Galaxy Digital CEO Michael Novogratz says he doesn’t believe the price of bitcoin will fall back down to the $50K-$55K level. “I think that’s the new floor unless something dramatic happens,” he described. “This has been a wild ride of an asset,” he added, noting that we’re in price discovery mode and if you look […]

Galaxy Digital CEO Michael Novogratz says he doesn’t believe the price of bitcoin will fall back down to the $50K-$55K level. “I think that’s the new floor unless something dramatic happens,” he described. “This has been a wild ride of an asset,” he added, noting that we’re in price discovery mode and if you look […]

Source link

Galaxy

Galaxy Digital Sees ‘Tremendous Global Demand for Bitcoin’ — CEO Says ‘There’s a New Army of Buyers’

Galaxy Digital CEO Mike Novogratz sees “a tremendous global demand for bitcoin,” emphasizing: “This is probably the first time in the history of bitcoin that we have true price discovery.” Noting that there is “a new army of buyers” and there is also “an army of salespeople,” he expects the price of bitcoin to be […]

Galaxy Digital CEO Mike Novogratz sees “a tremendous global demand for bitcoin,” emphasizing: “This is probably the first time in the history of bitcoin that we have true price discovery.” Noting that there is “a new army of buyers” and there is also “an army of salespeople,” he expects the price of bitcoin to be […]

Source link

To uphold the token’s value, stablecoin issuers often reserve cash or liquid assets. Amid rising interest rates, DWS is poised to manage the reserves for the new stablecoin.

Deutsche Bank’s DWS Group, along with Dutch market maker Flow Traders Ltd. and crypto fund manager Galaxy Digital Holdings Ltd, is set to establish a new entity named AllUnity. The primary objective of AllUnity is also to issue a euro-denominated stablecoin, aiming to foster wider acceptance of tokenized assets in mainstream finance.

The company, headquartered in Frankfurt and led by Alexander Höptner, former BitMex CEO, plans to apply for an e-money license with Germany’s financial watchdog, BaFin, with the ambition to launch the stablecoin within the next 18 months.

Drawing on their collective expertise in both traditional and crypto markets, the consortium aims to create a successful stablecoin tailored for institutions, corporates, and private users. DWS, majority-owned by Deutsche Bank, oversees assets totaling €860 billion ($927 billion), while Flow Traders, active in the crypto space since 2017, traded assets worth €2.8 trillion ($3 trillion) in the first half of the year.

For the Euro stablecoin launch, the DWS Group has partnered with Galaxy Digital. Galaxy Digital, led by renowned investor Michael Novogratz, offers a range of services, including crypto trading, asset management, and mining. Speaking on the development, Höptner further said:

“You need to have the stability, the trust, the connection and market power to make stablecoins really viable and usable. This partnership is pretty unique because it combines the trustworthiness of a big asset manager, that of a highly successful market maker and of a leading innovator in the crypto sector.”

Growing Focus on Euro-Backed Stablecoin

In a strategic move, Deutsche Bank’s DWS Group, Flow Traders, and Galaxy Digital plan to create AllUnity, a Frankfurt-based company, to issue a euro-denominated stablecoin. The collaboration reflects a growing trend among major institutions entering the stablecoin market, catering to crypto’s widely traded tokens often pegged one-to-one with traditional assets like the dollar.

To uphold the stability of the token, issuers of stablecoins usually reserve a certain amount in cash or liquid assets, like US government securities. With the current upward trend in interest rates, this model has proven to be a profitable venture for stablecoin issuers. The intention is for DWS to oversee the reserves of the planned stablecoin, as stated by Höptner.

Stablecoins, known for their low volatility, appeal to traders and businesses for various use cases, including swift cross-border transactions and facilitating digital payments. While the stablecoin market has reached $130 billion, the dominance of dollar-backed tokens, notably Tether’s USDT, is evident. Besides, Euro stablecoins have seen lower demand, with monthly trading volumes averaging $90 million compared to $600 billion for USD stablecoins.

Societe Generale’s crypto asset subsidiary recently introduced its euro-denominated stablecoin, EUR CoinVertible, on the Bitstamp crypto exchange. The European Union’s new cryptoasset regime provides a regulatory framework, potentially driving greater adoption of euro-denominated tokens. AllUnity plans to launch in Q1 2024, contingent on regulatory approvals and obtaining a full e-money license.

next

Blockchain News, Cryptocurrency News, News

You have successfully joined our subscriber list.

Galaxy Digital Chief Executive Officer Mike Novogratz has shared his recent optimistic view on XRP, its army, and Ripple, asserting that he was wrong about his earlier skepticism towards them.

Related Reading: Analyst Places XRP As The Top Coin For The 2024-2025 Bull Run

Mike Novogratz’s Recent View On XRP And Ripple

The Galaxy CEO revealed his optimism about the XRP token in a recent podcast known as Real Vision on Sunday. He previously doubted the token’s potential because he believed it would not last in the crypto market. Novogratz stated:

I was skeptical that XRP would have lasting power because payment company Ripple owns 60% of XRP, now 55% or 50%. And I was like, ‘That just doesn’t seem a proposition that’s going to work.’ And I’ve been dead wrong.

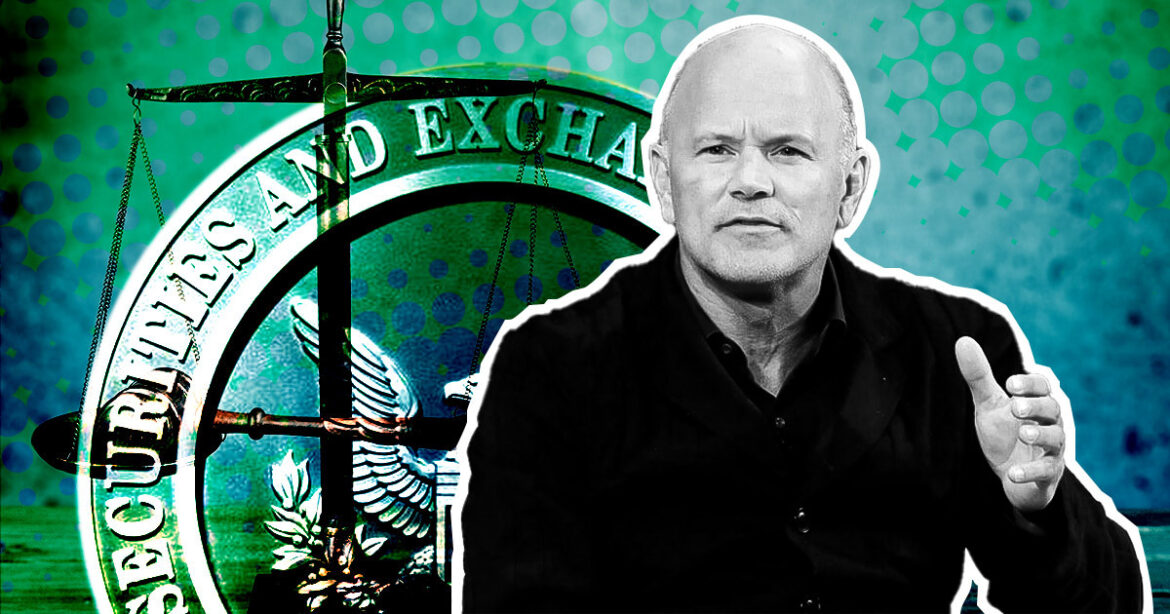

His recent view follows Ripple’s significant court victories over the US Securities and Exchange Commission (SEC) in 2023. The United States Securities and Exchange Commission (SEC) has lost about three times to the crypto firm this year.

In October 2021, Novogratz claimed that the asset’s value had tripled since the SEC’s actions. “It’s evidence that communities are incredibly resilient once they are established around shared interests,” he added.

Now, Mike Novogratz continued by praising the whole Ripple team and CEO Brad Garlinghouse. In addition, he also recognized Ripple’s development into a powerful player in the payment industry.

The Galaxy Digital CEO Confirms XRP’s Army Is “Real”

Furthermore, he also gave the “XRP Army” direct recognition, emphasizing the emotional community actively advancing and supporting its ecosystem. He confirmed the reality of the army while noting that they care about their asset and ecosystem. He stated:

Hats off to Brad Garlinghouse and his team, Ripple is now an institution. The XRP army is real, they care about their ecosystem and their coin.

Novogratz highlighted that the crypto asset presents use cases like Bitcoin (BTC). Due to this, it provides another “alternative for people who want to store value.”

So far, Mike Novogratz’s recent optimism about the asset has generated much interest in its community. Prominent XRP influencer Crypto Eri highlighted Novogratz’s remark regarding the digital asset in a post.

In a mocking response to Crypto Eri’s tweet, someone asked whether Novogratz had joined the ranks of XRP investors. He further asked whether he was still “confused” about its mission.

Featured image from Shutterstock, chart from Tradingview.com

Bitcoin ETFs will drive institutional adoption in 2024 — Galaxy Digital’s Mike Novogratz

Galaxy Digital founder Mike Novogratz has told investors that 2024 will be headlined by institutional adoption of cryptocurrencies, which will be driven by the pending approval of Bitcoin (BTC) spot exchange-traded funds (ETFs).

During Galaxy Digital’s third-quarter earnings call on Nov. 9, Novogratz highlighted the firm’s belief that approving several ETFs “is now not a matter of if but when.” The fund manager filed its spot Bitcoin and Ether (ETH) ETF applications with the United States Securities and Exchange Commission in partnership with Invesco in Q3 2023.

Related: Bitcoin briefly tops $37K amid market optimism for pending spot ETF approvals

Investors’ sentiment has turned bullish in November 2023, with prominent ETF research analysts predicting the SEC will have approved 12 major Bitcoin spot ETF applications by January 2024.

“2024 literally is going to be a year of institutional adoption, primarily first through the Bitcoin ETF, which will be followed by an Ethereum ETF,” Novogratz said during the Q3 earnings call.

“As institutions get more comfortable, if the government gives its seal of approval that Bitcoin is a thing, you are going to see the rest of allocators starting to look at things outside of that. And so, money will flow into the space.”

Novogratz added that institutional investment could come to a head in 2025 as investments “in tokenization and wallets” ramp up. The Galaxy Digital CEO added that a key focus for the U.S. landscape should be ensuring that dollar-backed stablecoins remain a central cog in the wider cryptocurrency ecosystem.

“We are going to continue to be dollar-dominant. We better have a dollar-backed stablecoin that reflects our values and is taken up around the world.”

According to Novogratz, a Bitcoin ETF will bring a measure of institutional confidence and a significant amount of funding to the cryptocurrency space.

“This ETF is giving us all breathing space, putting life in the system. That brings in capital that allows the rest of the stuff to flourish. But I think if you look at the crypto long-term plan, it’s on target,” he added.

The potential influence of an Ether spot ETF was also brought up during the investor call. Galaxy Digital’s CEO said its possible approval might not be as well received as a Bitcoin ETF, given that Ethereum’s validating model is based on a staking model and staking yields.

Related: CME overtakes Binance to grab largest share of Bitcoin futures open interest

“Unless they can figure out an ETF that actually passes through the staking rewards, it will be kind of a subpar product from just owning Ethereum with someone like us and having it staked,” Novogratz explained.

He added that the technical difference would be significant if investors were looking at yields between 4% and 7%, depending on the method of staking. Utility remains an important factor, with Novogratz stressing that different blockchains and their native tokens need to “serve a purpose” and have “stuff built on them” to sustain long-term value.

Magazine: Exclusive: 2 years after John McAfee’s death, widow Janice is broke and needs answers

Invesco and Galaxy’s spot Bitcoin (BTC) exchange-traded fund (ETF) ticker BTCO has appeared on the website of the U.S. Depository Trust and Clearing Corporation (DTCC).

While it was unclear when the listing occurred, Web archive records suggest it happened after Oct. 25. This means Invesco Galaxy’s BTCO joins BlackRock’s IBTC, which also recently appeared on the site, sparking speculations within the community.

The DTCC is a prominent post-trade settlement house, managing trillions of dollars in daily securities transactions worldwide. In 2022, the company handled an impressive $2.50 quadrillion in securities assets, according to Reuters.

DTCC listing does not equal approval

Amid ongoing anticipation within the crypto community regarding the numerous ETF applications, it’s important to note that a presence on the DTCC website doesn’t signify approval from the U.S. Securities and Exchange Commission (SEC), according to a DTCC spokesperson.

According to the company, the recent ticker listing of the spot BTC ETF applications is “standard practice in preparation for an ETF’s launch.”

Meanwhile, both ETF products are marked with an “N” designation in their “Create/Redeem” status.

James Seyffart, an ETF analyst at Bloomberg, explained that this tag signifies whether the products are currently open for creation and redemptions. Additionally, he noted that it suggests the applicants’ preparedness to launch immediately upon approval.

However, Eric Balchunas, a Senior ETF analyst at Bloomberg, raised concerns regarding this tag. He pointed out that some active ETFs on the list also bear the “N” designation.

The post Invesco and Galaxy spot Bitcoin ETF ticker seen on DTCC list appeared first on CryptoSlate.

Asset managers keep pursuing digital asset products, with Invesco and Galaxy Digital allegedly filing for a spot Ether (ETH) exchange-traded fund (ETF) on Sept. 29.

Bloomberg ETF analyst James Seyffart disclosed the filing on X (formerly Twitter), even though the application hadn’t been uploaded to the SEC’s public database at the time of writing.

Invesco Galaxy just filed for a spot Ether ETF, I think this is the 3rd of 4th one of these, have to check tho.. pic.twitter.com/SIJVu8VzFk

— Eric Balchunas (@EricBalchunas) September 29, 2023

A spokesperson for Invesco declined to confirm the application, stating that products still being registered cannot be commented on. Cointelegraph reached out to Galaxy but did not immediately receive a response.

With the Sept. 29 filing, Invesco and Galaxy join a growing line of investment managers seeking regulatory approval for a spot ETH ETF. On Sept. 27, the SEC delayed decisions on previous applications from ARK 21Shares and VanEck, extending the deadline until Dec. 25–26. “The Commission finds it appropriate to designate a longer period within which to take action on the proposed rule change so that it has sufficient time to consider the proposed rule change and the issues raised therein,” said the SEC.

Although a spot Ether ETF may not be available for a while, futures-based Ether ETFs should be available as soon as next week. On Sept. 28, investment firms started gearing up to add ETH futures vehicles to their portfolios. VanEck, for instance, published a statement about its upcoming Ethereum Strategy ETF — tickered EFUT — which will be listed on the Chicago Board Options Exchange in the coming days.

Another company debuting a futures crypto ETF is Valkyrie. The asset manager will begin offering exposure to Ether futures through its existing Bitcoin Strategy ETF, now rebranded as Valkyrie Bitcoin and Ether Strategy ETF. A Valkyrie spokesperson told Cointelegraph that the firm’s Bitcoin Strategy ETF will allow investors access to Ether and Bitcoin (BTC) futures “under one wrapper.”

Likewise, Bitwise submitted an updated prospectus for their equal-weight Bitcoin and Ether futures ETF on Sept. 28, which is also expected to go live next week. According to Seyffart, Proshares also applied and Kelly ETFs partnered with Hashdex to deliver futures Ether ETFs in the coming days.

Ether is trading in the green at the time of writing at $1,666, driven by euphoria over the debut of futures ETFs.

Magazine: Are DAOs overhyped and unworkable? Lessons from the front lines

FTX files motion for Galaxy Digital to manage recovered crypto holdings

On Aug. 24, the company filed a motion with the United States District Court for the District of Delaware seeking authorization and approval of guidelines for the sale of digital assets recovered during ongoing bankruptcy proceedings.

The filing outlines FTX’s requests and plans to transfer some $7 billion worth of recovered cryptocurrency tokens under Galaxy Digital’s management following the exchange’s collapse in 2022.

Related: FTX releases restructuring plan, hints at rebooted offshore exchange

FTX intends to provision for the potential sale of its cryptocurrency holdings and stake tokens through Galaxy Digital, as set out in its preliminary statement. The filing notes a “comprehensive management and monetization plan” for its cryptocurrency holdings that intends to reduce exposure to volatility and potential fiat repayments to creditors.

FTX intends to retain Galaxy Digital as a registered investment adviser, tapping into its “specialized knowledge” of digital asset markets to assist the company in maximizing the value of its token portfolio.

The company noted a number of potential benefits of the partnership, including being able to anonymously sell its holdings into the markets and mitigate the risk of market manipulation.

“Similarly, the Debtors expect that the Investment Adviser’s expertise will be crucial in assessing the timing, trading venues and counterparties of potential transactions.”

FTX notes that the general investment guidelines will see Galaxy Digital sell various FTX-owned digital assets in the future, as well as being responsible for hedging Bitcoin (BTC) and Ether (ETH) before any potential sales.

FTX will look to sell its crypto holdings for fiat to reduce exposure to market volatility while taking advantage of liquid hedging markets for Bitcoin and Ether to lessen exposure to unexpected price fluctuations before their sale.

Decentralized Finance also gets a nod in the filing, with FTX noting that it intends to stake certain cryptocurrencies to generate passive yield income under the guidance of Galaxy Digital:

“The debtors submit that staking certain digital assets pursuant to the staking method will inure to the benefit of the estate – and, ultimately, creditors – by generating low risk returns on their otherwise idle digital assets.”

As bankruptcy proceedings continue, FTX recently filed a proposed restructuring plan that hints at creating a rebooted offshore exchange. This could see creditors be given the option to get a portion of their lost funds or opt for a share of equity, tokens and other interests in an FTX reboot.

Collect this article as an NFT to preserve this moment in history and show your support for independent journalism in the crypto space.

Magazine: Can you trust crypto exchanges after the collapse of FTX?

Galaxy Digital wins dismissal of BitGo lawsuit, looks to non-US markets amid ‘legislative stalemate’

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Oops…you must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.