Data shows that U.S. spot bitcoin exchange-traded funds (ETFs) experienced negative outflows on Friday, totaling $55.1 million, with Grayscale’s Bitcoin Trust (GBTC) seeing another notable decrease. Metrics from Thursday reveal GBTC held 316,193.43 bitcoins, but after a decline of 2,048.23 bitcoins, the fund’s holdings reduced to 314,145.2 bitcoins. Blackrock and Fidelity Absorb Bitcoin Despite GBTC’s […]

Data shows that U.S. spot bitcoin exchange-traded funds (ETFs) experienced negative outflows on Friday, totaling $55.1 million, with Grayscale’s Bitcoin Trust (GBTC) seeing another notable decrease. Metrics from Thursday reveal GBTC held 316,193.43 bitcoins, but after a decline of 2,048.23 bitcoins, the fund’s holdings reduced to 314,145.2 bitcoins. Blackrock and Fidelity Absorb Bitcoin Despite GBTC’s […]

Source link

GBTC

Quick Take

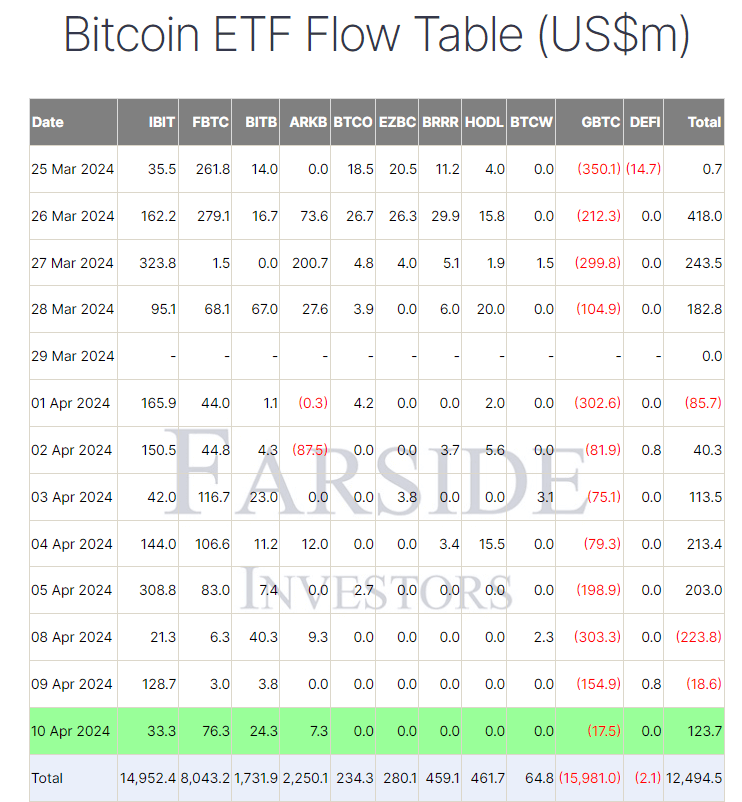

Farside data indicates that Bitcoin (BTC) Exchange-Traded Funds (ETFs) experienced a significant inflow of $123.7 million on Apr. 10, following a period of consecutive outflows. Notably, the Grayscale GBTC ETF saw its lowest outflow at just $17.5 million since launch. However, its total outflows reached $15,981.0 billion.

Farside data highlights that among the BTC ETFs, including BlackRock IBIT, Fidelity FBTC, ARK’s ARKB, and Bitwise BITB, which have seen the most significant inflows, only these four registered positive inflows on Apr. 10. Leading the group was FBTC, with an inflow of $76.3 million, its largest since Apr. 5, pushing its total inflows to $8,043.2 billion. The total net inflows to Bitcoin ETFs now stand at $12,494.5 billion.

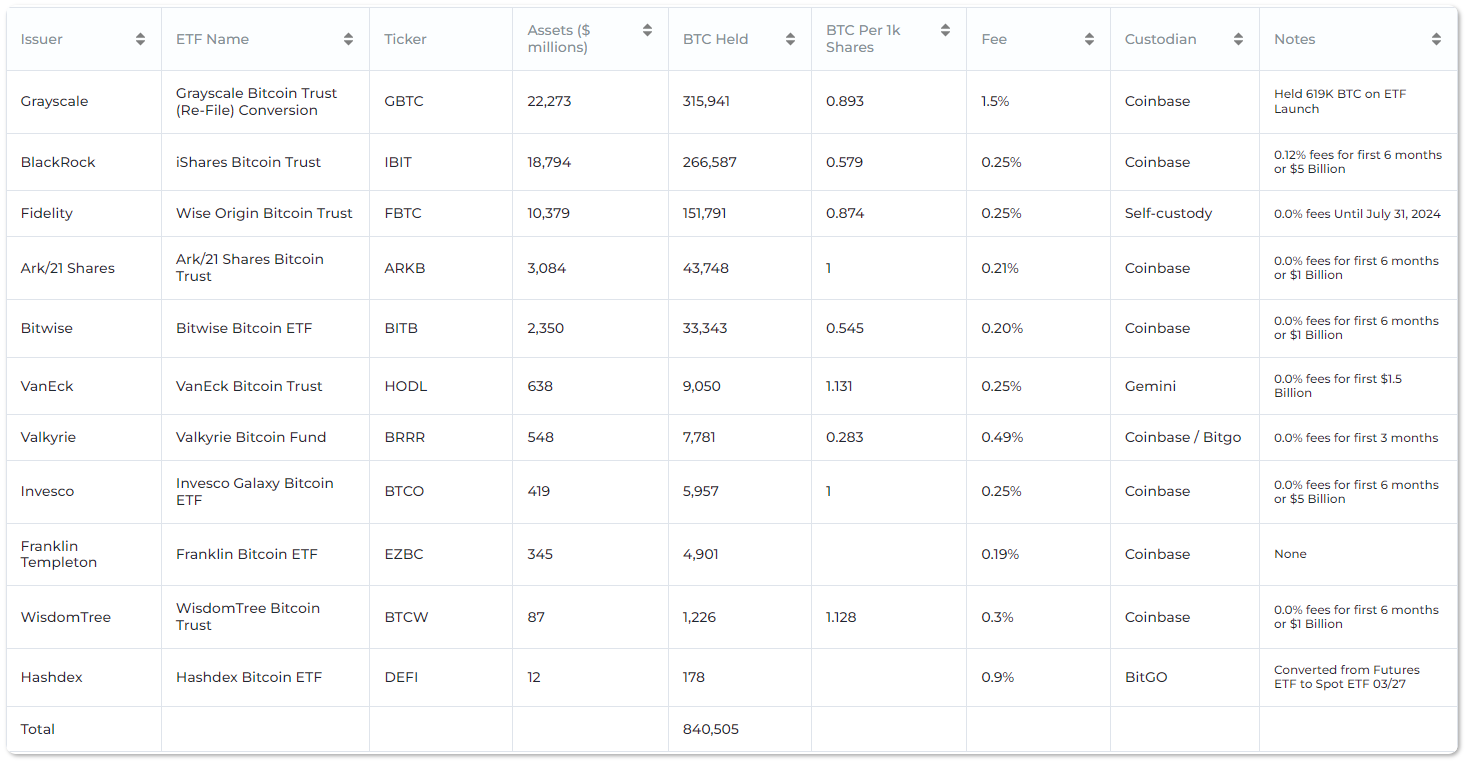

According to Heyappollo data, the eleven US spot BTC ETFs collectively hold 840,505 BTC.

The post GBTC ETF records lowest outflow since launch: $17.5 Million appeared first on CryptoSlate.

US Spot Bitcoin ETFs Record $19.4 Million in Outflows, GBTC Holdings Decline

U.S. spot bitcoin exchange-traded funds (ETFs) experienced another round of net withdrawals, documenting a $19.4 million decrease. The holdings of GBTC diminished from 322,697.17 bitcoins to 318,451.70. U.S. Spot Bitcoin ETF Landscape: Outflows Continue to Persist On April 8, 2024, the U.S. spot bitcoin ETFs saw a substantial $223.8 million in outflows, and on April […]

U.S. spot bitcoin exchange-traded funds (ETFs) experienced another round of net withdrawals, documenting a $19.4 million decrease. The holdings of GBTC diminished from 322,697.17 bitcoins to 318,451.70. U.S. Spot Bitcoin ETF Landscape: Outflows Continue to Persist On April 8, 2024, the U.S. spot bitcoin ETFs saw a substantial $223.8 million in outflows, and on April […]

Source link

Embattled crypto lender Genesis Global Capital has continued to ramp up efforts to pay up creditors after filing for bankruptcy protection in January 2023. As part of these efforts, Genesis has now reportedly sold off the entirety of its Grayscale GBTC holdings to acquire a substantial amount of Bitcoin in order to implement its repayment strategy.

Genesis Converts GBTC Shares To Bitcoin In Preparation For Debt Settlement

According to a Friday report by Bloomberg Law, Genesis finalized the sale of its 36 million GBTC shares, as revealed by the company’s lawyers in a court filing on April 2. Genesis had initially received legal approval to liquidate its GBTC holdings on February 2 with each unit share valued at $38.50. However, court documents showed that the current price of GBTC as at the time of sale on April 2 was $58.50 resulting in a total sale price of $2.1 billion.

Bloomberg’s report disclosed that the bankrupt crypto lender then used these proceeds to purchase 32,041 Bitcoin at a market price of $65,685, which will be distributed to creditors as part of its repayment plan, especially those who were previously enrolled in the Gemini Earn program.

These recent transactions align with Genesis’s bankruptcy plan which allows the conversion of GBTC shares to either Bitcoin or direct cash for the settlement of its existing debt. Currently, the crypto lender owes $3.5 billion to creditors and will commence repayment following court approval.

However, Genesis faces fierce opposition from its parent company, Digital Currency Group (DCG), over its proposed repayment plan. In a petition filed in February, DCG argues that its bankrupt subsidiary looks to settle creditors’ claims at amounts higher than their respective entitlement.

DCG believes such a repayment strategy violates the Bankruptcy Code and is “unfair” since it will only benefit senior creditors who will largely gain from an appreciation in Genesis’s crypto assets value while equity holders and company stakeholders are left in unfavorable positions.

Founded in 2013, Genesis is one of the prominent crypto firms to file for bankruptcy. Its insolvency is largely linked to the sudden collapse of the defunct crypto exchange FTX.

Bitcoin Price Overview

In other news, Bitcoin gained by 2.55% in the last day to reach a price of $69,339. Such price gain would be encouraging to investors especially following the token’s overall negative performance in the past week. On higher timeframes, BTC largely remains largely bullish as anticipation continues to build ahead of the halving event on April 19. The fourth halving in Bitcoin’s history is expected to reduce the mining reward from 6.25 BTC to 3.125 BTC.

BTC trading at $69,314 on the daily chart | Source: BTCUSDT chart on Tradingview.com

BTC trading at $69,314 on the daily chart | Source: BTCUSDT chart on Tradingview.com

Featured Image from Nairametrics, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

US Bitcoin ETFs See $85.7M Outflow After 4 Days of Gains; Grayscale’s GBTC Leads the Dip

After four days of consecutive inflows, the U.S. spot bitcoin exchange-traded funds (ETFs) experienced a downturn, with $85.7 million flowing out during Monday’s trading hours. U.S. Spot Bitcoin ETFs’ Momentum Halted With $85.7M in Outflows, Spotlight on GBTC Between March 25 and March 28, 2024, the U.S. spot bitcoin ETFs enjoyed an upward trend, amassing […]

After four days of consecutive inflows, the U.S. spot bitcoin exchange-traded funds (ETFs) experienced a downturn, with $85.7 million flowing out during Monday’s trading hours. U.S. Spot Bitcoin ETFs’ Momentum Halted With $85.7M in Outflows, Spotlight on GBTC Between March 25 and March 28, 2024, the U.S. spot bitcoin ETFs enjoyed an upward trend, amassing […]

Source link

First back-to-back net outflows for Bitcoin ETFs since late January due to $443 million GBTC outflow

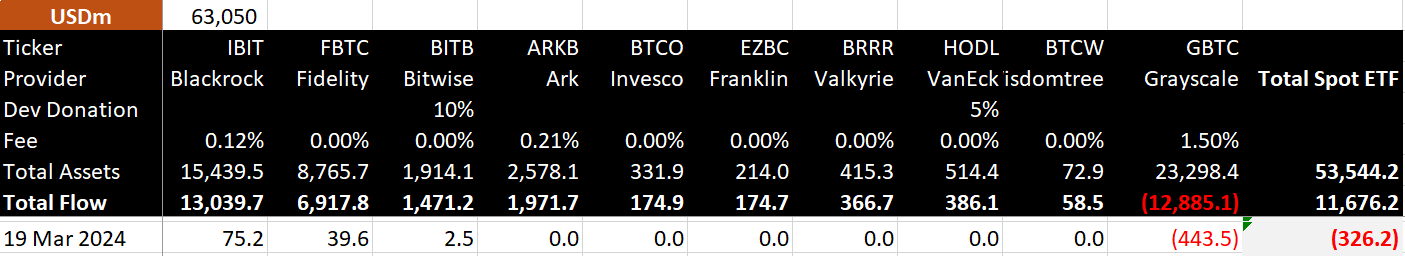

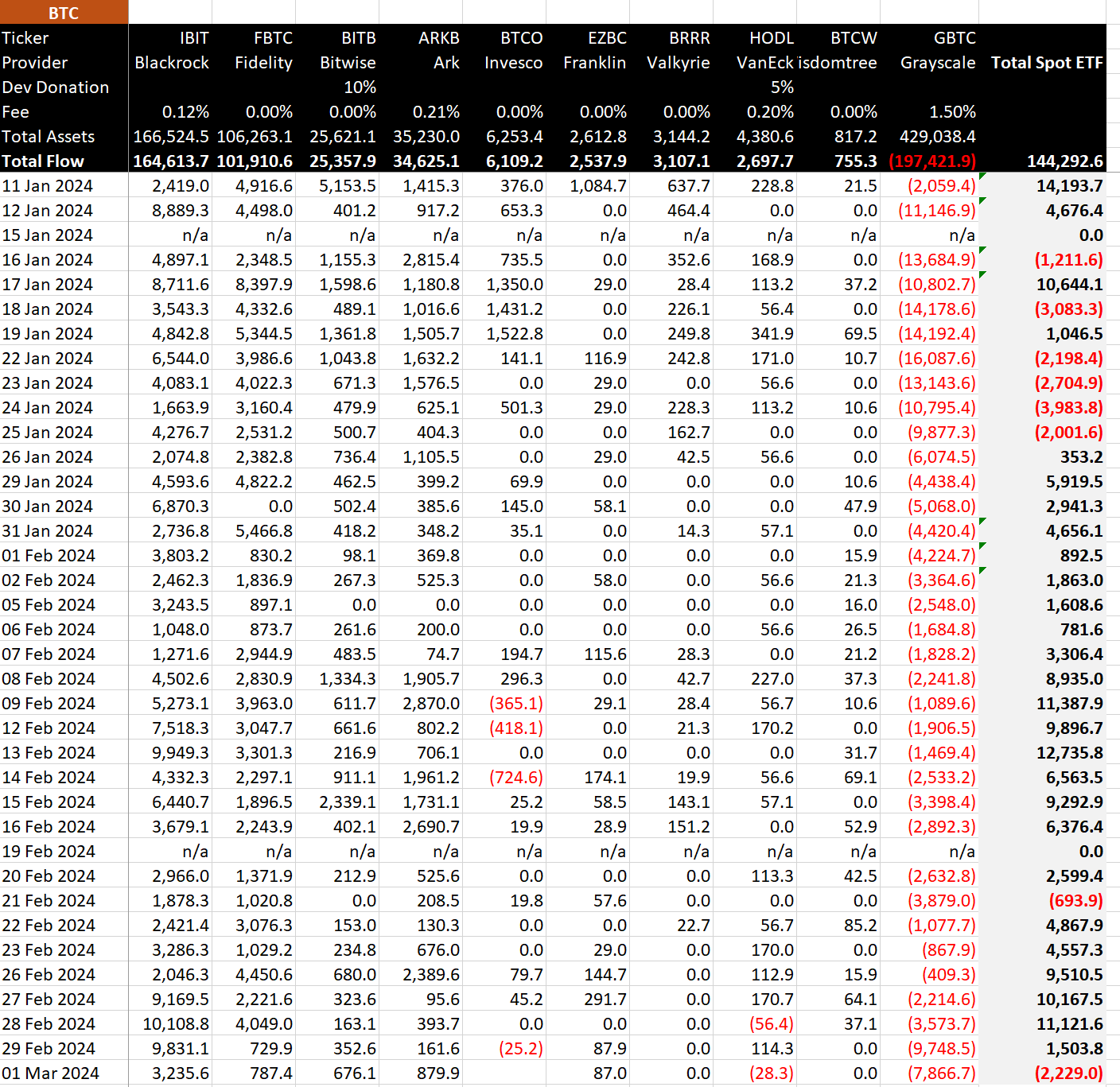

Bitcoin ETFs saw a second day of outflows on March 19, the first instances of back-to-back outflows since Jan 25. Net outflows totaled $362 million, with Grayscale accounting for all outflows at $443 million. Most funds saw no net movement, with BlackRock, Fidelity, and Bitwise seeing inflows, according to Bitmex Research.

BlackRock recorded just $75 million, Fidelity $39 million, and Bitwise $2.5 million in inflows on a rare poor performance day for the record-breaking Newborn Nine.

On a positive note, while Bitcoin fell approximately 9% on the day, the net outflows amounted to only 2.7% of total inflows since launch and 0.6% of total assets under management.

Further, $117 million was added to funds on a confidently ‘red’ day for Bitcoin. BlackRock, Fidelity, Bitwise, Ark Invest, Franklin Templeton, and Valkyrie are yet to post a single day of net outflows from their funds, regardless of volatility.

The lack of outflows from many funds can be seen as a bullish indicator, as authorized participants appear reluctant to sell Bitcoin even at prices above $60,000.

The post First back-to-back net outflows for Bitcoin ETFs since late January due to $443 million GBTC outflow appeared first on CryptoSlate.

9 New Bitcoin ETFs Surpass GBTC by Accumulating 450,000 BTC Worth Over $30B

The latest statistics on bitcoin reserves from the nine new spot bitcoin exchange-traded funds (ETFs) reveal they currently possess 453,503.98 bitcoins, valued at approximately $30.29 billion based on the current exchange rates. The 9 New ETFs Hold Nearly a Half Million Bitcoin Since their inception on Jan. 11, 2024, these nine spot bitcoin ETFs have […]

The latest statistics on bitcoin reserves from the nine new spot bitcoin exchange-traded funds (ETFs) reveal they currently possess 453,503.98 bitcoins, valued at approximately $30.29 billion based on the current exchange rates. The 9 New ETFs Hold Nearly a Half Million Bitcoin Since their inception on Jan. 11, 2024, these nine spot bitcoin ETFs have […]

Source link

GBTC AUM sees modest $1.6 billion drop post-ETF launch, despite major outflows

Quick Take

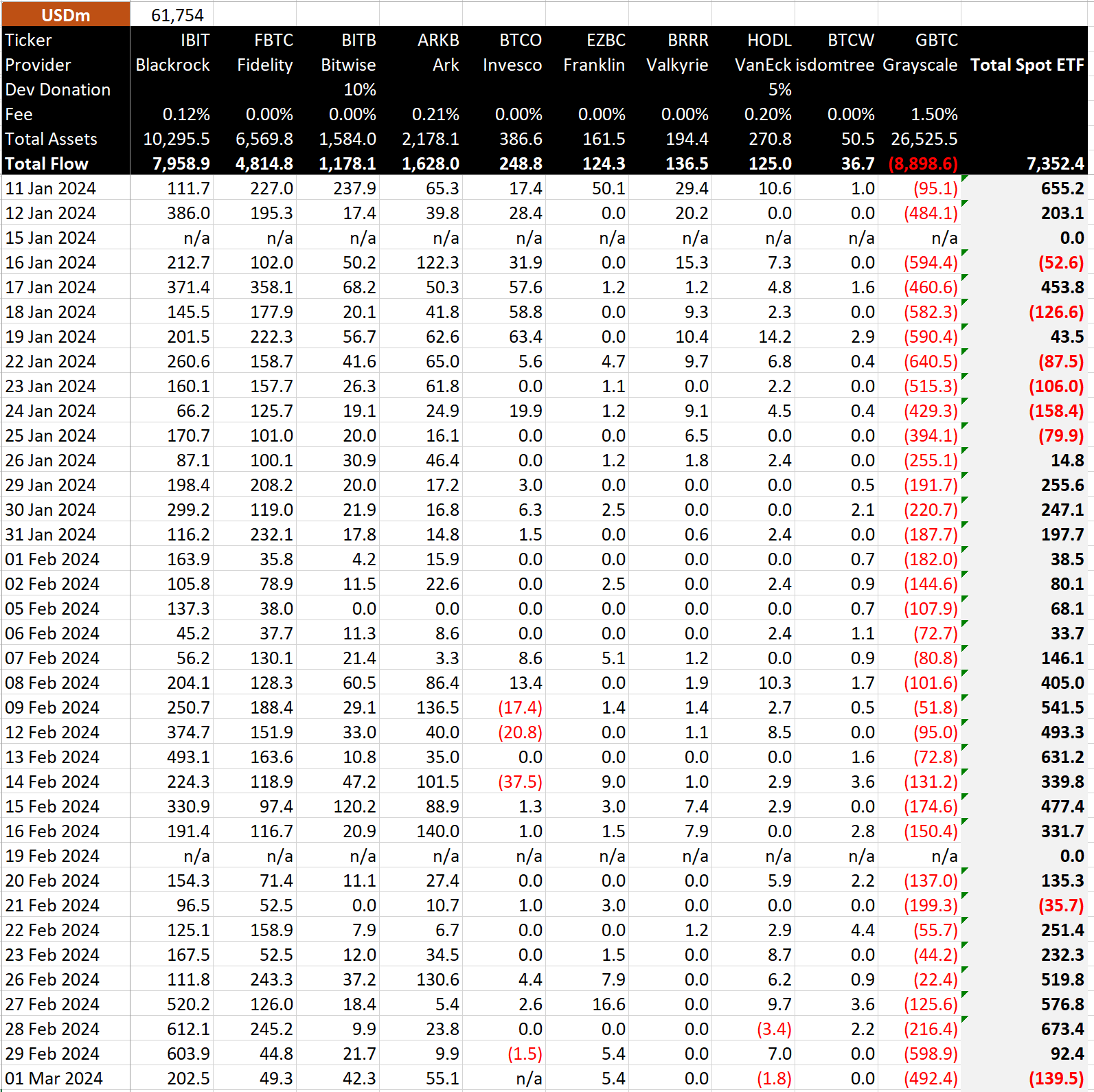

Data from BitMEX shows March began with the first total outflow since Feb. 21. The day saw an outflow of $140 million, significantly impacted by a massive $492 million outflow from the Grayscale Bitcoin Trust (GBTC), marking one of the largest single-day outflows.

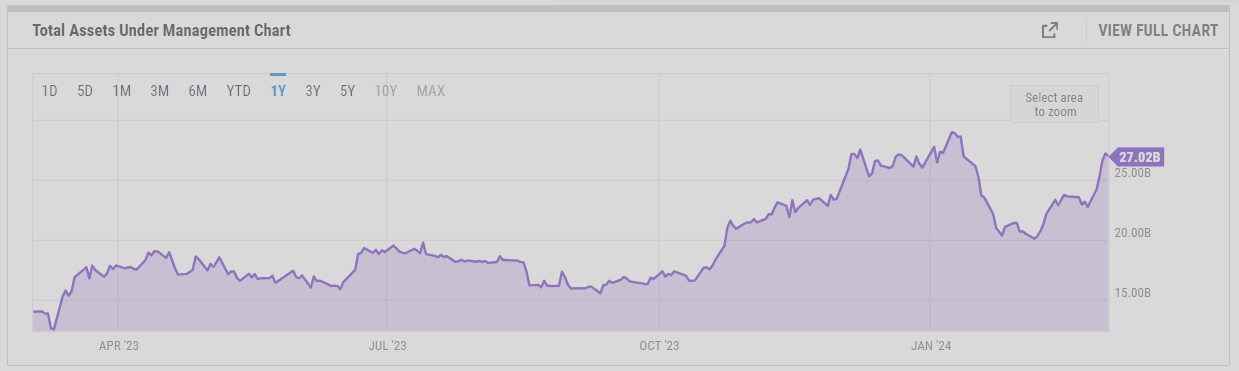

According to BitMEX data, the Grayscale Bitcoin Trust (GBTC) has experienced outflows totaling $8.9 billion. Despite this significant outflow, the assets under management (AUM) of GBTC only decreased by $1.6 billion, moving from $28.6 billion to $27 billion, as reported by ycharts.

This relatively small decrease in AUM, in the face of large outflows, can be attributed to the increase in Bitcoin’s price, which rose from $49,000 to $65,000 since the ETF was launched on Jan. 11.

Despite these outflows, GBTC maintains a strong market presence with a 55% share, though down from 100% two months ago, as noted by ETF Store President Nate Geraci.

Furthermore, GBTC’s annual fee revenue stands at a significant $398 million, dwarfing the $53 million from the nine new ETFs, not including fee waivers, according to Geraci.

Meanwhile, BlackRock’s IBIT saw much quieter inflows of $203 million on Mar. 1, following consecutive record-breaking days. These inflows have taken their total net inflow to $8 billion, roughly equivalent to holding 165,000 Bitcoin, according to BitMEX.

BitMEX has noted that Invesco Galaxy Bitcoin ETF (BTCO) has not disclosed its data for Mar. 1.

The post GBTC AUM sees modest $1.6 billion drop post-ETF launch, despite major outflows appeared first on CryptoSlate.

Despite $7 billion GBTC outflow, Bitcoin ETFs net $4.9 billion since January

Quick Take

BitMEX’s data analysis presents a clear picture of the recent Bitcoin inflows and outflows into the ETFs. The Bitcoin ETFs experienced a significant inflow of $331 million on Feb. 16, contributing to a weekly net flow of $2.273 billion. This robust inflow marks a continued trend since Jan. 11, with the total net flow reaching a substantial $4.926 billion, according to BitMEX data.

BlackRock IBIT has been a core player leading these inflows, contributing $191 million on Feb. 16 and bringing its total inflows to a hefty $5.4 billion. Conversely, GBTC experienced outflows of $150 million, pushing its total outflows to $7 billion, according to BitMEX data.

In Bitcoin terms, BitMEX reports a net inflow of 6,376 BTC on Feb. 16, 44,865 BTC for the week of Feb 12. to Feb 16, and a total of 102,888 BTC since Jan. 11, 2024.

Meanwhile, according to Bytetree, the global ETPs hold approximately 947,000 BTC. Over the past seven days, ByteTree data indicates an addition of 47,500 BTC.

The post Despite $7 billion GBTC outflow, Bitcoin ETFs net $4.9 billion since January appeared first on CryptoSlate.

In his latest essay, Arthur Hayes, the founder of BitMEX, articulates a contrarian perspective on the recent downturn in Bitcoin’s price, refuting the mainstream narrative that attributes the decline to outflows from the Grayscale Bitcoin Trust (GBTC). Instead, Hayes points to macroeconomic maneuvers and monetary policy shifts as the real drivers behind Bitcoin’s volatility.

Monetary Policy And Market Reactions

Hayes kickstarts his analysis by shedding light on the US Treasury’s recent strategic shift in borrowing, a decision announced by Janet Yellen on November 1. This pivot towards Treasury bills (T-bills) has triggered a substantial liquidity injection, compelling money market funds to reallocate their investments from the Fed’s Reverse Repo Program (RRP) to these T-bills, offering higher yields.

Hayes articulates the significance of this move, stating, “Yellen acted by shifting her department’s borrowing to T-bills, thus adding hundreds of billions of dollars’ worth of liquidity so far.” However, he contrasts this tangible financial maneuver with the Federal Reserve’s mere rhetoric about future rate cuts and the tapering of quantitative tightening (QT), pointing out that these discussions have not translated into actual monetary stimulus.

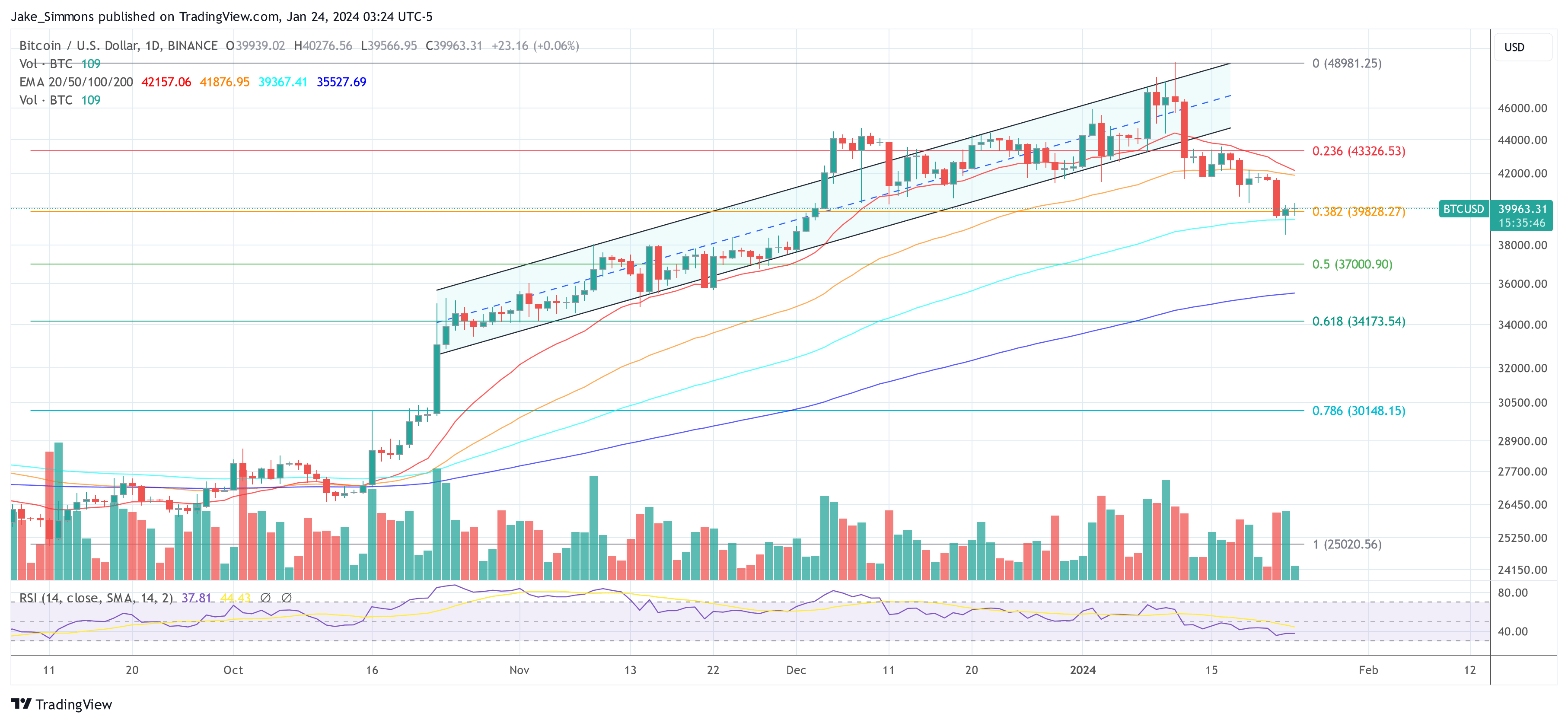

While the traditional financial markets, particularly the S&P 500 and the Nasdaq 100, responded positively to these developments, Hayes argues that Bitcoin’s recent price trajectory serves as a more accurate barometer of the underlying economic currents. He remarks, “The real smoke alarm for the direction of dollar liquidity, Bitcoin, is throwing a cautionary sign.”

He notes the cryptocurrency’s decline from its peak and correlates it with the fluctuations in the yield of the 2-year US Treasury, suggesting a deeper economic interplay at work. “Coinciding with Bitcoin’s local high, the 2-year US Treasury yield hit a local low of 4.14% in mid-January and is now marching upwards,” Hayes remarked.

Dissecting True Reasons Behind The Bitcoin Dip

Addressing the narrative surrounding GBTC, Hayes emphatically dismisses the notion that outflows from GBTC are the primary catalyst for Bitcoin’s price movements. He clarifies, “The argument for Bitcoin’s recent dump is the outflows from the Grayscale Bitcoin Trust (GBTC). That argument is bogus because when you net the outflows from GBTC against the inflows into the newly listed spot Bitcoin ETFs, the result is, as of January 22nd, a net inflow of $820 million.”

This realization shifts the focus to economic mechanisms at play. The crux of Hayes’s argument lies in the anticipation surrounding the Bank Term Funding Program (BTFP)‘s expiration and the Federal Reserve’s hesitancy to adjust interest rates to a range that would alleviate the financial strain on smaller, non-Too-Big-to-Fail (TBTF) banks.

Hayes elucidates, “Until rates are reduced to the aforementioned levels, there is no way these banks can survive without the government support provided via the BTFP.” He predicts a looming mini-financial crisis in the event of the BTFP’s cessation, which he believes will compel the Federal Reserve to pivot from rhetoric to tangible action—namely, rate cuts, a tapering of QT, and potentially a resumption of quantitative easing (QE).

“I believe Bitcoin will dip before the BTFP renewal decision on March 12th. I didn’t expect it to happen so soon, but I think Bitcoin will find a local bottom between $30,000 and $35,000. As the SPX and NDX dump due to a mini financial crisis in March, Bitcoin will rise as it will front-run the eventual conversion of rate cuts and money printing talk on behalf of the Fed into the action of pressing that Brrrr button,” Hayes writes.

Strategic Trading Moves In A Turbulent Market

In a revealing glimpse into his tactical trading strategies, Hayes shares his approach to navigating the tumultuous market landscape. He discloses his positions, including the purchase of puts and the strategic adjustment of his BTC holdings. He concludes:

A 30% correction from the ETF approval high of $48,000 is $33,600. Therefore, I believe Bitcoin forms support between $30,0000 to $35,000. That is why I purchased 29 March 2024 $35,000 strike puts. […] Bitcoin and crypto in general are the last freely traded markets globally. As such, they will anticipate changes in dollar liquidity before the manipulated TradFi fiat stock and bond markets. Bitcoin is telling us to look for Yellen and not Talkin’.

At press time, BTC traded at $39,963.

Featured image created with DALL·E, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.