According to the latest data, the countdown to the Bitcoin network’s halving event shows fewer than 10,000 blocks from becoming a reality. Further analysis suggests that the halving is anticipated to take place between April 19 and April 21, 2024, reducing the block rewards from the existing rate of 6.25 bitcoins per block to 3.125 […]

According to the latest data, the countdown to the Bitcoin network’s halving event shows fewer than 10,000 blocks from becoming a reality. Further analysis suggests that the halving is anticipated to take place between April 19 and April 21, 2024, reducing the block rewards from the existing rate of 6.25 bitcoins per block to 3.125 […]

Source link

Grayscale

The countdown to Bitcoin’s highly anticipated halving event is on, with fewer than 10,000 blocks left as of Feb. 12.

According to the Bitcoin Halving Clock, approximately 9,843 blocks remain before the event, which is estimated to occur by April 17.

The halving event is significant for the crypto industry because it enhances Bitcoin’s scarcity by reducing miner rewards. CryptoSlate Insight reported that the event would slash the number of BTC produced daily by miners to 450 BTC from 900 BTC.

Historically, BTC halving has usually been followed by an increased difficulty in mining the top crypto asset and a bullish price movement.

Bitcoin upcoming halving is ‘different’

Crypto asset management firm Grayscale said the impending halving event carries distinct implications compared to its predecessors due to the notable surge in BTC’s utility over the past year.

“Despite miner revenue challenges in the short term, fundamental onchain activity and positive market structure updates make this halving different on a fundamental level,” Grayscale wrote.

According to the firm, the recent introduction of Bitcoin Exchange-Traded Funds (ETFs) presents a stable demand outlet that could counteract the downward pressure from mining issuance.

It said:

“ETFs, in general, create access to Bitcoin exposure to a greater network of investors, financial advisors, and capital market allocators, which in time could lead to an increase in mainstream adoption.”

Furthermore, Grayscale highlighted the significance of Non-Fungible tokens (NFTs)-like ordinal inscriptions in the BTC ecosystem. The firm said these assets “present a new path toward sustaining network security through increased transaction fees.”

Beyond that, the emergence of ordinal inscriptions has invigorated on-chain activity, yielding over $200 million in transaction fees for miners as of February 2024. This trend is anticipated to endure, buoyed by renewed developer engagement and ongoing innovations within the blockchain.

In addition, Grayscale noted that miners have been proactively preparing for the halving’s financial implications by liquidating their BTC since late 2023. This proactive stance positions them favorably ahead of the halving event.

Even if some miners were to exit the network, Grayscale said the subsequent decrease in hash rate would prompt an adjustment in mining difficulty, safeguarding network stability.

“While [BTC] has long been heralded as digital gold, recent developments suggest that [it] is evolving into something even more significant,” Grayscale concluded.

At the time of press, Bitcoin is ranked #1 by market cap and the BTC price is up 3.52% over the past 24 hours. BTC has a market capitalization of $980.27 billion with a 24-hour trading volume of $30.81 billion. Learn more about BTC ›

Market summary

At the time of press, the global cryptocurrency market is valued at at $1.86 trillion with a 24-hour volume of $62.28 billion. Bitcoin dominance is currently at 52.66%. Learn more ›

Fidelity inflows smash Grayscale outflows as $255 million Bitcoin enters US market

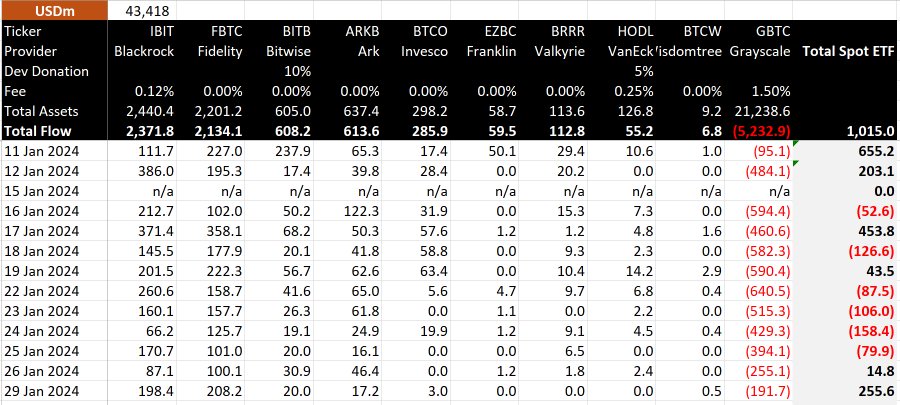

Grayscale’s Bitcoin Trust (GBTC) is experiencing a slowdown in outflows, with just under $200 million withdrawn from the fund on Jan. 29.

Data from BitMEX Research indicates a total outflow of around $192 million during this reporting period. Notably, this marks the lowest outflows since the fund’s inception, surpassing only the initial day of trading when withdrawals amounted to $95 million.

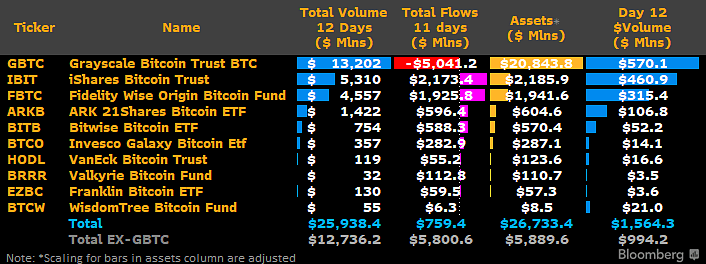

Meanwhile, a look at the newborn nine shows that the inflows into the funds keep offsetting that of Grayscale.

The Fidelity Wise Origin Bitcoin Fund (FBTC) emerged as a standout, concluding the twelfth trading day with the highest inflow at $208 million. In comparison, other funds, including BlackRock’s IBIT, experienced a $198 million inflow. ETFs such as BITB, ARKB, and BTCO recorded inflows of $20 million, $17 million, and $3 million, respectively, while others reported zero inflows.

The robust trading activities contributed a net inflow of $255.6 million during the twelfth trading day.

GBTC maintains ‘liquidity crown’

However, Grayscale’s GBTC remains the top cryptocurrency ETF in liquidity, as Bloomberg Intelligence analyst James Seyffart observed.

Despite recent outflows, GBTC’s trading volume reached $570 million on Jan. 29, surpassing BlackRock’s IBIT by $110 million and reaffirming its market dominance.

Following its recent conversion, Grayscale’s ETF has experienced substantial outflows totaling more than $5 billion. Analysts attribute the outflows to profit-taking maneuvers by investors exposed to its previous net asset value discount.

Furthermore, the fund’s relatively high 1.5% management fee is cited as a factor that has led some investors to shift towards competing ETF providers such as BlackRock and Fidelity, who charge a lower fee of 0.25%.

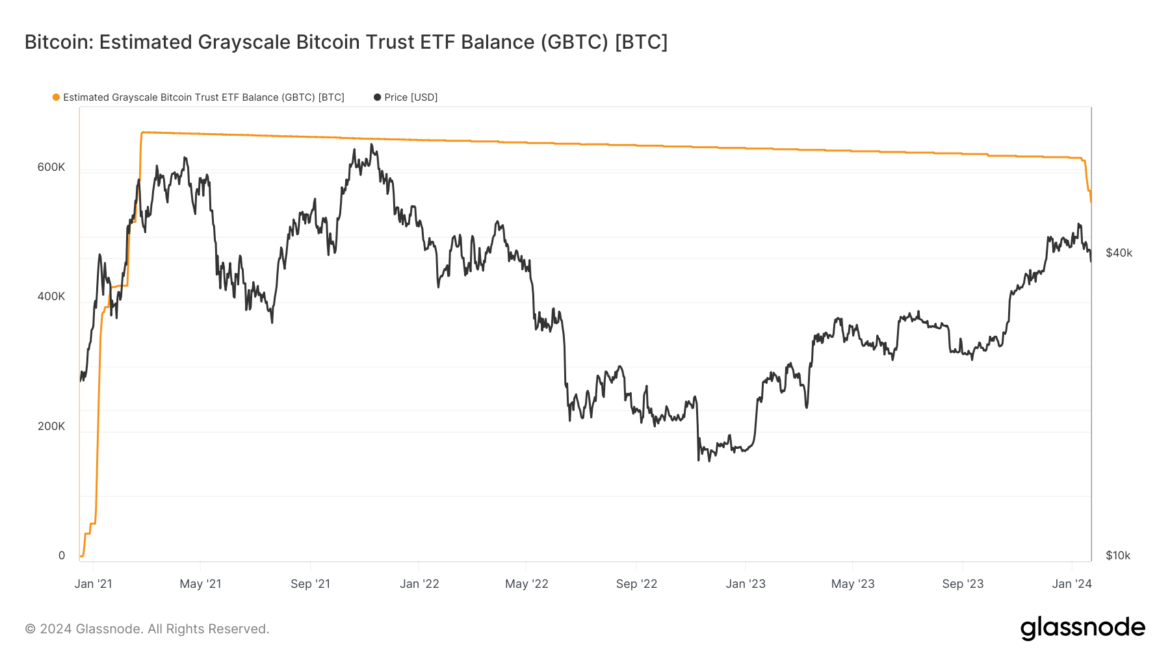

As of Jan. 29, the outflows have resulted in Grayscale’s ETF’s Assets Under Management (AUM) dropping to approximately $21.431 billion (equivalent to 496,573 BTC) from its year-to-date peak of nearly $29 billion (623,390 BTC), as reported by the fund’s official website. This data indicates that fund users have divested over 100,000 units of the leading cryptocurrency since the approval of the ETF conversion.

Grayscale selling pressure ‘largely behind us,’ spotlight on Newborn Nine: JP Morgan

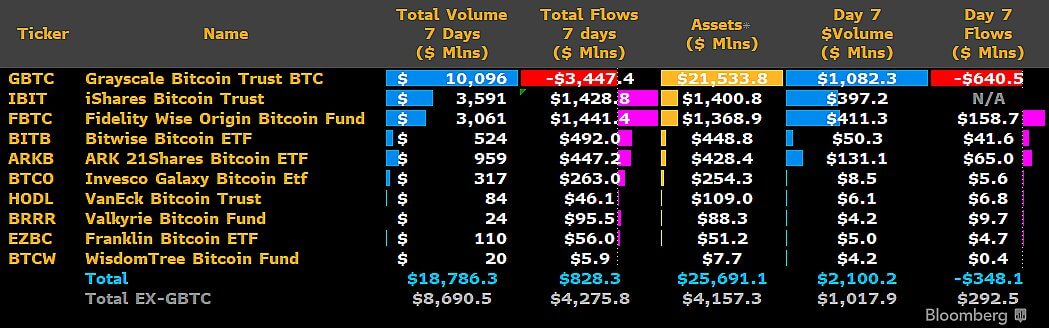

Analysts from banking giant JPMorgan believe that the profit-taking from the Grayscale Bitcoin Trust (GBTC) may have concluded, potentially alleviating the downward pressure on Bitcoin prices.

The analysts explained that they had estimated that GBTC could see as much as $3 billion in outflows from investors previously exposed to its discount. But with the flow now reaching as much as $4.3 billion since the ETF conversion, they believe that the “GBTC profit taking has largely happened already” and that “most of the downward pressure on Bitcoin from that channel should be largely behind us.”

This view is similar to that shared by Alistair Milne, the chief investment officer of Altana digital currency fund, who stated that the “GBTC selling should now be market neutral.”

Over the past weeks, BTC’s price has fallen by around 20% since the Securities and Exchange Commission (SEC) approved the launch of several spot Bitcoin ETFs in the U.S.

Observers have attributed this decline to the outflows from Grayscale’s fund, noting that it mainly had traded at a discount to its net asset value during the past two years. So, the ETF approval gave investors profit-taking opportunities on their previous GBTC investments.

BlackRock and Fidelity ETFs emerge as competitors.

JPMorgan analysts pointed out that BlackRock’s IBIT and Fidelity’s FBTC have emerged as major competitors for GBTC (the Newborn Nine.)

According to the firm, the ETFs from these traditional financial institutions have attracted nearly $2 billion in inflows since their launch, and their fees are much lower than that of GBTC, making them attractive options for investors.

GBTC has the highest fees among the newly launched ETFs, charging a 1.5% fee while competing ETFs like BlackRock’s IBIT and Fidelity’s FBTC charge just 0.25%.

As such, the analysts concluded that the outflows from GBTC to these ETFs could continue apace if the asset manager failed to lower its fees soon.

“The current $3 billion per month shift from GBTC to cheaper newly created spot Bitcoin ETFs could even accelerate if other spot ETFs reach critical mass to start competing with GBTC in terms of size and liquidity,” they wrote.

ETFs to induce significant change in the BTC market

The analysts also posited that these developments in the ETFs would result in a “significant change in the BTC market structure.”

JPMorgan analysts assert that the U.S. crackdown on foreign marketplaces in the previous year has opened avenues for “onshore spot exchanges and CME Bitcoin futures” to assume more prominent roles in determining top cryptocurrency prices.

With the launch of the ETFs, the market is expected to see more liquidity and depth; thereby, these newly launched investment vehicles will play a role in BTC’s price discovery process.

“The emergence of spot Bitcoin ETFs would make the Bitcoin price discovery process more rather than less efficient,” they concluded.

Grayscale Bitcoin Trust hits new low for outflows with $429 million leaving fund

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Oops…you must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.

Bitwise CIO says Bitcoin’s dip driven by ETF overenthusiasm, not Grayscale outflows

Bitwise chief investment officer Matt Hougan attributed the recent decline in the crypto market to overinflated expectations regarding the potential impact of the newly launched Bitcoin exchange-traded funds (ETFs).

In a Jan. 23 post on X (formerly Twitter), Hougan explained that the current market sell-off is driven by what he terms an “ETF Expectations-led” phenomenon.

According to him, investors anticipating “larger net flows into (these) ETFs” front-ran the approval news by piling into both spot and derivatives positions on the flagship digital asset. However, with the expected inflows not materializing, these investors are now “unwinding that bet,” prompting the current market situation.

“Just as the market overestimated the short-term impact of ETFs, it is underestimating the long-term impact,” Hougan concluded.

Since the Securities and Exchange Commission (SEC) approved the launch of several spot Bitcoin ETFs in the U.S., the value of the top cryptocurrency has been on a downturn. The digital asset fell to as low as under $39,000 on Jan. 23 but has recovered to $40,389 as of press time, according to CryptoSlate’s data.

This downward trend raised concerns within the crypto community, with some attributing it to the outflows from Grayscale’s Bitcoin Trust ETF (GBTC).

Contrary to this sentiment, analysts, including CryptoQuant founder Ki Young Ju, share a perspective aligned with Hougan’s.

Young Ju recently emphasized that Bitcoin operates in a futures-driven market, making it less susceptible to spot-selling activities from GBTC-related issues.

“BTC falls due to derivative market selling, not GBTC. OTC (over the counter) markets are very active, but no price impact,” he added.

ETFs are BTC net buyers.

Meanwhile, the Bitwise investment chief also clarified that the recently launched ETFs are net buyers of Bitcoin despite the outflows emanating from GBTC.

Hougan pointed out that while GBTC functions as a net seller, the cumulative BTC acquisitions from the new ETFs surpass that being offloaded by Grayscale.

Bloomberg data corroborates Hougan’s view. As of Jan. 23, GBTC’s outflows stood at $3.45 billion, while the newly introduced nine ETFs had a combined inflow of more than $4 billion in assets under management.

This data stresses a compelling narrative—that the ETFs have seen substantial interest from the community, leading to a swift and significant accumulation of the leading cryptocurrency.

Grayscale Bitcoin Trust balance sees 12% reduction as FTX bankruptcy stirs $3.5 billion outflow

Quick Take

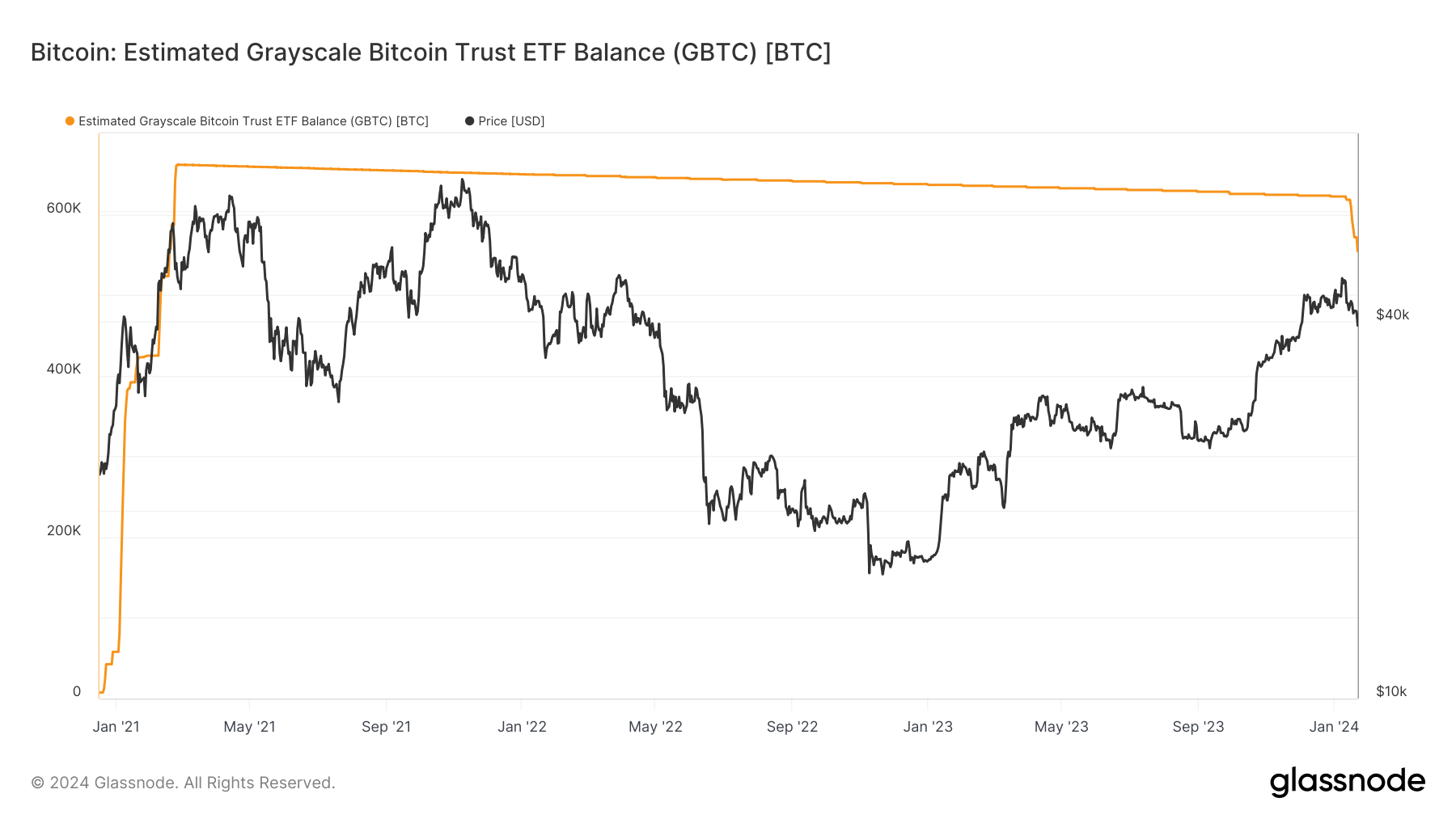

Recent data analysis from Glassnode reveals a substantial decrease in the balance of the Grayscale Bitcoin Trust ETF (GBTC), now estimated at around 553,000 Bitcoin, which is roughly 12% down from its high of 630,000 Bitcoin.

A key contributing factor to this decline appears to be the increasing outflows, which have been estimated at around $3.5 billion over its seven most recent trading days. These outflows are on the rise while the discount to the Net Asset Value (NAV) continues to close, currently roughly -0.11%, according to Y Charts. As this discount continues to narrow, the market may witness a further surge in GBTC selling.

Similarly, the digital asset exchange FTX reports significant sales nearing $1 billion, resulting from FTX’s bankruptcy estate offloading approximately 22 million shares, according to CoinDesk. Some of the outflows from GBTC have been redeemed into spot Bitcoin ETFs, roughly a third, according to Bloomberg analysts. However, it is noteworthy that about a third of the GBTC outflows ended up in USD, not in ETF vehicles, due to the FTX bankruptcy.

The post Grayscale Bitcoin Trust balance sees 12% reduction as FTX bankruptcy stirs $3.5 billion outflow appeared first on CryptoSlate.

Grayscale outflows add further $800 million BTC liquidity to Coinbase Prime OTC desk

Quick Take

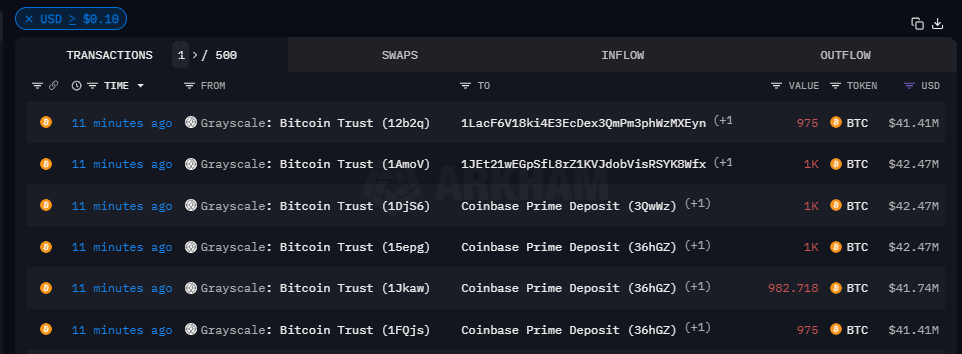

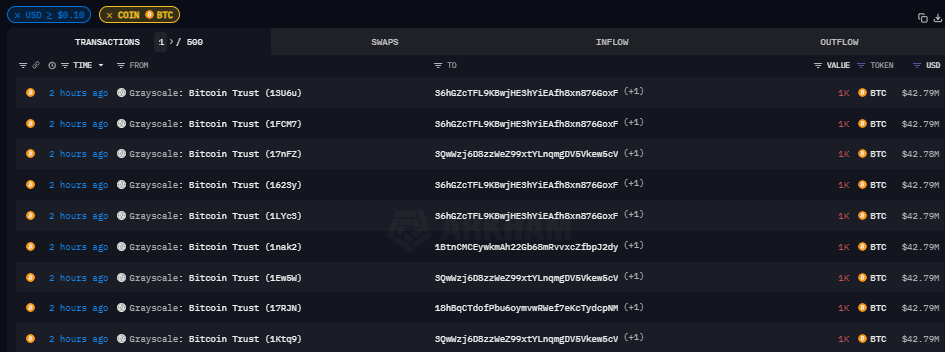

According to Arkham Intelligence data, Grayscale transferred another 18,400 BTC to a Coinbase Prime hot wallet on Jan. 17. Sent in several 1,000 BTC transactions, the Bitcoin was valued at around $800 million as of press time.

On Jan. 16, a similar transfer worth $387 million was also conducted by Grayscale, again to Coinbase Prime. The repetitive nature of these hefty transactions suggests possible redemption activity on Grayscale’s part as investors potentially rotate into lower-fee ETFs.

It’s also worth noting that all these transactions were conducted seconds before the U.S. markets opened at 2:30 PM GMT, possibly hinting at a strategy to leverage global market dynamics.

Given the limited supply of Bitcoin and the nature of Coinbase Prime’s role across multiple spot Bitcoin ETFs, the outflows from Grayscale are likely to be used as liquidity for any potential inflows into other Bitcoin ETFs. Only a handful of venues are available to the ETF Trust to purchase Bitcoin, with Coinbase Prime being the leading player.

The post Grayscale outflows add further $800 million BTC liquidity to Coinbase Prime OTC desk appeared first on CryptoSlate.

Grayscale moves $387 million in Bitcoin to Coinbase in possible redemption play

Quick Take

Just before the U.S. market opened on Jan. 16, Grayscale, the world’s largest digital currency asset manager, initiated a significant transfer to Coinbase. The transactions involved shifting 9,000 BTC across nine separate transactions, each valued at around $43.7 million, towards a Coinbase Prime hot wallet, for a total of $387 million, according to Arkham Intelligence data.

This substantial movement was not a standalone occurrence. Just four days prior, on Jan. 12, Grayscale was observed making a similar transfer worth $200 million to Coinbase Prime.

These large-scale, high-value transactions hint at possible redemption activity on Grayscale’s part, an interpretation that takes on weight considering the repetitive nature of the activity. These transfers also underscore the importance of Coinbase Prime, a platform geared towards institutional investors, in managing high-value transactions of this scale.

All transactions, so far, have been before the U.S. markets opened at 2:30 PM GMT.

The post Grayscale moves $387 million in Bitcoin to Coinbase in possible redemption play appeared first on CryptoSlate.