Tesla stock soared on the potential for the company to be worth $4 trillion—a

huge valuation it could only achieve years from now. Investors would probably be happy enough if the stock held its ground in the near term.

Stellar (XLM) has experienced a robust resurgence, bouncing off a crucial support level at $0.11. Chart indicators are pointing towards a promising outlook for bullish investors, marking a significant shift in momentum since mid-August. This second rebound from the same support level underscores the formidable strength exhibited by bulls, hinting at the potential for further gains.

A price analysis notes that the $0.11 support level has emerged as a steadfast defense line for XLM enthusiasts. Recent price action has illustrated that bears would need to work diligently to flip this level in their favor, extending the bearish momentum.

However, the bulls have displayed unwavering determination, as evidenced by the latest retest of the support on Sept. 4, which triggered a notable price pump.

As of the latest data, XLM is trading at $0.124 according to CoinGecko, reflecting a 2% rally over the past 24 hours and an impressive 10% surge in the last seven days. These gains are indicative of growing optimism among XLM investors.

The on-chain indicators are aligning with the bullish sentiment surrounding XLM. The Relative Strength Index (RSI) hovers around the neutral 50 mark, suggesting a healthy demand for XLM.

Additionally, the Chaikin Money Flow (CMF) stands at +0.10, indicating an influx of capital into XLM. This influx is typically a bullish sign, pointing towards the growing confidence among investors in the cryptocurrency.

Despite the resurging optimism, XLM faces a battleground in the long/short ratio on exchanges. The tight margins indicate that sellers are actively trying to thwart the bullish rally.

While long positions are inching closer to the critical 50% flip point of the long/short ratio, sellers currently maintain the upper hand, exerting pressure on XLM’s upward trajectory.

XLM market cap currently at $3.4 billion. Chart: TradingView.com

With the $0.11 support level proving to be a formidable stronghold for bulls and chart indicators hinting at further gains, XLM enthusiasts are eyeing a target range of $0.17 to $0.19, aiming to revisit the highs last seen in July.

The crypto market remains dynamic and volatile, so investors should remain vigilant and stay tuned for developments that could impact XLM’s price trajectory.

XLM has staged an impressive rebound, bolstered by strong support and positive chart indicators. While challenges persist in the form of bearish resistance in the long/short ratio, the bullish momentum remains intact, with investors setting their sights on recapturing the July highs. The cryptocurrency market continues to evolve, and XLM’s resurgence is a testament to its resilience in the face of market fluctuations.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Stellar

US Treasury Secretary Janet Yellen (R) arrives at Beijing Capital International Airport in Beijing on July 6, 2023.

Pedro Pardo | AFP | Getty Images

Treasury Secretary Janet Yellen landed in Beijing Thursday on a four-day trip aimed at finding common ground as rivalry between the U.S. and China becomes increasingly adversarial.

Yellen’s trip marks a deepening thaw in ties between the U.S. and China and comes weeks after Secretary of State Antony Blinken’s visit to Beijing in last month, which was the first high-level meeting between the two countries after months of tensions.

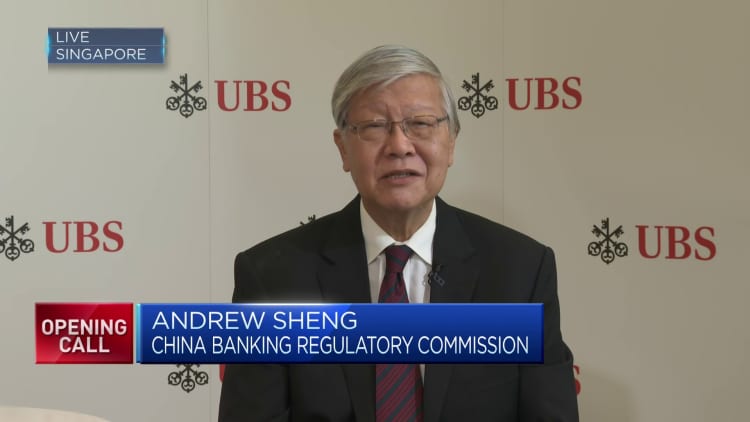

“The two sides are basically talking, trying to find the strategic space for both sides to operate, and this will be very good for the rest of the world,” Andrew Sheng, a distinguished fellow at the University of Hong Kong’s Asia Global Institute, told CNBC Thursday.

Yellen’s trip comes just days after China abruptly imposed export curbs on chipmaking metals and its compounds, escalating Beijing’s technological war with the U.S. and Europe.

Before departing for China, Yellen had a “frank and productive discussion” with Xie Feng, the Chinese U.S. ambassador, according to the U.S. Treasury.

“While in Beijing, Secretary Yellen will discuss with [People’s Republic of China] officials the importance for our countries — as the world’s two largest economies — to responsibly manage our relationship, communicate directly about areas of concern, and work together to address global challenges,” the Treasury Department said Sunday.

In an April speech, Yellen stressed the importance of fairness in the U.S. economic competition with China.

She outlined three economic priorities for the U.S.-China relationship: securing national security interests and protecting human rights, fostering mutually beneficial growth and cooperating on global challenges like climate change and debt distress.

A senior administration official told reporters Sunday that Yellen’s visit will underscore these objectives.

“We do not seek to decouple our economies,” the official said. “A full cessation of trade and investment would be destabilizing for both of our countries and the global economy.”