Houthi rebels since the start of the Israel-Hamas war.

Read: Attacks in the Red Sea add to global shipping woes

The actions by the Houthi rebels to “disrupt international shipping lanes are not only an act of war but also an assault on the global economy,” said Phil Flynn, senior market analyst at The Price Futures Group. While the U.S. is setting up an international coalition to try to stop the piracy, “the question becomes whether they will go after Iran.”

On Tuesday, the U.S. announced the launch of an international naval effort to thwart the attacks.

See: Inflation worries return after Red Sea shipping attacks

“For the oil trade, it is a wake-up call,” said Flynn, in a note. “Last month, the market declared that war premium was unnecessary, but we are seeing that war premium forced back into the price.”

Still, in a note, Marios Hadjikyriacos, senior investment analyst at XM, said that it’s “questionable” whether such concerns over the disruptions to global trade will manage to keep oil prices supported for long, “against the backdrop of slowing demand next year coupled with record-high U.S. crude production.”

The Year Ahead: Why oil may not see a return to $100 a barrel in 2024

Supply data

U.S. crude, gasoline and distillate supplies all climbed last week, according to data from the Energy Information Administration released Wednesday. Domestic petroleum production, meanwhile, marked a climb to another record high, based on EIA data going back to 1984.

Domestic commercial crude inventories rose by 2.9 million barrels for the week ended Dec. 15.

On average, analysts polled by The Wall Street Journal expected the report to show a climb of 2.5 million barrels. The American Petroleum Institute late Tuesday reported that U.S. crude inventories rose 939,000 barrels last week, according to a source citing the data.

The EIA report also revealed supply increases of 2.7 million barrels for gasoline and 1.5 million barrels for distillates. Analysts had forecast supply increases of 700,000 barrels each for gasoline and distillates.

Crude stocks at the Cushing, Okla., Nymex delivery hub rose by 1.7 million barrels last week, the EIA said, while domestic petroleum production moved up by 200,000 barrels a day last week to a record of 13.3 million barrels a day.

With its latest break above the $74 barrier, Litecoin (LTC) is showing encouraging signs of a breakout into the bull market.

Increased transaction activity from miners and major investors in cryptocurrency is fueling expectations of an upward trend and suggests that a huge price spike is imminent.

At the time of writing, the price range for LTC is $61.50 to $74.50, up 3.5% in the last 24 hours, figures by crypto market price aggregator CoinGecko show. The crypto has so far been able to hold its ground and sustain a 37% increase in the last four months, data shows.

The 100-Day Moving Average, on the other hand, is currently at $67.40, while the 10-Day Moving Average is at $73.25. These indicators suggest that Litecoin is gaining pace, with resistance levels found at $80.11 and $93.05.

Litecoin hasn’t changed much in response to recent events in the crypto sector, even though it stands to gain directly. Companies like Blackrock, Invesco, Franklin Templeton, Ark Invest and Fidelity recently applied for a spot Bitcoin ETF.

Blackrock recently submitted a separate document for an Ethereum ETF. This indicates the prevailing confidence of the largest asset management firm globally in the potential approval of its Bitcoin ETF.

Litecoin has emerged as one of the most active blockchains in the industry, with a solid achievement of surpassing 1 million transactions on November 14th, marking the first time the proof-of-work (PoW) network has reached this milestone.

This surpasses the previous all-time high of 660,153 transactions recorded just a day earlier. Remarkably, Litecoin’s transaction activity over this two-day period has exceeded that of Bitcoin, highlighting a significant surge in LTC’s blockchain engagement.

LTC market cap currently at $5.4 billion on the 24-hour chart: TradingView.com

According to latest data, Litecoin has a strong daily trading volume that surpassed $612 million in the previous day. Like Bitcoin, Litecoin has shown to be resistant to manipulation.

Moreover, Litecoin continues to hold its position as a cryptocurrency with significant processing power for handling heavy transactions with a relatively consistent hash rate in recent months.

In the meantime, there are two very encouraging signs: the miners’ accumulation of LTC, which has reached reserves of over 2.5 million, and the spike in whale transactions, which peaked eight weeks ago.

But before the bulls can confidently shoot for $80 and higher, they must be able to breach the initial barrier at $78. A correction may begin if the price falls below $65; however, early support may come from the 406,590 holders who purchased 4.8 million LTC at approximately $67.

Source: Santiment

Meanwhile, the performance of the derivatives market presented a varied scenario. The Open Interest (OI) for Litecoin Futures on Binance exhibited a lateral movement, suggesting a decreased inclination among traders to speculate on the future price movements of the cryptocurrency.

Conversely, the Funding Rate on the exchange portrayed a positive trend, signifying the prevalence of long-position traders in the market. This divergence in market indicators reflects a nuanced sentiment among participants, with some exhibiting caution and a wait-and-see approach, while others express confidence in the upward trajectory of Litecoin.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Creative Commons