After four days of consecutive inflows, the U.S. spot bitcoin exchange-traded funds (ETFs) experienced a downturn, with $85.7 million flowing out during Monday’s trading hours. U.S. Spot Bitcoin ETFs’ Momentum Halted With $85.7M in Outflows, Spotlight on GBTC Between March 25 and March 28, 2024, the U.S. spot bitcoin ETFs enjoyed an upward trend, amassing […]

After four days of consecutive inflows, the U.S. spot bitcoin exchange-traded funds (ETFs) experienced a downturn, with $85.7 million flowing out during Monday’s trading hours. U.S. Spot Bitcoin ETFs’ Momentum Halted With $85.7M in Outflows, Spotlight on GBTC Between March 25 and March 28, 2024, the U.S. spot bitcoin ETFs enjoyed an upward trend, amassing […]

Source link

Grayscales

Grayscale’s $529 Million BTC Move To Coinbase Pushes Price Below $41,000

Bitcoin (BTC), the largest cryptocurrency in the market, has experienced a sharp drop below the $41,000 mark as exchange-traded funds (ETFs) for Bitcoin went live on January 12.

The subsequent profit-taking, selling pressure, and outflows from Grayscale’s Bitcoin Trust ETF (GBTC) played a significant role in the downward trend.

Grayscale’s Bitcoin Transfers To Coinbase Intensify

On Tuesday, NewsBTC reported that six days ago, Grayscale initiated the first batch of BTC outflows from their holdings to a Coinbase, totaling 4,000 BTC (approximately $183 million) over six days.

However, the asset manager resumed outflows from the Trust to the exchange on Tuesday, sending an additional 11,700 BTC (equivalent to $491.4 million) to Coinbase.

Furthermore, on Friday, data from Arkham Intelligence revealed that 12,865 BTC ($529 million) were transferred from the Grayscale Trust address to Coinbase Prime.

In total, the Grayscale Trust address has transferred 54,343 BTC ($2.313 billion) to Coinbase Prime during the opening hours of the US stock market over five consecutive trading days since January 12, which has undoubtedly contributed to the downtrend in Bitcoin’s price.

Selling Frenzy Among BTC Miners

In addition to Grayscale’s selling spree, there has been increased selling activity by Bitcoin miners ahead of the upcoming Bitcoin halving.

Crypto analyst Ali Martinez highlights that on-chain data from CryptoQuant indicates a substantial increase in selling activity by BTC miners. In the past 24 hours, miners offloaded nearly 10,600 BTC, with a value of approximately $455.8 million.

The persistent selling pressure has caused BTC to trade at $40,900, reflecting a slight 0.2% decrease over the past 24 hours.

The downtrend has been evident across various time frames, with declines of 5%, 6%, and 7% over the seven, fourteen, and thirty-day periods, respectively. However, despite these recent setbacks, Bitcoin remains remarkably positive year-to-date, with an impressive 98% gain.

Overall, the combined impact of Grayscale’s Bitcoin Trust ETF outflows and increased selling activity by miners has intensified the downward pressure on Bitcoin’s price, breaching the critical support level of $41,000.

The focus now turns to how Bitcoin bulls will defend the crucial $40,000 support level, which stands as the last line of defense before a potential dip toward the $37,700 mark.

Should this support level fail to hold, the Bitcoin market could witness further price declines, potentially pushing the price down to the $35,800 mark. However, with the Bitcoin halving scheduled for April, bullish investors are hopeful that this event will catalyze a significant bull run.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Grayscale’s Bitcoin Trust (GBTC) has seen a 4% increase in its value during pre-market trading

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Oops…you must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.

Cathie Wood’s ARK Invest cashes out part of its Grayscale’s GBTC stake as Bitcoin ETF optimism grows

Cathie Wood’s asset management firm ARK Invest sold more than 700,000 shares of its Grayscale Bitcoin Trust (GBTC) holding in the past month amid the rapid closure of the fund’s discount.

Data from Cathies Ark, a website monitoring the daily trades of ARK, showed that the firm’s Next Generation Internet ETF (ARKW) offloaded 724,043 units of GBTC shares between Oct. 23 and today, Nov. 24. The firm is estimated to have earned more than $10 million from these sales.

During this period, GBTC shares value grew by more than 16% to as high as $30.85 today, Nov. 24, according to Tradingview data. This was fueled by the market optimism surrounding the possibility of the U.S. Securities and Exchange Commission (SEC) approving a spot Bitcoin (BTC) exchange-traded fund (ETF).

Grayscale is one of the numerous asset managers, including BlackRock, who have a pending application with the financial regulator.

Despite these rapid selling activities, GBTC remains one of ARKW’s largest holdings, representing more than 9% of its portfolio, behind only crypto exchange Coinbase and advertising technology firm Roku.

GBTC discount falls under 10%

GBTC’s discount to net asset value (NAV) has fallen under 10% for the first time in the last two years, according to Coinglass data.

GBTC is one of the largest BTC investment options globally, holding over 620,000 BTC valued at over $23 billion. It offers investors exposure to the top crypto asset without direct ownership.

In 2021, a discount arose due to shareholders being unable to redeem their shares. This discount expanded to nearly 50% in 2022 before narrowing to about 40% earlier this year.

However, the situation changed notably after BlackRock submitted an application for a spot BTC ETF in June, sparking heightened institutional interest in the market.

Since then, the discount has significantly decreased. Market observers have suggested that the metric serves as a real-time gauge of investors’ confidence regarding the likelihood of the SEC approving a spot BTC ETF in the U.S.

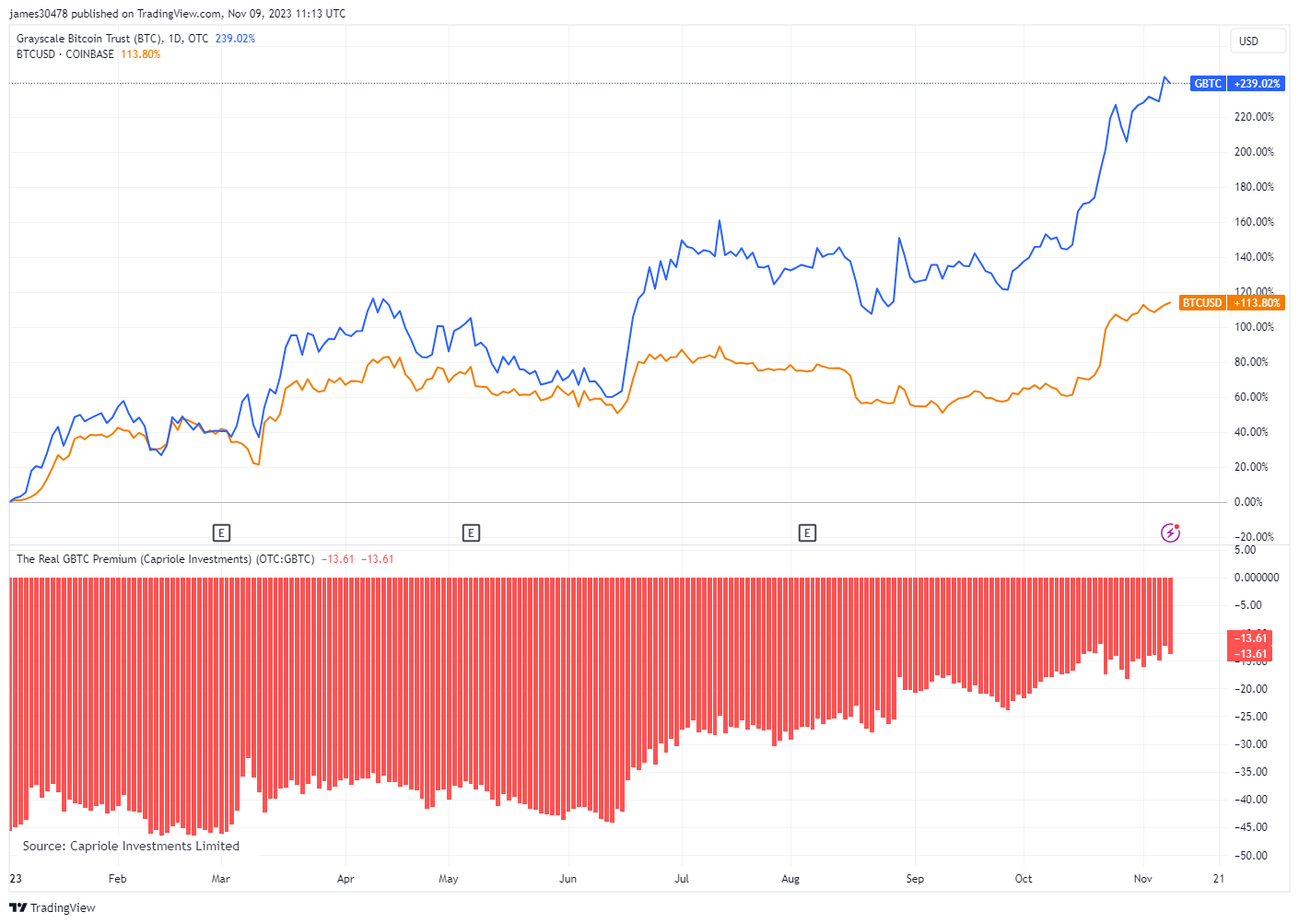

Grayscale’s GBTC climbs 239% in 2023 as market eyes spot ETF approval

Quick Take

The Grayscale Bitcoin Trust (GBTC) is riding a surge of growth in 2023, with its value climbing by over 239% since January. Concurrently, the discount to its Net Asset Value (NAV) is contracting, currently standing at 13.6% – among the year’s lowest. These market dynamics suggest an anticipation of the approval of a spot Bitcoin ETF, which appears to be imminent in the coming weeks.

GBTC’s value has continued to rise even after market hours, with a 1% increase bringing its price to $28.15. Notably, Bloomberg analysts have pinpointed an eight-day window commencing today, Nov. 9, during which several spot ETFs could potentially be greenlit. This period is expected to serve as a critical observation phase for GBTC’s price action, providing valuable insights into the market’s expectations and responses to regulatory decisions.

As the crypto industry awaits an official announcement, it’s evident from the GBTC’s performance and the shrinking NAV discount that the market is starting to price in the possibility of the approval of a spot Bitcoin ETF, which could dramatically influence the future of the digital asset market.

The post Grayscale’s GBTC climbs 239% in 2023 as market eyes spot ETF approval appeared first on CryptoSlate.

Grayscale Investments‘ flagship product, Grayscale Bitcoin Trust (GBTC), serves as a crucial bridge between the traditional financial world and the relatively new realm of cryptocurrencies. GBTC offers investors exposure to Bitcoin without the need for direct ownership, effectively bypassing challenges like storage, security, and regulatory concerns. By purchasing shares of GBTC, investors can gain exposure to Bitcoin’s price movements through a vehicle that trades on traditional markets.

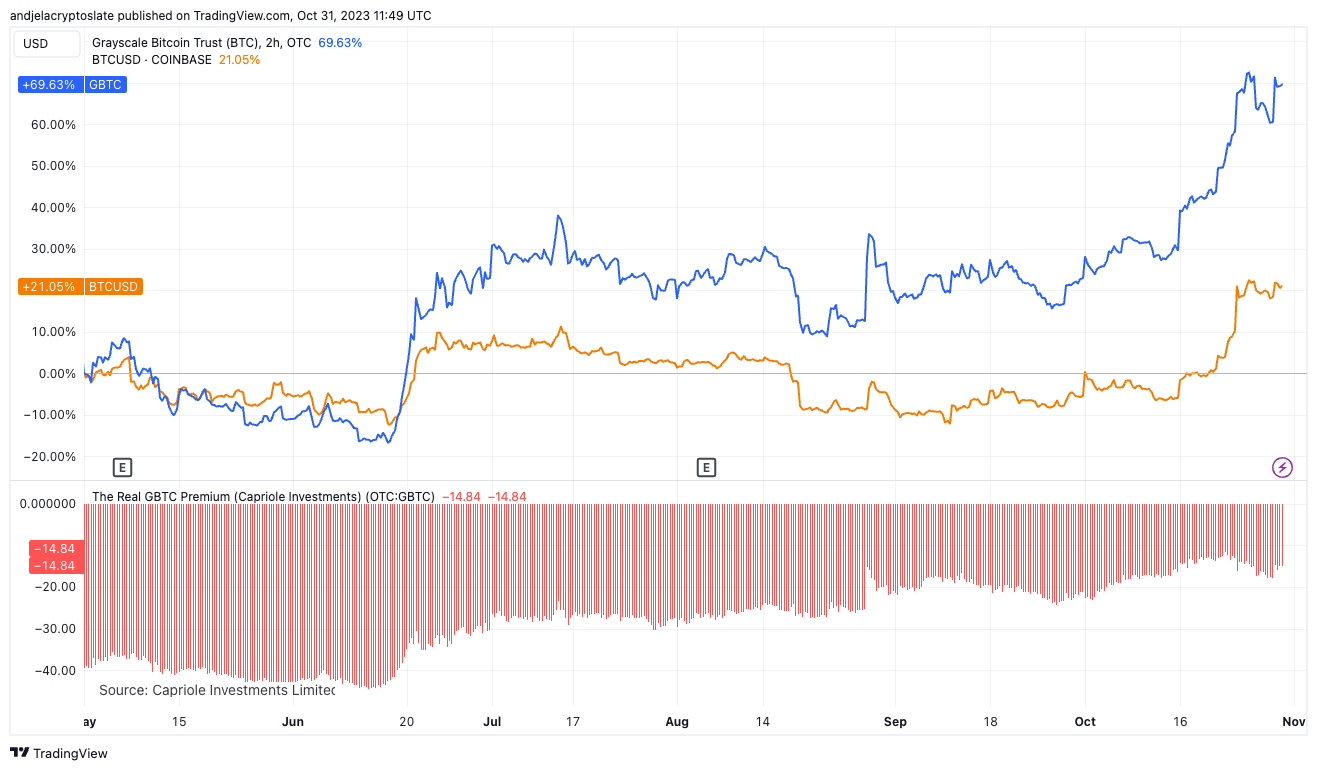

A striking observation from recent data is the divergence between GBTC’s daily performance and that of Bitcoin (BTC). On Oct. 30, while GBTC increased by 2.52%, Bitcoin saw a decline of 0.61%. Such a divergence raises questions about market dynamics and investor sentiment. Does this mean the traditional market’s appetite for Bitcoin exposure, as seen through GBTC, is stronger than the direct cryptocurrency market?

The data seems to suggest so, especially when we expand our lens to longer timeframes.

Over the past month, GBTC rose by 31.7% compared to Bitcoin’s 20.6%. The trend continues over three and six months, with GBTC growing by 39.1% and 69.6%, respectively, significantly outpacing BTC’s growth of 17.3% and 21.1%. Year-to-date, it grew a whopping 222.9%, doubling Bitcoin’s commendable rise of 106.9%.

| 1D | 1M | 3M | 6M | YTD | |

|---|---|---|---|---|---|

| GBTC | +2.52% | +31.7% | +39.1% | +69.6% | +222.9% |

| BTC | -0.61% | +20.6% | +17.3% | +21.1% | +106.9% |

| GBTC Premium | -14.88 | -14.87 | -14.86 | -14.84 | -14.98 |

However, while these numbers paint a rosy picture of GBTC’s performance, the persistent negative premium offers a more nuanced narrative. Despite its stronger returns, it consistently trades at a discount to the actual value of the Bitcoin it holds. This discount, hovering around -14.88 to -14.98 across the board, indicates that the market values the actual Bitcoin more than the GBTC shares representing it. Such a stable negative premium, even in the face of GBTC’s outperformance, could be a manifestation of various concerns. Investors might be wary of the asset due to its fee structure, potential liquidity issues, or the inability to redeem shares for actual Bitcoin. The consistency of this discount also suggests that the market sentiment regarding these concerns has remained unchanged.

The broader implications of this stable discount are manifold. It might indicate a latent demand for a more direct exposure mechanism to Bitcoin, which a U.S. Bitcoin ETF could satiate. The introduction of such an ETF would allow institutional investors to gain exposure to Bitcoin in a manner more aligned with the actual cryptocurrency, potentially offering more liquidity and the ability to redeem shares for actual Bitcoin. A Bitcoin ETF would also likely have a more competitive fee structure. With the growing interest in Grayscale’s Bitcoin Trust, the launch of a Bitcoin ETF in the U.S. could see a massive influx of institutional money into the crypto space, further legitimizing the asset class and potentially leading to price appreciation.

While GBTC has consistently demonstrated strong performance, outpacing Bitcoin over various timeframes, the persistent discount to the underlying asset cannot be ignored. It serves as a bellwether of market sentiment, indicating possible concerns or a desire for more direct exposure mechanisms.

The post Grayscale’s GBTC paradox: Performance at a discount appeared first on CryptoSlate.

Initially submitted on October 2, 2023, the proposal aims to convert the Grayscale Ethereum Trust, the largest Ethereum investment vehicle globally, into an ETF.

In a recent turn of events, the US Securities and Exchange Commission (SEC) has approved Grayscale Investments’ application for a spot Ethereum (ETH) exchange-traded fund (ETF). Sharing the news on Tuesday, Nate Geraci, President of The ETF Store, announced on X (formerly Twitter) that the SEC has officially acknowledged the filing for the potential conversion of the Grayscale Ethereum Trust (ETHE) into an ETF.

SEC has acknowledged Grayscale’s spot ether ETF filing…

This would be conversion of $ETHE into ETF. pic.twitter.com/JMmutgbakZ

— Nate Geraci (@NateGeraci) October 23, 2023

Grayscale’s Ethereum Trust Holds 2.5% of Ether in Circulation

Initially submitted on October 2, 2023, in collaboration with NYSE Arca, the proposal aims to convert the Grayscale Ethereum Trust, the largest Ethereum investment vehicle globally, into an ETF.

Presently, the trust holds an impressive 2.5% of the circulating ETH and manages assets worth $5 billion. According to a press release, the transition to an ETF has long been anticipated as the final phase of the trust’s lifecycle.

Like its Bitcoin (BTC) counterpart, the Grayscale Ethereum Trust operates by holding the underlying asset, enabling investors to purchase shares representing a fraction of the total holding. However, the transformation of ETHE into an ETF would allow investors to trade it on the stock exchange, backed by physical Ethereum, thereby broadening its accessibility and appeal to potential investors.

US Court Orders SEC to Review Grayscale Bitcoin ETF

Grayscale’s move aligns with the market trend, where several firms have filed for Ethereum ETFs based on futures contracts rather than physical ETH. These contracts involve agreements to buy or sell financial assets at predetermined prices at future dates, providing a speculative avenue for investors to wager on the asset’s price trajectory.

The new development comes in the wake of the SEC facing pressure from various financial firms, including BlackRock and Fidelity, to approve spot Bitcoin and Ethereum ETFs, aiming to streamline the integration of cryptocurrencies into traditional financial systems.

In the United States, a court has also mandated that the regulator review Grayscale’s filing to convert its Bitcoin Trust into a Listed BTC ETF. The new order from the United States Court of Appeals for the District of Columbia follows an initial court ruling on August 29, asking the SEC to approve Grayscale’s application or file an appeal before October 13.

However, the SEC failed to present an appeal for the ruling, and, according to a filing on October 23, the Court of Appeals has issued a formal mandate for the SEC to review its decision on the Grayscale Bitcoin ETF.

Last week, the asset management company submitted a proposal to the SEC to list shares of its Bitcoin Trust on the New York Stock Exchange Arca under the ticker GBTC.

While the SEC is yet to approve any of the Bitcoin spot ETFs filed under its jurisdiction, Grayscale’s Chief Legal Officer Craig Salm urged the securities watchdog in July to greenlight all the eight Bitcoin ETFs applications fairly and systematically without choosing the winners and losers.

next

Bitcoin News, Cryptocurrency News, Ethereum News, Funds & ETFs, Market News

Chimamanda is a crypto enthusiast and experienced writer focusing on the dynamic world of cryptocurrencies. She joined the industry in 2019 and has since developed an interest in the emerging economy. She combines her passion for blockchain technology with her love for travel and food, bringing a fresh and engaging perspective to her work.

You have successfully joined our subscriber list.

Bitcoin ETF approval odds increase to 75% following Grayscale’s court victory: Bloomberg analysts

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Oops…you must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.

No decision expected today on Grayscale’s challenge to SEC over Bitcoin ETF conversion

Despite rumors, there will be no decision today, Aug. 18, Grayscale’s lawsuit against the Securities and Exchange Commission (SEC) over their denial of a spot Bitcoin Exchange-Traded Fund (ETF) conversion,

While some had hoped for a decision today, that idea was dispelled by Bloomberg Intelligence Analyst James Seyffart in an Aug. 18 tweet.

The potential outcome of the lawsuit, whenever it’s decided, could set a precedent for the future of digital asset transactions.

Grayscale, the global leader in digital currency asset management, has been in a legal battle for months, challenging the SEC’s decision to prevent the company from converting its Bitcoin investments into a spot ETF.

The core of Grayscale’s argument centers on what they perceive as unfair treatment towards spot Bitcoin ETFs. This lawsuit has sparked discussions about the SEC’s role in regulating and overseeing cryptocurrencies.

Conversely, the SEC stands firm in its stance, arguing that their decision is grounded in the necessity to shield investors from the unpredictability and possible market manipulation linked with cryptocurrencies.

Recent history of Grayscale’s ETF issues

In Oct 2022, Grayscale Investments, a Digital Currency Group (DCG) subsidiary, opened a legal action against the SEC, arguing against the regulator’s discriminatory practice of allowing Bitcoin Futures ETFs but not a spot ETF.

Grayscale had initially applied to convert its Bitcoin Trust (GBTC) into an ETF, which was rejected by the SEC, citing concerns over market manipulation and the role of Tether (USDT) in the broader crypto ecosystem.

This rejection spurred Grayscale to challenge the SEC’s decision, citing “special harshness” in the SEC’s ruling. Grayscale argued that approving several Bitcoin Futures ETFs was inconsistent with rejecting a spot ETF product, as both derive pricing “based on overlapping indices” and are “subject to the same risks and protections.”

In March 2023, during the first appeals hearing, judges questioned the SEC’s logic for rejecting Grayscale’s spot Bitcoin ETF application. The SEC’s lawyer, Emily Parise, was asked by Judge Neomi Rao to explain why Grayscale was wrong in their argument, wherein they provided substantial information on how the spot and futures markets function with each other.

Fast forward to July 2023, Grayscale’s GBTC narrowed its discount to its net asset value, outperforming Bitcoin’s value. It witnessed a rise of nearly 43% in the past month compared to Bitcoin’s 17% gain during the same timeframe. This improved performance was attributed to BlackRock’s application for a Bitcoin spot ETF and similar applications from other traditional financial institutions.

As of Aug.15, 2023, Bloomberg’s Senior ETF Analyst, Eric Balchunas, indicated that a decision concerning the Grayscale lawsuit against the SEC could be revealed today, Aug. 18. The outcome of this decision could have significant implications for the approval of Bitcoin exchange-traded products (ETPs).

The legal wrangling between Grayscale and the SEC presents a pivotal moment in the evolution of the digital assets market, with the potential to influence future regulatory guidelines and practices.

Stay tuned for further updates on this landmark decision.