Goldman Sachs is seeing more institutions diving into crypto, the global investment bank’s head of digital assets has revealed, noting that until now the bitcoin price action has been driven primarily by retail investors. “But it’s the institutions that we’ve started to see come in,” he stressed, adding that the appetite has “transformed.” Bitcoin ETFs […]

Goldman Sachs is seeing more institutions diving into crypto, the global investment bank’s head of digital assets has revealed, noting that until now the bitcoin price action has been driven primarily by retail investors. “But it’s the institutions that we’ve started to see come in,” he stressed, adding that the appetite has “transformed.” Bitcoin ETFs […]

Source link

Goldman

Goldman Sachs management committee is getting an overhaul: Wall Street Journal

A previous version of this story contained incorrect information about the management changes at Goldman Sachs. The story has been updated.

Two members of the management committee at Goldman Sachs Group Inc. have departed the key ruling body at the bank as it reshuffles the roles of its most powerful senior executives, the Wall Street Journal reported on Friday.

Under Chief Executive David Solomon and President John E. Waldron, the bank is mulling the launch of two new committees to help run the lucrative markets unit and investment-banking division at Goldman Sachs

GS,

the report said.

George Lee and Alison J. Mass have both left the management committee, the newspaper reported, citing people familiar with the situation.

Lee is co-head of the office of applied innovation as well as former co-chief information officer at the bank, according to the Goldman Sachs website.

Mass is chair of investment banking and was former global head of the financial and strategic investors group in the investment-banking division.

A Goldman Sachs spokesperson contacted by MarketWatch declined to confirm the report.

“Final decisions haven’t been made,” the spokesperson said.

The report surfaced just days after the firm announced in an internal memo that management-committee member Jim Esposito, co-head of global banking and markets, will retire after 29 years and become senior director at Goldman Sachs.

“Jim represents the very best attributes of Goldman Sachs — partnership, client service, excellence and integrity,” Solomon said in the memo, which was seen by MarketWatch.

In another change to the top echelon of Goldman Sachs leadership, the bank’s independent lead director, Adebayo Ogunlesi, is joining BlackRock Inc.

BLK,

The move is part of BlackRock’s $12.5 billion acquisition of Global Infrastructure Partners, the private-equity firm founded by Ogunlesi.

Under Solomon, Goldman Sachs has realigned its businesses into three main units: Global Banking & Markets, Asset & Wealth Management and Platform Solutions. It has also sold off its GreenSky lending unit and shed thousands of jobs in the process.

Goldman Sachs shares rose 1% on Friday. The stock has risen 4.8% in the past year, compared with a 13.9% increase by the Dow Jones Industrial Average

DJIA.

Also read: Goldman Sachs, Jefferies stand out among undervalued big banks, Oppenheimer says

Tether reports $5B reserve excess after making more profit than Goldman Sachs last quarter

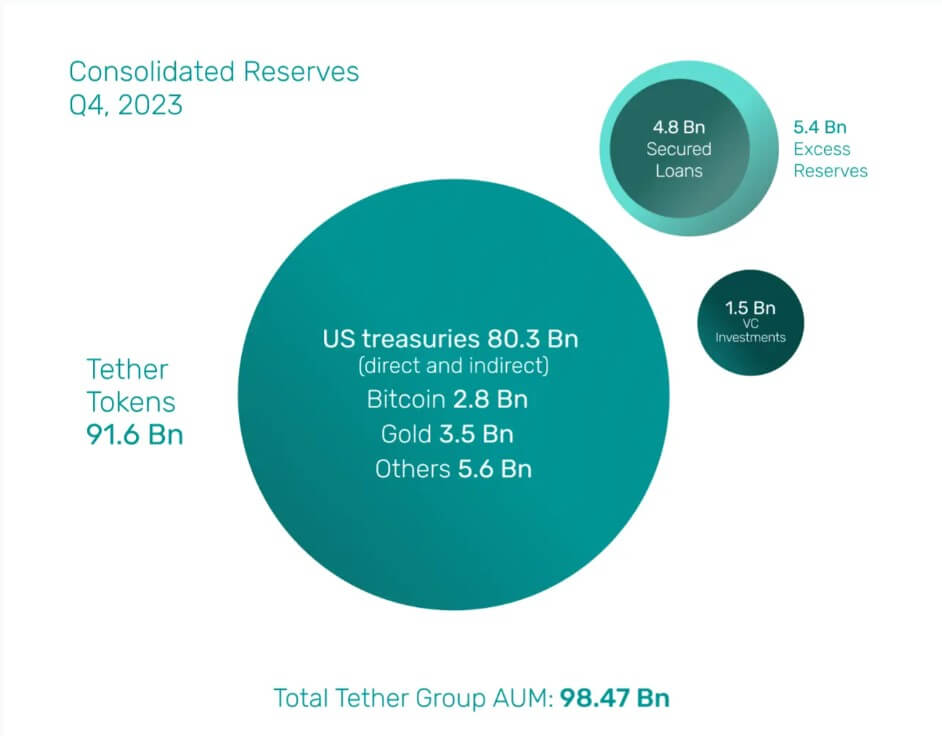

Goldman Sachs reported a profit of $2.01 billion in the last three months of the previous year, while Tether’s Q4 report revealed that its profits comprised $1 billion from U.S. Treasury bills and $1.85 billion from holdings in Gold and Bitcoin.

This remarkable performance can be attributed to the surge in the crypto market, driven by the enthusiasm surrounding the spot Bitcoin exchange-traded fund (ETF) between October and December 2023. During this period, Bitcoin’s value skyrocketed to over $42,000 from around $27,000, coinciding with Tether’s USDT supply rising to nearly 92 billion from approximately 83 billion tokens.

Observers noted that the increased demand for Tether’s fiat-backed stablecoin signaled a growing interest from institutional investors entering the market. CryptoSlate’s data shows that Tether’s USDT supply has risen to $96.2 billion as of press time.

However, despite its impressive performance, Tether’s overall profit for the year was $6.2 billion, notably lower than Goldman Sachs’s earnings of $8.52 billion.

Meanwhile, Paolo Ardoino, Tether’s CEO, emphasized that these substantial profits emphasize the company’s financial strength throughout the year.

“The substantial net profits generated not only in the last quarter of the year but throughout the year, amounting to $6.2 billion, showcases our financial strength,” Ardoino said.

Goldman Sachs, a globally renowned investment banking firm, holds the status of the second-largest investment bank in the world by revenue and is recognized as a systemically important financial institution by the Financial Stability Board.

Over $5 billion in excess reserves

The substantial profit margin enabled Tether to bolster its excess reserves to $5.4 billion. Of this, $640 million was allocated to various project investments, including sustainable energy, Bitcoin mining, AI infrastructure, and P2P communications. Tether does not consider these investments part of its reserves.

“Our investments in sustainable energy, Bitcoin mining, data, AI infrastructure, and P2P telecommunications technology illustrate our commitment to a more sustainable and inclusive financial future,” Ardoino explained.

BDO Italia, a prominent global accounting firm conducting Tether’s attestations, verified that the stablecoin’s excess reserves entirely covered its $4.8 billion in outstanding unsecured loans. Tether highlighted its achievement in eliminating the risk of secured loans from its token reserves.

As of December 31, 2023, Tether’s held assets were valued at $98.47 billion, with liabilities amounting to $91.59 billion.

Is $203 Trillion In Derivatives Held By Goldman Sachs, JPMorgan And Other Top Banks Causing an ‘Everything Bubble?’

The scale of derivatives held by major banks like JPMorgan Chase & Co., Citibank and Goldman Sachs, amounting to $203 trillion, has raised concerns about the potential risks these positions might pose to the global economy. The third-quarter Quarterly Report on Bank Trading and Derivatives Activities, published by the Office of the Comptroller of Currency, provides a comprehensive dive into this issue.

This figure surpasses the world’s gross domestic product (GDP) by roughly double, highlighting the enormity of the market.

JPMorgan Chase, in particular, is noted for its substantial exposure to derivatives risk, topping the list with roughly $58 trillion in derivatives. The mounting scale of derivatives owned by banks raises several questions and concerns among regulators and investors.

Don’t Miss:

The 15-digit number has recently drawn speculation among retail investors on social media platforms like Reddit and TikTok. But as recently as March 9, 2023, Congress held a hearing on managing volatility in global commodity derivatives markets.

A derivative is a contract that derives its value from the performance of an underlying entity. This underlying entity can be an asset, index or interest rate. Derivatives can be used to offset risks in the future or used as leverage to increase gains or losses.

But it’s unlikely the banks are the ones holding these derivatives. Rather, many of the top banks act as market makers for entities buying and selling derivatives.

While these banks have large derivative positions on their balance sheets, the notional value is a fraction of the total derivatives market. This is because there are typically two sides to every trade: a short and a long. Because each side has a bullish and bearish position, the total size of the derivatives market doesn’t necessarily correlate to risk.

Trending: Copy and paste Mark Cuban’s startup investment strategy according to his colorful portfolio.

According to the Federal Reserve, the total long exposure for financial derivatives for hedge funds, for example, has remained largely unchanged since being tracked in 2012. There was a large spike between 2017 and 2018, but as the total derivatives market size increased, the notional value slowly approached 0. Hedge funds have a total long exposure of about $1 trillion.

The banks likely don’t hold exposure to most of these individual positions. They are market makers for these transactions and largely facilitate the transactions between parties. Those parties often use the derivatives market to manage risk by hedging their bets or using swaps to limit future exposure.

This isn’t to say there isn’t significant market exposure to derivatives. By all metrics, the use of derivatives is increasing. Between the first quarter of 2022 and the third quarter of 2023, the notional amounts of derivatives increased by about $10 trillion. If an entity mismanages its risks and becomes too exposed to derivatives, there could be risks associated with those trades. But regulatory measures like the Dodd-Frank Act and higher capital requirements imposed by the Federal Reserve are regularly used to mitigate such risks.

A larger concern is the lack of reporting and availability of data surrounding the derivatives market. For example, a recent BIS article highlighted the growing trillions in missing debt created by certain derivatives. Forex swaps, forwards and currency swaps create debts that don’t appear on balance sheets and most debt statistics. Swaps such as these are an underlying common denominator for many financial crises and shocks to the system, causing entities to fail or creating funding squeezes. These off-sheet debts are estimated to be at a staggering $97 trillion globally across all currencies and growing fast.

The lack of reporting for these debts makes it difficult to predict future recessions and make policy regulating derivatives.

The $203 trillion in derivatives held by major banks underscores a complex financial landscape where the interplay of risk management and market speculation is pivotal. While banks often act as intermediaries rather than principal holders, the sheer size of these positions raises questions about systemic risk and market stability.

Regulatory frameworks and reporting standards, although improved, still face challenges in fully capturing the nuances of the derivatives market. The need for enhanced transparency and oversight in the sector remains critical, particularly in light of the growing off-balance-sheet debts that continue to elude conventional monitoring mechanisms.

Read Next:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article Is $203 Trillion In Derivatives Held By Goldman Sachs, JPMorgan And Other Top Banks Causing an ‘Everything Bubble?’ originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Goldman Sachs: Global Economy Is on Cusp of New ‘Super Cycle’ Fueled by AI and Decarbonization

Peter Oppenheimer, head of macro research in Europe at Goldman Sachs expects major global economic expansion akin to the late 19th century.

The global economy is fast approaching a new ‘super cycle’ similar to the one experienced during the late 1980s fueled by the rise of Artificial Intelligence (AI) and decarbonization. While speaking on Monday at Squawk Box Europe, Peter Oppenheimer, a researcher at Goldman Sachs, noted that the global economy is moving into a super cycle that is commonly defined by a high employment rate, rising gross domestic product (GDP), and robust demand for goods thus triggering increased prices. He further noted that global super cycles have been preceded by peaks of interest rates and inflation, followed by a decade of falling inflation and interest rates.

Already, the leading global economy, the United States, has recorded a series of interest rate hikes in the past three years but the Federal Reserve has signaled several rate cuts by the end of this year. Moreover, US inflation has dramatically slowed down in the past year without major reports of unemployment. Meanwhile, Oppenheimer highlighted that the world may not record extreme interest rate cuts in the next decade but a change in economic policies to enable privatization and globalization.

In the next coming years, Oppenheimer expects to see a notable rise in AI applications, thus widening human productivity. Furthermore, the ongoing modernization of industrialization has largely been driven by technological developments.

“The second thing that we haven’t yet seen, and I think we’re relatively positive that we will see, is an improvement in productivity on the back of the applications of AI which could be positive for growth and of course for margins,” Oppenheimer noted.

Global Market Outlook

With the help of Artificial Intelligence and blockchain technology, the global economy is fast opening up from traditional geographical areas. For instance, more institutional investors are using blockchain technology to enable real-world assets (RWA) tokenization in areas like carbon credits, real estate, and government bonds, among many others. Consequently, more governments around the world have been enacting regulatory policies that attract web3 investors and developers.

Moreover, there is a significant demand for digital assets from both retail traders and institutional investors. Already, the global cryptocurrency market has eclipsed over $1.7 trillion led by Bitcoin, which has rallied above $47k for the first time since the Terra Luna UST crypto capitulation. Nonetheless, the entire crypto market cap is dismal compared to the global debt that recently eclipsed above $304 trillion.

Meanwhile, more countries are coming together through the BRICS alliance to dethrone the United States dollar as the global reserve currency. Led by Russia, China, and India, the global economic shift is expected to be expedited in the coming years amid the Middle East crisis and the ongoing Ukraine war.

next

Artificial Intelligence, News, Technology News

You have successfully joined our subscriber list.

Goldman Sachs Predicts a 2024 Turnaround for These 2 Major Energy Stocks

The crystal balls are cloudy, and the energy sector is difficult to predict for 2024. Conventional wisdom says, ‘Oil is going higher;’ after all, there is a war in the Middle East. But neither Israel nor Hamas exports oil, and prices are down from a mid-October spike.

The conflicted headwinds of the energy sector, and the oil industry especially, have put heavy pressure on energy stocks in recent months. Even the current war in the Middle East only caused a brief spike in prices, and the OPEC+ group’s efforts to pare back production have simply provided a floor in the current environment – they have not pushed prices back toward recent high levels.

The wild card here is a possible US recession. If one hits in 2024, that could crimp oil demand – but we may also see a Fed rate cut, which could in turn goose a call for more oil.

For Goldman analyst Neil Mehta, however, this confused environment equals opportunity. He sees a strong chance for several energy stocks to make a 2024 turnaround. “As we make the turn into 2024, we continue to screen for companies with turnaround and mean reversion potential in a mid-cycle $80/b Brent and $3.50/MMBtu Henry Hub environment,” the 5-star analyst recently wrote. “Amid a tougher year for Energy equities, there has been significant differentiation in stock performance across sub-sectors.”

Moving forward, Mehta sees opportunity in specific names and is bullish on the prospects of two major energy stocks that have underperformed over the past year. We ran them through the TipRanks database to see what makes them stand out. Here’s the lowdown.

Schlumberger Limited (SLB)

For the first, we’ll look at a leader in the oilfield services sector. The exploration and production companies put their money down finding the oil, siting the wells, and bringing the product to the surface. But, they lack the specific expertise to complete those wells; companies like Schlumberger provide all the particular engineering and technical know-how needed to complete wells and put them into operation. These skills include, among others, drilling, hydraulic engineering, and pollutant control. In 2022, Schlumberger was the world’s largest offshore drilling company, measured by revenue.

Drilling and well completion, however, are only part of Schlumberger’s operations. The company sees the writing on the wall, and understands that today’s fossil fuel energy regime will not last forever, and it is diversifying its operations now, both to expand its revenue base and to prepare the next generation of energy technology. These forays into alternate business models include Schlumberger’s business in digital technology, scaled to fit customer needs at any size and capable of tracking and accessing data, developing insights from it, and using that data to elevate performance. The company is also moving into AI technology, to enable autonomous operations on the oil patch.

Schlumberger’s operations brought the company solid year-over-year increases in its headline financial results in the third quarter of 2023, the latest reported. The company had a bottom line of 78 cents per share, in non-GAAP measures; this was a full 15 cents per share better than the prior-year result, and came in 1 cent above the forecast. The earnings were based on $8.31 billion in total revenue, a figure that was up 3% from the previous quarter and 11% year-over-year. The company’s revenue, however, came up short of the forecasts, missing by $10 million.

Free cash flow in the third quarter was strong, listed as $1.04 billion. This made up the larger part of the company’s $1.76 billion FCF for the first nine months of 2023. Schlumberger generated far stronger cash flows in Q1,2, and 3 of 2023 than in the prior year, when the nine-month total came to just $563 million.

While Schlumberger saw sound financial performance, we should note here that the stock price has simply been treading water in 2023. Shares were barely breaking even at the end of trading on December 29, the year’s last trading day, and the stock was down approximately 16% from the peak it hit in September 2023.

Turning to the Goldman view, we find that analyst Neil Mehta is bullish here, basing his view at least in part on the company’s solid performance as an offshore driller and its moves into digital tech. Moreover, the stock’s underperformance represents an opportunity. Mehta writes, “We believe that at the current price the stock is fundamentally undervalued as international rig count still remains below pre-COVID levels, offshore activity outlook has remained resilient and SLB continues to expand its digital business. We believe that the stock should be positioned to outperform as macro activity indicators continue to grind higher, margin expansion from repricing contract portfolios continue to improve and over time as the company begins to commercialize its newer businesses in new energy.”

For Mehta, this provides support for a Buy rating, and his price target, set at $65, suggests a one-year upside potential of 25%. (To watch Mehta’s track record, click here)

This stock has a Strong Buy rating from the Street, based on a lopsided split among the 13 recent analyst reviews – 12 to Buy and 1 to Hold. The shares are trading for $52.04 and their $70.58 average target price points toward a one-year gain of 36%. (See Schlumberger stock forecast)

Chevron Corporation (CVX)

From oilfield services we can move over now and take a look at a major-name exploration and production company. Chevron is ranked, by market cap, as the world’s third-largest oil company, valued at ~$281 billion by that measure.

The company’s business and activities revolve around oil and natural gas exploitation, transport of hydrocarbon products, operation of a maritime shipping line for both crude oil and natural gas products, and a large-scale petroleum refining segment.

Chevron is a major producer and supplier of a wide range of petrochemicals, including fuels, lubricants, and various additives. While not the main thrust of Chevron’s business, it’s probably the most visible in our everyday life – Chevron markets many of these products, including gasoline and diesel fuel, through its nation-wide chain of branded gas stations.

The biggest recent news for Chevron, however, has come from two updates in its oil business. In 2023, in October, the company entered a definitive agreement with Hess Corporation, an independent E&P firm specializing in offshore hydrocarbon extraction. The agreement’s total value comes to $60 billion, including the $53 billion all-stock acquisition transaction and approximately $7 billion in debt assumption by Chevron. The merger is expected to be completed in 1H24.

The second large piece of news for Chevron comes from Kazakhstan, near the northeastern shores of the Caspian Sea. Chevron is expanding an already significant operation in this area, where it has a 50% interest in Tengizchevroil, or TCO. TCO is the operating firm exploiting the Tengiz oil field, a ‘supergiant’ field known to be one of the world’s largest single-trap producing reservoirs. The Tengiz has a massive proven reserve, estimated at 25.5 billion barrels of recoverable oil. Daily production in the field is already averaging 600,000 barrels of crude oil every day, along with 22 million cubic meters of natural gas.

Chevron’s last reported financial results on record are from 3Q23, when the company had $54.08 billion at the top line. While this total was more than 18% below the prior-year revenue, it did beat the forecast, by $1.08 billion. The oil giant’s earnings, the non-GAAP EPS, came to $3.05 per diluted share – and missed the forecast by 64 cents per share. Investors were not too keen on the results, sending shares down in the aftermath. Overall, the stock trended lower in 2023, falling some 17% from the peak seen in January last year.

Laying out the Goldman Sachs view of Chevron, analyst Mehta lists several factors to support optimism, including strong prospects for gains in the HES acquisition and the Tengiz oilfield expansion operations. He writes of CVX, “Heading into 2024, we believe (a) improving earnings execution, (b) regular updates on TCO, (c) continued commitment to return of capital through-the-cycle, and (d) attractive balance sheet should drive 2024 outperformance. On capital returns we expect the company to be competitive in return of capital, with GS estimates of ~$29 bn in 2024 (buybacks + dividends), representing ~10% yield, with room for upside on potential HES transaction close, based on company commentary. On Tengiz, we continue to look for updated management commentary surrounding the WPMP and FGP start-ups in 2024 and 2025, where we see the project driving a clear Upstream volume ramp and cash flow inflection in 2025.”

Putting this into quantifiable form, Mehta rates CVX as a Buy, and his $180 price target implies the shares will appreciate by 21% through 2024.

For the Street generally, this stock remains a Buy, albeit a Moderate Buy. This consensus rating comes from 18 analyst reviews, breaking down 12 to 6 in favor of Buys over Holds. Chevron’s shares have a current average target price of $179.59, suggesting a 20% one-year increase from the last trading price of $149.16. (See Chevron stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Traders that fueled stock-market rally are now nearly tapped out, Goldman says

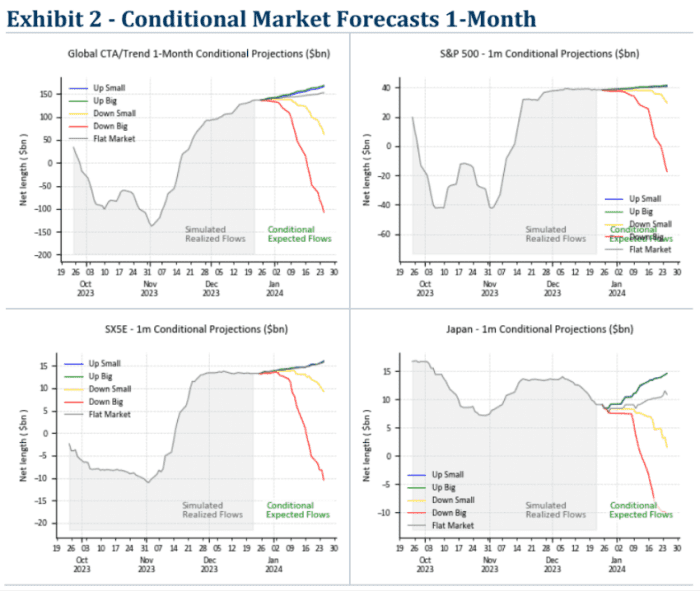

After helping to push U.S. stocks’ higher in November and December, trend-following trading firms known as CTAs are nearly tapped out, according to a report published by a Goldman Sachs Group trading desk.

That could limit further upside for the market, although the analysts cautioned that CTAs’ positioning may not be indicative of what other market participants are doing.

According to a report reviewed by MarketWatch on Wednesday, Goldman’s models suggest that CTAs — or commodity trading advisers — are already nearly max long when it comes to their exposure to the S&P 500, which they typically trade by buying or shorting futures contracts tied to the index.

Numbers from the Goldman trading desk that typically services CTAs show that this class of traders is carrying about $40 billion in long exposure to the S&P 500, and nearly $150 billion in exposure to global equities.

This would suggest that even if global stocks continue to power higher, CTAs’ ability to keep chasing the tape may have reached its limit.

GOLDMAN SACHS

CTAs certainly have a lot of influence across equity, fixed-income and commodity markets.

That said, Goldman’s numbers represent only a partial view of what’s happening in the space, and there are plenty of other types of traders aside from CTAs who can help push markets higher or lower.

See: November’s stock-market rally gets a boost from trend-following funds and company share buybacks

The S&P 500

SPX

gained 0.1% on Wednesday, closing at around 4,781, just a few points shy of its record closing high from Jan. 3, 2022, according to FactSet data. The large-cap index has gained nearly 25% since the beginning of 2023. The Dow Jones Industrial Average

DJIA

rose by around 111 points, or 0.3%, to notch its sixth record close of the year.

Check out: The latest threat to U.S. stocks: computerized trend-following funds are cutting their exposure to the market

Head of Digital Assets at Goldman Sachs, Matthew McDermott, has projected a massive growth in the cryptocurrency market in 2024. McDermott shared these positive predictions in a recent interview with Fox Business, expressing much optimism in the future of digital assets.

Goldman Exec Expects Spot ETFs To ‘Gradually’ Boost Institutional Demand For Crypto Assets

Speaking to Fox Business, McDermott has backed the continuous growth of cryptocurrencies as he foresees a rise in the institutional adoption of these assets.

Notably, the Goldman executive shares popular sentiment with many crypto enthusiasts that the approval of a Bitcoin or Ethereum spot ETF will open up the digital asset ecosystem to more institutional investors who are weary of the market volatility attached to direct crypto investments.

McDermott said:

One, it broadens and deepens the liquidity in the market. And why does it do that? It does that because you’re actually creating institutional products that can be traded by institutions that don’t need to touch the bare assets. And I think that, to me, that opens up the universe of the pensions, insurers, etc.

However, McDermott has cautioned crypto enthusiasts against expecting a sudden impact of crypto spot ETFs. He believes the anticipated increased demand and price rise will be a gradual process that will occur over the course of 2024.

The US Securities and Exchange Commission (SEC) is expected to grant approval orders to several Bitcoin spot ETF applications in the coming weeks following discussions between the regulator and multiple asset managers. Bloomberg analyst Eric Balchunas has set a potential decision window of January 8 – January 10, stating there is a 90% chance the SEC finally delivers a verdict on these various applications putting an end to the 6-months chronicle.

Asset Tokenization In 2024

In addition to potential crypto spot ETFs, McDermott also mentioned a potential increase in commercial blockchain application as another contributing factor to his projected rise in institutional demand for digital assets.

Particularly, he spoke about an improvement in existing tokenization systems, which can lead to the creation of secondary liquidity on blockchains.

He said:

When I think about tokenization, which is obviously a topic that’s kind of talked about quite extensively, I think for me next year what we’ll start to see is the development of marketplaces. So where we start to see scale adoption, particularly across the buy side in the context of investors. And that’s because we’ll start to see the emergence of secondary liquidity on chain, and that’s a key enabler. So for me, that’s one of the key developments for next year.”

At the time of writing, the entire crypto ecosystem is valued at $1.602 trillion, with a 15.09% gain in the last month. The market’s leader Bitcoin currently trades at $42,082, having declined by 1% in the past day.

Total crypto market valued at $1.602 trillion on the daily chart | Source: TOTAL chart on Tradingview.com

Featured image from Money, chart from Tradingview

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Goldman Sachs Says Utilities and Consumer Staples Stocks Are Set to Outperform as the Presidential Election Approaches — Here Are 2 Names the Banking Giant Likes

Almost exactly a year from now, Americans will cast their ballots and vote for a President, doing so for the 60th time since 1788. The election process will kick off in earnest on January 15th when the Iowa Republican caucuses mark the official commencement of primary season.

Right on time, says Goldman Sachs’ Chief U.S. Equity Strategist David Kostin, investors have started asking how the 2024 election will impact the stock market.

Going by the history books, it’s not going to be a vintage year. In the 12 months heading into an election, since 1932, the S&P 500 has averaged a return of 7%, below the 9% average return seen in non-election years. In fact, recent performance has been even worse; since 1984, the S&P 500 has posted an average return of only 4% in the preceding 12 months of an election.

So, what should investors specifically focus on during the next year? “Profit growth is typically strong in election years while valuations move sideways,” Kostin noted. “Info Tech has usually been the worst performing sector in the year ahead of the election. Defensive sectors tend to perform best, led by Utilities and Consumer Staples.”

Against this backdrop, Goldman Sachs analysts have pinpointed two stocks in these defensive sectors worth examining closely. We’ve decided to give them a closer look and for a fuller view of their prospects we ran them through the TipRanks database. Here’s what we found.

Don’t miss

Sempra (SRE)

Starting with the Utilities sector, we’ll explore Sempra, an energy infrastructure company that ranks among the largest regulated providers of electricity and natural gas services in the United States. Sempra primarily serves approximately 40 million customers in Southern California and Texas.

The company’s operations are organized into distinct segments, which include San Diego Gas and Electric Company (SDG&E), Southern California Gas Company (SoCalGas), Sempra Texas Utilities, Sempra Mexico, and Sempra LNG. By the numbers, at the end of 2022, the company boasted of $79 billion in total assets while Sempra oversees a 20,000-strong workforce spread across its family of businesses.

The company only recently released its Q3 earnings report, showing mixed results. On the one hand, revenue fell by 8% year-over-year to $3.33 billion, while missing the Street’s forecast by $350 million. However, Sempra fared much better at the other end of the equation, with Q3 adj. earnings rising from $622 million in the year-ago period, or 0.98 per diluted share, to $685 million, or $1.08 per diluted share, thereby outpacing analyst expectations by $0.07.

On the back of the strong performance seen during the first 9 months of the year, for the full year, the company now expects adj. earnings to come in above or at the high-end of its guided range of $4.30 to $4.60 vs. Street expectations of $4.49.

Scanning these results, Goldman Sachs analyst Carly Davenport finds plenty to like about the latest display whilst noting the catalysts ahead.

“This quarter increased our conviction that SRE’s Texas utility Oncor is a material strength for the company. The reduction of regulatory lag, potential increase in capex, and a clear runway for organic load growth in the region all highlight why we have viewed Oncor as an underappreciated asset for SRE. We believe SRE has several key catalysts ahead, including the aforementioned capex raise, the conclusion of the California GRC (general rate case), and the announcement of FID for the Cameron expansion and Port Arthur Phase 2 in 2024. SRE continues to trade at a 0.7x discount to our coverage group on our 2025 numbers, which we view as unwarranted given these strengths,” Davenport opined.

These comments underpin Davenport’s Buy rating while her $89 price target suggests shares will climb 24% higher in the months ahead. (To watch Davenport’s track record, click here)

Overall, the analyst consensus rates SRE shares a Moderate Buy based on a mix of 6 Buys and 4 Holds. The forecast calls for one-year returns of 11%, considering the average target stands at $80.56. The company also pays a regular dividend. The latest div payout reached $0.59 per share, providing a ~3.25% yield.

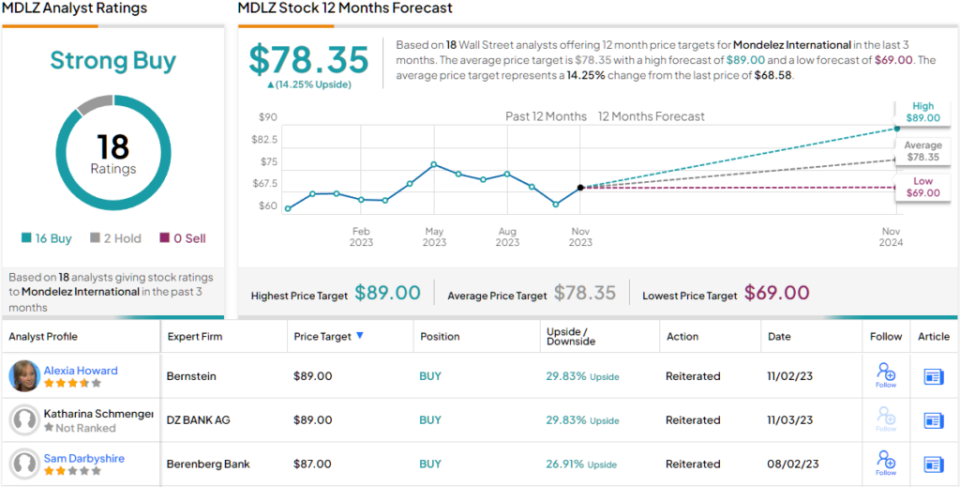

Mondelez International (MDLZ)

Let’s now turn to the Consumer Staples sector and check the details on global snack powerhouse Mondelez International. The company was created in 2012 when spun off from Kraft Foods and boasts a diverse range of iconic products, including Oreos, Cadbury, Toblerone, Ritz, and Trident, to name just a few. With a presence in more than 150 countries, Mondelez is one of the world’s biggest snack companies, claiming first global spot in biscuits (cookies and crackers) ands second in chocolate.

Last year, global net revenues reached around $31.5 billion, and the company appears on track to exceed that figure this year. In fact, in the recently released Q3 report, despite substantial reinvestment endeavors, the company bettered expectations on several fronts. Revenue reached $9.03 billion, representing a 16.4% YoY increase while beating the consensus estimate by $220 million. On the bottom-line, adj. EPS of $0.82 outdid the forecast by $0.04.

And looking ahead, the company delivered, too. Mondelez increased its FY23 organic net sales growth outlook from 12%+ beforehand to +14-15% vs. the consensus estimate of +13.8% and boosted the adj. EPS growth outlook to ~16% compared to the prior 12%.

Goldman Sachs analyst Jason English expects that strong performance to persist. “We continue to believe the company is well positioned to see widening fundamental outperformance versus Staples peers,” English said. “It is aggressively investing in both marketing and commercial activation with a long runway of distribution growth still ahead of it in markets such as Mexico, Brazil, China, India and other Southeast Asian markets. We expect this to sustain its momentum in the foreseeable future and reiterate our Buy rating in this context.”

That Buy rating is accompanied by an $82 price target, which makes room for one-year growth of 20%. (To watch English’s track record, click here)

Overall, Mondelez gets plenty of support on Wall Street. The stock claims a Strong Buy consensus rating, based on 16 Buys vs. just 2 Holds. Over the next year, shares are expected to appreciate by 14%, considering the average target stands at $78.35. Investors can also enjoy a dividend here. The latest payout stood at $0.42/share, and that offers a yield of ~2.45%.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.