PRESS RELEASE. Dubai, April 12, 2024: The Global Blockchain Show is pleased to announce Global Market of Artification (GMA) as its diamond sponsor at the upcoming two-day conference, set to take place at the Grand Hyatt, Dubai. Artworks by renowned masters like Rubens and Rembrandt will be featured at the event. With the inclusion of […]

PRESS RELEASE. Dubai, April 12, 2024: The Global Blockchain Show is pleased to announce Global Market of Artification (GMA) as its diamond sponsor at the upcoming two-day conference, set to take place at the Grand Hyatt, Dubai. Artworks by renowned masters like Rubens and Rembrandt will be featured at the event. With the inclusion of […]

Source link

Global

South Korea’s Crypto Market Continues to Defy Global Trends With Premium Prices

Metrics reveal that cryptocurrency premiums in South Korea consistently outpace the global average. As of now, bitcoin exchanges hands at $69,245 per piece globally, while on the South Korean platform Upbit, it’s being traded at $73,513 each. Additionally, March witnessed a notable increase in Upbit’s trade volume, skyrocketing by 172.25% from February’s data. Ethereum, Solana, […]

Metrics reveal that cryptocurrency premiums in South Korea consistently outpace the global average. As of now, bitcoin exchanges hands at $69,245 per piece globally, while on the South Korean platform Upbit, it’s being traded at $73,513 each. Additionally, March witnessed a notable increase in Upbit’s trade volume, skyrocketing by 172.25% from February’s data. Ethereum, Solana, […]

Source link

European trading hours lead global Bitcoin surge in 2024’s first quarter

Quick Take

Bitcoin has experienced a remarkable first quarter in 2024, as reported by Coinglass, with the digital asset surging by an impressive 64% over the quarter and by 13% in March alone.

This surge marks the seventh consecutive month of gains for Bitcoin. The introduction of spot Bitcoin ETFs in the United States has played a significant role, attracting over $12 billion in net inflows.

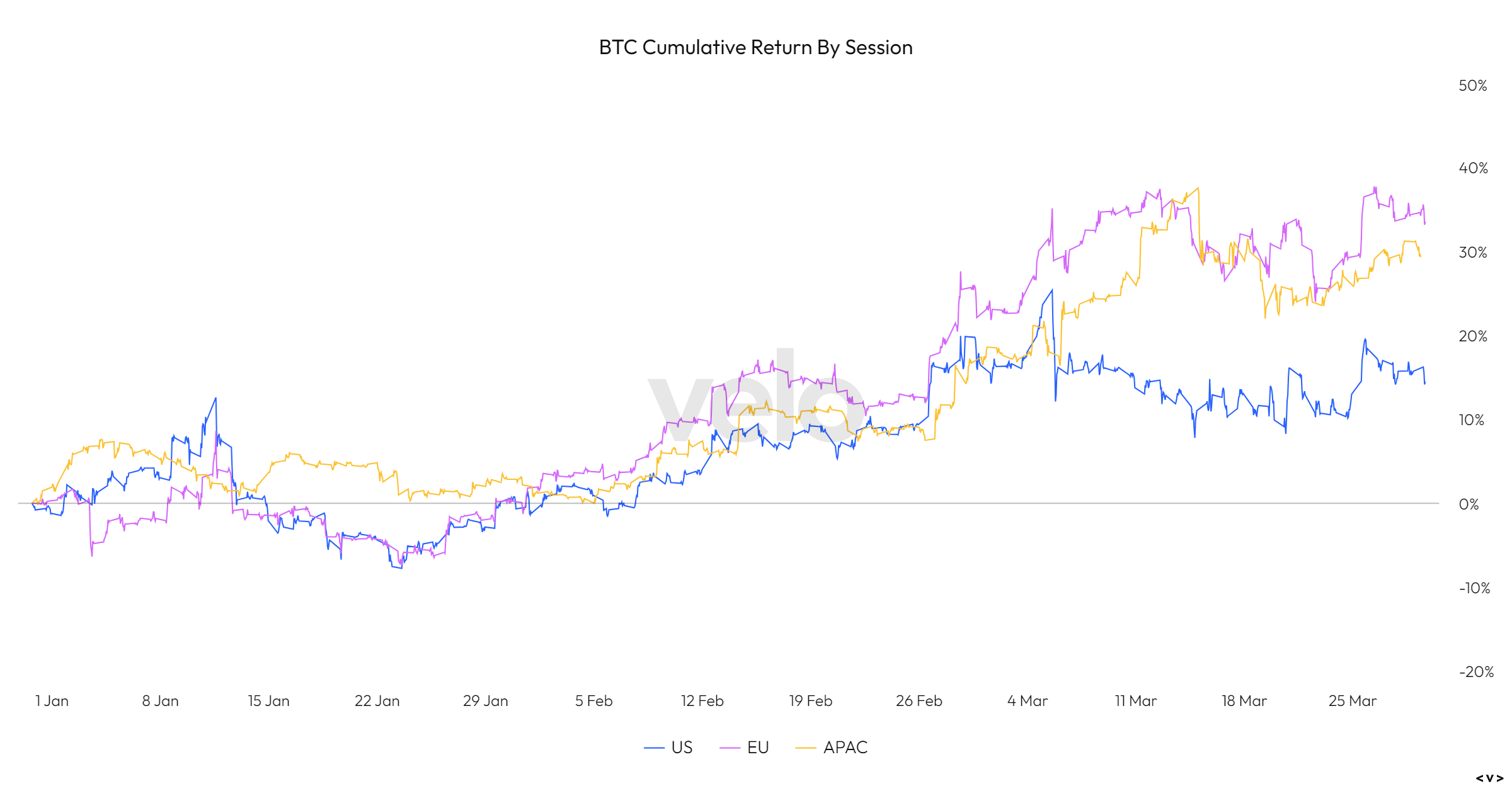

Furthermore, analysis of session data from Velo Data indicates that European trading hours have surpassed both the US and Asia in performance year-to-date. European sessions have seen a 34% increase compared to 30% for Asia and 14% for the US.

Notably, there was a significant spike on March 25, coinciding with the announcement by the London Stock Exchange (LSE) of the launch dates for Bitcoin and Ethereum Exchange Traded Notes (ETNs).

Looking ahead, a number of anticipated bullish events, such as the Bitcoin halving, the launches of LSE ETNs, and the potential introduction of Hong Kong ETFs, are expected to provide further impetus to Bitcoin’s momentum.

The post European trading hours lead global Bitcoin surge in 2024’s first quarter appeared first on CryptoSlate.

U.S. Treasury Secretary Janet Yellen testifies during a hearing before the Financial Services and General Government Subcommittee of the House Appropriations Committee at Rayburn House Office Building on Capitol Hill on March 21, 2024 in Washington, DC.

Alex Wong | Getty Images

Treasury Secretary Janet Yellen on Wednesday warned that China is treating the global economy as a dumping ground for its cheaper clean energy products, depressing market prices and squeezing green manufacturing in the U.S.

“I am concerned about global spillovers from the excess capacity that we are seeing in China,” Yellen said during a speech at a Georgia solar company called Suniva. “China’s overcapacity distorts global prices and production patterns and hurts American firms and workers, as well as firms and workers around the world.”

China has a surplus of solar power, electric vehicles and lithium-ion batteries that it can ship out to other countries at cheaper prices. That makes it difficult for the more adolescent green manufacturing industries of the U.S. and elsewhere to compete.

Yellen said she intends to put pressure on Chinese officials about these trade practices during her upcoming visit to China.

“I plan to make it a key issue in discussions during my next trip there,” she said. “I will press my Chinese counterparts to take necessary steps to address this issue.”

The secretary’s concerns come as the White House tries to build a burgeoning clean energy industry domestically with investments from the 2022 Inflation Reduction Act, along with other legislation like the CHIPS and Science Act.

Yellen has regularly touted the gains from these investments, including at another recent speech where she doubled down on the electric vehicle “boom” spurred by the IRA.

But those investments are playing catch-up with China’s government.

“The Biden Administration also recognizes that these investments are new,” Yellen said Wednesday.

Meanwhile, China has been pouring billions into clean energy for years, outpacing the rest of the world in the energy transition.

Yellen added that the more China’s clean energy glut interferes with global market prices, the worse off supply chains for these energy sectors will be.

“President Biden is committed to doing what we can to protect our industries from unfair competition,” Yellen said.

The Chinese Embassy in Washington did not immediately respond to a request for comment.

Yellen’s comments highlight ongoing U.S.-China trade tension even as the two countries try to steady relations.

Read more CNBC politics coverage

President Joe Biden met with Chinese President Xi Jinping in November as an olive-branch effort to break the ice after years of tension, marked in part by a tariff war launched by former President Donald Trump.

Trump has floated reinstating significant tariff levels on Chinese products if he wins a second presidential term.

In the time since the Biden-Xi meeting, strengthening U.S.-China relations has proven a precarious effort due to ongoing cybersecurity and trade concerns.

In February, Biden launched an investigation into Chinese smart cars, which he said pose a national security risk because they connect to U.S. infrastructure when they drive on American roads.

“China is determined to dominate the future of the auto market, including by using unfair practices,” Biden said in a February statement. “China’s policies could flood our market with its vehicles, posing risks to our national security. I’m not going to let that happen on my watch.”

Don’t miss these stories from CNBC PRO:

The shipping container is a logistics marvel that can affordably move thousands of items from hundreds of different companies all around the globe.

If there is a slowdown in shipping-container circulation, there could be massive supply chain bottlenecks.

“The skill involved in containerization is moving that container from point A to point B and getting it back to point A as quickly and efficiently as you possibly can,” Simon Heaney, senior manager of container research at Drewry, a maritime research and consulting firm, told CNBC.

Supply chain disruptions

Disruptions to global trade can have major impacts on shortages and inflation, causing serious ramifications for American households and businesses.

For example, the Federal Reserve Bank of San Francisco found that supply chain disruptions “contributed on average about 60% of the run-up of U.S. inflation” in the two years following the coronavirus pandemic outbreak.

“People suddenly realized how important that container is to everybody’s standard of living,” John Fossey, senior analyst of container equipment at Drewry, told CNBC.

Indeed, inflation cooled alongside the bounce back of the supply chain, according to a White House analysis of the U.S. economy. The study showed more than 80% of recent progress in lowering inflation can be attributed to the supply chain.

Attacks by Iran-backed Houthi militants on ships traveling through the Red Sea have also led ocean carriers to take longer voyages around the Cape of Good Hope.

“Taking the long way [around] the bottom of Africa, that’s adding about one-third to their voyage distance,” John McCown, nonresident senior fellow at the Center for Maritime Strategy, told CNBC.

Longer voyages result in higher fuel costs for ocean carriers and late arrivals of shipments to their planned destinations, contributing to delays in returning containers to nations like China to be reloaded with exports.

China is a world leader in exports and manufacturing, and accounts for more than 95% of shipping-container production, according to the Federal Maritime Commission.

“Particularly with the Asian countries, [they] long ago recognized that a very key part of [their] economy is exports, and if [they] want to be efficient at exporting products, [they] need to make sure there is a good conveyance system,” McCown said.

Attacks on ships in the Red Sea are the latest shock to the global supply chain after Russia’s invasion of Ukraine and the coronavirus pandemic shook up the logistics industry — including shipping container availability.

“During the pandemic, we had the phenomenon that there were not enough containers because many containers were stuck in rail yards or they were stuck in container ports,” Goetz Alebrand, head of ocean freight for the Americas with DHL Global Forwarding, told CNBC. “There was not the fluidity that we usually had.”

When shipping-container prices skyrocketed in 2020 and 2021, it became more lucrative for shipping companies and leasing firms to send containers back to Asia as fast as possible.

“Because of the need to replenish and reposition containers back to Asia,” Heaney said, “that container will make another sea journey back, but completely empty.”

That trend resulted in a trade imbalance that hit U.S. exports, including agricultural products. In response, some farms dumped milk in fields and plowed crops back into the soil.

“Ideally, you would have the most efficient system,” Heaney said. “The only way to make that happen is to have a completely balanced manufacturing ecosystem, and we don’t have that and we’re unlikely to have that. [It’s] an inefficiency born not of container shipping but just of the nature of the global economy.”

Watch the video above to learn more about how shipping containers enable global trade, why China dominates the shipping industry and what happens after a container shortage.

UN adopts global AI resolution to ensure ‘safe, secure and trustworthy’ AI advancement

The United Nations General Assembly adopted a global artificial intelligence (AI) resolution on March 21.

The new resolution aims to promote “safe, secure, and trustworthy” AI development. The Assembly said it is paramount that AI is developed in a sustainable manner that does not threaten human rights.

The AI Resolution

The UNGA has requested member states and stakeholders to refrain from deploying AI in manners inconsistent with international human rights laws. It also acknowledged the varying technological advancements across countries and called for efforts to bridge this development gap.

Sections of the eight-page document call for raising awareness, strengthening investments, safeguarding privacy, ensuring transparency, and addressing diversity issues around AI.

The resolution also encourages governments to develop safeguards, practices, and standards for AI development and calls on specialized agencies and UN-related agencies to address AI issues.

The resolution is co-sponsored by over 120 countries. It was adopted without a vote, representing unanimous support among all 193 UN member states.

US played key role

According to a statement from the White House and National Security Advisor Jake Sullivan, the US was the primary sponsor of the resolution, which finally succeeded after four months of negotiations with other countries.

Sullivan emphasized the human rights aspects of the resolution and said:

“Critically, the resolution makes clear that protecting human rights and fundamental freedoms must be central to the development and use of AI systems.”

In another statement, Vice President Kamala Harris said that she and President Joe Biden are committed to creating and strengthening international rules on AI and other technologies.

Harris also called the resolution a “historic step toward establishing clear international norms” and said that nations should address both catastrophic and small-scale risks.

Other AI efforts

The UN’s global resolution follows other, more localized efforts to regulate the rapidly growing AI industry in recent months.

The European Parliament voted in favor of an AI Act, which aims to set governance standards for the region, on March 13. The European Commission launched an inquiry into the use of AI by major online tech companies based on a separate Digital Services Act on March 14.

Meanwhile, the Biden administration signed an executive order in October 2023 that addresses various safety and security issues around AI development and use in the US.

India also introduced requirements around AI in March ahead of the country’s national elections.

Mentioned in this article

United States Dominates Global Crypto Market With Massive $9.3 Billion In Profits

In a recent report by market intelligence firm Chainalysis, it has been revealed that global crypto gains in 2023 amounted to a staggering $37.6 billion. This profit surge reflects improved asset prices and market sentiment compared to 2022.

Although this figure falls short of the $159.7 billion gains witnessed during the 2021 bull market, it signifies a significant recovery from the estimated losses of $127.1 billion experienced in 2022.

Sharp Surge In Crypto Gains

The report suggests that despite similar growth rates in crypto asset prices in 2021 and 2023, the total gains for the latter year were lower. According to Chainalysis, this discrepancy could potentially be attributed to investors’ decreased inclination to convert their crypto assets into cash.

The analysis further suggests that investors in 2023 seem to have anticipated further price increases, as crypto asset prices did not exceed previous all-time highs (ATHs) during the year, unlike in 2021.

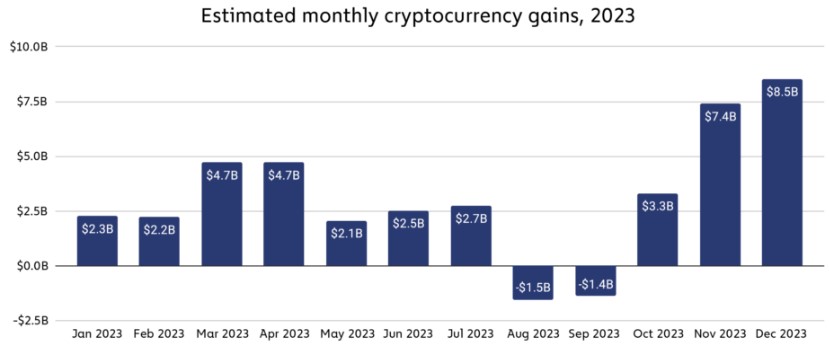

Cryptocurrency gains remained relatively consistent throughout 2023, except for two consecutive months of losses in August and September, as seen in the image above. However, gains surged sharply thereafter, with November and December eclipsing all previous months.

United States Leads

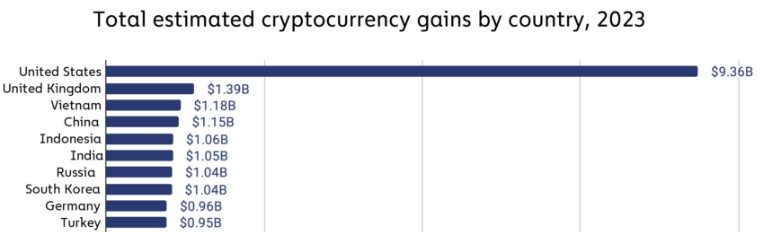

Leading the pack in cryptocurrency gains was the United States, with an estimated $9.36 billion in profits in 2023. The United Kingdom secured the second position with an estimated $1.39 billion in crypto gains.

Notably, several upper and lower-middle-income countries, particularly in Asia, such as Vietnam, China, Indonesia, and India, achieved significant gains, each surpassing $1 billion and ranking within the top six countries worldwide.

Chainalysis had previously observed strong cryptocurrency adoption in these income categories, particularly in “lower-middle-income” countries, which demonstrated resilience even during the recent bear market. The gains estimates indicate that investors in these countries have reaped substantial benefits from embracing the asset class.

Ultimately, the Chainalysis report suggests that the positive trends observed in 2023 have carried over into 2024, with prominent cryptocurrencies such as Bitcoin (BTC) hitting all-time highs of $73,700 following the approval of Bitcoin exchange-traded funds (ETFs) and increased institutional adoption.

If these trends persist, the firm believes that it is conceivable that gains in 2024 will align more closely with those witnessed in 2021.

As of this writing, the total crypto market cap valuation stands at $2.5 trillion, a sharp drop of over 4% in the last 24 hours alone, and down from Thursday’s two-year high of $2.7 trillion. Bitcoin, on the other hand, is trading at $68,400 after dropping as low as $65,500 but has quickly regained its current trading price, limiting losses to 4% over the past 24 hours.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

McDonald’s suffers global tech outage forcing some restaurants to halt operations

CFOTO | Future Publishing | Getty Images

LONDON — McDonald’s suffered a system failure Friday that left customers in some parts of the world unable to order food.

“We are aware of a technology outage, which impacted our restaurants; the issue is now being resolved,” a McDonald’s spokesperson said. “We thank customers for their patience and apologize for any inconvenience this may have caused.”

The spokesperson added that the incident “is not related to a cybersecurity event.”

The outage was first flagged by the the Australian unit of the U.S.-based fast-food chain which said it was working to resolve the issue as soon as possible. At around 6.45 a.m. ET, McDonald’s Australia said on X that most of its restaurants had reopened.

McDonald’s Japan took to social media to say that operations at stores nationwide were temporarily suspended. “We apologize for any inconvenience caused to our customers,” it said.

On Downdetector, a website which tracks when apps and websites are having technical difficulties, there was a spike in reports of issues with the McDonald’s app in Australia around 2 a.m. ET on Friday.

People stand in front of a temporary closed McDonald’s in Shimbashi district of Tokyo on March 15, 2024. Hungry McDonald’s customers in parts of Asia had trouble ordering at stores, on cellphones and at electronic kiosks after a system outage.

Philip Fong | AFP | Getty Images

There was also a spike in reports of issues with the McDonald’s app in the U.K. around the same time, with further reports of issues at around 5 a.m. ET, according to Downdetector. A map on the website also showed outages reported in U.S. cities such as New York, Chicago, Los Angeles, Phoenix and Seattle.

McDonald’s has around 40,000 restaurants globally. Just over 1,000 are in Australia and there are more than 1,450 in the U.K. Japan has nearly 3,000 restaurants, making it one of the largest markets for McDonald’s.

Report: Global Crypto Investments Surge to Record $2.7 Billion in Weekly Inflows

In an unprecedented surge, global crypto investment products experienced a historic influx of $2.7 billion last week, signaling strong confidence among investors and propelling assets under management (AUM) back to December 2021 levels. Record $2.7 Billion Flows Into Crypto Investments in a Historic Week The record-breaking week saw digital asset investment vehicles garner inflows of […]

In an unprecedented surge, global crypto investment products experienced a historic influx of $2.7 billion last week, signaling strong confidence among investors and propelling assets under management (AUM) back to December 2021 levels. Record $2.7 Billion Flows Into Crypto Investments in a Historic Week The record-breaking week saw digital asset investment vehicles garner inflows of […]

Source link

Worldcoin’s adoption continues to grow despite the growing privacy concerns from several jurisdictions.

According to its website, registered users on its platform have reached almost 4 million in less than a year after its launch, registering more than 600,000 accounts within the past week.

Worldcoin, a crypto project co-founded by Sam Altman, is a blockchain-based initiative that allows individuals to validate their human identity through iris scanning. Upon successful verification, users receive a “World ID” credential that can be seamlessly integrated into future applications, proving they are human.

Notably, the project recently announced its integration with several prominent online platforms, including Minecraft, Reddit, Telegram, Shopify, and Mercado Libre.

These milestones reflect the notable adoption rate of the polarizing project despite the regulatory scrutiny about its data-handling practices from various regulatory authorities.

South Korea begins investigations

Earlier today, the South Korean regulatory body, the Personal Information Commission, said it initiated an investigation into Worldcoin’s practices on Feb. 29, prompted by complaints over potential violations of data protection laws.

The commission will scrutinize Worldcoin’s gathering, handling, and possible international transfer of sensitive personal data. It added that any violations of local privacy regulations will prompt immediate regulatory action.

The regulator furthered that Worldcoin was collecting facial and iris data at ten South Korean sites. Worldcoin has repeatedly highlighted that it only collects ‘hashes’ of biometric data and not the visual scans themselves.

South Korea joins a growing list of jurisdictions scrutinizing Worldcoin’s data collection practices. Regulatory bodies in Hong Kong, France, Germany, Britain, and Kenya have also taken an interest, with some issuing directives to halt user registrations.

WLD price performance

Despite these issues, the price of Worldcoin’s WLD token remains strong, largely buoyed by recent market sentiments and the positive developments surrounding the project’s sister company, OpenAI.

CryptoSlate’s data show that WLD increased 246% during the past 30 days. However, its value has slightly corrected by 1.43% to $7.88 as of press time.