In recent times, bitcoin has consistently remained above the $60,000 mark throughout the entire month of March. With its value soaring, many long-standing holders have started to transfer substantial quantities of dormant bitcoins from wallets that have not seen activity for years. March has emerged as a pivotal month for transactions involving these vintage bitcoins. […]

In recent times, bitcoin has consistently remained above the $60,000 mark throughout the entire month of March. With its value soaring, many long-standing holders have started to transfer substantial quantities of dormant bitcoins from wallets that have not seen activity for years. March has emerged as a pivotal month for transactions involving these vintage bitcoins. […]

Source link

giants

EU launches inquiry into how tech giants are dealing with risks posed by AI

The European Commission has initiated a comprehensive inquiry into the risks posed by generative AI technology on some of the world’s largest online platforms and search engines.

The March 14 request targets eight online services: Google Search, Microsoft Bing, Facebook, X, Instagram, Snapchat, TikTok, and YouTube.

The European Commission said:

“The questions relate to both the dissemination and the creation of Generative AI content.”

These platforms have been requested to furnish detailed information on their risk management strategies, particularly in relation to AI-induced “hallucinations,” the spread of deepfakes, and the automated manipulation of content that could potentially mislead voters.

The Commission’s inquiry extends to a broad spectrum of concerns, including the impact of generative AI on electoral integrity, the spread of illegal content, the safeguarding of fundamental rights, gender-based violence, child protection, and mental health. The request encompasses both the creation and dissemination of content generated by AI technologies.

The partial focus on election issues follows the agency’s broader efforts to mitigate the risks posed by the rise of AI, including the introduction of the Digital Services Act (DSA).

The DSA mandates Very Large Online Platforms (VLOPs) and Very Large Online Search Engines (VLOSEs) to adhere to a comprehensive set of regulations designed to combat the dissemination of illegal content and mitigate any adverse effects on fundamental rights, electoral processes, mental well-being, and child protection.

Responses due in April

Each service must provide the requested information regarding elections by April 5 and must provide information regarding other categories by April 26.

Failure to provide accurate, complete, and transparent information may result in substantial penalties. The Commission has emphasized its authority to impose fines for any responses deemed incorrect, incomplete, or misleading.

Additionally, should the platforms fail to respond within the stipulated timeframe, the Commission could enforce compliance through a formal decision-making process, potentially leading to further financial penalties.

This initiative marks a significant step in the enforcement of the DSA and highlights the EU’s commitment to mitigating the risks associated with digital technologies and ensuring a safe online environment.

The news comes months after reports of a separate EU initiative called the Artificial Intelligence Act, which bans certain biometrics applications of AI while carving out exceptions for law enforcement.

Mentioned in this article

Bitcoin Mining Stocks Soar Past $3.5B in Volume, Surpassing Tech Giants

Marathon Digital’s spectacular performance aligns with the broader boom in the Bitcoin mining sector.

In an astonishing turn of events, Bitcoin (BTC) mining stocks experienced an unparalleled jump in trading volumes this week, outperforming some of the world’s greatest tech giants. Marathon Digital Holdings Inc (NASDAQ: MARA) and Riot Platforms Inc (NASDAQ: RIOT), two major players in the Bitcoin mining sector, collectively recorded a staggering $3.55 billion in trading volume on Monday, according to data from Yahoo Finance.

Marathon Digital Takes the Lead

Marathon Digital stole the spotlight by securing the position of the top-traded stock in the United States on Monday. With a trading volume of 112 million total shares, the Bitcoin miner surpassed well-known names such as Tesla Inc (NASDAQ: TSLA), Advanced Micro Devices, Inc (NASDAQ: AMD), Nvidia Corp (NASDAQ: NVDA), and Apple Inc (NASDAQ: AAPL) by a considerable margin. Even Tesla, the second most traded stock in the United States lagged behind with a daily trading volume of approximately 85 million shares.

Simultaneously, Grayscale’s Bitcoin Trust (GBTC) traded close to half a billion on the same day. Industry expert Eric Balchunas pointed out that this volume surpassed over 99% of the 3,000 current Exchange-Traded Funds (ETFs). Notably, Grayscale Investments, the firm behind GBTC, is seeking approval from the Securities and Exchange Commission (SEC) to convert this trust into a spot ETF.

As the market eagerly anticipates the potential approval of spot Bitcoin ETFs, Balchunas noted that GBTC is wielding a remarkable advantage, describing it as “bringing a (volume) gun to a knife fight.” He, however, emphasized that Grayscale’s 1.5% fee will act as a repellent to investors. As a reference, fees from BlackRock Inc (NYSE: BLK) are pegged at 0.30% with many wondering how Grayscale Investments will match up with this competition.

Bitcoin Mining Sector Boom

Marathon Digital’s spectacular performance aligns with the broader boom in the Bitcoin mining sector. On Monday, Core Scientific secured a $55 million equity investment, marking a successful emergence from its debt crisis.

The oversubscribed equity offering positions the company for relisting on the Nasdaq exchange after completing bankruptcy proceedings. Similarly, CleanSpark announced a strategic agreement that could see the acquisition of up to 160,000 miners by the end of 2024, further contributing to the sector’s upward trajectory.

Moreover, Marathon Digital recently disclosed that it mined a whopping 1,853 Bitcoin in December 2023. Marathon’s mining results from last month indicate that it increased production by 56% in just one month. In addition, the company’s production increased by 290% from December 2022 levels.

The extraordinary trading volumes witnessed by Bitcoin mining stocks on January 8 underscore the growing influence of the crypto mining industry. As Marathon Digital and other key players outpace established tech giants, the narrative around Bitcoin continues to evolve.

With the anticipation of spot Bitcoin ETF approvals and ongoing developments within the mining sector, the stage is set for further excitement and exploration of the dynamic intersection between traditional finance and the crypto space.

next

Market News, News, Stocks

You have successfully joined our subscriber list.

Updated Dec. 31, 2023 12:20 am ET

HONG KONG—Investors in China’s biggest internet companies have suffered through a tumultuous 2021, a lackluster 2022 and a disappointing 2023.

After a lousy three years for the once-hot sector, many investors are asking—where do things go from here?

Copyright ©2024 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

Want $300 of Passive Income? Invest $15,000 in These 2 Dow Dividend Giants.

The Dow Jones Industrial Average is a great place to go shopping if you’re an investor seeking passive income. This collection of 30 of the world’s largest publicly traded businesses is packed with companies that have stellar track records for earnings growth. Their dividend yields provide instant cash returns, too, with a high chance of steady annual hikes on the way for many years into the future.

It doesn’t take a very large investment to start to build that income stream, either. With a $15,000 investment split about evenly between Walmart (WMT 0.38%) and Home Depot (HD 0.62%), for example, you’d receive about $300 annually, or 2% on your cost. Here’s why that’s an attractive option for dividend stock investors today.

Walmart is well-positioned

Walmart’s dividend yield is relatively small at 1.5%, but don’t let that issue scare you away from this stock. The retailer is checking all the right boxes for investors, after all.

Sales growth was a healthy 5% year over year in the most recent quarter, putting it well ahead of peers like Target. Shoppers are more focused on saving money and on buying consumer essentials like groceries these days, and that trend favors Walmart’s focus on value.

Look beyond the headline numbers and there’s even better news for this retailer. Walmart’s customer traffic is solidly positive, and shoppers are spending more with each visit. Profit margins are improving as well. Sure, Walmart’s executive team had some cautious comments about short-term growth trends. But its slim inventory holdings and strong traffic trends mean it has a good chance of continuing its positive momentum into 2024 and beyond.

Home Depot will bounce back

It’s understandable that Home Depot stock would trail the market this year as rising interest rates have slowed the housing market. The company has been through many previous downturns, though, including the Great Recession. It emerged from each of these slumps to set new sales records, though. Look for another such rebound ahead, potentially starting in 2024.

Home Depot is expecting comparable-store sales to drop by between 3% and 4% this year, roughly consistent with the declines expected by peer Lowe’s. Yet profits will remain strong.

Home Depot’s operating margin is on track to stay above 14% of sales. Home Depot is also one of the market’s most efficient businesses when it comes to return on invested capital. That’s a sure sign the management team is good at allocating excess cash, whether that means more investments in the e-commerce infrastructure, stock buybacks, or a rising dividend.

Home Depot aims to return 55% of annual earnings to shareholders in the form of dividend payments. That’s more generous than Lowe’s 35% goal and is one reason why its yield is so high.

Sure, the dividend stock might underperform if the economy tilts into a recession in the coming quarters. But that’s a normal part of the retailing world. Income investors can look past those short-term swings to focus on Home Depot’s bright future as it keeps capitalizing on its dominant position in the attractive home improvement industry.

Demitri Kalogeropoulos has positions in Home Depot. The Motley Fool has positions in and recommends Home Depot, Target, and Walmart. The Motley Fool recommends Lowe’s Companies. The Motley Fool has a disclosure policy.

Quick Take

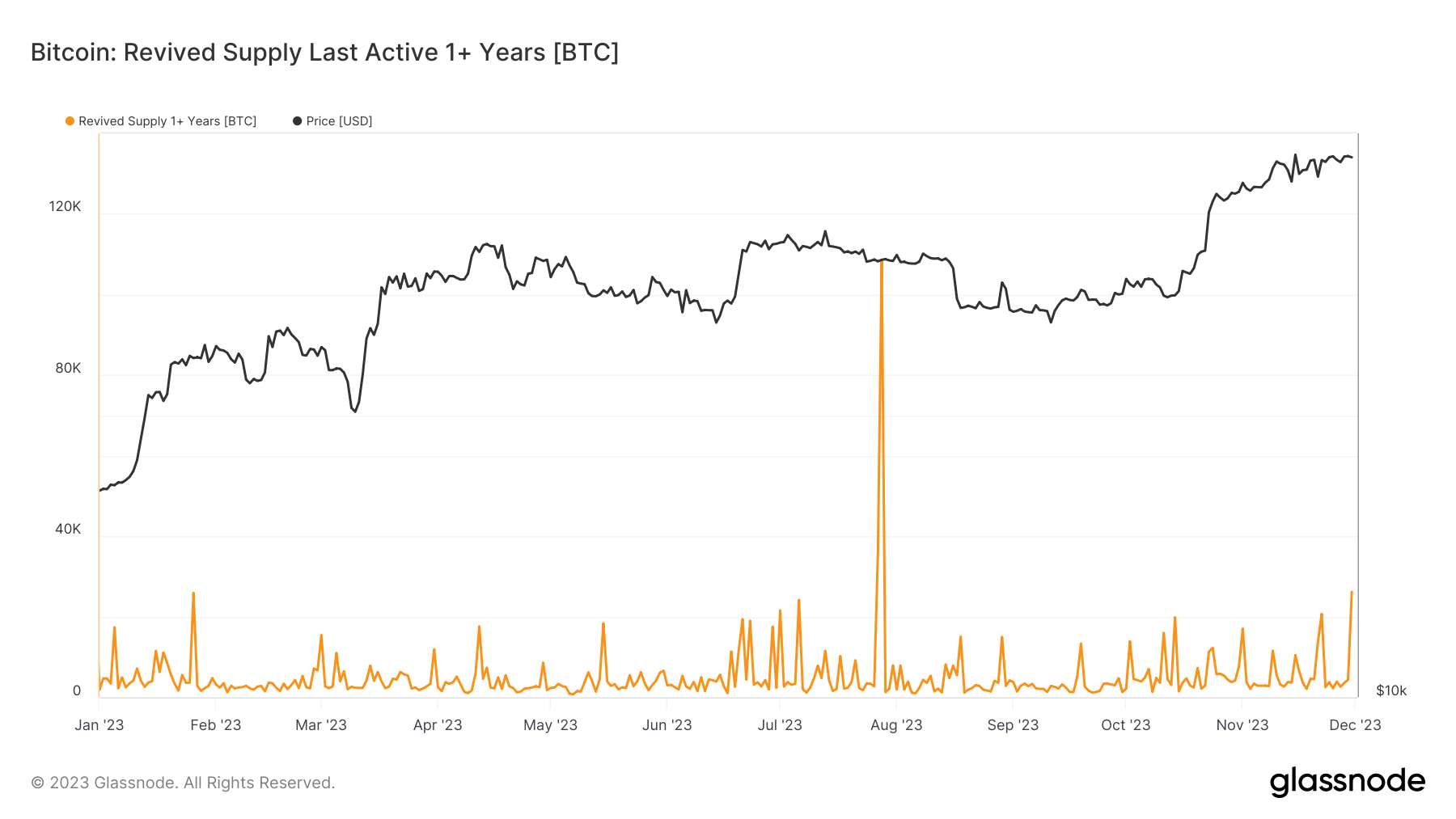

The Bitcoin ecosystem has recently witnessed a noteworthy trend as a substantial quantity of coins, dormant for years, have sprung back into circulation. Data from Glassnode reveals a significant increase in the transfer volume of previously dormant coins for periods of over 1, 2, 3, and 5 years. Approximately 26,000 Bitcoins that were inactive for more than a year have registered movement, marking the second-highest revival this year.

In the 2+ years cohort, a yearly high of around 25,000 Bitcoins returned to circulation. The 3+ and 5+ year cohorts weren’t left behind, revealing an elevated revival of approximately 4,500 and 2,600 Bitcoins, respectively. This emergence coincided with the year-to-date high price of Bitcoin, indicating a correlation between price peaks and the resurrection of dormant coins.

The post Dormant Bitcoin re-enters circulation as sleeping giants stir appeared first on CryptoSlate.

Sam Altman was fired from OpenAI on Friday night, putting one of the most valuable tech start-ups in the world into turmoil. In the fast-moving artificial intelligence industry even a small loss of confidence or talent can change your fortunes.

In this video, Travis Hoium discusses how tech companies may take advantage of the turmoil at OpenAI.

*Stock prices used were end-of-day prices of Nov. 18, 2023. The video was published on Nov. 18, 2023.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Travis Hoium has positions in Alphabet. The Motley Fool has positions in and recommends Alphabet, Amazon, Microsoft, and Oracle. The Motley Fool has a disclosure policy. Travis Hoium is an affiliate of The Motley Fool and may be compensated for promoting its services. If you choose to subscribe through their link they will earn some extra money that supports their channel. Their opinions remain their own and are unaffected by The Motley Fool.

The tech industry was abuzz in 2020 when Nvidia announced its ambitious plan to acquire Arm Holdings from SoftBank for a staggering $40 billion before its planned IPO.

British semiconductor and software design company Arm Holdings plc recently revealed that multiple technology giants, including Apple Inc (NASDAQ: AAPL), Alphabet Inc (NASDAQ: GOOGL), and Nvidia Corp (NASDAQ: NVDA), are interested in purchasing up to $735 million in its shares as it eyes an Initial Public Offering (IPO).

Tech Giants Show Massive Interest in Arm Holdings IPO

While these investments are not certain, their mere consideration highlights Arm’s enormous position in changing the technology world, with its designs powering processors in data center servers, consumer devices, and industrial products.

The impending IPO of Arm Holdings is attracting more attention and intrigue than ever before. Along with Apple, Google’s Alphabet, and Nvidia, a host of semiconductor industry leaders and innovative firms have also expressed an eagerness to invest in Arm.

Notably, Intel Corp (NASDAQ: INTC), Samsung Electronics Co Ltd (KRX: 005930), and Taiwan Semiconductor Manufacturing Co Ltd (TPE: 2330) have joined the race, along with Advanced Micro Devices Inc (NASDAQ: AMD), MediaTek Inc (TPE: 2454), Cadence Design Systems Inc (NASDAQ: CDNS), and Synopsys Inc (NASDAQ: SNPS).

As a result, Arm’s IPO, if successful, could lead to a market capitalization of $52 billion and inject nearly $5 billion in fresh capital into the company. This diversified group of investors emphasizes Arm’s critical role in the semiconductor and technology ecosystem.

Meanwhile, the tech IPO landscape has experienced a noticeable slowdown over the past two years, primarily due to the impact of rising interest rates, which has made investors more cautious about betting on high-growth, high-risk companies.

However, Arm stands out as an exception. Its unique trajectory, from its proposed IPO in London and New York to its acquisition sets it apart from the typical tech IPO narrative.

Nvidia Corp’s Unwavering Backing in Arm

The tech industry was abuzz in 2020 when Nvidia announced its ambitious plan to acquire Arm Holdings from SoftBank for a staggering $40 billion before its planned IPO. However, regulatory hurdles in both the United States and the United Kingdom led to the abandonment of this acquisition in 2022.

Yet, Nvidia’s interest in Arm remains unwavering, and it is evident that the two companies continue to see a promising future together, even if it’s not in the form of a direct merger. Nvidia’s co-founder and CEO, Jensen Huang, has been an enthusiastic advocate for Arm during Arm’s current IPO roadshow.

In a prerecorded video presentation, Huang lavishly praised Arm. He referred to Arm as an “extraordinary company” and highlighted the platform’s value, franchise, and world-class management team. His words resonated with the tech community, emphasizing that Arm’s significance goes far beyond its potential as a merger partner.

Nvidia’s collaboration with Arm extends beyond rhetoric. The company is actively working with Arm on the development of a new cloud data center ecosystem. Historically, Intel’s x86 architecture has been the dominant force in data center servers. However, with Arm’s energy-efficient designs and Nvidia’s computational prowess, this partnership could usher in a new era for data center technology.

The collaboration aligns with the industry’s growing emphasis on energy efficiency, performance, and scalability. Arm’s architecture has already made significant dominance in data center servers, and Nvidia’s involvement could accelerate this trend.

next

Business News, IPO News, Market News, News, Stocks

Benjamin Godfrey is a blockchain enthusiast and journalist who relishes writing about the real life applications of blockchain technology and innovations to drive general acceptance and worldwide integration of the emerging technology. His desire to educate people about cryptocurrencies inspires his contributions to renowned blockchain media and sites.

You have successfully joined our subscriber list.

U.S real estate investment trusts today manage $4.5 trillion in real estate worldwide. Many groups on Wall Street offer these tax-friendly funds to retail investors.

KKR’s real estate business is one of the big players in the REIT game. The private equity firm manages multiple REIT funds. The KKR Real Estate Select Trust, which currently manages $1.5 billion in assets, paid a dividend of 5.4% to its investors in July 2023.

But the benefits extend beyond returns.

“When you look at the after tax equivalent of that yield, it is very compelling.” said Billy Butcher, CEO of KKR’s global real estate business. “The depreciation from our properties has covered 100% of the income generated by our properties, and there’s no tax on that dividend,” he said in an interview with CNBC.

Larger funds sometimes contain a diversified pool of assets. Categories may include office, student housing, casino, timberlands, radio and cell towers, server farms, self-storage properties, billboards, and much more.

“Back in the 1960s, there were three or four different types [of REITs], said Sher Hafeez, a managing director at Jones Lang LaSalle, a real estate services firm. “Now, I can count at least 20 different types.”

Top performing REIT sub-sectors in recent years include data centers, self-storage properties, residential housing and tower REITs. Residential housing delivered a return of 16% from 2010 to 2020, according to a S&P Global Investments report.

The investor-friendly tax rules can also increase the pace of large-scale development.

“Having REITs there as a potential exit helps the market, and helps the availability of financing,” said Michael Pestronk, CEO and co-founder of Post Brothers, a Philadelphia-based housing developer.

Some funds like Invitation Homes and American Homes 4 Rent were founded in the yearslong slowdown in U.S. home construction. At the time, REITs bought and managed commercial-scale properties, which could include products like master-planned communities or traditional apartment complexes.

In recent years, publicly traded trusts have targeted single-family rental market, and today, these REITs have grown tremendously — enough to build new neighborhoods in their entirety.

Watch the video above to learn the fundamentals of real estate investment trusts.

Bitcoin bought by corporate giants should not be feared — Michael Saylor

During a recent podcast interview, MicroStrategy’s Michael Saylor expressed the opinion that large corporations purchasing and holding Bitcoin (BTC) in their custody should not be a cause for concern.

While speaking to Natalie Brunell on the Coin Stories podcast, released on Aug. 7, Saylor emphasized the inevitability of third-party and corporate participation growing in the Bitcoin space.

However, he suggested that while Bitcoin enthusiasts may desire total self-control, or sovereignty, over their Bitcoin, it might not be the only answer, as people will be using Bitcoin for diverse purposes.

“We need to be prepared for Bitcoin to infuse everything,” Saylor stated, explaining that as Bitcoin becomes more integrated into society, it will have many use cases, and there will not be a one-size-fits-all model.

“There are different types of wrappers. Some people will always be self-custody, some will be multisig, some will need a layer-3 custodian. There will be a need for political or utility or functionality purposes.”

Saylor outlined three main reasons underpinning the need for custodians: technical, political and natural.

From a political standpoint, relying on a third party might be the only course of action.

“The mayor of New York is still the mayor of New York. Unless you get rid of New York City, California or Iceland, the country, political reasons will mean the need for custodians.”

Related: Saylor’s MicroStrategy plans $750M stock sale, possibly buying more Bitcoin

On the technical side, there will be people that will want to transact in crypto with their mobile phones, so trusting layer-3 third parties, such as Bank of America and Apple, will be unavoidable, Saylor said.

“Bitcoin is going to be a base layer. There is going to be layer 2’s like lightning to make things fast. Then there is going to be layer 3’s like Bank of America and Apple. Custodial layer 3 is going to exist to provide functionality.”

As for natural reasons, Saylor suggested the possibility that it is safer for certain people to entrust their assets to others.

He gave the example of an 85-year-old grappling with Alzheimer’s or the desire to secure holdings for a yet-to-be-born grandchild.

“I didn’t complain that my mother and father had the car keys when I was twelve years old, and I didn’t get the car key,” Saylor stated.

Saylor stated that the optimal blend of Bitcoin integrations will be determined by the market.

“We shouldn’t be afraid of all the different ways people integrate, wrap, embed or execute with Bitcoin, there is no one right answer; the marketplace will determine the right mix of integrations of Bitcoin.“

Magazine: Why Coin Stories’ Natalie Brunell doesn’t want a Bitcoin ATH anytime soon: Hall of Flame